Abstract

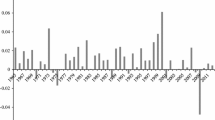

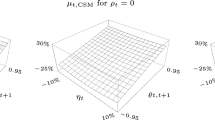

This paper proposes the concept of “upward or downward momentum effect” and “low or high reversal effect” to revise the concept of the momentum life cycle of the stock price. Based on this, combining with the fractal fluctuation of the stock price, the “trend entropy dimension” is constructed as the measurement of the momentum life cycle stage. Also, the validity and robustness of the identification are analyzed empirically. The research shows that the trend entropy dimension can effectively identify the momentum life cycle stage, and it is robust. The results not only help to deepen the theoretical study of momentum life cycle, but also help investors using momentum life cycle to build investment strategy.

Similar content being viewed by others

References

Fama, E.F.: Efficient capital markets: a review of theory and empirical work. J. Finance 25(2), 383–417 (1970)

Asness, C.S., Moskowitz, T.J., Pedersen, L.H.: Value and momentum everywhere. J. Finance 68(3), 929–985 (2013)

DeBondt, W.F.M., Thaler, R.: Does the stock market overreact? J. Finance 40(3), 793–805 (1985)

Jegadeesh, N., Titman, S.: Returns to buying winners and selling losers: implications for stock market efficiency. J. Finance 48(1), 65–91 (1993)

Ahmed, W.M.A.: The trading patterns and performance of individual vis-à-vis institutional investors in the Qatar exchange. Rev. Account. Finance 13(1), 24–42 (2014)

Bart, F., La, Q., Tourani-Rad, A.: Institutional trading and stock returns: evidence from China. Rev. Pac. Basin Financ. Mark. Polic. 17(1), 39–54 (2014)

Nnadi, M., Tanna, S.: Accounting analyses of momentum and contrarian strategies in emerging markets. Asia Pac. J. Account. Econ. 24(1), 1–21 (2017)

Khan, M.S.R., Rabbani, N.: Momentum in stock returns: evidence from an emerging stock market. Macroecon. Finance Emerg. Mark. Econ. 10(2), 191–204 (2017)

Franck, A., Walter, A., Witt, J.F.: Momentum strategies of German mutual funds. Fin. Mark. Portf. Manag. 27(3), 307–332 (2013)

Galariotis, E.C.: Contrarian and momentum trading: a review of the literature. Rev. Behav. Finance 6(1), 63–82 (2014)

Daniel, K., Moskowitz, T.J.: Momentum crashes. J. Financ. Econ. 122(2), 221–247 (2016)

Andrei, D., Cujean, J.: Information percolation, momentum and reversal. J. Financ. Econ. 123(1), 1–29 (2017)

Bernstein, R.: The earning expectation life cycle. Financ. Anal. J. 49(2), 90–93 (1993)

Barroso, P., Clara, P.S.: Momentum has its moments. J. Financ. Econ. 116(1), 111–120 (2015)

Grobys, K.: Another look at momentum crashes: momentum in the European Monetary Union. Appl. Econ. 48(19), 1759–1766 (2016)

Grobys, K.: Momentum crash, credit risk and optionality effects in bear markets and crisis periods: evidence from the US stock market. Appl. Econ. Lett. 24(6), 387–391 (2017)

Booth, G.G., Fung, H.G., Leung, W.K.: A risk-return explanation of the momentum-reversal “anomaly”. J. Emp. Finance 35(1), 68–77 (2016)

Grobys, K., Haga, J.: Are momentum crashes pervasive regardless of strategy? evidence from the foreign exchange market. Appl. Econ. Lett. 24(20), 1499–1503 (2017)

Bhattacharya, D., Li, W.H., Sonaer, G.: Has momentum lost its momentum? Rev. Quant. Finance Account. 48(1), 191–218 (2017)

Cont, R.: Empirical properties of assets returns: stylized facts and statistical issues. Quant. Finance 1(2), 223–236 (2001)

Cheng, W.H., Hung, J.C.: Skewness and leptokurtosis in GARCH-typed VaR estimation of petroleum and metal asset returns. J. Emp. Finance 18(2), 160–173 (2011)

Xi, J., He, M., Liu, H., Zheng, J.: Admissible output consensualization control for singular multi-agent systems with time delays. J. Frankl. Inst. 353(16), 4074–4090 (2016)

Jacobs, B.I., Levy, K.N.: The complexity of the stock market. J. Portf. Manag. 16(1), 19–27 (2016)

Xi, J., Fan, Z., Liu, H., Zheng, T.: Guaranteed-cost consensus for multiagent networks with Lipschitz nonlinear dynamics and switching topologies. Int. J. Robust Nonlinear Control 28(7), 2841–2852 (2018)

Mandelbrot, B.B.: A multifractal walk down. Sci. Am. 280(2), 70–73 (1999)

Zunino, L., Tabak, B.M., Figlioa, A., Pérez, D.G., Garavaglia, M., Rosso, O.A.: A multifractal approach for stock market inefficiency. Physica A Stat. Mech. Appl. 387(26), 6558–6566 (2008)

Wu, X., Song, G.H., Deng, Y., Xu, L.: Study on conversion between momentum and contrarian based on fractal game. Fractals: Complex Geom. Patterns Scaling Nat. Soc. 23(3), 1–10 (2015)

Mandelbrot, B.B.: Three fractal models in finance: discontinuity, concentration, risk. Econ. Notes 26(2), 197–212 (1997)

Lux, T., Alfarano, S.: Financial power laws: empirical evidence, models, and mechanisms. Chaos Solitons Fractals 88(7), 3–18 (2016)

Wei, Y., Wang, Y., Huang, D.S.: A copula-multifractal volatility hedging model for CSI 300 index futures. Physica A Stat. Mech. Appl. 390(23), 4260–4272 (2011)

Domański, P.D., Ławryńczuk, M.: Assessment of predictive control performance using fractal measures. Nonlinear Dyn. 89(2), 773–790 (2017)

Shyu, K.K., Wu, Y.T., Chen, T.R., Chen, H.Y., Hu, H.H., Guo, W.Y.: Analysis of fetal cortical complexity from MR images using 3D entropy based information fractal dimension. Nonlinear Dyn. 61(3), 363–372 (2010)

Duncan, T.E., Hu, Y., Pasik-Duncan, B.: Stochastic calculus for fractional Brownian motion I. Theory. SIAM J. Control Optim. 38(2), 582–612 (2000)

Gneiting, T., Schlather, M.: Stochastic models that separate fractal dimension and the Hurst effect. SIAM Rev. 46(2), 269–282 (2004)

Bouligand, G.: Ensembles impropres et nombre dimensionnel. Bull. Math. Sci. 52(3), 361–376 (1928)

Olson, E.: Bouligand dimension and almost Lipschitz embeddings. Pac. J. Math. 202(2), 459–474 (2002)

Acknowledgements

This work is supported by the Ministry of Education in China Project of Humanities and Social Sciences (17YJC790168), National Natural Science Foundation of China (71771032, 71501018), National Social Science Foundation of China (17BJY188), Soft Science Research Plan Project of Sichuan Province (2017ZR0205), and Construction Plan of Scientific Research and Innovation Team of Provincial Universities in Sichuan Province (18TD0016).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wu, X., Chun, W., Lin, Y. et al. Identification of momentum life cycle stage of stock price. Nonlinear Dyn 94, 249–260 (2018). https://doi.org/10.1007/s11071-018-4356-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11071-018-4356-1