Abstract

Remittances have become a significant component of international capital flows, with millions of migrants sending billions of dollars back to their home countries annually. However, the way these outflows affect macroeconomic variables has not received sufficient attention in the literature, especially in the context of varying levels of financial development. Using time series data from 1987 to 2022 for the United Kingdom, this study examines the macroeconomic effects of remittance outflows and financial development. Our baseline estimation using the Autoregressive Distributed Lag model reveals heterogeneous impacts, as remittance outflows adversely affect economic growth but improve exchange rates. We find remittances do not have a significant effect on inflation or bank rates. The moderating effect of financial development analysis reveals a similar outcome. Our results suggest governments should consider stimulus policies that support investment in productive sectors to improve macroeconomic indicators and facilitate financial inclusion to enhance the adoption of growth strategies that promote remittances.

Similar content being viewed by others

Introduction

Without a doubt, economic openness has been a significant factor in increasing cross-border labour migration in recent years [17, 24]. Given that foreign labour is crucial for economic progress, both in host countries and in home countries, through remittances, the ongoing increase in global labour migration is anticipated to have significant effects on remittances [16, 23, 40, 60]. Large remittance outflows can have significant implications for several macroeconomic indicators in the host country, including inflation, interest rates, exchange rates, current accounts, and foreign reserves [see 37, 40], etc.). Although, a decrease in the money supply in the host country can in some cases lead to lower inflation [55], a decrease in output in real terms will lead to a depreciation of the local currency. Achieving equilibrium in this situation may require using foreign reserves, which could have detrimental effects on economic growth. Remittance outflows can strain government expenditures and investment [60], as money earned by migrants that is remitted to their home countries is not reinvested into the host country’s economy, which could negatively impact economic growth [6, 18]. Generally, an increase in remittances increases macroeconomic volatility and uncertainty [22]. This, in turn, could discourage investment in the host nation, weakening the country’s balance of payments and its currency.

Remittances have garnered growing interest from researchers, policymakers, and international institutions because of their potential impact on macroeconomic conditions in the countries that receive them [see 30, 36, 40, 47, 59]. Various studies have thoroughly examined the economic advantages of incoming remittances for recipient countries [45, 50, 53]. However, their findings have been inconclusive, with differing results regarding the correlation between remittance inflows and economic growth [for example, see 41, 19]. The significance of remittance outflows from nations that host migrants has been somewhat overlooked due to the relatively small magnitude of these remittances, both in terms of monetary value and as a percentage of GDP, for many host countries [11]. Nonetheless, gaining a better understanding of the macroeconomic impacts of overseas remittances would allow policymakers to design suitable policies and pursue initiatives that promote economic stability and sustainable growth.

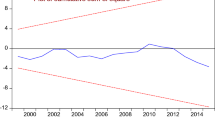

According to the World Bank, remittances worldwide are predicted to have grown five percent in 2022, reaching USD 831 billion [60], and a modest one percent growth, to USD 840 billion, is projected for 2023. In recent years, the United Kingdom (UK) has seen a significant flow of remittances, both incoming and outgoing. Specifically, in 2022, remittance outflows amounted to $10.8 billion, while remittances inflows totalled $3.9 billion [60]. It is important to analyse the macroeconomic consequences of these transfers, particularly the outflow of remittances, in the UK. Since 2000, the amount of money sent from the country as remittances has exceeded the amount received. Initially, this difference was small but has subsequently increased, reaching a significant discrepancy of $7 billion in 2022. The World Bank Bilateral Remittances Matrix continually ranks the UK as the fourth-largest global source of remittance outflows, highlighting India and Nigeria as the main beneficiaries of these remittances [57]. The cumulative impact is expected to significantly shape the economic and immigration policies in the UK. Hence, the goal of this study is to analyse how remittances affect macroeconomic performance, focusing on key variables such as exchange rates, inflation, interest rates, and GDP.

In addition to examining the relationship between remittance outflows and macroeconomic performance in the UK, our study offers novel insights by considering the financial sector’s role in that relationship. Apart from the fact that studies suggest a positive correlation between financial development and remittance levels [20], considering the financial sector’s role is germane for a number of reasons. Most importantly, the financial sector not only serves as the intermediary for all remittance transactions, it also helps to determine exchange rates through the dynamics of demand and supply [25, 37]. Fluctuations in exchange rates can affect the amount of money remitters send back to their home countries; a strong UK pound may increase the value of remittances in foreign currencies, while a weak pound may encourage higher remittance outflows as migrants seek to leverage favourable exchange rates [28]. Furthermore, a well-developed financial market offers efficient channels for sending and receiving remittances, including international money transfers, foreign exchange (forex) capabilities, and general banking services [4, 46]. Although lower transaction costs and faster transfer times encourage higher remittance flows [40] a well-developed financial system may motivate migrants to re-invest their remittances in financial assets such as stocks and bonds [46]. Therefore, we conjecture that the complex role of the financial system in the remittance-macroeconomic nexus holds important implications for macroeconomic policy.

The remaining sections of our study are organised as follows. Sect. "Literature review" reviews the literature. Sect. "Methodology and data" explains the methodology. Sect. "Result" describes the data and empirical results. Sect. "Conclusion and policy recommendations" provides conclusion and policy recommendations.

Literature review

Theoretical framework: the Dutch disease model

The Dutch disease model serves as a theoretical foundation for this study. Introduced by Corden and Neary in 1982 [21], the theory explains the economic phenomenon in which a significant increase in revenue from a natural resource boom has negative consequences for other sectors of the economy. The Dutch disease model, which originated with natural gas exports from the Netherlands, is widely applied to explain the adverse effects on a nation's economy resulting from an upsurge in exports of natural resources, which can be seen as including remittances [43, 59]. According to the model, as exports of a natural resource in this case, remittances increase, the country's currency may appreciate, making the rest of the country's export sector less competitive [34]. The model conjectures that a country’s export-oriented sectors may suffer negative effects due to the appreciation of the real exchange rate, which increases prices for those exports in foreign markets. The fundamental concept underlying the Dutch disease model in this context is that the outflow of remittances results in an inflow of foreign currency into the home country of the remitter. This influx increases the money supply, which may cause the local currency to appreciate in value. This causes the prices of the home countries’ domestic products to rise in global markets, perhaps decreasing the need for export earnings that are not derived from remittances. The decline in revenue from and reduced demand for non-remittance exports can have a detrimental effect on a country's economy, resulting in diminished economic growth and increased unemployment rates [56].

In essence, the Dutch disease model proposes that the outflow of remittances may harm a country's economy by causing its currency to appreciate. It is important to note that the results of this model are influenced by various factors. The impact of remittance outflows can differ based on the total amount remitters send to their home countries, as discussed in Khan et al. [40] and Rahmouni and Debbiche [52]. Additionally, the effects can be influenced by policies and financial developments, as explored in Pandikasala et al. [49]. These factors constitute the trajectory of empirical investigation for this study.

Empirical review

In accordance with the overarching objective of the study, here we review related empirical findings pertaining to remittance outflows, financial development, and various macroeconomic indicators.

To begin, the effects of remittances on economic development and growth has become a topic of significant interest in the literature. We note that some use the term ‘migration remittances’ to describe all transfers of money from migrants to people living in the migrants’ home countries [17, 53 among many others]. However, it is important to differentiate ‘migration remittances’ from ‘workers’ remittances’, which are usually regular payments earned by workers based in a foreign country for a year or more. Many studies examine the effect of remittances on economic factors such as economic growth, consumption, investments, savings, poverty, and human capital. Some examples include Al-Assaf and Al-Malki’s [8] and Bashier and Bataineh’s [13] studies of Jordan, Kratou and Gazdar [41] for the MENA region, Golitsis, Avdiu, and Szamosi [31] for Albania, Meyer and Shera [44] for Bosnia Herzegovina, Bulgaria, Romania, Moldova, Macedonia, and Albania, Zahran [61] for Egypt, Raza [54] for Pakistan, Ekanayake and Moslares [26] for Latin America, Abduvaliev and Bustillo [1] for former Soviet-bloc countries, and Sutradhar [58] for Sri Lanka, Pakistan, India, and Bangladesh. Most of these studies primarily examine the effects of remittances on the economies of the countries that receive them, neglecting the effects of remittance outflows on the nations hosting the migrants. One of the main reasons for this oversight is that the amount of money sent is miniscule relative to the size of the host countries’ economies.

However, there has been a recent shift in focus from analysing the effects of remittances on the recipient country's macroeconomic performance to studying their influence on the host countries [for example, see [33, 38]. This body of research can be categorized into two distinct strands. The first holds that relying on imported human capital has a detrimental impact on host countries’ economies by creating labour imbalances, remittance outflows, and disparities in income distribution [for example, see [3, 39, 41, 42, 48]. The other strand emphasizes the beneficial impact migrant workers have in their host countries. According to this viewpoint, these workers can alleviate shortages of skilled labour in their host countries, and the positive effect on the country where remittances are sent is that the outflow of remittances can help lower inflation. This is supported by findings in Hathroubi and Aloui [34], Al-Abdulrazag and Foudeh [7], and Basnet et al. [14].

Due to the importance of the financial system in remittance transactions that can have ripple effects on macroeconomic performance, a budding body of literature examines the connection between remittance flows and financial development. However, studies on remittance outflows and financial development have not produced a unanimous consensus regarding the effects of remittance outflows on various macroeconomic indicators. An advanced financial system that encompasses established financial institutions such as banks is crucial to facilitate higher volumes of remittances. Advances in financial institutions, financial contracts and instruments, financial markets, and connections between domestic and international financial institutions and markets can increase trade, decrease transactions costs and risks, improve efficiency, and bolster investments [15, 48]. Furthermore, establishing a robust financial sector not only enhances the range of available financial services, it also helps to establish a standardized regulatory framework. Donou-Adonsou et al. [24] discover a positive correlation between remittances and financial development in sub-Saharan African countries over an extended period. They also show that in an underdeveloped financial system, high transaction costs are a crucial factor that significantly influences the movement of remittances. Remittance inflows to recipient nations are typically deterred by high transaction costs, whereas reduced transaction costs tend to attract higher levels of remittances. Ha and Ngoc [32] show that financial development has a positive impact on human capital in Vietnam. They highlight that a robust financial system allows individuals to obtain superior financial services, hence promoting the development of human capital. When a robust financial system is in place, recipients of remittances go beyond simply spending the money and instead use it for productive endeavours, choosing to invest remittances through banks, as stated by Ngoma et al. [46]. Cao and Kang [19] examine the relationship between remittances, financial development, and human development in sub-Saharan Africa. They find that when financial development is taken into account, the effect of remittances on human capital is statistically significant influence. Pandikasala et al. [49] show a strong positive association between financial development and remittance inflows in the Indian economy. This is because individuals receiving remittances use various financial institutions to save and invest these external monies in sectors that offer higher productivity.

Gaps in the literature

Our review of the literature reveals that the strand on the dynamics of remittance outflow and financial development, as well as remittance outflows and macroeconomic performance is reasonably well developed. However, several gaps remain unfilled, which form the basis of the novel analysis in this study. To begin with, prior studies do not examine the immediate and long-term effects of remittance outflows on the macroeconomic performance of the host countries; for example, no such study focusing on the UK exists. To the best of our knowledge, the closest attempt in this regard is Al-Malki et al. [10] who examine the relationship between remittance outflows and economic growth in Gulf Cooperation Council (GCC) nations, taking into account the intermediary influence of financial development. Nonetheless, that study, while novel, is limited in the following ways; first, it uses an aggregate financial development index that is susceptible to an aggregation bias. Second, the study’s primary focus is on economic growth and neglects other salient indicators of macroeconomic performance. Lastly, the study considers a specific group of countries, the GCC, which may subject the results to homogeneity bias. We address these deficiencies by considering a disaggregated form of a financial development index (i.e., one that measures both financial market development and financial institution development). Also, we examine several indicators of macroeconomic performance (economic growth, exchange rates, bank rates and inflation rates). Lastly, our study has a single-country focus, allowing us to pursue our analysis in greater depth. By offer a novel perspective on the effects of remittance outflows and financial development, our goal is to uncover valuable findings for researchers and assist policymakers in implementing strategies that support the overall economic wellbeing of the UK.

Methodology and data

Data

Based on data availability, we use yearly data for 10 key economic variables over the 35-year period from 1987 to 2022. We use a 35-year sample to make it feasible to determine the stationarity properties of the data. Table 1 provides a detailed description of the variables used in our analyses.

Finally, all variables are transformed into their natural logarithms except OPENNESS, BR, INF, FID and FMD.

Methodology

We use the Autoregressive Distributed Lag (ARDL) model developed by Pesaran et al. [51] to analyse how remittance outflows and financial development affect macroeconomic indicators in the UK. This model has several advantages over the traditional Ordinary Least Square method, including the ability to account for time series with different levels of integration and first differences. This allows for a more accurate analysis of the data used in our study and produces a more robust model. Another benefit of the ARDL model is that it can provide information about the speed of adjustment from a short-run to a long-run equilibrium through an error correction term (ECT). This helps to account for changes in the data over time, and helps to correct for errors that may be present in the time series. Additionally, the ARDL model helps to control for the problem of endogeneity, which occurs when key independent variables are correlated with the error term. The ARDL (a,b,c,d,e) model used here accounts for the response of remittances outflow to macroeconomic indicators and includes other control series as presented below:

To account for the role of financial market and financial institution development, we have:

where MAC represents the macroeconomic indicators GDP, EXR, INF and BR (see Table 1). REM represent remittance outflows, while FIN represents the financial development indicators FMD and FID. Y \(\boldsymbol{^{\prime}}\) is a vector of control variables including GFCF, EXP, and OPENNESS. \({\mu }_{t}\) denotes the stochastic series. \(a, b,\) and \(c\) denote the maximum number of lags, while \({\delta }_{1}, {\delta }_{2},{\delta }_{3}, {\delta }_{4}\) and \({\delta }_{5}\) are the short-run parameters of macroeconomic indicators, remittance outflows, financial development, and other control variables, respectively. The long-run slopes of the macroeconomic indicators, remittance outflows, and other control variables are calculated as \(\frac{{\delta }_{0}}{{\alpha }_{0}}, \frac{{\delta }_{0}}{{\alpha }_{1}}, \frac{{\delta }_{0}}{{\alpha }_{2}}\), \(\frac{{\delta }_{0}}{{\alpha }_{3}}\) and \(\frac{{\delta }_{0}}{{\alpha }_{4}}\), respectively. The optimal lags for the series with first-differences, selected using the Schwarz information criterion (SIC), are indicated by \(a, b,c, d,\) and \(e\).

To understand the linear relationships between our macroeconomic indicators and regressors over the long-run, we use the F-statistics of the ARDL bounds test in Pesaran et al. [51]. Based on this, we impose restrictions on the long-run coefficients calculated for the time series. This approach tests whether the null hypothesis of no cointegration is valid by examining whether the lagged levels of the variables in the model have zero effect on the dependent variable, stated as \({H}_{0}: {\alpha }_{0}={\alpha }_{1}={\alpha }_{2}={\alpha }_{3}={\alpha }_{4}=0.\) This is compared to the alternative hypothesis of \({H}_{1}: {\alpha }_{0}\ne {\alpha }_{1}\ne {\alpha }_{2}\ne {\alpha }_{3}\ne {\alpha }_{4}\ne 0.\) Next, we compare the F-statistics to the critical values for the lower and upper bounds according to Pesaran et al. [51]. If the calculated F-statistic is greater than the upper bound, cointegration exists; if it is below the lower bound, we can clearly state there is no cointegration. If it is between the lower and upper bounds, the result is inconclusive. This allows us to be more precise about the long-run relationship between the variables.

While we can establish the long-run relationships between variables, it is important to recognize that this steady state may not be immediately achieved. This is due to the adjustment process and lags involved when the determinants of macroeconomic indicators change. It may take time for the effects of these changes to be fully realized, and the speed of this adjustment can be a factor in determining how quickly an economy returns to its steady state. We use an error correction term (ECT) to account for the speed of this adjustment, as explained in Eqs. 3 and 4:

In Eqs. 3 and 4 above, as the coefficient of the ECT that explains the long-run speed of adjustment, \(\rho\) is expected to be between − 1 and 0. A significant, negative value indicates a long-run causal relationship.

Result

Discussions of findings

This discussion of our findings begins with a preliminary analysis that consists of descriptive statistics, a unit root test, and cointegration analyses. The descriptive statistics provide a basic overview of the data, followed by unit root tests that determine whether the variables are stationary or non-stationary. Finally, a cointegration analysis shows whether there are long-run relationships between the variables. Next, we conduct the ARDL analysis was. The baseline regression model estimates the relationship between remittance outflows and key macroeconomic indicators. Next, interaction terms are used to estimate the moderating effects of financial market development and financial institution development on these relationships, allowing for a more nuanced analysis that provides insights into the role of these variables.

Preliminary analysis

For the macroeconomic indicators in Table 2, average GDP is estimated to be 1.37 trillion GBP, the average USD-GBP exchange rate (EXR) over the period is 0.64, average inflation (INF) is 2.83%, and the average bank rate (BR) is 4.46%. These estimates indicate the UK economy was growing over the study period, though at a relatively modest rate. In terms of the regressors, the data show average remittances (REM) to be $6.67 billion per year, an average FID of 0.856, and an average FMD of 0.713. These estimates suggest REM has been relatively high and that the UK has a strong financial development as the averages of the two indicators are above 0.5. The control variables, which include gross fixed capital formation as a percent of GDP (GFCF), cash payments for operating activities of the government (EXP), and trade openness as a percent of GDP (OPENNESS) have an average of 2.43 billion GBP, 5.30 billion GBP, and 54.87%, respectively. This indicates the level of capital investment has been moderate, the government has been spending a significant amount of money, and trade openness has been relatively high. The statistical distributions of GDP, EXR, INF, and BR show these variables are not normally distributed but instead are positively skewed. Specifically, the skewness values for these variables are 0.14, 0.54, 1.59, and 0.77, respectively. In contrast, the skewness values for REM, FID, and FMD are negative (− 0.34, − 0.24, and − 0.83, respectively). The positive skewness of GFCF, EXP, and OPENNESS (0.49, 0.26, and 0.51, respectively) indicate that the data for these variables are relatively symmetric around their means, without a significant bias towards either lower or higher values.

To test the robustness and reliability of the unit root results, we use two different unit root tests: the Augmented Dickey-Fuller (ADF) test and the Phillips Perron (PP) test, as shown in the right-hand side of Table 2. These tests are widely used in the literature to detect unit roots in time series data [5, 27, 51]. In addition, the ADF and PP tests have the advantage of being able to account for serial correlation in the data, which can improve the reliability of the results [43]. The fact that the stationarity of the variables is mixed; i.e. at levels (I(0)) and first differences (I(1)), further supports our decision to use the ARDL framework, as the ARDL framework can accommodate variables that are fractionally integrated [29]. This makes the ARDL model well-suited for our purposes, as it allows us to analyse a wide range of possible relationships between the variables.

Lastly, we conduct the ARDL bounds cointegration test to establish the long-run relationships among our variables. The F-test results show there is cointegration in both the baseline model and the models that include financial development, indicating there are long-run relationships among the variables. This is an important finding that provides the basis for estimating the models (Table 3).

Impact of remittance outflow on macroeconomic indicators

We first consider how remittance outflows affect various macroeconomic indicators, as shown in Table 4, where Panels A, B, C, and D represent models for GDP, EXR, INF, and BR, respectively. Then, we turn our attention to the role of financial markets and institutions in moderating these relationships.

Table 4 shows that for the short-run model, an increase in REM has a negative impact on both GDP and EXR that is significant at the 10% level, with the strongest effect on EXR. This means that over the short-run, higher remittance outflows are associated with a decrease in economic growth in the UK and a decline in the exchange rate against the US$, meaning one GBP is worth fewer USD. The coefficients show a 1% increase in REM leads to a 0.011% decline in GDP, and an appreciation of 0.059% (0.149%) in the EXR. In the long-run, the impact of REM on GDP is not significant but the impact on EXR is significant at the 1% level. The effects on INF and BR are insignificant in both the short-run and long-run. Also, it is established that the effects are more pronounced in the long-run than in the short-run.

There are several potential reasons for the negative impact of REM on GDP in the UK. One reason is that REM may decrease the amount of capital and domestic savings that could otherwise be used to fund businesses, pay for consumers’ purchases of goods and services, and fuel other drivers of economic growth in the UK. Also, money sent abroad is often sent tax-free, reducing potential government revenues and the ability to finance public goods that could boost economic activity. The impact of REM on the EXR may be attributed to two factors. First, the outflow of remittances from the UK increases the supply of foreign currency in the foreign exchange market, leading to an appreciation of pounds against other currencies. Second, some economies, such as Nigeria and other African countries, heavily rely on remittances from foreign workers, including those based in the UK, which can result in a depreciation of their currencies relative to the pound. The intuitive explanation for REM’s insignificant relationship with BR and INF is that remittance outflows may not be a major driver of monetary policy in the UK. In other words, while it may have some impact on economic conditions, it is not a major factor for the Bank of England in setting interest rates. Therefore, a change in REM is unlikely to have a significant impact on bank rates. In addition, REM has an insignificant impact on GDP, INF, and BR in the long-run. The UK has a large and diverse economy, which makes it less vulnerable to REM. This finding disagrees with Khan et al. [41], who observe a positive relationship between remittance outflows and macroeconomic indicators such as GDP. Additionally, the exchange rate and REM relationship is consistent with findings in Hien et al. [35] for Asian economies, while the insignificant impacts on inflation contrasts with Al Kaabi [6] who observes a negative relationship between REM and INF.

In the short run, GFCF significantly affects GDP and BR in the UK but not EXR or INF. However, in the long run, only the effect on GDP is significant. Particularly in the short run, the impact of GFCF is strongest for BR (4.137), followed by GDP (0.431). The reasons for this positive relationship are as follows: first, GFCF entails investment in productive tangible assets, such as machinery and buildings; this boosts an economy’s productive capacity and supports growth and development. GFCF affects BR through the lens of financial intermediation, which is a significant driver of economic growth and boosts confidence in the economy, promoting the outlook for future inflation through the supply-leading hypothesis. This may lead to higher interest rates, causing the Bank of England to increase bank rates to curb inflation. In the long run, the only macroeconomic indicator that is significantly affected by changes in GFCF is GDP. This is because the effects of GFCF on other indicators, such as inflation, exchange and bank rates, dissipate over time. The main reason for this is that changes in GFCF have a multiplier effect on GDP, meaning that a small change in GFCF can have a large impact on GDP. Our finding is consistent with Rahmouni and Debbiche [52], who find a positive link between GFCF, REM, and macroeconomic indicators of growth in Saudi Arabia. Theoretically, our findings are aligned with the balanced theory of capital formation, which posits that accumulation of physical capital increases production capacity, which subsequently increases employment and economic growth. However, we find no link between GFCF and our other macroeconomic indicators in the literature.

GDP is the only macroeconomic indicator in our study that is significantly and positively affected by government expenditures in both the short and long run. In the short run, a 1% increase in government expenditures leads to a 0.083% increase in GDP, while in the long run the increase is 0.493%. This means that government expenditures have a relatively small but positive impact on GDP in the short run, and a stronger impact in the long run. This is consistent with the Keynesian theory of aggregate demand, which posits that an increase in government spending can benefit the economy as a whole. Increased government spending could create jobs, either directly through public sector employment or indirectly through government contracts and subsidies. Government spending can increase aggregate demand, which can lead to higher levels of production and consumption, and can increase productivity through investments in infrastructure, education, and research and development. Thus, government spending can have a multiplier effect on economic activity, resulting in higher income and consumption, and ultimately increasing GDP. Our findings align with those in Aluthge et al. [12], who establish a positive link between government expenditures and economic growth.

The negative relationship between trade openness and GDP over the long run indicates that increased openness to trade may not necessarily lead to higher economic growth. This finding is in contrast to widely held theories of new trade and the Hecksher-Ohlin theorem, which posit that trade openness promotes economic growth. This negative relationship may be due to the fact that increased trade openness may lead to job losses as production moves to other countries with lower labour costs. It may also lead to increased competition from foreign goods, which may put pressure on domestic industries in the UK, potentially resulting in lower output and prices, with a negative effect on GDP. This is consistent with Rahmouni and Debbiche [52], who find a negative relationship between trade openness and economic growth.

Moderating roles of FID and FMD in the impact of remittance outflows on macroeconomic indicators

As Adekoya et al. [2] note, the financial sector plays an essential role in ensuring the efficient flow of funds and credit from surplus regions to deficit regions. Financial development can moderate the impact of remittance outflows on macroeconomic indicators by providing a platform for the efficient flow of funds, allowing remittances to be more effectively channelled into productive investments [9]. We use two measures of financial development, FID and FMD, to capture financial development’s role in moderating the impact of remittance outflows on macroeconomic indicators. We choose these measures because they reflect the different aspects of the financial sector that can impact both remittances and the economy. This allows us to assess the overall moderating impact of financial development on remittance outflow [10].

Tables 5 and 6 report the results that include the interaction terms with FID and FMD, respectively. These findings are similar to the baseline results presented in the previous section (which exclude the interaction terms), providing further evidence that REM significantly affects GDP and EXR. Aside from the expected changes in magnitude, the coefficients maintain the same sign as in the baseline model, affirming that REM negatively affects GDP but increases EXR. A key takeaway from this analysis is that GDP and EXR tend to be more sensitive to REM than other macroeconomic indicators included in this study when FID and FMD are included. This can also be seen when we examine the direct impacts of FID and FMD on the macroeconomic indicators, as they tend to have a positive impact on GDP and EXR but do not affect INF and BR. Again, this is likely because the UK’s financial system incorporates well-functioning financial institutions and financial markets, which are key factors influencing GDP and EXR. A well-functioning financial system allows capital to be allocated efficiently, risk to be managed effectively, and economic activity to be supported by providing credit and liquidity. It also provides the necessary infrastructure for the exchange rate to be managed by the monetary authority and to facilitate trade.

Interacting FID and FMD with REM continues to have negative impacts on GDP but has a favourable and significant impact on EXR, while the interaction effects for INF and BR are negligible. One explanation for the negative interaction effects of these variables on GDP is that remittance outflows may compensate for credit constraints in the financial sector, which can limit the development of the financial sector and negatively impair economic growth and development. As the UK economy is characterized by an efficient system of the financial sector, the payment system tends to be efficient, which makes it easy for individuals and businesses to send remittances abroad. These remittance outflows decrease the demand for British pounds, negatively affecting exchange rates. This finding is in contrast with findings in Al-Malki et al. [10] that show REM moderates the process by which financial development enhances economic growth.

The insignificant interaction effect for REM with financial development on INF and BR may be due to several factors. First, it is possible that the amount of remittances sent abroad may not be significantly affected by the development of the UK financial sector, as individuals and businesses will always find various ways to send money back to their home countries regardless of the level of financial development. Also, sending remittances is not a major source of income for banks, regardless of the level of financial development. Therefore, changes in REM may not significantly affect bank lending rates. Finally, REM is always a small proportion of the UK’s GDP. Therefore, regardless of the changes in REM and the development of the financial sector, their interaction does not significantly affect monetary policy.

Conclusion and policy recommendations

Remittances are a significant component of international capital outflows and can have a far-reaching impact on certain macroeconomic indicators. How this variable influences the macro economy is a complex process that includes a country’s level of financial development. As remittances continues to perform vital roles in many countries’ economies, understanding its effects on macroeconomic indicators is important. The core objective of this study is to examine how remittances affect macroeconomic indicators, including GDP, exchange rates, inflation, and bank rates in the UK, using yearly data from 1987 to 2022. Additionally, we examine the moderating roles of FID and FMD with REM on these indicators. We use the ARDL estimator for the analysis, based on our findings of a mixed integration order among our variables based on unit root tests and the cointegration submission of the bounds test. Our findings reveal that REM significantly affects GDP and exchange rates but not bank rates or inflation. Remittance outflows from the UK have a significant negative impact on GDP and cause the GBP to weaken relative to the USD. The same relationship is observed when the interaction terms of REM with FID and FMD are examined. The impact on EXR may be attributed to the fact that remittance outflows from the UK increases the supply of foreign currency in the foreign exchange market, leading to an appreciation of pounds against other currencies. REM does not have a significant impact on inflation or bank rates, most likely because the UK has a large and diverse economy which makes it less vulnerable to the impact of remittance outflows. Similar outcomes are obtained when FID and FMD interactions with REM are included in the model.

Given these results regarding the effect of REM and key UK macroeconomic indicators, we offer some policy recommendations. First, to mitigate the negative consequences of remittance outflows on GDP, the government should support investments in the productive sector of the UK economy. These could be in the form of innovation, research and development. Doing this tends to foster an supportive environment for quality investment, which in turn can boost economic growth and job creation. In addition, incentives such as tax breaks and investment opportunities could be granted to migrant workers to encourage them to invest in the UK rather than send large remittances back to their home countries. Encouraging migrant workers to start businesses in the UK would foster employment and contribute to the UK’s economic growth. To maintain the favourable impact of REM on the GBP, the Bank of England should implement monetary policies that could stabilize exchange rate fluctuations. While REM does not significantly affect inflation or bank rates, proper monitoring should be given to financial stability indicators to build the resilience of the financial sector. Also, a strict regulatory framework for remittances should be maintained to prevent illicit financial flows and help maintain financial stability. Finally, policymakers should support adoption of remittance-promoting growth strategies by facilitating financial inclusion. This could help to empower various households to access formal financial products and investment opportunities.

Limitation of the study and future research

This study does have some limitations. First, it is a time series analysis based on a single economy. Second, it fails to fully account for the effects of workers’ remittances on the macroeconomic variables of the United Kingdom. Finally, due to data scarcity we could not conduct a threshold analysis for the relationships between remittances and our macroeconomic variables.

This study’s findings provide avenues for future research, including an examination of how REM influences macroeconomic indicators across a range of countries, and how diverse forms of remittances and financial development affect macroeconomic indicators.

Availability of data and materials

The datasets used and/or analysed during the current study are available from the corresponding author on reasonable request.

Abbreviations

- ADF:

-

Augmented Dickey-Fuller

- ARDL:

-

Autoregressive Distributed Lag

- BR:

-

Bank rate

- ECT:

-

Error correction term

- EXP:

-

Government expenditure

- EXR:

-

Exchange rate

- FID:

-

Financial institution development

- FMD:

-

Financial market development

- GCC:

-

Gulf Cooperation Council

- GDP:

-

Gross domestic product

- GFCF:

-

Gross fixed capital formation

- INF:

-

Inflation

- IMF:

-

International Monetary Fund

- OPENNESS:

-

Trade openness

- MAC:

-

Macroeconomic indicators

- PP:

-

Phillips Perron

- REM:

-

Remittances paid

- RMO:

-

Remittance outflow

- SIC:

-

Schwarz information criteria

- UK:

-

United Kingdom

- WDI:

-

World Development Indicators

References

Abduvaliev M, Bustillo R (2020) Impact of remittances on economic growth and poverty reduction amongst CIS countries. Post Communist Econ 32:525–546

Adekoya OB, Ogunbowale GO, Akinseye AB, Oduyemi GO (2021) Improving the predictability of stock returns with global financial cycle and oil price in oil-exporting African countries. Int Econ 168:166–181

Adeseye A (2021) The effect of migrants remittance on economy growth in Nigeria: an empirical study. Open J Pol Sci 11:99

Ahmed J, Mughal M, Martínez-Zarzoso I (2021) Sending money home: transaction cost and remittances to developing countries. World Econ 44:2433–2459

Ajewole KP, Adejuwon SO, Jemilohun VG (2020) Test for stationarity on inflation rates in Nigeria using augmented Dickey-Fuller test and Phillips-persons test. J Math 16:11–14

Al Kaabi FA (2016) The nexus between remittance outflows and GCC growth and inflation. J Int Bus Econ 4:76–85

Al-Abdulrazag B, Foudeh M (2022) Does inflation reduce remittance outflows in Saudi Arabia? Cogent Econ Fin 10:214–142

Al-Assaf G, Al-Malki AM (2014) Modelling the macroeconomic determinants of workers’ remittances: the case of Jordan. Int J Econ Financ Issues 4:514–526

Ali Bare UA, Bani Y, Ismail NW, Rosland A (2022) Does financial development mediate the impact of remittances on sustainable human capital investment? New insights from SSA countries. Cogent Econ Fin 10:2078460

Al-Malki AM, Hassan MU, Ul-Haq J (2023) Nexus between remittance outflows and economic growth in GCC countries: the mediating role of financial development. Appl Econ 55:5451–5463

Alsamara M (2022) Do labor remittance outflows retard economic growth in Qatar? Evidence from nonlinear cointegration. Q Rev Econ Fin 83:1–9

Aluthge C, Jibir A, Abdu M (2021) Impact of government expenditure on economic growth in Nigeria, 1970–2019. CBN J Appl Stat 12:139–174

Bashier AA, Bataineh TM (2007) The causal relationship between foreign direct investment and savings in Jordan: an error correction model. Int Manage Rev 3:1–6

Basnet HC, Donou-Adonsou F, Upadhyaya K (2022) Remittances-inflation nexus in South Asia: an empirical examination. J Financ Econ Policy 14:152–161

Bhattacharya M, Inekwe J, Paramati SR (2018) Remittances and financial development: empirical evidence from heterogeneous panel of countries. Appl Econ 50:4099–4112

Bortnyk N, Didkivska G, Tylchyk V (2018) The impact of international labour migration on the development of states under globalization: economic and legal aspects. Baltic J Econ Stud 4:47–52

Brown RP, Jimenez-Soto E (2015) Migration and remittances. Handbook of the economics of international migration. North-Holland, Amsterdam, pp 1077–1140

Brzozowski J (2024) 18 remittances: immigrant entrepreneurs and their impact on the home-country economy. De Gruyter handbook of migrant entrepreneurship.

Cao S, Kang SJ (2020) Personal remittances and financial development for economic growth in economic transition countries. Int Econ J 34:472–492

Chowdhury M, Das A (2016) Remittance behavior of Chinese and Indian immigrants in Canada. Rev Econ 67:185–208

Corden WM, Neary JP (1982) Booming sector and de-industrialisation in a small open economy. Econ J 92:825–848

Das A, Brown L, Mcfarlane A (2023). Economic misery and remittances in Jamaica. J Econ Dev 48.

De Haas H, Czaika M, Flahaux ML, Mahendra E, Natter K, Vezzoli S, Villares-Varela M (2019) International migration: trends, determinants, and policy effects. Popul Dev Rev 45:885–922

Donou-Adonsou F, Pradhan G, Basnet HC (2020) Remittance inflows and financial development: evidence from the top recipient countries in sub-Saharan Africa. Appl Econ 52:5807–5820

Dornbusch R (2019) The theory of flexible exchange rate regimes and macroeconomic policy. Flexible exchange rates/h. Routledge, London, pp 123–143

Ekanayake EM, Moslares C (2020) Do remittances promote economic growth and reduce poverty? Evidence from Latin American countries. Economies 8:35

Escobari D, Garcia S, Mellado C (2017) Identifying bubbles in Latin American equity markets: Phillips-Perron-based tests and linkages. Emerg Market Rev 33:90–101

Essayyad M, Palamuleni M, Satyal C (2018) Remittances and real exchange rates in South Asia: the case of Nepal. Asian Econ Financ Rev 8:1226–1238

Fasanya IO, Odudu TF, Adekoya O (2019) Oil and agricultural commodity prices in Nigeria: new evidence from asymmetry and structural breaks. Int J Energy Sect Manage 13:377–401

Friedberg RM, Hunt J (2018) The impact of immigrants on host country wages, employment and growth. The new immigrant in the American economy. Routledge, London, pp 89–110

Golitsis P, Avdiu K, Szamosi LT (2018) Remittances and FDI effects on economic growth: a VECM and GIRFs for the case of Albania. J East West Bus 24:188–211

Ha NM, Ngoc BH (2022) The asymmetric effect of financial development on human capital: evidence from a nonlinear ARDL approach. J Int Trade Econ Dev 31:936–952

Hassan GM, Shakur S (2017) Nonlinear effects of remittances on per capita GDP growth in Bangladesh. Economies 5:25

Hathroubi S, Aloui C (2016) On interactions between remittance outflows and Saudi Arabian macroeconomy: new evidence from wavelets. Econ Model 59:32–45

Hien NP, Hong Vinh CT, Phuong Mai VT, Kim Xuyen LT (2020) Remittances, real exchange rate and the Dutch disease in Asian developing countries. Quart Rev Econ Fin 77:131–143

Islam MS, Alhamad IA (2023) Do personal remittance outflows impede economic growth in Saudi Arabia? The role of trade, labor force, human, and physical capital. Hum Soc Sci Commun 10:1–9

Itskhoki O, Mukhin D (2021) Exchange rate disconnect in general equilibrium. J Pol Econ 129:2183–2232

Jawaid ST, Raza SA (2016) Effects of workers’ remittances and its volatility on economic growth in South Asia. Int Migr 54:50–68

Khan I (2024) Economic and governance drivers of global remittances: a comparative study of the UK, US, and UAE to India. J Financ Econ Policy 16:1757–6385

Khan K, Su CW, Tao R, Yang L (2019) Does remittance outflow stimulate or retard economic growth? Int Migr 57:105–120

Kratou H, Gazdar K (2016) Addressing the effect of workers’ remittance on economic growth: evidence from MENA countries. Int J Soc Econ 43:51–70

Lucy A, Sunday RJ, Pacific YKT (2015) Exchange rate and trade balance in Ghana: testing the validity of the Marshall-Lerner condition. Int J Dev Emerg Econ 3:38–52

Ma Y, Wang F (2023) Dutch disease via remittances and natural resources: a perspective of global economy. Resour Policy 80:103248

Meyer D, Shera A (2017) The impact of remittances on economic growth: an econometric model. Economia 18:147–155

Misati RN, Kamau A, Nassir H (2019) Do migrant remittances matter for financial development in Kenya? Financ Innov 5:31

Ngoma AL, Ismail NW, Law SH (2021) The role of financial development and institutional quality in remittance-growth Nexus in Asia. J Dev Areas 55:399–425

Oladipo OS (2020) Migrant workers’ remittances and economic growth: a time series analysis. J Dev Areas 54:4

Oteng-Abayie EF, Awuni PA, Adjeidjei TK (2020) The impact of inward remittances on economic growth in Ghana. Afr J Econ Rev 8:49–65

Pandikasala J, Vyas I, Mani N (2022) Do financial development drive remittances? Empirical evidence from India. J Public Aff 22:e2269

Paparoditis E, Politis DN (2018) The asymptotic size and power of the augmented Dickey-Fuller test for a unit root. Econometr Rev 37:955–973

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Economet 16:289–326

Rahmouni O, Debbiche I (2017) The effects of remittances outflows on economic growth in Saudi Arabia: empirical evidence. J Econ Int Finance 9:36–43

Rapoport H, Docquier F (2006) The economics of migrants’ remittances. Handb Econ Giv, Altruism Recipr 2:1135–1198

Raza SA (2015) Foreign direct investment, workers’ remittances and private saving in Pakistan: an ARDL bound testing approach. J Bus Econ Manage 16:1216–1234

Silva CV, Klimaviciute L (2020) Migrant remittances to and from the UK. The Migration Observatory at the University of Oxford, 24.

Snudden S (2018) International remittances, migration and primary commodities. World Econ 41:2934–2953

Soekirman A (2024) Economic growth determinants: the role of consumption, investment, government spending, and import-export. Dinasti Int J Digit Bus Manage 5:612–620

Sutradhar SR (2020) The impact of remittances on economic growth in Bangladesh, India, Pakistan and Sri Lanka. Int J Econ Policy Stud 14:275–295

Taguchi H, Shammi RT (2018) Emigrant’s remittances, Dutch disease and capital accumulation in Bangladesh. S Asian J Macroecon Public Fin 7:60–82

World Health Organization (2022) Remittances Grow 5% in 2022, Despite Global Headwinds. Available online at: https://www.worldbank.org/en/news/press-release/2022/11/30/remittances-grow-5-percent-2022. Assessed 20 May 2024.

Zahran MSA (2023) The response of remittances inflows to asymmetric oil price shocks in Egypt. Rev Econ Pol Sci 8:520–539

Acknowledgements

We are grateful to Gideon Ogunbowale and Ademola Akinseye for their editorial work, and to the anonymous reviewers for their valuable time and consideration.

Funding

No funding sources were used to conduct this study or to prepare this manuscript.

Author information

Authors and Affiliations

Contributions

OP contributed to the study conception, analysis and wrote the initial and final draft, and MFS contributed to the research methodology. Both authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Periola, O., Salami, M.F. Remittance outflow, financial development and macroeconomic indicators: evidence from the UK. Futur Bus J 10, 83 (2024). https://doi.org/10.1186/s43093-024-00373-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s43093-024-00373-x