Abstract

Complacency is almost archaic in the knowledge economy, because firms are overwhelmingly confronted with diverse expectations from better informed stakeholders, who pressure on societal issues amid shareholders’ calls for greater financial security. Similarly, there is a growing call for corporations to redefine their responsibilities to stakeholders, and to integrate socio-economic and environmental concerns into business processes and strategies in order to transparently impact on societies. In a bid to support mutually beneficial relationships, this paper shows how stakeholder theory proactively moderates the strength of CSR in social interactions, environmental protection, and sustainable development. It proposes a four-stage stakeholder dialogue ladder which attempts to synergize CSR, stakeholder and stakeholder theory based on the stages as defined by the firm’s extent of development, and her regularity and intensity of interaction with stakeholders. The paper argues that subject to the problem to solve, the languages of CSR and stakeholder theory are useful and that, the dichotomies of covering wrongdoing and creating falsehoods could be addressed when firms adopt stakeholder dialogue and collaboration that aid friendly CSR programmes. Thus, the relationship turns that of dyadic partnership, because corporations follow issue or purpose-based CSR programmes that create values that trickle to interdependent stakeholders. In sum, corporations need to continually get committed to environmentally-sensitive CSR since there is a strong relationship between CSR activities, stakeholders and actual performance.

Similar content being viewed by others

Introduction

The Fordist era was obsessed by transaction-cost and resource-dependence archetypes that awfully defined corporate weird in resource-transaction relationship between corporations and stakeholders. Such ‘mechanistic management dialectics’ and its concomitant though arguable business controversies gave avid credence to nascent discourse on friendly company-wide orientations or ‘organic management system’ that tames societal disaffection (Burns & Stalker, 1961; Freeman, 1984; Kotler & Keller, 2009). The surge of organic management system and of course knowledge economy is a product of continued structural collapse, shift to market economy of the former Communist economies, and/or practice of stakeholders and corporate social responsibility (CSR) management system. Scholars opine that the social economy and its attendant mass production and consumption, advances in science and technology, wasteful consumption of resources and pollution, and deterioration of global environment (Tokoro, 2007) call for incorporating proactive and/or reactive social and environmental programmes into decision process to unlock ‘strategic windows’ and have them continually open (Abell, 1978; Awa & Eze, 2010). Whether real and/or imagined, the general public typically holds hoax, cynical and shenanigan feelings about corporations (Greenfield, 2004; Kantabutra & Ketprapakorn, 2020; Kotler & Lee, 2005), especially when corporations assume they owe the society only efficient economic responsibility while governments owe the social ends (Freeman & Dmytriyev, 2017; Kazmi, 2008; Sweeney & Coughlan, 2008).

Corporate sustainability seems on edge when stakeholder approach appears abysmal and/or natural resources repatriated without adequate reparation, even where there are symptoms of environmental degradation, toxic emissions and oil spillages, as well as their attendant ravages on ecosystems, cultivatable lands and crop yields, air and water, cost of living, and man’s general well-being. These suggest that it is only a thin line that demarcates normal business practices from unethical or irresponsible behaviours (Zhao, 2021; Nikolova & Arsic, 2017; Kotler & Keller, 2009) albeit tainted impressions are often escalated, amongst other stakeholders, by the media, environmentalists, and social activists (Fatima & Elbanna, 2022; Sweeney & Coughlan, 2008) and supposedly addressed by CSR. The ontological perspective is that corporations are primarily agog with “champion of free markets,” money-centredness (Friedman, 1970), profit maximization and/or social deficits; they pursue more of shareholders’ interest, indirectly deceive the vulnerable stakeholders and sacrifice minority customer groups. Scholars (Cooper et al., 2001; Kantabutra & Ketprapakorn, 2020; Sweeney & Coughlan, 2008) alluded that different stakeholders vehemently criticize corporations on high profitability and fostering materialism, false warranties and inaccurate labeling, theft of business secrets, use of patents, political lobbying, poor research and development, excessive executive salaries, planned obsolescence and unsustainable consumption patterns, exploiting labour rights, exclusive dealing and tying agreements, innovation stifling and lowering of quality standards, limited access to product’s life-saving information, barriers to entry and cutthroat/predatory competition, deceptive promotion and hiked product claims, and environmental insensitivity.

The soaring of corporate sustainability amid globalization, ICT and ‘the world-is-flat’ (Friedman, 2005) suggests that these scenarios are up for a new dawn as the theory of business evolves towards the late 20th century social epoch and precipitates organizations coming under heavy pressure(s) from inter alia consumers, investors, employees, suppliers, civil rights crusaders, environmentalists, host-communities, governments, non-governmental organizations (NGOs) and agencies, civil societies/activists and media to respond to the challenges of social deficits (Sweeney & Coughlan, 2008; Nikolova & Arsic, 2017; Freeman & Dmytriyev, 2017). Other scholars (Albuquerque et al., 2020; Boone & Kurtz, 2007; Dordi & Palaschuk, 2022; Fatima & Elbanna, 2022; Kantabutra & Ketprapakorn, 2020) propose that global pandemics (e.g., COVID-19 and EBOLA), economic upheavals, environmental disasters, garbage disposal, acid rain, depletion of the ozone layers, global warming and global governance initiatives like large-scale sustainability accords are other fundamental scenarios that pose unprecedented and unavoidable charges on corporations to develop, navigate, adapt or regularly overhaul CSR programmes to guarantee sustainability. These suggest a new world of corporate development and sustainability via CSR programmes that support stakeholder-friendly orientation. Scholars (Carroll & Shabana, 2010; Sweeney & Coughlan, 2008; Nikolova & Arsic, 2017; Kantabutra & Ketprapakorn, 2020) propose that this dawn is driven by knowledge economy, intense competition, strategic consolidation, operating standards from international bodies, Keynesian epoch, and complex and interconnected large-scale issues characterized by uncertainty, nonlinearity and increasing stakeholders’ dynamism and/or demands.

These surge the voluntary corporate concern for stakeholders vis-à-vis alignment with societal values and natural systems (Albuquerque et al., 2020; Vermeulen & Writjes, 2016) with strong implications for strategic decisions on corporate governance, public relations and corporate citizenship, pollution control, waste recycling, resource conservation, and other measures of building public trust amidst dynamic environment shaped by socio-economic and institutional factors (Albuquerque et al., 2020; Freeman & Dmytriyev, 2017; Zhao, 2021). Corporations that tend to undermine the clarion calls for stakeholder interest in the current existential knowledge economy experience gross resistance. First, studies show that stakeholders’ lifetime diminishes as CSR budget decreases – in the traditional sense, about 88 percent of stakeholders favour products from corporations that exhibit philanthropic and no funny concern for stakeholders (Smith, 1996); and about 76 percent of consumers switch to brands and/or stores that show concern for host communities (Jones, 1995). Further, approximately 90 percent of disgusted stakeholders boycotts the provider (Business Week, 1984) and shares their experiences with 10 to 20 others; whereas satisfied ones share with only 4 or 5 individuals (Abd-Rashid et al., 2014), and as much as 12 ethical experiences are needed to overcome the negative effects of one ugly encounter (Kau & Loh, 2006). Conversely in the digital sense, disgusted stakeholders exploit the real-time and ubiquitous features of different platforms to make their experiences known to the world. Second, in extreme cases corporations suffer community resistance and its attendant high operating costs expressed in idle time, replacement costs, thefts, shut-down of operations, vandalization, assassination, kidnapping and hostage-taking and demands for ransom.

The emphasis on stakeholder interest may imply strategic trade-offs; hence integration and channeling of every interest in the same direction for competitive advantage qua sustainability (Donaldson & Preston, 1995; Freeman et al., 2010), given that CSR is obligatory and aims at higher responsiveness to stakeholders (Carroll, 1994; Freeman, 1984; Tanggamani et al., 2017). Scholars (Vermeulen & Writjes, 2016; Zhao, 2021) posit that corporate behaviour to stakeholders requires legitimate integration of extant theories to accommodate systems and environmental appeals, as well as multiple stakeholder groups at different levels. Similarly, response to social deficits is a strategic managerial issue that demands CSR’s comprehensive agility to exploit the appeals of stakeholder theory, agency theory, ecological modernization theory, institutional theory or other cognate theories that legitimately bring in the systems epoch at multi-levels to deal with the ethical and social fabrics for corporate sustainability vis-à-vis customer attraction and retention, as well as win–win affair(s) with stakeholders (Risi et al., 2023; Starik & Kanashiro, 2020; Zhao, 2021). Guided by stakeholder theory, corporations empower board members to negotiate and compromise with, and incorporate, stakeholders in wealth creation, as well as providing social amenities, ethical and safe-working conditions, and green marketing to the society. However, because corporations rarely flourish in the 21st century without stakeholders’ support (Freeman, 1984), CSR provides a global standard of social responsibilities, builds social welfare beyond profitability, develops employee loyalty and company reputation, and ultimately serves as a building block for corporate sustainability and competitive advantage (Ormiston & Wong, 2013; Vermeulen & Writjes, 2016; Nikolova & Arsic, 2017).

Because relationships and treating stakeholders as individuals and groups that contribute to the corporation’s wealth (Freeman, 1984; Ormiston & Wong, 2013) are key; then, the stakeholder approach and CSR management systems are strengthened and moderated by stakeholder theory, with the utmost goal of recognizing economic, environmental, and social aspects of corporate activities. In its criticality to CSR, corporate sustainability and crisis management, scholars (Freeman & Dmytriyev, 2017; Ormiston & Wong, 2013; Tanggamani et al., 2017) affirmed that stakeholder theory enjoys huge scholarship ahead of other theories. Analyzing corporations exclusively from their own perspective requires stakeholder theory to describe and predict corporate behaviour and outcomes in terms of stakeholders’ nature, their management, values and relative influence on decisions. Further analysis involves how directors think about the interests of corporate constituencies, and the link between stakeholder management and achievement of CSR. The strategic position of stakeholders suggests improving understanding of their perspectives and concerns on key issues, including CSR issues, and to integrate those perspectives and concerns as much as possible into corporate strategy. This article uses stakeholder theory to study winning societal acceptance by moving from quantitative to qualitative improvements, and by showing how stakeholder theory and stakeholder dialogue proactively explain the strength of relationship between CSR programmes and social interactions, environmental protection, sustainable development and others that aid co-existence with stakeholders. The structure spans theoretical frameworks and early driving thoughts, corporate responsibility and CSR, stakeholders and stakeholder theory, CSR and stakeholder theory, the synergistic role of stakeholder dialogue ladder and conclusion.

Corporate responses and business management

Business activities migrate from the Holy Bible and the corporate response in particular integrates firmly with The Ten Commandments from God as that spell out the self-regulatory moral standard of behaviour expected in dealing(s) with others. In business and non-business dealings, these commandants have been espoused to develop the several social exchange and equity theories, and propositions that seem to explain, predict, regulate and guide interpersonal relationship(s). Similarly, the phenomena of corporate response were long practiced in the ancient Greece (Eberstadt, 2006), and relate to the Ancient Mesopotamia of about 1700 BC, when King Hammurabi introduced a code where builders, innkeepers, farmers or others were subjected to death when their carelessness or negligence caused deaths of others, or major inconveniences to citizens (Albuquerque et al., 2020; Freeman & Dmytriyev, 2017). Further, Nikolova and Arsić (2017) posit that in the Ancient Rome, Senators complained about businesses’ failure to contribute sufficiently to fund military campaigns, whereas in 1622 disgusted shareholders in Dutch East India Company issued pamphlets of complaint on management secrecy and “self-enrichment.” Adam Smith in the 18th century proposed the first classical economic model that suggested meeting public’s needs is at its best if one acts in self-interest manner. Self-interest implies earning profits from business and also meeting other people’s needs. In management theory, since after Frederick Winslow Taylor’s scientific management of 1911, management of organizations has remained pivotal, and the relationship between organizations and their stakeholders remained less epochal.

In 1930s, Wendell Wilkie enlightened business practitioners on the philosophy of social responsibility (Ahlstrom, 2010; Boone & Kurtz, 2007; Carroll, 1979; Votaw, 1972); whereas Bowen’s (1953) seminal book on Social Responsibilities of the Businessman drives the contemporary thoughts on, and shift in terminology to, relationship between organizations and their stakeholders. Regardless that corporate response to external environment is a product of over 2000 years tradition (Panwar et al., 2006), the pioneering studies (Burns & Stalker, 1961; Lawrence & Lorsch, 1967) from the 1960s to 1970s connecting corporations firmly with their environments provided a new wave of thought termed ‘contingency theories’ or ‘open-system perception’ with surged emphases on the restrictiveness of environments on corporate lives. However since the 1980s, corporations’ external environments have further grown much more complex and complicated, informing a critical theme in studies on how to respond to them without losing smooth and efficient operation. In keeping with stakeholder approach in business management, scholars (Sims, 2003) proposed the panaceas of charity and stewardship—the principle of charity is a religious tradition of giving arms to the less privileged; and the principle of stewardship (which is often spurred by the activities of the press, governments, and other groups, as well as the law) emphasizes the obligation to serve or to return to the societies from where the economic power was generated. Implicit is that, corporate responses to environmental and societal wellbeing connect some social exchange theories—ethical relativism, ethical egoism, golden rule, distributive justice, utilitarian, and symbolic.

The ethical relativism considers one universal standard or a set of standards that judges actions; ethical egoism promotes long-run greatest possible balance of good over evil; golden rule entails dealing with others in a manner you would want them to deal onto you; and distributive justice discourages too much richness at the expense of the poor. Whereas utilitarian theory literarily emphasizes one’s action making the greatest good for the greatest number of people and involves pecuniary resources (e.g., re-performance, amenities, donations, or scholarships); the symbolic exchanges involve psychological and/or social resources (apology, status, respect, esteem, or empathy) to douse tensions when defaults occur. Perhaps the strength of these theories and the earlier mindset of business and society led Milton Friedman and Lord Keynes to theorize though differently. CSR was engulfed in a full-scale ideological battle (Carroll, 1994; Freeman & Dmytriyev, 2017; Kotler & Keller, 2009) under the Chicago School ideology on free-markets led by Nobel economist, Professor Milton Friedman who proposed that CSR was immoral, undermines shareholders’ rights, and violates firm’s obligations to shareholders (Freeman et al., 2010; Friedman, 1970). While almost aligning with the traditional economics theory of Adam Smith and/or Freeman and Dmytriyev’s (2017) first contestability on violation of obligation to stakeholders, the school recognizes CSR as stealing from business owners, and advised shareholders to privately deal with non-business activities. Although Milton Friedman and his followers tend to undermine that organizations rely on interplay of multiple interdependent relationships with stakeholders; their thoughts developed full-blown ideological stands that profoundly govern the business landscape even today.

However, the instrumental theories provide almost synonymous thoughts with Friedman, given that they assume corporation is the only instrument for wealth creation, and its social activities are only a means to achieve economic results. Nevertheless, the subversive nature of CSR as enshrined in the Chicago School ideology has been vehemently contested and criticized amid social and environmental dynamism. Some integrative theorists (Freeman & Dmytriyev, 2017; Freeman & Dmytriyev, 2017; Freeman et al., 2010; Kotler & Keller, 2009) along with Lord Keynes, the New Institutional Economics, and other institutions critiqued Friedman in their attempt to enlarge firm’s obligations to shareholders or bridge the dichotomies between economic and social values, business and ethics, and profits and society. The Keynesian dawn of satisfying social demands was propelled by contemporary developments in competition, globalization and liberalization, and ICT, as well as pressures from stakeholders to recognize the critical link between corporate sustainability and socio-economic consciousness (Aguilera et al., 2007; Bush et al., 2010; Reed, 1998). The rising voice and demand for more sustainable business operation by customers, investors, employees, suppliers, civil rights crusaders, environmentalists, host-communities, governments, non-governmental organizations (NGOs) and agencies, civil societies/activists, media, environmental protection agencies and other stakeholders (Freeman et al., 2010; Risi et al., 2023; Starik & Kanashiro, 2020) call for stakeholder-focused operations.

At the supra-systems level, the United Nations, World Business Council for Sustainable Development (WBCSD), Canadian Institute of Chartered Accountants, Deloitte Touche Tohmatsu, and Shell Group strongly advocate that in addition to profit maximization, corporations owe wider responsibilities to the society (social contracts) spanning human rights, ethics and safe-working conditions, green marketing and stewardships, corporate contribution (e.g., to charity) and accountability, transparency and partnerships for sustainable development, and community development.

Corporate responsibility and CSR

A reminiscence of organization’s responsibilities to its stakeholders shows that they come under corporate responsibilities, but when corporations began promoting economic and social responsibilities simultaneously; then, the issues of what corporate responsibility should then be challenged scholarly discourse. The recognition that it is often a practice to separate some key stakeholders for special treatments gave the impetus to CSR as an instrument that singles out special treatments for communities and society at large. Contemporary corporations are taking corporate responsibilities to the next level of giving it a global touch in order to make for a better world, as well as reposition what is today referred to as CSR. At the instance of the age-long oppression of African Americans, the American Civil Rights Movement naturally recognized that every life matters when it launched Black Lives Matter in attempt to liberate the oppressed blacks and/or to prioritize one aspect of the society of America. Corporate responsibilities relate to firm’s responsibilities to all stakeholders – All Lives Matter; whereas, CSR emphasizes more of social orientations and exists when firms narrow responsibilities to local communities and/or society at large—Black Lives Matter.

Indeed because Black Lives Matter, CSR disclosure of the American Civil Rights Movement frowns at oppressing blacks in the US and promotes better health-care services and friendly environmental conditions, as well as improved access to education amongst black community or the society at large. Further, CSR programmes have their domain in social responsibilities and are narrow focus of firm’s corporate responsibilities. Scholars (Freeman & Dmytriyev, 2017; Ormiston & Wong, 2013) suggest that corporate responsibilities encompass broader spectrum bordering on creating meaningful work or long-term career opportunities for employees, providing sustainable contract terms or building reliable partnerships with suppliers, addressing consumer needs or providing the best value for customers’ money, informing investors on key strategic decisions or utilizing shareholders’ assets more productively (Risi et al., 2023; Nikolova & Arsic, 2017; Starik & Kanashiro, 2020; Zhao, 2021). The term CSR, otherwise referred loosely to as corporate citizenship, responsible business, society and business, stakeholder management, social issues management, public policy and business, or simply corporate responsibility, has been evolving for decades at a different pace. However, defining CSR is rather an uphill task, given the obvious lack of consensus on the concept’s meaning to different people. To some, it represents legal responsibility or liability; to others, it is socially responsible behaviour and social consciousness; still to others, it equates charitable contributions and returns to humanity; and others perceive it as fiduciary duty of imposing higher standards of behaviour on businesses than on the citizens at large (Votaw, 1972).

Carroll (1994) posits that such divergent view is informed by the discipline’s wide breadth and multidisciplinary inquiries, eclectic with loose boundaries, multiple memberships, and differing training, perspectives and mindsets. Drawing from Wendell Wilkie, Bowen (1953) defines CSR as organization’s social obligations, which is conceptually and operationally diverse. Some others define CSR as actions partially taken beyond the economic or technical sense (Keith, 1960), casting the firm’s shadow on social scenes (Eells & Walton, 1961), and paying certain responsibilities beyond the economic and legal obligations (Freeman et al., 2010; McGuire, 1963; Reed, 1998; Tanggamani et al., 2017). Like Bowen’s (1953), they lean on Wendell Wilkie but the words or phrases in italics rarely show explicitly the current criticality of CSR in organizations as a competitive weapon, a mantra for business success, a continuing commitment and a long-term action in the contemporary business setting. Organizations must be fully active in CSR, given that its programmes and public disclosure associate with performance (Jones, 1995; Smith, 1996) affirmed that. CSR is a self-regulatory mechanism whereby an organization actively monitors society, the environment, global trends, ethical principles, and legal standards for compliance. Similarly, the WBCSD in her Making Good Business Senses by Lord Holme and Richard Watts describes CSR as the business’ continual commitment to behave ethically and to contribute economically as well as to improve the quality of life of the workforce, their families, the local community and society at large.

This definition stretches CSR further to corporate responsibilities but provided the reach of the particular CSR pragrmmes is narrowed, it is permissible. By these, CSR actively and continually supports the organization’s core mission and extends its responsibility and commitments to secondary stakeholders and other members of society, because CSR process fosters organizational actions that positively affect society as a whole: environment, communities, and people. Organizations that adopt CSR as part of their business mission have a pyramid of moral, ethical, and discretionary responsibilities in addition to their economic and legal obligations (Carroll, 1979; Freeman, 1984; Nikolova & Arsić, 2017). However while the CSR pyramid is eulogized for accommodating ethical and discretionary responsibilities; its programmes are still besieged with some contestability. Freeman (1984) posits that CSR is not easily distinguished as most business decisions are not purely economic, legal, ethical, or philanthropic; and the separation of economic and social responsibilities for which CSR stands is not always welcomed. The general responsibilities implied by CSR are rarely accounted for the specificity of the individual firms or for the specific stakeholder networks where it is embedded (Amran et al., 2013; Freeman, 1984; Votaw, 1972). Challenging Friedman’s (1970) tradition of CSR programmes, Freeman and Dmytriyev (2017) accused CSR of following the principles of traditional economics theory that subtly permit violation of the stakeholders’ obligation, covering or distorting firm’s wrong-doing and creating false dichotomies.

Organizations are necessary and indispensable evils for societies—sometimes, managers maximize short-term economic gains for their own self-interest (Ahamed et al., 2014; Boone & Kurtz, 2007; Freeman & Dmytriyev, 2017) and resort to CSR programmes to rebuild reputation. They do bad and later, do good as may be likened to armed robbers going to church after heinous operations. Freeman et al. (2010) argue that CSR activities come as moral substitutes to compensate for previous irresponsible activities. Similarly, Ormiston and Wong (2013) talked about CSR’s moral licensing (doing something good that misleads stakeholders’ feelings) and window-dressing or cosmetic colouration (programmes that pre-empt government from enforcing stricter regulations) as likely options of covering wrongs. These tools, to a reasonable extent, are the aftermath of false dichotomies of economic vs social, business vs. ethics, or stakeholder interests vs. societal interests, though a morally situated purpose that lies on ethical domain defends a firm against such dichotomies (Freeman & Dmytriyev, 2017).

Stakeholder and stakeholder theory

Corporations affect external environments; they act on stakeholders to establish favourable environments, giving rise to stakeholder theory and similar theories. Sometimes juxtaposed as external environment(s), classic, broad and unambiguous definition of stakeholder describes it as any identifiable persons, group of persons, organizations, or concern constituencies that have existential interests, rights, and/or ownership in an organization and its activities. They are entities outside the firm, which the organization aims to influence and which have impact on the organization’s existence (Murray & Vogel, 1997). Scholars (Freeman, 1984; Freeman et al., 2010; Kotler & Keller, 2009) opined that such individuals directly or indirectly affect, restrict, exchange stuffs or are affected by the organizations’ actions, objectives and policies. The phrase outside the firm as used above tends not to undermine the activities of internal environment (e.g., employees and shareholders) as powerful voice in the affairs of any organizations. Simply put, stakeholders have vested interests in the corporation and are affected by its actions; they benefit when the corporation prospers and suffer when it is harmed by misfortune. These definitions foretell that stakeholders contribute either voluntarily or involuntarily to corporation’s wealth creation, and are potential beneficiaries and risk bearers. Further conceptualization of stakeholders spans ‘primary’ or ‘participant’ and ‘secondary’ or ‘non-participant;’ (Clarkson, 1995) where, the former is indispensable for corporate survival, and the latter affect or is affected by the corporation but is not engaged in transactions with the corporation and is not as essential as the former in corporate survival (Metcalfe, 1998).

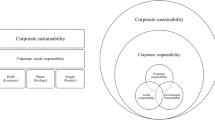

Indeed, stakeholders are critical to corporate lives, since they may work in accord to achieve common goals, or diametrically oppose each other on issue(s) affecting long-term corporate existence (Amran et al., 2013; Greenfield, 2004; Jones & Nisbet, 2011). Another perspective of stakeholder anchors possibilities of benefit – providers/receivers, and risk – providers/bearers (Sachs et al., 2006; Starik & Kanashiro, 2020), as well as myriads of heterogeneous and integrated set of stakeholders (see Fig. 1): market-based (e.g. customers, trade-partners and competitors), resource-based (e.g., suppliers, employees, directors, banks and owners/investors), and social and political-based (e.g., governments and their agencies, regulatory agencies, environmentalists, trade and labour unions, political parties, NGOs and social groups, and the media). Scholars note that stakeholder approach to CSR suggests that managing the pluralistic principles associated with stakeholder relationships recognizes that CSR disclosure serves as competitive asset (Aguilera et al., 2007; Elijido-Ten, 2007; Freeman et al., 2010) that often requires the import of stakeholder theory to build distinctiveness and improved stakeholders’ support (Amran et al., 2013; Lee, 2011; Reed, 1998). Recognizing that corporations owe obligation and responsibility to different stakeholders, the stakeholder theory serves as a managerial tool to attract and/or maintain stakeholders’ support (Vermeulen & Writjes, 2016; Freeman & Dmytriyev, 2017; Nikolova & Arsić, 2017) through balancing interests/claims and treating shareholders as one of the claimants (Health & Norman, 2004) in lieu of having more privileges over other stakeholders (Orts & Strudler, 2002; Ruf et al., 2001).

Stakeholder theory graduates stakeholders in terms of their corporate importance and apportions resultant attention (Cooper et al., 2001; Freeman & Dmytriyev, 2017) needed to address their different expectations and conflicting interests (Freeman et al., 2010; Risi et al., 2023; Sen et al., 2006). With the theory, choosing which stakeholder dialogue practices to adopt and why is guided, because corporation’s responsibility transcends owners’ and employees’ interests, and includes creating stakeholders’ values and aligning the stakeholders’ dynamic expectations with corporate direction. Mitchell et al. (1997) proposed urgency, legitimacy and power as the key stakeholder attributes, whose different mixes in some cases foretell the amount of corporate attention to give to each stakeholder. Urgency refers to the timeous sensitivity and how dear the claim is to the stakeholder; legitimacy is the appropriateness of the stakeholders’ claims (Thorne et al., 2003); and power is the ability to bring desired outcomes (Starik & Kanashiro, 2020; Mitchell et al., 1997; Nikolova & Arsic, 2017). These mean the delivery of profit maximization goal and stakeholders’ benefits and expectations in order to propose an insightful relationship map that guide decision on dealing with the different stakeholders even as organizations move in different stages of life cycle. Therefore the stakeholder theory provides potentially insightful theoretical lenses to address stakeholder issues, build stakeholders’ information and value systems, as well as situational behaviours to systematically guide decisions to protect and/or balance different interests, and to predict corporate behaviour and measure outcomes.

In keeping with scholars (Dordi & Palaschuk, 2022; Clifton & Amran, 2010; Ahamed et al., 2014; Amran et al., 2013; Kotler & Keller, 2009), Fig. 1 grants category-compliant levels of salience; thus, specifying and prioritizing stakeholders to whom corporations are accountable to in terms of recognizing their expectations or rights in CSR disclosures – that is, developing a CSR framework and corporate activities to deal with the prioritized arrays of people’s interests and to build consistent relationship with all. Although one may have more than one stake in a corporation, a review of scholars (Caroll, 1979; Starik & Kanashiro, 2020; Clarkson, 1995; Cooper et al., 2001; Lepoutre & Heene, 2006) indicated the different stakeholders and their expectations as shown in Table 1 below. These suggest that the proposed framework (see Fig. 1) makes for a resounding theoretical base that provides in a normative manner, more practical guide to decisions because it addresses the significance of property rights in the society, the dynamic expectations of each stakeholder and captures same when crafting and implementing strategy. The framework, subtly distinctive showcases the roles, rights, responsibilities, and legitimacies of different actors and stakeholders. The property rights in the context of stakeholders suggest that organizations care not only for those that provided the financial resources (e.g., resource-based stakeholders) but also those that contribute other firm-specific investments such as knowledge and networks—market-based stakeholders and social and political stakeholders. Such rights involve integrating stakeholders since corporate wealth distribution is organized in accordance with stakeholders’ contributions/capitals and risk spans wealth creation process.

These are necessary to discourage shareholder activism and to surge sustainable and responsible investment (SRI). In most economies, shareholder activism on CSR issues, especially those on environmental and social (E&S) resolutions is on surge, demanding further engagement between companies, their shareholders and other stakeholders. For SRI, actual and potential environmentalists, investors and consumers evaluate CSR issues when making demands, as well as investment and purchase decisions. Recall that CSR programmes affect corporate performance given that firm’s involvement in social responsibilities represents its genuine care and concern for the welfare and well-being of its stakeholders. Studies show that firm’s financial strength relates to its ability to design and implement CSR strategy that proficiently manages its relationships with stakeholders (Aguilera et al., 2007; Donaldson & Preston, 1995) because stakeholders regularly seek information on how the firm makes impact on them (Deegan & Unerman, 2006; Greenfield, 2004; Jenkins, 2009; Reed, 1998).

CSR and stakeholder theory

Ethical and stakeholder thoughts involve CSR and stakeholder theory as critical concepts. These concepts are discrete though overlap in most ramifications, suggesting cloudy distinction in their meanings, relationships and boundaries. Scholars (Ahlstrom, 2010; Freeman & Dmytriyev, 2017; Starik & Kanashiro, 2020) posit that the jargons of CSR and stakeholder theory cross-cut in the issues they address but from different perspectives; hence, their usefulness and application depend on the problems to solve. However, studies provide evidence of improved clarity on their relationships while undoubtedly proving that they look at the same business issues from slightly different perspectives. Regardless that some scholars treat either concepts as subsets of the other (Bush et al., 2010; Garriga & Mele, 2004), and others perceive them as somewhat competing (Ahlstrom, 2010; Lee, 2011) or complementary (Jenkins, 2009; Russo & Perrini, 2010), both stress on integrating society’s interests into business operations or press for corporate responsibility toward societies albeit at different paces and lengths (Freeman & Dmytriyev, 2017; Zhao, 2021). Scholars (Aguilera et al., 2007; Lee, 2011; O’Riordan & Fairbrass, 2008) opine that both enjoy empirical and theoretical links, and rekindle corporations as creating as much value as possible for stakeholders; thus ensuring that stakeholders’ expectations move in the same direction. Further, they assist to build public image and long-term relationships with stakeholders; and facilitate cooperation with and support from stakeholders, which ultimately contribute to higher corporate performance.

Specifically, stakeholder theory takes into account wider consequences within the surrounding societies and communities, where the corporation operates; hence, it examines the nature of CSR adoption and its link with corporate outcome (Freeman, 1984; Freeman & Dmytriyev, 2017; Freeman et al., 2010) because corporate social and environmental involvements are instruments of genuine care and concern for stakeholders (Donaldson & Preston, 1995; Zhao, 2021). The stakeholder theory brings a new dominant world into CSR that defines corporate obligations and responsibilities to every stakeholder and integrates same into strategy. Scholars (Freeman, 1984; Freeman et al., 2010; Jones, 1995; Reed, 1998; Tanggamani et al., 2017) attest that such insights explain and predict the relationship between CSR and stakeholders since corporations are continuously involved in CSR activities to build or rebuild trust, support and cooperation from stakeholders. Freeman (1984) proposes that stakeholder theory explains firm’s motivations with respect to CSR disclosure; emphasizing that corporate sustainability and survival predominantly lie on relationships with, and value-delivery to, stakeholders. In addition to what stakeholder theory is known for, it addresses company responsibilities toward financiers and suppliers (Tanggamani et al., 2017), while CSR rarely emphasizes such stakeholder groups though corporate responsibility may be multidirectional. CSR stretches social orientation further to its maximum domain—responsibility programmes are unidirectional (company to communities and societies) and do not focus on a particular stakeholder group(s), though recently social responsibilities could be tailored per stakeholder (Amran et al., 2013; Jenkins, 2009; Kantabutra & Ketprapakorn, 2020; Vormedal & Ruud, 2009).

Murray and Vogel (1997) and Elijido-Ten (2007) assert that CSR represents a significant element that determines the relationship between the organization and its stakeholders. Unlike stakeholder theory and corporate responsibilities, which assume ‘generalist philosophies,’ or overall range of responsibilities, CSR assumes a social mindset with narrow perspective by focusing on specific stream of social issues and prioritizing corporate responsibilities for special treatment on communities and society at large. The social vibe of CSR narrows disclosures and programmes on say access to education and healthcare services, as well as improved environmental conditions for the community or the society at large. Tanggamani et al. (2017) gave instance where corporations design CSR programmes to fight diseases and poverty or to emphasize charity, volunteering, environmental efforts, and ethical labour practices even when they have no single operation in some of the beneficiaries’ domain and no particular expertise in-house to deliver the tasks. Thus, when corporations are viewed holistically in terms of their overall purpose and mission, value, effectiveness and productivity, and impact on stakeholders; then, stakeholder theory will provide the operating guides and stipulate company’s responsibilities to all stakeholders under the term—corporate responsibilities, which naturally go beyond the domain of CSR.

When corporations move from general to particular in their dealings with stakeholders such as trimming down corporate responsibilities to local communities or society at large; then, the focus is social orientation or CSR. For corporate responsibilities to employees and customers, CSR predominantly focuses on ethical labour practices and environmental efforts (unidirectional), whereas stakeholder theory attempts to deliver in full corporate responsibilities toward these stakeholders, as well as the stakeholders’ responsibilities towards the company and its other stakeholders – thus, stakeholder theory and corporate responsibility are multi-directional. Therefore, stakeholder theory helps to develop CSR framework on accounts that stakeholders are recognized as group of people affected by corporation’s operations (Jenkins, 2009; Freeman, 1984; Risi et al., 2023; Nikolova & Arsic, 2017). Further, stakeholder theory and CSR view the corporation’s scope differently – the stakeholder theory perceives the corporation as stipulating corporate responsibilities for immediate stakeholders—customers, employees, financiers and suppliers, and communities. Scholars (Fatima & Elbanna, 2022; Freeman, 1984; Freeman et al., 2010; Smith, 1996) anchored that perspective on the theory’s claim that corporations operate in the interests of all her stakeholders, and the stakeholders themselves are interdependent, to the extent that value created for one has multiplier or spill-over effects (stakeholder interdependence and chain effect).

CSR, on the other hand, perceives corporations from the perspective of the society at large – CSR prioritizes some responsibilities over others; for instance, firm’s responsibilities to the society (mainly communities and partially employees and customers) over responsibilities to other stakeholders (financiers, suppliers, shareholders, etc.). Figure 2 explains the visual relationship between stakeholder theory and CSR—first, both throw emphases on firm’s responsibilities to communities and societies. Second, stakeholder theory focuses on narrow reach of corporate activities – local communities and surrounding society (primary and secondary), where the firm operates; whereas, CSR extends social orientation much further and outside the stakeholder circle.

Aligning CSR and stakeholder via stakeholder dialogue ladder

Recall that corporate performance is a function of symbiotic relationship between CSR and stakeholders nay stakeholder theory. Jones (1995) shows that CSR disclosure is a dependable strategy to build and/or maintain stakeholders’ support; thus, organizations that are socially responsible experience high levels of performance. Tokoro (2007) proposed the relationship between stakeholders and business management, and between CSR and stakeholders, with the focus on CSR. The traditional theory of business suggests that the orientations of ‘exchange’ and ‘restriction’ justify the relationships between corporations and stakeholders, because at one end, stakeholders display restrictiveness on corporate entities and at another, they take value-in-exchange or what Vargo and Lusch (2004) referred to as operand ethos, paranoid or functionally siloed operation of the Fordist dialectic. Value-in-use, operant and two-way flow of values, value-chain orientation, end-to-end stakes and system theory appeals ensue when relationship matures to parties turning resource-exchange partners. Further, the activities of Movement for the Survival of the Ogoni People (MOSOP) championed by slayed environmentalist, Ken Saro-Wiwa posed serious restrictions that metamorphosed into grounding of SPDC’s operations for want of CSR.

However while it is phenomenal to keenly observe the specific characteristics of these relationships, it is epochal to note that corporation-stakeholder relationship in the contemporary world of globalization and knowledge economy has further spanned non-belligerence nature of resource-exchanges to new property of value creation, because doing good in CSR is synonymous with creating value for stakeholders. Value creation attempts to take corporate perspectives beyond the traditional domain by giving stronger credence to CSR via identifying with the emerging wave of intensive and energetic stakeholder dialogue as a way to create value to every stakeholder or to recover corporate social standing amid severe criticism. Suffice it to say that globalization, ICT and knowledge economy infuse increasingly diverse and complex connections between stakeholders and corporations, and reposition corporations beyond mere profit growth and/or pandering of corporate interest. Corporate sustainability is only guaranteed in the 21st century if undiluted attention is paid to the opinions and demands of the various stakeholders, and attempts are made to factor them into the decision-making process. Scholars opine that stakeholder resistance to propositional and conformance values relates to intelligence failure (Edmondson, 2011; Greenfield, 2004); thus non-conformist, stakeholder dynamic idiosyncrasies, post-Fordist attraction (Frank, 2000; Holt, 2000); and passive, voicer, irate, antagonist and activist movements (Zeithaml et al., 2006) are critical processes that promote stakeholder dialogue and/or town-hall meeting as a very useful arsenal in business management, with CSR playing a pivotal role.

Stakeholder endorsement is a critical competitive advantage, given that stakeholder dialogue unveils stakeholders’ complexities and value propositions more than extant theories, and permits leveraging on stakeholders’ knowledge and skills for social ends. As organs of the society, whose basic purpose lies outside within the ethical and responsible standpoints (Abell, 1980; Drucker, 1974; Thompson & Strickland, 1987), corporations use stakeholder dialogue to ensure the inspiring purpose, including corporate direction, vision, mission and strategy for which they are birthed and known for are not forgotten as the corporation grows to maturity (Freeman & Dmytriyev, 2017; Freeman et al., 2010). That a corporation always sits on moral purpose and upholds stakeholder theory of creating values for all stakeholders make stakeholder dialogue worthwhile and weaken the gory dichotomy of using CSR to cover ill-doing as the reason for wrongdoing. Further, there are unfounded dichotomies that may be cleared by stakeholder dialogue, especially on the grounds of stakeholder interdependence. Amidst scarce resources, trade-offs may ensue in corporate decisions because impacting on the communities suggests disadvantaged stockholders; higher employee incentives go with less values to other stakeholders; and/or fair deals with suppliers amount to customers paying more. Freeman and Dmytriyev (2017) posit that stakeholder dialogue resonates stakeholder interdependence and chain behaviour, given that value to one stakeholder also contributes to values to others. For instance, impacting on the communities and societies rubs off on owners’ returns by way of higher stock-values, higher credit rating, higher patronage, motivated and dedicated employees, improved corporate reputation, just as impacting on suppliers and/or employees may trickle down on the quality of value delivered to the customers.

However, the significance of stakeholder dialogue in synergizing CSR, stakeholder and stakeholder theory informed the proposition of a four-stage stakeholder dialogue ladder that reflects the corporation’s extent of development and her frequency and intensity of interaction with its stakeholders. Figure 3 reports that at the base category, corporation-stakeholder relationship involves one-sided flow of information from the corporation or more autocratic approach because the stakeholder is rarely involved in the CSR report releases, information on homepages, and explanatory meetings. Perhaps this works when CSR is used to cover wrongdoing (Freeman & Dmytriyev, 2017), when rigid mindset of Adam Smith and Milton Friedman subsists, when the corporation is new and does not know much about the stakeholders’ interest, when issues require reactive measures or some other reasons. The next category involves social interaction or two-way communication (opinion sharing), which Katz and Lazarsfeld (1955) relate to as listening to and sharing of opinions, attitude development and behaviour stimulation. The Maussian’s gift-giving theory suggests that corporate life-saving ideas are shared for free when stakeholders are given the opportunity of interaction with the firm (Mauss, 1990). Thus, opinion sharing involves holding CSR report and town-hall meetings, whereupon outsiders contribute to improve meeting of minds though there is the obvious risk of the discussion having little content and lacking well-defined focus.

Next up in the level is dialogue; dialogue on a theme has the potential of freely expanding discussion and debate on the issues at hand beyond immediate and remote focus by experts from universities, industrialists, environmentalists, government agencies, etc., who come to brainstorm and think-loud in a focused group on integrated and cynical-free resolution(s) to the problem. The last but the highest category is collaboration and networking; this suggests that corporations and stakeholders dialogue on issues or themes and work in one accord for mutual benefits. Collaboration and/or networking means stakeholders and corporations dialogue, and engage in mutually beneficial activities that show that the stakeholders have serious stake in the firm’s corporate existence to the extent that they patronize them, offer them timeous inputs, and promote the corporation(s) and its products to friends, acquaintances, colleagues, etc.

Conclusion

The stakeholders are categorized into resource-based, market-based and socio-political-based dialectics; they influence, and are influenced by, corporations. In the contemporary knowledge economy, corporations are critically besieged with the growing hegemonies and expectations from better informed and diverse stakeholders and more specific pressures to address societal issues amidst internal calls to generate wealth and/or greater financial security. Scholarly calls on CSR stir-up, coerce, or force corporations to redefine their responsibilities to the stakeholders and to integrate social, environmental and economic concerns into business processes and strategies in a manner that impacts on the society more transparently than ever before (Greenfield, 2004; Kotler & Lee, 2005). Corporations are seriously pressured to implement actions that protect the environment, fight against exclusion and contribute to local economies; and because CSR contributes to social interaction and sustainable development, it provides the panacea to such pressures. In business and political settings, CSR represents an aspect of corporate responsibilities oriented toward social ends and, and which aids the understanding of corporate obligations and duties toward society as expressed in Carroll’s (1979) pyramid: economic (profit-making and delivery of quality product), legal (abiding by laws, rules and regulations), ethical (respect for ethical standards and principles shared within corporate environment), and philanthropic (fairness and service to charity or humanity).

The stakeholder theory attempts to analyze the interests of those groups to whom the corporation is responsible to and the scope of responsibility due to each stakeholder because organizational success is increasingly shaped by stakeholder relationships. Stakeholder theory explains the motive behind CSR; however, though CSR policies are often less structured and formalized (reactive), still corporations attempt to adopt interesting and proficient behaviours to manage societal issues in the present knowledge economy. The CSR practices are diverse in meaning and context within corporate strategy; some (e.g., Milton Friedman and Adam Smith) focus on instrumental theories and wealth creation, in which case, CSR is fundamentally synonymous with profit maximization and financial performance under societal constraint, and others (e.g., Lord Keynes and New Institutional Economics) take more of integrative theories and global performance and, perceive CSR to create value for a broad range of stakeholders. Further, the meaning and scope of CSR activities depend on firm’s strategic positioning – some CSR policies could be defensive to limit constraints, and others defined to be proactive to seek new opportunities. Defensive behaviour, though may be profitable, is highly pragmatic and may in the long-run be counter-productive if the corporation sermonizes without the cognate actions. Practically, defensive behaviour involves running limited CSR programmes to minimize risks or to respond to stakeholders’ pressures (Castello & Lozano, 2009; Halme & Laurila, 2009).

For instance, corporations follow professionally prescribed standards to provide employee health and safety, and to save natural environment through managing pollution, waste, and energy consumption in order to avert penalties and legal issues. Active perspective is strategic and proactive in creating shared values for corporations’ sustainability, given that corporations use CSR programmes to foresee and identify new business opportunities, such as developing new products, processes and technologies, transforming corporation’s business model, and accessing new markets. The paper therefore concludes that subject to the problem to solve, the languages of both CSR and stakeholder theory are useful and that, the dichotomies of covering wrongdoing and creating falsehoods could be addressed when firms adopt stakeholder dialogue and collaboration that update on the development of stakeholder friendly CSR programmes. By so doing, corporations and stakeholders see themselves as partners in lieu of adversaries, because corporations follow the philosophy of issue and purpose-driven within the moral archetype, create values for all, and allow interdependent stakeholders spirit with its rub-off effects to ensue. Implicit is that corporations need to continually make strong commitment to CSR since there is a strong relationship between corporation’s CSR activities and its stakeholders and the actual corporation’s performance.

Availability of data and materials

Not applicable.

References

Abd Rashid, M., Sh. Ahmadb, F., & Othman, A. (2014). Does service recovery affect customer satisfaction? A study on co-created retail industry. Procedia-Social and Behavioral Sciences, 130, 455–460.

Abell, D. (1980). Defining the business: The starting strategic planning. Prentice-Hall.

Abell, D. (1978). Strategic windows. Journal of Marketing, 42(3), 21–25.

Aguilera, R., Rupp, D., Williams, C., & Ganapathi, J. (2007). Putting the S back in corporate social responsibility: A multi-level theory of social change in organizations. Academy of Management Review, 32(3), 836–863.

Ahamed, W., Suhazeli, W., Almsafir, M., & AlSmadi, A. (2014). Does corporate social responsibility lead to improve in firm financial performance? Evidence from Malaysia. International Journal of Economics & Finance, 6(3), 126–138.

Ahlstrom, D. (2010). Innovation and growth: How business contributes to society. Academy of Management Perspectives, 24(3), 10–23.

Albuquerque, R., Koskinen, Y., Yang, S., & Zhang, C. (2020). Resiliency of environmental and social stocks: an analysis of the exogenous COVID-19 market crash. The Review of Corporate Finance Studies, 9(3), 593–621.

Amran, A., Zain, M., Sulaiman, M., Sarker, T., & Ooi, S. (2013). Empowering society for better Corporate Social Responsibility (CSR): The case of Malaysia. Kajian Malaysia, 31(1), 57–78.

Awa, H., & Eze, S. (2010). Democracy and user community collaboration in innovation: A value creation paradigm in an extended enterprise. International Business and Management, 1(1), 90–106.

Boone, L., & Kurtz, D. (2007). Contemporary marketing. Harcourt College Publisher.

Bowen, R. (1953). Social responsibilities of the business. New York: Harper & Row.

Burns, T., & Stalker, G. (1961). The management of innovation. Tavistock.

Bush, V., Bush, A., & Orr, L. (2010). Monitoring the ethical use of sales technology: An exploratory field investigation. Journal of Business Ethics, 95(2), 239–257.

Business Week. (1984). Making service a potential marketing tool: spending big on customer care is becoming good business, 2846, 164–170.

Carroll, A. (1979). A three-dimensional conceptual model of corporate social performance. Academy of Management Review, 4(4), 497–505.

Carroll, A. (1994). Social issues in management research: Experts’ views, analysis and commentary. Business and Society, 33(1), 5–29.

Carroll, A., & Shabana, K. (2010). The business case for corporate social responsibility: A review of concepts, research and practice. International Journal of Management Reviews, 12(1), 85–105.

Castello, I., & Lozano, J. (2009). From risk management to citizenship corporate social responsibility: Analysis of strategic drivers of change. Corporate Governance, 9(4), 373–385.

Clarkson, M. (1995). A stakeholder framework for analyzing and evaluating social performance. Academy of Management Review, 20(1), 92–118.

Clifton, D., & Amran, A. (2010). The stakeholder approach: A sustainability perspective. Journal of Business Ethics, 98(1), 121–136.

Cooper, S., Crowther, D., Davies, M., & Davis, E. (2001). Shareholder or stakeholder value: The development of indicators for the control and measurement of performance. The Chartered Institute of Management Accountants.

Deegan, C., & Unerman, J. (2006). Financial accounting theory. McGraw Hill.

Donaldson, T., & Preston, L. (1995). The stakeholder theory of the corporation: concepts, evidence, and implications. Academy of Management Review, 20(1), 65–91.

Dordi, T., & Palaschuk, N. (2022). Mapping 70 Years of advancements in management research on sustainability. Journal of Cleaner Production, 365, 132741. https://doi.org/10.1016/J.JCLEPRO.2022.132741

Drucker, P. (1974). Management. Harper & Row.

Eberstadt, N. (2006). The health crisis in the USSR. International Journal of Epidemiology, 35(6), 1384–1394. The New York Review.

Edmondson, A. (2011). Strategies for learning from failure. Harvard Business Review, 89(4), 48–55.

Eells, R., & Walton, C. (1961). Conceptual Foundations of Business. Homewood 111: Richard D. Irwin.

Elijido-Ten, E. (2007). Applying stakeholder theory to analyze corporate environmental performance: Evidence from Australian listed companies. Asian Review of Accounting, 15(2), 164–184.

Fatima, T., & Elbanna, S. (2022). Corporate Social Responsibility (CSR) implementation: a review and a research agenda towards an integrative framework. Journal of Business Ethics, 183(1), 105–121.

Frank, T. (2000). One market under God: Extreme capitalism, market populism and the end of economic democracy. Doubleday.

Freeman, R. (1984). Strategic management: A stakeholder approach. Pitman.

Freeman, R., Harrison, J., Wicks, A., Parmar, B., & De Colle, S. (2010). Stakeholder theory. The state of the art. Cambridge University Press.

Freeman, R., & Dmytriyev, S. (2017). Corporate social responsibility and stakeholder theory: Learning from each other. Symphonya Emerging Issues in Management, 2, 7–15.

Friedman, M. (1970). The social responsibility of business is to increase its profits. In The New York Times Magazine. https://www.nytimes.com/1970/09/13/archives/a-friedmandoctrine-the-social-responsibility-of-business-is-to.html

Friedman, T. (2005). The world is flat: a brief history of the 21st century. Farrar: Straus & Giroux.

Garriga, E., & Mele, D. (2004). Corporate social responsibility theories: Mapping the territory. Journal of Business Ethics, 53(1–2), 51–71.

Greenfield, W. (2004). In the name of corporate social responsibility. Business Horizons, 47(1), 19–28.

Halme, M., & Laurila, J. (2009). Philanthropy, integration or innovation? Exploring the financial and societal outcomes of different types of corporate responsibility. Journal of Business Ethics, 84(3), 325–339.

Heath, J., & Norman, W. (2004). Stakeholder theory, corporate governance, and public management. Journal of Business Ethics, 53(3), 247–265.

Holt, D. (2000). Post-modern market. In J. Cohen, & J. Rogers (Eds.) New Democracy Form (pp. 63-68). Beacon Press.

Jenkins, H. (2009). A business opportunity’ model of corporate social responsibility for small-and medium-sized enterprises. Business Ethics: A European Review, 18(1), 21–36.

Jones, B., & Nisbet, P. (2011). Shareholder value versus stakeholder values: CSR and financialization in goal global food firms. Socio-Economic Review, 9(2), 287–314.

Jones, T. (1995). Instrumental stakeholder theory: A synthesis of ethics and economics. Academy of Management Review, 20(2), 404–437.

Kantabutra, S., & Ketprapakorn, N. (2020). Toward a theory of corporate sustainability: A theoretical integration and exploration. Journal of Cleaner Production, 270(4), 122292. https://doi.org/10.1016/J.JCLEPRO.2020.122292

Katz, E., & Lazasfeld, P. (1955). Personal influence. Free Press.

Kau, A., & Loh, E. (2006). The effects of service recovery on consumer satisfaction: A comparison between complainants and non-complainants. Journal of Services Marketing, 20(2), 101–111.

Kazmi, A. (2008). A proposed framework for strategy implementation in the Indian context. Management Decision, 46(10), 1564–1581.

Keith, R. (1960). The marketing revolution. Journal of Marketing, 24(3), 35–38.

Kotler, P., & Lee, N. (2005). Corporate social responsibility: Doing the most good for your company and your cause. Wiley.

Kotler, P., & Keller, K. (2009). Marketing management (13th ed). Pearson Education Ltd.

Lawrence, P., & Lorsch, J. (1967). Organization and environment, division of research. Harvard Business School.

Lee, M. (2011). Configuration of external influences: The combined effects of institutions and stakeholders on corporate social responsibility strategies. Journal of Business Ethics, 102(2), 281–298.

Lepoutre, J., & Heene, A. (2006). Investigating the impact of firm size on small business social responsibility: A critical review. Journal of Business Ethics, 67(3), 257–273.

Mauss, M. (1990). The Gifts (1950), Reprint. London: Routledge.

McGuire, J. (1963). Business and society. McGraw-Hill.

Metcalfe, C. (1998). The stakeholder corporation. Business Ethics: A European Review, 7(1), 30–36.

Mitchell, R., Agle, B., & Wood, D. (1997). Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Academy of Management Review, 22(4), 853–896.

Murray, K., & Vogel, C. (1997). Using a hierarchy-of-effects approach to gauge the effectiveness of CSR to generate goodwill toward the firm: Financial versus non-financial impacts. Journal of Business Research, 38(2), 141–159.

Nikolova, V., & Arsić, S. (2017). The stakeholder approach in corporate social responsibility. Engineering Management, 3(1), 24–35.

O’Riordan, L., & Fairbrass, J. (2008). CSR - theories, models and concepts in stakeholder dialogue – a model for decision-makers in the pharmaceutical industry. Journal of Business Ethics, 83(4), 754–758.

Ormiston, M., & Wong, E. (2013). License to ill: The effects of corporate social responsibility and CEO moral identity on corporate social irresponsibility. Personal Psychology, 66(4), 861–893.

Orts, E., & Strudler, A. (2002). The ethical and environmental limits of stakeholder theory. Business Ethics Quarterly, 12(2), 215–233.

Panwar, R., Rinne, T., Hansen, E., & Juslin, H. (2006). Corporate responsibility. Balancing economic, environmental, and social issues in the forest industry. Forest Products Journal, 56(2), 4–12.

Reed, K. (1998). Contextualising comparative research: Health beliefs and behaviours of American and British Born Asian women’ current research proceedings New York state sociological association. FIT, State University of New York.

Risi, D., Vigneau, L., Bohn, S., & Wickert, C. (2023). Institutional theory-based research on corporate social responsibility: Bringing values back in. International Journal of Management Reviews, 25(1), 3–23.

Ruf, B., Muralidhar, K., Brown, R. Jay., & J. & Paul K. (2001). An empirical investigation of the relationship between change in corporate social performance and financial performance: a stakeholder theory perspective. Journal of Business Ethics, 32(2), 143–156.

Russo, A., & Perrini, F. (2010). Investigating stakeholder theory and social capital: CSR in large firms and SMEs. Journal of Business Ethics, 91(2), 207–221.

Sachs, S., Maurer, E., Rühli, E., & Hoffmann, R. (2006). Corporate Social Responsibility for a ‘“stakeholder view”’ perspective: CSR implementation by a Swiss mobile telecommunication provider. Corporate Governance, 6(4), 506–515.

Sen, S., Bhattacharya, C., & Korschun, D. (2006). The role of Corporate Social Responsibility in strengthening multiple stakeholder relationships: A field experiment. Journal of the Academy of Marketing Science, 34(2), 158–166.

Sims, R. (2003). Ethics and corporate social responsibility: Why giants fall (pp. 300- 318).

Smith, M. (1996). Shareholder activism by institutional investors: Evidence from CalPERS. The Journal of Finance, 51(1), 227–252.

Starik, M., & Kanashiro, P. (2020). Advancing a multi-level sustainability management theory. Sustainability, 4, 17–42. https://doi.org/10.1108/S2514-175920200000004003/FULL/XML

Sweeney, L., & Coughlan, J. (2008). Do different industries report Corporate Social Responsibility differently? An investigation through the lens of stakeholder theory. Journal of Marketing Communications, 14(2), 113–124.

Tanggamani, V., Abu-Bakar, S., & Othman, R. (2017). Incorporating role of stakeholder into corporate CSR strategy for sustainable growth: An exploratory Study. SHS Web of Conferences, 36, 00040. https://doi.org/10.1051/shsconf/20173600040

Thompson, A. J., & Strickland, A. (1987). Strategic management: concept and cases. Business Publication, Inc.

Thorne, D., Ferrell, O., & Ferrell, C. (2003). Business and society: A strategic approach to corporate citizenship. Houghton Mifflin Company.

Tokoro, N. (2007). Stakeholders and Corporate Social Responsibility (CSR): A new perspective on the structure of relationships. Asian Business & Management, 6, 143–162. https://doi.org/10.1057/palgrave.abm.9200218

Vargo, S., & Lusch, R. (2004). Evolving to a new dominant logic for marketing. Journal of Marketing, 68, 1–17.

Vermeulen, W., & Witjes, S. (2016). On addressing the dual and embedded nature of business and the route towards corporate sustainability. Journal of Cleaner Production, 112, 2822–2832. https://doi.org/10.1016/j.jclepro.2015.09.132

Vormedal, I., & Ruud, A. (2009). Sustainability reporting in Norway: An assessment of performance in the context of legal demands and sociopolitical drivers. Business Strategy and the Environment, 18(4), 207–222.

Votaw, D. (1972). Genius becomes rare: A comment on the doctrine of social responsibility Pt. I. California Management Review, 15(2), 25–32.

Zeithaml, V., Bitner, M., & Gremler, D. (2006). Services marketing: Integrating customer focus across the firm. (4th ed). McGraw- Hill.

Zhao, J. (2021). Reimagining Corporate Social Responsibility in the era of COVID-19: Embedding resilience and promoting corporate social competence. Sustainability, 13(12), 65–48.

Acknowledgements

Not applicable.

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

Equal contribution.

Corresponding author

Ethics declarations

Competing interests

Not applicable.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Awa, H.O., Etim, W. & Ogbonda, E. Stakeholders, stakeholder theory and Corporate Social Responsibility (CSR). Int J Corporate Soc Responsibility 9, 11 (2024). https://doi.org/10.1186/s40991-024-00094-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40991-024-00094-y