Abstract

Purpose

This paper uses the event study methodology to analyze the impact of unexpected political event on stocks abnormal returns. The objective is twofold. The first is to reach robust estimates of stocks abnormal returns. The second is to reach robust estimates of the effects of unexpected political events on stocks abnormal returns.

Design/methodology/approach

This paper experiments with three different methods to estimate stocks abnormal returns, namely: market model, mean-adjusted model and market-adjusted model. The sample includes the firms listed in the leading index in Egypt stock exchange (EGX30). The statistical tests, Anderson–Darling test for normality, Wilcoxon rank-sum test for comparing the significance of the estimates, and Breusch–Pagan, Cook–Weisberg test for heterogeneity of abnormal returns.

Findings

The results indicate that (a) statistical differences between the three estimates exist, which indicates that the three methods of abnormal return estimation are not substitutes, or alternatives, to each other, (b) that is, the political event is considered an anomaly which has idiosyncratic effects. This is contrary to the common belief that political events have systematic effects.

Originality/value

The contribution of this paper is twofold. First, the estimation of abnormal returns must be examined for robustness in order to ensure reliability. Second, the results offer robust evidence that political risk premium is an anomaly, which is a call for stock market participants not to panic. Eventually, it saves investors’ wealth.

Similar content being viewed by others

Introduction

Information uncertainty poses an ongoing challenge to financial estimations. Robustness of measuring uncertain financial variables results in making valid decisions. One of the very well-known sources of uncertainty is political instability. Many countries have witnessed political disruptions that have taken various forms such as presidential elections, change of government administration and riots. The uncertainty that surrounds political events leads investors and financial analysts formulate their own expectations about the cost of equity financing. Analysts’ expectations must be robust enough to reach reliable estimation of the cost of equity financing.

This paper focuses on one event of political disruption that occurred in Egypt. Indeed, the event is a leading event that occurred when the Minister of defense delivered a speech to the entire country on June 23, 2013, calling citizens to delegate military forces the power to fight terrorism, followed by overthrowing the elected president. It is worth noting that the authors’ concern in this paper is not to do with this event literally, but rather with a methodology that deals with the measurement and estimation of abnormal stock returns.

Objectives of the Study

This paper aims at examining the objectives as follows:

-

1.

To reach robust estimates of stocks abnormal returns as the literature includes three methods that have different bases.

-

2.

To reach robust estimates of the effects of unexpected political structural event (the speech of the former Minister of defense on 23rd of June 2013) on stocks standardized abnormal returns.

Contribution of the Paper

The contribution of this paper can be outlined as follows:

-

1.

The estimation of abnormal returns is tested for reliability. That is, three methods of abnormal return estimation are employed in order to ensure the consistency of the estimates.

-

2.

The paper examines whether a political structural event can be considered systematic, as commonly believed, or idiosyncratic. This is an examination to the extent to which panic in the stock market is justified.

The rest of the paper is organized as follows: “Relationship between politics and stock market performance” section discusses the studies that examine the relationship between politics and stock market performance. “The stock market, economic and political climate in Egypt” section discusses a brief about political and economic climate in Egypt. “Methods” section discusses a brief about the Egyptian stock market. “Results and discussion” section describes the data, variables and statistical estimation methods. Section 6 discusses the results. “Conclusion” section concludes.

Relationship between politics and stock market performance

Politics can be defined in several ways according to different conditions or contexts. Etzioni [27] and Cheian et al. [17] hold the view that a prolific definition is that political processes are concerned with bridging strength differences within the community with those within the nation, bridges that transfer inputs both from the community to the nation (e.g., the results of polling) and from the nation to the community (e.g., presidential speeches; laws). Researchers argue that politics play a decisive role mostly when it comes to a developing country’s stock market [11]. Political risk is generally considered by investors as one of the most effective factors that affect portfolio investment. Political disruptions may lead to market inefficiency which promotes speculators to enter a stock market trying to gain abnormal returns [17]. George Soros is an example to one of the notable speculators. In 1992, Soros damaged the English economy by his speculation activities [18]. This example shows that a government should protect their stock markets and devote all possible efforts toward enhancing the efficiency of their stock markets [38].

The literature includes many studies that argue that political factors affect the performance of stock market [30]. Mbaku [42] claims that many countries in Africa have not been able to establish a stable political system even after decades after independence. Unfortunately, political instability forms a considerable obstacle against economic development. As far as political events are considered systematic factor, the impacts of political instability can be examined at an aggregate level through the movements in stock market indexes. The stock market index of a country reflects the existing and future performance of the economy [17]. Srivastava [50] and Wang et al. [53] argue that stock market performance is very vulnerable to any passive powers.

The above-mentioned arguments of the effects of political instability show that analytical judgment of the investors is a dominant factor. That is, in case the coming news raise investors’ expectations, stock markets’ returns respond favorably in the form increases in stocks prices, otherwise prices fall as a reflection of unfavorable reaction [51]. Wang and Lin [52] offer an evidence from Taiwan’s presidential elections in 2004. They conclude that the crash in Taiwan’s stock market was a result of investors panic through the political crises. In this regard, Ferri [30] offers further evidence that unplanned general elections and changes in the government’s structure are predominantly negatively correlated to country’s stock market performance. Chuang and Wang [20] state that political changes had negative impacts on stock returns in France, USA, Japan and UK. This is because political parties have various economic views that resulted in frequent changes in the economic policies. These changes created states of uncertainty by investors that have led to take conservative investment policies.

Kim and Mei [36] conclude that changes in government administration negatively affect stock markets due to the implementation of new fiscal policies. The latter may increase uncertainties that affect investors’ willingness to take risk resulting in negative stock returns. On the other side, Nimkhunthod [45] reports an evidence from Thailand that a change in government administration has only a negative impact on stock returns on the short term. But in the long run, a change in government administration leads to considerable stock returns. Jones and Banning [35] examine the impact of American elections on stock returns and conclude that no major differences are found in monthly stock returns regardless who wins the presidential elections.

The stock market, economic and political climate in Egypt

The Egyptian stock exchange is one of the oldest stock markets the Middle East region. The Egyptian stock exchange traces its origins to 1883 when Alexandria stock exchange was established, followed by the Cairo stock exchange in 1903 (renamed as Egyptian exchange in 2014). In 1940, both exchanges were very active, and the joint Egyptian stock exchange was ranked the 5th in the world. However, the Egyptian stock exchange became dormant between 1961 and 1992 due to the central planning and socialist policies adopted in mid-1950s.

In 1990s, an economic reform and restructuring program were adopted by the Egyptian government that has resulted in the Egyptian stock market to become active again. A major change in the organization of Cairo and Alexandria stock exchange was introduced in January 1997 as a result of the election of a new board of directors and accordingly establishing multiple board committees (Egyptian Exchange 2014). The Egyptian stock market is the second largest in Africa in terms of capitalization and turn over. Market capitalization kept increasing since the initiation of the economic recovery program in 1990s and stood at $38,515 million by the end of 2004. The number of listed companies increased dramatically from 656 companies in 1992 to 1151 companies in 2002 [1]. The major indexes are EGX 30 (which is considered the benchmark), EGX 20, EGX 70 and EGX 100 (Egyptian exchange 2014). As of January 2014, market capitalization reached $61,629 million with 236 listed companies (SSE, 2014).

Since the Egyptian revolution on the 25th of January 2011, Egypt witnessed political instability. Unfortunately, to the best of the authors’ knowledge until the final writing and submission of this paper, there are almost no studies that examine the impact of this political structural event on the Egyptian stock market.

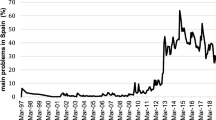

In terms of the current state of investments in Egypt, on Feb 2014, the Egyptian Ministry of Finance announced that investments in Egypt declined by 7.3% during current year. It conjointly showed that the expansion rate of gross domestic product (GDP) fell to 1% within the first quarter of that year compared to a 2.5% within the same period last year, representing a 60% decline. According to the interim government foreign debts reached 45.8 billion US $ by the end of 2013, while according to the estimates of the economists’ actual debt exceeded 52 billion US $ based on separate official statements received from the Central Bank of Egypt [31]. The Egyptian economy was additionally mirrored in an exceedingly deficit of over 12.8 billion US $ and a decrease in foreign currency reserves of 18.9 billion US $ in January 2014 [31]. Despite the very critical situation of the Egyptian economy after the Egyptian revolution on 25th of January 2011, the Egyptian stock exchange and its indexes EGX 30 & EGX 70 kept rising since 23rd of June 2013 till to date, when the former Minister of defense called on Egyptian political parties to seek conciliation and harmony to save Egypt in a speech on Sunday 23rd of June 2013.

Methods

This section describes the conceptual framework of the methodology, the hypothesis of the paper, the data, the estimation of SAR, the reliability of SAR estimates and testing for the heteroskedasticity of political structural break.

Conceptual framework and hypothesis of the paper

Certain studies in the literature conclude that the Egyptian stock market is a weak-form efficient [4, 5]. Nevertheless, Mlambo and Biekpe [44] claim that there are no rules that can be used in detecting stock prices so that they can be used in predicting future prices in the Egyptian stock market. In this regard, the event study methodology is quite relevant as a further examination of that issue. Therefore, the framework of this paper can be illustrated as follows.

Hypothesis

This paper tests the hypothesis that follows:

“The structural political break in Egypt on 23rd of June 2013 has a significant effect on stocks abnormal returns.”

Data

The data are obtained from Egypt stock exchange for the stocks listed in the index (EGX30). The data cover the period June 3, 2012– March 4, 2014. Although the literature does not specify certain time interval in event studies [33], the authors consider 25 days before the event (estimation period) and 25 days after the event (event period). The event day is excluded.

Estimation of standardized abnormal returns in event study methodology

Event study methodology offers a way for avoiding the bias of accounting-based measures of returns [43]. This methodology is well cited in the literature for variety of applications [12, 26, 29, 34, 37, 46, 48, 49]. The aim of an event study is to quantify and statistically test the presence of any abnormal or excess returns that are associated with certain events. The abnormal or excess returns are calculated as the difference between the observed returns and expected returns which is the expected return in case of non-occurrence of the event using a specific return calculation model [46].

The literature includes three main methods to estimate the expected return. There methods are as follows [16, 46]:

-

1.

Market model (MM).

-

2.

Mean-adjusted return model (MAR).

-

3.

Market-adjusted or index model (IM).

Estimation of standardized abnormal returns

In this paper, the event time is identified as the speech of the Egyptian Minister of defense on June 23, 2013. The expected returns of listed firms in the index (EGX30) before and after the event are estimated using the three above-mentioned methods that follow.

-

A.

Market model [29].

$$R_{it} = \alpha_{i} + \beta_{i} R_{mt} + \varepsilon_{it}$$(1)where \({\text{R}}_{\text{it}}\) is return on security i for period t (observed return), \(\alpha_{i}\) is constant intercept, \(\beta_{i}\) is slope coefficient, \(R_{mt}\) is return on market index m for period t, \(\varepsilon_{it}\) is error term (abnormal return) for security i in period t. In this case, the observed minus predicted return equal abnormal return, which is the disturbance term.

-

B.

Mean-adjusted return model [14, 15].

$$R_{it} = \mu_{i} + \varepsilon_{it}$$(2)where \({\text{R}}_{\text{it}}\) is return on security i for period t (observed return), \(\mu_{i}\) is the mean return on security i over t periods within estimation period normal (expected or predicted) return, \(\varepsilon_{it}\) is disturbance term (assumed to have mean = zero, and SD = 1). In this case, the observed minus mean return equal abnormal return, which is the disturbance term.

-

C.

Market-adjusted or index model [14, 15].

$$R_{it} = R_{mt} + \varepsilon_{it}$$(3)where \({\text{R}}_{\text{it}}\) is return on security i for period t (observed return), \(R_{mt}\) is return on market index m in period t, \(\varepsilon_{it}\) is disturbance term (white noise) assumed to have mean = zero, and SD = 1. Each period’s observation in white noise time series is a complete surprise. In this case, the observed minus index returns equal abnormal return (or disturbance term).

The authors in this paper compute the standardizing abnormal returns (SAR) to ensure the robustness of abnormal returns estimation [24, 41]. The standard error of the estimate is calculated as follows [46], taking into consideration that this equation applies to the market model and the market-adjusted model only.

The standardized abnormal return (SAR) for security i in period t is calculated as follows:

In the mean-adjusted model, the standardized abnormal return for security i in period t is calculated as follows:

The standard error of the estimate that can be used in the case of mean-adjusted returns is as follows [46].

Results and discussion

This section includes two parts: The first part reports and discusses the results of Wilcoxon test. The objective of the first part is to examine the reliability of the three estimates of standardized abnormal returns. The second part reports and discusses the results of heteroskedasticity test. The objective of the second part is to examine the extent to which standardized abnormal returns are heterogeneous before and after the structural break political event.

The reliability of standardized abnormal returns estimates (Wilcoxon test)

The estimation of abnormal returns using more than one method raises a methodological question whether the estimates are reliable and consistent. As the estimates are statistically consistent (whether significant or insignificant), the methods of estimation are considered reliable. As far as the estimated abnormal returns are not normally distributed (using Anderson–Darling test, [2, 3], a nonparametric test is required. In this case, Wilcoxon rank-sum test [54] is used for comparing the significance of the estimates produced by the three methods.

Table 1 reports the significance of the estimation of abnormal returns before and after the event. The hypotheses are as follows:

H 0

The distribution is the same for both groups.

H 1

The distribution is NOT the same for both groups.

Table 1 reports the significance level of pairwise comparisons between abnormal returns (being measured by three different methods) before and after the event. The results reveal many indications as follows:

-

1

In terms of the method of estimation of abnormal returns, as far as the literature includes different measures of abnormal returns, one must take into consideration the possible effect of measurement error. This requires experimenting with the three commonly known methods of estimating abnormal returns. The results show that this argument is realized in many firms such as Arab Real Estate Investment Co., Arabia Investments, Development, Egyptian Kuwaiti Holding, El Kahera Housing, Juhayna Food Industries and T M G Holding. It is worth emphasizing that the stability of the estimated coefficients in terms of significance and trend offers strong indication to the robustness of the results. In this case, the results in Table 1 show that the three methods of abnormal return estimation are not substitute, or alternative, to each other. This is a call that the robustness of the estimates requires the deployment of the three methods.

-

2

In terms of the effect of political disruption on firm’s abnormal returns, the results offer further and new understanding of systematic risk. The latter being commonly understood and is treated in the literature of investments as a source of risk that affects all participants in the stock market taking a leading index as representative to market-wide systematic factors. The results in Table 1 indicate that the effect of political disruption indeed must be treated as anomaly. That is, political disruption exerts significant effect on one firm, but does not in another firm. In this case, it might be plausible to argue that political disruption can be treated as idiosyncratic risk. This argument can also be extended to country level where political instability is treated as part of country risk rating, then premium.

Testing for the heteroskedasticity of political structural break

The literature includes number of studies that examine and reveal the effects of structural breaks on the distribution of the error terms, which is commonly referred to as heteroskedasticity [6,7,8,9,10, 19, 21, 25, 32, 39, 40, 47]. The authors of the current paper use Breusch–Pagan test [13] and Cook–Weisberg [22, 23] test to examine the extent to which abnormal returns are heterogeneous before and after the above-mentioned structural break political event. The test is run under the hypotheses as follows:

H 0

“Error variances are all equal (Homoskedastic).”

H 1

“Error variances are not equal (Heteroskedastic).”

The results reported in Table 2 show that the variance of error terms before and after the event is statistically significant for certain firms and insignificant for others. These results indicate that the standardized abnormal stock returns before and after the structural break event are homogeneous in certain firms and heterogeneous for other firms. That is, the structural break political event did have mixed effects. That is, political event had an idiosyncratic effect, which is contrary to the common belief that political events have systematic effects. The comparisons with related studies in the literature are worth it. That is, these results are in contrary to Wang et al. [53] that stock market’s performance is very vulnerable to any passive powers. The results also are in contrary to the claim made by Ferri [30] that political factors including presidential elections affect the performance of stock market. As far as the event in this study involves a change in government administration, the results are in contrary to the conclusion reached by Kim and Mei [36] that changes in government administration negatively affect stock markets. The same arguments hold in other developing countries such as Thailand. Nimkhunthod [45] concludes that in Thailand, government change leads to considerable stock returns in the long run. As far as the above-mentioned studies are concerned, the results in the current paper can be considered an extension to the hypotheses of stock market efficiency that claims stock markets are very sensitive to public information [28]. In this case, an inefficiency is realized. Nevertheless, Jones and Banning [35] conclude that the American elections had no major differences in monthly stock returns regardless who wins the presidential elections.

Conclusion

This paper examines a methodological issue regarding the measurement of abnormal stock returns. The paper experiments with three different methods for estimating abnormal returns which help reaching robust estimations of abnormal returns and further robust impacts of political structural break as well. The robustness of standardized abnormal returns is further examined statistically which shows that the three methods of abnormal return estimation are not substitutes to each other. The use of the three of them is recommended for reaching reliable conclusions.

The paper concludes that the political structural event that passed through Egypt had mixed statistical significance, which is considered an anomaly. The results can be considered a call to current and potential investors as well as financial analysts to be careful enough regarding the measurement of cost of equity financing during political disruptions. The results recommend the treatment of political risk as an idiosyncratic (firm-specific) in order to reach realistic cost of equity.

Availability of data and materials

The raw data are obtained for fees from Egypt for Information Dissemination (http://www.egidegypt.com/). The mathematical and statistical computations are done by the authors. The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Abbreviations

- MM:

-

Market model

- MAR:

-

Mean-adjusted return model

- IM:

-

Market-adjusted or index model

- EGX30:

-

Egypt stock market index

- SD:

-

Standard deviation

- ARit :

-

Abnormal return

- SAR:

-

Standardizing abnormal returns

- Si :

-

Standard errors

References

Alagidede P (2008) Market efficiency and stock return behaviour in Africa’s emerging equity markets, Ph.D. thesis, Loughborough University, UK

Anderson TW, Darling DA (1952) Asymptotic theory of certain ‘goodness-of-fit’ criteria based on stochastic processes. Ann Math Stat 23(2):193–212

Anderson TW, Darling DA (1954) A test of goodness-of-fit. J Am Stat Assoc 49(268):765–769

Appiah-Kusi J, Menyah K (2003) Return predictability in African stock markets. Rev Financ Econ 12:247–270

Asal M (2000) Are There Trends Towards Efficiency for the Egyptian Stock Market?. Working Paper, School of Economics and Commercial Law. University of Goteberg, Sweden

Bai J (1994) Least squares estimation of a shift in linear processes. J Time Ser Anal 15:453–472

Bai J (1997) Estimation of a change point in multiple regression models. Rev Econ Stat 79:551–563

Bai J (1997) Estimating multiple breaks one at a time. Econ Theory 13:315–352

Bai J, Perron P (2003) Critical values for multiple structural change tests. Econom J 6:72–78

Baltagi Badi H, Feng Q, Kao C (2016) Estimation of heterogeneous panels with structural breaks. J Econom 191(1):176–195

Bilson M, Brailsford J, Hooper J (2002) The explanatory power of political risk in emerging markets. Int Rev Financ Anal 11(1):1–27

Binder J (1998) The event study methodology since 1969. Rev Quant Financ Acc 11(2):111–137

Breusch TS, Pagan AR (1979) A simple test for heteroscedasticity and random coefficient variation. Econometrica 47:1287–1294

Brown Stephen J, Warner Jerold B (1980) Measuring security price performance. J Financ Econ 8(September):205–258

Brown Stephen J, Warner Jerold B (1985) Using daily stock returns: the case of event studies. J Financ Econ 14(March):3–32

Cable J, Holland K (1999) Modelling normal returns in event studies: a model selection approach and pilot study. Eur J Finance 5(4):331–341

Cheian A, Siang BM, Woon CL, Chiang CL, Hoong LC (2013) Efficient market hypothesis: impact of 12th Malaysian General Election on The Stock Market, Research Project submitted in partial fulfilment of the degree of Bachelor of Business Administration, Tunku Abdul Rahman University: Malaysia

Cheong KC (2007) The return of soros: revisiting malaysian ‘facts’ about the asian crisis. Malays J Econ Stud 44(2):107–115

Chong TTL (2001) Structural change in AR(1) models. Econom Theory 17:87–155

Chuang C, Wang Y (2009) Developed stock market reaction to political change: a panel data analysis. Qual Quant 43(6):941–949

Çoban B, Firuzan E (2016) The role of structural break and volatile innovations on cointegration tests: tsunami and global economics crisis. Int J Arts Sci 9(02):211–224

Cook RD, Weisberg S (1982) Residuals and influence in regression. Chapman & Hall/CRC, New York

Cook RD, Weisberg S (1983) Diagnostics for heteroscedasticity in regression. Biometrika 70:1–10

Dann Larry Y, Mikkelson Wayne H (1984) Convertible debt insurance, capital structure change and financing-related information. J Financ Econ 13(June):157–186

Davidson R, MacKinnon JG (1985) Heteroskedasticity-robust tests in regression directions. Ann l’INSEE 59(60):183–218

Dua V, Puri H, Mittal RK (2010) Impact of buy-back of shares on stock prices in India: an empirical testing of stock market efficiency in its semi-strong form. Pranjana J Manag Aware 13(1):59–71

Etzioni A (2003) ‘What is political’ [online]. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2157170. Accessed 15 Aug 2014

Fama E (1995) Random walks in stock market prices. Financ Anal J 51(1):75–80

Fama EF, Fisher L, Jensen MC, Roll R (1969) The adjustment of stock prices to new information. Int Econ Rev 10(1):1–21

Ferri M (2008) The response of US equity values to the 2004 presidential election. J Appl Finance 18(1):29–37

Fouly M (2014) Egypt’s economy in dire need for stability to revive’ [online]. http://www.neurope.eu/news/wire/roundup-egypts-economy-dire-need-stability-revive-experts. Accessed 14 March 2014

Halungaa Andreea G, Orme Chris D, Yamagata T (2017) A heteroskedasticity robust Breusch–Pagan test for Contemporaneous correlation in dynamic panel data models. J Econom 198(2):209–230

Henderson GV Jr (1990) Problems and solutions in conducting event studies. J Risk Insur 57(2):282–306

Himmelmann A, Schiereck D, Simpson MW, Zschoche M (2012) Long-term reactions to large stock price declines and increases in the European stock market: a note on market efficiency. J Econ Finance 36(2):400–423

Jones T, Banning K (2009) US elections and monthly stock market returns. J Econ Finance 33(3):273–287

Kim Y, Mei P (2001) What makes the stock market jump? An analysis of political risk on Hong Kong stock returns. J Int Money Finance 20(7):1003–1016

Koch JV, Fenili Robert N (2013) Using event studies to assess the impact of unexpected events. Bus Econ 48(1):58–66

Litterick D (2002) Billionaire who broke the Bank of England. The Telegraph, 13 September, Finance P

MacKinnon James G (1989) Heteroskedasticity-robust tests for structural change. Empir Econ 14(2):77–92

Maddala GS (1992) Introduction to econometrics, 2nd edn. Macmillan Publishing Company, New York

Masulis Ronald W (1980) The effect of capital structure change on security prices. J Financ Econ 8:139–178

Mbaku J (1992) Political instability and economic development in Sub-Saharan Africa: further evidence. Rev Black Polit Econ 20(4):39–53

McWilliams A, Siegel D (1997) Event studies in management research: theoretical and empirical issues. Acad Manag J 40(3):626–657

Mlambo C, Biekpe N (2007) The efficient market hypothesis: evidence from ten African markets. Invest Anal J 66:1–14

Nimkhunthod MW (2007) An impact of political events on the stock exchange of Thailand, Unpublished doctoral dissertation, Thammasat University: Thailand

Peterson Pamela P (1989) Event studies: a review of issues and methodology. Q J Bus Econ 28(3):31–36

Phillips GDA, McCabe BP (1983) The independence of tests for structural change in regression models. Econ Lett 12(3–4):283–287

Salameh H, Albahsh R (2011) Testing the efficient market hypothesis at the semi strong level in Palestine stock exchange-event study of the mandatory disclosure. Int Res J Finance Econ 69:45–50

Sharma A (2009) Impact of public announcement of open offer on shareholders return: an empirical test for efficient market hypothesis. IUP J Appl Finance 15(11):37–51

Srivastava A (2010) Relevance of marco economic factors for the Indian Stock Market. Decision 37(3):69–89

Tan G, Gannon G (2002) Information effect of economic news: SPI futures. Int Rev Financ Anal 11(4):467–489

Wang Y, Lin C (2009) The political uncertainty and stock market behavior in emerging democracy: the case of Taiwan. Qual Quant 43(2):237–248

Wang Y, Lee M, Lin C (2008) General election, political change and market efficiency: long- and short-term perspective in developed stock market. J Money Invest Bank 3:58–67

Wilcoxon Frank (1945) Individual comparisons by ranking methods. Biomet Bull 1(6):80–83

Acknowledgements

The authors are quite thankful to anonymous reviewers for helpful comments and suggestions that improved the contribution and readability of the paper.

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

TE has contributed to the formulation of the research design of the paper and implementation of statistical estimation. MA and NM have contributed to the refinement and writing up the literature review. MH has contributed to the computation of the variables. All the authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Eldomiaty, T.I., Anwar, M., Magdy, N. et al. Robust examination of political structural breaks and abnormal stock returns in Egypt. Futur Bus J 6, 22 (2020). https://doi.org/10.1186/s43093-020-00014-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s43093-020-00014-z