Abstract

Using unique data sets on German banks, we decompose their net interest margin and quantify the different components by estimating the costs of the various functions they perform. We investigate three major functions: liquidity and payment management for customers, bearing credit risk, and term transformation. For 2013, the costs of liquidity and payment management correspond, in the median, to 47% of the net interest margin, with bearing of credit risk and earnings from term transformation accounting for 12 and 37%, respectively.

Similar content being viewed by others

Notes

Bolt et al. (2012) also model banks’ net interest margin as a function of the past and current interest rates and expected loss rates. However, their data set is much less granular (no maturity breakdown and no industry breakdown), so that they have to rely heavily on simplifying assumptions. Even in our data set, we have no information about borrowers’ creditworthiness or about soft information, which is fundamental to the German “Hausbank” relationships (see Elsas and Krahnen 1998).

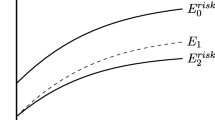

If we interpret the risk premium as a contribution to the unexpected loss in the Basel formula, the relationship between the probability of default (a measure for the expected losses) and the unexpected losses is not linear, but strictly monotonic increasing. In this context, Eq. (2) can be seen as an approximation. We refrain from a more sophisticated functional form so as to have a parsimonious model.

Our sample mostly consists of small and medium-sized banks that engage in little trading activity. For large banks, a significant part of the bond portfolio may belong to the trading book so that these bonds do not contribute to the interest income.

We prefer fixed effects to random effects, since the Hausman test has shown systematic differences between coefficients, indicating inconsistency of the coefficients in the random effects specification.

Some banks, most of them regional banks, did not report the number of ATMs, cards, and transactions; we treat these as missing values.

Large banks comprise “Landesbanken”, “big banks,” and central cooperative institutions. We chose this grouping because individual groups differ in their income ratios due to differences in business models.

For ease of readability, henceforth we use “industries” instead of “industries/sectors”.

We rely on specification II-b to calculate the operating expenses for the provision of liquidity and payment management, as time trend and interaction term do not play a significant role, but the differentiation between PAYMENTS-IN and PAYMENTS-OUT does provide further information.

This could be due to a short time horizon. Even in specification I, some banks face short time series as we control for mergers.

The shares of the variances that are due to the cross-sectional variation are 98.3% for the net interest margin, 97.6% for the loans’ credit risk, 96.9% for the bonds’ credit risk, 94.1% for the earnings from term transformation, 99.0% for the cost of payment and liquidity management, and 95.9% for the variable “Other.”

Correlations between variables and their squared terms in specification I and specification II are about 90%.

References

Alessandri, P., Nelson, B.: Simple banking: profitability and the yield curve. Bank of England Working Paper 452 (2012)

Angbazo, L.: Commercial bank net interest margins, default risk, interest-rate risk, and off balance sheet banking. J. Bank. Finance 21, 55–87 (1997)

Bliss, R.R.: Movements in the term structure of interest rates. Economic Review, Federal Reserve Bank of Atlanta, Fourth Quarter (1997)

Bolt, W., de Haan, L., Hoeberichts, M., van Oordt, M.R.C., Swank, J.: Bank profitability during recessions. J. Bank. Finance 36, 2552–2564 (2012)

Bos, J.W.B., Heid, F., Koetter, M., Kolari, J.W., Koos, C.J.M.: Inefficient or just different? Effects of heterogeneity on bank efficiency scores, Deutsche Bundesbank Discussion Paper 15/2005 (2005)

Carbó, S., Rodriguez, F.: The determinants of bank margins in European banking. J. Bank. Finance 31, 2043–2063 (2007)

Carhart, M.M.: On persistence in mutual fund performance. J. Finance 52(1), 57–82 (1997)

Costa, A.C.A., Nakane, M.I.: Revisiting the methodology for the bank interest spread decomposition in Brazil: an application of the theory of cost allocation (2005, unpublished manuscript)

De Bondt, O.: Interest rate pass-through: empirical result for the Euro area. Ger. Econ. Rev. 6(1), 37–78 (2005)

Deutsche Bundesbank.: Estimating the term structure of interest rates, Monthly Report, October 1997, pp. 61–66 (1997)

ECB.: Recent developments in the retail bank interest pass-through in the Euro area. ECB Mon. Bull., pp. 93–105 (2009)

Elsas, R., Krahnen, J.P.: Is relationship lending special? Evidence from credit file data. J. Bank. Finance 22, 1283–1316 (1998)

English, W.B.: Interest rate risk in the bank net interest margins. BIS Q. Rev. (2002)

English, W.B., Van den Heuvel, S., Zakrajsek, E.: Interest rate risk and bank equity valuations. Mimeo (2012)

Entrop, O., Memmel, C., Ruprecht, B., Wilkens, M.: Determinants of bank interest margins: impact of maturity transformation. J. Bank. Finance 54, 1–19 (2015)

Fama, E.F., French, K.R.: The cross-section of expected stock returns. J. Finance 47(2), 427–465 (1992)

Fiorentino E., Karmann, A., Koetter, M.: The cost efficiency of German banks: a comparison of SFA and DEA, Deutsche Bundesbank Discussion Paper 10/2006 (2006)

Georgievska, L., Kabashi, R., Manova-Trajkovska, N., Mitreska, A., Vaskov, M.: Determinants of lending interest rates and interest rates spreads. Bank of Greece Special Conference Paper 9 (2011)

Gunter, U., Krenn, G., Sigmund, M.: Macroeconomic, market and bank-specific determinants of net interest margins in Austria. Financial Stability Report Oesterreichische Nationalbank (2013)

Hauner, D.: Explaining efficiency differences among large German and Austrian banks. Appl. Econ. 37, 969–980 (2005)

Ho, T.S.Y., Saunders, A.: The determinants of bank interest margins: theory and empirical evidence. J. Financial Quant. Anal. 16, 581–600 (1981)

Koetter, M., Kolari, J.W., Spierdijik, L.: Enjoying the quiet life under regulation? Evidence from adjusted Lerner indices for U.S. banks. Rev. Econ. Stat. 94(2), 462–480 (2012)

Koetter, M., Poghosyan, T.: The identification of technology regimes in banking: implications for the market power-fragility nexus. J. Bank. Finance 33, 1413–1422 (2009)

Koetter, M., Vins, O.: The quiet life hypothesis in banking: Evidence from German savings banks. Working Paper Series: Finance and Accounting 190, Department of Finance, Goethe University Frankfurt am Main (2008)

Lepetit, L., Nys, E., Rous, P., Tarazi, A.: The expansion of services in European banking: implications for loan pricing and interest margins. J. Bank. Finance 32, 2325–2335 (2008)

Lozano-Vivas, A., Pasiouras, F.: The impact of non-traditional activities on the estimation of bank efficiency. J. Bank. Finance 34, 1436–1449 (2010)

Maudos, J., Fernández de Guevara, J.: Factors explaining the interest rate margin in the banking sectors of the European Union. J. Bank. Finance 28, 2259–2281 (2004)

Maudos, J., Solís, L.: The determinants of net interest income in the Mexican banking system: an integrated model. J. Bank. Finance 33, 1920–1931 (2009)

McShane, R.W., Sharpe, I.G.: A time/cross section analysis of the determinants of Australian trading bank loan/deposit interest margins: 1962–1981. J. Bank. Finance 9, 115–136 (1985)

Memmel, C.: Banks’ exposure to interest rate risk, their earnings from term transformation, and the dynamics of the term structure. J. Bank. Finance 35, 282–289 (2011)

Memmel, C., Schertler, A.: Banks’ management of the net interest margin: new measures. Financial Mark. Portf. Manag. 27(3), 275–297 (2013)

Saunders, A., Schumacher, L.: The determinants of bank interest rate margins: an international study. J. Int. Money Finance 19, 813–832 (2000)

Schlüter, T., Busch, R., Hartmann-Wendels, T., Sievers, S.: Loan pricing: do borrowers benefit from cost-efficient banking? Credit Cap. Mark. 49(1), 93–125 (2016)

Sharpe, W.F.: Capital asset prices: a theory of market equilibrium under condition of risk. J. Finance 19, 425–442 (1964)

Tortosa-Ausina, E.: Nontraditional activities and bank efficiency revisited: a distributional analysis for Spanish financial institutions. J. Econ. Bus. 55, 371–395 (2003)

Weth, M.A.: The pass-through from market interest rates to bank lending rates in Germany. Deutsche Bundesbank Discussion Paper 11/02 (2002)

Author information

Authors and Affiliations

Corresponding author

Additional information

The views expressed in this paper are those of the authors and do not necessarily reflect the opinions of the Deutsche Bundesbank. The authors thank Puriya Abbassi, Helmut Elsinger, Rodrigo Guimaraes, Peter Raupach, Benedikt Ruprecht, Alexander Schmidt, and the anonymous referee, as well as the participants of the Bundesbank seminar, the 17th SGF conference (2014, Zurich) and the conference “Achieving Sustainable Financial Stability” (2014, Berlin) for their helpful comments.

Appendix

Appendix

In this appendix, the weighting function \(h(\cdot )\) is derived, i.e., the function that shows how the past and current expected credit loss rates for an industry are to be weighted for the contribution to the net interest margin that covers the expected losses in a bank’s credit portfolios (see Eq. (1)). The expected loss rates \(\mu \left( {t_m ,j,m} \right) \) in \(t_m \) in industryj for newly granted loans with maturity m are relevant for today, i.e., at time t, for loans that were granted at time \(t_m \) and have not matured yet, i.e., \(m>v:=t-t_m \). We make two assumptions. First, the expected loss rate at time \(t_m \) is the same for all the loans in the initial maturity bracket under consideration, i.e., \(\mu \left( {t_m ,j,m} \right) =\mu _{t_m ,j,k} \). Second, the loan volume for a certain initial maturity m is spread equally across the maturity bracket k, i.e., \(g(m,a_k ,b_k )=1/(b_k -a_k )\), where \(g(\cdot )\) is the density, and \(a_k \) and \(b_k \) are the lower and upper bounds of the maturity bracket k, respectively. In a given time span \(\Delta t\), the fraction \(1/m\cdot \Delta t\) of loans with initial maturity m must be renewed to have a constant balance sheet. For \(1\le a_k <b_k \) and \(0\le v:=t-t_m <a_k \), the expression for the weighting function \(h(\cdot )\) is therefore

where \(v:=t-t_m \) is the time difference between today t and the point in time \(t_m \) in the past.

In the event that \(a_k \le v<b_k \), we can express \(h(\cdot )\) as

As we have only yearly data for the expected credit loss rates, we calculate the yearly average of the weighting function, i.e.,

For \(l\le a_k -1\), we obtain

and for \(a_k -1<l\le b_k -1\), the corresponding expression is

This can be seen using the formula \(\int {\ln (x)\mathrm{d}x=x\cdot \ln (x)-x+C} \). For the first maturity bracket, i.e., \(a_1 =0\) and \(b_1 =1\), the function \(h(\cdot )\) and its average \(h_{0,1} \) are set to 1. The values of the weighting function \(h_{l,k} \) are shown in Table 1.

Rights and permissions

About this article

Cite this article

Busch, R., Memmel, C. Quantifying the components of the banks’ net interest margin. Financ Mark Portf Manag 30, 371–396 (2016). https://doi.org/10.1007/s11408-016-0279-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11408-016-0279-3