Abstract

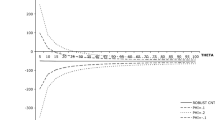

We study an estimation approach that is robust to misspecifications of the dynamic economic model being estimated. Specifically, the approach allows researchers to focus on a particular sub-problem or sub-period of the optimizing agent’s finite horizon and thus alleviates the need for assumptions regarding expectation formation about the (distant) future. This is accomplished by approximating a pseudo terminal period policy- or value function non-parametrically rather than fully specifying the remaining economic environment anticipated by agents until the terminal period. We illustrate through two Monte Carlo experiments the superior robustness of the approximate estimator compared to a standard full solution estimator.

Similar content being viewed by others

Notes

By misspecification we refer to any situation in which either the researcher or the optimizing agent have a misperception about the distant future.

A parametric approach similar to the one discussed here has been successfully employed in Keane and Wolpin (2001) who study the postsecondary educational choices of US youth and the role of parental transfers.

While we focus on a full-solution or nested fixed point (NFXP) type estimator throughout, our approach would also apply to alternative estimators such as the mathematical programming with equilibrium constraints (MPEC) proposed by Su and Judd (2012).

An alternative strategy is to use reforms as exogeneous variation to identify the structural parameters in the model. Blundell et al. (2016), for example, use tax and welfare reforms to estimate a model of female labor force participation. In doing so, the authors must take a stand on household’s expectation formation regarding institutional settings and assume that all reforms are completely unanticipated. While this assumption is computationally attractive, the amount of reforms to the tax and welfare system suggests that households would be better of by putting some positive probability to alternative schemes in the future.

In fact, the computation time required by the approximate estimator is not necessarily lower than that of the full-solution estimator: Computational time is reduces in the approximate estimator because the model needs to be solved for \({\overline{T}}-{\check{T}}\) fewer periods but computational time might also increase because the number of parameters to estimate increases due to the introduced parameters in the approximation.

Other approaches related to ours are those suggested in Geweke and Keane (2000) and Judd, Maliar, Maliar and Tsener (forthcoming).

While this does not include the recursive Epstein–Zin-Weil preferences, we see no reason why not to believe our approach could be implemented with such preferences.

Some caution may be advised when performing counter-factual policy simulations based on the approximate model. Although the approximate model provides an acceptable approximation for observed data, the approximate model might provide a poorer approximation for simulated data under alternative contingencies. In many cases this is unlikely to be important but if the counter factual simulation changes the distribution of data radically, this might be a real concern.

Note, we here frame the analysis as a cohort-analysis since time and age are on-to-one in the current formulation. If data from several cohorts are used in estimation, the age should be an independent state variable in the model and the pseudy-terminal period approximation should then also be a function of age.

References

Arcidiacono, P., Bayer, P., Bugni, F. A., & James, J. (2013). Approximating high-dimensional dynamic models: Sieve value function iteration. In T. B. Fomby, R. C. Hill, I. Jeliazkov, J. C. Escanciano, & E. Hillebrand (Eds.), Advances in econometrics (Vol. 31, pp. 45–95). Bingley: Emerald Group Publishing Limited.

Bhat, N., Farias, V. F., & Moallemi, C. C. (2012). Non-parametric approximate dynamic programming via the Kernel method. Unpublished working paper, Graduate School of Business, Columbia University.

Blundell, R., Dias, M. C., Meghir, C., & Shaw, J. M. (2016). Female labour supply, human capital and welfare reform. Econometrica, 84(5), 1705–1753.

Carroll, C. D. (1992). The buffer-stock theory of saving: Some macroeconomic evidence. Brookings Papers on Economic Activity, 2, 61–135.

Deaton, A. (1991). Saving and liquidity constraints. Econometrica, 59(5), 1221–1248.

Ewald, C., & Wang, W. (2011). Analytic solutions for infinite horizon stochastic optimal control problems via finite horizon approximation: A practical guide. Mathematical Social Sciences, 61(3), 146–151.

Geweke, J . F., & Keane, M . P. (2000). Bayesian inference for dynamic discrete choice models without the need for dynamic programming. In R. Mariano, T. Schuermann, & M . J. Weeks (Eds.), Simulation-based inference in econometrics: Methods and applications (pp. 100–131). Cambridge: Cambridge University Press. Chap. 4.

Gourinchas, P.-O., & Parker, J. A. (2002). Consumption over the life cycle. Econometrica, 70(1), 47–89.

Judd, K. (1998). Numerical methods in economics. Cambridge: MIT Press.

Judd, K. L., Maliar, L., Maliar, S., & Tsener, I. (2017). How to solve dynamic stochastic models computing expectations just once. Quantitative Economics, 8(3), 851–893.

Kaboski, J. P., & Townsend, R. M. (2011). A structural evaluation of a large-scale quasi-experimental microfinance incentive. Econometrica, 79(5), 1357–1406.

Keane, M. P., & Wolpin, K. I. (1994). The solution and estimation of discrete choice dynamic programming models by simulation and interpolation: Monte carlo evidence. The Review of Economics and Statistics, 76(4), 648–672.

Keane, M. P., & Wolpin, K. I. (1997). The career decisions of Young Men. The Journal of Political Economy, 105(3), 473–522.

Keane, M. P., & Wolpin, K. I. (2001). The effect of parental transfers and borrowing constraints on educational attainment. International Economic Review, 42(4), 1051–1103.

Kroemer, O. B., & Peters, J. R. (2011). A non-parametric approach to dynamic programming. In J. Shawe-Taylor, R. Zemel, P. Bartlett, F. Pereira, & K. Weinberger (Eds.), Advances in neural information processing systems (Vol. 24). los angeles: Neural Information Processing Systems Foundation Inc.

Manski, C. F. (1993). Adolescent econometricians: How do youth infer the returns to schooling? In C. T. Clotfelter & M. Rothschild (Eds.), Studies of supply and demand in higher education (pp. 43–60). Chicago: University of Chicago Press. Chap. 2.

Rust, J. (2000). Parametric policy iteration: An efficient algorithm for solving multidimensional DP problems?. unpublished working paper, Yale University.

Rust, J., Hall, G., Benítez-Silva, H., Hitsch, G. J., & Pauletto, G. (2005). A comparison of discrete and parametric approximation methos for solving dynamic programming problems in economics. Unpublished working paper, University of Maryland.

Su, C.-L., & Judd, K. L. (2012). Constrainted optimization approaches to estimation of structural models. Econometrica, 80(5), 2213–2230.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank Jeppe Druedahl, Anders Munk-Nielsen, Itay Saporta-Eskten and Mette Ejrnæs for helpful comments and discussions. Financial support from the Danish Council for Independent Research in Social Sciences is gratefully acknowledged (FSE, Grant No. 4091-00040). The current research is part of and funded by an European Research Council Starting Grant (No. 312474).

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Jørgensen, T.H., Tô, M. Robust Estimation of Finite Horizon Dynamic Economic Models. Comput Econ 55, 499–509 (2020). https://doi.org/10.1007/s10614-019-09898-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-019-09898-8