Abstract

We set up a laboratory experiment to investigate systematically how varying the magnitude of outside options—the payoffs that materialize in case of a bargaining breakdown—of proposers and responders influences players’ demands and game outcomes (rejection rates, payoffs, efficiency) in ultimatum bargaining. We find that proposers as well as responders gradually increase their demands when their respective outside option increases. Rejections become more likely when the asymmetry in the players’ outside options is large. Generally, the predominance of the equal split decreases with increasing outside options. From a theoretical benchmark perspective we find a low predictive power of equilibria based on self-regarding preferences or inequity aversion. However, proposers and responders seem to be guided by the equity principle (Selten, The equity principle in economic behavior. Decision Theory, Social Ethics, Issues in Social Choice. Gottinger, Hans-Werner and Leinfellner, Werner, pp 269–281, 1978), while they apply equity rules inconsistently and self-servingly.

Similar content being viewed by others

Notes

Asymmetry can also be induced by assigning different chip values to each of the two players (Nydegger and Owen 1974; Güth et al. 1982; Kagel et al. 1996) or by a production outcome from a production phase prior to the actual UG experiment (Ruffle 1998; Gantner et al. 2001; Bediou et al. 2012; Fischbacher et al. 2016). As we focus on asymmetry in outside options, we exclusively survey papers that analyze the effect of asymmetric outside options in ultimatum bargaining.

We are aware, that in employing this procedure, we have to assume monotonicity in the responders’ behavior. Hennig-Schmidt et al. (2008) show that, at least in a German sample, this assumption can safely be made.

We use a neutral language in the instructions and on the computer screens. Proposers are called “Players A”. Responders are called “Players B” (see Appendix C for a translation of the instructions). The original instructions were provided in German and are available upon request from the authors.

Henceforth denoted as KW.

Henceforth denoted as MWU.

Henceforth denoted as WSR.

The magnitude of these opposite effects obviously depends on the specific game parameters. One also has to keep in mind that outside options are typically not acquired without any costs (e.g., search or effort costs).

Pairwise comparisons of frequencies of equal split offers yield: for proposers—Baseline vs. \(P_{90}\), \(p=0.065\), \(\chi ^{2}\)-test; Baseline vs. \(P_{150}\), \(p<0.001\), Fisher exact test; Baseline vs. \(R_{90}\), \(p=0.221\), \(\chi ^{2}\)-test; Baseline vs. \(R_{150}\), \(p=0.009\), Fisher exact test; For responders—Baseline vs. \(P_{90}\), \(p=0.759\), Fisher exact test; Baseline vs. \(P_{150}\), \(p=0.051\), Fisher exact test; Baseline vs. \(R_{90}\), \(p=0.240\), \(\chi ^{2}\)-test; Baseline vs. \(R_{150}\), \(p=0.524\), Fisher Exact test (note that we apply the Fisher exact test when there are fewer than five observations in one cell).

For the purpose of our analysis, we count players who exactly choose the outside option of the responder and players who choose the outside option of the responder plus one unit as SPE players.

In our numerical calculations, we considered a broader range of inequity parameter values. The results do not qualitatively change.

Some authors also refer to the difference between EQ and PS as the difference between equality and equity (see e.g., Rodríguez-Lara 2016).

The reader can find the formal derivation and application to each treatment of these three rules in Appendix B.

Note that SD does not apply to the total amount to be distributed, but to the remaining pie after the outside options have been subtracted a. Assuming that the outside options can be regarded as threat points, the distribution rule SD also follows from the Nash bargaining solution (Nash 1953) and the Shapley value (Shapley 1953). For a discussion, see Roth (1988), Chiu and Yang (1999) and Anbarci and Feltovich (2013).

References

Adams JS (1965) Equity in social exchange. In: Berkowitz L (ed) Advances in experimental social psychology, vol 2, pp 267–299

Anbarci N, Feltovich NJ (2013) How sensitive are bargaining outcomes to changes in disagreement payoffs? Exp Econ 16(4):560–596

Babcock L, Loewenstein G, Issacharoff S, Camerer CF (1995) Biased judgments of fairness in bargaining. Am Econ Rev 85(5):1337–1343

Bediou B, Sacharin V, Hill C, Sander D, Scherer KR (2012) Sharing the fruit of labor: flexible application of justice principles in an ultimatum game with joint-production. Soc Justice Res 25(1):25–40

Bhatt M, Camerer CF (2005) Self-referential thinking and equilibrium as states of mind in games: fMRI evidence. Games Econ Behav 52:414–459

Blanco M, Engelmann D, Normann HT (2011) A within-subject analysis of other-regarding preferences. Games Eco Behav 72(2):321–338

Bolton GE, Karagözoğlu E (2016) On the influence of hard leverage in a soft leverage bargaining game: the importance of credible claims. Games Econ Behav 99:164–179

Buchan NR, Croson RT, Johnson EJ (2004) When do fair beliefs influence bargaining behavior? Experimental bargaining in Japan and the United States. J Consum Res 31(1):181–190

Camerer CF (2003) Behavioral game theory: experiments in strategic interaction. Princeton University Press, Princeton

Cappelen AW, Hole AD, Sørensen EØ, Tungodden B (2007) The pluralism of fairness ideals: an experimental approach. Am Econ Rev 97(3):818–827

Cappelen AW, Sørensen EØ, Tungodden B (2010) Responsibility for what? Fairness and individual responsibility. Eur Econ Rev 54(3):429–441

Chiu YS, Yang BR (1999) The outside option, threat point, and nash bargaining solution. Econ Lett 62(2):181–188

Costa-Gomes MA, Crawford VP (2006) Cognition and behavior in two-person guessing games: an experimental study. Am Econ Rev 96(5):1737–1768

Fehr E, Schmidt KM (1999) A theory of fairness, competition, and cooperation. Q J Econ 114(3):817–868

Fischbacher U (2007) z-Tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10(2):171–178

Fischbacher U, Kairies N, Stefani U (2016) Non-additivity and the salience of marginal productivities: experimental evidence on distributive fairness. Economica (forthcoming)

Fischer S (2005) Inequality aversion in ultimatum games with asymmetric conflict payoffs. Working Paper

Fischer S, Güth W, Pull K (2007) Is there as-if bargaining? J Soc Econ 36(4):546–560

Franco-Watkins AM, Edwards BD, Acuff RE (2013) Effort and fairness in bargaining games. J Behav Decis Making 26(1):79–90

Frohlich N, Oppenheimer J, Kurki A (2004) Modeling other-regarding preferences and an experimental test. Public Choice 119(1):91–117

Gächter S, Riedl A (2005) Moral property rights in bargaining with infeasible claims. Manag Sci 51(2):249–263

Gantner A, Güth W, Königstein M (2001) Equitable choices in bargaining games with joint production. J Econ Behav Organ 46(2):209–225

Gärtner W, Schokkaert E (2012) Empirical social choice questionnaire-experimental studies on distributive justice. Cambridge University Press

Greiner B (2015) Subject pool recruitment procedures: organizing experiments with ORSEE. J Econ Sci Assoc 1(1):114–125

Güth W, Kocher MG (2014) More than thirty years of ultimatum bargaining experiments: motives, variations, and a survey of the recent literature. J Econ Behav Organ 108:396–409

Güth W, Schmittberger R, Schwarze B (1982) An experimental analysis of ultimatum bargaining. J Econ Behav Organ 3:367–388

Hennig-Schmidt H, Li Z-Y, Yang C (2008) Why people reject advantageous offers—non-monotonic strategies in ultimatum bargaining: evaluating a video experiment run in PR China. J Econ Behav Organ 65(2):373–384

Hennig-Schmidt H, Walkowitz G (2010) On the nature of fairness in bargaining—experimental evidence from Germany and PR China. mimeo

Kagel JH, Kim C, Moser D (1996) Fairness in ultimatum games with asymmetric information and asymmetric payoffs. Games Econ Behav 13(1):100–110

Karagözoğlu E, Riedl A (2015) Performance information, production uncertainty, and subjective entitlements in bargaining. Manag Sci 61(11):2611–2626

Knez MJ, Camerer CF (1995) Outside options and social comparison in three-player ultimatum game experiments. Games Econ Behav 10(1):65–94

Kohnz S (2006) Self-serving biases in bargaining. Working Paper (899)

Kohnz S, Hennig-Schmidt H (2005) Asymmetric outside options in ultimatum bargaining—an experimental study. Working Paper

Konow J (1996) A positive theory of economic fairness. J Econ Behav Organ 31(1):13–35

Malhotra D, Bazerman MH (2008) Negotiation genius: how to overcome obstacles and achieve brilliant results at the bargaining table and beyond. Bantam Books

Malhotra D, Gino F (2011) The pursuit of power corrupts: how investing in outside options motivates opportunism in relationships. Admin Sci Q 56(4):559–592

Nash J (1953) Two-person cooperative games. Econometrica 21:128–140

Nydegger RV, Owen G (1974) Two-person bargaining: an experimental test of the Nash axioms. Int J Game Theory 3(4):239–249

Oosterbeek H, Sloof R, Van De Kuilen G (2004) Cultural differences in ultimatum game experiments: evidence from a meta-analysis. Exp Econ 7(2):171–188

Rode J, Menestrel ML (2011) The influence of decision power on distributive fairness. J Econ Behav Organ 79(1):246–255

Rodríguez-Lara I (2016) Equity and bargaining power in ultimatum games. J Econ Behav Organ 130:144–165

Rodríguez-Lara I, Moreno-Garrido L (2012) Self-interest and fairness: self-serving choices of justice principles. Exp Econ 15(1):158–175

Roth AE (ed) (1988) The Shapley value: essays in honor of Lloyd S. Cambridge University Press, Shapley

Roth AE (1995) Bargaining experiments. In: Kagel JH, Roth AE (eds) The handbook of experimental economics. Princeton University Press, pp 253–349

Ruffle BJ (1998) More is better, but fair is fair: tipping in dictator and ultimatum games. Games Econ Behav 23(2):247–265

Schmitt PM (2004) On perceptions of fairness: the role of valuations, outside options, and information in ultimatum bargaining games. Exp Econ 7(1):49–73

Selten R (1978) The equity principle in economic behavior. Decision Theory, Social Ethics, Issues in Social Choice. Gottinger, Hans-Werner and Leinfellner, Werner, pp 269–281

Shapley LS (1953) Contributions to the theory of games, Chapter A Value for n-person Games. Princeton University Press, pp 307–317

Author information

Authors and Affiliations

Corresponding author

Additional information

We want to thank the editor and two anonymous referees for their constructive comments and suggestions. We are grateful to Ralph Bayer, Julia Berndt, Julian Conrads, Brian Cooper, Anastasia Danilov, Sven Fischer, Oliver Gürtler, Reinhard Selten, Matthias Sutter, and the seminar participants at various conferences for their valuable comments and suggestions. Financial support from the Deutsche Forschungsgemeinschaft through grant ‘TP3 Design of Incentives Schemes within Firms: Bonus Systems and Performance Evaluations’ (sub-project of the DFG-Forschergruppe “Design and Behavior”, FOR 1371) and through the Leibniz Award to Axel Ockenfels is gratefully acknowledged.

Appendix A

Appendix A

See Table 6 and Figs. 1 and 2.

1.1 Appendix B: Formal derivation of the equity rules

The three equity rules can be derived from applying the generalized equity principle (Selten 1978) to bargaining with (asymmetric) outside options. Two players i (the proposer) and j (the responder) negotiate about how to divide amount a. The equity principle proposes balancing the players’ shares according to individual weights. Let \(r\le a\) be the amount of money that is to be distributed. The non-negative weights \(w_{i}\) and \(w_{j}\) of the players reflect a certain characteristic according to which the players can be compared (e.g., outside options). Selten (1978) calls the vector of weights the standard of comparison. A standard of distribution is a vector \((r_{i},r_{j})\), with \(r_{i},r_{j}\ge 0\) and \(r_{i}+r_{j}=r\). The generalized equity principle requires that \(r_{i}/w_{i}=r_{j}/w_{j}.\) Thus, the standard of distribution with respect to player i is given by \(r_{i}=\frac{w_{i}}{w_{i}+w_{j}}\cdot r\).

Depending on the amount r and the standard of comparison \(w_{i}\) and \(w_{j}\), at least three different distribution rules can be derived for ultimatum bargaining with outside options. The candidates for the amount r are the complete amount, i.e., \(r=a\), or the complete amount diminished by the respective outside options, i.e., \(r=a-o_{i}-o_{j}\). Natural candidates for the weights are \(w_{i}=w_{j}=1\) (because, e.g., each bargaining party is constituted by one individual) or \(w_{i}=o_{i}\) and \(w_{j}=o_{j}\) (since, e.g., outside options are likely to be a major source of bargaining power).

Equal split The Equal Split (EQ) results from the generalized equity principle when one assumes that both players have the same weight \(w_{i}=w_{j}=1\) and that r is equal to the total amount a. According to this equity rule, every player receives the same amount, that is, \(a_{i}=a_{j}=a/2\).

Split the difference The distribution rule Split the Difference (SD) emerges from the generalized equity principle when \(r=a-o_{i}-o_{j}\) and players apply \(w_{i}=w_{j}=1\). Player i’s amount is then determined by \(a_{i}=o_{i}+1/2\cdot \left( a-o_{i}-o_{j}\right) \) and player j’s amount is given by \(a_{j}=o_{j}+1/2\cdot \left( a-o_{i}-o_{j}\right) \). SD yields an unequal distribution if \(o_{i}\ne o_{j}\).Footnote 15

Proportional split The Proportional Split (PS) can be derived from the generalized equity principle by using a standard of comparison based on the relative magnitude of outside options, i.e., \(w_{i}=o_{i}\) and \(w_{j}=o_{j}\) and by assuming that r is equal to the total amount a to be distributed. Each player’s share represents her proportional bargaining power induced by her outside option. Player i receives \(a_{i}=a\cdot o_{i}/(o_{i}+o_{j})\) and player j receives \(a_{j}=a\cdot o_{j}/(o_{i}+o_{j})\). This equity rule also leads to an unequal distribution if \(o_{i}\ne o_{j}\).

Note that EQ, SD, and PS result in the same payoffs if, and only if, \(o_{i}=o_{j}\). In the standard ultimatum game, where \(o_{i}=o_{j}\), the equal split appears to be prevalent (see, e.g., Güth and Kocher 2014).

1.2 Appendix C: Instructions (translated from German)

Welcome to the experiment!

You are participating in an economic experiment and you have the possibility to earn a certain amount of money, which varies according to your decisions. Please read the following descriptions thoroughly.

During the experiment we will talk about “Taler” and not €. Hence, your payout will be initially calculated in Taler. The achieved total amount of money of Taler will be converted into € at the end of the experiment and then we will give you a cash payout, at a rate of

10 Taler = 0,6 €.

The decisions in the experiment

At the beginning of the experiment all participants will be randomly divided into two groups—players in the role of A and players in the role of B– who will interact with each other during the experiment. You will not know, neither before nor after the experiment, with whom you are interacting. At the beginning of the experiment, you will be informed of whether you are player A or B, which was determined randomly by drawing the cabin number.

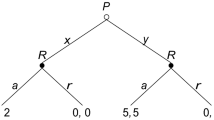

The experiment is about splitting 240 Taler among player A and B. Player A makes a proposal of how to split the 240 Taler among player A and player B. Player B decides from which amount of money he is willing to accept the proposal of player A. After both players have made their decisions, the decisions will be compared.

If the proposal of allocation of player A is in the acceptable range of player B, then

-

the 240 Taler will be split in accordance with the decisions.

If the proposal of allocation of player A is not in the acceptable range of player B, then

-

player A and player B will each receive a guaranteed amount of money, which can be identical or different for player A and player B. Both player A and player B know the two guaranteed money amounts before the decisions are made.

Every player A interacts in two different, successive games with two different players B.

Every player B interacts in two different, successive games with two different players A.

If you are player A you will see this screen:

The decisions of player A and player B are made simultaneously. This implies for player B that he makes his decision before knowing which proposal player A will actually make.

If the proposed amount of money from player A for player B is greater than or equal to the lowest amount of money player B is willing to accept, then the proposal will be accepted. Vice versa, the proposal of player A will be rejected if the proposed amount of money of player A is smaller than the lowest amount of money player B is willing to accept.

Before the experiment starts, we would like you to answer a couple of control questions. These questions will help to familiarize you with the decision situation. At the end of the experiment, we would like you to answer some further questions.

In the course of the experiment, any form of communication with the other participants is forbidden. Please now once again read the instructions thoroughly to make sure that you have understood everything. If there are any uncertainties left, please put your hand up. We will then come to you and answer your questions.

Rights and permissions

About this article

Cite this article

Hennig-Schmidt, H., Irlenbusch, B., Rilke, R.M. et al. Asymmetric outside options in ultimatum bargaining: a systematic analysis. Int J Game Theory 47, 301–329 (2018). https://doi.org/10.1007/s00182-017-0588-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-017-0588-4