Abstract

Sweden reached the 2009 OECD average level of female labor force participation already in 1974. Before 1971 spouses were taxed jointly. This meant that the wife’s financial gain of working was a function of the husband’s income. The higher income of the husband, the lower was the wife’s work incentive ceteris paribus. After the reform, the link between the husband’s income and the wife’s participation tax rate was, in principle, abolished. This paper exploits a rich longitudinal register data source and the large variation provided by the individual tax reform to analyze the evolution of female employment in Sweden in the years surrounding the 1971 reform. I provide clear evidence that employment grew considerably more among women married to high-income earners in the years following the announcement of the reform, especially among households with kids. Estimated participation elasticities are in the range 0.5–1 for the total sample.

Similar content being viewed by others

Notes

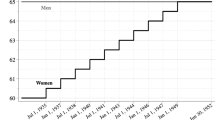

These figures represent labor force participation for females aged 25 to 54. The participation rates of prime-aged women are diverse across OECD countries. In the labor force statistics reported by the OECD (for 2009), Sweden has the second highest participation rate of females aged 25 to 54 in the OECD, 87.1 %, whereas countries like Italy (64.5 %), UK (78.5 %) and US (75.6 %) exhibit considerably lower rates.

In fact, this figure is very close to the benchmark value of 0.5 of the secondary earner’s participation elasticity used by Kleven et al. (2009) to simulate optimal income tax schedules for the UK.

Liebman and Saez (2006) revisit the results of Eissa (1995) on SIPP data matched to longitudinal uncapped earnings records from the Social Security Administration. They conclude that there is little empirical support for the result of Eissa (1995) that wives married to high-income earners increased their labor supply behavior in response to the major tax reform of 1986.

Single households with children were taxed according to the tax schedule for couples.

The pension insurance fee was progressively levied on taxable income and was essentially a sort of income tax.

When calculating the participation tax rates I assume that households choose separate taxation prior to 1971 if this option minimizes tax payments in the household.

Henceforth, all nominal values are expressed in the price level of 2006. 1 USD=7 SEK.

This model requires a notion of the state of non-work. In this context, it is most reasonable to assume that the wife is a housewife who does not receive means-tested transfers when not working. Given that, I exclude low-income households from the analysis (see the discussion below in Sect. 4.1); this should be an uncontroversial assumption.

As will be further described in Sect. 4.1, I choose 1975 as the post-reform year since census data, used to calculate the individuals’ budget constraints, is available every fifth year, 1970 and 1975.

If one also takes the business cycle situation into account, anticipatory responses are likely to occur. In 1970, the business cycle peaked: the GDP growth rate was 5.5 %. Accordingly, the demand for labor was high, and there were a lot of jobs available. In 1971, the year after the reform, Sweden went into a recession, and the GDP growth rate was close to zero.

An unfortunate limitation of the placebo exercise is that I only have access to two years of pre-reform data. However, even with access to more pre-reform data a placebo analysis would be complicated by the introduction of optional separate taxation in 1966.

Even though non-married cohabiting couples with common children were treated as married couples for tax purposes, I will only include married women in the study. This is because partners of cohabiting sampled individuals were not included in the source data set.

While data from tax registers are available annually from 1968 onwards, the censuses were only conducted every fifth year. The latter were based on questionnaires that all Swedish residents were required by law to fill in and return to the authorities. As a consequence, the response rates were extremely high. See SCB (1974, 1979, brief English summaries are included) for detailed descriptions of the censuses.

The first bracket cut-off, in nominal terms, was SEK 12,000 in both 1968 and 1969.

This implies that the spousal income of those at the bottom of the taxable earnings distribution is measured with error. To get an idea of the magnitude of this measurement problem I did the following exercise. I subtracted taxable social benefits (unemployment and sickness benefits) from taxable earnings in 1975 and created deciles based on this adjusted taxable earnings measure, which is comparable with the 1969 taxable earnings measure. Then, I studied the ratio of social benefits to adjusted taxable earnings in 1975 by deciles. It turned out that the ratio was 0.36 in the first decile, 0.06 in the second decile and 0.005 in the top decile. As these transfers were available but non-taxable in 1969, it is very likely that non-labor income in the first tax bracket is measured with considerable error.

As pointed out by Chetty et al. (2012), unless the distribution of reservation wages is uniform, all quasi-experimental estimates are local to the tax variation used for identification.

The price base amount is a Swedish administrative concept that is used by the government when computing transfers. It is calculated based on changes in the general price level.

One such mechanism was the abolishment of the deduction for local taxes (‘kommunalskatteavdraget’), which reduced the central government tax payment for high-income earners before the reform.

The changes in the Swedish wage structure during this time period have been discussed by Edin and Holmlund (1995).

The transfers have been computed based on the socio-demographic characteristics in the censuses, see Appendix A for a description.

I estimate a linear probability model. The actual level of employment in 1975 is given by \(E(P_{it} \mid t = 1975, \mathit{actual\ PTR}) = \frac{\sum_{i} (\beta \ln (1-\tau_{i1975}^{A})+ \mathit{othertems}_{t=1975})}{N}\), where N is the number of individuals in the sample. The hypothetical employment level in 1975, if individuals instead faced the 1969 tax rates, can be expressed as \(E(P_{it} \mid t = 1975, \mathit{hypothetical\ PRT} ) = \frac{\sum_{i} (\beta \ln (1-\tau_{i1971}^{A})+ \mathit{othertems}_{t=1975})}{N}\). The difference between actual and hypothetical employment is \(\beta [ \overline{\ln (1-\tau_{i1975}^{A})} - \overline{\ln (1- \tau_{i 1971}^{A})}]\). In the main regression without non-labor income we obtained \(\widehat{\beta} =0.76\), \(\overline{\ln (1-\tau_{i1975}^{A})} = -0.57\) and \(\overline{\ln (1- \tau_{i1971}^{A})}= -0.81\). This implies a reform effect of 0.76×(−0.57−(−0.81))=0.182. Note that the 1969 tax rates have been computed based on the income variables of 1969.

Child care subsidies are essentially a kind of in-work subsidy that, in principle, can be included in the participation tax rate measure. Child care subsidies are typically decreasing in household income and would therefore reduce participation tax rates relatively more for low-income households.

References

Bargain, O., Orsini, K., & Peichl, A. (2011). Labor supply elasticities in Europe and the US (IZA discussion paper No. 5820).

Blomquist, N. S., & Hansson-Brusewitz, U. (1990). The effect of taxes on male and female labor supply in Sweden. The Journal of Human Resources, 25(3), 317–357.

Blundell, R., & MaCurdy, T. (1999). Labor supply: a review of alternative approaches. In O. Ashenfelter & D. Card (Eds.), Handbook of labor economics (pp. 1559–1695). Amsterdam: Elsevier.

Blundell, R., Duncan, A., & Meghir, C. (1998). Estimating labor supply responses using tax reforms. Econometrica, 66, 827–861.

Brewer, M., Saez, E., & Shephard, A. (2010). Means testing and tax rates on earnings. In Dimensions of tax design. The Mirrlees review, London: Oxford University Press.

Callan, T., van Soest, T., & Walsh, J. R. (2007). Tax structure and female labour market participation: evidence from Ireland (IZA discussion paper series, Nr. 3090).

Chetty, R., Guren, A., Manoli, D., & Weber, A. (2012). Does indivisible labor explain the difference between micro and macro elasticities? NBER Macroeconomics Annual, 27.

Crossley, T. F., & Jeon, S.-H. (2007). Joint taxation and the labour supply of married women: evidence from the Canadian tax reform of 1988. Fiscal Studies, 28(3), 343–365.

Edin, P. A., & Fredriksson, P. (2000). LINDA—Longitudinal INdividual DAta for Sweden (Working paper 2000:19). Uppsala University.

Edin, P. A., & Holmlund, B. (1995). The Swedish wage structure: the rise and fall of solidarity wage policy? In L. F. Katz & R. B. Freeman (Eds.), National bureau of economic research comparative labor markets series. Differences and changes in wage structures, Chicago: University of Chicago Press.

Eissa, N. (1995). Taxation and the labor supply of married women: the tax reform act of 1986 as natural experiment (NBER working paper No. 5023).

Eissa, N. (1996). Labor supply and the economic recovery act of 1981. In M. Feldstein & J. M. Poterba (Eds.), National bureau of economic research project report series. Empirical foundations of household taxation. Chicago: University of Chicago Press.

Eissa, N., & Hoynes, H. W. (2004). Taxes and the labor market participation of married couples: the earned income tax credit. Journal of Public Economics, 88, 1931–1958.

Elvander, N. (1972). Svensk skattepolitik 1945–1970. En studie i partiers och organisationers funktioner. Stockholm: Rabén & Sjögren.

Gelber, A. M. (2012, forthcoming). Taxation and the earnings of husbands and wives: evidence from Sweden. Review of Economics and Statistics.

Gustafsson, S. (1992). Separate taxation and married woman’s labor supply. A comparison of West Germany and Sweden. Journal of Population Economics, 5, 61–85.

Gustafsson, S., & Jacobsson, R. (1985). Trends in female labor force participation in Sweden. Journal of Labor Economics, 3, 256–274.

Heckman, J. J. (1996). Comment. In M. Feldstein & J. M. Poterba (Eds.), National bureau of economic research project report series, Empirical foundations of household taxation (pp. 32–38). Chicago: University of Chicago Press.

Heim, B. T. (2007). The incredible shrinking elasticities. Married female labor supply, 1978–2002. The Journal of Human Resources, 42(4), 881–918.

Immervoll, H., Kleven, H. J., Kreiner, C. T., & Verdelin, N. (2011). Optimal tax and transfer programs for couples with extensive labor supply responses. Journal of Public Economics, 95(11–12), 1485–1500.

Jaumotte, F. (2003). Labour force participation of women: empirical evidence on the role of policy and other determinants in OECD countries. OECD Economic Studies, 37, 51–108.

Kleven, H. J., Kreiner, C. T., & Saez, E. (2009). The optimal income taxation of couples. Econometrica, 77(2), 537–560.

LaLumia, S. (2008). The effects of joint taxation of married couples on labor supply and non-wage income. Journal of Public Economics, 92(7), 1698–1719.

Landais, C., Piketty, T., & Saez, E. (2011). Pour une révolution fiscale. Seuil: La République des Idées.

Liang, C.-Y. (2012). Nonparametric structural estimation of labor supply in the presence of censoring. Journal of Public Economics, 96(1–2), 89–103.

Liebman, J. B., & Saez, E. (2006). Earnings responses to increases in payroll taxes (Mimeo).

Mincer, J. (1962). Labor force participation of married women: a study of labor supply. In H. G. Lewis (Ed.), Aspects of labor economics, Princeton: Princeton University Press.

Pencavel, J. (1998). Assortative mating by schooling and the work behaviour of wives and husbands. The American Economic Review, 88(2), 326–329.

SCB (1974). Folk- och bostadsräkningen 1970. Del 12. Redogörelse för folk- och bostadsräkningens uppläggning och utförande. Stockholm: Statistiska centralbyrån.

SCB (1979). Folk- och bostadsräkningen 1975. Del 11. Redogörelse för folk- och bostadsräkningens uppläggning och utförande. Stockholm: Statistiska centralbyrån.

Steiner, V., & Wrohlich, K. (2008). Introducing family tax splitting in Germany: how would it affect the income distribution, work incentives, and household welfare? Finanzarchiv, 64(1), 115–142.

Acknowledgements

This paper has benefited from comments from anonymous referees, Thomas Aronsson, Sören Blomquist, Karin Edmark, Mikael Elinder, Alex Gelber, Erik Glans, Per Johansson, Wojciech Kopczuk, Che-Yuan Liang, Eva Mörk, Henry Ohlsson, Arthur van Soest, Christopher Taber and conference participants at the OTPR Conference on Tax Policy Analysis in Ann Arbor, the CESifo Area Conference on Employment and Social Protection in Munich, the IIPF Conference in Maastricht, the First Summer School in Public Economics in Barcelona and the Workshop on Taxation, Public Provision and the Future of the Nordic Welfare Model in Helsinki, as well as seminar participants at the Research Institute of Industrial Economics (IFN, Stockholm), Tinbergen Institute (Rotterdam) and Uppsala University. I am grateful for being allowed to use tax calculation programs earlier constructed by Sören Blomquist as a basis for my own work. Financial support from Jan Wallander’s and Tom Hedelius’ Research Foundation and the Uppsala Center for Fiscal Studies is also gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Tax and benefit calculations

1.1 A.1 Tax calculations

The statutory tax schedules for 1969 and 1975, respectively, are depicted in Table 6. Other features of the income tax system, which have all been taken into account, are summarized in Table 7. Even though the register data have a very high degree of accuracy, there are some shortcomings. Therefore, the following simplifying assumptions have been made in the tax calculations: Even though the tax rules were gender-neutral in 1975, we assumed the wife to be the secondary earner of the household in 1975. Another simplification in the tax calculations is that the sickness insurance fee for 1969 has been computed for national averages, even though some local variation prevailed.

1.2 A.2 Public transfers

Two public transfers are relevant for the studied population: housing allowances and child allowances. In both years, families were entitled to a housing allowance that was designed to compensate families for their housing costs. The basic structure of the allowance was that a maximum allowance was first computed as a function of the number of children in the family, housing quality (1969 only) and housing costs. Then, the maximum allowance was reduced as a function of family income and family wealth two years ago (1967 and 1973). Since register data are only available from 1968 onwards, housing allowances for 1969 have been computed based on income and wealth variables for 1968.

During the period of study, housing allowances had two components: (1) ‘statskommunala bostadstillägg’, which were financed both by the central government and the municipalities, and (2) ‘statliga bostadstillägg’, which were exclusively financed by the central government. The allowance rate for the former component varied at the local level. Here, it is assumed that the allowance equaled the subsidy provided by the central government. Moreover, in the absence of information on housing costs, we assumed that all households faced housing costs above the maximum limit. There were two major legislative changes with respect to housing allowances between 1969 and 1975. First, in 1969, but not in 1975, full allowance required that the dwelling exhibited a set of attributes. Information on housing quality is available in the 1970 censuses. Second, families without children were eligible for housing allowances in 1975 but not in 1969.

In both years, the second transfer system, child allowances, was designed as a lump-sum transfer for each child aged below 16 years in the household. In 1969, the transfer amounted to SEK 6600 per child and in 1975 to SEK 8740 per child.

Appendix B: Distribution of work hours in last week of 1968 and 1974

Source: The Swedish Level of Living Survey (see Figs. 7 and 8).

Appendix C

See Table 8.

Rights and permissions

About this article

Cite this article

Selin, H. The rise in female employment and the role of tax incentives. An empirical analysis of the Swedish individual tax reform of 1971. Int Tax Public Finance 21, 894–922 (2014). https://doi.org/10.1007/s10797-013-9283-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-013-9283-y