Abstract

We study the problem of a fund manager whose compensation depends on the relative performance with respect to a benchmark index. In particular, the fund manager’s risk-taking incentives are induced by an increasing and convex relationship of fund flows to relative performance. We consider a dynamically complete market with N risky assets and the money market account, where the dynamics of the risky assets exhibit mean reversions, either in the drift or in the volatility. The manager optimizes the expected utility of the final wealth, with an objective function that is non-concave. The optimal solution is found by using the martingale approach and a concavification method. The optimal wealth and the optimal strategy are determined by solving a system of Riccati equations. We provide a semi-closed solution based on the Fourier transform.

Similar content being viewed by others

Notes

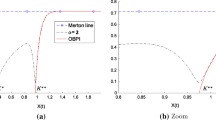

In Fig. 1b of BPS, such a step is not observed as \(\ln {\overline{V}}\) is closer to \(\eta _H\) with respect to the case we analyze here in Fig. 3.

References

Angelini, F., & Herzel, S. (2015). Evaluating discrete dynamic strategies in affine models. Quantitative Finance, 15(2), 313–326.

Angelini, F., & Nicolosi, M. (2010). On the effect of skewness and kurtosis misspecification on the hedging error. Economic Notes, 39(3), 203–226.

Barucci, E., & Marazzina, D. (2015). Risk seeking, nonconvex remuneration and regime switching. International Journal of Theoretical and Applied Finance, 18(02), 150009. doi:10.1142/S0219024915500090.

Barucci, E., & Marazzina, D. (2016). Asset management, High Water Mark and flow of funds. Operations Research Letters, 44(5), 607–611.

Basak, S., Pavlova, A., & Shapiro, A. (2007). Optimal asset allocation and risk shifting in money management. The Review of Financial Studies, 20(5), 1583–1621.

Beltratti, A., & Colla, P. (2007). A portfolio-based evaluation of affine term structure models. Annals of Operations Research, 151(1), 193–222.

Björk, T. (2009). Arbitrage theory in continuous time. Oxford: Oxford University Press.

Brown, K. C., Van Harlow, W., & Starks, L. T. (1996). Of tournaments and temptations: An analysis of managerial incentives in the mutual fund industry. The Journal of Finance, 51(1), 85–110.

Busse, J. A. (2001). Another look at mutual fund tournaments. Journal of Financial and Quantitative Analysis, 36, 53–73.

Carpenter, J. N. (2000). Does option compensation increase managerial risk appetite? Journal of Finance, 55, 2311–2331.

Carr, P., & Madan, D. (1999). Option valuation using the fast Fourier transform. Journal of Computational Finance, 2(4), 61–73.

Chevalier, J., & Ellison, G. (1997). Risk taking by mutual funds as a response to incentives. The Journal of Political Economy, 105, 1167–1200.

Cox, J. C., & Huang, C. F. (1989). Optimal consumptions and portfolio policies when asset prices follow a diffusion process. Journal of Economic Theory, 49, 33–83.

Cuoco, D., & Kaniel, R. (2011). Equilibrium prices in the presence of delegated portfolio management. Journal of Financial Economics, 101, 264–296.

Duffie, D., Filipović, D., & Schachermayer, W. (2003). Affine processes and applications in finance. Annals of Applied Probability, 13, 984–1053.

Duffie, D., & Kan, R. (1996). A yield-factor model of interest rates. Mathematical Finance, 6, 379–406.

Eberlein, E., Glau, K., & Papapantoleon, A. (2010). Analysis of Fourier transform valuation formulas and applications. Applied Mathematical Finance, 17(3), 211–240.

Filipović, D. (2009). Term structure models. Berlin: Springer.

Fusai, G., & Meucci, A. (2007). Pricing discretely monitored Asian options under Lévy processes. Journal of Banking & Finance, 32(10), 2076–2088.

Hainaut, D. (2009). Dynamic asset allocation under VaR constraint with stochastic interest rates. Annals of Operations Research, 172(1), 97–117.

Hubalek, F., Kallsen, J., & Krawczyk, L. (2006). Variance-optimal hedging for processes with stationary independent increments. The Annals of Applied Probability, 16(2), 853–885.

Karatzas, I., & Shreve, S. E. (1991). Brownian motion and stochastic calculus. Graduate Texts in Mathematics (Vol. 113). Berlin: Springer.

Merton, R. (1971). Optimum consumption and portfolio rules in a continuous-time model. Journal of Economic Theory, 3, 373–413.

Poterba, J. M., & Summers, L. H. (1988). Mean reversion in stock prices: Evidence and implications. Journal of Financial Economics, 22, 27–59.

Sirri, E. R., & Tufano, P. (1998). Costly search and mutual fund flows. The Journal of Finance, 53, 1589–1622.

Stein, E. M., & Stein, J. C. (1991). Stock price distributions with stochastic volatility: An analytic approach. Review of Financial Studies, 4, 727–752.

Wachter, J. A. (2002). Portfolio and consumption decisions under mean-reverting returns: An exact solution for complete markets. Journal of Financial and Quantitative Analysis, 37, 63–91.

Author information

Authors and Affiliations

Corresponding author

Additional information

Herzel and Nicolosi are grateful to the Center for Finance of the School of Economics and Law of the University of Gothenburg for the kind hospitality during the writing of the paper. Research partially funded by the Swedish Research Council Grant 2015-01713.

Appendix

Appendix

1.1 Solutions of the Riccati equations for the one-dimensional models

We show the solutions \(A(\tau ;z)\), \(B(\tau ;z)\) and \(C(\tau ;z)\), with \(\tau =T-t\), of the Riccati equations arising from our models, when the number of assets is \(N=1\), both in the case of stochastic market price of risk of Sect. 3.1 and in the case of stochastic volatility of Sect. 3.2.

The basic result is that the solution of the equation

where \(a, b, c \in {\mathbb {C}}\), with \(a \ne 0\), is given by

where

and

where \(b^2-4ac \in {\mathbb {C}} - {\mathbb {R}}_-\) and \(\sqrt{\cdot }\) denotes the analytic extension of the real square root to \({\mathbb {C}} - {\mathbb {R}}_-\). Moreover

Such a result is a particular case of Lemma 10.12 in Filipović (2009) and it can be obtained by standard methods for differential equations. For convenience of the reader, we show how to integrate C(u) through the change of variable \(x=e^{\alpha u}\):

Equation (41) is an equation for \(C(\tau )\) obtained when setting to zero the quadratic terms of the partial differential equation for \(H_t (z)\) for both models. In the model with stochastic market price of risk this is Eq. (23), hence in this case the coefficients of Eq. (41) are

In the model with stochastic volatility this is Eq. (34), hence the coefficients are

The linear terms give a linear differential equation of the first order for \(B(\tau )\) in both models:

where

Also, we can write

with coefficients \(a_f, b_f \in {\mathbb {C}}\) that depend on the model. Namely, from Eq. (24), in the case of mean reverting market price of risk, we have

and from Eq. (35) for the model with mean reverting volatility

We can now proceed to the computation of \(B(\tau )\) for both models at once. The solution of (42) is

We have

Therefore

Next we compute

Substituting in Eq. (43), we obtain:

Finally, we get \(A(\tau )\) in both models by direct integration.

Rights and permissions

About this article

Cite this article

Nicolosi, M., Angelini, F. & Herzel, S. Portfolio management with benchmark related incentives under mean reverting processes. Ann Oper Res 266, 373–394 (2018). https://doi.org/10.1007/s10479-017-2535-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-017-2535-y