Abstract

The free riding incentive has been a major obstacle to establishing markets and payment incentives for environmental goods. The use of monetary incentives to induce private provision of public goods has gained increasing support to help market ecosystem services. Using a series of lab experiments, we explore new ways to raise money from individuals to support private provision of multi-unit threshold public goods. In our proposed mechanisms, individuals receive an assurance contract that offers qualified contributors an assurance payment as compensation in the event that total contributions fail to achieve the threshold provision cost. Contributors qualify by contracting to support provision with a minimum contribution. Evidence from lab experiments shows that the provision probability, group demand revelation, and social welfare significantly increase when the assurance contract is present. Coordination is improved by the assurance payment especially for agents with values above the assurance level, leading to significantly higher aggregate contributions. A medium level of assurance payment used on units with medium and high value-cost ratios is observed to induce the largest improvement on social surplus. Our approach contributes to the private provision of environmental and other types of public goods.

Similar content being viewed by others

Notes

For example, websites exist where individuals may buy carbon offsets for personal travel. The ecosystemmarketplace.com provides an overview of alternatives, and a Google inquiry uncovers numerous alternatives (e.g., https://www.terrapass.com).

Our motivating example here is the provision of safe habitat for grassland nesting birds, particularly the bobolink (Swallow et al. 2018). In the northeast of U.S., bobolinks largely depend on working hayfields for habitat, the nesting season directly conflicts with the desirable harvest schedule for agricultural providers to capture the peak nutritional value of hay as feed for livestock. Bobolink populations have experienced steep declines and are attractive to even casual bird watchers due to their visibility over grasslands and their easily identifiable song. In focus groups and feedback from donors to The Bobolink Project (Swallow et al. 2018), many individuals identify these birds with rural or childhood and family experiences, which stimulate a willingness to pay. Conservation of nesting habitat requires that farms forego harvests of a minimum of 10-acre hayfields so that a provision point of funding is necessary to compensate farmers for a discrete increment in foregone harvesting of hay. Furthermore, the presence of multiple parcels of habitat challenges the traditional framework of one unit threshold public good provision and requires us to allow local residents to potentially contribute to multiple parcels which motivates our multi-unit setup.

Here, free-riding occurs when an individual expresses a positive Hicksian willingness to pay (WTP) for a good but does not contribute to provision (zero contribution), while cheap-riding implies this person contributes a non-zero amount to provision but their contribution falls well short of reflecting their Hicksian WTP, at least at the margin.

Note that the minimum contribution level in order to obtain the compensation in case of non-provision is the same as the compensation assurance level in our current setup, which significantly simplifies our discussion and experimental design as the first step. A more general setup where these two parameters are set differently is investigated in our companion paper An et al. (2020).

Complete information here means that the following information is common knowledge: the provision cost for each unit, the group size, and the value of each unit for each individual.

Liu and Swallow (2019) provide a general condition where individuals cannot deviate from the provision by more than one unit. Here we assume that individuals cannot obtain a higher profit by deviating from the equilibrium outcome by one unit, while our framework in this paper can still be generalized to cases where deviating by more than one unit is allowed. The proof can be reconstructed easily from Proposition 4 below.

Here we assume the assurance payment \(\ge C/N\) on each unit to avoid the trivial case in which everyone just contributes the assurance level but the good is not provided and everyone earns the assurance payment.

We use a within-subject design, with four sessions of treatment sequences (Base-P10-P14, P10-Base-PDe, P14-PDe-P10, PDe-P14-Base) for phase 1 and two sessions of treatment sequences (Base-C10-C14, Base-C14-C10) for phase 2. That is, for phase 1, a treatment sequence consists of three of the four treatments of Base, P10, P14, and PDe, with each ordered in the first, second, and third once in one of the four treatment sequences, while for phase 2, sessions start with Base and rotate C14 and C10 as the second, leaving the other as the third. Each session has two groups of the same size.

See sample experimental instructions in “Appendix”.

The characterization of the equilibrium set for the multi-unit case with assurance payments in an information environment close to the real world is beyond the scope of this paper. Our lab experiments are designed to mimic some real-world scenarios and to provide insights on how assurance payments could improve the private provision of public goods.

In our experiment, the provision-only equilibria condition under \(AP=14\) is satisfied with 100%, 99%, and 80% of the realized group value profiles for data analysis for the first, second, and third unit, respectively.

In our design, \(AP=18\) is only used for the first unit and the provision-only equilibria condition under \(AP=18\) is satisfied with 72% of the realized group value profiles for data analysis.

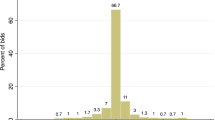

Since the total group values vary with group size and the value realization and we are mainly interested in the effects of the level of AP, we use the ratio of group contributions to total realized group values, that is, the group contribution-value ratio, to normalize group contributions, and pool group contribution-value ratios based on the assurance payment level. The average ratio of provision cost to the realized group induced value pooling all treatments on each unit is used to provide a baseline comparable across AP levels.

We have 36 group level observations in total on each unit in Fig. 1. Specifically, on unit 1, we have 10 observations for each of AP = 0, 10, and 14, and 6 for AP = 18. On unit 2, we have 10 for each of AP = 0 and 10, and 16 for AP = 14. On unit 3, we have 10 for each of AP = 0 and 14, and 16 for AP = 10. On units 4 to 6, we have 28 for AP = 10, and 4 for each of AP = 10 and 14.

When calculating the provision rate, we exclude the case in which it is not efficient to provide a unit given the total realized induced value. In our experiment data, the case of the total realized induced value being less than the cost happens only for units 5 (15 out of 720 observations, or 2.1%) and 6 (340 out of 720 observations, 47.2%).

On units 1 and 2, the value-cost ratios are relatively high (2 and 1.8) with the lowest induced values of 15 and 13 on the first and second units, respectively. The unit cost per capita is 10.

The two-factor random effects models are based on the following regression: \(y_{it}=X_{it}\beta + \mu _{i}+v_i+\epsilon _{it}\), where \(y_{it}\) represents the group contribution-value ratio for group i in period t, with the two random effects denoted by \(\mu _{i}\) and \(v_i\), respectively, and \(X_{it}\) is a set of regressors including dummies for assurance payment levels and some interaction terms across treatments. The group contribution-value ratio of aggregating the two groups, that is, the ratio of the aggregated two-group contributions to the aggregated two-group induced values, is used in the regression to be consistent with the session-group specific effect, since group members are reshuffled among two groups in each period. We exclude the observations from the first five periods to avoid potential learning effects in the early periods. We have run the same model specifications using all 15 periods of data and results are very close.

We use dummies of AP10 and AP14 to denote the conditional assurance schemes on all six units and they are respectively interacted with dummies of P10 and P14 for partial assurance on Units 1 to 3 (AP10*P10 and AP14*P14) to distinguish the potential different effects from the partial and conditional assurance payments. Since the treatment PDe induces three different assurance payments of 18, 14, and 10 respectively for Units 1 to 3, a dummy AP18 and the interaction terms of AP14*PDe and AP10*PDe are added respectively into regressions for Units 1 to 3. The treatment dummies P10, P14, PDe are included for Units 4 to 6 to distinguish the difference between the partial assurance and no assurance payment schemes, with the latter as the baseline. The specifications in Table 3 are designed to simplify the regression models and highlight the effects of assurance payment levels on the contribution-value ratio.

See Table 6 in "Appendix" for the percentages of group contributions being equal to the unit cost under each assurance payment level on each unit.

The cumulative probability curve of \(AP=10\) uses the data of P10 on units 1 to 3 and C10 on all six units; similarly, the curve of AP=14 uses P14 on units 1 to 3 and C14 on all six units. The curve of \(AP=18\) uses PDe on unit 1, and all the other observations are used for the curve of AP = 0.

In Fig. 5, the horizontal axis denotes the induced values, the vertical axis denotes the observed individual contributions. Both of induced values and contributions are rounded to the nearest integers for easier comparisons. The size of the circles is proportional to the frequency of the contributions. The colored solid horizontal lines in panels (b) to (d) denote the corresponding assurance payment levels in the experiment.

We observe similar patterns for the percentage of individual contributions at or above AP conditional on values strictly above AP. For \(AP=10, 14, 18\), the percentages are 76.5%, 59.7% and 65.0% at or above 10, 14 and 18, respectively, while 40.5%, 19.1%, and 14.3% under \(AP=0\).

Since the assurance payment level of 18 is used only on unit 1, contributions under \(AP=18\) can be only observed in the value range of 15 to 25. Contributions under other assurance payment levels can be observed in the full value range of 5 to 25.

We also run three random effects tobit regressions of individual contributions on treatment dummies to compare PPM and the assurance payment treatments with \(AP=10, 14, 18\), respectively. See Table 8 in "Appendix". The baseline is PPM in all three models. We use an indicator variable to reflect whether the value is greater than or equal to the assurance payment level AP and a dummy of AP to denote the treatment with the assurance payment level of AP. We also include an interaction term of the two dummies. We find the assurance payment treatments with \(AP=10, 14, 18\) all have intercepts significantly higher than PPM with \(p = 0.022, 0.002, 0.010\), respectively. We observe a significant jump of the intercept coefficient for the value range of 14 and above (\(p < 0.001\)) under the treatment with \(AP=14\).

Panel (a) is for units 1 to 3 and panel (b) for units 4 to 6, representing high and low value-cost ratios, respectively. The vertical grey line at 10 represents the group-size normalized unit cost.

In panel (a), the CDFs of \(AP=14\) (the green ones) are all below those of \(AP=10\) (the red ones), and the lower the intercept of a CDF and the vertical unit cost line, the larger the percentage of contributions above the threshold cost. By Kolmogorov-Smirnov tests with permutations, the differences of CDFs between \(AP=14\) and 10 on units 1 to 3 are at the significance levels of 0.221, 0.011, and 0.023, respectively.

The contribution variance under AP=10 is significantly less than that under \(AP=14\) on units 4 to 6. By variance ratio tests, the p-values for the comparisons that \(AP=10\) induces a smaller variance than \(AP=14\) are 0.0749, 0.0009, and 0.0338 for units 4 to 6, respectively. By Kolmogorov-Smirnov tests with permutations, the differences of CDFs between \(AP=14\) and 10 on units 4 to 6 are at the significance levels of 0.392, 0.081, and 0.862, respectively.

For example, the percentages (probability) of the assurance payments being paid in case of provision failure are sharply different under \(AP=10\) and 14, on average around 67% for the former while only 38% for the latter.

See Fig. 9 in "Appendix" for the cumulative distribution of group contributions normalized by the group size N for different assurance payment levels on each unit.

Since the assurance payment involves a surplus transfer to consumers, it would be interesting to compare the performance of the assurance payment mechanism to a matching fund approach when the amounts of money to incentivize consumers are the same.

References

Alboth D, Lerner A, Shalev J (2001) Profit maximizing in auctions of public goods. J Public Econ Theory 3(4):501–525

An Y, Li Z, Liu P (2020) Assurance contracts in threshold public goods provision with incomplete information. Working Papers

Attiyeh G, Franciosi R, Isaac RM (2000) Experiments with the pivot process for providing public goods. Public Choice 102(1–2):93–112

Bagnoli M, Lipman BL (1989) Provision of public goods: fully implementing the core through private contributions. Rev Econ Stud 56(4):583–601

Bagnoli M, Ben-David S, McKee M (1992) Voluntary provision of public goods: the multiple unit case. J Public Econ 47(1):85–106

Banerjee S, Secchi S, Fargione J, Polasky S, Kraft S (2013) How to sell ecosystem services: a guide for designing new markets. Front Ecol Environ 11(6):297–304

Banerjee S, Kwasnica AM, Shortle JS (2015) Information and auction performance: a laboratory study of conservation auctions for spatially contiguous land management. Environ Resource Econ 61(3):409–431

Cason TN, Gangadharan L (2004) Auction design for voluntary conservation programs. Am J Agr Econ 86(5):1211–1217

Cason TN, Zubrickas R (2017) Enhancing fundraising with refund bonuses. Games Econom Behav 101:218–233

Cason TN, Zubrickas R (2019) Donation-based crowdfunding with refund bonuses. Eur Econom Rev 119: 452-471

Cason TN, Tabarrok A, Zubrickas R (2021) Early refund bonuses increase successful crowdfunding. Games Econom Behav 129:78–95

Clarke EH (1971) Multipart pricing of public goods. Public Choice 11(1):17–33

Falkinger J, Fehr E, Gächter S, Winter-Ember R (2000) A simple mechanism for the efficient provision of public goods: experimental evidence. Am Econ Rev 90(1):247–264

Ferraro PJ (2008) Asymmetric information and contract design for payments for environmental services. Ecol Econ 65(4):810–821

Ferraro PJ (2011) The future of payments for environmental services. Conserv Biol 25(6):1134–1138

Fischbacher U (2007) z-Tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10(2):171–178

Gómez-Baggethun E, de Groot R, Lomas PL, Montes C (2010) The history of ecosystem services in economic theory and practice: from early notions to markets and payment schemes. Ecol Econ 69(6):1209–1218

Groves T (1973) Incentives in teams. Econometrica 41(4):617–631

Kawagoe T, Mori T (2001) Can the pivotal mechanism induce truth-telling? An experimental study. Public Choice 108(3–4):331–354

Laussel D, Palfrey TR (2003) Efficient equilibria in the voluntary contributions mechanism with private information. J Public Econ Theory 5(3):449–478

Ledyard JO (1995) Public goods: a survey of experimental research. In: J. Kagel/A. Roth (Hrsg.) Handbook of experimental economics, pp 111–194

Li Z, Liu P (2019) The assurance payment mechanism for threshold public goods provision: an experimental investigation. Working paper

Li Z, Anderson CM, Swallow SK (2016) Uniform price mechanisms for threshold public goods provision with complete information: an experimental investigation. J Public Econ 144:14–26

List JA (2011) The market for charitable giving. J Econ Perspect 25(2):157–180

List JA, Lucking-Reiley D (2002) The effects of seed money and refunds on charitable giving: experimental evidence from a university capital campaign. J Polit Econ 110(1):215–233

Liu P (2021) Balancing cost effectiveness and incentive properties in conservation auctions: experimental evidence from three multi-award reverse auction mechanisms. Environ Resource Econ 78(3):417–451

Liu P, Swallow SK (2019) Providing multiple units of a public good using individualized price auctions: experimental evidence. J Assoc Environ Resour Econ 6(1):1–42

Liu P, Swallow SK, Anderson CM (2016) Threshold level public goods provision with multiple units: experimental effects of disaggregated groups with rebates. Land Econ 92(3):515–533

Marks M, Croson R (1998) Alternative rebate rules in the provision of a threshold public good: an experimental investigation. J Public Econ 67(2):195–220

Masclet D, Noussair C, Tucker S, Villeval M-C (2003) Monetary and nonmonetary punishment in the voluntary contributions mechanism. Am Econ Rev 93(1):366–380

MEA (2005) Ecosystems and human well-being. Isand Press, Washington

Poe GL, Clark JE, Rondeau D, Schulze WD (2002) Provision point mechanisms and field validity tests of contingent valuation. Environ Resource Econ 23(1):105–131

Rondeau D, Schulze WD, Poe GL (1999) Voluntary revelation of the demand for public goods using a provision point mechanism. J Public Econ 72(3):455–470

Rondeau D, Poe GL, Schulze WD (2005) VCM or PPM? A comparison of the performance of two voluntary public goods mechanisms. J Public Econ 89(8):1581–1592

Rose SK, Clark J, Poe GL, Rondeau D, Schulze WD (2002) The private provision of public goods: tests of a provision point mechanism for funding green power programs. Resource Energy Econ 24(1):131–155

Schomers S, Matzdorf B (2013) Payments for ecosystem services: a review and comparison of developing and industrialized countries. Ecosyst Serv 6:16–30

Spencer MA, Swallow SK, Shogren JF, List JA (2009) Rebate rules in threshold public good provision. J Public Econ 93(5):798–806

Swallow SK, Anderson CM, Uchida E (2018) The Bobolink project: selling public goods from ecosystem services using provision point mechanisms. Ecol Econ 143:236–252

Tabarrok A (1998) The private provision of public goods via dominant assurance contracts. Public Choice 96(3–4):345–362

Zubrickas R (2014) The provision point mechanism with refund bonuses. J Public Econ 120:231–234

Acknowledgements

Zhi Li thanks the National Natural Science Foundation of China (Grant No. 71873116 and 71774136) and the Basic Scientific Center Project (Grant No. 71988101) of National Science Foundation of China for funding support. Pengfei Liu thanks USDA-NIFA through Agricultural Experiment Station (AES) and/or Cooperative Extension (CE) at the University of Rhode Island (URI) under RI0018-W4133, No. 1014661. Comments from conference participants through AAEA, ACES, ESA, EAERE, EfD, and CES, and seminar and workshop participants at ECUST, XJTU, DUFE, SHUFE, RUC and ShanghaiTech are greatly appreciated. The authors would like to thank the Editor and two anonymous reviewers for insightful comments and suggestions that have improved the paper.

Funding

This research was funded in part by USDA/NIFA/AFRI Award No. 2011-67023-30378, UCONN-Storrs Agricultural Experiment Station project no. CONS00887, and UCONN DelFavero Faculty Fellowship.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Confict of interest

The authors declare that they have no confict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendices

1.1 Theoretical Framework and Proof

Proof for Proposition 4

When j units are provided, condition (a) ensures that the total bids on a provided unit just equal the cost, together with \(\sum _ib_i^{j+1}<C\) we can conclude that only j units will be provided.

Individual i’s profit from providing j units is

where the term \(\sum _{l=1}^{j}v_i^l-j(C-\sum _{k\ne i}b_k^{j})\) represents the profit from the public goods without the assurance payment, \(I(b_i^{j+1}\ge AP^{j+1})AP^{j+1}\) is the potential assurance payment from the \(j+1\) unit since the assurance payment is only available on the first unit not provided, which depends on individual i’s bid \(b_i^{j+1}\) and the assurance payment level \(AP^{j+1}\) with \(I(\cdot )\) as the indicator function.

To eliminate the incentive to provide one more unit (\(j+1\) units), we need to require no individual can obtain a higher profit by providing \(j+1\) units. Individual i’s profit from providing \(j+1\) units is

where the term \(\sum _{l=1}^{j+1}v_i^l-(j+1)(C-\sum _{k\ne i}b_k^{j+1})\) represents the profit from the public goods without the assurance payment when \(j+1\) units are provided. When providing j units are provided, we need \(\pi _i^{j}\ge \pi _i^{j+1}, h>j\) so that no individual can be better by providing \(j+1\) units unitarily, which implies,

To eliminate the incentive to provide \(j-1\) units, we need to require no individual can obtain a higher profit by providing \(j-1\) units. Individual i’s profit from providing \(j-1\) units is

where the term \(\sum _{l=1}^{j-1}v_i^l-(j-1)(C-\sum _{k\ne i}b_k^{j-1})\) represents the profit from the public goods without the assurance payment when \(j-1\) units are provided. We need \(\pi _i^{j}\ge \pi _i^{j-1}\) so that no individual can be better by providing \(j-1\) units unitarily, which implies,

\(\square\)

Proof for Corollary 1

When providing j units is the equilibrium outcome and assurance is not available, according to Proposition 3, we have

When assurance is available, according to Proposition 4, similarly we have

where we define that \(N^{l}_{-}= \left| \left\{ i: b_i^l < AP^l \right\} \right|\) and \(N^l_{+}= \left| \left\{ i: b_i^l \ge AP^l \right\} \right|\). Note that when the assurance payment is constant or decreasing, and since the number of individuals qualify for assurance payment becomes lower at a higher unit as the induced value decreases, the presence of assurance payment will increase the upper bound of the total group contribution in equilibrium when \(N^{j+1}_{+}AP^{j+1}-N^{j+2}_{+}AP^{j+2}>0\). Also note that for \(i\in N^{j+1}_{-}\), \(C-\sum _{i \ne k}b_k^{j+1}\le AP^{j+1}\) since otherwise individual i can just contribute \(AP^{j+1}\) on the \(j+1\)th unit to increase the profit by \(AP^{j+1}\), therefore, we have

\(\square\)

Proof for Corollary 2

Here we impose a monotonic assumption so that individual i’s bid is not decreasing when induced value increases. As a result, individual i’s bid will be non-increasing when induced value is downward sloping as the unit number increases, or \(b_i^{j}>b_i^{j+1}\). When equilibrium outcome is j units, we have \(\sum _ib_i^{j+1}\le C\). If \(b_i^{j+1}<AP^{j+1}\), then \(AP^{j+1}\ge C-\sum _ib_i^{j+1}\) since otherwise individual i can just contribute \(AP^{j+1}\) on the \(j+1\)th unit to increase the profit by \(AP^{j+1}\). Also, since j is not provided, then individual i must receive a smaller profit providing \(j+1\) units compared to when providing j units. Let \({\tilde{b}}_i^{j+1}<C-\sum _ib_i^{j+1}\) be the new bid needed to provide the \(j+1\) units. Therefore, \(v_i^{j+1}-(j+1){\tilde{b}}_i^{j+1}+jb_i^k< 0\), or \(v_i^{j+1}< (j+1){\tilde{b}}_i^{j+1}-jb_i^k\). According to the monotonic constraint, we have \(v_i^{j+1}< (j+1){\tilde{b}}_i^{j+1}-jb_i^k\le {\tilde{b}}_i^{j+1}=C-\sum _ib_i^{j+1}\le AP^{j+1}\).

When \(j+1\)th unit is not provided in the equilibrium and if \(b_i^{j+1}<AP^{j+1}\), we find that \(v_i^{j+1}<AP^{j+1}\), which implies that if \(v_i^{j+1}\ge AP^{j+1}\), then \(b_i^{j+1}\ge AP^{j+1}\). When \(AP^{j+1}={\bar{v}}^{j+1}\), and the number of individuals with values greater than or equal to \({\bar{v}}^{j+1}\) is great than \(C/v^{j+1}\), the contributions from the set of individuals with values greater than or equal to \({\bar{v}}^{j+1}\) would be at least C, contradicting with the non-provision condition when the \(j+1\)th unit is not provided. \(\square\)

1.2 Supplementary Tables and Figures

1.3 Lab Experiment Instructions

This is an experiment in the economics of decision-making. During the experiment, you will be asked to make a series of decisions. If you follow the instructions and make careful decisions, you can earn a considerable amount of money.

1.3.1 Experiment Overview

-

You will be asked to decide how much money to offer towards the cost of several public goods in discrete units. This cost of the public good is predetermined and known to you.

-

You will be randomly assigned to one of the two groups at the beginning. Your group members will change after each decision period.

-

All members of your group receive a benefit that depends on the number of units being provided. The number of units provided depends on your decision AND those decisions of the other people in your group.

-

Earnings in each decision period are based on how much you are willing to invest, how much you earn (your benefits) if the good is provided and the investment decisions of the others in your group. In some of the treatments, you may also earn extra money by satisfying our assurance contract requirement.

1.3.2 How You Earn Money

At the beginning of each period, you will be told the individual values (benefits) you receive if that unit of public good is provided. The individual value for one unit of public good can be different across people; someone may have a higher value than you, while the others may have a lower value than you. Your individual value will change after each decision period. You will then be asked to make contributions according to our rules. There are six public good units available in total and the cost is same for each unit.

You will be working with experimental dollars. Your initial fund will be 250 experimental dollars, which represents your fee for showing up today. Your earnings for each period will be added to or subtract from this amount. After the experiment, we will convert your earning to cash with a ratio 50:1; that is, if your balance at the end of the experiment is $1000, you will receive $20 in cash. There are three treatments in the experiment. You will be paid as you leave.

1.3.3 Group

Your group is important because the moderator, using a computer program, will evaluate the combined decisions (i.e. contributions) from each member of your group to determine the outcome. In this way, the decisions of every person in your group may impact your profit. You do not know others’ contributions or benefits.

1.3.4 Communication

Communication is NOT allowed between participants once we begin today. If you have any questions during the treatments, please raise your hand.

1.3.5 Treatments, Periods

There are 15 decision periods in each treatment. We expect to finish the whole experiment within one hour and thirty minutes or so.

1.3.6 What you need to do?

Once the program is activated, please make a contribution for \({\underline{{\varvec{each}}}}\) public good unit. There are six units of public good available in total.

1.3.7 Your value

Your value on the first unit is randomly drawn from [15, 25], your value on the sixth (last) unit is randomly drawn from [5, 15]. Others’ values are also randomly drawn from the same intervals; thus, someone may have a higher value than you, while some may have a lower value than you. Your value decreases from the first unit to the last unit.

1.3.8 How is your profit calculated?

-

Your profit\(=\) Your benefit - Your cost.

-

Your benefit\(=\) sum of your values for all the units that are provided.

Your benefit depends on the number of units that your group collectively supports. You will receive your value for each unit supported. For example, if your group supported the first three units, and your values for the first three units are $20, $15, $10, your benefit is $20+$15+$10=$45.

-

Your cost = contribution on the last unit provided \(\times\) number of units provided.

Your cost also depends on the number of units that your group could collectively support. Your cost is your contribution on the last unit provided times the number of units provided. For example, if your group supported the first three units, your contribution on the third unit is $5, then your cost $5 × 3 = $15.

-

Under this situation, your profit = $45−$15 = $30.

1.3.9 How to decide if a unit can be provided?

-

We will compare the total contribution of your group for each unit with the public good cost for that unit, starting from the first unit. If the group’s total contribution on the first unit is higher or equal to the cost for the first unit, we continue to compare the contribution on the second unit with the cost of that unit, and so on.

-

We will stop when the total group contribution for a unit is smaller than the unit cost.

All the numbers used in examples serve only illustrative purpose; please do not try to use these examples to guess what would actually happen in the experiment.

1.4 Assurance

In this treatment, we offer an assurance contract for the first three units. Your total profit is whatever you can get from providing the public good, plus any assurance payment whenever applicable. We try to protect you from getting zero benefits when you were willing to contribute above a certain level. That is, if your contribution on the first three units is higher or equals to a certain level, and if that unit is the first unit not provided, then we will compensate you an amount equal to the level we set with the table below, which we call the minimum contribution for assurance. Below is the minimum contribution for assurance you need to reach in order to get an assurance payment in case of provision failure; you may decide to contribute less if you wish, but then you will not be eligible to receive the assurance payment.

Unit | Minimum Contribution | Your Compensation |

|---|---|---|

1 | 14 experimental dollars | 14 experimental dollars |

2 | 14 experimental dollars | 14 experimental dollars |

3 | 14 experimental dollars | 14 experimental dollars |

You receive assurance payment only for the first unit not provided. For example, if your values on the six units are \(\{ 20, 15, 10, 5, 4, 3\}\) , and contributions on the six units are \(\{15, 14, 10, 5, 4, 2\}\) , with the assurance,

-

If 0 units are provided, and we fail to provide Unit 1: Since your contribution on Unit 1 is $15, which is higher than $14, the minimum contribution, you will get a compensation from our assurance, $14. Thus, your total profit is $14. However, if you contributed lower than $14, say $10, your profit is $0.

-

If 1 unit is provided, and we fail to provide Unit 2. Since your contribution on Unit 2 is $14, which equals $10, the minimum contribution, you will get a compensation from our assurance, $14. Thus, your total profit is your profit from providing 1 unit, $20-$15\(=\)$5, plus the compensation from our assurance, $14; therefore, your total profit is $5\(+\)$14\(=\)$19. However, if you contributed lower than $14 on the unit 2, say $8, your profit is $5.

-

If 2 units are provided, and we fail to provide Unit 3. Since your contribution on Unit 3 is $10, which is smaller than $14, the minimum contribution, you will NOT get a compensation from our assurance. Thus, your total profit is your profit from providing 2 units, $20\(+\)$15-2*$14\(=\)$7. However, if you contributed more than (or equal to) $14 on Unit 3, say $15, then your profit is $7\(+\)$14\(=\)$21, since you get the assurance $14.

-

We only provide assurance for the first three units.

1.4.1 Quiz (4 mins)

-

1.

If your contributions on the first 4 units are $15, $10, $9, $6, respectively, and your group provides 2 units, what’s your cost in this case?

-

2.

If your contributions on the first 4 units are $15, $10, $9, $6, respectively, your benefits on the first 4 units are $20, $10, $5, $3, and if your group provides 2 units, what’s your profit in this case? What’s your profit if your group provided 1 unit? What’s your profit if your group provided 0 units?

-

3.

If there are five people in your group, their values are the same for the first five units which are {20, 18, 16, 14, 12}; their contributions on the first unit are {15, 15, 15, 15, 15}, their contributions on the second unit are {13, 13, 13, 13, 13}, their contributions on the third unit are {9, 9, 9, 9, 9}, their contributions on the fourth unit are {5, 5, 5, 5, 5}, and if the provision cost is 50. How many units are provided in total? What’s the profit of one people? If only one unit is provided, what’s the profit of one people?

At the end of the experiment, your earnings will be totaled across all periods and converted from experimental dollars to real dollars. You will be paid as you leave.

Now please make your decisions!

Rights and permissions

About this article

Cite this article

Li, Z., Liu, P. & Swallow, S.K. Assurance Contracts to Support Multi-Unit Threshold Public Goods in Environmental Markets. Environ Resource Econ 80, 339–378 (2021). https://doi.org/10.1007/s10640-021-00588-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-021-00588-4