Abstract

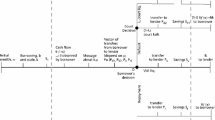

We extend the theoretical model of external corporate financing to the case when the buyers of the borrowing firm may default during the financing period. In our setup there is an asymmetric information and hence moral hazard between the lender and the borrower concerning the efforts of the borrower. We define the optimal debt contract in two cases. In the symmetric case the lender and the borrower has the same information about the buyer, its probability of default. In the asymmetric case the borrower learns whether the buyer will pay or not before choosing her level of efforts. We prove that in the asymmetric case the borrowing capacity and the welfare of the society is weakly smaller than in the symmetric case. We also show that the nonnegative default risk of a buyer weakly decreases borrowing capacity compared to the case when the buyer pays for sure. However, it turns out that having a risky buyer might increase borrowing capacity and welfare.

Similar content being viewed by others

References

Beck T, Demirguc-Kunt A, Peria MSM (2007) Reaching out: access to and use of banking services across countries. J Financ Econ 85(1):234–266

Biais B, Gollier C (1997) Trade credit and credit rationing. Rev Financ Stud 10(4):903–937

Brennan MJ, Maksimovic V, Zechner J (1988) Vendor financing. J Financ 43(5):1127–1141

Carbó-Valverde S, Rodríguez-Fernández F, Udell GF (2008) Bank lending, financing constraints and SME investment. Working Paper Series WP-08-04, Federal Reserve Bank of Chicago

Cook LD (1999) Trade credit and bank finance: financing small firms in Russia. J Bus Ventur 14(5–6): 493–518

Demirguc-Kunt A, Maksimovic V (2001) Firms as financial intermediaries: evidence from trade credit data. Policy Research Working Paper Series 2696, The World Bank

Devjak S, Bogataj L (2007) Optimisation of short term commercial bank loans to corporates in terms of financing operating activities in Slovenia. Cent Eur J Oper Res 15(4):393–403

Emery GW (1984) A pure financial explanation for trade credit. J Financ Quant Anal 19(03):271–285

Fudenberg D, Tirole J (1990) Moral hazard and renegotiation in agency contracts. Econometrica 58(6):1279–1319

Garcia-Appendini E (2007) Soft information in small business lending. EFA 2007 Ljubljana Meetings Paper

Garcia-Appendini E, Montoriol-Garriga J (2013) Firms as liquidity providers: evidence from the 2007–2008 financial crisis. J Financ Econ 109(1):272–291

Hart O, Moore J (1998) Default and renegotiation: a dynamic model of debt. Q J Econ 113(1):1–41

Holmstrom B, Tirole J (2000) Liquidity and risk management. J Money Credit Bank 32(3):295–319

Klingen C, Castillo L (2012) European Banking Coordination “Vienna” Initiative. Technical report

Myers SC (1977) Determinants of corporate borrowing. J Financ Econ 5(2):147–175

Petersen M, Rajan R (1994) The benefits of lending relationships: evidence from small business data. J Financ 49(1):3–37

Raddatz C (2010) Credit chains and sectoral comovement: does the use of trade credit amplify sectoral shocks? Rev Econ Stat 92(4):985–1003

Schwartz RA (1974) An economic model of trade credit. J Financ Quant Anal 9(04):643–657

Tirole J (2006) The theory of corporate finance. Princeton University Press, Princeton

Acknowledgments

We would like to thank two anonymous referees for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Corporate financing under moral hazard and the default risk of buyers: This work was partially supported by the European Union and the European Social Fund through project FuturICT.hu (grant no.: TAMOP-4.2.2.C-11/1/KONV-2012-0013).

Rights and permissions

About this article

Cite this article

Csóka, P., Havran, D. & Szűcs, N. Corporate financing under moral hazard and the default risk of buyers. Cent Eur J Oper Res 23, 763–778 (2015). https://doi.org/10.1007/s10100-013-0319-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-013-0319-2