Abstract

Prior research on corporate headquarters (CHQ) characteristics identifies the impact of CHQ location and composition on the innovation outcomes of internal subsidiaries. However, given that external strategic alliances with high-tech entrepreneurial firms represent a key source of innovation for the corporation, corporations must also consider how their choices of CHQ location and composition affect the innovation outcomes of these partners. In a study of 36 incumbent pharmaceutical corporations in 377 strategic alliances with 143 VC-backed biotechnology startups, we leverage detailed hand-collected data on CHQ locations and functions to estimate the effect of the CHQ on the innovation performance of the corporations’ entrepreneurial alliance partners. We find that a 1000-km decrease in CHQ–partner distance leads to an increase of 28 forward citations for the alliance partner, i.e., a 1% decrease in the distance is associated with a 1.7% increase in innovation performance. We find that the co-located presence of the corporation’s R&D function at the CHQ attenuates the benefit of CHQ–partner proximity, particularly for alliances structured for horizontal collaboration at the same part of the value chain. This study contributes to the literatures on both CHQ design and technology alliances.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

An extensive body of prior work documents strategic importance of the location and composition of the corporate headquarters (CHQ) for the performance of business units or subsidiaries internal to the boundaries of the corporation (Bouquet and Birkinshaw 2008; Menz et al. 2015). First, the location of the CHQ relative to internal business units or subsidiaries affects the performance of those individual units. Geographic distance affects the ability of the CHQ to monitor, manage, or collaborate with subsidiaries (Roth and O’Donnell 1996; Flores and Aguilera 2007; Slangen 2011; Baaij and Slangen 2013) and has thus been particularly highlighted in studies of multinational corporations (MNCs) (Monteiro et al. 2008; Boeh and Beamish 2011). Second, the composition of the CHQ—in terms of the business functions and leadership represented or co-located at the CHQ—also affects the performance of internal business units. In a survey of over 600 CHQ, Collis et al. (2007) identify significant relevant heterogeneity in the functions present at the CHQ and link that heterogeneity to corporate performance, consistent with a more recent study of 105 European incumbent firms by Menz and Barnbeck (2017).

However, existing work on CHQ location and composition overlooks the potential effect of these CHQ design decisions on the performance of a corporation’s alliance partners outside the traditional boundary of the corporation. A separate literature on technology commercialization underscores why corporations should care about the entrepreneurial innovation stemming from their strategic alliances. Established incumbent firms partner with entrepreneurial firms to tackle the commercialization of a new product and to combine their complementary assets with the innovation production capabilities of the entrepreneurial firm (Hitt et al. 2001; Rothaermel 2001; Gans and Stern 2003; Aggarwal and Wu 2019). The portfolio of alliance relationships with entrepreneurial partners represents a significant corporate asset for long-term innovation and performance of the incumbent firm (Ozcan and Eisenhardt 2009; Sarkar et al. 2009; Jiang et al. 2010). An established stream of work maintains that the capability to manage an alliance portfolio is an important source of sustained competitive advantage (Dyer and Singh 1998; Ireland and Vaidyanath 2002; Lavie 2006). Thus, an incumbent needs to take great care in cultivating the innovation of its partners to sustain the value of its portfolio relationships and its access to future entrepreneurial innovations (Weaver and Dickson 1998; Robson et al. 2008).

Thus, we seek to extend our understanding of the consequences of the CHQ—beyond the performance of internal units within the traditional firm boundary—to the performance of external entrepreneurial alliance partners. In particular, we study the consequences of CHQ distance and functional composition for the performance of the incumbent corporation’s entrepreneurial alliance partners. Given that prior work argues that the distance and composition of the CHQ relative to internal businesses affect the value creation of those internal businesses, we argue that these same CHQ characteristics may also affect the performance of alliance partners. As the strategic apex and central unit (Chandler 1991; Menz et al. 2015) of the corporation, the CHQ occupies a core decision-making role (Campbell et al. 1995; Collis et al. 2012) in the orchestration and control of resources for the broader corporation (Deeds and Hill 1996; Birkinshaw et al. 2006; Nell and Ambos 2013). Alliance partners may fall under the purview of decisions made and resources allocated by the CHQ, making the design of the CHQ relevant to the performance of the entrepreneurial alliance partners. In turn, the capabilities of the CHQ should translate into long-term value creation and innovation among the components of the corporation (Chandler 1991; Foss 1997; Menz et al. 2015; Meyer and Benito 2016), which includes its external alliance partners.

To explore this empirically, we use alliance data from the pharmaceutical and biotechnology industry to build a startup–corporation–year panel. We manually collect detailed data on the headquarters (and subsidiaries) of the incumbent pharmaceutical corporations. In particular, we longitudinally track the location of the CHQ and several of the functions present at the CHQ over time. We exploit CHQ relocations over time as the primary source of heterogeneity in CHQ–partner distance, which enables us to account for unobservable differences in which alliances form; in a review of the CHQ literature, Kunisch et al. (2015) note that CHQ relocations tend to be frequent yet significant decisions. We document significant heterogeneity in both the CHQ–partner distance and the presence of the R&D function at the CHQ over time within corporations, as well as across corporations. Our data structure enables us to investigate the innovation performance of entrepreneurial alliance partners while controlling for incumbents, startups, and alliance relationship-specific characteristics through control variables and multiple fixed effects. To account for potential endogeneity related to the pre-alliance performance of entrepreneurial firms (affecting the incumbent’s choice of alliance partner) and pre-relocation performance of the entrepreneurial firms (affecting the decision of the corporation whether and where to relocate), we conduct several robustness tests to exclude these alternative explanations.

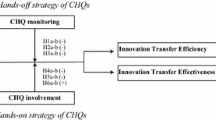

Our empirical results demonstrate a positive and statistically significant relationship between the CHQ–partner proximity and the partner’s innovation performance. We theorize that the geographic distance between incumbent firm CHQ and its alliance partners affects collaboration between the entrepreneur and the incumbent’s downstream business functions represented at the CHQ. Distance limits the efficient coordination of the incumbent’s complementary assets and the entrepreneur’s favorable innovation capabilities. We then study the moderating effect of the presence of the R&D function at the incumbent CHQ, finding that the R&D presence at the CHQ attenuates the benefit of CHQ–partner proximity. We argue that proximity to R&D at the CHQ reduces the autonomy needed for partner innovation, while also biasing the resource allocation decisions of the incumbent CHQ. We support these findings with an additional test on contingent effects of the alliance structure, namely the horizontal (collaboration at same level of value chain) versus vertical (specialization in upstream or downstream activities) forms of alliance, finding that horizontal alliance structures further exacerbate the attenuation of the proximity benefit to a partner when R&D is located at CHQ.

This study contributes to both the literatures on technology alliances and on CHQ. For the technology alliance literature, we identify the effect of incumbent organizational design choices for entrepreneurial alliance innovation. More broadly, we suggest that internal design choices of one firm can have performance implications for external parties. For the literature on CHQ, we draw attention to the implication of CHQ design for the performance of external partners, beyond existing work on CHQ design for the performance of the focal corporation (Trichterborn et al. 2016; Findikoglu and Lavie 2019). In turn, we offer another perspective on CHQ and the organizing of transactions across alternative governance structures, i.e., external and non-hierarchical, which help to shape the boundaries of the firm (Foss 2019).

Background and hypotheses development

We focus specifically on alliances between the larger incumbent corporations and the younger entrepreneurial firms. We refer to the entrepreneurial firm as the alliance partner or partner. We define alliances broadly as all kinds of contractual collaborative relationships among firms to develop and/or commercialize products (Shan et al. 1994; Deeds and Hill 1996). Encompassing both non-equity and equity alliances, this broad definition of alliances captures the richness of alliance forms in our pharmaceutical and biotechnology industry context, as the industry contains thousands of cooperative relationships formed under various contract types and purposes (Rothaermel and Deeds 2004). Whereas the relevant characteristics of the CHQ—its location and functions—are at the discretion of the incumbent corporation, the relevant performance outcome is that of the entrepreneurial firm, the counterparty in an alliance. The characteristics of the alliance itself are of course a joint decision between the incumbent and the entrepreneurial partner.

Our study considers two dimensions of the design of the CHQ and one dimension of alliance design that may have an impact on alliance partners. Our primary consideration is the distance from the CHQ to the alliance partners, where distance is a function of the location of the CHQ. Then, we consider what functions are contained within the CHQ, in particular the upstream function of R&D. As we will present later in our data section, in the pharmaceutical and biotechnology context, most downstream functions, such as marketing or manufacturing, have some presence at the CHQ. However, the most relevant function for our study is the R&D function; as we will show, CHQ vary substantially in whether they contain a dedicated R&D function, with about half of the firms without an R&D function at the CHQ. Finally, we consider the form of the alliance contract, namely, whether it specifies a horizontal or vertical relationship between the incumbent and entrepreneurial partner.

Baseline: CHQ–partner distance

We start by laying out a baseline hypothesis relating CHQ–partner geographic distance with the innovation performance of the partner, consistent with prior work on geographic distances in alliances.Footnote 1 Geographic distance is a barrier to communication between the incumbent and the entrepreneur, where distance is associated with greater communication costs (Rosenzweig and Singh 1991; Stuart and Sorenson 2003), resulting in less frequent in-person visits (Giroud 2013; Bernstein et al. 2016) and less personal interaction (Lerner 1995; Chen et al. 2010). Prior work documents this effect of distance specifically in alliances (Reuer and Lahiri 2014; Van Kranenburg et al. 2014). Distance reduces both the quality and frequency of intentional collaborative communication and incidental knowledge spillovers. Closer distance of a CHQ to its alliance partners encourages inter-firm interactions involving in-person communication between executives (Allen 1977). In turn, this improved communication leads to better coordination and knowledge sharing (Kale et al. 2002). Prior work identifies the consequences of geographic distance for the incumbent corporation’s innovation (Capaldo and Petruzzelli 2014; Hsiao et al. 2017) or financial performance (Lavie and Miller 2008; Zaheer and Hernandez 2011).Footnote 2 We now focus on the performance of the entrepreneurial alliance partner, which has not been addressed yet in the literature.

To build up to Hypothesis 1, we focus on the mechanism of managerial coordination, which we argue is the primary mechanism at play in the CHQ–partner context. There are two mechanisms—managerial coordination and scientific knowledge spillovers—that might relate CHQ–partner distance to partner innovation performance. These two mechanisms both have the same implication: CHQ–partner proximity improves the innovation performance of the partner. When we develop Hypothesis 2 below, we will consider the mechanism of scientific knowledge spillovers, where we will ultimately rule it out as a second-order consideration (at best) for CHQ design, relative to the primary consideration of managerial coordination.

Reduced CHQ–partner distance facilitates greater managerial coordination between the partner and the top corporate executives (e.g., CEO) towards the utilization of downstream business-oriented functions (e.g., sales, marketing) of the incumbent. Reduced distances improve inter-party communication, enhancing the efficiency of resource allocation as well as integration of joint activities (e.g., Reuer and Lahiri 2014). Incumbent firms amass extensive resources over time to support technology commercialization, both in the form of later-stage R&D capabilities and downstream complementary assets for activities such as manufacturing, marketing, and distribution (e.g., Zahra and Nielsen 2002; Lavie and Miller 2008). Entrepreneurial firms, particularly those backed by venture capital investors, serve as laboratories for risky early-stage R&D that can generate novel products (e.g., Lowe and Ziedonis 2006; Katila et al. 2008). A successful alliance requires efficient collaboration between the incumbent and its complementary assets as well as the innovation generated by the entrepreneurial partner. Thus, effective CHQ–partner coordination is critical (Menz et al. 2015). Furthermore, increased coordination of this form allows both parties to specialize. By having the incumbent specialize in the downstream functions for which it has complementary assets, the alliance allows the entrepreneurial partner to specialize in innovation, devoting more resources and attention towards generating patentable ideas. We elaborate on the benefits of specialization later in this section when we develop Hypothesis 3.

Over time, learning effects may further enhance the importance of the managerial coordination mechanism. Proximity engenders interaction with the CHQ, facilitating the learning process for the entrepreneurial partner who presumably has less past alliance experience (Anand and Khanna 2000). Experientially learning to manage alliances creates relational capital and accelerates the coordination process by lessening competitive tension and encouraging cooperative behavior (Kale et al. 2000). The accumulated knowledge not only creates value within the alliance where the experience was accumulated (Doz 1996; Arino and De La Torre 1998), but it also creates value across a portfolio of alliances (Anand and Khanna 2000). As the relational capital disseminates, the learning-to-learn process leads to a virtuous cycle that further improves the performance of the alliance (Arino and De La Torre 1998; Anand and Khanna 2000).

For these reasons, we argue that the distance of the CHQ to alliance partners is a determinant of partner innovation performance, motivating the following hypothesis:

Hypothesis 1: Proximity between the CHQ and an entrepreneurial alliance partner positively relates to the innovation performance of the alliance partner.

Heterogeneity in CHQ functions: research and development

However, not all CHQ are the same. Collis et al. (2007) and Young (1998) highlight the tremendous heterogeneity in size and structure of CHQ across firms: while some functions, such as legal or finance, nearly always exist at the CHQ, functions such as R&D vary in representation at the CHQ. Kunisch et al. (2012) and Kunisch et al. (2014) further document this heterogeneity in CHQ functional composition in more recent large-scale surveys that demonstrate the growing importance of CHQ design. Because our study concerns innovation productivity, we now focus on the moderating effect of the R&D function at the CHQ.

By examining heterogeneity on this dimension of CHQ composition, we can separate out the effect of the two possible mechanisms that could have motivated Hypothesis 1: management coordination and scientific knowledge spillovers. Our argument so far has considered only the management coordination mechanism. Now, given empirical variation in whether the CHQ contains the R&D function, we can test whether the scientific knowledge spillovers channel drives the main benefit of proximity. First, we will argue that, in fact, the scientific knowledge spillovers channel is not a salient benefit of CHQ–partner proximity even when the R&D function is at the CHQ, in contrast to prior work on technology alliances that emphasizes the benefits of knowledge spillovers. Then, we will present two channels through which this proximity to a CHQ with an R&D function may actually hurt partner performance.

In principle, the partner could benefit from the accumulated scientific knowledge of the R&D function at the CHQ. Taking the view that innovation results from the recombination of existing knowledge, exposure to more diverse knowledge is more likely to result in novel combinations associated with impactful innovation (Fleming 2001). Prior research on strategic alliances, especially in high-tech industries, demonstrates consistent patterns of knowledge transfers among the network of participants (Chen 2004; Sammarra and Biggiero 2008), which ultimately lead to more innovation for the involved parties as knowledge accumulates (Kotabe and Swan 1995; Zollo et al. 2002).

However, in our CHQ–partner context, we argue that there is, in fact, not a substantive amount of scientific knowledge at the CHQ and that this knowledge, if it existed, would not actively circulate to the partner. The CHQ tends to contain only a limited number of scientific staff if it does contain the R&D function (Collis et al. 2007), such as the Chief Scientific Officer (CSO). Any possible knowledge transfers would need to rely on deep inter-personal knowledge sharing by many frontline scientists actually engaged in cutting-edge scientific work, whereas the R&D activity at the CHQ typically contains only a few executives. Given that the scale and scope of R&D activity at the CHQ are minimal, we argue that the location of R&D at the CHQ would not enable much interaction between scientists that would allow for the scientific knowledge spillovers to alliance partners.

While there are only limited benefits from scientific knowledge spillovers engendered by CHQ–partner proximity, we propose two channels for which the presence of the R&D function at CHQ may attenuate the benefit of proximity. First, the partner needs autonomy from the incumbent to generate innovation, but the partner’s autonomy could be restricted when the R&D function is present at the CHQ and there is CHQ–partner proximity. The entrepreneurial partner needs to preserve flexibility, slack, and autonomy to continue generating exploratory innovations (Puranam et al. 2006). When organizing for innovation, the corporation must balance coordination with the preservation of the autonomy of the alliance partner (Puranam et al. 2006). To the incumbent firm, technology startup firms are attractive sources of innovation because the startup partner does not face the organizational rigidity and inertia that limit the larger established corporation (Zenger 1994; Doz 1996; Brown and Eisenhardt 1997). However, the deeper interactions stemming from their proximity could enhance intervention by the established corporation if the R&D function is present at the CHQ because the CHQ may no longer delegate its research activities solely to its proximate partners. Hence, the strengthened intervention by the incumbent, through the R&D function at its CHQ, may hurt the existing innovation potential of the startup partner. This effect occurs as the incumbent’s unfavorable atmosphere for innovation negatively affects the activity of the partner. If the R&D function is present at the CHQ, then proximity to the CHQ makes it more likely that the incumbent might intervene in the activities of the startup, limiting its slack.

Second, the presence of the R&D function at the CHQ may bias the ability of the CHQ to efficiently allocate resources that might be better used at the alliance partner as opposed to being used at the internal R&D function. As a strategic apex and central unit of the corporation (Chandler 1991; Menz et al. 2015), the CHQ acts as a control tower for corporate resources (Deeds and Hill 1996; Birkinshaw et al. 2006) and must make decisions to allocate those resources across its internal business units and external alliance partners. Given constraints on corporate resources, the alliance partners compete for access to those resources (Aggarwal 2014), putting the internal business units and the external alliance partners in an adversarial position (Goerzen 2005). Having the R&D function at the CHQ may make it more likely that the CHQ favors its internal R&D activities over external partners in its decisions to allocate corporate resources, given that the co-location of the internal R&D function draws more attention from corporate leadership. For example, Bouquet and Birkinshaw (2008) find that geographic distance moderates the attention that a CHQ pays to a particular subsidiary, and we extend this argument to corporate functions and alliance partners alike. Allocating fewer resources to the alliance partner reduces the slack available to the partner, where slack fosters experimentation (Nohria and Gulati 1996).

Due to reduced partner autonomy and biases in incumbent resource allocation, we argue that the presence of the R&D function at the CHQ attenuates the benefit of CHQ–partner proximity:

Hypothesis 2: The presence of an R&D function at the CHQ attenuates the positive relationship between CHQ–partner proximity and the innovation performance of the alliance partner.

Horizontal versus vertical alliances

We argued above that the location of an internal R&D function at CHQ has an attenuating effect on the proximity benefit otherwise expected to accrue to alliance partners. We now turn to the implications of the structure of the alliance itself to verify that the previously described predictions result from improved managerial coordination but not from knowledge spillovers. We now consider whether the structure of the alliance has implications for both the effect of distance and the moderating effect of the R&D function at the CHQ.

We characterize alliances between incumbent firms and entrepreneurial firms into two types: horizontal and vertical. In our usage, horizontal alliances are those representing a horizontal relationship between the incumbent and the entrepreneur, where the contract specifies joint activities between parties at the same level of the value chain, such as co-development or collaboration (Hagedoorn and Schakenraad 1994; Kotabe and Swan 1995; George et al. 2001).Footnote 3 In contrast, vertical alliances are those contracts where one party is designated to be responsible for an activity further upstream or downstream than the other. As Stuart et al. (2007) note, the entrepreneurial partner generally addresses upstream activities (e.g., R&D), while the incumbent generally engages in downstream activities (e.g., marketing).

We argue that the horizontal alliance form, as opposed to the vertical alliance form, further attenuates the proximity benefit to a partner when R&D is located at CHQ for two reasons. First, a horizontal alliance implies greater intervention by the incumbent into the innovation activities of the entrepreneurial partner, which hurts the ability of the entrepreneurial firm to operate autonomously. Horizontal alliances prescribe collaboration between the incumbent and the entrepreneur at a given part of the value chain. Given that the resource-constrained entrepreneurial partner necessarily operates on a comparatively limited scope of the value chain, any horizontal collaboration implies that the incumbent is collaborating on the finite part of the value chain where the entrepreneur operates. For an entrepreneur whose primary purpose is R&D towards new patentable technology, intervention by the incumbent encumbers the entrepreneur with the detrimental qualities of the incumbent’s innovation capacity, namely the organizational rigidity and inertia of the incumbent corporation (Zenger 1994; Doz 1996; Brown and Eisenhardt 1997).

Second, the vertical alliance form allows the entrepreneurial partner to specialize in innovation-related activities. Vertical alliances suggest intended specialization by the parties, with coordination limited to the interface between different levels of the value chain, e.g., the incumbent coordinating on manufacturing a drug discovered by the entrepreneurial partner. In these vertical alliances, corporations can leverage the existing innovation of the startup firm in combination with the complementary assets of the corporation (Rothaermel and Deeds 2004; Lavie and Rosenkopf 2006), where the incumbent’s exploitation-oriented capabilities apply to downstream activities such as manufacturing and applied late-stage research. Entrepreneurial success then depends on vertical coordination with established firms (Stuart et al. 2007).Footnote 4

In most industries, the CHQ contains representatives from the business functions (Collis et al. 2007) and, especially in our context, the CHQ almost always contains leadership for the downstream functions that leverage the complementary assets of the incumbent. Improved coordination from CHQ–partner proximity in a vertical alliance allows the entrepreneur to leverage these downstream resources of the incumbent, enabling the entrepreneurial partner to dedicate its own limited resources towards its upstream innovation activities. Baum et al. (2000) note that vertical alliances are particularly effective for enhancing innovation in high-technology industries such as biotechnology.

For these two reasons—decreased partner autonomy and decreased partner specialization—we argue that the horizontal alliance form further attenuates the benefit of CHQ–partner proximity when R&D is present at the CHQ:

Hypothesis 3: When the R&D function is present at the CHQ, the positive relationship between CHQ–partner proximity and the innovation performance of the alliance partner is further attenuated for a horizontal alliance relative to a vertical alliance form.

Empirical approach

Industry setting

To test the three hypotheses, we study strategic alliances in the pharmaceutical and biotechnology industry, which provides a rich source of data for empirical investigation. There have been frequent strategic alliances in the biotechnology industry since the early 1970s (Rothaermel and Deeds 2004). These alliances allow firms in this industry’s technology-intensive environment to share their knowledge and exploit complementary assets to develop and commercialize their products (Powell et al. 1996; Baum et al. 2000).

The characteristics of the pharmaceutical and biotechnology industry align well with our research framework. In this industry, alliances facilitate upstream horizontal collaboration—for sharing cutting-edge knowledge for new product development—and vertical upstream–downstream transaction relationships—for commercializing products developed by one party using the complementary assets held by the other (Baum et al. 2000).

This setting conveniently allows for a contextually legitimate metric of performance: patenting outcomes. Patent activity in the industry plausibly represents innovation performance because biotechnology firms use patents as the primary method of appropriating value from innovation (Levin et al. 1987). Patent production in this industry is particularly strong, giving firms a strong incentive to generate patents aggressively (Deeds and Hill 1996). Prior work also shows that firms leverage shared alliance resources in the race for patents (Deeds and Hill 1996; Baum et al. 2000). While some work interprets the number of patents granted to a firm as a measure of the direct output of R&D investment (Shan et al. 1994), our main dependent variable of forward citations intends to capture the economic potential and innovative impact of the entrepreneurial partner’s R&D activity.

Data and sample

We combine hand-collected CHQ data with archival data on alliances, incumbent and startup location, incumbent and startup patenting activity, and incumbent and startup firm characteristics. Our data construction starts with a set of incumbent pharmaceutical corporations for which we hand-collect CHQ characteristics over time. We match those corporations to entrepreneurial alliance partners. We build patent performance outcomes for the entrepreneurial alliance partners. For both corporations and their partners, we collect office location data and other time-varying firm characteristics. The final data consists of startup–incumbent–year observations.

We start with 36 top publicly traded pharmaceutical corporations for which we can locate a CHQ in the United States.Footnote 5 We manually collect data on CHQ characteristics of all 36 pharmaceutical incumbent firms over time. We define the CHQ as the office where the CEO is located. In most cases, we confirm the location of the US CHQ in each year based on information in the corporation’s annual 10-K filings in the EDGAR database of the US Securities and Exchange Commission (SEC).Footnote 6 We hand-collect data on the functional composition of the CHQ, documenting whether the CHQ contains the R&D, legal, and manufacturing functions. We also collect data from Dun & Bradstreet (D&B) on the CHQ size and spatial design. The Appendix details the manual CHQ data collection process.

Table 1 summarizes the functions, characteristics, and spatial design of CHQ of the 36 incumbents over time. Each corporation has a unique time-series for which they appear in our data, meaning that they each have a different initial year and final year in which we observe them. In panel A, about half of the CHQ have an R&D function in the initial year they appear in our data, and the percentage decreases to less than 40% in the final year they appear. In contrast to the across-firm and within-firm-over-time heterogeneity of the R&D function at CHQ, a majority of corporations have legal and manufacturing functions at the CHQ over time. Importantly, for our empirical study, panel B shows that 70% of the incumbents experience at least one CHQ relocation, providing rich time-sectional variation in CHQ–partner distance.

The underlying alliance data consists of all strategic alliances from 1985 to 2009 between these 36 pharmaceutical corporations and venture capital-backed entrepreneurial firms located in the USA. The alliance data from Deloitte Recombinant Capital (Recap) contains party names, contract start dates, contract terms, and alliance-associated technology types. The alliance contracts linking the 36 incumbent corporations and 386 startups form 1299 unique startup–incumbent dyads, where each dyad has one or more underlying alliance contracts.Footnote 7 From these dyads, we set up the data as a startup–incumbent–year panel, where each startup–incumbent alliance relationship can last for several years and each startup–incumbent dyad has multiple observations.Footnote 8 Because the alliance contract end dates may not be announced publicly, we assume a startup–incumbent alliance relationship lasts 5 years from the observable start year of their first alliance contract, a typical alliance duration (Stuart 2000; Lavie and Miller 2008). If a startup–incumbent renews its contract within the 5-year window of a previous contract, we continue the time series for that relationship for 5 years after the renewal year.

To measure or control for innovation performance, we then link these startup partners and incumbent corporations to their patenting history. We use the Harvard Institute for Quantitative Social Science (IQSS) version of the United States Patent and Trademark Office (USPTO) patent grant data created by Li et al. (2014).Footnote 9 Given the lack of unique and common firm identifiers, we engaged in a challenging and lengthy matching process to link incumbent and startup firm names from Recap to assignees in the patent data. We standardize firm names and fuzzy match these standardized names across datasets, based on the fuzzy matching methods by Wasi and Flaaen (2015).Footnote 10 We then manually verify those matches. We end up identifying patent information for 284 startups in the Recap data, tentatively accounting for 954 startup–incumbent dyads and 3953 startup–incumbent–year observations.

To measure geographic distance between the CHQ (or corporate subsidiaries) and the startup alliance partners, we use detailed historical location data from D&B. The D&B data covers a large portion of firms and their business units located in the USA between 1969 and 2016. We use the same fuzzy matching method to identify the incumbent and startup firms from the Recap–IQSS data in the D&B data. From the 284 startups in the last step, this matching process results in 143 startups; we verify that the startup location data is missing at random relative to observable patent outcomes.Footnote 11 Each corporation has multiple offices including subsidiaries; in some cases, more than one office may be labeled as an HQ, but we identify a single CHQ in each year based on the previously described manual process. We assume the entrepreneurial alliance partners have only a single establishment, which is true for the vast majority of these startup firms; we exclude startup branch locations in our data. The D&B data provides office ZIP codes, which we convert to longitudes/latitudes and match to core-based statistical areas (CBSA) based on US Census Bureau data. The D&B data also provides longitudinal information on the office-level SIC code, size (employee count), and age. For control variables, we obtain incumbent corporation characteristics from Compustat and startup partner characteristics from Thomson ONE VentureXpert.

The final dataset used in our regression analysis consists of 1478 startup–incumbent–year observations, comprising 36 incumbent corporations and the 143 startup alliance partners forming 377 unique startup–incumbent dyads. The Appendix presents further detail about the sample construction and archival dataset merging process. Our number of dyad–year observations is similar to (Lavie and Miller 2008; Capaldo and Petruzzelli 2014) or greater than (Zaheer and Hernandez 2011; Van Kranenburg et al. 2014) those of previous studies.

Variables

Dependent variable

We measure startup partner innovation performance by the number of forward citations, Forward Citation Count. Compared to just using the raw count of patents granted, the number of forward citations better captures the economic importance of the innovation (Trajtenberg 1990) and better predicts firm productivity (Hall et al. 2005; Kogan et al. 2017). We define Forward Citation Count by the count of forward citations to the focal firm’s patent applications in the focal year, where the forward citations are from US patents applied for in the 4-year window after the focal year that cites a focal firm’s patent. For example, suppose a firm A applied for two patents B and C at year t. If each patent was cited 10 times and 20 times, respectively, between t and t + 4, then firm A’s forward citation at t is counted as 30. Consistent with the conventions in the literature (e.g., Aggarwal and Hsu, 2013), limiting forward citations to a 4-year window allows comparison of innovation performance across years: earlier patents mechanically have more total forward citations than more recent patents because there is more time for the forward citations to accumulate.

Independent variables and moderators

The variable Distance CHQ to Startup measures the geodetic geographic distance between incumbent CHQ and their startup alliance partners in thousands of kilometers.Footnote 12 In the regression models, we multiple this and other distance measures by − 1 to facilitate the interpretation of the point estimates as being the benefit of proximity from reduced distance. Figure 1 shows the distribution of the primary independent variable Distance CHQ to Startup and the control variable Distance Subsidiary to Startup (Closest), which we describe in the next section. There is no significant difference in the two distributions relative to the R&D presence at CHQ.

Distribution of distance between corporations and startup partners. The histograms show the distribution of the primary independent variables measuring distance Distance CHQ to Startup and the control variable Distance Subsidiary to Startup (Closest) in the top and bottom panel respectively. We separately display CHQ with an R&D function (dark grey) and CHQ without an R&D function (light transparent grey). There is no significant difference in the distribution of observed distances by R&D presence at CHQ

We include two moderators to capture heterogeneity in the effect of CHQ–partner distance on partner performance. The first moderator CHQ R&D Function takes a value of 1 if the R&D function is present at the CHQ in a year. We assume that CHQ contains the R&D function if the CSO is primarily located at the CHQ. To get this information, we access the BoardEx database to identify the name of each firm’s CSO. We track her office location using professional longitudinal profiles (e.g., Linkedin accounts) and articles announcing her appointments from Factiva and LexisNexis.Footnote 13

The second moderator variable Horizontal Alliance takes a value of 1 when an alliance contract specifies horizontal collaborative activity, as opposed to a vertical relationship where it takes a value of 0. An alliance is considered to be horizontal if it includes at least one contract term about co-development, co-marketing, co-promotion, or cross-license, as listed in the Recap data.

Control variables

We control for a battery of time-variant incumbent corporation, startup partner, and alliance characteristics. To control for the incumbent’s overall spatial design of its one or many designated US headquarters, of which only one is the CHQ, the binary variable CHQ Consolidated takes a value of 1 if the CHQ and all other HQ units are co-located in one city. This case accounts for 61% of the observations. We use this variable on its own and in an interaction term.

We use Distance Subsidiary to Startup (Closest) to control for the effect of proximity between corporate subsidiaries and their alliance partners. This variable measures the geographic distance from a startup partner to the closest research-related subsidiary location of the corporation.Footnote 14 This variable assumes that an alliance partner could work with the nearest corporate subsidiary.

We include three control variables for alliance characteristics: exploitation versus exploration orientation with Alliance Exploitation; equity investment by the incumbent with Alliance Equity and Joint Venture; and time length with Alliance Duration. For Alliance Exploitation, we assign a value of 1 if the alliance contract contains more terms related to exploitative activities such as commercialization or manufacturing; explorative activities are those related to research or new product development (Rothaermel and Deeds 2004). We group equity alliances and joint ventures together because they provide similar ownership incentives to the incumbent. Lastly, Alliance Duration is the difference of the first year and the focal year of a startup–incumbent–year time series.

We control for the dispersion of subsidiaries because widely scattered incumbent units could affect resource allocation that could be associated with startup performance. Incumbent Subsidiary Dispersion counts the unique CBSAs from all operating corporate subsidiary locations for each incumbent in each year.Footnote 15 Incumbent Acquired indicates whether an incumbent corporation is acquired by another corporation, taking a value of 1 in the years after the acquisition, to capture structural changes in the incumbent corporation.

We control for the spatial dispersions of the incumbent’s and startup’s alliance portfolios analogously by counting the unique CBSAs of all alliance affiliates in a given year, leading to the respective variables Incumbent Portfolio Dispersion and Startup Portfolio Dispersion.

To control for pre-alliance innovation performance of the incumbent and the startup, we create the 5-year lagged patent count variables Incumbent Patent Count (Five-Year Lagged) and Startup Patent Count (Five-Year Lagged)).Footnote 16

We control for other incumbent and startup firm characteristics. The age variables Incumbent Age and Startup Age are relative to the founding year of the firm. Since the firm size distribution for the incumbents and the startups are very different, we control for their sizes in a slightly different way. Incumbent Size (Logged) is the logged total number of employees in a year, logged to normalize the right-skewed distribution. Startup Size (Binary) is a dichotomous variable taking a value of 1 if a startup has more than 100 employees; the distribution of startup employee count is relatively discontinuous and narrow.

We control for startup functional heterogeneity with Startup Manufacturing, which takes a value of 1 if the startup conducts manufacturing activities. Startup Capital Investment (Cumulative) is the stock venture capital investment in million dollars received by the startup up to the focal year, intended to control for startup financial resources.

Analysis

To estimate the effect of the independent variables and moderators, we exploit time-sectional heterogeneity in CHQ design and alliance form. In particular, we seek to isolate the impact of the CHQ–partner distance on startup innovation performance from all potential confounding factors: identification of the coefficient for Distance CHQ to Startup comes primarily from variation over time in CHQ location (i.e., CHQ relocation). We control for an extensive battery of time-variant alliance, incumbent, and startup characteristics. Pre-alliance incumbent and startup performance control for pre-alliance trends. The main regression model takes the following form for startup–incumbent dyad i, startup j, incumbent corporation k, and year t:

where X is a vector of alliance characteristics, Y is a vector of incumbent characteristics, Z is a vector of startup characteristics, ui is startup–incumbent fixed effects, ηj is startup location fixed effects, θk, tis incumbent CHQ location fixed effects, ρt is year fixed effects, and εi, t is the usual error term. We use CBSA as the location unit for the startup and incumbent location fixed effects, which capture the regional clusters of the US pharmaceutical and biotechnology industry (e.g., Owen-Smith and Powell, 2004). Recall that Distance CHQ to Startup is multiplied by − 1 in the regressions so that it represents proximity (i.e., its positive coefficient implies that CHQ–startup proximity is beneficial to startup innovation).

To estimate Eq. (1), we use a high-dimensional fixed-effects (HDFE) ordinary least squares regression model. Because we include four high-dimensional fixed effects, the HDFE regression model provides more consistent estimates than a traditional OLS fixed-effects regression model does when there is more than one high-dimensional fixed effect (Guimaraes and Portugal 2010).Footnote 17 Robust standard errors are clustered at the startup–incumbent level. We weight startup–incumbent–year observations by incumbent return on assets (ROA) to account for the incumbent’s significance.Footnote 18

From this baseline model that tests Hypothesis 1, we include (triple) interaction terms to estimate heterogeneity in the effect of CHQ–partner proximity with respect to CHQ composition and alliance form. The test of Hypothesis 2 includes the variables in the baseline model and two additional variables, CHQ R&D Function and Distance CHQ to Startup × CHQ R&D Function. The test of Hypothesis 3 adds three further variables, Horizontal Alliance, CHQ R&D Function × Horizontal Alliance, and Distance CHQ to Startup × CHQ R&D Function × Horizontal Alliance, to the set of variables used to test Hypothesis 2. While we control for observable confounding factors in Eq. (1), other unobservable factors may cause endogeneity. We consider and rule out two potential sources of endogeneity: pre-alliance bias and pre-relocation bias. To test these two potential biases, we investigate the relationship between CHQ–partner distance and ex ante innovation performance, presented in the endogeneity and robustness checks section of the Appendix.

Results

We first present descriptive statistics before discussing the main results. Table 2 documents the summary statistics for all variables used in the main regressions and the robustness tests. Among these 1478 startup–incumbent–year observations, 34% involve a CHQ where the R&D function is present and 10% involve horizontal alliance relationships. For all the explanatory variables used in the main analysis, Table 3 presents the correlation matrix and variance inflation factors (VIF) of them; we do not observe a significant multicollinearity problem.Footnote 19

Table 4 summarizes the three hypotheses and the empirical findings for each. Hypothesis 1 argues that the entrepreneurial partner benefits from proximity to the CHQ in general. However, Hypothesis 2 predicts that if an R&D function is present at CHQ, the partner’s benefit from CHQ proximity attenuates. Hypothesis 3 predicts that this benefit attenuates even further for horizontal (as opposed to vertical) alliance forms, for CHQ with an R&D function. We find empirical support for all these predictions.

Table 5 presents the main empirical results. The first column (5.1) tests Hypothesis 1. We find that a 1000-km decrease in the CHQ–partner distance (an increase in Distance CHQ to Startup, which is the distance multiplied by − 1) is associated with an increase of 28 forward citations to patents assigned to the entrepreneurial alliance partner (p < 0.10). In terms of elasticity, a 1% decrease in distance leads to a 1.7% increase in innovation performance. The elasticity is calculated by taking the ratio of the mean values of Distance CHQ to Startup and Forward Citation Count and mutiplying that ratio (0.058) by the estimated coefficient of Distance CHQ to Startup (28.415). The second column (5.2) presents the test of Hypothesis 2, where the key variable is the interaction term Distance CHQ to Startup × CHQ R&D Function. We confirm that the benefit of proximity attenuates if the CHQ contains the R&D function: the size of this statistically significant effect represents a decrease of about five forward citations from the benefit of proximity for partners associated with CHQ without the R&D function (p < 0.01). In other words, if an R&D function is present at CHQ, a 1000-km decrease in the CHQ–partner distance is associated with an increase of 23 forward citations (adding together the coefficients on Distance CHQ to Startup and Distance CHQ to Startup × CHQ R&D Function). The significantly negative coefficient of Distance Subsidiary to Startup (Closest) also implies that proximity from research-related units of incumbents may hurt startup innovation performance.

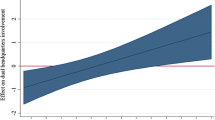

The results in the third column (5.3) test Hypothesis 3. The negative coefficient of the triple interaction term (Distance CHQ to Startup × CHQ R&D Function × Horizontal Alliance) means that the benefits from CHQ–partner proximity further attenuates when a partner—aligned with the corporation with an R&D function at CHQ (CHQ R&D Function)—engages in a horizontal alliance rather than a vertical alliance with the corporation (p < 0.10). In this model, the startup experiences an additional decrease of eight forward citations from the benefit it would otherwise get from a 1000-km decrease in CHQ–partner distance with a CHQ with an R&D function. Figure 2 visually compares the heterogeneity in predicted performance related to CHQ R&D Function and Horizontal Alliance.

Distance CHQ to Startup on Innovation Performance. The lines represent the relationship between the predicted forward citation count and the CHQ–partner distance in each of the circumstances of the three hypotheses. The predicted values are calculated by the estimated coefficients in the main model. The predicted forward citation count is scaled to 150 when the distance is zero so that we can clearly observe how it changes as the distance increases

The Appendix documents several additional robustness checks and analyses to rule out endogeneity associated with pre-trends in alliance formation and CHQ relocation.

Discussion

Contributions to literature

We contribute to both the literatures on CHQ and on technology alliances. For the literature on CHQ, we extend the understanding of the consequences of CHQ design beyond the boundary of the firm to its external alliance partners. Although prior work addresses the performance consequences of the CHQ, it focuses on the impact on the corporation itself, primarily through the effects on the internal business units (and subsidiaries) of the firm. We extend this logic to argue that those characteristics might also affect alliance partners.

A comprehensive view of corporate strategy not only takes into account the activity inside the boundary of the corporation, but also the activity taking place in the ecosystem of arms-length affiliates engaged in long-term relationships with the corporation (Grigoriou and Rothaermel 2017). However, in contrast to work on internal subsidiaries, the external alliance partners face a different set of CHQ design trade-offs than internal business units do. First, the more significant organization boundary that separates the alliance partner from the CHQ, than separates an internal business unit from the CHQ, makes coordination more important but also more difficult. This more severe organization barrier may also limit beneficial knowledge spillovers (Mowery et al. 1996). Second, given that the corporation does not capture all the value generated by the entrepreneurial partner’s innovation, the CHQ has different resource allocation incentives with respect to the alliance partner than to its internal business unit; the incumbent may more cautiously and skeptically allocate resources, putting the alliance partner in competition with other partners (Aggarwal 2014) and potentially with the internal business units.

For the literature on technology alliances, we suggest that the characteristics of the CHQ have salient effects on alliance performance. Prior studies document the performance consequences of alliance characteristics (e.g., Baum et al. 2000; Rothaermel and Deeds 2004), partner characteristics (e.g., Stuart 2000; Kale et al. 2002), and both together (Saxton 1997; Sampson 2007). However, this body of work overlooks the implications of CHQ design, which previously mentioned work documents as an important determinant of performance for other corporate-specific performance outcomes. Our work sheds light on the possibility of CHQ design affecting the upstream–downstream coordination (Rothaermel and Deeds 2004; Lavie and Rosenkopf 2006) within an alliance, but not necessarily the knowledge spillovers within an alliance (Mowery et al. 1996; Reuer and Lahiri 2014). Furthermore, we extend the understanding of alliance structure, namely the horizontal versus vertical design of the alliance (e.g., Kotabe and Swan 1995; Mowery et al. 1996) to suggest that the consequences of alliance structure are contingent on CHQ design.

Managerial implications

Our findings have implications for executives of large corporations as well as for entrepreneurial founders. Before noting the specific actions they might consider, we first address the reasons why incumbent executives should take responsibility for the innovation performance of entrepreneurial alliance partners. First, an incumbent can commercialize future innovations generated by the partner (Rothaermel and Deeds 2004). Second, an incumbent directly profits from partner financial performance in equity alliances and joint ventures (Sampson 2007). Third, building a track record for facilitating partner performance engenders a corporate reputation that can lead to future success in securing new alliance partners and maintaining relationships with existing partners (Weaver and Dickson 1998; Robson et al. 2008). Thus, incumbent corporations cannot ignore the innovative performance of their alliance partners and need to consider them in their strategic decisions around CHQ characteristics.

Given those reasons, our conceptual model and empirical findings suggest that executives designing CHQ should take alliance partners into account. First, a corporation can improve partner innovation performance by locating its CHQ closer to its partners, while balancing the distance to partners with distance to its internal business units (Flores and Aguilera 2007; Slangen 2011; Baaij and Slangen 2013) and foreign subsidiaries (Roth and O’Donnell 1996; Boeh and Beamish 2011). Second, when deciding on which functions to co-locate at the CHQ, executives should cautiously evaluate whether to include the R&D function at the CHQ, given its undesirable moderating effects on the coordination between the CHQ and alliance partners.

Our findings also have implications for the entrepreneurs that make up the ecosystem of partners of the incumbent corporation. Entrepreneurs should locate closer to the CHQ of corporations they expect to partner with because doing so can drive beneficial coordination leading to their own innovation performance. And while entrepreneurs may not have sufficient discretion to select for alliances with corporations without an R&D function at the CHQ, they may want to cautiously evaluate the extent to which they might expect benefits from scientific knowledge spillovers and focus more on the biases that the CHQ might exhibit in resource allocation and coordination unfavorable to the entrepreneur.

Limitations and future research

While we manually collect extensive data on CHQ to supplement the rich archival data available on alliances, public incumbent firms, and venture capital (VC)-backed entrepreneurial firms, this data also represents the primary limitation to the work. We now outline four ways in which future scholars could extend and improve on the present findings.

First, other studies could consider a broader battery of CHQ characteristics as determinants of entrepreneurial alliances performance. While we focus on CHQ–partner distance and the presence of the R&D function at the CHQ, it is likely that other CHQ characteristics will affect partner performance through similar theoretical channels. With respect to the incidence of functions appearing at CHQ, most legal and financial (e.g., treasury, taxation, control) functions do not vary a sufficient amount for an empirical study of this sort (Collis et al. 2007). However, there are several other functions that Collis et al. (2007) report as varying substantially across incumbent corporations—e.g., training, government relations, purchasing—that would likely have implications for alliance performance. For example, the availability of purchasing at CHQ may have implications for the ability of the less prominent alliance partner to participate in lower-cost volume purchases of scientific equipment and consumables that can increase the efficiency of the alliance partner’s work.

Prior work also shows the importance of dedicated M&A or alliance management functions at the CHQ. Although we were unable to collect data on these dedicated functions in the present study, future work could assess whether these dedicated M&A or alliance functions at CHQ affect performance of entrepreneurial partners. Dyer et al. (2004) argue that corporate strategy for M&A versus alliance activity is not interchangeable, suggesting a need for dedicated (but also coordinated) functions for each at CHQ. In this vein, Trichterborn et al. (2016) show that a dedicated M&A function benefits the focal corporation’s M&A performance and enhances M&A learning effects. Likewise, in a response to contradictory findings regarding the consequence of a dedicated alliance function, Findikoglu and Lavie (2019) find that a dedicated alliance function can improve alliance value creation by enabling the focal corporation to better leverage its firm-specific routines for managing alliances.

Second, further studies could address the antecedents to CHQ design as a function of a corporation’s alliance strategy. In a study of MNCs, Collis et al. (2012) demonstrate that CHQ size, in terms of headcount or functions, is a function of the organization of the firm, where the size of CHQ increases with the geographic scope of the MNC. The scope of the alliance portfolio may have a similar effect on the CHQ, where the scope can vary in geography, but also in technology (Sarkar et al. 2009) or stage of the value chain (upstream or downstream) (Jiang et al. 2010). These dimensions of scope can vary not only in terms of alliance partner characteristics but also in terms of the specific alliance contracts.

Third, we only consider one dimension of distance—geographic distance—and prior work suggests other concepts of distance represent meaningful determinants of performance for collaborating firms (Vassolo et al. 2004; Hoffmann 2007). For example, extant literature has studied institutional distance (Van Kranenburg et al. 2014), cultural distance (Kogut and Singh 1988), economic distance (Tsang 2007), and composite distance index (Lavie and Miller 2008). Geographic distance may interact with other types of distance, and the results, without considering the interactions, would not necessarily fully capture these considerations. In particular, Reuer and Lahiri (2014) show that the impact of geographic distance on the formation of R&D collaborations is moderated by market relatedness and technological similarity. Thus, examining the impact of geographic distance with other dimensions of distance would expand our research scope and strengthen the results.

Fourth, further studies could implement other dimensions of innovation performance, and even financial performance, by the entrepreneurial firm. Even though forward citations capture firms’ innovation performance more broadly than the raw number of patents in terms of their economic importance (Hall et al. 2005; Kogan et al. 2017), there are scholars who assert that forward citations are still not a perfect measure of innovation performance because forward citations cannot consider variation in the importance of technologies that is not directly related to patents’ creativeness (Bernstein 2015). Alternatively, Bernstein (2015) constructs “scaled citations” that weight less on patents whose citation count is affected by the upward trend of their technology class. In addition, “scaled originality” is the count of forward citations to a patent outside of its original technology field. It also weights more on diverse selection of outside industries. Beyond the impact of the patentable innovation, scholars also propose a variety of performance measures that could be generated from the patent data (Jaffe and De Rassenfosse 2017): generalizability/originality (Trajtenberg, Henderson and Jaffe 1997; Jung and Lee 2016), complexity (Fleming 2001), and inter-firm citation patterns (Jaffe et al., 1993).

Conclusion

Our findings demonstrate that CHQ characteristics have a significant impact on the performance of entrepreneurial alliance partners. We conduct an empirical study of public incumbent corporations and VC-backed entrepreneurial firms in the pharmaceutical and biotechnology industry. We find that reducing geographic distance between the CHQ and the entrepreneurial alliance partner significantly improves the innovation performance of the partner. However, the presence of the R&D function at the CHQ attenuates the benefits of the proximity. We confirm the conceptual logic behind this result by also demonstrating that horizontal alliances, as opposed to vertical alliances, further attenuate the benefits of proximity when the CHQ contains the R&D function.

Availability of data and materials

The data sets that support the findings of this study are available from Deloitte Recombinant Capital, Dun & Bradstreet, ThomsonONE, and Compustat. Restrictions apply to the availability of these data sets, which were used under license for the current study, and so are not publicly available. Data is however available from the authors upon reasonable request and with the permission of the above organizations. Publicly available data from Harvard IQSS was also used.

Notes

Empirically, we measure the geographic distance between the CHQ of the incumbent firm and the primary office of the entrepreneurial alliance partner, where we define CHQ as the office where CEO is located.

We take a more general definition of a horizontal alliance than does prior work in strategy. Baum et al. (2000) consider horizontal alliances only between pairs of biotechnology firms and not between biotechnology and incumbent pharmaceutical firms. Oxley (1997) studies horizontal technology transfer alliances only.

Rothaermel and Deeds (2004) find that horizontal relationships (exploration alliances) originally focusing on early-stage R&D transform into exploitation alliances interacting vertically as the corporation eventually tries to impose more control in the relationship to commercialize the products, rather than collaboratively developing new technology.

Although some of these firms have an international headquarters, we include them if they have a United States headquarters. For example, the global healthcare company Novartis International AG is included in our data because one of its multiple global headquarters is located in the USA. We include 11 foreign-based corporations, representing 31% of our starting sample of 36 incumbent firms.

For the firms whose CHQ locations are not available in the EDGAR database, we use the BoardEx database to identify the CEO of each corporation. We then identify public longitudinal profiles (e.g., Linkedin profile) to identify where the CEO was based during her employment.

In other words, on average, a corporation contracts with 1299 ÷ 36 = 36 different entrepreneurial alliance partners during the whole period.

There are 8505 startup–incumbent–year observations in the original Recap data, meaning that there are 8505 ÷ 1299 = 6.5 years of observations for each startup–incumbent dyad, on average.

Li et al. (2014) provide a clean, inventor-disambiguated version of the data on patents granted by the USPTO. Their data derives from patent data that the National Bureau of Economic Research (NBER) patent database first codified.

Wasi and Flaaen (2015) provide a Stata module to execute a fuzzy match. The fuzzy match determines a matched record if it passes a match score cutoff where a match score denotes similarity of the standardized firm names. We set the threshold at 0.95 and then manually checked the matches.

To investigate potential bias from missing data, we conducted a t test comparing the forward citations of startups with available location information (143 startups) with startups with missing location information (141 startups). We find no evidence of missing data bias. We fail to reject the null hypothesis that there is no difference in innovation performance between the two groups (t = 0.608, p = 0.545).

Geodetic distance is the length of the shortest curve between two points along the surface of a mathematical model of the earth. Our calculation uses the same model of the earth as used by Google Earth/Map and GPS devices.

If neither of these methods works, we visit each corporation’s official website and historical websites (via the Wayback Machine) to identify location information for their R&D activity.

Subsidiaries whose unit-level SIC is “Commercial Physical and Biological Research” (8731) are considered research-related for our purposes. On average, each incumbent had 12 subsidiary units per year, and three of them were related to research. By this definition, the maximum number of research-related subsidiaries is 32, for Amgen Inc. in 2008.

We exclude non-operating subsidiaries, which are those that list zero employees. These are likely shell entities or “mailbox” locations that exist for tax or legal reasons.

We use a 4-year window of forward citations in our research. We use the number of patents at t-5, because its effective period expires one year before having an alliance, to avoid any contamination from forward citations of those past patents to forward citations of the focal-year patents.

“High-dimensional” means that a fixed effect consists of many values. If a model includes dummy variables for each fixed effect, the model becomes saturated with too many covariates and loses huge degrees of freedom, as constrained by the sample size.

Without this weighting, we still find results consistent with our main findings; this alternate analysis preserves the same coefficient signs and maintains statistical significance.

None of the VIF measures exceed the conventional threshold of 5 indicating significant multicollinearity. In particular, the main independent variable Distance CHQ to Startup and the two main moderators have VIFs ranging from 1 to 2, which would be considered safe under even a stricter criteria than the conventional rule of thumb.

Abbreviations

- CBSA:

-

United States Census Bureau Core-Based Statistical Area

- CHQ:

-

Corporate headquarters

- CSO:

-

Chief scientific officer

- D&B:

-

Dun & Bradstreet

- HDFE:

-

High-dimensional fixed effects

- IQSS:

-

Harvard Institute for Quantitative Social Science

- MNC:

-

Multinational corporation

- R&D:

-

Research and development

- Recap:

-

Deloitte Recombinant Capital

- ROA:

-

Return on assets

- SEC:

-

United States Securities and Exchange Commission

- USPTO:

-

United States Patent and Trademark Office

- VC:

-

Venture capital

References

Aggarwal VA (2014) Alliance portfolios and resource competition: how a firm’s partners’ partners influence the benefits of collaboration. INSEAD Working Paper, Fontainebleau

Aggarwal VA, Hsu DH (2013) Entrepreneurial exits and innovation. Management Science 60(4):867–887

Aggarwal VA, Wu A (2019) Inter-organizational collaboration and start-up innovation. In: Reuer JJ, Matusik SF, Jones J (eds) The Oxford handbook of entrepreneurship and collaboration. Oxford University Press, Oxford, pp 611–628

Allen TJ (1977) Managing the flow of technology: technology transfer and the dissemination of technological information within the R&D organization. MIT Press, Cambridge

Anand B, Khanna T (2000) Do firms learn to create value? The case of alliances. Strategic Management Journal 21(3):295–315

Angrist JD, Pischke JS (2008) Mostly harmless econometrics: an empiricist’s companion. Princeton University Press, Princeton

Arino A, De La Torre J (1998) Learning from failure: towards an evolutionary model of collaborative ventures. Organization Science 9(3):306–325

Baaij MG, Slangen AH (2013) The role of headquarters–subsidiary geographic distance in strategic decisions by spatially disaggregated headquarters. Journal of International Business Studies 44(9):941–952

Baum JAC, Tony C, Silverman BS (2000) Don’t go it alone: alliance network composition and startups’ performance in Canadian biotechnology. Strategic Management Journal 21(3):267–294

Bernstein S (2015) Does going public affect innovation? Journal of Finance 70(4):1365–1403

Bernstein S, Giroud X, Townsend RR (2016) The impact of venture capital monitoring. Journal of Finance 71(4):1591–1622

Birkinshaw J, Braunerhjelm P, Holm U, Terjesen S (2006) Why do some multinational corporations relocate their headquarters overseas? Strategic Management Journal 27(7):681–700

Boeh KK, Beamish PW (2011) Connecting flights: the time sink that kills profits. Harvard Business Review 89(12):30–30

Bouquet C, Birkinshaw J (2008) Weight versus voice: how foreign subsidiaries gain attention from corporate headquarters. Academy of Management Journal 51(3):577–601

Brown SL, Eisenhardt KM (1997) The art of continuous change: linking complexity theory and time-paced evolution in relentlessly shifting organizations. Administrative Science Quarterly 42(1):1–34

Campbell A, Goold M, Alexander M (1995) The value of the parent company. California Management Review 38(1):79–97

Capaldo A, Petruzzelli AM (2014) Partner geographic and organizational proximity and the innovative performance of knowledge-creating alliances. European Management Review 11(1):63–84

Chandler AD (1991) The functions of the headquarter unit in the multinational firm. Strategic Management Journal 12(12):31–50

Chen CJ (2004) The effects of knowledge attribute, alliance characteristics, and absorptive capacity on knowledge transfer performance. R&D Management 34(3):311–321

Chen H, Gompers P, Kovner A, Lerner J (2010) Buy local? The geography of venture capital. Journal of Urban Economics 67(1):90–102

Collis DJ, Young D, Goold M (2007) The size, structure, and performance of corporate headquarters. Strategic Management Journal 28(4):383–405

Collis DJ, Young D, Goold M (2012) The size and composition of corporate headquarters in multinational companies: empirical evidence. Journal of International Business Studies 18(3):260–275

Deeds DL, Hill CWL (1996) Strategic alliances and the rate of new product development: an empirical study of entrepreneurial biotechnology firms. Journal of Business Venturing 11(1):41–55

Doz YL (1996) The evolution of cooperation in strategic alliances: initial conditions or learning processes? Strategic Management Journal 17(S1):55–83

Dyer JH, Kale P, Singh H (2004) When to ally and when to acquire. Harvard Business Review 82(7/8):108–115

Dyer JH, Singh H (1998) The relational view: cooperative strategy and sources of interorganizational competitive advantage. Academy of Management Review 23(4):660–679

Findikoglu M, Lavie D (2019) The contingent value of the dedicated alliance function. Strategic Organization 17(2):177–209

Fleming L (2001) Recombinant uncertainty in technological search. Management Science 47(1):117–132

Flores RG, Aguilera RV (2007) Globalization and location choice: an analysis of US multinational firms in 1980 and 2000. Journal of International Business Studies 38(7):1187–1210

Foss NJ (1997) On the rationales of corporate headquarters. Industrial and Corporate Change 6(2):313–338

Foss NJ (2019) The corporate headquarters in organization design theory: an organizational economics perspective. Journal of Organization Design 8(8):1–9

Gans JS, Stern S (2003) The product market and the market for “ideas”: commercialization strategies for technology entrepreneurs. Research Policy 32(2):333–350

George G, Zahra SA, Wheatley KK, Khan R (2001) The effects of alliance portfolio characteristics and absorptive capacity on performance: a study of biotechnology firms. Journal of High Technology Management Research 12(2):205–226

Giroud X (2013) Proximity and investment: evidence from plant-level data. Quarterly Journal of Economics 128(2):861–915

Goerzen A (2005) Managing alliance networks: emerging practices of multinational corporations. Academy of Management Executive 19(2):94–107

Grigoriou K, Rothaermel FT (2017) Organizing for knowledge generation: internal knowledge networks and the contingent effect of external knowledge sourcing. Strategic Management Journal 38(2):395–414

Guimaraes P, Portugal P (2010) A simple feasible procedure to fit models with high-dimensional fixed effects. Stata Journal 10(4):628–649

Hagedoorn J, Schakenraad J (1994) The effect of strategic technology alliances on company performance. Strategic Management Journal 15(4):291–309

Hall BH, Jaffe A, Trajtenberg M (2005) Market value and patent citations. RAND Journal of Economics 36(1):16–38

Hitt MA, Ireland RD, Camp SM (2001) Strategic entrepreneurship: entrepreneurial strategies for wealth creation. Strategic Management Journal 22(6–7):479–291

Hoffmann WH (2007) Strategies for managing a portfolio of alliances. Strategic Management Journal 28(8):827–856

Hsiao YC, Chen CJ, Lin BW, Kuo CI (2017) Resource alignment, organizational distance, and knowledge transfer performance: the contingency role of alliance form. Journal of Technology Transfer 42(3):635–653

Ireland RD, Vaidyanath D (2002) Alliance management as a source of competitive advantage. Journal of Management 28(3):413–446

Jaffe AB, De Rassenfosse G (2017) Patent citation data in social science research: overview and best practices. Journal of the Association for Information Science and Technology 68(6):1360–1374

Jaffe AB, Trajtenberg M, Henderson R (1993) Geographic localization of knowledge spillovers as evidenced by patent citations. Quarterly Journal of Economics 108(3):577–598

Jiang RJ, Tao QT, Santoro MD (2010) Alliance portfolio diversity and firm performance. Strategic Management Journal 31(10):1136–1144

Jung H, Lee JJ (2016) The quest for originality: a new typology of knowledge search and breakthrough inventions. Academy of Management Journal 59(5):1725–1753

Kale P, Dyer JH, Singh H (2002) Alliance capability, stock market response, and long-term alliance success: the role of the alliance function. Strategic Management Journal 23(8):747–767

Kale P, Singh H, Perlmutter H (2000) Learning and protection of proprietary assets in strategic alliances: building relational capital. Strategic Management Journal 21(3):217–237

Katila R, Rosenberger JD, Eisenhardt KM (2008) Swimming with sharks: technology ventures, defense mechanisms and corporate relationships. Administrative Science Quarterly 53(2):295–332

Kogan L, Papanikolaou D, Seru A, Stoffman N (2017) Technological innovation, resource allocation, and growth. Quarterly Journal of Economics 132(2):665–712

Kogut B, Singh H (1988) The effect of national culture on the choice of entry mode. Journal of International Business Studies 19(3):411–432

Kotabe M, Swan KS (1995) The role of strategic alliances in high-technology new product development. Strategic Management Journal 16(8):621–636

Kunisch S, Menz M, Ambos B (2015) Changes at corporate headquarters: review, integration and future research. International Journal of Management Reviews 17(3):358–381

Kunisch S, Müller-Stewens G, Campbell A (2014) Why corporate functions stumble. Harvard Business Review 92(12):110–117

Kunisch S, Müller-Stewens G, Collis DJ (2012) Housekeeping at corporate headquarters: international trends in optimizing the size and scope of corporate headquarters. University of St. Gallen/Harvard Business School Survey Report. https://www.alexandria.unisg.ch/212825/1/CHQ_Survey_Report_2012_final.pdf

Lavie D (2006) The competitive advantage of interconnected firms: an extension of the resource-based view. Academy of Management Review 31(3):638–658

Lavie D, Miller SR (2008) Alliance portfolio internationalization and firm performance. Organization Science 19(4):623–646

Lavie D, Rosenkopf L (2006) Balancing exploration and exploitation in alliance formation. Academy of Management Journal 49(4):797–818

Lerner J (1995) Venture capitalists and the oversight of private firms. Journal of Finance 50(1):301–318

Levin RC, Klevorick AK, Nelson RR, Winter SG, Gilbert R, Griliches Z (1987) Appropriating the returns from industrial research and development. Brookings Papers on Economic Activity 18(3):783–831

Li GC, Lai R, D’Amour A, Doolin DM, Sun Y, Torvik VI, Yu AZ, Fleming L (2014) Disambiguation and co-authorship networks of the U.S. patent inventor database (1975–2010). Research Policy 43(6):941–955

Lowe RA, Ziedonis AA (2006) Overoptimism and the performance of entrepreneurial firms. Management Science 52(2):173–186

Menz M, Barnbeck F (2017) Determinants and consequences of corporate development and strategy function size. Strategic Organization 15(4):481–503

Menz M, Kunisch S, Collis DJ (2015) The corporate headquarters in the contemporary corporation: advancing a multimarket firm perspective. Academy of Management Annals 9(1):633–714

Meyer KE, Benito GRG (2016) Where do MNEs locate their headquarters? At home! Global Strategy Journal 6(2):149–159

Monteiro LF, Arvidsson N, Birkinshaw J (2008) Knowledge flows within multinational corporations: explaining subsidiary isolation and its performance implications. Organization Science 19(1):90–107

Mowery DC, Oxley JE, Silverman BS (1996) Strategic alliances and interfirm knowledge transfer. Strategic Management Journal 17(S2):77–91

Nell PC, Ambos B (2013) Parenting advantage in the MNC: an embeddedness perspective on the value added by headquarters. Strategic Management Journal 34(9):1086–1103

Nohria N, Gulati R (1996) Is slack good or bad for innovation? Academy of Management Journal 39(5):1245–1264

Owen-Smith J, Powell WW (2004) Knowledge networks as channels and conduits: the effects of spillovers in the Boston biotechnology community. Organization Science 15(1):5–21

Oxley JE (1997) Appropriability hazards and governance in strategic alliances: a transactions cost approach. Journal of Law Economics and Organization 13(2):387–409

Ozcan P, Eisenhardt KM (2009) Origin of alliance portfolios: entrepreneurs, network strategies, and firm performance. Academy of Management Journal 52(2):246–279