Abstract

In the following article I not only aim at giving a comprehensive overview, but at integrating contemporary research on PE into a comprehensive model of PE investment. In doing so, I point out new avenues for future research and the methodological challenges. Finally, I attempt to look at the opportunities for interdisciplinary knowledge transfer to strategic management (SM) and international business (IB) research. I argue that the lessons of PE research offer a unique opportunity to (re)discover the “liabilities side” of strategy and international business.

Similar content being viewed by others

Notes

In the following article I use the term PE for institutional private equity funds only. As such it does not include investment by private individuals.

Previous literature reviews were mostly descriptive and concentrated on impact related PE studies (e.g. Peneder 2006; Lutz and Achleitner 2009; Strömberg 2009; Wood and Wright 2009; Wright et al. 2009b), on early stage VC or leveraged buyouts (e.g. St-Pierre et al. 2003; Landström 2007; Siegel et al. 2011), or solely on Anglo-American literature (e.g. Wright and Robbie 1998; Wright and Gilligan 2010; Metrick and Yasuda 2011).

The only comparable attempt familiar to the author was prominently made by Wright et al. (2009a), who explicitly stressed the need include “other theoretical explanations of PE-backed buyouts.” (Wright et al. 2009a, p. 371). In another paper, Wood and Wright (2009, p. 375) mention the financialization approach as an alternative to the governance dominance in PE research.

One study which explicitly considers the double-sided agency relationship is by Houben (2002).

This regional disparity is also evidenced in the naming of the official US interest group “National Venture Capital Association” (NVCA 2010). In this article I adhere to the European understanding of PE as the umbrella term which comprises the early stage VC segment as a subset.

The article was later picked up and counter stated by Rappaport (1990).

Although Jensen himself spoke of active investors like LBO partnerships at the time (Jensen 1989, p. 65).

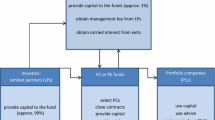

Strictly speaking the fund is only a special purpose company managed by the GP. For simplicity reasons I will not make this distinction throughout the article.

In addition to the contractual covenants regulating the management company’s investment decision, PE funds are usually supervised by an independent investment committee (Zahradnik 2003, p. 419).

They simulate that on average two thirds of the GP revenue stems from such fixed income components.

Such strategies relate, for example, to due diligence, diversification, monitoring, involvement and syndication.

Pecking order theory predicts that PFCs will only revert to costly PE finance after they have exhausted cheaper means of finance (Myers and Majluf 1984, p. 207). As a result, PE and traditional finance are not perfectly substitutable but complementary instruments. Due to this complementarity any regulatory intervention potentially changes the equilibrium and potentially leads to crowding out effects (e.g. Leleux and Surlemont 2003; European Commission 2005; Cumming and MacIntosh 2006; Peneder et al. 2006, p. 66).

Specialization usually relates to certain industries, regions or types of investments.

On the 11th of November 2010 the European Parliament (2010) introduced the Alternative Fund Managers Directive (AIFMD) limiting PE funds legal room of maneuver in asset stripping.

Shepherd et al. (2003) have found interesting evidence that PE experience may not necessarily improve decision making. The reason for this negative learning effect is a tendency towards overgeneralization, oversimplification and overfitting.

Accordingly, funds are often grouped into hands-on and hands-off investors (e.g. Sweeting and Wong 1997).

Regarding PE involvement, the German works of Schefczyk and Gerpott (1998) must be emphasized. In a very elaborate LSREL model on German VCs’ he demonstrated that the degree of involvement may not be as important as the kind of interaction. In a similarly elaborate study (Meier 2006, p. 114; Meier et al. 2006, p. 1050) found out that informal relationships, active participation of the VC, the use of external consultants and efficient management systems are associated with better PFC performance. Finally, Kranz (2008) analyzed gaps between actual and desired involvement.

The AIFM Directive will also include provision to limit the scope of debt-push-down (European Parliament 2010).

The author attributes this effect to opposing signals regarding ownership concentration. A similar study by Achleitner et al. (2010a) affirms positive short term wealth creation effects of PE announcements.

Phalippou and Gottschalg (2009, p. 1447) contest the view of persistent over-performance articulated by Kaplan and Schoar (2005) and find that this is only true due to unskilled LP allocation. In the case of sophisticated LPs, previous fund performance loses its predictive capacity (Phalippou 2010, p. 577).

More optimistically, Achleitner (2009, p. 2) estimates that 66 % of PE return is attributable to operational improvements. A very interesting, but methodologically disputable study by Meerkatt et al. (2008) has attempted a longitudinal view of PE return. Supposedly the 1980s were characterized by a high reliance on leverage, while the boom years of the 1990s were driven by multiples expansion. From the millennium until the financial crisis in 2008 PE funds benefited from global earnings growth. The authors predict that margin improvements will be the most important post-crisis success factors (Meerkatt et al. 2008, p. 13).

A similar attempt was recently made by Siegel et al. (2011).

Matched sample studies are sometimes combined with two-step regressions based on Heckman (1979).

Müllner (2012) applies a novelty approach and combines objective performance measures with subjective matching by asking PFC management for their “main competitor” and conducting a subsequent matched-sample study.

Such immense challenges have prompted Lockett et al. (2008, p. 47) to state that: “…measuring does not accurately represent the interaction between the VC firm and the investee. …actually asking the investee firm what assistance they received …is a potential solution to this problem”.

An interesting, and largely ignored, group of investors are, for example, sovereign wealth funds (SWFs) (see International Monetary Fund 2008). Due to their unique governance setting, SWF could be valuable in explaining, the institutional antecedents of PE heterogeneity.

One such study was made by Bharath and Dittmar (2010), who analysed the different motivations of firms attempting a public-to-private and firms deciding to stay quoted. In another study, Achleitner et al. (2010b) model the propensity of being taken over by a PE as a function of incumbent shareholder monitoring and control.

As Acharya et al. (2009, p. 38) noted: “…considerable interest remains in understanding in greater depth the nature of engagement and involvement of PE houses with portfolio companies and providing more robust evidence on how theses relate to value creation.”

This assessment is also shared prominently by Siegel et al. (2011, p. 193) who demand more case-study based research.

One such attempt was made by Ruhnka et al. (1992) who analyzed the dynamics of what he termed the “living dead phenomenon”.

Lockett et al. (2008, p. 55) agree and demand that “future research should provide a more nuanced understanding of the precise nature of VC resources in relation to internationalization activities.”

The current edition of the AIFMD Directive of the European parliament has, for example, been heavily criticised for not differentiating between different types of funds (EVCA 2009b).

Less optimistically, Kaplan and Strömberg (2009, p. 137) predicts “years that will prove disappointing for PE”. However, in a following paper they see “little that makes us believe that the VC model has changed or is broken” (Kaplan and Lerner 2010, p. 46). Different post-crisis scenarios are discussed by Lerner (2011).

References

Acharya VV, Hahn M, Kehoe C (2009) Corporate governance and value creation: evidence from private equity. Centre for Economic Policy Research. CEPR discussion paper No 7242. London

Achleitner A-K (2009) Wertschöpfung in Private Equity nicht nur von Fremdkapital abhängig (Value creation in private equity is not only dependent on leverage). Capital Dynamics. Medienmitteilung, Frankfurt am Main

Achleitner A-K, Andres C, Betzer A, Weir C (2010a) Wealth effects of private equity investments on the German stock market. Eur J Finance 17(3):217–239

Achleitner A-K, Betzer A, Goergen M, Hinterramskogler B (2010b) Private equity acquisitions of continental European firms: the impact of ownership and control on the likelihood of being taken private. Eur Financ Manag. doi:10.1111/j.1468-036X.2010.00569

Achleitner A-K, Braun R, Engel N, Figge C, Tappeiner F (2009) Wertsteigerungshebel in Private Equity-Transaktionen (Value creation in private equity transactions). Centre for Entrepreneurial and Financial Studies (CEPS) and Capital Dynamics. Consultants, München

Achleitner A-K, Klöckner O (2005) Employment contribution of private equity and venture capital in Europe. European Private Equity and Venture Capital Association (EVCA) and the Center for Entreprenurial and Financial Studies, Brussels

Admati AR, Pfleiderer P (1994) Robust financial contracting and the role of venture capitalists. J Finance 49(2):371–402

Agmon T (2006) Bringing financial economics into international business research: taking advantage of a paradigm change. J Int Bus Stud 37(5):575–577

Amess K (2002) Management buyouts and firm-level productivity: evidence from a panel of UK manufacturing firms. Scott J Polit Econ 49(3):304–317

Amess K, Wright M (2007a) Barbarians at the gate? Leveraged buyouts, private equity and jobs. Working paper—SSRN eLibrary. Nottingham University Business School

Amess K, Wright M (2007b) The wage and employment effects of leveraged buyouts in the UK. Int J Econ Bus 14(2):179–195

Amess K, Wright M (2012) Leveraged buyouts, private equity and jobs. Small Bus Econ 38(4):419–430

Amit R, Brander J, Zott C (1998) Why do venture capital firms exist? Theory and Canadian evidence. J Bus Venturing 13(6):441–466

Amit R, Glosten L, Muller E (1990) Does venture capital foster the most promising entrepreneurial firms? Calif Manag Rev 32(3):102–111

Axelson U, Strömberg P, Weisbach MS (2009) Why are buyouts levered? The financial structure of private equity funds. J Finance 64(4):1549–1582

Bacon N, Wright M, Meuleman M, Scholes L (2012) The impact of private equity on management practices in European buy-outs: short-termism, Anglo-Saxon, or host country effects? Ind Relat 51:605–626

Bacon N, Wright M, Scholes L, Meuleman M (2010) Assessing the impact of private equity on industrial relations in Europe. Hum Relat 63(9):1343–1370

Baker GP, Wruck KH (1989) Organizational changes and value creation in leveraged buyouts: the case of the OM Scott & Sons Company. J Financ Econ 25(2):163–190

Balboa M, Martí J (2007) Factors that determine the reputation of private equity managers in developing markets. J Bus Venturing 22(4):453–480

Bank D (2006) Deutsche Bank eröffnet Filiale im DIFC in Dubai (Deutsche bank opens office in DIFC in Dubai). Deutsche Bank. Accessed on 29.05.2012. Frankfurt am Main

Barney JB, Busenitz LW, Fiet JO, Moesel D (1994) The relationship between venture capitalists and managers in new firms: determinants of contractual covenants. Manag Finance 20(1):19–30

Barney JB, Busenitz LW, Fiet JO, Moesel DD (1996) New venture teams’ assessment of learning assistance from venture capital firms. J Bus Venturing 11(4):257–272

Barry CB, Muscarella CJ, Peavy JW, Vetsuypens MR (1990) The role of venture capital in the creation of public companies: evidence from the going-public process. J Financ Econ 27(2):447–471

Bascha A, Walz U (2000) Hybride Finanzierungsinstrumente als Anreiz- und Kontrollmechanismen bei Venture Capital (Hybrid financial instruments as incentive and control mechanisms). Finanzbetrieb 6(1):410–418

Bascha A, Walz U (2001) Convertible securities and optimal exit decisions in venture capital finance. J Corp Finance 7(3):285–306

Baum JA, Silverman BS (2004) Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology startups. J Bus Venturing 19(3):411–436

Baygan G, Freudenberg M (2000) The internationalisation of venture capital activity in OECD countries: Implications for measurement and policy. OECD Science, Technology and industry working papers. Organisation for Economic Co-operation and Development. Paris

Becker A (2009) Private Equity Buyout Fonds – Value Creation in Portfoliounternehmen (Private equity buyout funds—value creation in portfolio companies). Bank- und finanzwirtschaftliche Forschungen. Haupt Verlag, Bern

Belke AH, Fehn R, Foster N (2003) Does venture capital investment spur employment growth? CESIFO Working paper. University of Hohenheim, Hohenheim

Berg A, Gottschalg O (2003) Understanding value generation in buyouts. INSEAD Working paper series. Witten Herdecke University, Frankfurt am Main

Berger A, Udell G (1998) The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. J Bank Finance 22(6–8):613–673

Bernstein S, Lerner J, Sorensen M, Stromberg P (2009) Private equity and industry performance. Working paper—SSRN eLibrary. Stanford Graduate School of Business

Bertoni F, Colombo MG, D’Adda D, Grilli L (2010) VC financing and the growth of new technology-based firms: correcting for sample self-selection. VICO research papers. Politecnico Milano, Milano

Bertoutsos A, Freeman A, Kehoe CF (2007) What public companies can learn from Private Equity. McKinsey on Finance 22(Winter):1–12

Bharath ST, Dittmar AK (2010) Why do firms use private equity to opt out of public markets? Rev Financ Stud 23(5):1771–1818

Bigus J (2006) Staging of venture financing, investor opportunism and patent law. J Bus Finance Account 33(7–8):939–960

Birmingham C, Busenitz LW, Arthurs JD (2003) The escalation of commitment by venture capitalists in reinvestment decisions. Venture Capital 5(3):217–231

Bloom N, Sadun R, Van Reenen J (2009) Do private equity owned firms have better management practices? CEP occasional papers. Centre for Economic Performance, London School of Economics and Political Science, London

Bottazzi L, Da Rin M (2002) Venture capital in Europe and the financing of innovative companies. Econ Policy 17(34):229–269

Bottazzi L, Da Rin M, Hellmann T (2008) Who are the active investors? Evidence from venture capital. J Financ Econ 89(3):488–512

Boucly Q, Sraer D, Thesmar D (2009) Job creating LBOs. Working paper—SSRN eLibrary. HEC Paris, Paris

Bowe M, Filatotchev I, Marshall A (2010) Integrating contemporary finance and international business research. Int Bus Rev 19(5):435–445

Brander JA, Amit R, Antweiler W (2002) Venture-capital syndication: Improved venture selection vs. the value-added hypothesis. J Econ Manag Strategy 11(3):422–451

Brav A, Gompers PA (1997) Myth or reality? The long-run underperformance of initial public offerings: Evidence from venture and nonventure capital-backed companies. J Finance 52(5):1791–1821

Brettel M (2001) Entscheidungskriterien von Venture Capitalists – Eine empirische Analyse (Decision criteria by venture capitalists—an empirical analysis). WHU-Forschungspapier 82

Brinkrolf A (2002) Managementunterstützung durch Venture-Capital Gesellschaften – eine Untersuchung des nichtfinanziellen Beitrags von Venture-Capital-Gesellschaften bei der Entwicklung ihrer Portfoliounternehmen (Management support by venture capital funds—an analysis of the non-financial contributions to the development of portfolio companies). Thesis, St. Gallen University, St. Gallen

Bruno AV, Tyebjee TT (1985) The entrepreneur’s search for capital. J Bus Venturing 1(1):61–74

Bruton GD, Filatotchev I, Chahine S, Wright M (2010) Governance, ownership structure, and performance of IPO firms: the impact of different types of private equity investors and institutional environments. Strateg Manag J 31(5):491–509

Bull I (1989) Financial performance of leveraged buyouts: an empirical analysis. J Bus Venturing 4(4):263–279

Burgel O, Fier AH, Licht G, Murray GC (2000) Internationalisation of high-tech start-ups and fast growth—Evidence for UK and Germany. Working paper—SSRN eLibrary. London Business School, London

Busenitz LW, Fiet JO, Moesel DD (2004) Reconsidering the venture capitalists’ “value added” proposition: an interorganizational learning perspective. J Bus Venturing 19(6):787–807

Bygrave WD (1988) The structure of the investment networks of venture capital firms. J Bus Venturing 3(2):137–157

Carter RB, Van Auken HE (1994) Venture capital firms’ preference for projects in particular stages of development. J Small Bus Manag 32(1):60–73

Casamatta C (2002) Financing and advising: optimal financial contracts with venture capitalists. Working paper—SSRN eLibrary. TSE-University of Toulouse, Toulouse

Casamatta C, Haritchabalet C (2003) Learning and syndication in venture capital investments. Working paper—SSRN eLibrary. University of Toulouse, Toulouse

Caselli S, Gatti S, Perrini F (2009) Are venture capitalists a catalyst for innovation? Eur Financ Manag 15(1):92–111

Chan Y-S (1983) On the positive role of financial intermediation in allocation of venture capital in a market with imperfect information. J Finance 38(5):1543–1568

Chemmanur TJ (2010) Venture capital, private equity, IPOs, and banking: an introduction and agenda for future research. J Econ Bus 62(6):471–476

Cornelius P, Juttmann K, De Veer R (2009) Industry cycles and the performance of buyout funds. J Priv Equity 12(4):14–21

Cornelli F, Yosha O (2003) Stage financing and the role of convertible securities. Rev Econ Stud 70(242):1–32

Cossin D, Leleux B, Saliasi E (2002) Understanding the economic value of legal covenants in investment contracts: a real options approach to venture equity contracts. Working paper—SSRN e Library. University of Lausanne, Lausanne

Cotter JF, Peck SW (2001) The structure of debt and active equity investors: the case of the buyout specialist. J Financ Econ 59(1):101–147

Cressy RC, Munari F, Malipiero A (2007a) Creative destruction? UK evidence that buyouts cut jobs to raise returns. Working paper—SSRN eLibrary. Birmingham Business School, Birmingham Business School

Cressy RC, Munari F, Malipiero A (2007b) Playing to their strengths? Evidence that specialization in the private equity industry confers competitive advantage. J Corp Finance 13(4):647–669

Cumming D, Fleming G, Suchard J-A (2005) Venture capitalist value-added activities, fundraising and drawdowns. J Bank Finance 29(2):295–331

Cumming DJ (2005) Agency costs, institutions, learning, and taxation in venture capital contracting. J Bus Venturing 20(5):573–622

Cumming DJ (2006) Provincial preferences in private equity. Financ Mark Portf Manag 20(4):369–398

Cumming DJ, Johan S (2007) Regulatory harmonization and the development of private equity markets. J Bank Finance 31(10):3218–3250

Cumming DJ, MacIntosh JG (2006) Crowding out private equity: Canadian evidence. J Bus Venturing 21(5):569–609

Darwin VN (1999) Staged financing: an agency perspective. Rev Econ Stud 66(227):255–275

Davila A, Foster G, Gupta M (2003) Venture capital financing and the growth of startup firms. J Bus Venturing 18(6):689–708

Davis SJ, Haltiwanger J, Jarmin R, Lerner J, Miranda J (2008) Private equity and employment. World Economic Forum. The global economic impact of private equity report 2009—Globalization of alternative investments working papers, vol 1, Geneva

Davis SJ, Haltiwanger J, Jarmin R, Lerner J, Miranda J (2009) Private equity, jobs and productivity. World economic forum. The global economic impact of private equity report 2009—Globalization of alternative investments working papers, vol 2, Geneva

De Clercq D, Dimov D (2003) A knowledge-based view of venture capital firms’ portfolio investment specialization and syndication. Working paper. Babson College, Wellesley

De Clercq D, Dimov DP (2004) Explaining venture capital firms’ syndication behaviour: a longitudinal study. Venture Capital 6(4):243–256

De Clercq D, Sapienza HJ (2006) Effects of relational capital and commitment on venture capitalists’ perception of portfolio company performance. J Bus Venturing 21(3):326–347

De Maeseneire W, Claeys T (2012) SMEs, foreign direct investment and financial constraints: the case of Belgium. Int Bus Rev 21(3):408–424

Demiroglu C, James CM (2010) The role of private equity group reputation in LBO financing. J Financ Econ 96(2):306–330

Diller C, Kaserer C (2009) What drives private equity returns?—Fund inflows, skilled GPs, and/or risk? Eur Financ Manag 15(3):643–675

Dimov D, De Clercq D (2006) Venture capital investment strategy and portfolio failure rate: a longitudinal study. Entrep Theory Pract 30(2):207–223

Dimov D, Shepherd DA, Sutcliffe KM (2007) Requisite expertise, firm reputation, and status in venture capital investment allocation decisions. J Bus Venturing 22(4):481–502

Ehrlich SB, De Noble AF, Moore T, Weaver RR (1994) After the cash arrives: a comparative study of venture capital and private investor involvement in entrepreneurial firms. J Bus Venturing 9(1):67–82

Engel D (2002) The impact of venture capital on firm growth: an empirical investigation. Zentrum für Europäische Wirtschaftsforschung GmbH. ZEW-Discussion Paper, Mannheim

Engel D, Keilbach M (2002) Firm level implications of early stage venture capital investment—an empirical investigation. Zentrum für Europäische Wirtschaftsforschung GmbH; ZEW Discussion Paper, Mannheim

European Commission (2005) Working group on venture capital—final report. United States Department of Commerce International Trade Administration and the European Commission Directorate General for Enterprise and Industry, Brussels/Washington

European Commission (2006) White paper on enhancing the single market framework for investment funds. European Commission, Brussels

European Commission (2007a) Bringing down the barriers to SME finance. European Commission—Enterprise and Industry Directorate General, Brussels

European Commission (2007b) Expert group report on removing obstacles to cross-border investments by venture capital funds. Directorate general enterprise and industry. Brussels

European Parliament (2010) Directive of the European Parliament and the Council on Alternative Investment Fund Managers and amending directives—2003/41/EC and 2009/65/EC and Regulation (EU) No …/2010 [ESMA]. European Parliament, Brussels

EVCA (2009a) 2009 EVCA yearbook—Pan-European private equity & venture capital activity report. European Private Equity and Venture Capital Association (EVCA), Brussels

EVCA (2009b) European private equity & venture capital industry—response to the proposed directive of the European Parliament and Council on Alternative Investment Fund Managers (AIFM). European Private Equity and Venture Capital Association. Policy paper. Brussels

EVCA (2012) Online glossary-private equity. European Venture Capital Association. http://www.evca.eu/toolbox/glossary.aspx?id=982. Zaventem

Fernhaber SA, McDougall-Covin PP (2009) Venture capitalists as catalysts to new venture internationalization: the impact of their knowledge and reputation resources. Entrep Theory Pract 33(1):277–295

Filatotchev I, Wright M, Mufit A (2006) Venture capitalists, syndication and governance in initial public offerings. Small Bus Econ 26:337–350. doi:10.1007/s11187-005-2051-3

Florin J (2005) Is venture capital worth it? Effects on firm performance and founder returns. J Bus Venturing 20(1):113–135

Fluck Z, Garrisom K, Myers SC (2005) Venture capital contracting and syndication: an experiment in computational corporate finance. NBER working paper series. National Bureau of Economic Research. Washington

Folta TB, Janney JJ (2002) Strategic benefits to firms issuing private equity placements. Strateg Manag J 25(3):223–242

Franke N, Gruber M, Harhoff D, Henkel J (2006) What you are is what you like-similarity biases in venture capitalists’ evaluations of start-up teams. J Bus Venturing 21(6):802–826

Fredriksen Ö, Olofsson C, Wahlbin C (1997) Are venture capitalists firefighters? A study of the influence and impact of venture capital firms. Technovation 17(9):503–511

Fried VH, Bruton GD, Hisrich RD (1998) Strategy and the board of directors in venture capital-backed firms. J Bus Venturing 13(6):493–503

Fried VH, Hisrich RD (1988) Venture capital research: past, present and future. Entrep Theory Pract 13(1):15–28

Fried VH, Hisrich RD (1994) Toward a model of venture capital investment decision making. J Finan Manag Assoc 23(3):28–37

Fried VH, Hisrich RD (1995) The venture capitalist: a relationship investor. Calif Manag Rev 37(2):101–113

Fried VH, Polonchek A (1993) Venture capitalists’ investment criteria: a replication. J Small Bus Finance 3(1):37–42

Friedman T (2010) 2009 Prequin global private equity review. Prequin alternative assets data. New York

Gietl R, Landau C, Hungenberg H (2008) Einflussnahme von Private Equity-Gesellschaften auf ihre Portfoliounternehmen und deren Entwicklung nach einem Buyout (Involvement of private equity investors in their portfolio companies and their post-buyout development). Working paper. Universität Erlangen-Nürnberg, Nürnberg

Gilson RJ, Schizer DM (2003) Understanding venture capital structure: a tax explanation for convertible preferred stock. Harvard Law Rev 116(3):874

Goergen M, O’Sullivan N, Wood G (2011) Private equity takeovers and employment in the UK: some empirical evidence. Corporate Governance: An International Review 19(3):259–275

Gompers PA (1996) Grandstanding in the venture capital industry. J Financ Econ 42(1):133–156

Gompers PA, Kovner A, Lerner J, Scharfstein D (2006) Skill vs. luck in entrepreneurship and venture capital: evidence from serial entrepreneurs. NBER working paper series. National Bureau of Economic Research, Washington

Gompers PA, Lerner J (1996) The use of covenants: an empirical analysis of venture partnership agreements. J Law Econ 39(2):463–498

Gompers PA, Lerner J (1998) Venture capital distributions: short-run and long-run reactions. J Finance 53(6):2161–2184

Gompers PA, Lerner J (1999a) An analysis of compensation in the US venture capital partnership. J Financ Econ 51(1):3–44

Gompers PA, Lerner J (1999b) Conflict of interest in the issuance of public securities: evidence from venture capital. J Law Econ 42(1):1–28

Gompers PA, Lerner J (1999c) What drives venture capital fundraising? Working paper—SSRN eLibrary. Harvard Business School, Boston

Gompers PA, Lerner J (2000) Money chasing deals? The impact of fund inflows on private equity valuation. J Financ Econ 55(2):281–325

Goossens L, Manigart S, Meuleman M (2008) The change in ownership after a buyout: impact on performance. J Priv Equity 12(1):31–41

Gorman M, Sahlman WA (1989) What do venture capitalists do? J Bus Venturing 4(4):231–248

Gottschalg O, Groh A (2006) The risk-adjusted performance of US buyouts. Working paper. Darmstadt University of Technology, Darmstadt

Gottschalg O, Kress B (2007) Grenzen des Debt-Push-Down (Limits of debt-push-down). Jahrbuch für Unternehmensfinanzierung. ConVent and Bundesverband deutscher Kapitalbeteiligungsgesellschaften (BVK), Frankfurt am Main

Gottschalg O, Zipser D (2006) Money chasing deals and deals chasing money—the impact of supply and demand on buyout performance. Working paper. HEC Management School, Paris

Gottschalg O, Zollo M, Loos N (2004) Working out where the value lies. Eur Venture Capital J June(01):36–39

Grabenwarter U, Weiding T (2005) Exposed to the j-curve: understanding and managing private equity fund investments. Euromoney Books, London

Greene PG, Brush CG, Hart MM, Saparito P (2001) Patterns of venture capital funding: is gender a factor? Venture Capital 3(1):63–83

Greg Bell R, Filatotchev I, Rasheed A (2012) The liability of foreignness in capital markets: sources and remedies. J Int Bus Stud 43(2):107–122

Guo S, Hotchkiss ES, Song W (2007) Do buyouts (still) create value? Working paper—SSRN eLibrary. Boston College—Carroll School of Management, Cincinnati

Guo S, Hotchkiss ES, Song W (2011) Do buyouts (still) create value? J Finance 66(2):479–517

Haagen F (2008) Determinants of venture capital contract design in Germany: convertible securities vs preferred equity and silent partnerships. Österreichisches Bank Archiv 7:485–495

Hall J, Hofer CW (1993) Venture capitalists’ decision criteria in new venture evaluation. J Bus Venturing 8(1):25–42

Harris R, Siegel DS, Wright M (2005) Assessing the impact of management buyouts on economic efficiency: plant-level evidence from the United Kingdom. Rev Econ Stat 87:148–153

Hass WJ, Pryor Iv SG (2009) What public companies can learn from private equity: pursue the value journey. J Priv Equity 12(3):20–28

Hassan A, Leece D (2008) The influence of venture capitalists’ source of finance on their post-investment behavior in investee companies. J Priv Equity 11(3):69–84

Heckman JJ (1979) Sample selection bias as a specification error. Econometrica 47(1):153–161

Hellmann TF (1998) The allocation of control rights in venture capital contracts. Rand J Econ 29(1):57–76

Hellmann TF (2006) IPOs, acquisitions, and the use of convertible securities in venture capital. J Financ Econ 81(3):649–679

Hellmann TF, Puri M (2002) Venture capital and the professionalization of start-up firms: empirical evidence. J Finance 57(1):169–197

Hochberg YV, Ljungqvist A, Lu Y (2010) Networking as a barrier to entry and the competitive supply of venture capital. J Finance 65(3):829–859

Holmstrom B, Milgrom P (1991) Multitask principal-agent analyses: incentive contracts, asset ownership, and job design. J Law Econ Organ 7:24–52 (Special Issue, Papers from the Conference the New Science of Organization)

Houben E (2002) Venture capital, double-sided adverse selection, and double-sided moral hazard. Working paper—SSRN eLibrary. University of Kiel, Kiel

Hsu Y (2011) Staging of venture capital investment: a real options analysis. Working paper—SSRN eLibrary. National Taiwan University, Department of International Business, Taipeh

Hyytinen A, Toivanen O (2003) Asymmetric information and the market structure of the venture capital industry. J Financial Services Res 23(3):241

International Monetary Fund (2008) Sovereign wealth funds—generally accepted principles and practices—“Santiago Principles”. International Monetary Fund, Washington

Jain BA, Kini O (1995) Venture capitalist participation and the post-issue operating performance of IPO firms. Manage Decis Econ 16(6):593–606

Jelic R, Wright M (2011) Exits, performance, and late stage private equity: the case of UK management buy-outs. Eur Financ Manag 17(3):560–593

Jensen MC (1989) Eclipse of the public corporation. Harv Bus Rev 67(5):61–74

Kaplan SN (1989a) The effects of management buyouts on operating performance and value. J Financ Econ 24(2):217–254

Kaplan SN (1989b) Management buyouts: Evidence on taxes as a source of value. J Finance 44(3):611–632

Kaplan SN (1991) The staying power of leveraged buyouts. J Financ Econ 29(2):287–313

Kaplan SN, Lerner J (2010) It ain’t broke: the past, present, and future of venture capital. J Appl Corp Finance 22(2):36–47

Kaplan SN, Martel F, Strömberg P (2007) How do legal differences and experience affect financial contracts? J Financ Intermed 16(3):273–311

Kaplan SN, Schoar A (2005) Private equity performance: returns, persistence, and capital flows. J Finance 60(4):1791–1823

Kaplan SN, Strömberg P (2001) Venture capitalists as principals: contracting, screening, and monitoring. Am Econ Rev 91(2):426–430

Kaplan SN, Strömberg P (2003) Financial contracting theory meets the real world: an empirical analysis of venture capital contracts. Rev Econ Stud 70(243):281–315

Kaplan SN, Strömberg P (2004) Characteristics, contracts, and actions: evidence from venture capitalist analyses. J Finance 59(5):2177–2210

Kaplan SN, Strömberg P (2009) Leveraged buyouts and private equity. J Econ Perspect 23(1):121–146

Kearney AT (2007) Creating jobs and value with private equity—All companies can learn from the strategies employed by PE firms. AT Kearney Research Papers. Chicago

Knight RM (1994) Criteria used by venture capitalists: a cross cultural analysis. Int Small Bus J 13(1):26–37

Knill AM (2009) Should venture capitalists put all their eggs in one basket? Diversification versus pure play strategies in venture capital. Working paper—SSRN eLibrary. Florida State University, Miami

Kortum S, Lerner J (1998) Does venture capital spur innovation. Working paper series. National Bureau of Economic Research, Washington

Kortum S, Lerner J (2000) Assessing the contribution of venture capital to innovation. Rand J Econ 31(4):674–692

Kranz P (2008) Managementunterstützung von mittleren Unternehmen bei Private Equity (Management assistance in SMEs by private equity funds). Thesis, Hochschule für Wirtschafts-, Rechts- und Sozialwissenschaften St. Gallen (HSG), St. Gallen

Kreuter B, Gottschalg O, Zollo M (2006) Truths and myths about determinants of buyout performance. Working paper. HEC School of Management, Paris

Kuckertz A, Middelberg N (2008) Signaling im Prozess des Fundraisings von Venture Capital Gesellschaften (Signaling in the fundraising process of venture capital funds). Finanz-Betr 7–8(1):556–563

La Porta R, Lopez-De-Silanes F, Shleifer A, Vishny RW (1997) Legal determinants of external finance. J Finance 52(3):1131–1150

Landau C (2010) Wertschöpfungsbeiträge durch Private-Equity-Gesellschaften bei europäischen Buyouts – Theoretische Betrachtung aus der Perspektive des ressourcenbasierten Ansatzes des strategischen Managements und eine empirische Untersuchung mittels Strukturgleichungsmodellierung. (Value creating contributions of private equity funds in European buyouts). Thesis, Universität Erlangen-Nürnberg, Nürnberg

Landstöm H, Manigart S, Mason CM, Sapienza H (1998) Contracts between entrepreneurs and investors: terms and negotiation processes. Working paper—frontiers of entrepreneurship research. Wellesley, Babson College

Landström H (2007) Handbook of research on venture capital. Edward Elgar Publishing, Northampton

Lehmann EE (2006) Does venture capital syndication spur employment growth and shareholder value? Evidence from German IPO data. Small Bus Econ 26(5):455–464

Leleux B, Surlemont B (2003) Public versus private venture capital: seeding or crowding out? A pan-European analysis. J Bus Venturing 18(1):81–104

Lerner J (1994a) The syndication of venture capital investments. J Financial Manag Assoc 23(3):16–27

Lerner J (1994b) Venture capitalists and the decision to go public. J Financ Econ 35(3):293–316

Lerner J (1995) Venture capitalists and the oversight of private firms. J Finance 50(1):301–318

Lerner J (2011) The future of private equity. Eur Financ Manag 17(3):423–435

Lerner J, Schoar A (2004) The illiquidity puzzle: theory and evidence from private equity. J Financ Econ 72(1):3–40

Lerner J, Sorensen M, Strömberg P (2008) Private equity and long-run investment: the case of innovation. World economic forum. The global economic impact of private equity report 2009—globalization of alternative investments working papers, vol 1, Geneva

Lerner J, Sorensen M, Strömberg P (2011) Private equity and long-run investment: the case of innovation. J Finance 66(2):445–477

Leslie P, Oyer P (2008) Managerial incentives and value creation: evidence from private equity. NBER working paper series. National Bureau of Economic Research, Washington

Lichtenberg FR, Siegel D (1990) The effects of leveraged buyouts on productivity and related aspects of firm behavior. J Financ Econ 27(1):165–194

Liebeskind J, Margarethe W, Hansen G (1992) LBOs, corporate restructuring, and the incentive-intensity hypothesis. Financ Manag 21(1):73–88

Lin TH, Smith RL (1998) Insider reputation and selling decisions: the unwinding of venture capital investments during equity IPOs. J Corporate Finance 4(3):241–263

Lindsey L (2008) Blurring firm boundaries: the role of venture capital in strategic alliances. J Finance 63(3):1137–1168

Lockett A, Ucbasaran D, Butler J (2006) Opening up the investor—investee dyad: syndicates teams, and networks. Entrep Theory Pract 30(2):117–130

Lockett A, Wright M (1999) The syndication of private equity: evidence from the UK. Venture Capital 1(4):303–324

Lockett A, Wright M (2001) The syndication of venture capital investments. Omega 29(5):375–390

Lockett A, Wright M, Burrows A, Scholes L, Paton D (2008) The export intensity of venture backed companies. Small Bus Econ 31(1):39–58

Lockett A, Wright M, Sapienza H, Pruthi S (2002) Venture capital investors, valuation and information: a comparative study of the US, Hong Kong, India and Singapore. Venture Capital 4(3):237–252

Loitlsberger E (1984) Innovationsfinanzierung und Finanzierungsinstrumentarium (Innovation finance and financial instruments). J Betriebswirtsch 2(1):54–69

Long WF, Ravenscraft DJ (1993) The financial performance of whole company LBOs. Working paper. Centre for Economic Studies, US Consensus Bureau, Washington

Loos N (2006) Value creation in leveraged buyouts—analysis of factors driving private equity investment performance. Thesis. Universität St. Gallen, St. Gallen

Lossen U (2007a) Performance of private equity funds: does diversification matter? In: Franke N, Harhoff D (Hrsg) Portfolio strategies of private equity firms—theory and evidence. Munich School of Management, Munich, S 95–133

Lossen U (2007b) Portfolio strategies of private equity firms theory and evidence. Innovation und Entrepreneurship. Deutscher Universitätsverlag, Gabler edition Wissenschaft, Wiesbaden

Lutz E, Achleitner A-K (2009) Angels or demons? Evidence on the impact of private equity firms on employment. Z Betriebswirtsch (ZfB), Special Issue Entrepreneurial Finance 5:53–81

MacMillan IC, Kulow DM, Khoylian R (1989) Venture capitalists’ involvement in their investments: extent and performance. J Bus Venturing 4(1):27–47

MacMillan IC, Siegel R, Narasimha PNS (1985) Criteria used by venture capitalists to evaluate new venture proposals. J Bus Venturing 1(1):119–128

MacMillan IC, Zemann L, Subbanarasimha PN (1987) Criteria distinguishing successful from unsuccessful ventures in the venture screening process. J Bus Venturing 2(2):123–137

Mainprize B, Hindle K, Smith B, Mitchell R (2003) Caprice versus standardization in venture capital decision making. J Private Equity 7(1):15–25

Mäkelä MM (2004) Essays on cross-border venture capital. Thesis. Helsinki University of Technology, Helsinki

Mäkelä MM, Maula MVJ (2005) Cross-border venture capital and new venture internationalization: an isomorphism perspective. Venture Capital 7(3):227–257

Mäkelä MM, Maula MVJ (2006) Interorganizational commitment in syndicated cross-border venture capital investments. Entrep Theory Pract 30(2):273–298

Mäkelä MM, Maula MVJ (2008) Attracting cross-border venture capital: the role of a local investor. Entrepreneurship & Regional Development 20(3):237–257

Manigart S, De Waele K, Wright M, Robbie K, Desbrieres P, Sapienza H, Beekman A (2000) Venture capitalists, investment appraisal and accounting information: a comparative study of the USA, UK, France, Belgium and Holland. Eur Financ Manag 6(3):389–403

Manigart S, Lockett A, Meuleman M, Wright M, Landström H, Bruining H, Desbrières P, Hommel U (2006) Venture capitalists’ decision to syndicate. Entrep Theory Pract 30(2):131–153

Manigart S, Van Hyfte W (1999) Post-investment evolution of Belgian venture capital backed companies: an empirical study. In: Frontiers of Entrepreneurship Research, Babson College, Vlerick Leuven Gent Management School and University of Gent, Gent

Manigart S, Wright M, Lockett A, Meuleman M, Landström H, Bruining H, Desbrieres P, Hommel U (2002) Why do European venture capital companies syndicate? Working paper—SSRN eLibrary, Vlerick Leuven Gent Management School, Gent

Manigart S, Wright M, Robbie K, Desbrieres P, De Waele K (1997) Venture capitalists’ appraisal of investment projects: an empirical European study. Entrep Theory Pract 21(4):29–43

Marchart J, Url T (2008) Hemmnisse für die Finanzierung von Frühphasen- oder Venture-Capital-Fonds in Österreich (Barriers in financing early stage and venture capital funds in Austria). Österreichisches Institut für Wirtschaftsforschung (WIFO), WIFO Studien, Wien

Meerkatt H, Rose J, Brigl M, Heinrich L, Prats JM, Herrera A (2008) The advantage of persistence: how the best private-equity firms beat the fade. IESE Business School, Barcelona, Madrid

Megginson WL, Weiss KA (1991) Venture capitalist certification in initial public offerings. J Finance 46(3):879–903

Meier D (2006) Post-investment value addition to buyouts—analysis of European private equity firms. Thesis. Reinisch-Westfählische Technische Hochschule Aachen, Aachen

Meier D, Hiddemann T, Brettel M (2006) Wertsteigerung bei Buyouts in der Post Investment-Phase – der Beitrag von Private Equity-Firmen zum operativen Erfolg ihrer Portfoliounternehmen im europäischen Vergleich (Value creation in buyouts in the post-investment phase—comparing the contribution of European private equity firms to the operational performance of portfolio companies). Z Betriebswirtsch 76(10):1035–1066

Metrick A, Yasuda A (2010) The economics of private equity funds. Rev Financ Stud 23(6):2303–2341

Metrick A, Yasuda A (2011) Venture capital and other private equity: a survey. Eur Financ Manag 17(4):619–654

Meuleman M, Amess K, Wright M, Scholes L (2009a) Agency, strategic entrepreneurship, and the performance of private equity-backed buyouts. Entrep Theory Pract 33(1):213–239

Meuleman M, Wright M (2011) Cross-border private equity syndication: Institutional context and learning. J Bus Venturing 26(1):35–48

Meuleman M, Wright M, Manigart S, Lockett A (2009b) Private equity syndication: agency costs, reputation and collaboration. J Bus Finance Account 36(5/6):616–644

Meyer T, Mathonet P-Y (2005) Beyond the J curve—Managing a portfolio of venture capital and private equity funds. Wiley, Chichester

Moser R (2009) Internationales Management aus der Perspektive der Internationalen Finanzierung (International management from the perspective of international finance) (International Management from the perspective of international finance). In: Oesterle M-J, Schmid S (Hrsg) Internationales Management—Forschung, Lehre, Praxis, Bd 682–698. Schäffer-Poeschel Verlag, Stuttgart

Müllner J (2012) Die Wirkung von Private Equity auf das Wachstum und die Internationalisierung (The impact of private equity on firm-level growth and internationalization). Thesis. Vienna University of Economics and Business. Peter Lang Verlag (forthcoming), Vienna

Munari F, Cressy RC, Malipiero A (2006) The heterogeneity of private equity firms and its impact on post-buyout performance: evidence from the United Kingdom. Working paper SSRN eLibrary. University of Bologna, Department of Management, Bologna

Muscarella CJ, Vetsuypens MR (1990) Efficiency and organizational structure: a study of reverse LBOs. J Finance 45(5):1389–1413

Muzyka D, Birley S, Leleux B (1996) Trade-offs in the investment decisions of European venture capitalists. J Bus Venturing 11(4):273–287

Myers SC, Majluf NS (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Financ Econ 13(2):187–221

Norton E, Tenenbaum BH (1993) Specialization versus diversification as a venture capital investment strategy. J Bus Venturing 8(5):431–442

NVCA (2010) National Venture Capital Association. www.nvca.org. 17.08.2010

Ofek E (1994) Efficiency gains in unsuccessful management buyouts. J Finance 49(2):637–654

Peneder M (2006) Venture Capital: Ergebnisse internationaler Wirkungsanalysen (Venture capital—results of international impact studies). Wirtschaftsforschungsinstitut. WIFO Monatsbericht, Wien

Peneder M, Schwarz G, Jud T (2006) Der Einfluss von Private Equity (PE) und Venture Capital (VC) auf Wachstum und Innovationsleistung Österreichisches Unternehmen (The impact of private equity and venture capital on growth and innovation of Austrian companies). Österreichisches Institut für Wirtschaftsforschung, Wien

Phalippou L (2010) Venture capital funds: flow-performance relationship and performance persistence. J Bank Finance 34(3):568–577

Phalippou L, Gottschalg O (2009) The performance of private equity funds. Rev Financ Stud 22(4):1747–1776

Pindur DC (2007) Value creation in successful LBOs. Thesis. Universität Ulm, Ulm

Puri M, Zarutskie R (2008) On the life-cycle dynamics of venture-capital- and non-venture capital financed firms. NBER working paper series National Bureau of Economic Research, Washington

Pütter T (2006) Value creation in private equity. In: Euromoney (Hrsg) International investment & securities review. Euromoney, London

Rappaport A (1990) The staying power of the public corporation. Harv Bus Rev 68(1):96–104

Reeb D, Sakakibara M, Mahmood IP (2012) From the editors: endogeneity in international business research. J Int Bus Stud 43(3):211–218

Rosenstein J (1988) The board and strategy: venture capital and high technology. J Bus Venturing 3(2):159–170

Rosenstein J, Bruno AV, Bygrave WD, Taylor NT (1990) How much do CEOs value the advice of venture capitalists on their boards? Working paper—frontiers of entrepreneurship research. Babson College, Massachusetts

Rosenstein J, Bruno AV, Bygrave WD, Taylor NT (1993) The CEO, venture capitalists, and the board. J Bus Venturing 8(2):99–114

Ruhnka JC, Feldman HD, Dean TJ (1992) The ‘living dead’ phenomenon in venture capital investments. J Bus Venturing 7(2):137–155

Sahlman WA (1988) Aspects of financial contracting in venture capital. J Appl Corp Finance 1(2):23–36

Sahlman WA (1990) The structure and governance of venture-capital organizations. J Financ Econ 27(2):473–521

Sapienza HJ (1992) When do venture capitalists add value? J Bus Venturing 7(1):9–27

Sapienza HJ, Manigart S, Vermeir W (1996) Venture capitalist governance and value added in four countries. J Bus Venturing 11(6):439–469

Schefczyk M, Gerpott TJ (1998) Beratungsunterstützung von Portfoliounternehmen durch deutsche Venture Capital Gesellschaften. Eine empirische Untersuchung (Consultation assistance of portfoliocompanies by German venture capital investors—an empirical analysis). Z Betriebswirtsch 2(Ergänzungsheft):143–166

Seppä T, Jääskeläinen M (2002) How the rich become richer in venture capital: firm performance and position in syndication networks. Working paper. Helsinki University of Technology, Wesseley

Shane S, Cable D (2002) Network ties, reputation, and the financing of new ventures. Manag Sci 48(3):364–381

Shepherd DA (1999) Venture capitalists’ introspection: a comparison of “in use” and “espoused” decision policies. J Small Bus Manag 37(2):76–87

Shepherd DA, Zacharakis A (1999) Conjoint analysis: a new methodological approach for researching the decision policies of venture capitalists. Venture Capital 1(3):197–217

Shepherd DA, Zacharakis A (2002) Venture capitalists’ expertise: a call for research into decision aids and cognitive feedback. J Bus Venturing 17(1):1–20

Shepherd DA, Zacharakis A, Baron RA (2003) VCs’ decision processes: evidence suggesting more experience may not always be better. J Bus Venturing 18(3):381–401

Siegel D, Wright M, Filatotchev I (2011) Private equity, LBOs, and corporate governance: international evidence. In: Corporate Governance: An International Review, S 185–194

Singh H (1990) Management buyouts: Distinguishing characteristics and operating changes prior to public offering. Strateg Manag J 11:111–129

Smith AJ (1990) Corporate ownership structure and performance: the case of management buyouts. J Financ Econ 27(1):143–164

Sorensen M (2007) How smart is smart money? A two-sided matching model of venture capital. J Finance 62(6):2725–2762

Sorenson O, Stuart TE (2001) Syndication networks and the spatial distribution of venture capital investments. Am J Sociol 106(6):1546–1590

St-Pierre J, Mathieu C, Andriambeloson É, El Arch H (2003) Financing with venture capital: Advances in knowledge over the last ten years and research avenues. Institut de recherche sur les PME. Research report presented to industry Canada, Ottawa

Strömberg P (2008) The new demography of private equity. World economic forum. The global economic impact of private equity report 2009—globalization of alternative investments working papers, vol 1. Geneva

Strömberg P (2009) The economic and social impact of private equity in Europe: summary of research findings. Working papers Stockholm School of Economics. Institute for Financial Research (SIFR), Stockholm

Sweeting RC, Wong CF (1997) A UK “hands-off” venture capital firm and the handling of post-investment investor-investee relationships. J Manag Stud 34(1):125–152

Teece DJ, Pisano G, Shuen A (1997) Dynamic capabilities and strategic management. Strateg Manag J 18(7):509–533

Thorsten K, Jennifer M (2009) Fundraising im deutschen Private Equity-Markt – Der Einfluss des Finanzmarkts (Fundraising in the German private equity market—the role of the financial markets). Finanz Betrieb Aufsätze 1(2):94–99

Tian X (2012) The role of venture capital syndication in value creation for entrepreneurial firms. Rev Finance 16(1):245–283

Timmons H (2007) Dubai investment unit acquires a 2.2 % stake in Deutsche Bank. The New York Times; May 17, 2007. http://query.nytimes.com/gst/fullpage.html?res=990CE3DD1031F934A25756C0A9619C8B63. Accessed

Timmons JA, Bygrave WD (1986) Venture capital’s role in financing innovation for economic growth. J Bus Venturing 1(2):161–176

Trester JJ (1998) Venture capital contracting under asymmetric information. J Bank Finance 22(6–8):675–699

Tyebjee T, Vickery L (1988) Venture capital in Western Europe. J Bus Venturing 3(2):123–136

Tyebjee TT, Bruno AV (1984) A model of venture capitalist investment activity. Manag Sci 30(9):1051–1066

Tykvová T (2000) Venture capital in Germany and its impact on innovation. Working papers. University of Prague, Prag

Tykvová T (2006) How do investment patterns of independent and captive private equity funds differ? Evidence from Germany. Financ Mark Portf Manag 20(4):399–418

Tykvová T, Borell M (2012) Do private equity owners increase risk of financial distress and bankruptcy? J Corp Finance 18(1):138–150

Ughetto E (2010) Assessing the contribution to innovation of private equity investors: a study on European buyouts. Res Policy 39(1):126–140

Weber C (2003) Diversifikation versus Spezialisierung – Vorteilhaftigkeit von Portfoliostrategien bei Venture Capital Investments (Diversification vs. specialization—the advantages of portfolio strategies in venture capital investments). Kovac Verlag, Hamburg

Weir C, Jones P, Wright M (2008) Public to private transactions, private equity and performance in the UK: an empirical analysis of the impact of going private. Working paper series. University of Nottingham, Nottingham

Weir C, Laing D (1998) Management buy-outs: the impact of ownership changes on performance. J Small Bus Enterprise Development 5(3):261–269

Wiersema MF, Liebeskind JP (1995) The effects of leveraged buyouts on corporate growth and diversification in large firms. Strateg Manag J 16(6):447

Wijbenga FH, Postma TJBM, Stratling R (2007) The influence of the venture capitalist’s governance activities on the entrepreneurial firm’s control systems and performance. Entrep Theory Pract 31(2):257–277

Wilson N, Wright M, Siegel DS, Scholes L (2012) Private equity portfolio company performance during the global recession. J Corp Finance 18(1):193–205

Wilson R (1968) The theory of syndicates. Econometrica 36(January):119–136

Wood G, Wright M (2009) Private equity: a review and synthesis. Int J Manag Rev 11(4):361–380

Woodward SE, Hall RE (2003) Benchmarking the returns to venture. Working paper—SSRN eLibrary. Sand Hill Econometrics and Stanford University, Palo Alto

Wright M, Amess K, Weir C, Girma S (2009a) Private equity and corporate governance: Retrospect and prospect. Corp Gov 17(3):353–375

Wright M, Bacon N, Amess K (2009b) The impact of private equity and buyouts on employment, remuneration and other HRM practices. J Ind Rel 51(4):501–515

Wright M, Gilligan J (2010) Private equity demystified: an explanatory guide, 2nd edn. ICAEW Corporate Finance Faculty; Corporate Finance Faculty, March 2010, London

Wright M, Lockett A (2003) The structure and management of alliances: syndication in the venture capital industry. J Manag Stud 40(8):2073–2102

Wright M, Pruthi S, Lockett A (2005) International venture capital research: from cross-country comparisons to crossing borders. Int J Manag Rev 7(3):135–165

Wright M, Robbie K (1996a) The investor-led buy-out: a new strategic option. Long Range Plan 29(5):691–702

Wright M, Robbie K (1996b) Venture capitalists, unquoted equity investment appraisal. Account Bus Res 26(2):153

Wright M, Robbie K (1998) Venture capital and private equity: a review and synthesis. J Bus Finance Account 25(5–6):521–570

Wright M, Thompson S, Robbie K (1992) Venture capital and management-led, leveraged buy-outs: a European perspective. J Bus Venturing 7(1):47–71

Wruck KH (1989) Equity ownership concentration and firm value: evidence from private equity financings. J Financ Econ 23(1):3–28

Zacharakis AL, McMullen JS, Shepherd DA (2007) Venture capitalists’ decision policies across three countries: an institutional theory perspective. J Int Bus Stud 38(5):691–708

Zacharakis AL, Meyer GD (1998) A lack of insight: do venture capitalists really understand their own decision process? J Bus Venturing 13(1):57–76

Zacharakis AL, Meyer GD (2000) The potential of actuarial decision models: can they improve the venture capital investment decision? J Bus Venturing 15(4):323–346

Zacharakis AL, Shepherd DA (2001) The nature of information and overconfidence on venture capitalists’ decision making. J Bus Venturing 16(4):311–332

Zahra SA, Neubaum DO, Naldi L (2007) The effects of ownership and governance on SMEs’ international knowledge-based resources. Small Bus Econ 29(1):309–327

Zahradnik A (2003) Rechtsverhältnisse zwischen Investoren, Venture Capital Funds und Managementgesellschaft (Legal relationships between investors, venture capital funds and the management company). In: Kofler G, Polster-Grüll B (Hrsg) Private Equity & Venture Capital – Finanzwirtschaftliche, steuerliche und rechtliche Aspekte der Finanzierung mit Risikokapital. Linde Verlag, Wien, S 405–429

Zollo M, Phalippou L (2005) What drives private equity fund performance. Working paper—Scholar One. INSEAD Buyout Research Group, Paris

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Müllner, J. Private equity and venture capital funds—from the state of research to a comprehensive model and an interdisciplinary research outlook. J Betriebswirtsch 62, 119–167 (2012). https://doi.org/10.1007/s11301-012-0085-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11301-012-0085-6

Keywords

- Private equity

- Venture capital

- Buyout

- Ownership

- Involvement

- Strategic management

- International business

- Governance