Abstract

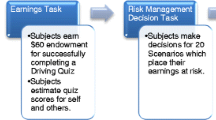

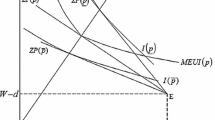

In a series of experiments, economically sophisticated subjects, including professional actuaries, priced insurance both as consumers and as firms under conditions of ambiguity. Findings support implications of the Einhorn-Hogarth ambiguity model: (1) For low probability-of-loss events, prices of both consumers and firms indicated aversion to ambiguity; (2) As probabilities of losses increased, aversion to ambiguity decreased, with consumers exhibiting ambiguity preference for high probability-of-loss events; and (3) Firms showed greater aversion to ambiguity than consumers. The results are shown to be incompatible with traditional economic analysis of insurance markets and are discussed with respect to the effects of ambiguity on the supply and demand for insurance.

Similar content being viewed by others

References

ArrowKenneth. (1963). “Uncertainty and the Welfare Economics of Medical Care,” American Economic Review 53, 941–973.

ArrowKenneth. (1982). “Risk Perception in Psychology and Economics,” Economic Inquiry 20, 1–9.

AtkissonArthur, and WilliamPetak. (1981). Earthquake Insurance: A Public Policy Analysis. Report prepared for the Federal Insurance Administration, Federal Emergency Management Agency, Washington, DC 20472.

BeckerSelwyn W., and Fred O.Brownson. (1964). ”What Price Ambiguity? Or the Role of Ambiguity in Decision Making,” Journal of Political Economy 72, 62–73.

Bewley, Truman. (1986). Knightian Decision Theory: Part I. Cowles Foundation Discussion Paper No. 807. Yale University.

Camerer, Colin, and Howard Kunreuther, (1988). Experimental Markets for Insurance. Center for Risk and Decision Processes, working paper. Wharton School, University of Pennsylvania.

CurleyShawn P., and J. FrankYates. (1985). “The Center and the Range of the Probability Interval as Factors Affecting Ambiguity Preferences,” Organizational Behavior and Human Decision Processes 36, 273–287.

CurleyShawn P., J. FrankYates, and Richard A.Abrams. (1986). “Psychological Sources of Ambiguity Avoidance,” Organizational Behavior and Human Decision Processes 38, 230–256.

DohertyNeil A., and HarrisSchlesinger. (1983). “Optimal Insurance in Incomplete Markets,” Journal of Political Economy 91, 1045–1054.

EhrlichIsaac, and GaryBecker. (1972). “Market Insurance, Self-Insurance and Self-Protection,” Journal of Political Economy 80, 623–648.

EinhornHillel J., and Robin M.Hogarth. (1985). “Ambiguity and Uncertainty in Probabilistic Inference,” Psychological Review 92, 433–461.

EinhornHillel J., and Robin M.Hogarth. (1986). “Decision Making Under Ambiguity,” Journal of Business 59, (No. 4, part 2), S225-S250.

EisnerRobert and Robert H.Strotz. (1961). “Flight Insurance and the Theory of Choice,” Journal of Political Economy 69, 355–368.

EllsbergDaniel. (1961). “Risk, Ambiguity, and the Savage Axioms,” Quarterly Journal of Economics 75, 643–669.

FishburnPeter. (1983). “Ellsberg Revisited: A New Look at Comparative Probability,” Annals of Statistics 11, 1047–1059.

FishburnPeter. (1986). “The Axioms of Subjective Probability,” Statistical Science 1, 335–358.

FuchsVictor. (1976). “From Bismarck to Woodcock: The Irrational Pursuit of National Health Insurance,” Journal of Law and Economics 19, 347–359.

GärdenforsPeter, and Nils-EricSahlin. (1982). “Unreliable Probabilities, Risk Taking, and Decision Making,” Synthese 53, 361–386.

GärdenforsPeter, and Nils-EricSahlin. (1983). “Decision Making with Unreliable Probabilities,” British Journal of Mathematical and Statistical Psychology 36, 240–251.

GretherDavid M., and Charles R.Plott. (1979). “Economic Theory of Choice and the Preference Reversal Phenomenon,” American Economic Review 69, 623–638.

HersheyJohn C., Howard C.Kunreuther, and Paul J. H.Schoemaker. (1982). “Sources of Bias in Assessment Procedures for Utility Functions,” Management Science 28, 936–954.

HeyJohn. (1982). “Search for Rules for Search,” Journal of Economic Behavior and Organizations 3, 65–81.

HogarthRobin M., and Howard C.Kunreuther. (1985). “Ambiguity and Insurance Decisions,” American Economic Review (AEA Papers and Proceedings) 75(2), 386–390.

HogarthRobin M., and Melvin W.Reder. (1986). “Editors' Comments: Perspectives from Economics and Psychology,” Journal of Business 59 (No. 4, part 2), S185-S207.

KnightFrank H. (1921). Risk, Uncertainty and Profit. Boston: Houghton Mifflin.

KunreutherHoward C., and Paul R.Kleindorfer. (1983). “Insuring Against Country Risks: Descriptive and Prescriptive Aspects,” In R.Herring (ed.), Managing International Risk. Cambridge, UK: Cambridge University Press.

KunreutherHoward et al. (1978). Disaster Insurance Protection: Public Policy Lessons. New York: Wiley.

Large, Arlen J. (1984). “Space Insurance Industry Is Seeking Greater Say In Satellite Technology,” Wall Street Journal, June 21.

LuceR. Duncan, and LouisNarens. (1985). “Classification of Concatenation Measurement Structures According to Scale Type,” Journal of Mathematical Psychology 29, 1–72.

NisbettRichard E., and Lee D.Ross. (1990). Human Inference: Strategies and Shortcomings of Social Judgment. Englewood Cliffs, NJ: Prentice-Hall.

PalfreyThomas R., and ThomasRomer. (1984). An Experimental Study of Warranty Coverage and Dispute Resolution in Competitive Markets. (Working paper #34–83–84). Pittsburgh, PA: Carnegie-Mellon University, Graduate School of Industrial Administration.

PashigianPeter, LawrenceSchkade, and GeorgeMenefee. (1966). “The Selection of an Optimal Deductible for a Given Insurance Policy,” Journal of Business 39(1), 35–44.

PlottCharles R. (1982). “Industrial Organization Theory and Experimental Economics,” Journal of Economic Literature 20, 1485–1527.

QuigginJohn. (1982). “A Theory of Anticipated Utility,” Journal of Economic and Organizational Behavior 3, 323–343.

SavageLeonard J. (1954). The Foundations of Statistics. New York: Wiley.

Schmeidler, David. (1984). Subjective Probability and Expected Utility Without Additivity. Preprint 84, Institute for Mathematics and Its Applications, University of Minnesota.

SchoemakerPaul, and HowardKunreuther. (1979). “An Experimental Study of Insurance Decisions,” Journal of Risk and Insurance 46, 603–618.

SegalUzi. (1987). “The Ellsberg Paradox and Risk Aversion: An Anticipated Utility Approach,” International Economic Review 28, 175–202.

SlovicPaul, BaruchFischhoff, and SarahLichtenstein. (1978). “Accident Probabilities and Seat Belt Usage: A Psychological Perspective,” Accident Analysis and Prevention 10, 281–285.

SlovicPaul, BaruchFischhoff and SarahLichtenstein. (1983). “Characterizing Perceived Risks.” In R. W.Kates and C.Hohenemser (eds.), Technological Hazard Management. Cambridge, MA: Oelgeschlager, Gunn and Hain.

SmithVernon L. (1982). “Microeconomic Systems as an Experimental Science,” American Economic Review 72, 923–955.

ThalerRichard. (1980). “Toward A Positive Theory of Consumer Choice,” Journal of Economic Behavior and Organization 1, 39–60.

TverskyAmos, and DanielKahneman. (1981). “The Framing of Decisions and the Psychology of Choice,” Science 211, 453–458.

U.S. Nuclear Regulatory Commission. (December 1983). The Price Anderson Act: The Third Decade. Report to Congress, Washington, DC.

vonNeumannJohn and OskarMorgenstern. (1947). Theory of Games and Economic Behavior (2nd edition). Princeton, NJ: Princeton University Press.

YaariMenahem. (1987). “The Dual Theory of Choice Under Risk,” Econometrica 55, 95–115.

YatesJ. Frank, and LisaG. Zukowski. (1976). “Characterization of Ambiguity in Decision Making,” Behavioral Science 21, 19–25.

Additional information

University of Chicago Graduate School of Business

University of Pennsylvania The Wharton School

Rights and permissions

About this article

Cite this article

Hogarth, R.M., Kunreuther, H. Risk, ambiguity, and insurance. J Risk Uncertainty 2, 5–35 (1989). https://doi.org/10.1007/BF00055709

Issue Date:

DOI: https://doi.org/10.1007/BF00055709