Abstract

The theoretical literature in economics has established causality from cost dispersion to price dispersion in a market for a homogeneous good in which buyers face search cost. In that literature, it is generally assumed that the cost distribution in the market is exogenous. In this paper we explore bidirectional causality between costs and prices, motivated by a long run perspective under which there are entry decisions on the sellers’ side on the basis of information about past prices. Moreover, we assume that decision makers do not have full information about former prices but they have access to a statistical estimate of past prices, typically provided by some external agency. We introduce a evolutionary discrete time model for the interaction of agents in the market which we analyze numerically. We show that, in this scenario of mutual influence between cost and prices, price dispersion (and cost dispersion) prevail in the stationary regime of the market. We provide evidence that features of the stationary price distribution are related with those of the initial distributions of price and costs and, in particular, we characterize initial conditions to deliver stationary leptokurtic price distributions, which have been recently reported to be prevalent in many markets.

Similar content being viewed by others

Notes

Our analysis is valid as long as the number of sellers is much larger than a number of ex-ante homogeneous buyers. We consider a representative buyer for simplicity.

Notice that the sequence of optimal search values \(n_t\) (solving (SP) for each period) can be obtained by all agents provided that \(F_{t-1}\) is made available and the unitary search cost \(\tau \) is known. Thus, it is sufficient for the belief formation process to work that the BoS makes public \(F_{t-1}\) and some estimate of \(\tau \).

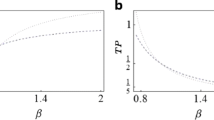

A number of standard probability distributions in economics belong to the GED family. Particularly, GED\((\mu ,\alpha ,1)\) is the Laplace distribution, GED\((\mu ,\alpha ,2)\) is the Normal distribution, and GED\((\mu ,\alpha ,\infty )\) is the Uniform distribution. Moreover, a GED\((\mu ,\alpha ,\beta )\) is leptokurtic for \(\beta <2\) and platykurtic for \(\beta > 2\), (see e.g. Forbes et al. 2011). The parameter \(\mu \) locates the mean, the median and the mode. The variance depends on both scale \(\alpha \) and shape \(\beta \), as follows

$$\begin{aligned} \sigma ^2:= Var [p] = {\dfrac{\alpha ^2\varGamma \left( 3/\beta \right) }{\varGamma \left( 1/\beta \right) }}. \end{aligned}$$The scale is determined by \(\hat{\alpha }_t\) rather than \(\alpha _t\) as the entry decision should be driven by the same information than the pricing decision.

Source codes are available from the corresponding author upon request.

This fact is relevant, since costs go typically unobserved and recovering their structure from observed price data is a difficult task—see e.g. Hong and Shum (2006).

References

Baye, M. R., Morgan, J., & Scholten, P. (2006). Information, search, and price dispersion. Handbook on Economics and Information Systems, 1, 323–375.

Burdett, K., & Judd, K. L. (1983). Equilibrium price dispersion. Econometrica: Journal of the Econometric Society, 51, 955–969.

Diamond, P. A. (1971). A model of price adjustment. Journal of Economic Theory, 3(2), 156–168.

Forbes, C., Evans, M., Hastings, N., & Peacock, B. (2011). Statistical distributions. New York: Wiley.

Hong, H., & Shum, M. (2006). Using price distributions to estimate search costs. The RAND Journal of Economics, 37(2), 257–275.

Hopkins, E. (2008). Price dispersion. In S. N. Durlauf & L. E. Blume (Eds.), The new Palgrave dictionary of economics. Basingstoke: Palgrave Macmillan.

Kaplan, G., & Menzio, G. (2015). The morphology of price dispersion. International Economic Review, 56(4), 1165–1206.

R Core Team. (2016). R: A language and environment for statistical computing. Vienna: R Foundation for Statistical Computing. https://www.R-project.org/.

Wildenbeest, M. R. (2007). Consumer search and oligopolistic pricing: A theoretical and empirical inquiry. Erasmus School of Economics (ESE).

Acknowledgements

We thank an anonymous referee for very helpful suggestions. Usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

Francisco Álvarez was partially supported by Grant ECO2014-56676 from Ministerio de Economía y Competitividad. José-Manuel Rey was partially supported by Grant AGL2015-69697-P from Plan Nacional de Investigación Científica of Spain.

Appendix: Sensitivity Analysis: Table and Figures

Appendix: Sensitivity Analysis: Table and Figures

Table 2 collects the parameter values used for the figures in this appendix. Each row in Table 2 corresponds to the figure indicated in the last column of the table. Each figure has four panels. Since each of them has a clear counterpart in the main text mutatis mutandis, explanatory captions are omitted.

Rights and permissions

About this article

Cite this article

Álvarez, F., Rey, JM. & Sanchis, R.G. Evolutionary Dynamics of Price Dispersion with Market-Dependent Costs. Comput Econ 53, 951–975 (2019). https://doi.org/10.1007/s10614-017-9770-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-017-9770-9