Abstract

The size of the rental housing market in most countries around the globe is small. In this article, we claim that this may be detrimental to macroeconomic stability. We do it in three steps. First, using survey data for Poland, a country with a high homeownership ratio, we discuss microeconomic housing tenure choice determinants. Second, with a panel of 28 EU countries over the period 2004–2017, we provide evidence that the response of house prices to macroeconomic fundamentals is attenuated by the size of the private rental market. Third, we propose a DSGE model in which households satisfy housing needs both by owning and by renting. By simulating the model, we show that reforms enhancing the rental housing market contribute to macroeconomic stability. We conclude by formulating policy recommendations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The role of housing for the macroeconomy cannot be overstated. According to Leamer (2007), fluctuations in housing market activity are the core cause of the business cycle and the data on residential investment can be successfully used as an early warning sign of an oncoming recession. In context of the European monetary integration, the high importance of the housing market has manifested in the form of substantial imbalances and painful adjustment in many countries, especially in Spain and Ireland (Rubio 2014a). There are also numerous analyses on the importance of the housing market for the transmission of macroeconomic disturbances to the economy (Iacoviello 2005; Kivedal 2014). Even though interactions between the housing market and the real economy are extensively explored in the literature (see the literature review in Lee et al. 2017), the number of studies analyzing the role of the housing tenure structure for macroeconomic stability is scarce. An example of such a study is the work of Arce and Lopez-Salido (2011), who build a theoretical model to show that the availability of rental housing reduces the risk of a house price bubble. Similarly, Rubio (2014b) finds, within a dynamic stochastic general equilibrium (DSGE) framework that a larger rental market makes monetary policy more stabilizing. These results are confirmed by panel regressions of Cuerpo et al. (2014) or Czerniak and Rubaszek (2018), who indicate that the rental market share diminishes fluctuations in the housing sector.

In this context, a low share of the private rental market observed in most countries around the globe might be considered as a serious structural weakness and raises two important questions. The first one relates to the reasons behind this situation. The literature provides some generic answers. At a macro level, it has been already shown that the different homeownership rates across European countries can be attributed to the efficiency of institutions, fiscal policies, as well as cultural or educational factors (Earley 2004; Mora-Sanguinetti 2010). At a micro level, it has been established that households’ tenure choices are affected not only by economic factors, but also by the fact that ownership usually provides higher housing satisfaction than renting (Elsinga and Hoekstra 2005; Ben-Shahar 2007; Diaz-Serrano 2009). However, the literature lacks studies that are able to connect the micro evidence with a macroeconomic approach, in order to give policy recommendations that are supported with data at the microeconomic level.

In this paper, we contribute to this literature by proposing a micro–macro perspective on the role of the private rental market. We start by providing the micro evidence to explain the reasons behind housing tenure choices in Poland, a paradigmatic case of a country in which the private rental market share (RMS) is small. By analyzing the answers of Poles to a survey, which was conducted by Rubaszek and Czerniak (2017), we show that the preferences of the respondents are strongly tilted toward owning, mainly because they perceive ownership as the only way to provide a safe place for the family and to really “feel at home.” Consequently, the rental market is currently treated only as a temporary solution, and not as a vital alternative to ownership for a longer stay. The reasons behind this choice are both psychological and economic but definitely closely related to the existent regulation. We continue by providing the macro evidence that a high RMS is a factor stabilizing house price fluctuations. We do it by constructing a database for a panel of 28 EU countries over the years 2004–2017 and conducting a series of regressions, which show that the relationship between real house prices and the standard determinants (economic activity, the level of interest rates, as well as the level of credit to households) depends on the size of the private rental market. In the third step, we match the micro and macro evidence by proposing a microfounded DSGE model with a housing rental market, in the spirit of Ortega et al. (2011) and Rubio (2014b) framework, to assess the role of the housing tenure structure for macroeconomic stability. We calibrate the model to Polish data and the results of the survey, which allows us to identify inefficiencies in the functioning of the rental market. Finally, we propose a series of reforms, the effects of which are estimated by conducting counterfactual simulations with the DSGE model. We quantify the effects of (i) improving tenant protection legislation, (ii) equalizing fiscal incentives for different types of housing tenures, and (iii) improving the standard of rental services. All three reforms lead to an increase in the share of the rental market, which in turn contributes to higher macroeconomic stability. In particular, we show that rental market development diminishes the impact of shocks to the financial sector on the key macroeconomic variables.

The rest of the paper is organized as follows. Section 2 describes the typical reasons behind the low popularity of the housing rental market using the data from the survey. Section 3 describes the results of panel data regressions. Section 4 presents the DSGE model. Section 5 discusses the effects of rental market reform. The last section concludes and provides some interpretation of the results in the form of policy recommendations.

2 The survey: micro evidence

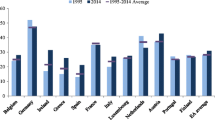

In this section, we focus on the microeconomic determinants of housing tenure choices in Poland, a representative country with an underdeveloped housing rental market. This underdevelopment is well illustrated by Eurostat data, which show that in 2016 the share of private market tenants amounted to merely 4.5%. This is much less compared to Western EU countries, in which the relevant shares amounted to 39.8% in Germany, 19.2% in France, 18.0% in the UK, or 16.8% in Italy. At the same time, the size of the private rental market was comparable to other countries in Eastern Europe, except for the Czech Republic (Fig. 1). Our analysis is based on a survey among a representative group of 1005 Poles, which was conducted between June 9 and June 13, 2016, within a regular Omnibus CAPI survey by IPSOS. The exact content of the survey as well as the distribution to all answers is discussed in detail in Rubaszek and Czerniak (2017).Footnote 1 Here, we present only the most important results in the context of the discussion on what determines tenure choices in countries with an underdeveloped rental market, which are useful in justifying the structure and calibration of the DSGE model presented in the next sections.

We start by describing the characteristics of the rental market that emerge from the survey. It turns out that private market tenants are usually unmarried and young (up to 30 years), do not have children, and inhabit relatively small dwellings (for over half of respondents the surface was smaller than 45 m\(^2\)) that are located in large cities. The duration of their stay in the currently occupied house is rather short (for almost three quarters of respondents it is < 5 years), and they plan to change their address in a short-term horizon (almost half of the respondents plan to move within 5 years). This description fits well students or people who have just started their professional careers, for whom renting is a temporary form of satisfying housing needs. The private rental market is not treated as a serious alternative to ownership for long-term stay. This is confirmed by the answers to the question in which the respondents could choose between renting and buying a house with a mortgage: 29.7% of them selected renting against 52.6% preferring a mortgage. Our interpretation of the above results is that preferences of households are strongly tilted toward ownership.

To further explore the reasons behind tenure choices, we have asked a series of questions related to economic and psychological reasons to own or rent. The exact choice of the factors, which are presented in Table 1, is based on the previous studies on housing tenure choice determinants (Henderson and Ioannides 1983; Bourassa 1995; Harding et al. 2000; Coolen et al. 2002; Sinai and Souleles 2005; Elsinga and Hoekstra 2005; Ben-Shahar 2007; Diaz-Serrano 2009). The results clearly show that Poles prefer owning to renting due to both psychological and economic reasons. The distribution of answers indicates that 64.0% of respondents think that servicing a mortgage is cheaper than paying a rent, whereas 12.6% are of the opposite opinion. Moreover, a dominant proportion of respondents (65.6%) consider the risk of rental price changes to be higher than the risk of house price fluctuations. This means that, for most households, renting is considered to be financially less attractive than owning. Regarding the psychological factors, the distribution of answers is broadly similar for all of them: about 70% of respondents prefer owning and about 10% of them indicate renting, whereas about 20% have no opinion. The result that is worth emphasizing is that the respondents do not consider rented dwellings to be a good place for a family. In this sense, the survey clearly indicates that households derive greater utility from living in owned rather than rented houses.

To better understand the reluctance toward renting, we also present the answers to a series of questions that could help to assess which factors are the main hindrance to the rental market development. The upper panel of Table 2 analyzes the barriers to demand for rental housing. It shows that among factors that are considered to decrease the comfort of being a tenant, the most important ones are related to how the rental market is organized and regulated. In the former case, more than half of respondents agree that tenants are excessively constrained in arranging the interior of rented apartments and landlords are inspecting housing units too often. This lack of professionalism among individual landlords obviously decreases satisfaction from living in a rented apartment as compared to owning it. In the latter case, more than half of the respondents agree that inefficient regulations related to rent control and tenant protection decrease the comfort of renting. It should be noted that regulations protecting tenants against unexpected eviction and reducing the risk of rent increases are of crucial importance for developing the demand for long-term rental. Finally, the level of rents and the offer of dwellings for rental also turned out to be important, albeit to a lower extent than the previous factors. The lower panel of Table 2 analyzes the barriers to the supply of rental housing. It demonstrates that the main factor decreasing the attractiveness of investment in houses to let is related to the low culture of tenants, which should be understood twofold. First, tenants usually care less about the housing unit than homeowners, which increases the depreciation rate and thereby the level of rents. Second, there is a non-negligible risk that a tenant stops paying a rent and other bills or might even devastate the housing unit. This, combined with a high protection of tenants against eviction, causes the risk of investing in rental housing in Poland to be high, which leads to a lower supply of rental housing.

To sum up, the results of the micro evidence are that households strongly prefer owning to renting due to economic and psychological factors. Households do not consider rental housing as a “true home”; hence, it is not treated as a serious alternative to owning in the case of a long-term stay. This might be partly explained by inefficient regulations, as well as low professionalism of landlords, which decreases satisfaction from living in rented dwellings. We will use this information when calibrating the DSGE model and designing the reforms of the rental market.

3 Panel regressions: macro evidence

In this section, we provide macro evidence that the RMS affects the aggregate dynamics of the housing sector. To be more precise, using a panel of data for 28 European Countries and years 2004–2017, we run a series of regressions to check if the reaction of real house prices to macroeconomic fundamentals depends on the housing tenure structure.

3.1 Specification

We regress the log dynamics of the real house prices (\(\Delta hp_{it}\)) on three factors that turned out to be important in earlier studies (see e.g., Egert and Mihaljek 2007 and references therein):

- \(\Delta y_{it}\):

A change in economic activity measured by the log growth rate of real GDP,

- \(\Delta r_{it}\):

A change in the level of real interest rates,

- \(\Delta L_{it}\):

A change in the level of credit to households in relation to GDP.

Moreover, following Cuerpo et al. (2014), as well as Czerniak and Rubaszek (2018), we assume that the relationship depends on the size of the private rental market (RMS\(_{it}\)) by introducing interaction variables. Finally, to account for the persistence in the dynamics of real house prices we add own lags to the set of regressors. The resulting specification of the model is:

where \(X_{it}= (\Delta y_{it}, \Delta r_{it}, \Delta L_{it})\), \(\mu _{i}\), and \(\phi _t\) are country and time-specific fixed effects, whereas \(\alpha \) and \(\beta \) are the parameters that are the main focus of our analysis. The former measures the strength of the relationship between real house prices and their macroeconomic determinants in a country with null RMS. The latter tells us to which extent this relationship is affected by the size of the private rental market, so that the short-term multiplier of \(\Delta hp_{it}\) with respect to \(X_{it}\) is equal to \(\alpha ^{\prime }+\beta ^{\prime }\times \hbox {RMS}\). If the private rental market is stabilizing real house prices, we would expect \(\beta \) to be significantly different from zero and that the sign of \(\beta \) is opposite to the sign of \(\alpha \).

3.2 The data

The parameters of the model were estimated using an unbalanced panel of the annual data for 28 European Union countries and years 2004–2017. All the data were collected from Eurostat using the eurostat package in R (Lahti et al. 2017). A detailed information about the series is as follows:

- \(\Delta hp_{it}\):

The dynamics of real house prices is calculated as the log growth rate of a house price index (HPI), deflated by the private final consumption expenditure deflator. The HPI is a broad index as it describes prices of all residential properties purchased by households (flats, detached houses, terraced houses, etc.), both new and existing, independently of their final use and their previous owners. The series are taken from the Macroeconomic Imbalance Procedure (MIP) indicators database (ticker tipsho20). It should be added that the panel of data for \(\Delta hp_{it}\) is unbalanced. The missing data are: Estonia (2004–2005), Hungary (2004–2007), Poland (2004–2008), Romania (2004–2008), and the Slovak Rep. (2004–2006).

- \(\Delta y_{it}\):

The change in economic activity is computed as the log change in the GDP chain-linked volumes index, which is normalized to 100 for the year 2010. The series are taken from the national accounts statistics (ticker nama_10_gdp).

- \(\Delta r_{it}\):

The dynamics of interest rates is calculated as a difference in the level of long-term interest rates used as a convergence criterion from the Maastricht Treaty (ticker irt_lt_mcby_a), which was deflated by the private final consumption expenditure deflator (ticker nama_10_gdp). The series describes the yields of government bonds denominated in national currencies, traded on the secondary market, with a residual maturity of around 10 years. The missing data for Estonia were replaced by the series for Finland.

- \(\Delta L_{it}\):

The dynamics of credit to the household sector is calculated as an increase in the consolidated value of loans held by households at the end of the year, which is taken from the MIP scoreboard statistics (ticker tipsdp26), divided by the value of nominal GDP (ticker nama_10_gdp). The missing values of outstanding loans for Belgium (2003–2011), Ireland (2003–2011), the Netherlands (2003–2011), and Portugal (2003–2011) were filled in using data taken from central banks Web pages.

- \(\hbox {RMS}_{it}\):

The tenure structure is taken from EU-SILC survey (ticker ilc_lvho02), and in rare cases of missing data they were interpolated with the na.fill function in R. The interpolation is justified as changes in the tenure structure are usually highly gradual.

3.3 Results

The results of panel regressions, which were obtained using the fixed effect estimator, are displayed in Table 3. Columns (i)–(v) present five versions of model (1), which differ on the subset of zero restrictions imposed on its parameters. In specification (i), we omit the interaction variables. In specifications from (ii) to (iv), we focus on single determinants of house prices, whereas in specification (v) is the unconstrained version of the model. After a series of tests, which were inspired by the comments of an anonymous referee, we have decided to not include country specific, but time fixed effects. This choice is supported, among others, by the results of significance tests for individual and time effects as well as model fit statistics. Moreover, the results presented in Table 3 show that this choice eliminates any cross-sectional dependence of residuals as well as alleviates the problem of serial correlation. Finally, the Hausman test confirms that using fixed rather than random effects estimator is justified. In the second stage, we estimate the unconstrained model with various assumptions related to the inclusion of country and time-specific fixed effects.

The estimates of model (i) confirm the results from the previous studies, in which the dynamics of house prices is to a large extent driven by changes in the economic activity and interest rates (e.g., Egert and Mihaljek 2007). The dynamics of loans to the household sector turned out to be less important, even though the sign and magnitude of the estimated parameter are acceptable. In specifications (ii)–(iv), we analyze the relationship between house prices and the three macroeconomic fundamentals, separately, accounting for the role of the \(\hbox {RMS}\). Column (ii) shows that the elasticity of real house prices with respect to GDP is decreasing with the size of the private rental market: the estimate of the parameter standing at the interaction variable indicates that an increase in the RMS by 10% points lowers the elasticity by 0.57. This result would indicate that in countries with the largest RMS, standing over 35% (Germany and Denmark, Fig. 1), the reaction of house prices to changes in GDP is almost negligible. In turn, column (iii) provides evidence that the relationship between house prices and real interest rates is significant, of expected sign and depends on the RMS. In this case, the relationship becomes negligible for the RMS amounting to about 25%. Regarding specification (iv), once again the private rental market is attenuating the relationship between house prices and the macroeconomic fundamental, this time the dynamics of credit to households.

A comparison of model fit, i.e., \(R^2\) statistic, for the three models with single determinants indicate that GDP and interest rates are much more correlated with house prices that the dynamics of loans. It should be emphasized, however, that variable \(\Delta L\) is only a rough proxy for the tightness of financing conditions. It is calculated as a change in the outstanding stock of loans and, hence, depends not only on the value of newly granted loans but also any factors that lead to valuation effects, exchange rate movements for instance.

In specifications (v)–(viii), we analyze the model with all three fundamentals together with their interaction variables. It turns out that the size of the rental market is significantly decreasing the effect of business cycle fluctuations in economic activity and interest rates on the dynamics of real house prices. Moreover, it can be stated that this result does not depend on the inclusion of individual or time fixed effects. On the contrary, the parameters describing the impact of credit dynamics are not always significant, which confirms the results in columns (ii)–(iv).

To sum up, the results of panel regressions indicate that the private rental market is stabilizing the economy. The reaction of real house prices to the three macroeconomic fundamentals is much stronger in countries with an underdeveloped rental market than in countries in which renting represents a viable alternative to homeownership. Below, we explain this feature of the housing market within a microfounded DSGE model.

4 DSGE model: matching the micro and macro evidence

In the previous sections, we have described the main factors that are a hindrance to rental market development as well as the aggregate effects of rental market underdevelopment. In this section, we propose a theoretical macroeconomic framework that can be used to assess the effects of changes in the organization of the housing rental market. The result from the previous section will be crucial to the development and implementation of the macro model. To be more precise, we use the micro results to feed the macro model and assess the effects of the following reforms in housing markets on the macroeconomy:

- (i)

Decreasing the impact of “bad tenant” risk on the level of rents,

- (ii)

Removing fiscal incentives to own,

- (iii)

Increasing the professionalism of landlords, for example by means of regulations on house inspections and maintenance, which would lower the psychological disadvantages of renting.

The choice of these reforms is made in light of the factors that appear to be most relevant in the survey. Therefore, this part of the paper comes as a natural consequence of the results found in Sect. 2.

The proposed DSGE model is based on the framework of Iacoviello (2005), in the sense that it includes housing and a collateral constraint for borrowers, whereas the description of the rental market is closely related to the recent works by Ortega et al. (2011) and Rubio (2014b). We use the latter two models, in which the rental market is well characterized for our purpose. However, we had to adapt them to study specifically the Polish market. In particular, we use a two-sector housing model with a rental market, as in Ortega et al. (2011). However, since that model is designed for Spain, it is a small open economy inside a monetary union. We, instead, propose a monetary policy framework in which the central bank is able to set interest rates, as in Rubio (2014b). The main structure of the model is as follows:

- 1.

There are two types of consumers, savers and borrowers, with different discount factors.

- 2.

Savers are the landlords and provide rental services to borrowers.

- 3.

Borrowers face collateral constraints when applying for a mortgage.

- 4.

There are two production sectors, construction and consumption goods.

- 5.

Housing can be purchased or rented.

- 6.

There are fiscal incentives to purchase or rent a dwelling.

A more elaborated description, with optimization problems, is presented below.

4.1 Savers

Savers maximize their utility from consumption \(C_{s,t}\), housing services \(H_{s,t}\), and working hours \(N_{s,t}\):

where \(\beta _{s}\in \left( 0,1\right) \) is the discount factor and \(E_{0}\) the expectation operator. \(1/\eta >0\) is the labor-supply elasticity and \(j>0\) constitutes the relative weight of housing in the utility function. \(N_{s,t}\) is a composite of labor supplied to the consumption \(N_{cs,t}\) and housing sector \(N_{hs,t}\),

where \(\omega _{l}\) is a weight parameter and \(\varepsilon _{l}\) the elasticity of substitution between both labor types.

The budget constraint is:

where \(q_{h,t}\) is the real housing price and \(w_{cs,t}\) (\(w_{hs,t}\)) denotes real wages in the consumption (housing) sector. Savers can purchase or sell houses, either to live in \(H_{s,t}\) or to rent it \(H_{z,t}\) at price \(q_{z,t}\). \(\delta _{h}\) and \(\delta _{z}\) are the depreciation rates for owner-occupied and rented dwellings, respectively. They might differ if tenants utilize the dwelling more intensively than owners, which is discussed in Sect. 2. We call this phenomenon “bad tenant” risk. We also allow for the existence of tax incentives to own, in particular a subsidy \(\tau _{h}\). Next, the level of savings is given by \(b_{s,t}\) and the risk-free interest rate by \(R_{t-1}\). \(\pi _{t}\) is the inflation rate at period t. Finally, \(S_{t}\) are the profits of firms and \(T_{t}\) a lump-sum government transfer.

The first-order conditions for this optimization problem are as follows:

Equation (6) is the standard Euler equation for consumption. Equations (7) and (8) represent the intertemporal conditions for housing purchased to own and let, respectively. In these equations, the benefits of purchasing a housing unit equate the alternative costs of forgone consumption. Finally, Eqs. (8) and (9) describe the labor-supply conditions for the consumption goods and the housing sectors.

4.2 Borrowers

Borrowers solve a similar optimization problem as savers:

where \(\beta _{b}<\beta _{s}\) is the discount factor for borrowers, and

The key difference in the optimization problems of savers and borrowers is that \(\tilde{H}_{b,t}\) is a composite of owned housing purchased with a mortgage \(H_{b,t}\) and rental services \(H_{z,t}\):

The parameter \(\omega _{h}\) is very important in our analysis, as it approximates the preference for owning a house (purchased on credit) versus the rental housing. In turn, \(\varepsilon _{h}\) describes the elasticity of substitution between preferences for owner-occupied and rental housing. In this way, borrowers derive utility from the two types of housing. It should be emphasized that this does not literally mean that each borrower lives simultaneously in their own house and in a rented house. Instead, the interpretation is that there exists a large representative borrower-type household with a continuum of members, some of whom live in owner-occupied houses, the rest of whom live in rented houses. This composite index in the equation thus represents the aggregate preferences of all household members with respect to each kind of housing service.

For borrowers, we also allow for tax incentives to rent, in particular a subsidy to rent \(\tau _{z}\) is considered. Thus, the budget constraint and the collateral constraint for the borrowers are as follows:

where \(b_{b,t}\) represents the level of debt and \(k_{t}\) is a maximum loan-to-value ratio (LTV) that follows an autoregressive process \(\log k_{t}=(1-\rho _{k})\log (\overline{k})+\rho _{k}\log k_{t-1}+\zeta _{t}\) with normally distributed shocks, where \(\overline{k}\) is a steady-state value of the LTV. A shock to the LTV represents a credit constraint loosening or tightening.

The first-order conditions of this maximization problem are:

where \(\lambda _{t}\) is the Lagrange multiplier of the collateral constraint. The above conditions can be interpreted analogously to those for savers. The most important difference is in the demand equation for owned and rented housing (17 and 18), which now equates the marginal utility from housing services (and the marginal value of housing as collateral in the case of Eq. 17) with the alternative cost of forgone consumption.

4.3 Firms

The intermediate consumption goods market is monopolistically competitive. The individual firm production function is:

where the only factor of production is labor supplied by each agent, with \(\gamma \in \left[ 0,1\right] \) measuring the relative size of each group in terms of labor. \(A_{t}\) represents technology, which is an autoregressive process \(\log A_{t}=\rho _{A}\log A_{t-1}+u_{t}\) with normally distributed shocks. The symmetry across firms allows for avoiding the index z and rewriting the above equation in the form of the aggregate production function for consumption goods:

The intermediate housing investment goods market is subject to the same technology shock \(A_{t}\). Both types of households also supply labor to the construction sector, with the same relative size as in the consumption sector. The aggregate production function for housing investment is therefore:

Intermediate goods producers maximize profits:

where \(X_{t}\) is the markup that is equal to the inverse of real marginal costs.Footnote 2 The first-order conditions are the following:

These first-order conditions represent the labor demanded for each type of consumer by each sector, respectively. The price setting problem for the intermediate goods producers is a standard Calvo–Yun case. They sell goods at price \(P_{t}\left( z\right) \). They can re-optimize the price with \(1-\theta \) probability in each period. The optimal reset price \(P_{t}^{OPT}\left( z\right) \) solves:

where \(\varepsilon _{p}\) represents the elasticity of substitution between intermediate goods.

The aggregate price level is therefore:

By combining (28) with (29) and log-linearizing, we can obtain the standard forward-looking Phillips curve.

4.4 Monetary authority and equilibrium conditions

To close the model, we assume that the central bank sets interest rates according to a Taylor rule that responds to inflation and output growth:Footnote 3

where \(0\le \rho \le 1\) is the parameter associated with interest rate smoothing. \(\phi _{\pi }>0\) and \(\phi _{y}>0\) measure the interest rate response to inflation and output growth, respectively. R is the steady-state value of the interest rate. \(\varepsilon _{R,t}\) is a white noise shock with 0 mean and \(\sigma _{\varepsilon }^{2}\) variance.

The equilibrium conditions for the consumption goods and housing investment markets are:

Finally, the equilibrium government budget constraint is:

5 Reforming the rental market

5.1 Calibrating the model

We calibrate the model to the characteristics of the Polish economy, including the data that we collected in the survey. The weight parameter in the CES basket of housing services \(\omega _{h}\) is set at 2 / 3, based on answers to the question asking the preferred tenure choice in the case of no funds to buy a dwelling (taking mortgage vs. renting). The parameters describing the labor market were fixed at \(\omega _{l}=0.14\) and \(j=0.06\) so that the share of labor in the construction sector stood at 7.6%. The value of j parameter, together with quarterly depreciation rates at \(\delta _{z}=1\%\) and \(\delta _{h}=0.75\%\), additionally fixes the residential investment to GDP ratio at 3.3%, close to the 2007–2015 average from the OECD data. The discount factor \(\beta _{s}\) was set to 0.995 so that, taking into account the value of \(\delta _{z}\), the ratio of quarterly rents \(q_{z}\) was equal to 1.5% of house value, in line with the National Bank of Poland data presented in quarterly reports “Information on home prices and the situation in the housing and commercial real estate market in Poland.” Regarding parameters describing regulations, we set the steady-state LTV value \(\overline{k}\) to 0.8, in line with the current restrictions related to the maximum LTV, and took into account that landlords have to pay 8.5% turnover taxes (\(\tau _{z}=-0.085\)). Finally, given all the above parameters, we set the share of savers to be \(\gamma =2/3\), so that the share of the rental market stood at 6.8%, in line with the survey data (excluding public rental). The above choice implies that the share of owners with a mortgage is 17.2%, a little bit more than in the survey (10.4% if we exclude public rental). This share is higher than what is observed in the data as the mortgage markets in Poland were almost nonexistent before 2004; hence, it is difficult to claim that the current share is the steady-state value.

The remaining parameters are set to values commonly used in the literature. For borrowers, we use a slightly lower discount factor than the one for savers. Following Horvath (2000), we set the elasticity of substitution between labor types to \(\varepsilon _{l}=1\). For the elasticity of substitution between services from home ownership and renting, we follow Ortega et al. (2011) and take the value \(\varepsilon _{h}=2\) in order to make households more sensitive to the relative price of buying a house and renting it than would be the case under lower values. The value for the elasticity of substitution among intermediate goods, \(\varepsilon _{p}=6\), implies a markup of 20% in the steady state, a value commonly found in the literature. The probability of not changing prices is chosen to be \(\theta =0.75\), implying that prices change every four quarters on average. The coefficients in the Taylor rule are set to \(\rho =0.9\) for the lagged interest rate and \(\phi _{\pi }=0.5\) for inflation and \(\phi _{y}=0.5\) output, respectively, as proposed in the seminal paper by Taylor. The values for the above parameters are reported in Table 4. The resulting model steady-state ratios, compared to their data counterparts, are presented in Table 5. It shows that the model reproduces the average proportion of residential investment over GDP, 3.4% (3.3% in the data), as well as the weight of employment in construction over total employment (7.7% in the model, 7.6% in the data). The rental share in the model is 6.9% (consistent with the 6.8 %, found in the survey), whereas the share of housing with mortgages is 17.2% in the model, which is above the number found in the data (10.4%) due to the reasons discussed above.

5.2 Steady-state analysis

We can now use the DSGE model described previously to evaluate the effects of residential rental market reforms on the main macroeconomic variables. In particular, based on the micro evidence, we focus on the quantitative effects of:

- (i)

Removing fiscal disincentives to rent (neutral taxes),

- (ii)

Improving regulations behind the rental contract (lower “bad tenant” risk),

- (iii)

Lowering the disutility of renting (professional rental services).

In terms of the model, this would correspond to setting taxes on rental income (\(\tau _{z}\)) equal to zero, diminishing the depreciation rate of rental housing (\(\delta _{z}\)), and lowering the preference parameter of owner-occupied housing (\(\omega _{h}\)), respectively. It should be noted that the time horizon of the above three reforms is different. As reforms (i) and (ii) can be introduced relatively quickly, reform (iii) should be considered as a long-lasting process, requiring an increase in the quality of rental services and a gradual shift in attitudes.

Here, we display the consequences of these reforms on steady-state values, to capture the long-run or structural effects of these measures. The results for the key variables and ratios are displayed in Table 6. Specifically, in the second column of the table we present the results for a fiscal policy reform, the third column displays the steady-state values associated with lower “bad tenant” risk, and the fourth column presents the long-run effects of lowering the disutility of renting. The fifth column presents the combined effects of the above three reforms.

We can observe that the first reform, moving to a neutral fiscal policy with no subsidies on housing markets, has relatively small effects on overall economic activity, although it contributes to increasing the housing rental share. This measure implies a reallocation of the available housing stock from the ownership to the rental segment of the market. In particular, the rental share in the housing market increases to 7.7%. On the contrary, borrowers reduce their holdings of mortgaged houses, so that the share of mortgaged houses in the total housing stock falls from 60.9 to 59.4% of GDP. The effects of the second reform are quite similar, in the sense that the overall economic activity is not affected much and the largest effect is the reallocation of the housing stock from the ownership to the rental segment, which translates into changes in mortgage debt. Finally, an increase in the household preference for renting also has similar effects to the other two measures. It increases the size of the rental market and lowers the amount of houses that are purchased with a mortgage. This measure brings the strongest effects, although it is more difficult to implement in the short run because it implies changing preferences or cultural factors. The last column displays the combined effects of all three reforms together. Since they all have effects that go almost in the same direction, we see that the housing rental share increases sizably from a value of 6.8 to 15%, whereas the value of mortgage debt decreases by one-third, from 60.9 to 40.9% of GDP. This suggests that there should be an effort toward implementing a combination of these measures in order to obtain stronger results.

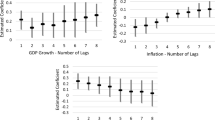

5.3 Impulse response analysis

We have already shown that the reforms of the rental market are mainly affecting the steady-state values of two variables: the rental share and the level of mortgage debt to GDP ratio. A question that arises is whether these changes affect fluctuations of the economy over the business cycle, that is, if they also have short-run effects. In order to assess this, we compare the dynamic response of the economy before and after the rental market reform with three macroeconomic disturbances: productivity, monetary, and loan-to-value shocks. The shape of the impulse response functions is presented in Fig. 2. The model is solved by taking a linear approximation of the structural equations. From the solution of the model, impulse responses can be calculated, that is, how variables respond to a given shock. Each row in the figure represents the variable of interest, which includes two key macrovariables, inflation and GDP, as well as house prices. In the case of columns, they represent three macroeconomic shocks (productivity, monetary, and LTV). Finally, each panel presents the effect of a given shock (one standard deviation) on the variable of interest (expressed in percentage deviations from the steady state) in two scenarios (before and after the full reform).

Figure 2 shows that the reform of the rental market is not changing the effect of a monetary and a productivity shock on the macroeconomy. This can be interpreted by the fact that both shocks do not have a significant impact on the relative costs of owning in comparison with renting. The availability of mortgages is not affected either because the strength of the financial accelerator, which is driven by the collateral constraint described in the model, does not change with these shocks.Footnote 4 In turn, the rental market reform affects how the economy responds to the LTV shock, defined as loosening the credit constraint. Our interpretation is as follows. The initial shock, i.e., credit loosening, is positively affecting the demand for mortgages as borrowers can now afford to acquire more housing services with credit. A well-functioning and affordable rental sector provides a viable alternative to satisfy these needs, hence limiting the demand for mortgages and softening the financial accelerator effect. During the expansionary phase on the housing market, affordable rental opportunities would then tame demand pressures and thus limit price increases. Equivalently, lower indebtedness of households means that price corrections during downturns are less severe. As a result, one would expect more stable housing markets after the reform. Since housing markets and the macroeconomy are linked through the collateral constraint, this will also bring higher macroeconomic stability. As shown in Table 7, this is exactly the case. After the reform, the volatility of house prices attributed to LTV shocks declines from 0.71 to 0.55 . This, in turn, leads to higher macroeconomic stability as evidenced by an almost 30% decline in the standard deviation of both GDP and inflation attributed to the LTV shock. Overall, a reform in the housing market that enhances the share of the rental market brings more stability to the economy in the aftermath of financial shocks, but not monetary or productivity shocks.

6 Conclusions and policy recommendations

The share of the rental housing market in many countries around the globe is small. In this paper, we have conducted a micro–macroanalysis to understand better the causes and effects of this phenomenon, as well as to provide some policy recommendations. For the micro evidence, we have focused on the study of Rubaszek and Czerniak (2017), which is based on a survey conducted in Poland, a country characterized by a very low share of the private rental market. The authors show that the rental market is treated as a short-term, temporary solution, and not as a vital alternative to ownership for a longer stay. The results of the survey indicate that the preferences of households are strongly skewed toward owning due to both economic and psychological factors. Households perceive ownership not only as a cheaper form of satisfying housing needs, but also as the only way to provide a safe place for the family and to really “feel at home.” The survey also suggests that inefficient institutions and the lack of professional renting services are among the most important barriers to the development of the private rental market. As regards macro evidence, with a panel of data for 28 EU countries and the period 2004–2017 we show that the underdevelopment of the private rental market amplifies the elasticity of house price with respect to key macroeconomic fundamentals: output, interest rates, and to a lower-degree credit dynamics.

Given the above micro–macroevidence about the reasons and consequences of rental market underdevelopment, we have used a DSGE model with rental housing and collateral constraints, which we calibrated to the Polish data, to quantify the effects of three reforms: (i) equalizing fiscal incentives for different types of housing tenure, (ii) removing the “bad tenant effect” on the level of rents, and (iii) improving the standard of rental services leading to a shift in housing tenure preferences. All three reforms lead to an increase in the share of the rental market in the long run. Our computations indicate that introducing the three reforms would shift the rental share from 6.8 to 15.0%. We also show that reforming the rental market is also beneficial for macroeconomic stability. For LTV shocks, the financial accelerator effects derived from loosening the collateral constraint are dampened after the reforms. Then, even though this financial shock promotes borrowing and consumption, a well-functioning rental market mitigates its effects and brings stability to both the housing market and the macroeconomy.

The above results justify why in some countries making the rental market function effectively should be considered a top priority for housing policy. Based on the results of the study, we may formulate a number of recommendations for housing policy. First of all, lowering the relative cost of renting in comparison with owning seems to be one of the key factors. A direct method would be to introduce rental subsidies, even if this kind of housing policy could have an impact on rental prices (Viren 2013). Lowering the relative cost of renting could also be achieved by introducing smart regulations, e.g., limiting the “bad tenant” risk. Eliminating fiscal measures promoting ownership would also help. Second, improving the quality of rental services would contribute to changing psychological attitudes toward renting. This could be achieved by encouraging professional investors that specialize in managing and building rental housing, but also by supporting associations of individual landlords or rental management companies. Third, smart regulations that protect “good tenants” against the risk of large rent hikes or unexpected eviction would increase the sense of security and stability of the rent contract. This would reduce one of the most important barriers to demand for rental houses: the belief that renting is not a stable form of satisfying housing needs. Finally, it is worth mentioning that the decision about buying a dwelling is often based on a flawed economic reasoning. This might lead to the conclusion that education or information campaigns about advantages and disadvantages of different forms of housing tenure could contribute to the increase in demand for rental as well as better housing choices of households.

Notes

Given that the article of Rubaszek and Czerniak (2017) is in Polish in “Appendix,” we provide the translation of selected questions into English.

The intermediate goods firms operate under monopolistically competitive conditions, and this is why there is a markup \(X_{t}.\) Therefore, they can make positive profits that are rebated back to savers (variable \(S_{t}\) in equation 4).

In terms of the dynamics of the model, there is not much difference between using output growth or output gaps in the Taylor rule. However, especially when taking the model to the data, output growth is much easier to observe than output gap. This is why we have made this choice.

This is consistent with the findings in Rubio (2014b). Impulse responses show little aggregate differences with respect to the rental market share. However, the policy trade-offs in the presence of supply shocks are improved when the rental market share increases.

References

Arce O, Lopez-Salido D (2011) Housing bubbles. Am Econ J Macroecon 3(1):212–41

Ben-Shahar D (2007) Tenure choice in the housing market: psychological versus economic factors. Environ Behav 39(6):841–858

Bourassa SC (1995) A model of housing tenure choice in Australia. J Urban Econ 37(2):161–175

Coolen H, Boelhouwer P, Driel KV (2002) Values and goals as determinants of intended tenure choice. J Hous Built Environ 17(3):215–236

Croissant Y, Millo G (2008) Panel data econometrics in R: the plm package. J Stat Softw 27(2):1–43

Cuerpo C, Pontuch P, Kalantaryan S (2014) Rental market regulation in the European Union. European Economy. Economic Papers 515, European Commission

Czerniak A, Rubaszek M (2018) The size of the rental market and housing market fluctuations. Open Econ Rev 29(2):261–281

Diaz-Serrano L (2009) Disentangling the housing satisfaction puzzle: does homeownership really matter? J Econ Psychol 30(5):745–755

Earley F (2004) What explains the differences in homeownership rates in Europe. Hous Finance Int 19:25–30

Egert B, Mihaljek D (2007) Determinants of house prices in Central and Eastern Europe. Comp Econ Stud 49(3):367–388

Elsinga M, Hoekstra J (2005) Homeownership and housing satisfaction. J Hous Built Environ 20(4):401–424

Harding J, Miceli TJ, Sirmans C (2000) Do owners take better care of their housing than renters? Real Estate Econ 28(4):663–681

Henderson JV, Ioannides YM (1983) A model of housing tenure choice. Am Econ Rev 73(1):98–113

Horvath M (2000) Sectoral shocks and aggregate fluctuations. J Monetary Econ 45(1):69–106

Iacoviello M (2005) House prices, borrowing constraints, and monetary policy in the business cycle. Am Econ Rev 95(3):739–764

Kivedal B (2014) A DSGE model with housing in the cointegrated VAR framework. Empir Econ 47(3):853–880

Lahti L, Huovari J, Kainu M, Biecek P (2017) Retrieval and analysis of Eurostat open data with the eurostat package. R Journal 9(1):385–392

Leamer EE (2007) Housing is the business cycle. In: Proceedings—economic policy symposium—Jackson Hole, pp 149–233

Lee C-C, Wang C-Y, Zeng J-H (2017) Housing price-volume correlations and boom-bust cycles. Empir Econ 52(4):1423–1450

Mora-Sanguinetti J (2010) The effect of institutions on European housing markets: an economic analysis. Number 77 in Estudios Económicos. Banco de Espana

Ortega E, Rubio M, Thomas C (2011) House purchase versus rental in Spain. Moneda y Credito 232:109–144

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. CESifo Working Paper Series 1229

Rubaszek M, Czerniak A (2017) Preferencje Polakow dotyczace struktury wlasnosciowej mieszkan: Opis wynikow ankiety. Bank i Kredyt 48(2):197–234

Rubio M (2014a) Housing-market heterogeneity in a monetary union. J Int Money Finance 40(C):163–184

Rubio M (2014b) Rented vs. owner-occupied housing and monetary policy. National Bank of Poland Working Papers 190, National Bank of Poland, Economic Institute

Sinai T, Souleles NS (2005) Owner-occupied housing as a hedge against rent risk. Q J Econ 120(2):763–789

Viren M (2013) Is the housing allowance shifted to rental prices? Empir Econ 44(3):1497–1518

Funding

This study was funded by the National Science Centre Grant No. 2014/15/B/HS4/01382.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This project was financed by the National Science Centre Grant No. 2014/15/B/HS4/01382. It benefited from comments made by the participants to the ESPA Poland 2016 Conference (Warsaw, September 2016), Macromodels 2016 (Lodz,November 2016), Prognozowanie i Modelowanie Gospoadarki Narodowej (Sopot, May 2017), ERES Annual Conference (Delft, June 2017), AREUEA International Conference (Amsterdam, July 2017) and ESEM-EEA (Lisbon, August 2017) as well as internal seminars at Warsaw School of Economics and the University of Nottingham. We are especially grateful to the Editor of the journal, an anonymous referee, K. Kuerschner, M.T. Punzi, Paul Mizen, T. Schmidt and Dimitrios Tsomocos for insightful feedback. We also thank Harriet Lee for help in editing the text.

Appendix. Fragments of the survey questionnaire

Appendix. Fragments of the survey questionnaire

-

Q1.

Year of birth

-

Q2.

Sex

-

Q3.

Marital status

-

Q4.

Number of children

-

Q6.

Education

-

Q7.

Employment status

-

Q8.

Income (your economic situation on a scale of 1 to 10)

-

Q9.

Size of town

-

Q10.

Tenure status of currently inhabited residence

-

Q11.

In comparison with the current place of your residence you grew up in:

- a.

Different country

- b.

Different town

- c.

The same town

- a.

-

Q12.

Since when have you lived at your current address?

-

Q13.

When do you expect to change your residence

-

Q14.

The most likely tenure status of new residence in case of moving

-

Q15.

A choice in case of no funds to buy a dwelling

-

Q16.

Ignoring other factors, please indicate if you prefer renting or buying with a mortgage:

- E1.

The burden of paying mortgage installments vs. the cost of renting

- E2.

Risk of house price vs. rent price fluctuations

- E3.

Transaction costs

- E4.

Taxes

- E1.

-

Q17.

Ignoring other factors, please indicate if you prefer renting or buying with a mortgage:

- P1.

Social status

- P2.

Sense of freedom and independence

- P3.

Comfort

- P4.

Peace of mind

- P5.

Well-being

- P6.

Attachment to dwelling

- P7.

Family

- P8.

Happiness

- P1.

-

Q18.

Please indicate which factors are decreasing the comfort of being a tenant?

- a.

Tenants are not well protected against rent increases

- b.

Tenants are too much constrained in decorating and modifying the apartment

- c.

Landlords are inspecting the apartment too often (invigilation in private life)

- d.

Tenants are not well protected against eviction

- e.

Rents are too high in comparison with mortgage installment

- f.

The offer of dwellings to rent is too scarce to meet preferences

- a.

-

Q19.

Please indicate which factors reduce the attractiveness of buy-to-let investment?

- a.

Excessive restrictions on rent increases

- b.

Lack of culture of tenants (e.g., devastation of rented dwellings)

- c.

Excessive protection of tenants against eviction, increasing the risk of business

- d.

The expected rate of return is too low because of the low levels of rents

- e.

Low demand for renting, i.e., due to strong preferences towards ownership

- a.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Rubaszek, M., Rubio, M. Does the rental housing market stabilize the economy? A micro and macro perspective. Empir Econ 59, 233–257 (2020). https://doi.org/10.1007/s00181-019-01638-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-019-01638-z