Abstract

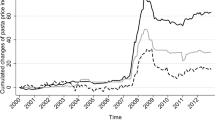

Cartel detection is one of the most basic and most complicated tasks of competition authorities. In recent years, however, variance filters have provided a fairly simple tool for rejecting the existence of price-fixing, with the added advantage that the methodology requires only a low volume of data. In this paper we analyze two aspects of variance filters: (i) the relationship that can be established between market structure and price rigidity, and (ii) the use of different benchmarks for implementing the filters. This paper addresses these two issues by applying a variance filter to a gasoline retail market that is characterized by a set of unique features. Our results confirm the positive relationship between monopoly and price rigidity, and confirm the variance filter’s ability to detect non-competitive behavior when an appropriate benchmark is used. Our findings should serve to promote the implementation of this methodology among competition authorities, albeit in the awareness that a more exhaustive complementary analysis is required.

Similar content being viewed by others

References

Abrantes-Metz, R. M., & Pereira, P. (2007). The impact of entry on prices and costs. SSRN-Working paper. [Online]. Available at: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1013619

Abrantes-Metz R. M., Bajari P. (2009) Screens for conspiracies and their multiple applications. Antitrust, Fall

Abrantes-Metz R. M., Froeb L. M., Geweke J. F., Taylor C. T. (2006) A variance screen for collusion. International Journal of Industrial Organization 24: 467–486

Abrantes-Metz, R. M., Kraten, M., Metz, A., & Seow, G. (2012). LIBOR manipulation? Journal of Banking and Finance., 36(1), 136–150.

Abrantes-Metz, R. M., Kraten, M., Metz, A., & Seow, G. (2012). LIBOR manipulation? Journal of Banking and Finance., 36(1), 136–150.

Athey S., Bagwell K., Sanchirico C. (2004) Collusion and price rigidity. Review of Economic Studies 71: 317–349

Baker J. B. (1993) Two Sherman Act Section 1 Dilemmas: Parallel pricing, the oligopoly problem and contemporary economic theory. The Antitrust Bulletin 38(1): 143–219

Basker E. (2005) Selling a cheaper mousetrap: Wal-Mart’s effect on retail prices. Journal of Urban Economics 58: 203–229

Basker E., Noel M. (2009) The evolving food chain: Competitive effects of Wal-Mart’s entry into the supermarket industry. Journal of Economics and Management Strategy 18(4): 977–1009

Bolotova Y., Connor J. M., Miller D. (2008) The impact of collusion on price behavior: Empirical results from two recent cases. International Journal of Industrial Organization 26(6): 1290–1307

Borrell J. R., Jiménez J. L. (2008) The drivers of antitrust effectiveness. Hacienda Pública Española/Revista de Economía Pública 185(2): 69–88

Borenstein S., Rose N. (1994) Competition and price dispersion in the U.S. Airline Industry. The Journal of Political Economy 102(4): 643–683

Brannon I. (2003) The effects of resale price maintenance laws on petrol prices and station attrition: Empirical evidence from Wisconsin. Applied Economics 35(3): 343–349

Buccirossi P. (2006) Does parallel behavior provide some evidence of collusion?. Review of Law and Economics 2(1): 85–102

Carlton D. W. (1986) The rigidity of prices. American Economic Review 76(4): 637–658

Carlton, D. W. (1989). The theory and the facts of how markets clear: Is industrial organization valuable for understanding macroeconomics? In: Schmalensee, R., & Willig, R. D. (eds.) Handbook of industrial organization, Vol. 1, handbooks in economics, 10, 909–946.

Carlson J. A., McAfee R. P. (1983) Discrete equilibrium price dispersion. Journal of Political Economy 91: 480–493

Clemenz G., Gugler K. (2006) Locational choice and price competition: Some empirical results for the Austrian retail gasoline market. Empirical Economics 31: 291–312

Comisión Nacionalde la Competencia (2010) Informe sobre la competencia en el sector de carburantes de automoción. Madrid

Connor J. M. (2005) Collusion and price dispersion. Applied Economics Letters 12(6): 335–338

Department of Justice. (2004) Price fixing, bid rigging and market allocation schemes: What they are and what to look for. [Online]. Available at: http://www.usdoj.gov/atr/public/guidelines/211578.htm

Esposito, F., & Ferrero, M. (2006). Variance screens for detecting collusion: An application to two cartel cases in Italy. Italian Competition Authority, Working Paper.

Fershtman C. (1982) Price dispersion in oligopoly. Journal of Economics, Behavior and Organization 3: 389–401

Genesove D., Mullin W. (2001) Rules, communication and collusion: Narrative evidence from the sugar institute case. American Economic Review 91(3): 379–398

Harrington, J. E. (2006a). Behavioral screening and the detection of cartels. EUI-RSCAS/EU Competition 2006-Proceedings.

Harrington J. E. (2006) Detecting cartels. In: Buccirossi P. (eds) Handbook in antitrust economics. MIT Press, MA

Harrington J. E., Chen J. (2006) Cartel pricing dynamics with cost variability and endogenous buyer detection. International Journal of Industrial Organization 24: 1185–1212

Hastings J. (2004) Vertical relationships and competition in the retail gasoline markets: Empirical evidence from contract changes in Southern California. American Economic Review 94(1): 317–328

Ivaldi M., Jullien, B., Rey, P., Seabright, P., & Tirole, J. (2003). The economics of tacit collusion. Final report for DG Competition, European Commission.

Jiménez, J. L., & Perdiguero, J. (2008). Análisis de fusiones, variaciones conjeturales y la falacia del estimador en diferencias. Documento de Trabajo de FUNCAS, n o 404. [Online]. Available at: http://www.funcas.ceca.es/Publicaciones/InformacionArticulos/Publicaciones.asp?ID=1414

Jiménez J. L., Perdiguero J. (2011) Could transport costs be lower?: The use of a variance screen to evaluate competition in the petrol market in Spain. International Journal of Transport Economics 38(3): 265–284

Lira L., Rivero R., Vergara R. (2007) Entry and prices: Evidence from the supermarket sector. Review of Industrial Organization 31: 237–260

MacLeod, B. (1985). A Theory of conscious parallelism. European Economic Review 27:25–44.

Means, G. (1935). Industrial prices and their relative flexibility. Senate Document 13, 74th Congress, 1st Session. Washington D.C.

Mills F. C. (1927) The behavior of prices. NBER, New York

Muthusamy K., McIntosh C., Bolotova Y., Patterson P. (2008) Price volatility of Idaho fresh potatoes: 1987–2007. American Journal of Potato Research 85: 438–444

Perdiguero J., Jiménez J. L. (2009) ?‘Competencia o colusión en el mercado de gasolina? Una aproximación a través del parámetro de conducta. Revista de Economía Aplicada 50(XVII): 27–45

Salop S. (1977) The noisy monopolist: Imperfect information, price dispersion and price discrimination. Review of Economic Studies 44: 393–406

Stigler G. (1961) The economics of information. The Journal of Political Economy 69: 213–225

Stigler G. (1964) A theory of oligopoly. Journal of Political Economy 72(1): 44–61

Tsuruta Y. (2008) What affects intranational price dispersion? The case of Japanese gasoline prices. Japan and the World Economy 20: 563–584

Turner D. (1962) The definition of agreement under the Sherman Act: Conscious parallelism and refusals to deal. Harvard Law Review 75: 655–702

Werden G. J. (2004) Economic evidence on the existence of collusion: Reconciling antitrust law with oligopoly theory. Antitrust Law Journal 71: 719–800

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jiménez, J.L., Perdiguero, J. Does Rigidity of Prices Hide Collusion?. Rev Ind Organ 41, 223–248 (2012). https://doi.org/10.1007/s11151-012-9337-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-012-9337-9