Abstract

The Earned Income Tax Credit (EITC) is a refundable credit for low-income workers mainly targeted at families with children. This study uses the Survey of Income and Program Participation’s topical modules on Assets and Liabilities to examine associations between the EITC expansions during the early 1990s and the unsecured debt of the households of single mothers. We use two difference-in-differences comparisons over the study period 1988–1999, first comparing single mothers to single childless women, and then comparing single mothers with two or more children to single mothers with exactly one child. In both cases we find that the EITC expansions are associated with a relative decline in the unsecured debt of affected households of single mothers. While not direct evidence of a causal relationship, this is suggestive evidence that single mothers may have used part of their EITC to limit the growth of their unsecured debt during this period.

Similar content being viewed by others

Notes

The only potential problems that could affect quality are attrition across waves and item non-response on particular asset and liability items. Missing values are imputed within bracketed categories, but these methods are less accurate when variables have high non-response rates.

The SIPP Asset and Liabilities survey instrument can be found at www.census.gov/sipp/top_mod/1996/quests/wave3/assetlia.html.

This comparison is used in numerous difference-in-differences studies of the labor market participation effects of the EITC, see Meyer and Rosenbaum (2001), and was used in a difference-in-differences study of the impact of the EITC and other public program and tax code changes on consumption by Meyer & Sullivan (2004). It should be noted that the EITC first offered a credit to low-wage workers with no children in tax year 1994, which likely would have benefited single childless women. However, this credit remains quite small, relative to what was received by families with children. By the end of our study period (1999), filers with no children could receive a maximum credit of about $400, while the maximum for filers with one child was about $2,700 and $4,475 for filers with two or more children (adjusted to 2005 dollars).

This comparison is used in a difference-in-differences study of labor market earnings effects of the EITC by Dahl et al. (2009).

The Assets and Liabilities topical module was also administered in 1998. However, the point estimates for our study populations for 1998 were associated with extremely large standard errors, making them essentially meaningless. Point estimates for the other years are not substantively changed by including 1998 in our sample. Thus, we dropped data from this year in our main specification, although results from models with this year included are available upon request.

We hypothesize that the EITC will have a direct impact over time on the difference in the real dollar value between the mean unsecured debt of the experimental group and the control group. The impact of the EITC on the ratio between these two measures will be less straightforward. Take the following example: let’s assume that prior to the EITC expansions, single mother households have an average unsecured debt of $3,500 and single childless women have an unsecured debt of $4,000 ($500 difference, ratio 88 %). In the first year after the EITC is implemented, the value for single mothers falls to $3250, while the value for single childless women increases to $4,500 ($1,250 difference, 72 %). But in the second year after implementation, the unsecured debt of single mothers is $4,250, while the value is $5,500 for single childless women. In this case, the difference-in-difference estimate in real dollars is the same (500 − $1250 = $750), but the estimate in terms of the ratio narrows (.88−.77).

The IHS transformation function is \( g\left( {y_{t} ,\theta } \right) = {{\log (\theta y_{t} + (\theta^{2} y_{t}^{2} + 1)^{1/2} )} \mathord{\left/ {\vphantom {{\log (\theta y_{t} + (\theta^{2} y_{t}^{2} + 1)^{1/2} )} \theta }} \right. \kern-\nulldelimiterspace} \theta } = \sinh^{ - 1} (\theta y_{t} )/\theta \). In STATA, the estimated function of IHS transformation is asinh(x) = ln{x+sqrt(x*x + 1)}. That is, theta is equal to 1.

We also examined the density of values for unsecured debt for the two groups, using the kernel density estimator. The densities for the two groups appear to have very similar shapes and ranges of values over the years. Zero values account for a relatively big proportion of the observations, so using IHS allows us to include all the values of the dependent variable, while also reducing the effects of the outliers.

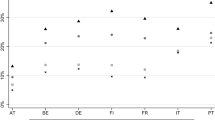

Note that 1998 is not included, see footnote 4.

We do not report median levels of unsecured debt because only about half of households of single mothers report any unsecured debt, thus making medians uninformative. In multivariate analyses we take this into account by estimating both a quantile regression model at the 75th percentile, and a model in which the dependent variable is transformed using IHS.

The IHS regression equation when θ=1 can be written as \( \log \left( {y + \sqrt {y^{2} + 1} } \right) = \beta x + \varepsilon \), and \( \hat{\beta } = \partial \log (y + \sqrt {y^{2} + 1} )/\partial x = (1/\sqrt {y^{2} + 1} )\partial y/\partial x, \) and therefore, \( \partial y/\partial x = \sqrt {y^{2} + 1} \times \hat{\beta } \) So the estimated impact of whether being a single mom in year t on the IHS transformed real unsecured debt is the IHS point estimate times the square root of the squared mean unsecured debt plus one. In this sense, the advantage of the IHS regression is that it can reduce the effects of the outliers like the natural log transformation while also allowing for the inclusion of zero values and an interpretation of the point estimates that is similar to the real value regressions since the estimates take into account the average values of the dependent variables.

References

Barrow, L., & McGranahan, L. (2000). The effects of the earned income credit on the seasonality of household expenditures. National Tax Journal, 53(4), 1211–1244.

Bumpass, L. L., & Raley, R. K. (1995). Redefining single-parent families: Cohabitation and changing family reality. Demography, 32(1995), 97–109.

Burbidge, J. B., Magee, L., & Robb, A. L. (1988). Alternative transformations to handle extreme values of the dependent variable. Journal of the American Statistical Association, 83(401), 123–127.

Crouse, G. (1999). State implementation of major changes to welfare policies, 1992–1998. Available at aspe.hhs.gov/hsp/Waiver-Policies99/policy_CEA.htm. Access date February 8, 2010.

Currie, J. (2006). The take-up of social benefits. In A. Auerbach, D. Card, & J. Quigley (Eds.), Poverty, the distribution of income, and public policy (pp. 80–148). New York: Russell Sage Foundation.

Czajka, J. L., Jacobson, J. E., & Cody, S. (2003). Survey estimates of wealth: A comparative analysis and review of the survey of income and program participation. Washington, DC: Mathematica Policy Research. Available at www.ssa.gov/policy/docs/contractreports/SurveyEstimatesWealth.pdf . Accessed April 12, 2010.

Dahl, M., DeLeire, T., & Schwabish, J. (2009). Stepping stone or dead end? The effect of the EITC on earnings growth. National Tax Journal, 62(2), 329–346.

Eissa, N. & Liebman, J. B. (1996). Labor supply response to the earned income tax credit. Quarterly Journal Of Economics, May, 605–637.

Ellwood, D. T. (2000). The impact of the Earned income tax credit and social policy reforms on work, marriage, and living arrangements. National tax journal, 53(4, 2), 1063–1105.

Folk, F. K. (1996). Single mothers in various living arrangements: Differences in economic and time resources. The American Journal of Economics and Sociology, 55(3), 277–292.

Garcia, J. A. (2007). Borrowing to make ends meet: The rapid growth of credit card debt in America. A report by Demos: A network for ideas & action. Available at www.demos.org/pubs/stillborrowing.pdf . Access date April 12, 2010.

Hotz, V. J. & Scholz, J. K. (2003). The earned income tax credit. In R. Moffitt (Ed.) Means-tested transfer programs in the U.S., (pp. 141–98). Chicago: University of Chicago Press.

Hoynes, H. (2008). The earned income tax credit, welfare reform, and the employment of low-skilled single mothers. Paper prepared for Chicago Federal Research Bank of Chicago Conference “Strategies for improving economic mobility of workers,” November 2007.

Mendenhall, R., Edin, K., Crowley, S., Sykes, J., Tach, L., Kriz, K. & Kling, J. (2010). The role earned income tax credit in the budgets of low-income families. National Poverty Center Working Paper #10-05, http://npc.umich.edu/publications/u/working_paper10-05.pdf.

Meyer, B. D., & Rosenbaum, D. T. (2001). Welfare, the earned income tax credit, and the labor supply of single mothers. Quarterly Journal of Economics, 116(3), 1063–1114.

Meyer, B. D., & Sullivan, J. X. (2004). The effects of welfare and tax reform: The material well-being of single mothers in the 1980s and 1990s. Journal of public economics, 88(2004), 1387–1420.

National Research Council. (1995). Measuring poverty: A new approach. Washington DC: National Academy Press.

Ratcliffe, C., Chen, H., Williams Shanks, T. R., Nam, Y., Schreiner, M., Zhan, M., et al. (2008). Assessing asset data. In S. McKernan & M. Sherraden (Eds.), Asset building and low-income families. Washington, DC: Urban Institute Press.

Rhine, S. L. W., Su S., Osaki Y., & Lee S. Y. (2005). Householder response to the earned income tax credit: Path of sustenance or road to asset building. Working Paper, Office of Regional and Community Affairs, Federal Reserve Bank of New York, and Community Food Resource Center, NY. Available at www.assetbuilding.org/AssetBuilding/Download_Docs/Doc_File_1238_1.pdf. Access date April 12, 2010.

Romich, J., & Weisner, T. (2000). How families view and use the EITC: Advance payment versus lump sum delivery. National tax journal, 53(4), 1245–1264.

Scholz, J. K. (1994). The earned income tax credit: Participation, compliance, and anti-poverty effectiveness. National Tax Journal, 47(March), 59–81.

Smeeding, T. M., Phillips, K. R., & O’Conner, M. (2000). The EITC: Expectation, knowledge, use, and economic and social mobility. National tax journal, 53(4), 1187–1210.

Spader, J., Ratcliffe J., & Stegman M. A. (2005). Transforming tax refunds into assets: A panel survey of VITA clients in Greenville, Henderson, and Raleigh, North Carolina. Center for Community Capitalism, University of North Carolina at Chapel Hill. Available at www.kenan-flagler.unc.edu/assets/documents/ccTransformingTaxRefunds.pdf. Access date April 12, 2010.

Sullivan, J. X. (2006). Welfare reform, saving, and vehicle ownership for the poor: Do asset tests and vehicle exemptions matter? Journal of human resources, 41(1), 72–105.

Sullivan, J. X. (2008). Borrowing during unemployment: Unsecured debt as a safety net. Journal of human resources, 43(2), 383–412.

Acknowledgments

This work has been supported in part by a grant to H. Luke Shaefer from the National Poverty Center at the University of Michigan, supported by award #1 U01AE000002-02 from the US Department of Health and Human Services, office of the Assistant Secretary for Planning and Evaluation; and in part by a grant from the National Science Foundation, award No. SES 1131500. Any opinions expressed are those of the authors alone and should not be construed as representing the opinions or policy of any agency or the Federal Government. We thank Jennifer Romich, Sheldon Danziger, and two anonymous reviewers for comments on earlier versions of this manuscript.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Shaefer, H.L., Song, X. & Williams Shanks, T.R. Do single mothers in the United States use the Earned Income Tax Credit to reduce unsecured debt?. Rev Econ Household 11, 659–680 (2013). https://doi.org/10.1007/s11150-012-9144-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11150-012-9144-y