Abstract

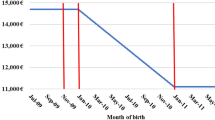

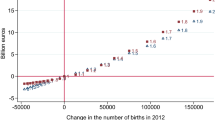

A number of countries have begun implementing tax incentives designed to reverse the decline in fertility. Whether such incentives are effective or equitable remains an open question. During the early twentieth century, France initiated an unusual tax policy to promote fertility and marriage: Household income was divided by family size to obtain a final tax bracket. The policy was regressive in that fertility incentives were so large and greatest among the rich. Similar policies whose fertility benefit increases with income are being implemented today. Using hand-collected archival data from aggregate tax returns and three natural experiments, I find mixed evidence that these kinds of tax incentives affect fertility and marriage.

Similar content being viewed by others

References

Alm, J., Dickert-Conlin, S., & Whittington, L. A. (1999). Policy watch: the marriage penalty. The Journal of Economic Perspectives, 13(3), 193–204.

Baughman, R., & Dickert-Conlin, S. (2003). Did expanding the EITC promote motherhood. The American Economic Review, 93(2), 247–251.

Becker, G. S., & Barro, R. (1988). A reformulation of the economic theory of fertility. Quarterly Journal of Economics, 103(1), 1–25.

Becker, G. S., Glaeser, E. L., & Shapiro, J. M. (2001). Explaining international differences in fertility. NBER Summer Institute, mimeo.

Buttner, T., & Lutz, W. (1990). Estimating fertility responses to policy measures in the German Democratic Republic. Population and Development Review, 16(3), 539–555.

Cohen, A., Dehejia, R., & Romanov, D. (2007). Do financial incentives affect fertility? Discussion Paper 13700, NBER.

Elwood, D. T. (2000). The impact of the earned income tax credit and social policy reforms on work, marriage, and living arrangements. National Tax Journal, 53(4–2), 1063–1106.

Gauthier, A. H., & Hatzius, J. (1997). Family benefits and fertility: an econometric analysis. Population Studies, 51(3), 295–306.

Goda, G. S., & Munford, K. (2009). Fertility response to the tax treatment of children. Krannert Working Paper No. 1219.

Hoynes, H. M. (1997). Work, welfare, and family structure. In A. J. Auerbach (Ed.), Fiscal policy: lessons from economic research. Cambridge: MIT Press.

Hyatt, D. E., & Milne, W. J. (1991). Can public policy affect fertility? Canadian Public Policy, 17(1), 77–85.

Kearney, M. S. (2004). Is there an effect of incremental welfare benefits on fertility behavior? A look at the family cap. Journal of Human Resources, 39, 295–325.

Landais, C. (2006). Le quotient familial a-t-il stimulé la natalité française? Économie publique 13-2003/2.

Laroque, G., & Salanie, B. (2005). Does fertility respond to financial incentives? CEPR Discussion Paper No. 5007. http://www.cepr.org/pubs/dps/DP5007.asp.

Milligan, K. (2005). Subsidizing the stork: new evidence on tax incentives and fertility. Review of Economics and Statistics, 87(3), 539–555.

Moffitt, R. A. (1998). The effect of welfare on marriage and fertility. In R. A. Moffitt (Ed.), Welfare, the family, and reproductive behavior. Washington: National Academy Press.

Perusse, D. (1993). Cultural and reproductive success in industrial societies: testing the relationship at the proximate and ultimate levels. Behavioral and Brain Sciences, 16, 267–322.

Piketty, T. (2001). Les hauts revenues en France au XX siecle: inegalites et redistributions 1901–1998. Paris: Bernard Grasset.

Piketty, T., & Saez, E. (2003). Income inequality in the United States, 1913–1998. Quarterly Journal of Economics, 118(1), 1–39.

Schneider, W. H. (1990). Quality and quantity: the quest for biological regeneration in twentieth-century France. Cambridge: Cambridge University Press.

Sjoquist, D. L., & Walker, M. B. (1995). The marriage tax and the rate and timing of marriage. National Tax Journal, 48(4), 547–558.

Soloway, R. A. (1990). Demography and degeneration: eugenics and the declining birthrate in twentieth-century Britain. Chapel Hill: The University of North Caroline Press.

Whittington, L., Alm, J., & Peters, H. E. (1990). Fertility and the personal exemption: implicit pronatalist policy in the United States. American Economic Review, 80(3), 545–556.

Zhang, J., Quan, J., & van Meerbergen, P. (1994). The effect of tax-transfer policies on fertility in Canada, 1921–1988. The Journal of Human Resources, 29(1), 181–182.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Chen, D.L. Can countries reverse fertility decline? Evidence from France’s marriage and baby bonuses, 1929–1981. Int Tax Public Finance 18, 253–272 (2011). https://doi.org/10.1007/s10797-010-9156-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-010-9156-6