Abstract

This study contributes to income equality (IE) literature by examining four important issues. First, the study examines the effects of foreign bank presence (FBP) on IE. Second, the paper identifies the minimum threshold level of FBP which can lead to IE. Third, the effect of economic freedom on IE was investigated. Fourth, the paper determines whether economic freedom interacts with FBP to minimise IE. The findings are based on macro data for 33 African countries from 1995 to 2020. The findings from the two-stage system generalised method of moment indicate that unconditionally, FBP reduces income inequality. Also, results from the threshold effect reveal that whilst FBP reduces income inequality, if it exceeds 52%, it may contribute to it. Additionally, the study reveals that economic freedom dampens IIE. Furthermore, economic freedom conditions FBP to reduce IE. Based on these findings, policymakers are advised to exercise caution in attracting foreign banks and to promote local financial institutions. Policymakers are also advised to implement policies to promote economic freedom.

Similar content being viewed by others

Introduction

Despite persistent efforts to address the issue, income inequality remains a long-lasting challenge that affects both developed and developing nations on a global scale [1]. However, Africa remains one of the most unequal regions globally [2]. In 2022, 431 million Africans lived in extreme poverty, exceeding past levels, with a $1.90 per day threshold [3]. Furthermore, despite the robust economic growth in numerous African nations, the expected progress in human development and poverty reduction indicators has not materialised as anticipated [4, 5]. For instance, from 2001 to 2010, six out of the top ten fastest-growing economies worldwide were from Africa [6]. However, as of 2010, 60.8% of Africa's population was classified as poor, yet they only held 36.5% of the total income. In stark contrast, the affluent, who made up just 4.8% of the population, possessed 18.8% of the total income [6].

In 2021, the highest decile of income earners in Africa held an average of approximately 54% of the total national income, surpassing the share held by the bottom 50% by more than sixfold [7]. When it comes to wealth distribution, the disparities are even more evident, as the top 10% in Africa accumulate nearly 71% of the total wealth, which is more than twice the combined wealth of the remaining 90% [7]. Notably, the lower 50% of the population collectively held a minimal share, amounting to approximately 1% of the total wealth. An analysis of the 2022 top 10% income distribution amongst Sub-Saharan Africa (SSA) nations reveals a clear pattern of increasing inequality, characterised by a noticeable North–South gradient [8]. The wealthiest 10% in SSA held approximately 56% of the total income in 2023 [8]. Addressing income inequality presents a challenge for African leaders pursuing sustainable development goals (SDGs) especially SDG 10 and the Africa Agenda 2063. The paper provides some pathways for tackling this issue which will help in fostering unity, human development, and better quality of life. These pathways are foreign bank presence (FBP) and economic freedom which align with Africa's Agenda 2063 and the United Nations’ Agenda 2030 but lack sufficient empirical backings. These channels offer strategies for fostering industrialisation and inclusive opportunities in African developing nations.

FBP has notably increased in Africa since the 1990s [9,10,11]. During the period from 1995 to 2009, the percentage of foreign banks in Africa increased from 31 to 54%. This growth rate surpassed the average observed in developing economies [12]. Foreign banks infuse additional capital, channel funds to profitable ventures, exert corporate oversight, and aid in risk management [9, 13,14,15]. These actions directly support capital accumulation and promote sustained long-term economic growth. Like foreign direct investment (FDI), FBP creates employment, technology transfer, and spillover effects [10, 15, 16]. FBP often promotes competition and efficiency in the banking sector [17, 18], resulting in improved banking services, lower transaction costs, and more effective capital allocation [19]. As a result, it has the potential to reduce barriers for individuals and businesses, making it easier for them to access financial services and participate more effectively in economic activities [20].

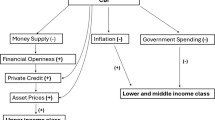

Economic freedom, on the other hand, refers to the degree of autonomy and opportunities individuals and businesses have to engage in economic activities, with minimal government interference or constraints from other entities [21, 22]. Three key dimensions elucidate the relationship between economic freedom and income inequality. Firstly, it promotes equitable access to property rights, offering chances for disadvantaged individuals to build wealth [21, 22]. Secondly, it stimulates economic growth and affects income distribution. Lastly, it sets limits on wealth redistribution. Regressive tax systems worsen income inequality, whilst progressive tax systems mitigate it [21, 23]. Economic freedom not only promotes income inequality but also creates an environment conducive to FBP. Whilst FBP may hamper income inequality, it can also promote it by selectively allocating credit [24,25,26]. However, with economic freedom, foreign banks can impartially allocate credit to all sectors of society. This inclusive approach can improve access to capital, empowering marginalised groups and reducing income inequality by enabling them to actively participate in economic activities.

Despite the above, there is a scarcity of comprehensive empirical studies guiding policymakers in Africa on whether FBP alleviates or worsens income inequality (e.g. [16, 20]). Although there are direct studies regarding economic freedom and income inequality (see [7, 21,22,23]), the joint effect of FBP and economic freedom remains unexplored, especially in Africa. Also, the threshold effect of FBP on income inequality has not received much attention. Therefore, the current study fills such gaps by answering the following questions:

-

1.

What is the direct effect of FBP on income inequality in Africa?

-

2.

Is there a nonlinear relationship between FBP and income inequality?

-

3.

Does economic freedom alleviate income inequality?

-

4.

What is the contingency effect of economic freedom in the FBP-income inequality relationships?

The empirical findings from two step generalised method of moment revealed that whilst FBP diminishes income inequality, it exhibits a nonlinear impact, suggesting that FBP exceeding 52% may contribute to income inequality. The results also revealed that economic freedom and its components reduce income inequality for the African sample. The study discovers that economic freedom enhances the ability of FBP to diminish income inequality. Except for government size, all elements of economic freedom index (EFI) work in synergy with FBP to decrease income inequality. These conclusions are relevant in the field of finance-growth nexus, where it shows that allowing foreign banks to participate in the financial sector can minimise inclusive growth. However, a need to be cautious about the excessive inflow of foreign banks into the banking sector.

This paper contributes to the literature in the following ways. First, this study provides more understanding of the implication of cross-border banking and capital flows in reducing income inequality in Africa. This is achieved by showing that unconditionally FBP is relevant in reducing income inequality. This offers insights for Africa, especially regarding leveraging the African Continental Free Trade Area (AfCFTA) to attract foreign investors,Footnote 1 including foreign banks, and enhancing financial sector development through FBP to address income inequality. Second, the study contributes to the literature by suggesting the maximum inflow of FBP that can reduce income inequality. This is because Africa's loosened FBP restrictions could lead to a concentrated banking sector unless empirical studies guide appropriate regulation points. Third, the study guides African governments and development partners on how the region's economic structure influences FBP's impact on income inequality. Ignoring the empirical dimension of this categorization could have repercussions for SSA governments. With AfCFTA in effect and relaxed restrictions on FBP inflows, neglecting the potential repression of economic freedom by FBP could diminish the alleviation of income inequality. Furthermore, the breakdown of economic freedom into components like the rule of law, government size, regulatory efficiency and open market is crucial for tailored policy recommendations. Last, Africa aims at achieving Agenda 2030 and 2063; therefore, this study provides a practical approach for tracking such progress, especially SDGs 10 of Agenda 2030 and Aspiration 1 of Agenda 2063.

The remaining structures are as follows; in “Literature review,” section captures the literature review whereas data and methods are presented in “Data and method” section. The empirical results and discussions are shown in “Results and discussion” section and “Conclusion and policy implication” section present the conclusion and policy implications.

Literature review

Theoretical review

The theory underpinning this study is the modernisation theory and neo-institutional theory. The correlation between FBP and income inequality finds support in the modernisation theory. This theory which takes its root from the hypothesis of Heckscher and Ohlin [27], asserts that developing nations, by specialising in less skill-intensive labour for trade, can bridge income gaps. The theory also suggests that the arrival of foreign entities, like FBP, can enhance socio-economic progress by generating employment, transferring technology, engaging in global value chains, and bolstering foreign exchange [28]. This implies that the presence of foreign banks in a host country can provide access to sophisticated financial services, fostering economic modernisation and advancement [15, 18, 29,30,31,32], with the potential to elevate income levels across various societal groups.

On the other hand, the paper applied the neo-institutional theory of North [33] for the FBP, economic freedom and income inequality nexus, which focuses on how effective institutions and governance influence organisational activities [34] and promote citizen well-being through effective allocation of resources [34, 35]. Similarly, economic freedom aims to establish a favourable business environment and enhance the welfare of citizens. In this scenario, economic freedom has the potential to diminish income inequality by efficiently allocating resources through robust rule of law, government size, regulatory efficiency, and open markets [36]. Within the framework of the joint effect of FBP and economic freedom, economic freedom can establish a conducive atmosphere that incentivizes foreign investors to enter a nation and engage in sustainable investments, thereby generating employment opportunities and mitigating inequality [37, 38]. Economic freedom facilitates FBP to mitigate inequality by efficiently channelling FBP spillover effects such as enabling knowledge transfer, innovation, and human capital development, leading to economic prosperity [34, 35, 39].

Empirical review

Empirically, various financial aspects like financial development, inclusion, and depth have garnered attention about finance and income inequality (see [29, 31, 40,41,42,43,44,45,46,47,48,49,50]). However, FBP has received comparatively limited focus in this nexus. Moreover, the majority of these scarce studies concentrated on alternative indicators such as poverty reduction, economic growth, and development,Footnote 2 drawing inferences for income inequalities. For instance, Wu et al. [15] show foreign banks' crucial role in enhancing capital allocation efficiency and fostering economic growth in 35 nations. Schnabel and Seckinger [51] contended that foreign banks disproportionately stimulate growth during crises compared to domestic banks in Europe. El Menyari [13] similarly suggests that the impact of foreign banks on economic development hinges on a nation's level of financial development in SSA. Hunegnaw and Bedhaso [52] also support the findings of El Menyari [13] and find that FBP promotes economic growth in Africa. Nanivazo et al. [16] found that FBP leads to poverty in Africa and hence concluded that FBP is associated with a higher income gap. Iddrisu et al. [53] also found that in Africa, FBP advances inclusive growth, especially in the presence of a developed financial sector. One of the current studies made a significant contribution to FBP-income inequality nexus (see [20]). Delis et al. [20] used the income inequality variable (GINI coefficient); however, their results corroborate with Nanivazo et al. [16] who employed the poverty reduction variable (poverty gap). Whilst their research contributes to the literature, policymakers in Africa might find limited reliance on these few studies for decision-making. Moreover, these studies did not identify a threshold effect of FBP on income inequality. Therefore, this present study augments the literature by investigating the impact of FBP and its threshold on income inequality in Africa.

Concerning the link between economic freedom and income inequality, numerous empirical studies exist, yet they have yielded conflicting results. For instance, Scully [54] found that increased economic freedom decreased income inequality. Ashby and Sobel [55] found economic freedom changes correlate with increased income and growth across all income segments. Migheli and Saccone [56] found that economic freedom increased income for the top percentiles but decreased middle and upper-middle incomes globally across 70 countries from 1980 to 2014. Machado and Fuinhas [57] stated that economic freedom was detrimental to income inequality across 102 countries from 2000 to 2018. Despite the efforts of economic freedom in reducing income inequality, there are strands of studies that believe that economic freedom promotes income inequality. For example, Berggren [58] discovers a positive correlation between economic freedom and income inequality. Carter [59] finds economic freedom positively correlates with income inequality, notably at higher levels, using data from 123 countries. In the United States (US), Apergis et al. [21] found that a decline in economic freedom was associated with a more pronounced increase in income inequality during the period from 1981 to 2004. Pérez-Moreno and Angulo-Guerrero [60] also found that economic freedom contributes to income inequality within the European Union (EU). Ahmad [36] observed a favourable impact of economic freedom on income inequality across 112 countries from 1970 to 2014.

From the above review, it is obvious that the joint effect of FBP and economic freedom on income inequality is hard to find. Additionally, the threshold effect of FBP on income inequality remains unexplored. There are few studies (see [16, 20]) that made an effort to examine the relationship between FBP and income inequality; hence, the current study contributes to such discussion.

Data and method

Data

The paper employs macroeconomic data spanning from 1995 to 2020 for 33 African countries, given data accessibility constraints. A summary of the data description is provided in Table 1. The dependent variable, income inequality, is proxied using the Gini coefficient from the Standardised World Income Inequality Database (SWIID) by Solt [61] as presented in Table 1. The paper relied on the SWIID database for its extensive coverage of Gini coefficients, which enhanced comparability by standardising consumption and wage income. Moreover, this variable was utilised by some existing studies [20, 57, 62] and also has adequate data for African countries. The Gini coefficient ranges from 0 to 100, with lower values indicating more equality (0) and higher values denoting inequality (100). The paper uses Gini post-tax, which represents disposable income after taxes and transfers, to demonstrate inequality after fiscal policy adjustments.

The independent variables being investigated are FBP and economic freedom (refer to Table 1). The proportion of foreign banks relative to the total number of banks per nation serves as a proxy for FBP, sourced from Claessens and van Horen [63]. The study collected data at the individual bank level, specifically differentiating between foreign-owned and domestic banks. Using this data, the paper calculated the ratio of foreign banks to the total number of banks. A FBP greater than 0.5 was considered a high presence of foreign banks. The EFI from the Heritage Foundation is used to measure economic freedom. This index reflects a market-oriented economy that operates under a stable legal framework with voluntary contracts [64]. The index measures economic freedom levels from 0 (low economic freedom) to 100 (high economic freedom). EFI is computed using 12 distinct indicatorsFootnote 3 and classified into four components: rule of law, government size, regulatory efficiency and open markets [65]. The paper explores the impact of each of the four components on income inequality in Africa.

The study incorporates six control variables grounded in existing literature [5, 20, 36, 45, 56, 57, 60, 62], African attributes, and data accessibility. Higher population growth (measured with popular growth annual %) can lead to income inequality [20, 62], given that Africa is characterised by higher population growth, this study incorporates this variable to see its impact. Trade openness [using net trade as a percentage of Gross Domestic Product (GDP)] was considered since it has some level of impact on income inequality [5, 45]. Evaluating Africa’s trade openness in reducing income inequality is crucial. Studies show schooling (proxy with school enrolment gross) boosts human capital, potentially easing income inequality [20]. African efforts in enrolment should be examined to understand their impact on inequality. It is important to include economic growth (proxied with GDP annual %) as a control variable to avoid mistakenly attributing broader macroeconomic impacts solely to FBP. It is imperative to empirically validate whether improved access to credit (i.e. domestic credit to the private sector as a percentage of GDP) promotes business expansion and consequently reduces income inequality in Africa. Inflation, consumer price (% annual) is used as a measure of inflation, reflecting a nation's macroeconomic stability. Since Africa tends to have high inflation rates [66], it is crucial to investigate whether these rates could drive income inequality.

Empirical strategy

The study primarily relies on modernisation and neo-institutional theories because they incorporate essential variables and have demonstrated potential in explaining how a nation's development can mitigate income inequality. In pursuit of the objectives, the paper delineates the empirical model utilising a dynamic model in both levels and first differences, encapsulating the system generalised method of moment (GMM) procedure outlined in Eqs. (1) and (2)

In both Eqs. (1) and (2), IIE is income inequality whilst fbp denotes foreign bank presence. \(\varphi\), \(\alpha_{1 - 4}\), and \(\delta_{h}\) represent the parameter estimated. \(\tau\) signifies the coefficient of autoregression whereas \(it\) denotes time and country measurements. Whilst ef is economic freedom, \({\text{fbp}} \times {\text{ef}}\) is the interaction term between FBP and economic freedom. Z represents the control variables: population growth, trade openness, school enrolment, economic growth, private credit, and inflation. \(\omega_{i}\) and \(\epsilon _{t}\) represent country-specific effects and time-specific constants, respectively. The disturbance term is captured with \(\mu_{it}\).

To capture the joint effect of FBP and economic freedom on income inequality, income inequality was partially differentiated with respect to FBP as shown in Eq. (3). From Eq. (3), \(\overline{{{\text{ef}}}}_{it}\) is the average value of economic freedom, \(\partial\) is a difference sign.

The study selected GMM as the estimation method due to the extensive variability in our cross-sectional data covering 33 countries over 26 years spanning 1995–2020. GMM is preferred in cases where N exceeds T. Additionally, GMM was chosen because of the pronounced persistence of the dependent variable. This persistence becomes evident when there is a strong correlation (typically above 0.800, as a rule of thumb) between the dependent variable and its lag. In this case, the persistence level is 0.99 (see Table 6), surpassing the rule of thumb. Furthermore, GMM was preferred to address concerns regarding endogeneity arising from the relationship between past and current values of inequality, FBP and economic freedom, misspecification, omission error and others [5, 14, 20]. Preferring system GMM over difference GMM due to the latter's weak instrument issues [67]. Additionally, system GMM was utilised due to its identification, limiting instrument proliferation, and controlling cross-country dependence in panel data. The study adopts Roodman [68] dynamic system GMM extended method which employed forward orthogonal deviation instead of the first difference. The preference for the Two-stage system generalised method of moment (2SGMM) over the first-stage system GMM was driven by its superior ability to handle autocorrelation and heteroskedasticity issues [69, 70].

Results and discussion

Descriptive statistics and correlation matrix

The paper presents descriptive statistics in Table 2 (the discussion is based on variables of interest), whilst the correlation matrix is presented in Table 3.

Table 2 reveals that, on average (approximately 46%), the income inequality persists in the African sample. In-country data also reveals that Namibia (64.5%) is characterised by high-income inequality, whereas Algeria (35.4%) has made efforts to reduce income inequality, as noted in Fig. 1a. Table 2 shows that, on average, FBP in the African sample is closely aligned with the presence of domestic banks (around 50%). This insight prompts further exploration into how the increased presence of foreign banks in Africa might contribute to lifting the region out of income inequality. Figure 1b indicates that Burkina Faso's banking sector comprises a higher percentage of foreign banks (approximately 91%), contrasting with Nigeria, where FBP is the lowest at around 13%. The findings presented in Table 2 reveal that, on average, the African sample has actively strived to improve economic freedom (55.5%). Consequently, there is a crucial need for empirical investigation to assess whether increased economic freedom can lead to a reduction in income inequality.

Amongst the four components studied, it was observed that the African sample excels in maintaining a higher level of government size, with a mean of 72.4% (see Table 2). At the country level, Sudan (81.5%) is linked with a significant degree of economic freedom, whilst Zimbabwe (35.9%) exhibits a notably lower level of economic freedom (see Fig. 2).

The findings in Table 3 indicate that there is generally a low correlation amongst the explanatory variables, except for the four components of the EFI. However, to mitigate potential multicollinearity issues, each of these components was employed separately in different regression analyses.

System GMM results of FBP, economic freedom and income inequality

In this subsection, the paper presents and discusses the results of the 2SGMM, which investigates the nexus between FBP, economic freedom and income inequality. The empirical findings are displayed in Tables 4 and 5, correspondingly. Starting with objective one, Table 4 shows that FBP reduces income inequality in Africa with a significant coefficient of 0.0055 at 1% significant level (see column 1). The negative effect implies that FBP can enrich local banking expertise, attracting skilled professionals and disseminating knowledge, thereby enhancing access to innovative financial services for marginalised groups [53, 71]. The negative effect of FBP can also be attributed to the ability of foreign banks to stimulate competition in the banking sector of the host countries [17]. This competition can incentivize domestic banks to enhance their operational efficiency and deliver superior services. Consequently, transaction costs are likely to decrease when operational efficiency improves [18, 19]. Enhancing inclusive credit access mitigates income inequality by supporting all economic segments, especially SMEs. The empirical results disagree with some prior studies that found that FBP leads to income inequality [16, 20].

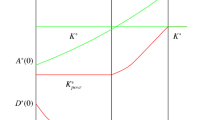

The paper accomplished the second objective by investigating the nonlinear impact of FBP on income inequality. Table 4 demonstrates a statistical nonlinear effect of FBP on income inequality. This suggests that FBP first decreases income inequality (with a negative impact of 0.020 at 5% significant level), but beyond a specific threshold, the higher inflow of FBP will lead to income inequality (with a positive effect of 0.0002 at 5% significant level). Using the calculations from column 2, the paper derives a turning point equivalent to 52% [0.0208/(2 × 0.0002)], suggesting that the inflow of FBP above 52% can cause income inequality. The findings suggest that with over 52% FBP, local banks may struggle to compete with foreign banks, leading to a concentration of resources and credit allocation towards wealthy clients. This may lead to an inefficient capital allocation, leaving innovative ideas from small entrepreneurs in host countries unfunded and contributing to rising income inequality [16, 20].

The pursuit of the third objective, which involved analysing the direct influence of economic freedom on income inequality, was initiated. The results from Table 4, column 3, indicate that economic freedom, as measured by EFI, has a notable adverse impact on income inequality, with a significant negative coefficient of 0.0288. The findings suggest that economic freedom helps to promote upward mobility and disrupt intergenerational inequality [56]. It also encourages the creation of wealth and attracts both local and international investments, which, in turn, reduce poverty and decrease income disparities across different sectors [54]. Our empirical results conform with the literature (e.g. [54,55,56,57]). Upon dissecting EFI into components including government size, rule of law, open market and regulatory efficiency, Table 4 reveals that each of these components decreases income inequality. Furthermore, our empirical results indicate that regulatory efficiency has a highly significant effect, decreasing income inequality by 0.0216 units compared to the other components (the rule of law − 0.0041; government size − 0.0118; open market − 0.0169). The high coefficient of regulatory efficiency can be attributed to the efficient allocation of spillover effects from FBP when the activities of foreign banks are well-regulated [39, 72].

Turning to the final objective of the paper, which investigated the moderating role of economic freedom on the relationship between FBP and income inequality, Table 5 reveals that economic freedom indeed plays a significant moderating role. This finding prompted us to examine the significance level of the interaction term, as computed in Eq. (3). This analysis is only relevant when both the direct effect of FBP (represented by the coefficient of FBP) and the indirect effect (indicated by the coefficient of the interaction term) on inequality are statistically significant.

From Table 5, EFI moderates the relationship between FBP and income inequality, as both the direct and indirect effects are significant, with negative coefficients of 0.0833 and 0.0014 at 1% significant level, respectively (see column 1). Thus, the net effect of EFI is − 0.0076, suggesting that in the presence of economic freedom, FBP can reduce income inequality by 0.0076, assuming all other factors remain constant. This outcome can be achieved when there are high-quality institutions, effective governance, and economic freedom. In such a scenario, the spillover effects from foreign banks can be distributed efficiently to the entire population. Moreover, countries with substantial economic freedom can mitigate foreign banks' tendencies to selectively serve only profitable markets [16, 53, 71], thus promoting inclusive allocation and reducing inequality.

Except for government size, the other components of EFI synergize with FBP to further reduce income inequality. The outcomes of these components suggest that in the presence of the rule of law, regulatory efficiency, and open market, FBP can additionally diminish income inequality by 0.0036, 0.0016, and 0.0013, respectively. The synergy between FBP and the rule of law mitigates income inequality by ensuring fair banking practices and discouraging monopolistic behaviour. A robust legal framework boosts investor confidence, attracting foreign investment and fostering economic growth, which creates employment opportunities and expands access to financial services for marginalised groups, further reducing income inequality [16]. The synergy between regulatory efficiency and FBP facilitates financial inclusion, empowering individuals and small businesses. Efficient regulations encourage foreign banks to invest in financial infrastructure, enhancing accessibility in underserved areas and fostering more equitable economic development. Furthermore, these regulations may prompt foreign banks to engage in meaningful corporate social responsibility (CSR) initiatives, directly addressing the root causes of income inequality [16, 20]. Furthermore, the joint effect between FBP and the open market fosters competition and efficiency, enhancing access to financial services and innovation. This leads to improved terms for borrowers, reduced fees, and increased credit access, benefiting underserved communities and promoting wealth equality.

Regarding the control variables, the paper found that these variables influence income inequality in some instances (refer to Table 4). For example, the population growth promote income inequality in columns 4 and 5. Trade openness also leads to income inequality in all columns except 1, 3 and 6. School enrolment also promotes income inequality in column 1. Economic growth and inflation minimise income inequality in almost all columns. Credit also minimises income inequality in column 1. A high population contributes to income inequality by impacting resource distribution, job markets, education access, social services, agriculture, urbanisation, and political-economic stability [14, 73]. Increased school enrolment in Africa promotes income inequality because as more individuals enrol in schools, there may be a divergence in the quality of education received. Wealthier families might afford better-quality education, leading to a widening skills gap between the educated elite and those with limited access to quality education. Economic growth alleviates income inequality through job creation, higher wages, entrepreneurial opportunities, education investments, social welfare, progressive taxation, infrastructure development, and inclusive policies [5, 20]. Despite Africa's increasing inflation (see Table 2), it appears to reduce income inequality by eroding the real value of debt. This benefits those with fixed-rate debts, easing the repayment burden. Moreover, inflation contributes to asset appreciation, potentially narrowing the wealth gap for lower-income individuals with investments in real estate and stocks.

The paper examines the robustness of the computed coefficients in Tables 4 and 5. Starting with the Arellano-Bond Autocorrelation (AR) test, AR at order one [AR (1)] suggests autocorrelation, whilst AR at the second order [AR (2)] shows no autocorrelation. Since AR (2) is insignificant, our model lacks serial correlation, as AR (1) takes priority [70]. Furthermore, the Hasan and Sargan over-identification constraints tests demonstrate no correlation between the instruments and the disturbance terms. This also means that the endogeneity issues have been corrected with the valid instruments. Additionally, the number of instruments is less than the number of nations, indicating that our results are robust.

Conclusion and policy implication

Africa's persistent high inequality contrasts with global trends, hindering expected progress in human development despite economic growth. Tackling income inequality in Africa, crucial for SDG 10 and Agenda 2063, involves leveraging FBP and economic freedom, fostering unity, human development, and improved quality of life. Therefore, this study utilised data from 33 African countries spanning 26 years (1995–2020) to empirically assess if FBP and economic freedom can reduce income inequality in Africa. The study achieves the following objectives, to: (1) examine the direct impact of FBP on income inequality, (2) determine the threshold effect of FBP, (3) investigate the direct impact of economic freedom on income inequality, and (4) analyse the moderating role of economic freedom on FBP- income inequality nexus. The empirical results from 2SGMM show that FBP reduces income inequality in Africa. This contrasts with some empirical studies that identify that FBP lead to income inequality [16, 20]. The variation can be attributed to the study time frame as this current paper included 2020; the other studies failed to capture that. However, the current study revealed that if Africa allows FBP above 52%, FBP will lead to income inequality. This is because as FBP dominate the banking sector, they may concentrate wealth in the hands of a few whilst leaving many communities with limited economic opportunities, perpetuating income disparities. Economic freedom also reduces income inequality in Africa. This empirical result confirms the findings of some literature such as Machado and Fuinhas [57] and Ashby and Sobel [55] who show that economic freedom often fosters an environment conducive to entrepreneurship and business growth. When individuals have the freedom to start businesses and pursue economic opportunities, it can lead to job creation and income generation, particularly for marginalised groups. Lastly, FBP condition on economic freedom promotes income inequality. This suggests that Africa can use FBP to further minimise income inequality when economic freedom is high.

The paper presents policy implications for policymakers and further studies. First, as FBP mitigates income inequality, the paper suggests policymakers cultivate collaboration between foreign banks, local governments, and regulatory bodies. This collaboration should align foreign bank activities with national development goals and strategies for reducing income inequality. Policymakers should also create policies and conducive environments to attract more foreign banks. However, caution is advised, as the study indicates that an influx of foreign banks exceeding 52% may increase income inequality. Policymakers can address this by promoting the development of local financial institutions, ensuring effective competition and meeting the diverse needs of the population. Second, given the negative relationship between economic freedom and income inequality, policymakers should promote international collaboration to exchange successful strategies. Drawing insights from effective policies in other regions can enhance the impact of measures in Africa. Policymakers are advised to allocate resources to infrastructure projects that foster connectivity, ensuring inclusive economic development and diminishing regional disparities. Furthermore, prioritising investments in education is crucial to equip the workforce with the skills necessary for a dynamic and competitive economy, aligning with the positive effects of economic freedom on income distribution. Third, since economic freedom forms synergy with FBP to hamper income inequality, there is a need for stronger regulatory oversight of foreign banks to ensure equitable income distribution. Encouraging CSR initiatives by foreign banks and maintaining data transparency are recommended. Additionally, collaboration between the government and FBP, along with enhanced regulatory frameworks, can leverage joint efforts to promote income equality and inclusive economic growth through targeted social programs and legal compliance monitoring.

Availibily of data and materials

The datasets used and/or analysed during the current study are available from the corresponding author upon reasonable request.

Notes

With exception of Delis et al. [20].

The indicators include property rights, judicial effectiveness, government integrity, tax burden, government spending, fiscal health, business freedom, labour freedom, monetary freedom, trade freedom, investment freedom and financial freedom.

Abbreviations

- 2SGMM:

-

Two-stage system generalised method of moment

- AR:

-

Autocorrelation

- AfCFTA:

-

African Continental Free Trade Area

- CSR:

-

Corporate social responsibilities

- EFI:

-

Economic freedom index

- EG:

-

Economic growth

- EU:

-

European Union

- FBP:

-

Foreign bank presence

- FBP2 :

-

Foreign bank presence squared

- FDI:

-

Foreign direct investment

- GDP:

-

Gross domestic product

- GMM:

-

Generalised method of moment

- GSS:

-

Government size

- IIE:

-

Income inequality

- IF:

-

Inflation

- OM:

-

Open market

- Pop:

-

Population

- RegE:

-

Regulatory efficiency

- RL:

-

Rule of law

- SDGs:

-

Sustainable development goals

- SE:

-

School enrolment

- SSA:

-

Sub-Saharan Africa

- SWIID:

-

Standardised world income inequality database

- TO:

-

Trade openness

- US:

-

United States

References

Stanley A (2022) Global inequalities: the big picture on wealth, income, ecological, and gender inequality looks bad. https://www.imf.org/en/Publications/fandd/issues/2022/03/Global-inequalities-Stanley. Accessed 2 Feb 2024

Chancel L, Cogneau D, Gethin A, Myczkowski A (2019) How large are African inequalities? Towards distributional national accounts in Africa, 1990–2017. World Bank working paper

Galal S (2024) Number of people living in extreme poverty in Africa 2016-2027. https://www.statista.com/statistics/1228533/number-of-people-living-below-the-extreme-poverty-line-in-africa/#:~:text=In%202022%2C%20around%20431%20million,compared%20to%20the%20previous%20years. Accessed 26 April 2024.

Chancel L, Cogneau D, Gethin A, Myczkowski A, Robilliard AS (2023) Income inequality in Africa, 1990–2019: measurement, patterns, determinants. World Dev 163:106162. https://doi.org/10.1016/j.worlddev.2022.106162

Ofori IK, Dossou MAM, Asongu SA, Armah MK (2023) Bridging Africa’s income inequality gap: How relevant is China’s outward FDI to Africa? Econ Syst 47:101055. https://doi.org/10.1016/j.ecosys.2022.101055

AfDB Market Brief (2011) The middle of the pyramid: dynamics of the middle class in Africa. African Development Bank Group. https://www.afdb.org/en/documents/document/market-brief-the-middle-of-the-pyramid-dynamics-of-the-middle-class-in-africa-23582. Accessed 26 Feb 2024

Robilliard AS (2022) What’s new about income inequality in Africa? (2022–09; World Inequality Lab Issue Brief 2022–09)

World Inequality Database (2023) What’s new about inequality in Sub-Saharan Africa in 2023? World Inequality Database https://wid.world/news-article/2023-wid-update-sub-saharan-africa/#:~:text=The%202023%20update%20of%20the,as%20Latin%20America%20and%20India. Accessed 7 Jan 2024

Iddrisu K, Abor JY, Banyen KT (2022) Fintech, foreign bank presence and inclusive finance in Africa: using a quantile regression approach. Cogent Econ Financ. https://doi.org/10.1080/23322039.2022.2157120

Kebede J, Selvanathan S, Naranpanawa A (2021) Foreign bank presence, institutional quality, and financial inclusion: Evidence from Africa. Econ Model 102:105572. https://doi.org/10.1016/j.econmod.2021.105572

Léon F (2016) Does the expansion of regional cross-border banks affect competition in Africa? Indirect evidence. Res Int Bus Finance 37:66–77. https://doi.org/10.1016/j.ribaf.2015.10.015

Claessens S, Van Horen N (2014) Foreign banks: trends and impact. J Money Credit Bank 46:295–326. https://doi.org/10.1111/jmcb.12092

El Menyari Y (2019) Financial development, foreign banks and economic growth in Africa. Afr Dev Rev 31:190–201. https://doi.org/10.1111/1467-8268.12377

Iddrisu K, Abor JY, Insaidoo M, Banyen KT (2023) Does China’s flow of FDI and institutional quality matter for poverty? Evidence from Sub-Sahara Africa. J Asian Afr Stud. https://doi.org/10.1177/00219096231188948

Wu J, Nam Jeon B, Luca AC (2010) Foreign bank penetration, resource allocation and economic growth: evidence from emerging economies. J Econ Integr 25:166–192

Nanivazo JM, Egbendewe AYG, Marcelin I, Sun W (2021) Foreign bank entry and poverty in Africa: Misaligned incentives? Fin Res Lett 43:101963. https://doi.org/10.1016/j.frl.2021.101963

Ofori-Sasu D, Mensah L, Akuma JK, Doku I (2019) Banking efficiency in emerging economies: Does foreign banks entry matter in the Ghanaian context? J Financ Econ 24:1091–1108. https://doi.org/10.1002/ijfe.1707

Yin H (2021) Foreign bank entry and bank competition: cross-country heterogeneity. Glob Fin J 48:100558. https://doi.org/10.1016/j.gfj.2020.100558

Boamah NA, Opoku E, Appiah KO (2022) Efficiency, foreign banks presence, competition and risk exposure of banks in middle-income economies. SN Bus Econ 2:114. https://doi.org/10.1007/s43546-022-00293-4

Delis MD, Hasan I, Mylonidis N (2020) Foreign bank ownership and income inequality: empirical evidence. Appl Econ 52:1240–1258. https://doi.org/10.1080/00036846.2019.1659931

Apergis N, Dincer O, Payne JE (2014) Economic freedom and income inequality revisited: evidence from a panel error correction model. Contemp Econ Policy 32:67–75. https://doi.org/10.1111/j.1465-7287.2012.00343.x

Bennett DL, Vedder RK (2012) A dynamic analysis of economic freedom and income inequality in the 50 U.S. States: empirical evidence of a parabolic relationship. SSRN. https://doi.org/10.2139/ssrn.2134650

Dincer OC, Gunalp B (2012) Corruption and income inequality in the United States. Contemp Econ Policy 30:283–292. https://doi.org/10.1111/j.1465-7287.2011.00262.x

Detragiache E, Tressel T, Gupta P (2008) Foreign banks in poor countries: theory and evidence. J Finance 63:2123–2160. https://doi.org/10.1111/j.1540-6261.2008.01392.x

Kleymenova A, Rose AK, Wieladek T (2016) Does government intervention affect banking globalization? J Jpn Int Econ 42:146–161. https://doi.org/10.1016/j.jjie.2016.11.001

Saleh MSM (2015) The impact of foreign banks entry on domestic banks financial performance: an overview. In: Proceeding of the 2nd international conference on management and Muamalah.

Heckscher E, Ohlin B (1933) International and inter-regional trade. Harvard University Press, London

Bernstein H (1971) Modernization theory and the sociological study of development. J Dev Stud 7:141–160. https://doi.org/10.1080/00220387108421356

Clarke G, Cull R, Martínez Pería MS (2006) Foreign bank participation and access to credit across firms in developing countries. J Comp Econ 34:774–795. https://doi.org/10.1016/j.jce.2006.08.001

Clarke G, Cull R, Martinez Peria MS, Sánchez SM (2003) Foreign bank entry: experience, implications for developing economies, and agenda for further research. World Bank Res Obs 18:25–59. https://doi.org/10.1093/wbro/lkg002

Clarke GRG, Xu LC, Zou H (2006) Finance and income inequality: What do the data tell us? South Econ J 72:578–596. https://doi.org/10.1002/j.2325-8012.2006.tb00721.x

Cull RJ, Martinez Peria MS (2007) Foreign bank participation and crises in developing countries. World Bank Policy Research Working Paper 4128

North DC (1990) Institutions, institutional change and economic performance. Cambridge University Press, Cambridge

Acemoglu D, Robinson JA (2012) Why nations fail: the origins of power, prosperity and poverty, 1st edn. Crown Business, Midtown Manhattan

World Bank (2013) Inclusion matters: the foundation for shared prosperity. The World Bank, Washington. https://doi.org/10.1596/978-1-4648-0010-8

Ahmad M (2017) Economic freedom and income inequality: Does political regime matter? Econ 5:18. https://doi.org/10.3390/economies5020018

Henisz WJ (2000) The institutional environment for economic growth. Econ Politics 12:1–31. https://doi.org/10.1111/1468-0343.00066

Nunnenkamp P (2004) Why economic growth has been weak in Arab countries: the role of exogenous shocks, economic policy failure and institutional deficiencies (409; Kieler Diskussionsbeiträge)

Staats JL, Biglaiser G (2012) Foreign direct investment in Latin America: the importance of judicial strength and rule of law1. Int Stud Q 56:193–202. https://doi.org/10.1111/j.1468-2478.2011.00690.x

Altunbaş Y, Thornton J (2020) Finance and income inequality revisited. Fin Res Lett 37:101355. https://doi.org/10.1016/j.frl.2019.101355

Chen Z, Paudel KP, Devadoss S (2024) Economic openness, financial bias, and the urban–rural income gap. Rev Dev Econ 28:242–263. https://doi.org/10.1111/rode.13052

Chiu YB, Lee CC (2019) Financial development, income inequality, and country risk. J Int Money Finance 93:1–18. https://doi.org/10.1016/j.jimonfin.2019.01.001

de Haan J, Sturm JE (2017) Finance and income inequality: A review and new evidence. Eur J Political Econ 50:171–195. https://doi.org/10.1016/j.ejpoleco.2017.04.007

Denk O, Cournede B (2015) Finance and income inequality in OECD countries. SSRN. https://doi.org/10.2139/ssrn.2649944

Hsieh J, Chen TC, Lin SC (2019) Financial structure, bank competition and income inequality. N Am J Econ Financ 48:450–466. https://doi.org/10.1016/j.najef.2019.03.006

Kim JH (2016) A study on the effect of financial inclusion on the relationship between income inequality and economic growth. Emerg Mark Finance Trade 52:498–512. https://doi.org/10.1080/1540496X.2016.1110467

Kling G, Pesqué-Cela V, Tian L, Luo D (2022) A theory of financial inclusion and income inequality. Eur J Financ 28:137–157. https://doi.org/10.1080/1351847X.2020.1792960

Seven U, Coskun Y (2016) Does financial development reduce income inequality and poverty? Evidence from emerging countries. Emerg Mark Rev 26:34–63. https://doi.org/10.1016/j.ememar.2016.02.002

Shahbaz M, Bhattacharya M, Mahalik MK (2017) Finance and income inequality in Kazakhstan: evidence since transition with policy suggestions. Appl Econ 49:5337–5351. https://doi.org/10.1080/00036846.2017.1305095

Thornton J, Tommaso CD (2020) The long-run relationship between finance and income inequality: evidence from panel data. Finance Res Lett 32:101180. https://doi.org/10.1016/j.frl.2019.04.036

Schnabel I, Seckinger C (2019) Foreign banks, financial crises and economic growth in Europe. J Int Money Financ 95:70–94. https://doi.org/10.1016/j.jimonfin.2019.02.004

Hunegnaw FB, Bedhaso AF (2021) A dynamic analysis on foreign bank entry Nexus economic growth in Sub-Sahara African countries. Cogent Econ Financ. https://doi.org/10.1080/23322039.2021.1991084

Iddrisu K, Abor JY, Banyen KT (2023) Foreign bank presence and inclusive growth in Africa: the moderating role of financial development. Afr J Econ Manag Stud. https://doi.org/10.1108/AJEMS-11-2022-0444

Scully GW (2002) Economic freedom, government policy and the trade-off between equity and economic growth. Public Choice 113:77–96. https://doi.org/10.1023/A:1020308831424

Ashby NJ, Sobel RS (2008) Income inequality and economic freedom in the U.S. states. Public Choice 134:329–346. https://doi.org/10.1007/s11127-007-9230-5

Migheli M, Saccone D (2023) Some new evidence on economic freedom and income distribution. Appl Econ 55:3154–3169. https://doi.org/10.1080/00036846.2022.2109578

Machado D, Fuinhas JA (2023) Income inequality and economic freedom revisited: Are freedom and equality conflicting values? Evidence from the twenty-first century. Int Econ J 37:294–323. https://doi.org/10.1080/10168737.2023.2212251

Berggren N (1999) Economic freedom and equality: Friends or foes? Public Choice 100:203–223. https://doi.org/10.1023/A:1018343912743

Carter JR (2007) An empirical note on economic freedom and income inequality. Public Choice 130:163–177. https://doi.org/10.1007/s11127-006-9078-0

Pérez-Moreno S, Angulo-Guerrero MJ (2016) Does economic freedom increase income inequality? Evidence from the EU countries. J Econ Pol Reform 19:327–347. https://doi.org/10.1080/17487870.2015.1128832

Solt F (2020) Measuring income inequality across countries and over time: the standardized world income inequality database. Soc Sci Q 101:1183–1199. https://doi.org/10.1111/ssqu.12795

Beck T, Demirgüç-Kunt A, Levine R (2007) Finance, inequality and the poor. J Econ Growth 12:27–49. https://doi.org/10.1007/s10887-007-9010-6

Claessens S, van Horen N (2015) The impact of the global financial crisis on banking globalization. IMF Econ Rev 63:868–918. https://doi.org/10.1057/imfer.2015.38

Berggren N (2003) The benefits of economic freedom: a survey. Indep Rev 8:193–211

Cabello JM, Ruiz F, Pérez-Gladish B (2021) An alternative aggregation process for composite indexes: an application to the heritage foundation economic freedom index. Soc Indic Res 153:443–467. https://doi.org/10.1007/s11205-020-02511-8

Iddrisu K, Ofoeda I, Abor JY (2023) Inward foreign direct investment and inclusiveness of growth: Will renewable energy consumption make a difference? Int Econ Econ 20:367–388. https://doi.org/10.1007/s10368-023-00562-z

Che Y, Lu Y, Tao Z, Wang P (2013) The impact of income on democracy revisited. J Comp Econ 41:159–169. https://doi.org/10.1016/j.jce.2012.05.006

Roodman D (2009) How to do Xtabond2: an introduction to difference and system GMM in Stata. Stata J Promot Commun Stat Stata 9:86–136. https://doi.org/10.1177/1536867X0900900106

Asongu SA, Odhiambo NM (2020) Foreign direct investment, information technology and economic growth dynamics in Sub-Saharan Africa. Telecommun Policy 44:101838. https://doi.org/10.1016/j.telpol.2019.101838

Tchamyou VS, Erreygers G, Cassimon D (2019) Inequality, ICT and financial access in Africa. Technol Forecast Soc Change 139:169–184. https://doi.org/10.1016/j.techfore.2018.11.004

Gopalan S (2015) Foreign banks in emerging markets: advantage or impediment? HKUST Institute for Emerging Market Studies

Acemoglu D, Robinson J (2010) The role of institutions in growth and development. Rev Econ Inst 1:1–33. https://doi.org/10.5202/rei.v1i2.14

Timothy PO (2018) Impact of economic globalization on life expectancy in Nigeria. Health Econ Outcome Res Open Access. https://doi.org/10.4172/2471-268X/1000152

Acknowledgements

Acknowledgements go to the authors of the research articles consulted and cited in the course of this study. The author is also grateful to the Specialised Presidential Council for Education and Scientific Research (SPCESR) for selecting my paper to be published under open access.

Funding

Not applicable. The study did not receive any financial assistance from any entity.

Author information

Authors and Affiliations

Contributions

Conceptualisation was contributed by [KI]; methodology was contributed by [KI]; formal analysis and investigation were contributed by [KI]; writing—original draft preparation, was contributed by [KI]; writing—review and editing, was contributed by [KI]; resources was contributed by [KI]; supervision was contributed by [KI]; approval of final version to be published by [KI]; agreed to be accountable by [KI].

Corresponding author

Ethics declarations

Ethical approval and consent to participate

Not applicable.

Consent for publication

Yes. Consent is provided.

Conflict of interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Iddrisu, K. Foreign bank presence and income inequality in Africa: What role does economic freedom play?. Futur Bus J 10, 60 (2024). https://doi.org/10.1186/s43093-024-00357-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s43093-024-00357-x