Abstract

We present experimental evidence on the effectiveness of corporate leniency programs. Different from other leniency experiments, ours allows subjects to have free-form communication. We do not find much of an effect of leniency programs. Leniency does not deter cartels. It only delays them. Free-form communication allows subjects to build trust and resolve conflicts. Reporting and defection rates are low, especially when compared to experiments with restricted communication. Indeed, communication is so effective that, with leniency in place, prices are not affected if cartels are fined and cease to exist.

Similar content being viewed by others

Notes

Apesteguia et al. (2007) also allow for free-form communication in a leniency experiment. However, they look at a one-shot game. Also, Clemens and Rau (2019) look at free-form communication, but do not allow subjects to choose prices or quantities. Hence, they are not able to study how free-form communication affects the effectiveness of collusion.

Bigoni et al. (2015) extend the study and also find a beneficial effect of leniency programs. They study how a change in the fine, and the probability of obtaining that fine, affects deterrence.

Hamaguchi et al. (2009) take a similar approach and find that larger cartels break down sooner; the extent of leniency has no effect.

Communication is only allowed to be in English. We do not believe that this is a problem, as the Faculty of Economics and Business at the University of Groningen, where the experiment was conducted, has an international student body and almost all degree programs are taught in English.

Chats were capped at 90 seconds when a cartel was first formed; at 45 seconds with a cartel in place, and at 60 seconds when a cartel is re-established. A countdown timer always appeared on the chat screen.

Admittedly, that makes our experimental AA more strict than most real-world AAs. We believe that this is immaterial as the subjects are fully aware of this rule. The only alternative would be to have someone evaluate during the experiment whether the participants had made price agreements, which leads to obvious complications. Moreover, every cartel that was formed in our experiment did make price agreements; see below.

We include these to make subjects aware of their reporting decision.

This is different from practice and some other experiments where fines are a percentage of revenues. However, Bigoni et al. (2012, p. 371) argue for fixed fines to simplify the subjects’ decision problem and to have full control of subjects’ perceived expected fines.

This is in line with e.g. US and EU cartel enforcement, where reporting may lead to full leniency if the AA has not yet started an investigation.

Instructions for this treatment can be found in online Appendix B at http://marcohaan.nl/leniencyexperiment/. These are couched in neutral terms to avoid normative connotations that may be implied by terms like cartel or Antitrust Authority. Instructions for other treatments are similar and available upon request.

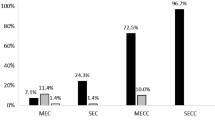

Our treatment Benchmark is comparable to treatment Communication in HS, and with Laissez-Faire in BFLS. Also, our treatment Antitrust is comparable to Fine in BFLS and Antitrust in HS.

Supporting materials for this paper can be found at http://marcohaan.nl/leniencyexperiment/.

Note that by construction, cartel incidence in Benchmark cannot decrease over time: A cartel can only be dissolved if it is detected by the AA. In Benchmark there is no AA.

The market price is the lowest price quoted in a market. Figures for each separate market can be found in online Appendix C at http://marcohaan.nl/leniencyexperiment/.

BFLS do not report how prices develop over time in their experiment.

Note however that in Benchmark a cartel cannot break down, so even if cartelists fall out with each other and start charging lower prices, they are still in a cartel.

Comparing prices in the first and last five periods, competition prices significantly (at 1%) increase in Profound and in the combined leniency treatments . For cartel prices, those in Benchmark significantly increase over time (at 10%; from 8.15 to 8.65). In all other cases, there is no significant trend.

A defection is defined here as any instance where subjects have an explicit agreement on price, but at least one subject sets a different price.

It is interesting to compare our chats with those of the infamous lysine cartel, for which a full transcript of all conversations is also available. All these conversations also contain explicit price agreements. See Hammond (2005).

Apart from Benchmark, there are only few instances of chats among subjects already in a cartel. Out of a total of 20 cartels in each of these treatments, in Antitrust there are 4 periods in which subjects communicate while already in a cartel, in Profound there are only 3 and in Superficial 11.

Instructions to coders and the full classification scheme are available upon request.

This measure is 0 when the amount of agreement is what random chance would imply, and 1 when the coders perfectly agree. Kappa values between 0.41 and 0.60 are considered as “moderate” agreement; those above 0.60 as “substantial” agreement (Landis and Koch 1977).

Instances in which coders did not agree are classified as one-half observation.

We define a conversation as the chat that takes place in a given market in a given period.

Unfortunately, the number of observations is too low to do detailed quantitative analyses of chat behavior to trace out possible differences between treatments.

In a companion note we study numerous other regression specifications, available online at http://marcohaan.nl/leniencyexperiment/.

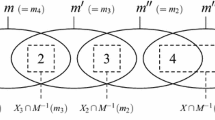

Suppose that in a market, a cartel is already formed in the very first period. In that case, there has never been any competition in the first place, so we cannot include that observation in our analysis of the survival of competition. But that seems odd; our purpose is to study how quickly a cartel is formed; and if we do not include observations where cartels are formed immediately, we are surely missing something. We therefore effectively start our analysis in period 0, when arguably competition is in effect by construction. Thus, if subjects decide to form a cartel immediately, we interpret this as the formation of a cartel after 1 period of competition. If they decide to form a cartel in period 2, we interpret this as the formation of a cartel after two periods of competition, etc.

The interaction discovered*sup is not included as this yields too few events to allow for a robust estimate.

The interaction threats*anti is not included, as that yields too few observations.

We chose not to include past discoveries or past reports in this regression. Doing so yields insignificant coefficients. Details are available upon request.

References

Apesteguia, J., Dufwenberg, M., & Selten, R. (2007). Blowing the whistle. Economic Theory, 31(1), 143–166.

Bigoni, M., Fridolfsson, S. O., Le Coq, C., & Spagnolo, G. (2012). Fines, leniency and rewards in antitrust. RAND Journal of Economics, 43(2), 368–390.

Bigoni, M., Fridolfsson, S. O., Le Coq, C., & Spagnolo, G. (2015). Trust, leniency, and deterrence. Journal of Law, Economics, and Organization, 31(4), 663–689.

Brenner, S. (2009). An empirical study of the European corporate leniency program. International Journal of Industrial Organization, 27(6), 639–645.

Brown-Kruse, J., Cronshaw, M. B., & Schenk, D. J. (1993). Theory and experiments on spatial competition. Economic Inquiry, 26(1), 139–165.

Bryant, P. G., & Eckard, E. W. (1991). Price fixing: The probability of getting caught. The Review of Economics and Statistics, 73(3), 531–536.

Cason, T. N. (1995). Cheap talk price signaling in laboratory markets. Information Economics and Policy, 7(2), 183–204.

Cason, T. N., & Mui, V. L. (2015). Rich communication and coordinated resistance against divide-and-conquer: A laboratory investigation. European Journal of Political Economy, 37, 146–159.

Clemens, G., & Rau, H. A. (2019). Do discriminatory leniency policies fight hard-core cartels? Journal of Economics & Management Strategy, 28(2), 336–354.

Cohen, J. (1960). A coefficient of agreement for nominal scales. Educational and Psychological Measurement, 20(1), 37–46.

Combe, E., Monnier, C., & Legal, R. (2008). Cartels: The probability of getting caught in the European Union. http://ssrn.com/abstract=1015061, Cahiers de Recherche PRISM-Sorbonne.

Cooper, D. J., & Kühn, K. U. (2014). Communication, renegotiation, and the scope for collusion. American Economic Journal: Microeconomics, 6(2), 247–278.

Davis, D. D., & Holt, C. A. (1998). Conspiracies and secret price discounts in laboratory markets. Economic Journal, 108(448), 736–756.

Dechenaux, E., & Mago, S. D. (2019). Communication and side payments in a duopoly with private costs: An experiment. Journal of Economic Behavior & Organization, 165, 157–184.

Ellis, C. J., & Wilson, W. W. (2001). What doesn’t kill us makes us stronger: An analysis of corporate leniency policy. Tech. rep.: University of Oregon.

Fischbacher, U. (2007). z-tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(21), 171–178.

Fonseca, M. A., & Normann, H. T. (2012). Explicit versus tacit collusion: The impact of communication in oligopoly experiments. European Economic Review, 56(8), 1759–1772.

Fonseca, M. A., & Normann, H. T. (2014). Endogenous cartel formation: Experimental evidence. Economics Letters, 125(2), 223–225.

Friedman, J. W. (1971). A non-cooperative equilibrium for supergames. Review of Economic Studies, 38(1), 1–12.

Gomez-Martinez, F., Onderstal, S., & Sonnemans, J. (2016). Firm-specific information and explicit collusion in experimental oligopolies. European Economic Review, 82, 132–141.

Haan, M. A., Schoonbeek, L., & Winkel, B. M. (2009). Experimental results on collusion. In H. T. Normann (Ed.), Hinloopen J (pp. 9–33). Cambridge University Press: Experiments and Competition Policy.

Hamaguchi, Y., Kawagoe, T., & Shibata, A. (2009). Group size effects on cartel formation and the enforcement power of leniency programs. International Journal of Industrial Organization, 27(2), 145–165.

Hammond, S. D. (2001). When calculating the costs and benefits of applying for corporate amnesty, how do you put a price tag on an individual’s freedom? Presented at the 15th National Institute on White Collar Crime, 8 March. San Francisco CA.

Hammond, S.D. (2005). Caught in the act: Inside an international cartel. Presented at OECD, Paris, France, https://www.justice.gov/atr/speech/caught-act-inside-international-cartel.

Harrington, J. E., Hernan Gonzalez, R., & Kujal, P. (2016). The relative efficacy of price announcements and express communication for collusion: Experimental findings. Journal of Economic Behavior & Organization, 128, 251–264.

Hinloopen, J., & Onderstal, S. (2014). Going once, going twice, reported! cartel activity and the effectiveness of leniency programs in experimental auctions. European Economic Review, 70, 317–336.

Hinloopen, J., & Soetevent, A. R. (2008). Laboratory evidence on the effectiveness of corporate leniency programs. RAND Journal of Economics, 39(2), 607–616.

Holt, C. A., & Davis, D. D. (1990). The effects of non-binding price announcements on posted-offer markets. Economics Letters, 34(4), 307–310.

Isaac, R. M., & Plott, C. R. (1981). The opportunity for conspiracy in restraint of trade. Journal of Economic Behavior & Organization, 2(1), 1–30.

Isaac, R. M., & Walker, J. M. (1985). Information and conspiracy in sealed bid auctions. Journal of Economic Behavior & Organization, 6(2), 139–159.

Isaac, R. M., Ramey, V., & Williams, A. W. (1984). The effects of market organization on conspiracies in restraint of trade. Journal of Economic Behavior & Organization, 5(2), 191–222.

Landis, J. R., & Koch, G. G. (1977). An application of hierarchical kappa-type statistics in the assessment of majority agreement among multiple observers. Biometrics, 33(2), 363–374.

Miller, N. H. (2009). Strategic leniency and cartel enforcement. American Economic Review, 99(3), 750–768.

Motta, M. (2004). Competition policy: Theory and practice. New York: Cambridge University Press.

Motta, M., & Polo, M. (2003). Leniency programs and cartel prosecution. International Journal of Industrial Organization, 21(3), 347–379.

Normann, H. T., Rösch, J., & Schultz, L. M. (2015). Do buyer groups facilitate collusion? Journal of Economic Behavior & Organization, 109, 72–84.

Spagnolo, G. (2000). Self-defeating antitrust laws: How leniency programs solve Bertrand’s paradox and enforce collusion in auctions. FEEM Working Paper No. 52.2000, Fondazione Eni Enrico Mattei, https://doi.org/10.2139/ssrn.236400.

Spagnolo, G. (2008). Leniency and whistleblowers in antitrust. In: Buccirossi P (Ed.) Handbook of Antitrust Economics, M.I.T. Press, pp 259–304.

Waichman, I., Requate, T., & Siang, C. K. (2014). Communication in Cournot competition: An experimental study. Journal of Economic Psychology, 42, 1–16.

Acknowledgements

We thank two anonymous referees and the Editor, Lawrence J. White, for helpful comments, as well as Rob Alessie, Gerhard Dijkstra, Pim Heijnen, Jeroen Hinloopen, Praveen Kujal, Sander Onderstal, Amrita Ray Chaudhuri, Adriaan Soetevent, Laura Spierdijk, Nick Vikander, and Tom Wansbeek. Financial support of the University of Groningen (RUG) is gratefully acknowledged. The views expressed in this paper do not necessarily reflect the official opinion of the ACM: the authors are fully responsible for the contents of the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Dijkstra, P.T., Haan, M.A. & Schoonbeek, L. Leniency Programs and the Design of Antitrust: Experimental Evidence with Free-Form Communication. Rev Ind Organ 59, 13–36 (2021). https://doi.org/10.1007/s11151-020-09789-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-020-09789-5