Abstract

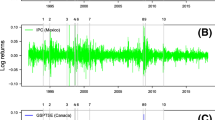

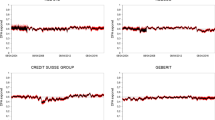

How stock markets relate to each other is very important because this could have positive effects (such as enhancing economic growth) but also negative effects (possible contagion risks). Considering this issue, this study proposes continuous evaluation of the cross-correlations between markets, applying a sliding windows approach based on the detrended cross-correlation analysis correlation coefficient. Measuring the cross-correlations between the USA and other eight stock markets (the remainder of the G7 plus China and Russia), this allows dynamic analysis of the evolution of cross-correlations and also continuous analysis of the contagion effect. The results show that in the period before the crisis the correlation levels with the US stock market decreased, while post-crisis the results point to a contagion effect. As the proposed approach could be used for continuous monitoring of cross-correlations, this kind of information could be important for the different agents involved in stock markets.

Similar content being viewed by others

References

Aloui R, Mohamed S, Duc K (2011) Global financial crisis, extreme interdependences, and contagion effects: the role of economic structure? J Bank Finance 35:130–141

Amin A, Lucjan O (2014) Returns, volatilities, and correlations across mature, regional, and frontier markets: evidence from South Asia. Emerg Mark Finance Trade 50:5–27

Ang A, Bekaert G (2002) International asset allocation with regime shifts. Rev Financ Stud 15(4):1137–1187

Ang A, Chen J (2002) Asymmetric correlations of equity portfolios. J Financ Econ 63(3):443–494

Bannigidadmath D, Narayan P (2016) Stock return predictability and determinants of predictability and profits. Emerg Mark Rev 26:153–173

Beine M, Cosma A, Vermeulen R (2010) The dark side of global integration: increasing tail dependence. J Bank Finance 34(1):184–192

Bekaert G, Harvey C, Lundblad C (2005) Does financial liberalization spur growth? J Financ Econ 77:3–56

Bekaert G, Ehrmann M, Fratzscher M (2014) The global crisis and equity market contagion. J Finance 69(6):2597–2649

BenSaïda A (2018) The contagion effect in European sovereign debt markets: a regime-switching vine copula approach. Int Rev Financ Anal 58:153–165

Bertero E, Mayer C (1990) Structure and performance: global interdependence of stock markets around the crash of October 1987. Eur Econ Rev 34(6):1150–1180

Bollerslev T, Wooldridge M (1992) Quasi-maximum likelihood estimation and inference in dynamic models with time-varying covariances. Econom Rev 11(2):143–172

Boubaker S, Jamel J, Lahiani A (2016) Financial contagion between the US and selected developed and emerging countries: the case of the subprime crisis. Q Rev Econ Finance 61:14–280

Brito A, Filho A, Zebende G (2015) Análise temporal de dados climatológicos de Feira de Santana-BA. Conjunt Planej 189:50–59

Cajueiro D, Tabak B (2004a) The Hurst exponent over time: testing the assertion that emerging markets are becoming more efficient. Phys A 336(3–4):521–537

Cajueiro D, Tabak B (2004b) Evidence of long range dependence in Asian equity markets: the role of liquidity and market restrictions. Phys A 342(3–4):656–664

Cajueiro D, Tabak B (2006) Testing for predictability in equity returns for European transition markets. Econ Syst 30(1):56–78

Cajueiro D, Tabak B (2008) Testing for time-varying long-range dependence in real estate equity returns. Chaos Soliton Fract 38(1):293–307

Calvo S, Reinhart S (1996) Capital flows to Latin America: Is there evidence of contagion effects? In: Calvo G, Goldstein M, Hochreiter E (eds) Private capital flows to emerging markets after the Mexican crisis. Institute for International Economics, Washington, pp 151–171

Cao G, Xu L, Cao J (2012) Multifractal detrended cross-correlations between the Chinese exchange market and stock market. Phys A 391(20):4855–4866

Chiang T, Jeon B, Li H (2007) Dynamic correlation analysis of financial contagion: evidence from the Asian markets. J Int Money Finance 26:1206–1228

Chouliaras A, Christopoulos A, Kenourgios D, Kalantonis P (2012) The PIIGS stock markets before and after the 2008 financial crisis: a dynamic cointegration and causality analysis. Int J Bank Account Finance 4(3):232–249

Collins D, Biekpe N (2003) Contagion: a fear for African equity markets. J Econ Bus 55(33):285–297

Couto R, Duczmal LH, Burgarelli D, Álvares F, Moreira GJP (2019) Nonparametric dependence modeling via cluster analysis: a financial contagion application. Commun Stat Simul Comput. https://doi.org/10.1080/03610918.2018.1563152

Da Silva M, Pereira É, da Silva Filho A, de Castro A, Miranda J, Zebende G (2016) Quantifying the contagion effect of the 2008 financial crisis between the G7 countries (by GDP nominal). Phys A 453:1–8

Demian C (2011) Cointegration in Central and East European markets in light of EU accession. J Int Financ Mark Inst Money 21:144–155

Dewandaru G, Masih R, Masih A (2015) Why is no financial crisis a dress rehearsal for the next? Exploring contagious heterogeneities across major Asian stock markets. Phys A 419:241–259

Dimitriou D, Simos T (2014) Contagion effects on stock and FX markets: a DCC analysis among USA and EMU. Stud Econ Finance 31(3):246–254

Dimitriou D, Kenourgios D, Simos T (2013) Global financial crisis and emerging stock market contagion: a multivariate FIAPARCH–DCC approach. Int Rev Financ Anal 30:46–56

El Alaoui M, Benbachir D (2013) Multifractal detrended cross-correlation analysis in the MENA area. Phys A 392(23):5985–5993

Engle R (2002) Dynamic conditional correlation: a simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J Bus Econ Stat 20(3):339–3500

Fama E (1965) The behavior of stock-market prices. J Bus 38(1):34–105

Fama E (1970) Efficient Capital markets: a review of theory and empirical work. J Finance 25(2):383–417

Ferreira P (2016) Does the Euro crisis change the cross-correlation pattern between bank shares and national indexes? Physica 463:320–329

Ferreira P (2017) Portuguese and Brazilian stock market integration: a non-linear and detrended approach. Port Econ J 16(1):49–63

Ferreira P (2018a) Long-range dependencies of Eastern European stock markets: a dynamic detrended analysis. Phys A 505:454–470

Ferreira P (2018b) Efficiency or speculation? A time-varying analysis of European sovereign debt. Phys A 490:1295–1308

Ferreira P, Dionísio A (2014) Revisiting serial dependence in the stock markets of the G7 countries, Portugal, Spain and Greece. Appl Financ Econ 24(5):319–331

Ferreira P, Dionísio A (2015) Revisiting covered interest parity in the European Union: the DCCA approach. Int Econ J 29(4):597–615

Ferreira P, Dionísio A (2016a) How long is the memory of the US stock market? Phys A 451:502–506

Ferreira P, Dionísio A (2016b) G7 stock markets: Who is the first to defeat the DCCA correlation? Rev Socio Econ Perspect 1(1):107–120

Ferreira P, Dionísio A, Zebende G (2016) Why does the Euro fail? The DCCA approach. Phys A 443:543–554

Ferreira P, Silva M, Santana I (2019) Detrended correlation coefficients between exchange rate (in Dollars) and stock markets in the world’s largest economies. Economies 7(1):9

Filho A, Silva M, Zebende G (2014) Autocorrelation and cross-correlation in time series of homicide and attempted homicide. Phys A 400:12–19

Forbes K, Rigobon R (2001) Contagion in Latin America: definitions, measurement, and policy implication. Econ J 1(2):1–46

Forbes K, Rigobon R (2002) No contagion, only interdependence: measuring stock market co-movements. J Finance 57(5):2223–2261

Fry-McKibbin R, Hsiao C, Tang C (2014) Contagion and global financial crises: lessons from nine crisis episodes. Open Econ Rev 25:521–570

Ftiti Z, Tiwari A, Belanès A, Guesmi K (2015) Tests of financial market contagion: evolutionary cospectral analysis versus wavelet analysis. Comput Econ 46:575–611

Guedes E, Zebende G, Filho A (2015) Análise temporal dos indicadores da indústria de transformação da Bahia: Uma abordagem com métodos da mecânica estatística. Conjunt Planej 186:34–43

Guedes E, Brito A, Filho F, Fernandez B, Castro A, Filho A, Zebende G (2018a) Statistical test for ∆ρDCCA cross-correlation coefficient. Phys A 501:134–140

Guedes E, Brito A, Filho F, Fernandez B, Castro A, Filho A, Zebende G (2018b) Statistical test for ∆ρDCCA: methods and data. Data Brief 18:795–798

Gunthorpe D, Levy H (1994) Portfolio composition and the investment horizon. Financ Annal J 50:51–56

Hemche O, Jawadi F, Maliki BS, Cheffou AI (2016) On the study of contagion in the next of the subprime crisis: a dynamic conditional correlation-multivariate GARCH approach. Econ Model 52(A):292–297

Horta P, Mendes C, Vieira I (2008) Contagion effects of the US subprime crisis on developed countries. CEFAGE-UE Working paper 2008/08

Horta P, Lagoa S, Martins L (2014) The impact of the 2008 and 2010 financial crises on the Hurst exponents of international stock markets: implications for efficiency and contagion. Int Rev Financ Anal 35:140–153

Horta P, Lagoa S, Martins L (2016) Unveiling investor-induced channels of financial contagion in the 2008 financial crisis using copulas. Quant Finance 16(4):625–637

Ins F, Kim S, Gençay R (2011) Investment horizon effect on asset allocation between value and growth strategies. Econ Model 28:1489–1497

Jin X, An X (2016) Global financial crisis and emerging stock market contagion: a volatility impulse response function approach. Res Int Bus Finance 36:179–195

Kearney C, Lucey B (2004) International equity market integration: theory, evidence and implications. Int Rev Financ Anal 13:571–583

Kenourgios D, Padhi P (2012) Emerging markets and financial crises: Regional, global or isolated shocks? J Multinatl Financ Manag 22:24–38

Kenourgios D, Samitas A, Paltalidis N (2011) Financial crises and stock market contagion in a multivariate time-varying asymmetric framework. J Int Financ Mark I 21(1):92–106

Kenourgios D, Christopoulos A, Dimitriou D (2013) Asset markets contagion during the global financial crisis. Multinatl Finance J 17(1):49–76

Khan S, Park K (2009) Contagion in the stock markets: the Asian financial crisis revisited. J Asian Econ 20:561–569

Kim B, Kim H, Lee B (2015) Spillover effects of the US financial crisis on financial markets in emerging Asian countries. Int Rev Econ Finance 39:192–210

King M, Wadhwani S (1990) Transmission of volatility between stock markets. Rev Financ Stud 3:5–33

Kiviaho J, Nikkinen J, Piljak V, Rothovius T (2014) The co-movement dynamics of european frontier stock markets. Eur Financ Manag 20:574–595

Kristoufek L (2012) Fractal market hypothesis and the global financial crisis: scaling, investment horizons and liquidity. Adv Complex Syst 15(6):1250065

Kristoufek L (2014a) Measuring correlations between non-stationary series with DCCA coefficient. Phys A 402:291–298

Kristoufek L (2014b) Detrending moving-average cross-correlation coefficient: measuring cross-correlations between non-stationary series. Phys A 406:169–175

Lahiani A, Nguyen D (2013) Equity market comovements and financial contagion: a study of Latin America and United States. Bank Mark Invest 126:17–29

Li D, Kou Z, Sun Q (2015) The scale-dependent market trend: empirical evidences using the lagged DFA method. Phys A 433:26–35

Ma F, Wei Y, Huang D (2013) Multifractal detrended cross-correlation analysis between the Chinese stock market and surrounding stock markets. Phys A 392(7):1659–1670

Ma F, Zhang W, Chen P, Wei Y (2014) Multifractal detrended cross-correlation analysis of the oil-dependent economies: evidence from the West Texas intermediate crude oil and the GCC stock markets. Phys A 410:154–166

Martin-Montoya L, Aranda-Camacho N, Quimbay C (2015) Long-range correlations and trends in Colombian seismic time series. Phys A 421:361–370

Mensi W, Hammoudeh S, Reboredo J, Nguyen D (2014) Do global factors impact BRICS stock markets? A quantile regression approach. Emerg Mark Rev 19:1–17

Mohti W, Dionísio A, Vieira I, Ferreira P (2019) Financial contagion analysis in frontier markets: evidence from the US subprime and the Eurozone debt crises. Phys A 525:1388–1398

Naoui K, Liouane N, Brahim S (2010) A dynamic conditional correlation analysis of financial contagion; the case of the subprime credit crisis. Int J Econ Finance 2(3):85–96

Narayan P, Sharma S (2015) Does data frequency matter for the impact of forward premium on spot exchange rate? Int Rev Financ Anal 39:45–53

Narayan P, Ahmed H, Narayan S (2015) Do momentum-based trading strategies work in the commodity futures markets? J Futures Mark 35(9):868–891

Neaime S (2012) The global financial crisis, financial linkages and correlations in returns and volatilities in emerging MENA stock markets. Emerg Mark Rev 13:268–282

Obstfeld M (1994) Risk-taking, global diversification, and growth. Am Econ Rev 84(5):1310–1329

Patton A (2009) Copula-based models for financial time series. In: Andersen T, Davis R, Kreiss J, Mikosch T (eds) Handbook of financial time series. Springer, Berlin, pp 767–785

Pelletier D (2006) Regime switching for dynamic correlation. J Econom 131:445–473

Peng C, Buldyrev S, Havlin S, Simons M, Stanley H, Goldberger A (1994) Mosaic organization of DNA nucleotides. Phys Rev E 49:1685–1689

Peters E (1991) Chaos and order in the capital markets—a new view of cycles, prices, and market volatility. Wiley, New York

Peters E (1994) Fractal market analysis—applying chaos theory to investment and analysis. Wiley, New York

Piao L, Fu Z (2016) Quantifying distinct associations on different temporal scales: comparison of DCCA and Pearson methods. Sci Rep 6:36759

Podobnik B, Stanley H (2008) Detrended cross-correlation analysis: a new method for analyzing two non-stationary time series. Phys Rev Let 100(8):084102

Podobnik B, Jiang Z, Zhou W, Stanley H (2011) Statistical tests for power-law cross-correlated processes. Phys Rev E 84:066118

Prasad E, Rogoff K, Wei S, Kose M (2004) Effects of financial globalization on developing countries: Some empirical evidence. International Monetary Fund Occasional Papers no. 220

Rachev S, Weron A, Weron R (1999) CED model for asset returns and fractal market hypothesis. Math Comput Model 29:23–36

Rajwani S, Kumar D (2016) Asymmetric dynamic conditional correlation approach to financial contagion: a study of asian markets. Glob Bus Rev 17(6):1339–1356

Rak R, Drozdz S, Kwapien J, Oswiecimka P (2015) Detrended cross-correlations between returns, volatility, trading activity, and volume traded for the stock market companies. EPL Europhys Lett 112(4):48001

Saiti B, Masih M, Bacha O (2016) Testing the conventional and Islamic financial market contagion: evidence from wavelet analysis. Emerg Mark Finance Trade 52(8):1832–1849

Samarakoon L (2011) Stock market interdependence, contagion and the U.S. financial crisis: the case of emerging and frontier markets. J Int Financ Mark Inst Money 21:724–742

Samitas A, Kampouris E (2018) Empirical analysis of market reactions to the UK’s referendum results—How strong will Brexit be? J Int Financ Mark Inst Money 53:263–286

Shi W, Wang S, Lin A (2014) Multiscale multifractal detrended cross-correlation analysis of financial time series. Phys A 403:35–44

Silva M, Pereira E, Filho A, Castro A, Miranda J, Zebende G (2015) Quantifying cross-correlation between Ibovespa and Brazilian blue-chips: the DCCA approach. Phys A 424:124–129

Su Y, Yip Y (2014) Contagion Effect of 2007 Financial crisis on emerging and Frontier stock markets. J Account Finance 14(5):97

Usman A, Syed Z, Qiasar A (2015) Robust analysis for downside risk in portfolio management for a volatile stock market. Econ Model 44:86–96

Valls C (2012) Rational integrability of a nonlinear finance system. Chaos Soliton Fract 45:141–146

Vassoler R, Zebende G (2012) DCCA cross-correlation coefficient apply in time series of air temperature and air relative humidity. Phys A 391:2438–2443

Wang L (2014) Who moves East Asian stock markets? The role of the 2007–2009 global financial crisis. J Int Financ Mark Inst Money 28:182–203

Wang G, Xie C, Han F, Sun B (2012) Similarity measure and topology evolution of foreign exchange markets using dynamic time warping method: evidence from minimal spanning tree. Phys A 391:4136–4146

Wang G, Xie C, Lin M, Stanley H (2017) Stock market contagion during the global financial crisis: a multiscale approach. Finance Res Lett 22:163–168

Zebende G (2011) DCCA cross-correlation coefficient: quantifying a level of cross-correlation. Phys A 390(4):1643–1662

Zebende G, Fernandez B, Pereira M (2017a) Analysis of the variability in the sdB star KIC 10670103: DFA approach. Mon Not R AstronSoc 464:2611–2642

Zebende G, Brito A, Filho A, Castro A (2017b) ρDCCA applied between air temperature and relative humidity: an hour/hour view. Phys A 494:17–26

Zhao X, Shang P, Huang J (2017) Several fundamental properties of DCCA cross-correlation coefficient. Fractals 25(2):1750017

Acknowledgements

Paulo Ferreira is pleased to acknowledge financial support from Fundação para a Ciência e a Tecnologia under Grant UID/ECO/04007/2019.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that he has no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Tilfani, O., Ferreira, P. & El Boukfaoui, M.Y. Dynamic cross-correlation and dynamic contagion of stock markets: a sliding windows approach with the DCCA correlation coefficient. Empir Econ 60, 1127–1156 (2021). https://doi.org/10.1007/s00181-019-01806-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-019-01806-1

Keywords

- Detrended cross-correlation analysis

- Dynamic contagion

- Dynamic correlations

- Fractal market hypothesis

- Sliding windows

- Stock markets