Abstract

Designing viable mobile services and business models that capture value for all the organizations involved is a challenge. There are many design issues that can be taken into account, and it is often unclear what their ultimate effect is on the performance of a business model. This paper offers a framework for relating critical design issues to success factors and tests the causal relationship between these core concepts in the organizational and financial domain of mobile business models, based on an international survey among 120 practitioners and experts in the mobile Internet services domain, most of them from EU countries. According to our findings, addressing organizational design issues (i.e. partner selection, governance and relation management) leads to an acceptable division of roles among actors, while addressing financial design issues (i.e., pricing, division of investments and costs among partners) results in risk levels that are perceived to be acceptable. The level of profitability that is perceived to be acceptable is influenced indirectly by these design issues, because the relationships are mediated through the risk level that the actors involved perceive to be acceptable and through the way the roles are divided among the actors.

Similar content being viewed by others

Introduction

Business models for mobile Internet services can only be viable in the long run if they manage to capture value for all the actors involved. Typically, the relevant resources are divided among operators, content providers, application developers and other players. Due to the conflicting strategic interests of partner organizations, capturing (network) value for business actors is a complex issue. The actors involved often operate in different industries (e.g. network operators, financial institutions and retailers) and have their own strategic interests (e.g. generate traffic, extend services to customers, generate transactions). Knowledge on how to balance requirements and strategic interests effectively is extremely scarce in existing business model literature (Hedman and Kalling 2003; Seddon and Lewis 2003). In this paper, we adopt a design research perspective. To develop insight into how organizations can design ‘balanced’ business models, designers need to understand the design issues involved and their interdependencies. As yet, the vocabulary needed for design research, specifically with regard to designing business models, is not available. The same holds for insight into the causality between the design issues on the one hand, and performance of services and the business models that support these services on the other hand. This paper adds to this vocabulary by striving to develop a meta-theory on business model design and making causality between core concepts explicit. One of our core concepts is that of ‘critical design’ issues. A critical design issue is defined as a variable that is perceived (by practitioners and/or researchers) to be of eminent importance to the viability and sustainability of the business model under examination and it can be seen as a variable that can be manipulated by the afore-mentioned practitioners and/or researchers. The issues involved include organizational issues, including selecting partners and installing governance mechanisms, and financial issues, for instance investment planning and revenue sharing models. With regard to (mobile) business models, existing studies list a range of design issues or parameters (e.g., Ballon 2007; Methlie and Pedersen 2007; Osterwalder and Pigneur 2002). To our knowledge, there is no existing framework or empirical research in which the causal relationship between these design issues and the performance of business models has been tested on the basis of a large-scale, quantitative approach (Methlie and Pedersen 2007).

Furthermore, there are no standard tools to measure the performance of business models. In our view, the performance of a business model involves several aspects and it can be broken down into a number of success factors, which can be defined as “the limited number of areas in which satisfactory results will ensure that the business model creates value for the business network” (adapted from Rockart and Bullen 1981). The underlying assumption is that multiple actors have to work together in the mobile business domain to realize a business model that is feasible and viable for the shared network-based activities as well as the individual businesses. In a business network, firms will on the one hand work together to create value based on their common interests, while on the other hand competing to capture value based on their individual interests (Brandenburger and Nalebuff 1997). While some authors, for instance Porter’s five forces model (Porter 1985), emphasize the competitive element involved, others focus more on the cooperative element, for example industrial marketing and purchasing (e.g., Axelsson and Easton 1992). In our approach (Bouwman et al. 2008), we draw a distinction between success factors with regard to network value, and success factors with regard to customer value. In this paper, we focus on network value, which has to do with balancing the competitive and collaborative aspects, with the aim of realizing acceptable outcomes for the participating firms, in particular those that provide essential resources and capabilities. With regard to business model performance, we use the perceived acceptability of specific success factors involved as a proxy. If a business model fails to perform adequately in the eyes of the actors involved with regard to a specific success factor, the related critical design issues ought to be reconfigured.

In this paper, we test the causal relationships between the critical design issues and success factors with regard to mobile business models. More specifically, we examine the impact of organizational and financial design issues on the success factors that ultimately explain the value captured by the organizations offering a given service. We do so by analyzing the results of a survey among 120 practitioners and experts in the mobile Internet services domain, mainly from Europe and more specifically from the Netherlands. In “Theory and approach”, we address the theoretical background of business models and address our design approach. In “Method”, we present our research method and the way we measured the constructs. “Results” contains the results of the data analysis based on structural equation modelling. In “Limitations”, we address the limitations to our research and “Conclusions” presents our conclusions.

Theory and approach

Business models

In recent years, research in the area of business models has shifted from defining business models, via exploring business model components and classifying business models into categories, towards developing descriptive models (for an overview, see Pateli and Giaglis 2004). First of all, it is important to define what a business model is. We follow the definition suggested by Chesbrough and Rosenbloom (2002), that a business model is a blueprint for the way a business creates and captures value from new services or products. As such, a business model describes how a company or network of companies aims to make money (network value) and create consumer value (customer value) from a specific service offering (Bouwman et al. 2008; Haaker et al. 2006). A central element is that a viable business model should create both customer value and network value.

A business model contains several basic components. Many researchers (Afuah and Tucci 2003; Bagchi and Tulskie 2000; Klueber 2000; McGann and Lyytinen 2002; Tapscott et al. 2000; Timmers 2000; Weill and Vitale 2001) focus on business model elements, such as service and product innovation, the actors involved and their relationships, information and application architectures, and information and value exchange. According to Alt and Zimmermann (2001), there are a few elements that are common in business model definitions: mission, structure, process and revenues. Based on what a company has to offer, who it targets, how the proposition can be realized and how much can be earned, Osterwalder and Pigneur (2002) distinguish four basic elements: (1) product innovation; (2) customer relationship; (3) infrastructure management, and (4) financials. In a meta-study of existing literature, Morris et al. (2005) identified 24 different business model components. In a similar study, Shafer et al. (2005) identified 42 different business model components that can be clustered into four generic components, i.e. strategic choices, value network, value creation and value capturing. In our model, which is extensively motivated based on extensive literature research and a large number of cases, we focus on common components that can be assigned to four domains (Bouwman et al. 2008):

-

Service domain: a description of the value proposition (added value of a service offering) and the market segment at which the offering is aimed

-

Technology domain: a description of the technical functionality required to realize the service offering

-

Organization domain: a description of the structure of the multi-actor value network required to create and distribute the service offering and describe the focal firm’s position within this value network

-

Finance domain: a description of the way a value network intends to generate revenues from a particular service offering and of the way risks, investments and revenues are divided among the various actors in a value network

As we discussed earlier, decisions with regard to the critical design issues in these four domains affect customer and network value. In this paper, we are interested specifically in the network value, which is why we focus on the latter two domains, i.e. organization and finance, although we are aware of the interdependencies between all four domains, which is reflected in our approach. Before explaining how we relate critical design issues to success factors, we first discuss our approach to design science and how it is related to business model research.

Design approach

With the seminal Hevner et al. (2004) paper, design science attracted a lot of attention in Information Systems research. At that time, we were already engaged in designing business models. Although much has been written about design science from a number of different disciplines, as yet there is no vocabulary for design science, nor are the available theories directly related to design in IS research. Based on an extensive literature study on design research (Hevner et al. 2004; Horváth 2004; Verschuren and Hartog 2005), we concluded that, although existing design taxonomies, modelling, philosophies and epistemology, as well as various practical research approaches, can be related to the phases and artefacts of the design process, as yet theories that explain business model performance are to a large extent lacking. Based on our research on business models we came up with the concepts of critical design issue and critical success factor, and specified these concepts for all four business models domains. In our approach (for an extensive discussion, see Bouwman et al. (2008)), we began by developing a descriptive model to analyze business models, after which we developed a set of critical design issues based on extensive case study research (Haaker et al. 2006). In contrast to the common-sense issues every organization has in mind when developing a service, critical design issues genuinely affect the ultimate success of service innovation projects. We tested assumptions with regard to the relationship between critical design issues and performance of business models in a case survey, using existing cases that were available in a case repository (De Reuver et al. 2006). Next, we applied our design approach to various real-life design projects (Bouwman et al. 2008), using the critical design issue and success factor concepts we had developed earlier.

Because we focus on network value in this paper, we look at the two domains that are most directly related, i.e. the organizational and financial domains. We specify the relationship between critical design issues and success factor in the next section. We are aware that, for that reason, we do not discuss equally relevant concepts from the service and the technical domain, such as the critical design issues that are crucial for the service definition and the technical architecture. Nor do we pay attention to the regulatory, market-related and technical conditions under which the business models have to be developed, the role of entrepreneurship or the dynamics involved in the development of an idea to a mature, established service, with a business model that proves to be robust (for an extensive discussion of these issues, see Bouwman et al. 2008, De Reuver et al. 2006).

Organizational theory, design issues and success factors

As far as arrangements in the organization domain are concerned, we focus on value networks. To offer mobile services, several resources are needed. For instance, access is needed to the communication network used to transmit the services, as well as to the user handsets. In the case of information and entertainment services, value-adding content needs to be sourced, adapted and aggregated. Moreover, in most cases, IT-related resources of content adaptation platforms and applications running on the user device are needed to provide the service. Finally, access to users is required, including identification, authentication, positioning and billing. As Barney’s resource-based view (Barney 1991) asserts, the resources that are required are not evenly divided among organizations, nor is it possible simply to transfer them from one organization to another. This means that there is no single organization that possesses all the resources needed for a typical mobile service offering, and the operators, content providers and application developers need to work together. Pfeffer and Salancik’s resource dependency theory (Pfeffer and Salancik 1978) predicts that this heterogeneity of resources among organizations will make them interdependent, requiring them to work together.

While traditional strategic theories address the exchange of resources between actors in terms of a value chain (Porter 1985), this kind of an approach may not apply to the value networks examined in this paper. In the mobile business area, actors operate in different industries, and the exchange of resources rarely takes place in a linear manner within a traditional buyer/supplier relationship (Li and Whalley 2002). Moreover, as Allee (2000) argues, the intangible exchange of resources involving information and knowledge is at least as important as the tangible exchange that plays a central role in a value chain approach. It is, therefore, more appropriate to speak of a value network, i.e., a dynamic network of customer supplier partnerships and information flows (Bovel and Martha 2000).

While actors in value networks typically have one shared goal, i.e. developing and offering a service that adds value for customers, there may also be various conflicts and tensions that are triggered by the strategic interests of the players involved (Brandenburger and Nalebuff 1997). Such conflicts specially come to the surface in discussions about the roles that players want to fulfil. The concept of roles was first discussed by Barley (1990), who wrote about the importance of role-based approaches in analyzing organizations at an individual level. Kambil and Short (1994) extended this concept to the organizational level, defining roles as technologically separable value-adding activities in a business network. They argued in favour of analyzing business networks on the basis of the roles and relationships between the players involved.

Roles can be played by different actors, and individual actors can play various roles. The resources that a player offers have an effect on the roles that that player can fulfil in the value network. The division of the roles among the various players within a value network can be a source of conflict. For example, both content providers and operators will be interested in owning the customer, because billing customers provides advantages of additional revenues as well as more in-depth information on customer transactions and behaviour (Weill and Vitale 2001). As such, the way the roles are divided is the outcome of a decision-making process in which the relative clout of the various actors involved may play a role. This clout may be the result of asymmetric dependencies between actors (Pfeffer and Salancik 1978), which often becomes notable in the mobile business arena, where operators have many indispensable recourses related to network and customer access that content providers need. For these reasons, we expect the acceptable division of roles as perceived by the actors involved will be a success factor for mobile business models.

In the organization domain, we consider the design issues that we developed in Haaker et al. (2006). These design issues are based on extensive case study research and involvement in the design of mobile services and business models (Bouwman et al. 2008). Partner selection is important in acquiring access to the resources and capabilities needed to realize a service offering. The partners involved can play multiple roles and in many cases some of the partners involved can provide the same resources and capabilities, and therefore may be competing. Selecting the right partner for a specific role without upsetting other partners is an important issue. So, the more careful the partner selection process is handled, the more likely the division of roles between the partners involved is acceptable. Network openness indicates the degree to which new business actors can join a value network and are allowed to provide additional services to customers by other partners within the network. In the mobile domain, in particular the involvement of a number of content and service providers is an important issue when it comes to obtaining critical mass. Generally speaking, there are two different organizational arrangements for involving content and service providers: the closed model, in which a relatively fixed consortium of partners collaborate, and the walled garden model, in which new partners are able to join the value network if they comply with certain rules. The way collaboration is modelled: open or closed, will affect the acceptability of the division of roles. It can be expected that some actors prefer a closed model in which they can play a role in partner selection, above an open model where no influence can be exercised. Orchestration of activities is relevant, as there is often a dominant actor with access to the customers and end-users or one that developed the service offering. In such a hierarchical model, these business actors often approach and select network partners, set the rules for collaboration (organizational arrangements) and monitor compliance with these rules. On the other hand, in a more networked environment, collaboration and trust are more important in managing the relationship between partners. As such, managing relationships with partners (hierarchical versus networked) is relevant. These three critical design issues can be manipulated by the developers of the services to influence the success factor perceived acceptable division of roles. An acceptable division of roles, as perceived by the actors involved, refers to the distribution of roles among firms and the integration of roles within firms participating in the business network. We hypothesize that

-

H1 If organizational design issues related to (1) partner selection (who takes which roles), (2) collaboration between partners (open-closed) and (3) the way collaboration is governed (collectively or by a dominant partner) are addressed, the division of roles between partners will be perceived as more acceptable.

Finance, investment and risks: design issues and success factors

Financial resources are among the most important resources required by a value network. There are two main questions to be dealt with when designing a mobile service, i.e. who is going to invest and how can we make money. This means that investment decisions and revenue models play a central role in the discussion regarding the financial domain. There are a number of investment methods that are predominantly based on financial criteria (Demkes 1999; Renkema 1996; Van Oirsouw et al. 1993), including multi-criteria, ratio and portfolio approaches. Some methods go beyond the merely financial considerations, for example the balanced score cards (Kaplan and Norton 1992) and Value Prism (Neely et al. 2002), while the option theory is a more detailed elaboration of the net cash worth concept (Demkes 1999; Renkema 1996). Important issues in all these investments methods are the balance between costs, revenues, risks and pricing, that in the end will lead to a profitable service, as perceived by all the involved network partners. We will discuss these four elements shortly. Generally speaking, the cost side is reasonably well charted. The relative importance and absolute magnitude of cost drivers will vary from industry to industry, and from firm to firm. Exploiting and shaping these structural factors in defining the financial arrangements is very important (see for a detailed discussion Bouwman et al. 2008). The drivers involved are related to the internal relationships in a firm, to external factors and to the relationship between internal and external factors (Stabell and Fjeldstad 1998). The business logic of the value network and the individual cost drivers constitute a framework for analyzing and gaining insight into the cost structure.

The cost structure of most service businesses, including mobile services, is characterized by a high ratio of fixed up front costs to variable costs (Shapiro and Varian 1999) and by a high degree of cost sharing (such that the same facilities, equipment and people are used to provide multiple services) (Guiltinan 1987). High fixed costs typically lead to economies of scale, with increased production reducing the average production costs. Similarly, a high degree of cost-sharing leads to economies of scope, with providing a combination of different services leading to cost reductions. Modularity in the service architecture is a way of obtaining cost advantage, as components or modules may be shared by several services.

As far as the revenue side is concerned, which from our point of view includes realizing cost reductions as well as long-term advantages that stem from intangibles, literature is less uniform (Low and Cohen Kalafut 2002). Revenue models indicate which payment methods are used, what is being paid for, and thus how revenues are generated. Literature on income generation or revenue models is less articulated than that on business models. Moreover, business models are often confused with revenue models (see for instance Madhavan et al. 1998; Rappa 2000). Weill and Vitale (2001) distinguish between (1) payments for transactions, (2) payments for information and advice, payments for services and commissions and (3) advertisement-generated income and payments for referrals.

Revenues depend on the price associated with a service. In its simplest form, the price of a service is the amount of money a customer has to pay to use that service. In an extended definition, price refers to all the sacrifices customers have to make to obtain and use a service. In telecommunication services, for example, switching costs can be considerable. Pricing, i.e. setting prices for a product or service, is a dynamic process that takes internal and external factors into account, e.g. cost considerations and competition from alternative services.

Risks need some closer attention. In decision theory, risk is defined as consisting of two elements: the probability (or likelihood) of the occurrence of a negative event during the lifetime of a service, and the consequence of such an event occurring (Berdica 2002). Managers perceive risk in a less precise way. The key point is that dealing with risk is a balancing act in which both the positive and the negative aspects should be considered, taking the likelihood and subsequent consequences of an event into account. Risks associated with implementing new innovations are the risks associated with the availability of the new technology, standards (will the technology be standardized to allow for mass production to occur), the risk of irreversibility of the chosen technology path, the risk of the innovation becoming outdated and path dependency (future choices depend on paths chosen in the past). To determine the practical impact and risks involved, all these issues need to be taken into account.

Because financial incentives are important for the participation of firms in new business initiatives, the profitability and risks are success factors for the firms in the business network. Profitability should be acceptable in an absolute sense, that is to say a positive financial result that matches a company’s risk/return profile, and in a relative sense, that is compared to the financial results of the other participating firms. Financial design issues should result in an acceptable profitability.

In the financial domain, we consider the following design issues (for an extensive discussion, see Bouwman et al. 2008). With regard to the adoption and actual use of a service, the perceived customer value must at least be equal to but preferably exceed the pricing of a service. Because developing and introducing a new service involves financial risks, division of investments between the partners involved is another design issue, as is division of costs and revenues. The last may be based on different kinds of logic, for instance cost-based or value-based. The degree to which these issues are extensively discussed (and negotiated) affects the feasibility and viability of the outcomes. To arrive at fair and viable revenue-sharing arrangements, valuing the contributions and benefits of each partner to the service offering is important, e.g. based on their access to resources and strategic interests. Finally, investment planning over time is relevant, because it affects the risks and costs involved in the service offering. We hypothesize, that

-

H2 If financial design issues related to (1) pricing, (2) division of investments, and (3) of costs and revenues between the partners involved, as well as (4) the valuation of contributions and benefits of the partners involved, and (5) investment planning over time, are addressed, the expected profitability will be perceived as more feasible.

Addressing the same critical design issues are also relevant with regard to risk assessment. Acceptable risks are a success factor for mobile initiatives because of the high uncertainty with respect to market acceptance and technology-related choices. We hypothesize that

-

H3 If financial design issues related to (1) pricing, (2) division of investments, and (3) of costs and revenues between the partners involved, as well as (4) the valuation of contributions and benefits of the partners involved, and (5) investment planning over time, are addressed, the expected risks will be perceived as more controllable.

Ultimately, acceptable risks will lead to acceptable profitability. We hypothesize that

-

H4 Risks that are perceived as acceptable based on an extensive evaluation of the financial critical design issues will create the perception that profitability will be feasible.

We do not expect the success factors associated with organizational and financial issues to be independent. An acceptable division of roles will lead to a distribution of risks and more acceptable risk levels as risks are often related to different roles actors fulfil, i.e. actors with experience in a specific role are more likely to have a clear idea and a better assessment of potential complications and hazards. Therefore, we hypothesize that

-

H5 If the division of roles is perceived to be acceptable, the risks involved will be perceived as being more acceptable

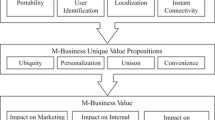

The conceptual model in Fig. 1 summarizes the propositions presented in this section.

In the next section we discuss the way we tested this model.

Method

We tested the hypotheses through survey research, in which we measured the constructs of the conceptual model independent of each other. In light of the concepts we want to study, we have to be aware that the respondents have different experiences, play different roles and desire different outcomes. To place the questions in their proper context, we asked the respondents to focus on the most important service offering in which they were involved most recently. Academic respondents were asked to focus on the most familiar service offering they had studied, and to adopt the point of view of the organization with which they were most familiar.

Sample

We collected the data between September and November 2007, using an online questionnaire.

Finding respondents for this type of survey is a challenge, because there is no database with all the relevant players in the mobile services industry. Respondents were recruited via social network sites that are relevant to professionals in the mobile telecommunication domain, such as Linkedin and Xing.

We took various measures to make sure that our respondents were sufficiently knowledgeable. First of all, we checked online social network site profiles for relevant key words (e.g. mobile, strategy, etc.) and experience in the mobile industry. Secondly, we sent out invitations prior to the actual survey with a clear explanation of the objectives and topics to be included in the survey, allowing potential respondents to assess whether or not it would be useful for them to participate. Thirdly, we sent invitations to specific e-mail addresses only, i.e. no general links or generic e-mail addresses were used. Fourthly, we asked respondents to think of specific service offerings and describe them, allowing us to verify the relevance of the services. Fifthly, we used multivariate outlier detection in the statistical analyses, which indicated no unusual patterns.

In total, we sent out 521 invitations were sent out, and received 137 responses. The reasons provided for not taking part in the survey were lack of time, lack of relevant expertise and lack of interest in the study. A specific group of non-respondents consisted of hardware providers and network manufacturers, who commented that they did not feel involved in mobile services, but only in technology platforms. Several academics also turned down our invitation, predominantly because they felt they had insufficient expertise to answer the detailed survey questions. To control for non-response bias, we compared the answers given by early and late respondents, and found no significant differences. Of the 137 respondents, 17 were removed, because they provided incomplete answers.

The final sample contained 120 respondents, of whom 77% came from industry, and 23% consisted of academics and consultancy experts. Although the survey targeted an international audience, most respondents are from the Netherlands (53%), although respondents from other countries and regions are also included, for instance Scandinavia, Germany, USA, Austria, UK, Italy, France, Latin-America, Australia and South-Africa. Our sample represents a wide variety of `most important services’, including advertising, banking, blogging, communication, e-mail, entertainment, adult services, games, health, Internet, location-based services, news, office, portal, radio, sports information, streaming, surveys, transport information, TV, user-generated content, weather information and workforce management. Of the total number of respondents, 30 adopted the point of view of a (virtual) network operator, 20 that of an application/software provider, 25 that of a consultancy firm, 28 that of a content/service provider, publisher or content aggregator, and only 3 that of a hardware/equipment manufacturer.

The organizations in our sample indicated that they interact on a day-to-day basis with no (29%), one (19%), two (21%), three (14%), four (4%), five (4%) or more (9%) organizations.

Measures

We used three to six indicators for each construct in the conceptual model. As illustrated in the previous section, a diverse range of services was included in our sample. Furthermore, the companies involved are very diverse as well (i.e. profits and not-for-profit companies, start-ups and established businesses, operators and content providers, large companies and small companies), which implies that it is hard to use and compare objective performance measures among the service concepts involved. In addition, some organizations may feel that tangible benefits are more important, while others may place greater value on intangible benefits. Moreover, the services could be in various phases of their lifecycle, and the measures of success are very different when comparing services in different phases of exploration or exploitation. We therefore chose to use perceived measures of success factors, rather than objective performance measures. This implies using adjectives like sufficient, acceptable and clear. A pragmatic reason to adopt this approach is that companies are generally reluctant to share objective profits and revenue figures, or unable to specify them for specific services. To measure the success factors, we followed the approach suggested by Martin and Larsen (1999), where respondents rate the importance of reaching underlying objectives.

The respondents were presented with the list of objectives in Table 1 and asked to rate the importance of these objectives with regard to their service offering on a Likert seven-point scale (Totally unimportant–Utmost important). We developed these indicators ourselves and pre-tested them in a survey among 30 respondents, and found the indicators clustered as expected in an exploratory factor analysis.

To measure the design issues, the respondents were presented with the list of issues in Table 2 and asked to rate the extent to which they had taken them into account, on a Likert seven-point scale (Not at all–Great extent). The indicators are identical to the design issues discussed in “Theory and approach”. The presentation of the items included a short explanation of the relevant core design choices.

To refine the measures, we conducted a confirmatory factor analysis using Amos 7.0, see Table 3. From the five-factor model, we subsequently removed items that load on multiple latent variables, as advised by Anderson and Gerbing (1988), based on standardized residuals and Modification Indices (MI). While refining the measurement model, we used an imputed dataset using expectation maximization in SPSS 15.0.

We retain this measurement model. Seven observations were removed with high departures from normality, based on Mahalanobis d 2 (p 2 < .001). We refit the measurement model with the original data using FIML, and find acceptable model fit: χ 2 (35) = 40.703, p = .234; CFI = .992; TLI = .984; RMSEA = .038. To solve a Heywood case, the variance of the error term to Roles_3 was constrained to 0.005 (Bagozzi and Yi 1988). Following the guideline suggested by Chen et al. (2001, pp. 503–504), we confirmed that the model is over-identified, that it converges without constraining the error variance to be positive, and that it contains no influential cases. As such, it is permissible to fix the error variance to 0.005.

Convergent validity is acceptable, as all factor loadings for each individual indicator in its respective construct are statistically significant (p < .001) and standardized regression weights exceed .5, see Table 4. In addition, for all latent variables we find average variance extracted exceeding the .5 benchmark (Fornell and Larcker 1981). With composite reliability exceeding the .6 benchmark, construct reliability is acceptable (Hair et al. 2006, p. 778).

Discriminant validity is acceptable, as we find the square of the correlation between two constructs to be smaller than the average variance extracted estimates of the two constructs (Fornell and Larcker 1981).

Results

We apply Structural Regression modelling, using Amos 7.0 to test the conceptual model from “Theory and approach”. The a priori model has an acceptable fit (χ 2(38) = 49.213, p = .105; CFI = .983; TLI = .971; RMSEA = .051). To obtain a parsimonious model, we remove the non-significant path from financial design issues to acceptable profitability. Residuals and modification indices do not suggest additional paths between the endogenous variables in the model. The final model has an acceptable fit (χ 2(39) = 49.617, p = .119; CFI = .984; TLI = .973; RMSEA = .049). The explained variance of the endogenous constructs is acceptable. See Fig. 2 for the model, from which the measurement part and errors are omitted for the sake of clarity.

We fixed the estimates of the errors to the endogenous constructs and one of the loadings for each latent variable. In terms of normality, critical ratio for skewness and kurtosis was found acceptable for most variables. Non-parametric bootstrapping indicates a robust overall model fit, as the p-value for the Bollen-Stinen statistic equals .215. Bias-corrected 95% confidence intervals indicate that most coefficients in the model are robust.

We find that our hypotheses are generally supported. Indeed, organizational design issues affect acceptable role division (H1). However, financial design issues do not affect acceptable profitability directly, although there is an indirect effect of .33 mediated by acceptable risks (H2). Financial design issues directly affect acceptable risks (H3). There is evidence to suggest that the success factors are related, as acceptable role division leads to acceptable risks (H5), which in turn affects acceptable profitability (H4).

Limitations

The limitations, which were already discussed in the theoretical part, imply that more attention needs to be paid to the role of design issues in the service (e.g., branding, targeting, customer retention) and technology domain (e.g., system integration, security, user profiling), as well as to the success factors explaining customer value (e.g., compelling value proposition, clear target group, acceptable quality of service delivery). However, some of the initial analyses indicate that design issues and success factors in these two domains may be very closely related. Although we are aware that our results are based on a convenience sample, we feel that there is no real viable alternative for collecting data. The sample is biased towards the Dutch mobile service industry sector. By repeating this research on an annual basis, as well as trying to involve the mobile industry sector in other countries, we hope to expand our study. A very important limitation has to do with the measurement tool. The success factors were measured by asking respondents to rate the importance of underlying objectives. While this is not uncommon to do so when studying success factors (e.g., Martin and Larsen 1999), items could be included to measure whether or not the intended objectives were actually reached. Moreover, objective measures, for instance profits or revenues, could be included instead of subjective perceptions, although in our experience the willingness among respondents to provide this kind of information, specifically with companies that are listed at the stock market, is low.

Conclusions

As far as we are aware, no frameworks are available in existing research on (mobile) information systems design that help understand the relationship between design choices and the outcome of the design process, i.e. the artefact. In our approach, we try to bridge this gap by introducing concepts such as critical design issues and success factors. We focus on mobile services and their underlying business models. In our research, we focus on the interrelation between four business models domains, i.e. service, technology, organization and financial. In this paper, we focus specifically on organizational and financial design issues. We find that, when organizational design issues relating to partner selection, openness, orchestration of activities and the way collaboration between partners is managed are more clearly addressed, the division of roles between partners will be perceived as being more acceptable. Financial design issues involving pricing, division of investments, costs and revenues between the partners involved, as well as the valuing of contributions and the planning of investments, lead to acceptable risks. However, profitability is influenced by these design issues only indirectly, as the relationships are mediated through acceptable risks and role division. The causalities found are supported by the model, alternative models with inversed causal relations proofed not to fit the data.

There are two success factors that appear to be relevant in explaining the value captured by service providers: the risks involved and the division of roles (i.e. who is doing what in the value web). To a large extent, this confirms discussions with regard to the evolution of value chains into value webs. In such a changing environment, the roles that different actors play, and will play in the future, have not yet been firmly established. Actors in a value web have to understand who is going to contribute what kind of resources and capabilities, as well as also who is going to provide specific generic services like authentication, billing, customer care and service management. We expect that, in the near future, clashes between different visions about how roles are to be divided among actors will become more relevant, mainly due to new technological developments in the mobile web services domain. These new mobile web services will enable content and service providers to control access to their customers, rather than leaving this to network operators. We expect that research in this area will also become more relevant.

The results of this study can be used to design, evaluate and refine existing and future mobile services and underlying business models. Researchers and practitioners can evaluate business models on the basis of the design issues and three success factors discussed in this paper. In case a success factor is insufficiently addressed, the results point to the design issues that should be addressed to improve business model performance. As a result, our findings can be used to streamline and focus business model design.

The empirical results presented in this paper also reinforce our confidence in the concepts of design issues and success factors. While conducting a rigorous confirmatory factor analysis, we found support for the dimensionality of both business model domains examined in this paper (i.e. organization and finance) and the success factors (i.e. acceptable profitability, risks and role division), which is an indication of the relevance and applicability of these concepts.

References

Afuah, A., & Tucci, C. (2003). Internet business models and strategies. Boston: McGraw-Hill.

Allee, V. (2000). The value evolution. Journal of Intellectual Capital, 1, 17–32.

Alt, R., & Zimmermann, H.-D. (2001). Preface: introduction to special section - business models. Electronic Markets, 11(1), 3–9.

Anderson, J. C., & Gerbing, D. W. (1988). Structural equation modeling in practice: a review and recommended two-step approach. Psychological Bulletin, 103(3), 411–423.

Axelsson, B., & Easton, G. (1992). Industrial networks, a new view of reality. London: Routledge.

Bagchi, S., & Tulskie, B. (2000). E-business Models: Integrating Learning from Strategy, Development Experiences and Empirical Research. Paper presented at the 20th Annual International Conference of the Strategic Management Society, Vancouver.

Bagozzi, R. P., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16(1), 76–94.

Ballon, P. (2007). Business modelling revisited: the configuration of control and value. Info, 9(5), 6–19.

Barley, S. R. (1990). The alignment of technology and structure through roles and networks—Technology, Organizations, and Innovation. Administrative Science Quarterly.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Berdica, K. (2002). An introduction to road vulnerability: what has been done, is done and should be done. Transport Policy, 9(2), 117–127.

Bouwman, H., Haaker, T., & De Vos, H. (2008). Mobile service innovation and business models. New York: Springer.

Bovel, D., & Martha, J. (2000). From supply chain to value net. The Journal of Business Strategy, Jul/Aug 2000, 24–28.

Brandenburger, A., & Nalebuff, B. (1997). Co-opetition. Strawberry Hills: Currency.

Chen, F., Bollen, K., Paxton, P., Curran, P., & Kirby, J. (2001). Improper solutions in structural equation models: causes, consequences, and strategies. Sociological Methods Research, 29(4), 468–505.

Chesbrough, H., & Rosenbloom, R. S. (2002). The role of the business model in capturing value from innovation: evidence from Xerox Corporation’s technology spin-off companies. Industrial and Corporate Change, 11(3), 529–555.

Demkes, R. (1999). COMET: a comprehensive methodology for supporting telematics in-vestment decisions. Enschede: Telematica Instituut.

De Reuver, M., Bouwman, H., & Haaker, T. (2006). Testing critical design issues and critical success factors during the business model life cycle. Paper presented at the 17th European Regional ITS Conference, Amsterdam, The Netherlands.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50.

Guiltinan, J. P. (1987). The price bundling of services: a normative framework. Journal of Marketing, 51(2), 74–85.

Haaker, T., Faber, E., & Bouwman, H. (2006). Balancing customer and network value in business models for mobile services. International Journal of Mobile Communications, 4(6), 645–661.

Hair, J. F., Black, B., Babin, B., Anderson, R. E., & Tatham, R. L. (2006). Multivariate data analysis. Upper Saddle River: Pearson Education.

Hedman, J., & Kalling, T. (2003). The business model concept: theoretical underpinnings and empirical illustrations. European Journal of Information Sciences, 12, 49–59.

Hevner, A. R., March, S. T., Park, J., & Ram, S. (2004). Design Science in Information Systems Research. MIS Quarterly, 28(1), 75–105.

Horváth, I. (2004). A treatise on order in engineering design research. Research in Engineering Design, 15(3), 155–181.

Kambil, A., & Short, J. (1994). Electronic integration and business network redesign: a roles-linkage perspective. Journal of Management Information Systems, 10(4), 59–83.

Kaplan, R., & Norton, D. (1992). The balanced scorecard: measures that drive performance. Harvard Business Review, January–February, 71–79.

Klueber, R. (2000). Business Model Design and Implementation for eServices. Paper presented at the Americas Conference on Information Systems, Long Beach, CA.

Li, F., & Whalley, J. (2002). Deconstruction of the telecommunications industry: from value chains to value networks. Telecommunications Policy, 26, 451–472.

Low, J., & Cohen Kalafut, P. (2002). Invisible advantage. How intangibles are driving business performance. Cambridge: Persues.

Madhavan, R., Koka, B. R., & Prescott, J. E. (1998). Networks in transition: how industry events (re)shape interfirm relationships. Strategic Management Journal, 19(5), 439–459.

Martin, B., & Larsen, G. (1999). Taming the tiger: key success factors for trade with China. Marketing Intelligence and Planning, 17, 202–208.

McGann, S., & Lyytinen, K. (2002). Capturing the Dynamics of eBusiness Models: The eBusiness Analysis Framework and the Electronic Trading Infrastructure. Paper presented at the 15th Annual Bled Electronic Commerce Conference, Bled, Slovenia.

Methlie, L. B., & Pedersen, P. E. (2007). Business model choices for value creation of mobile services. Info, 9(5), 70–86.

Morris, M., Schindehutte, M., & Allen, J. (2005). The entrepeneur’s business model: toward a unified perspective. Journal of Business Research, 58, 726–735.

Neely, A., Adams, C., & Kennerley, M. (2002). The performance prism. The scorecard for measuring and managing business success. London: Prentic Hall/Financial.

Osterwalder, A., & Pigneur, Y. (2002). An e-Business Model Ontology for Modeling e-Business. Paper presented at the 15th Bled Electronic Commerce Conference, Bled, Slovenia, June 17–19

Pateli, A. G., & Giaglis, G. M. (2004). A research framework for analyzing eBusiness models. European Journal of Information Sciences, 13, 302–314.

Pfeffer, J., & Salancik, G. R. (1978). The external control of organizations: a resource dependence perspective. New York: Harper & Row.

Porter, M. E. (1985). Competitive advantage; creating and sustaining superior performance. New York: Free.

Rappa, M. (2000). Business models on the web. Retrieved 23 February, 2006, from http://digitalenterprise.org/models/models.html, 13 February 2006

Renkema, T. (1996). Investeren in de Informatie-Infrastructuur. Richtlijnen voor besluit-vorming in organisaties (Investing in Information Infrastructure. Guidelines for Deci-sion making in Organisations). Deventer: Kluwer.

Rockart, J., & Bullen, C., (1981). A primer on Critical Success Factors. Center for Information Systems Research Working Paper No 69. Sloan School of Management, MIT, Cambridge

Seddon, P. B., & Lewis, G. P. (2003). Strategy and Business Models: What’s the Difference? Paper presented at the 7th Pacific Asia Conference on Information Systems, Adelaide, South Australia, 10–13 July.

Shafer, S. M., Smith, H. J., & Linder, J. C. (2005). The power of business models. Business Horizons, 48, 199–207.

Shapiro, C., & Varian, H. (1999). Information rules: A strategic guide to the network economy. Boston: Harvard Business School Press.

Stabell, C. B., & Fjeldstad, O. D. (1998). Configuring value for competitive advantage: on chains, shops, and networks. Strategic Management Journal, 19, 413–437.

Tapscott, D., Lowi, A., & Ticoll, D. (2000). Digital capital—harnessing the power of business webs. Boston: Havard Business School Press.

Timmers, P. (2000). Electronic commerce: strategies and business models for business-to-business trading. Chichester: Wiley.

Van Oirsouw, R., Spaanderman, J., & De Vries, H. (1993). Informatie-economie: investe-ringsstrategie voor de informatievoorziening (Information Economy: Investment Strategy for Data Processing). Schoonhoven: Academic Service.

Verschuren, P. J. M., & Hartog, R. (2005). Evaluation in design-oriented research. Quality & Quantity, 39(6), 733–762.

Weill, P., & Vitale, M. R. (2001). Place to space: migrating to e-business models. Boston: Harvard Business School Press.

Open Access

This article is distributed under the terms of the Creative Commons Attribution Noncommercial License which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Rolf T. Wigand

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License (https://creativecommons.org/licenses/by-nc/2.0), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

de Reuver, M., Bouwman, H. & Haaker, T. Mobile business models: organizational and financial design issues that matter. Electron Markets 19, 3–13 (2009). https://doi.org/10.1007/s12525-009-0004-4

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12525-009-0004-4