Abstract

This study uses high-frequency (1-min) price data to examine the connectedness among the leading cryptocurrencies (i.e. Bitcoin, Ethereum, Binance, Cardano, Litecoin, and Ripple) at volatility and high-order (third and fourth orders in this paper) moments based on skewness and kurtosis. The sample period is from February 10, 2020, to August 20, 2022, which captures a pandemic, wartime, cryptocurrency market crashes, and the full collapse of a stablecoin. Using a time-varying parameter vector autoregressive (TVP-VAR) connectedness approach, we find that the total dynamic connectedness throughout all realized estimators grows with the time frequency of the data. Moreover, all estimators are time dependent and affected by significant events. As an exception, the Russia–Ukraine War did not increase the total connectedness among cryptocurrencies. Analysis of third- and fourth-order moments reveals additional dynamics not captured by the second moments, highlighting the importance of analyzing higher moments when studying systematic crash and fat-tail risks in the cryptocurrency market. Additional tests show that rolling-window-based VAR models do not reveal these patterns. Regarding the directional risk transmissions, Binance was a consistent net transmitter in all three connectedness systems and it dominated the volatility connectedness network. In contrast, skewness and kurtosis connectedness networks were dominated by Litecoin and Bitcoin and Ripple were net shock receivers in all three networks. These findings are expected to serve as a guide for portfolio optimization, risk management, and policy-making practices.

Similar content being viewed by others

Introduction

Although cryptocurrencies were established as a decentralized payment schemes, they have gained popularity as innovative investment assets. Since Bitcoin came into existence in 2009, the cryptocurrency market has developed strikingly and continued its turbulent growth. In November 2021, the total market capitalization for cryptocurrencies topped three trillion US dollars (USD) before falling below one trillion over the consecutive eight months.Footnote 1 As a result, the volatile nature of cryptocurrencies has triggered interest among researchers. Most previous studies focused on connectedness through first- and second-order moments.

According to the findings of Akhtaruzzaman et al (2020), Briere et al (2015), Ghabri et al (2021), Guesmi et al (2019), Shahzad et al (2022), Stensås et al (2019), Qarni and Gulzar (2021), and Zeng et al (2020), cryptocurrencies show diversification, hedging, and safe-haven properties when included alongside traditional portfolio investments (e.g. common stocks, bonds, commodities and currencies). Other researchers examined how cryptocurrencies interact among themselves by analyzing their returns and volatility spillover effects, revealing that they are connected via both channels (e.g. Beneki et al 2019; Charfeddine et al 2022; Ji et al 2019; Kumar et al 2022). Furthermore, Chin and Lee (2017) showed how high-frequency automated algorithmic trading dominates financial asset prices.Footnote 2 Indeed, algorithmic trading is highly utilized by investors and analysts (Fang et al 2022).Footnote 3

Despite the accumulation of empirical studies examining the information transmission features of cryptocurrencies through first- and second-order moments, the analysis of their connectedness through high-order (third and fourth orders in this study) moments remains an underexplored area, with few exceptions. For example, Rubinstein (1973) showed that portfolio construction should be extended to consider higher-order moments in the presence of non-normal returns. Moreover, Ahmed and Mafrachi (2021) documented the significant impact of higher-order moments on cryptocurrency returns, and Catania and Grassi (2022) reported the forecasting ability of higher moments. Their findings show that high-order moments are not only important for price formation but also enable information transmission.

The analysis of high-order moments is relevant due to several stylized facts observed about cryptocurrency price behaviors. For instance, it has been documented that the return distribution of cryptocurrencies can be characterized as non-normal with asymmetries (i.e. non-zero skewness) and high kurtosis (e.g. Baek & Elbeck 2015). Further, Cheah and Fry (2015), Fry and Cheah (2016), and Corbet et al (2018) reported speculative bubbles in cryptocurrency prices and others reported jumps in returns and volatility (e.g. Chaim & Laurini 2018; Bouri et al 2020). Fry (2018) found that cryptocurrency return distributions are fat-tailed, and according to Baur et al (2018), Bitcoin is a speculative asset with high return volatility. Fang et al (2022) argued that the high volatility of the cryptocurrency market attracts speculative interest. Zhao et al (2022) reported herding behaviors in cryptocurrency prices as did Kallinterakis (2019), Bouri et al (2019), Ballis and Drakos (2020), and Kaiser and Stöckl (2020). Geuder et al (2019) documented exponential growth in Bitcoin’s price, Urquhart (2017) reported price clustering, and Phillip et al (2018) reported volatility and kurtosis clustering. Due to these stylized facts, structured analyses of the third and fourth orders are expected to be relevant to predicting cryptocurrency price dynamics because their connectedness is unlikely to be fully captured by first- and second-order moments (Hasan et al 2021).

The theoretical channel for the relevance of third-order moment cryptocurrency price formations was explained by Patton (2004), who showed that investors prefer positively skewed assets when the utility function exhibits a non-increasing risk aversion. Jia et al. (2020) empirically demonstrated that third-order moments can predict cryptocurrency returns. The aforementioned researchers attributed this finding to investors’ preferences for the lottery effect and an aversion to price crashes.Footnote 4 Other studies have shown that conditional skewness improves the forecasting of volatility and risk measures in cryptocurrency markets (e.g. Catania & Grassi 2022). Regarding fourth-order moments, Dittmar (2002) and Baillon (2017) documented that investors are averse to extreme outcomes, as measured by realized kurtosis.

Importantly, the third- and fourth-order moments offer incremental information that may lead to increased economic benefits in portfolio construction (Amaya et al 2015). Empirical studies have documented significant tail-risk dependencies among cryptocurrencies (Nguyen et al 2020; Xu et al 2021; Ahn 2022). Hence, examining spillovers through high-order moments in the cryptocurrency market should offer insights related to the transmission of crash and extreme event risks; both of which are characterized as systematic events. Notably, skewness measures the asymmetry of return distributions, and crash risk and kurtosis capture the extremeness of returns and tail risk (Greenwood-Nimmo et al 2016; Kräussl et al 2016). Accordingly, the skewness of spillover analysis should offer useful information on how cryptocurrencies are linked through downside and upside risks. Moreover, the transmission of fat-tail risk is expected to be illuminated by the occurrence of extreme events that is captures by kurtosis (Do et al 2016).

To test these predictions, this study examines spillover effects at high-order moments among six leading cryptocurrencies in terms of market capitalization and liquidity (i.e. Bitcoin, Ethereum, Binance, Cardano, Litecoin, and Ripple).Footnote 5 Using intraday price data at 1-min intervals from February 10, 2020, to August 20, 2022, we calculated the daily realized second-, third-, and fourth-order moments of cryptocurrency returns. Then, we investigate the dynamic spillovers based on volatility, skewness, and kurtosis measures using the connectedness methodology of Antonakakis et al (2020), which is formally known as the time-varying parameter (TVP) vector autoregressive (VAR) model. This model provides superior information on how spillovers evolve during different states of the market over time (Bouri et al 2021), thus enabling a clear observation of the dynamic evolution of systematic risk transmissions among financial assets.

This study makes several noteworthy contributions to the existing literature by examining the role of high-order moments for a better understanding of cryptocurrency market connectedness. First, systematic risk spillovers based on volatility, skewness, and kurtosis are documented using high-frequency data. The results are expected to enrich the literature by revealing how information is transmitted among cryptocurrencies during different episodes of the market in the frequency domain. The results show that higher moments play an important role in information transmission among cryptocurrencies.

Second, we identify cryptocurrencies that are shock transmitters and emitters within the connectedness systems, specifically during high volatility, crash risk, and fat-tail event conditions. This type of information is crucial for anyone concerned with high-frequency trading. We suggest that assets that influence market dynamics (i.e. shock transmitters) are often preferable to those that are influenced by the market (i.e. shock emitters). This intuition is based on the fact that fewer risk factors influence shock transmitters than do emitters (Bouri et al 2021). Thus, holding shock-emitting cryptocurrencies will lead to additional risk exposures. Third, this study analyzes the case of the Binance cryptocurrency in high-order connectedness network, which enriches the findings of Hasan et al (2021) and Cui and Maghyereh (2022) by documenting that Binance is a consistent transmitter of volatility, skewness, and kurtosis shocks. This level of elucidation is important to investors, policymakers, and strategists.

Fourth, we analyze the spillovers and their connectedness from recent stressful episodes (e.g. pandemic, a war, and stablecoin collapse). Despite the accumulation of research on information transmission between cryptocurrencies during the COVID-19 period (e.g. Shahzad et al 2021; Hasan et al 2021; Al-Shboul et al 2022; Özdemir 2022), and the Russia-Ukraine WarFootnote 6 (e.g. Cui & Maghyereh 2022), our results are the first to document the dynamic connectedness of cryptocurrency markets around the collapse of Luna using high-order moments.

Fifth, this study applies a very high-frequency (1-min) time domain for price data to calculate the needed high-order moments. Most relevant studies utilized 5-min of longer time domains (e.g. Hasan et al 2021; Cui & Maghyereh 2022). This is important for cryptocurrency speculators and investors. For instance, information is processed differently by investors depending on their investment strategy, i.e. short-term speculators versus long-term investors, how frequently they are trading, and how institutionally they are constrained (Dacorogna et al 2001). Furthermore, speculators (e.g. Chin & Lee 2017) and automated algorithmic trading dominate financial asset prices at a higher-frequency. Due to the unique characteristics of the cryptocurrency markets (e.g. high volatility with arbitrage opportunities), algorithmic trading is highly utilized (Fang et al 2022). Therefore, using high-frequency price data, our results provide information about the probable hidden linkages and systematic risk transmission associated with the trading behavior of day traders and algorithm-guided trading.

The main empirical findings of the study are threefold. First, significant systematic risk transmissions at higher moments are time dependent and higher during stressful events (e.g. COVID-19, wartime, and the collapse of Luna). Current findings further demonstrate that high-order estimators (i.e. skewness and kurtosis) capture additional dynamics on systematic risk transmissions, which analysis of volatility mainly missed. Thus, high-order estimates deserve in-depth investigations when studying systematic risk transmission among cryptocurrencies.

Second, cryptocurrency connectedness at the second moment (volatility) is higher than that of the third (skewness) and fourth (kurtosis), which corroborates the findings of several previous studies that used lower frequency price data (Bouri et al 2021; Hasan et al 2021; Cui & Maghyereh 2022). Moreover, our results demonstrate that the levels of connectedness among cryptocurrencies in all three estimators (volatility, skewness, and kurtosis) were higher at high-frequency. Showing that high-frequency trading in the cryptocurrency market is prone to higher risk spillovers. Higher connectedness level at higher frequency domain can be related with algorithmic trading, which occurs at a very high frequency.

Third, our net directional spillover analysis shows that Binance was the net shock transmitter in all three connectedness networks and was the dominant transmitter of volatility shocks. In contrast, Litecoin dominated skewness (crash risk) and kurtosis (tail risk). Bitcoin is losing its status as the leading transmitter of shocks, which corroborates previous lower-order analyses (Corbet et al 2018; Yi et al 2018). Further, Ripple was the largest emitter of volatility shocks, and Ethereum was the leading emitter of skewness and kurtosis shocks. Bitcoin and Ethereum were net shock emitters in all three connectedness networks, contrary to the findings of Cui and Maghyereh (2022). These patterns are more prevalent under stressful world conditions. As an overall recommendation, we report that investors and asset managers should hold shock transmitters and avoid receivers, given that transmitter assets are influenced by fewer risk factors than emitters.

The remainder of this study is organized as follows: Sect. "Literature review" provides a summary of the relevant literature. Sect. "Data and methods" explains the data and methods, and Sect. "Empirical results" presents the empirical findings. Sect. "Robustness tests" reports several robustness tests on our main empirical findings against the selection of lag orders, different forecasting horizons, and assumptions related to prior hyperparameter estimations in the TVP-VAR model. Finally, Sect. "Conclusion" concludes the study and discusses further implications for investors, portfolio managers, and policymakers.

Literature review

Owing to their astonishing returns and low correlations with other asset classes (Sebastião & Godinho 2021), cryptocurrencies have gained popularity as financial investments and safe-haven assets (Aharon et al. 2021; Baur et al 2018; Kumar et al 2022). This has attracted the attention of academics and has led to emerging lines of literature dealing with cryptocurrencies' diversification and risk management properties. For example, the dynamic relationship of major asset classes with cryptocurrencies has been compared to bonds and equities (Akhtaruzzaman et al 2020; Baur et al 2018; Bouri et al 2017, 2018; Kristjanpoller et al. 2020; Platanakis & Urquhart 2020), oil prices (Selmi et al. 2018), portfolios of gold, oil, and emerging equity market indices (Guesmi et al 2019), developing equity markets (Omane-Adjepong & Alagidede 2020; Shahzad et al 2022; Stensås et al 2019), developed equity markets (Dyhrberg 2016; Klein et al 2018), exchange rate risks (Kristjanpoller & Bouri 2019; Qarni & Gulzar 2021; Urquhart & Zhang 2019), gold, crude oil, and US market indices (Bouri et al. 2021; Charfeddine et al 2020; Zeng et al 2020), commodities index, currencies and equity markets (Corbet et al 2018), gold futures (Kang et al 2019), conventional asset liquidity risk (Ghabri et al 2021) and economic policy uncertainties (Demir et al 2018; Balli et al 2020). The results from these studies offer important insights into the role of cryptocurrencies in managing portfolio risk and achieving diversification benefits.

Other researchers have concentrated on the dynamic connectedness between cryptocurrencies, documenting their information transmission through return and volatility channels. The findings of earlier studies suggested that Bitcoin was a net receiver of return and volatility shocks from Ripple (Fry & Cheah 2016) and Ethereum (Beneki et al 2019). Ciaian et al (2018) reported that the prices of altcoins were driven by Bitcoin, mainly under a short horizon. Yi et al (2018) analyzed volatility spillovers between wide range of cryptocurrencies and revealed that mega-caps were the main risk transmitters within the system of volatility connectedness. Ji et al (2019) reported that Bitcoin and Litecoin were the primary transmitters of return and volatility shocks. Koutmos (2018) also identified Bitcoin as a net transmitter of both return and volatility shocks. However, the findings of Antonakakis et al (2019) indicated that Ethereum dominated Bitcoin as the primary transmitter of volatility shocks. Kumar et al (2022) confirmed that Ethereum was the primary transmitter of volatility shocks and Omane-Adjepong and Alagidede (2019) used wavelet-coherence and nonparametric causality analyses to show that return and volatility spillover tests were sensitive to scale and volatility proxies. In summary, low-order analytical reports on which cryptocurrency dominates the return and volatility connectedness are highly conflicting.

The impact of COVID-19 on cryptocurrency connectedness was also examined. For example, Yousaf and Ali (2020), Demiralay and Golitsis (2021), and Kumar et al (2022) reported higher return and volatility connectedness during the pandemic. Shahzad et al (2021) found that volatility spillovers among cryptocurrencies gained strength at the start of COVID-19, specifically under high volatility episodes. Reza et al. (2022) and Özdemir (2022) suggested that cryptocurrencies became more connected through return and volatility channels during pandemics. Despite the accumulation of empirical evidence related to the dynamic linkages and information transmission among cryptocurrencies, existing studies have mainly focused on the return and volatility spillover effects. Given the stylized facts associated with cryptocurrency returns, a high-order moment analysis of connectedness is expected to be highly relevant for detailed portfolio optimization and risk management strategies. Only two recent studies performed higher-moment analysis. Hasan et al (2021) examined the connectedness of cryptocurrencies using intraday return date observed every 5-min. They utilized a rolling-window-based VAR approach (Diebold & Yilmaz (2014) from June 1, 2018, to December 25, 2020. Cui and Maghyereh (2022) utilized the TVP-VAR approach to examine cryptocurrency connectedness from August 5, 2019 to April 23, 2022. Their findings implied that most shocks were transmitted during a short frequency (within a week). The TVP-VAR approach is more robust than the rolling-window-based VAR since it does not lead to the loss of noteworthy observations, is not sensitive to outliers, and avoids arbitrary rolling-window size selections (Antonakakis et al 2020).

The present study provides several differences in terms of analysis. First, we utilize a higher-frequency price data (1-min) to calculate realized estimators, which are expected to reveal important information about the trading patterns of high-frequency cryptocurrency investors and algorithmic trading. It should also reveal hidden linkages within the system of cryptocurrency connectedness. This is important because when the main aim is to identify system connectedness and risk transmission, the speed of adjustments is what investors seek (Antonakakis et al. 2019). In addition, our analytical approach extends the work of Cui and Maghyereh (2022) by evaluating different coins shown to have essential roles in the connectedness networks of cryptocurrencies.

The second analytical difference is that we include more recent data, which extends the research of Hasan et al (2021) and Cui and Maghyereh (2022) by accounting for severe oscillations in the market. Moreover, extreme world events, such as the Russia-Ukraine War and the collapse of Luna can be tested for effects. To the best of our knowledge, these effects have not yet been examined. Our study also distinguishes net transmitters and receivers of volatility, skewness, and kurtosis shocks. By identifying the cryptocurrencies that dominate the connectedness network (net shock transmitters) and those dominated by others (i.e. net receivers of shocks), we expect to provide critical information for portfolio asset allocation and risk management strategies for managers who want to make informed decisions in turbulent times.

Data and methods

Data

This study analyzes the spillover effects for the realized volatility, skewness, and kurtosis among six cryptocurrencies (i.e. Bitcoin, Ethereum, Binance, Cardano, Litecoin, and Ripple) with high market capitalization and liquidity. To this end, we employ intraday price data, measured every minute. The price data were extracted from www.cryptodatadownload.com and were mainly sourced from Binance Exchange, given that it is the sole trader for Binance Coin. Each day, 1440 daily price observations are recorded from February 10, 2020, to August 20, 2022. The availability of 1-min price information primarily drives our sample period. We use the price data to calculate intraday returns, which are then used to calculate the daily realized moments of the second, third, and fourth order. Subsequently, the spillover effects in the realized volatility, skewness, and kurtosis are analyzed using the TVP-VAR approach of Antonakakis et al (2020).

Realized moments

We calculate the second- (volatility), third- (skewness), and fourth-order (kurtosis) moments from intraday cryptocurrency returns observed each minute. Accordingly, we record price data around the clock, given that the cryptocurrency market is always active (Fang et al 2022). First, intraday 1-min returns, rt,i, are calculated as the logarithmic difference of closing price (p) at times t and t-1, starting with the closing price on February 10, 2020, at 12:00 a.m. and ending on August 20, 2022, at 12:00 a.m., as below:

where, pi,t is the ith intraday price of cryptocurrencies at time t, ri,t is the logarithmic intraday return and T is the total number of intraday returns.

Following the empirical studies of Bouri et al. (2021), Chen et al. (2021), and Gkillas et al (2022), the realized volatility (RVOLt) for each trading day is calculated by summing the squared intraday realized returns as given in Eq. (2):

Next, in accordance with Amaya et al. (2015), we calculate the realized higher moments, skewness, and kurtosis. Skewness is the third-order moment, and measures the shape of the return distribution as symmetric or asymmetric. Bouri et al. (2021) indicated that a negative realized skewness is associated with a fatter left-tail return distribution, and a positive realized skewness is associated with a fatter right-tail distribution. This further implies that an asset with a conditional return distribution of negative skewness experiences negative extreme returns more often than an asset with a conditional return distribution of positive skewness and vice versa. The construction of the realized skewness is expressed in Eq. (3):

where RSKEWt is the realized skewness at day t. Finally, to measure the extremity of deviations, the fourth moment, kurtosis, of realized returns is calculated following Amaya et al. (2015), per Eq. (4):

Table 1 lists the descriptive statistics for the realized volatility, skewness, and kurtosis calculated using Eqs. (2) to (4). Bitcoin provided the lowest mean values for realized volatility (0.0021) and the highest kurtosis (20.8354). The realized volatility value of Ripple (0.0056) was the highest among all cryptocurrencies, followed by Cardano (0.0053). Apart from Ethereum, the realized skewness values for the cryptocurrencies were negative, with Ripple having the highest negative realized skewness (− 0.0087). Generally, the realized volatility and kurtosis series are right-skewed, but the entire skewness series, with the exception of Ethereum, were left-skewed. All series showed high kurtosis values as indications of extreme peaks. The probability values of Jarque–Bera p(J–B) statistics reject the normal distribution for all realized estimators. Augmented Dickey–Fuller (ADF) test results showed that the time series were stationary at their level, which is a priori for VAR-based modeling.

In Fig. 1, we plot the daily time series of realized volatility (left panel), realized skewness (middle panel), and realized kurtosis (right panel) from February 11, 2020, to August 20, 2022. There is a clear indication that the realized estimators varied significantly over the sample period.

Spillover index calculation

To study the spillovers of intraday realized volatility, skewness, and kurtosis among the six cryptocurrencies, we relied on the TVP-VAR approach of Antonakakis et al (2020), which can be seen as an extension of the dynamic connectedness approach of Diebold and Yilmaz (2012, 2014). The method followed by Antonakakis et al (2020) uses a Kalman filter estimation with forgetting factors that allow the variance to vary over time.Footnote 7 The TVP-VAR approach solves the problem of arbitrary rolling window size selections and prevents the of loss of valuable observations (e.g., Bouri et al. 2021).

The TVP-VAR model can be given as follows;

with

where \({I}_{t-1}\) in Eqs. (5) and (6) demonstrates the information set until time t − 1. In Eq. (5), \({\varepsilon }_{t}\) is an N × 1 error vector, and \({S}_{t}\) is an N × N time-varying variance–covariance matrix. In Eq. (6), \({v}_{t}\) is an N × Np error matrix, and \({R}_{t}\) is an Np × Np variance–covariance matrix.

Susequenctly, the generalized impulse response function (GIRF) and generalized forecast error variance decomposition (GFEVD) are calculated following Koop et al (1996) and Pesaran and Shin (1998) that will be used in the calculation of the generalized connectedness measures of Diebold and Yilmaz (2014). To calculate GIRF and GFEVD, the VAR is transformed to its vector moving average representation following the specifications given below:

where \({\beta }_{t}={\left[{\beta }_{1,t}, {\beta }_{2,t},{\beta }_{3,t},\dots , {\beta }_{p,t}\right]}^{\prime}, {A}_{t}={\left[{A}_{1,t}, {A}_{2,t},{A}_{3,t},\dots , {A}_{p,t}\right]}^{\prime},\) and both \({\beta }_{i,t}\) and \({A}_{i,t}\) are N × N matrices.

The GIRFs measure responses of all variables with respect to a shock in one variable, i, within a system. Owing to the absence of a structural model, differences between an H-step-ahead forecast are computed where i is shocked and not shocked, which can be considered as the shock in variable i. This calculation can be given as follows:

where H indexes the forecast horizon, where \({\delta }_{j,t}\) is the selection vector that equals one on the jth position and zero otherwise.

The GFEVD which measures the share of forecast error variance held by one variable on another is calculated per Eq. (14):

Finally, we proceed to describe how a shock in one variable spills over to another variable. With the help of the GFEVD obtained by using Eq. (14), four different connectedness measures are calculated: total connectedness, total directional connectedness from variable i to others j, total directional connectedness to variable i from others j, net total directional connectedness, and net pairwise directional connectedness among each pair of variables.

First, the calculation of total connectedness takes the form of Eq. (15):

Second, the calculation of total directional connectedness from variable i to others j, which measures the spillover effect of a shock of one variable to others, takes the following of Eq. (16):

Third, the calculation of total directional connectedness from a variable i to others j, which measures the spillover effect of a shock from one variable to another, takes the form of Eq. (17):

Fourth, the calculation of net total directional connectedness is obtained by the difference of Eqs. (16) and (17), including the total directional connectedness from a variable i to others j minus the total directional connectedness to a variable i from others j:

If \({C}_{i,t}^{g}\) in Eq. (18) is greater than zero, i influences other variables more than being influenced by them and vice versa.

Finally, the calculation of net pairwise directional connectedness (NPDC) among two variables, such as i and j, can be given as Eq. (19):

If \({NPDC}_{ij}\left(H\right)\) in Eq. (19) is greater than zero, i dominates j, and vice versa.

Empirical results

This section begins with an overview of the average total connectedness based on three different estimators: realized volatility, realized skewness, and realized kurtosis. Subsequently, we examine the dynamic total connectedness, which analyzes time variations for overall spillover effects. In the third part, we examine the dynamic total directional connectedness followed by an empirical analysis of pairwise directional connectedness among cryptocurrencies. Finally, a rolling-window VAR-based connectedness model is performed for comparison purposes. Network diagrams for volatility (Fig. 14), skewness (Fig. 15), and kurtosis (Fig. 16) are presented in Appendix. To estimate TVP-VAR parameters, we follow Kumar et al (2022) and rely on the Akaike Information Criterion (AIC) in choosing lags where GFEVD is built on a 100-day ahead forecast. To estimate hyperparameters, Bayes prior is set to 200 days in the main analysis. Finally, following Koop and Korobis (2014) and Antonakakis et al. (2020), the decay factors used in the Kalman filter algorithm (i.e. the VAR forgetting factor and exponentially weighted moving average (EWMA) forgetting factor) are set to 0.99 and 0.96, respectively. Later, these selections are subjected to robustness tests.

Average total connectedness

Table 2 reports the average total volatility connectedness among the six cryptocurrencies. Each cryptocurrency's total forecast error analysis comprises two parts: autocorrelation (the focused cryptocurrency’s own contribution to its forecast error variance) and cross-correlation (the contribution by other cryptocurrencies to the forecast error variance of the focused cryptocurrency). For instance, the autocorrelation effect of Bitcoin of 20.81% is given in Cell (1, 1), which refers to Row 1 and Column 1. The value shows that more than one-fifth of the total forecast error variance of Bitcoin was caused by autocorrelation. The other cells in Raw 1 show the portion of forecast error variance coming from the volatility shocks of the other cryptocurrencies to Bitcoin. For instance, Cell (1, 2), which, similarly, refers to Row 1 and Column 2, shows the contribution of volatility shocks from Ethereum to the forecast errors of Bitcoin (16.72%). Binance had the highest autocorrelation effect at 24.80%, as reported in Cell (3, 3), followed by Ripple at 23.27% in Cell (6, 6). The highest contribution from one cryptocurrency to another was between Binance and Cardano, where the volatility shocks of Binance contributed 19.62% of forecast error variance in Cardano [Cell (4, 3)].

The TCI is given at the bottom-right corner, showing that, on average, 78.53% of a volatility shock in one cryptocurrency spill overs to others within the network. The remaining 21.47% reflects the autocorrelation effect. Nevertheless, Binance, on average, was the largest transmitter of volatility shocks (to others = 91.72%), followed by Ethereum (to others = 83.72%), as given in Cells (7, 2) and (7, 3), respectively. Litecoin was the largest receiver of volatility shocks (from others = 80.90%). Finally, the last row reports the net directional connectedness, which is the difference between how much of a shock in one cryptocurrency spill overs to others and how much of the shocks in all others are received by that cryptocurrency. The results showed that Bitcoin (− 5.13%), Cardano (− 3.95%), Litecoin (− 3.55%), and Ripple (− 8.09%) were net receivers of the volatility shocks, given that the total amount of volatility shocks they transmit to others was lower than the total amount of volatility shocks they received from the others. In contrast, Ethereum (4.19%) and Binance (16.52%) were net transmitters, and Binance dominated the network of volatility connectedness as the largest transmitter of volatility shocks.

According to Bouri et al (2021), portfolio managers should invest in an asset that drives the market, (i.e. net transmitter of the shocks) while avoiding assets driven by the market (i.e. net receivers of shocks) because net shock transmitters are influenced by a relatively lower number of risk sources, compared with net shock receivers. Hence, our results offer some implications for portfolio optimization and risk management strategies.

Binance was the largest transmitter of the shocks, followed by Ethereum and Cardano, whereas Ripple was the largest net receiver, followed by Bitcoin and Litecoin. Accordingly, Binance, Ethereum, and Cardano would be desired by investors during periods of higher volatility in the cryptocurrency market. In contrast, Ripple, Bitcoin, and Litecoin should be avoided by anyone wishing to attain diversification benefits. Compared with previous findings (Yi et al 2018; Ji et al 2019; Hasan et al. 2019; Cui & Maghyereh 2022; Kumar et al 2022), our findings suggest a higher total volatility connectedness among cryptocurrencies based on our 1-min frequency data. For instance, the findings of Yi et al (2018) revealed a total volatility connectedness index of 37.79% among eight leading cryptocurrencies from August 4, 2013, to April 1, 2018. Similarly, Ji et al (2019) reported a total volatility connectedness of 32.90% among six leading cryptocurrencies from August 7, 2015, to February 22, 2018. According to the results of Kumar et al (2022), the total volatility connectedness was higher, at 63.00%, from October 1, 2020, to January 5, 2021, including the COVID-19 period. Finally, the results of Cui and Maghyereh (2022) reported a total volatility connectedness of 67.31% based on their 5-min price data frequency to calculate realized cryptocurrency price volatility. Our volatility connectedness index of 78.53% implies that the diversification benefits of combining leading cryptocurrencies in a portfolio are lower when higher-frequency data are used. This further suggests that volatility risk spillovers are more substantial in higher-frequency trading. However, the current sample period includes major world events that may systematically affect cryptocurrency markets. We examine this phenomenon further in this study.

Our results show that the role of cryptocurrencies within the volatility connectedness network is changing. Yi et al (2018), Ji et al (2019), and Cui and Maghyereh (2022) showed that Bitcoin, Litecoin, and Cardano were the leading market drivers (net shock transmitters) when systematic volatility risk was considered. In contrast, Ethereum was driven by the market (net shock emitter). Our findings show dramatic differences. For instance, Bitcoin, Litecoin, and Ripple are net volatility shock emitters, and Binance and Ethereum are the primary transmitters of volatility shocks. One immediate interpretation is that Bitcoin is losing its dominance as a market driver, specifically when considering high-frequency trading. This is unsurprising, given the central role of Bitcoin during recent cryptocurrency market crashes. For instance, the withdrawal of Tesla from accepting Bitcoin as payment and external pressure from central banks on tightened regulations led the cryptocurrency market to tumble on May 19, 2021. Bitcoin lost almost 40% of its market price that day.

Table 3 presents the average skewness connectedness, demonstrating a total index of 56.08% [Cell (8, 7)], which shows that cryptocurrencies are also highly connected via shocks at third-order moments. Compared with the findings of Cui and Maghyereh (2022), who used 5-min price data to show a skewness connectedness index of 40.99%, we show that the transmission of crash risk is higher. We further show that past extreme skewness shocks largely contributed to the extreme skewness shocks of subsequent periods, demonstrating a higher autocorrelation effect in the skewness connectedness network. That is, a given cryptocurrency's own extreme returns (positive or negative) increases the probability of future extreme returns more than the shocks received from other cryptocurrencies. For example, the autocorrelation effect was strongest in Ethereum (49.85%), followed by Bitcoin (46.64%); however, Litecoin (34.91%) had the weakest autocorrelation effect. Litecoin was the largest transmitter of skewness connectedness, contributing 71.19% [Cell (7, 5)] of the total forecast error variance of other cryptocurrencies. It was also the largest receiver of skewness shocks from other cryptocurrencies, receiving 65.09% of its forecast errors from the skewness shocks of other cryptocurrencies. Among the cryptocurrency pairs, the highest skewness spillover was from Binance to Ripple (Cell (6, 3) = 15.73%). The net directional connectedness values reported in the last column show that Binance (2.04%), Cardano (1.21%), and, Litecoin (6.11%) were net transmitters, whereas Bitcoin (− 2.05%), Ethereum (− 5.07%), and Ripple (− 2.24) were net receivers. Given these results, Litecoin was the dominant cryptocurrency in skewness connectedness, mainly because it drove the others. In contrast, Ethereum was the largest emitter of shocks as it was mainly driven by others. Accordingly, when returns are asymmetrical with extrema toward either the positive or negative sides, Litecoin dominates as the transmitter of shocks. It is important to note that skewness reflects crash risk. Thus, Litecoin was the dominant transmitter of systematic crash risk to other cryptocurrencies.

The results related to the average kurtosis connectedness are presented in Table 4. The total kurtosis connectedness index was 56.08%, which approximates the skewness connectedness index but is lower than the volatility connectedness index. Similar to the patterns observed for skewness, a more significant portion of the total forecast errors in kurtosis was caused by autocorrelation effects, with Cardano having the highest value (48.83%) followed by Bitcoin (45.83%). The highest directional kurtosis spillover was from Ethereum to Bitcoin, with 16.10% and 15.91% of kurtosis shocks transmitted from Litecoin to Binance, respectively. The findings further suggest that Litecoin played a dominant role in transmitting kurtosis shocks to other cryptocurrencies, 72.42% of the kurtosis shocks in Litecoin were transmitted to others, whereas it received only 63.59% from others. This Demonstrates that Litecoin was a net transmitter and the largest transmitter, with a net shock transmission value of 8.82%. Binance and Cardano were net transmitters, whereas their net connectedness transmission values were near zero. In contrast, Bitcoin (− 3.57%), Ethereum (− 3.58%), and Ripple (− 2.55%) were net emitters of fat-tail (kurtosis) shocks. Accordingly, the network of kurtosis connectedness was mainly driven by Litecoin, given that it becomes the influencer of the connectedness system during extreme returns. Thus, Litecoin influenced the market when returns were extreme and concentrated at their tails.

Table 5 summarizes the results from the previous tables related to net directional shock transmissions of volatility, skewness, and kurtosis. The results show that Binance was a consistent net transmitter in all three connectedness systems, dominating the volatility connectedness network as the primary transmitter of the volatility shocks. In contrast, skewness and kurtosis connectedness networks were dominated by Litecoin as the largest transmitter of crash risk and fat-tail risk, respectively. Bitcoin and Ripple were net shock receivers in all three connectedness networks. Simultaneously, Ethereum (Cardano) was a net transmitter (receiver) in the volatility connectedness network and a net receiver(transmitter) in skewness and kurtosis connectedness networks.

In summary, the findings reported in this section reflects systematic risk transmissions between cryptocurrencies via second-, third-, and fourth-order moments. The total volatility connectedness index (78.53%) was higher than the total skewness (56.08%) and kurtosis (56.48%) connectedness indices, showing that systematic volatility risk was more prevalent. Furthermore, shock transmissions through higher moments were sizable. Therefore, the systematic transmission of crash and fat-tail risks significantly affected cryptocurrencies. The results further show that the connectedness in the cryptocurrency market increased in higher-frequency data when the current findings are compared with previous studies that used lower-frequency data, such as those by Yi et al (2018), Ji et al (2019), Hasan et al. (2021), and Cui and Maghyereh (2022). The current findings may support the findings of Bouri et al (2021), who found that cryptocurrencies were becoming more connected due to several recent events. Another notable finding relates to the ever-changing role of cryptocurrencies within systems of connectedness. Specifically, our findings imply that Bitcoin, Cardano, Litecoin, and Ripple were net volatility shock emitters, whereas Ethereum and Binance were the main volatility shock transmitters. These findings are in contrast to those of Yi et al (2018), Ji et al (2019), and Hasan et al. (2021). Related to skewness and kurtosis, our findings show that Litecoin was the dominant transmitter, which agrees with Hasan et al (2021). In contrast, Ethereum was the largest emitter of skewness (crash risk) and kurtosis shocks (fat-tail risk). We expect that these results can be used to guide portfolio optimization and risk management decisions, which is also important for policymakers as higher-moments risks are significant among cryptocurrencies.

Dynamic total connectedness

Figure 2 plots the dynamic total volatility connectedness, demonstrating a high connectedness level over the entire sample period. Until the middle of the fourth quarter of 2020, the total volatility connectedness among the six cryptocurrencies hovered above 95%, offering limited benefits to diversification during the initial year of the COVID-19 pandemic. In the middle of the last quarter of 2020, the index experienced a slight decline before dropping sharply to 70% in the middle of the first quarter of 2021. This decline can be attributable to quantitative and economic stimuli and various relief programs initiated by governments. The intuition is straightforward: the programs stimulated capital flow into cryptocurrency markets (Kumar et al 2022). The total volatility connectedness index hovered around the 80% level from February to May 2021, causing a market rally. However, the index surged to over 90% on May 19, 2021, due to the market crash, that erased one trillion USD from the cryptocurrency market amid concerns of government regulations. The Russia-Ukraine War, which started on February 24, 2022, had a negligible impact on the total volatility connectedness of cryptocurrencies. Although this was surprising it may indicate that the impact cannot simply be captured by second-order moments. However, the TCI for volatility increased from 90% to nearly 100% in May 2022, which denotes a period in which the price of Bitcoin saw its lowest level since 2020. Coinbase market lost a significant amount of value as well. Nevertheless, the total volatility connectedness index shows that the cryptocurrencies remained highly connected in the volatility channel at higher frequencies over the sample period, implying that high-frequency trading is very risky.

Figure 3 plots the dynamic total skewness connectedness to capture time-varying crash risk spillovers among cryptocurrencies. Notably, the average connectedness in skewness was lower but far more volatile than the total connectedness in volatility. The total skewness spillover index value ranged between 34.19 and 91.17%, and the total skewness connectedness index showed sharp increases during important events, demonstrating the transmission of systematic crash risk among cryptocurrencies during important events. For example, following the two sharp peaks that marked the initial days of COVID-19, the total skewness connectedness index increased from around 55% to slightly above 70% on May 10, 2020. On the same date, Bitcoin lost 15% of its market capitalization within minutes and half of its market value within two days. This can be attributed to the announcement of reduced mining rewards and increased transaction costs, which stimulated selloffs. Thus, the TCI of skewness shows an increased systematic crash around this announcement. As with the volatility connectedness index, the skewness connectedness index was lower than its average during the market rally of early 2021. However, it increased sharply to above 80% during the cryptocurrency market crash on May 19, 2021. Another significant increase occurred in December 2021, when a combined crypto market capitalization of 300 billion USD was wiped out following an announcement by the US Federal Reserve Bank about tapering.Footnote 8 This led to expectations of higher future interest rates and the migration of cryptocurrency investors to safer USD products. Finally, with the collapse of Luna, during the second week of May 2022, the index spiked again, from 60% to above 75%, marking another important event that increased the systematic crash risk spill overs among cryptocurrencies. Overall, information transmission among cryptocurrencies via the skewness channel strengthens during periods characterized by negatively skewed return distributions and loses strength during periods of positively skewed return distributions. These results further illustrate how the realized skewness estimator captures the systematic spillover of cryptocurrency market crash risk.

The dynamic total connectedness of the realized kurtosis plotted in Fig. 4 is far more volatile than the dynamic volatility. There are several peaks in the plot of dynamic kurtosis connectedness. The first peak reflects an increased systematic fat-tail risk among the network of cryptocurrency connectedness during the market meltdown of March 2020. In March 2021, the total kurtosis connectedness index was reduced to 50% from 80%, marking a period in which the cryptocurrency market experienced significant growth, topping above 1 trillion USD level for the first time. With the market crash of May 2021, the fat-tail risk transmission among cryptocurrencies increased significantly, reaching above 90%. As such, realized volatility, skewness, and kurtosis measures spiked (Fig. 1). Following the market crash of May 19, 2021, the connectedness index for kurtosis experienced a monotonic decline until the end of the second quarter of 2022 before exceeding 90% as the cryptocurrency market started to fall again. Not surprisingly, the TCI for kurtosis captures periods of extreme returns in the cryptocurrency market and offers further insights into fat-tail and extreme event risk transmission dynamics. A higher kurtosis implies heavier tails of return distributions, and our findings confirm that connectedness exists during times of extreme returns, lending support to the findings of Tiwari et al (2020), who reported extreme tail connectedness among cryptocurrencies.

Overall, the findings in this section imply that realized volatility, skewness, and kurtosis spillover indices can capture the impacts of systematic events. Aligning with the findings of Cui and Maghyereh (2022), the connectedness of realized volatility was stronger than that of skewness and kurtosis. However, information transmission effects at higher moments are also sizable, above the 55% level, confirming the presence of systematic crash and fat-tail risk transmissions within the connectedness network of cryptocurrencies. Moreover, some features not captured by the volatility index were captured by analyzing higher moments. Thus, our findings align with findings of Bouri et al (2021), who showed the importance of higher moments when studying connectedness among traditional financial assets. Our findings prove empirical evidence of dynamic cryptocurrency connectedness and support the findings of Kumar et al. (2022), who reported an increase in the total volatility spillover index among equities, bonds, commodities, and Bitcoin during the initial days of the Russia-Ukraine War. This effect is not very pronounced among cryptocurrencies, even at higher moments. Finally, our results add to those of Cui and Maghyereh (2022) by studying a wider variety of and utilizing a higher frequency price data.

Net total directional connectedness

This section examines dynamic net total directional connectedness in realized volatility, skewness, and kurtosis, calculated using Eq. (18). On any given day, a positive value indicates that a cryptocurrency is the net transmitter of a shock. In contrast, a negative value implies that a cryptocurrency is a net receiver.

Figure 5 plots the dynamic net directional volatility spillovers for the six cryptocurrencies. Notably, the net directional volatility connectedness plots exhibit significant degrees of variability over time, switching between positive and negative regions apart from Binance, which is a consistent transmitter of volatility shocks according to the evolution of its plot in the positive region. Bitcoin, Cardano, Litecoin, and Ripple were average net receivers of volatility shocks, as their net directional spillover plots were mainly in the negative region. These findings confirm the results listed in Table 2, including Bitcoin (− 5.13%), Cardano (− 3.92%), Litecoin (− 3.55%), and Ripple (− 8.09%), who were net receivers of volatility shocks within the system according to their negative net directional spillover values reported in the last row. Conversely, Ethereum (4.19%), and Binance (16.52%) were net transmitters. Ripple was the leading receiver, and Binance was the dominant transmitter. Another notable finding includes the sharp increases/decreases during specific periods, which can be marked as turbulent. For instance, the net directional spillover index for Binance soared above 60% at the start of the pandemic, during a market rally in early 2021, and at the collapse of Luna in May 2022. These patterns imply that volatility shock transmissions from Binance to others strengthened during cryptocurrency market turbulence. From May 2021 until the middle of 2022, Bitcoin played a dominant receiver role in the system. Our results differ from previous studies that reported Bitcoin mainly contributing to volatility connectedness networks (e.g. Bouer et al. 2021; Cui & Maghyereh 2022; Ji et al 2019; Koutmas 2018). This implies a changing role for cryptocurrencies when examining higher-frequency data and more recent period. Finally, Ethereum lost its net volatility shock transmitter status, becoming a net receiver, in June 2022, where it lost almost 45% of its market capitalization during investors’ fears of higher inflation rates and interest rate hikes.Footnote 9 During the same period, Bitcoin and Litecoin shared the same trend. In contrast, Binance regained its dominant net shock transmitter status after its decline with the collapse of Luna. These findings show that volatility shock transmissions are time varying and gain strength under stressful cryptocurrency market conditions.

Net Volatility Spillovers. Dynamic net volatility connectedness based on TVP-VAR for Bitcoin, Ethereum, Binance Coin, Cardano, Litecoin, and Ripple. The x-axis reports years and quarters, and the y-axis reports net directional spillovers. The TVP-VAR coefficients are plotted in dark blue, whereas the red dashed line shows zero

Figure 6 plots the evolution of net skewness connectedness for the six cryptocurrencies separately, demonstrating significant variability over time. For example, before the cryptocurrency market crash on May 19, 2021, Bitcoin mainly acted as a net transmitter of skewness shocks, whereas after the crash, it became a net receiver. This finding is unsurprising as Bitcoin was at the center of debate during that period. For example, Elon Musk posted his intention on Twitter to stop accepting Bitcoin for Tesla payments, and the Central Bank of China sent warnings to various financial institutions about accepting cryptocurrency payments. Litecoin was quite persistent in transmitting skewness shocks, whereas Ethereum was a persistent receiver. These results support the average net transmission analysis of skewness shocks provided in Table 3. For example, Litecoin was the largest net transmitter. In contrast, Ethereum was the largest net receiver. When the cryptocurrency market experienced asymmetric returns, Litecoin and Ethereum played dominant roles as transmitters and receivers of the systematic crash risk, respectively. Other important patterns were observed around the collapse of Luna. Subsequently, Binance became a dominant shock transmitter, whereas Ripple became a dominant shock receiver.

Net Skewness Spillovers. Dynamic net skewness connectedness based on TVP-VAR for Bitcoin, Ethereum, Binance Coin, Cardano, Litecoin, and Ripple. The x-axis reports years and quarters and the y-axis reports net directional spillovers. The TVP-VAR coefficients are plotted in dark blue, whereas the red dashed line shows zero

Next, we plot the evolution of net directional kurtosis spillovers in Fig. 7. As with the results reported in Figs. 5 and 6 for net directional volatility and skewness spillover indices, respectively, the net directional spillover plots for kurtosis were highly volatile and even higher during important events. On average, Bitcoin and Ethereum were the largest net receivers of kurtosis shocks, whereas Litecoin mostly acted as transmitters of kurtosis shocks. These results are validated by the results reported in Table 4, where Bitcoin (− 3.57%) and Ethereum (− 3.58%) were net transmitters on average, and Litecoin (8.83%) was the largest net transmitter. Furthermore, during the market crash of May 19, 2021, the net direction spillover index for Bitcoin and Ethereum experienced a sudden deep, indicating a higher systematic fat-tail risk shock transmitted from others. Binance, Cardano, Litecoin, and Ripple switched from negative to positive regions, becoming net transmitters of fat-tail risk shocks and net shock transmitters of kurtosis. We attribute increased kurtosis shock spillover effects to the extreme daily returns seen around the cryptocurrency market crash.

Net Kurtosis Spillovers. Dynamic net kurtosis connectedness based on TVP-VAR for Bitcoin, Ethereum, Binance Coin, Cardano, Litecoin, and Ripple. The x-axis reports years and quarters and the y-axis reports net directional spillovers. The TVP-VAR coefficients are plotted in dark blue, whereas the red dashed line shows zero

Overall, Bitcoin was the leading net receiver of realized volatility, skewness, and kurtosis shocks, specifically during the period following the market crash on May 19, 2021. Ethereum was a net receiver of skewness and kurtosis shocks, Binance was the net transmitter of volatility (with dominance), skewness, and kurtosis shocks, and Litecoin was the net and dominant transmitter of skewness and kurtosis shocks. Cardano was a net receiver of volatility shocks but was a net transmitter of kurtosis shocks. The net position of Cardano in the skewness connectedness network was positive but barely greater than zero. Ripple was a net receiver according to all three estimators. Compared with the results of Ji et al (2019) and Cui and Maghyereh (2022), which suggested that Bitcoin was the dominant volatility transmitter, our findings implied that Bitcoin lost status and became the largest receiver of volatility shocks after the crash. Our findings extend the results of Ji et al (2019) by studying the connectedness among cryptocurrencies at higher moments, including Binance. These results also enrich the findings of Cui and Maghyereh (2022) for similar reasons. The net directional skewness spillover index also captured the impact of the Luna crash which is the first in the literature.

Net pairwise directional connectedness

This section studies net pairwise directional volatility, skewness, and kurtosis spillovers. The analysis shows dynamic net shock spillovers among each pair of cryptocurrencies over time. A positive value indicates that the first in a pair is the net shock transmitter, and the latter is the receiver. In contrast, a negative value indicates that the first in a pair is the net shock receiver, and the latter is the transmitter. The pairwise analysis helps us understand which cryptocurrencies had higher dominance in transmitting shocks and offers keen insights into portfolio diversification strategies, as combining shock transmitters with shock-resilient cryptocurrencies way improve risk characteristics of portfolios. Notably, the average net pairwise connectedness among cryptocurrencies was obtained from their average connectedness (see Tables 2, 3 and 4) based on the difference between the average shock transmitted and the average shock received.

We begin our analysis with net pairwise spillovers of volatility (see Fig. 8). The results show that Bitcoin, on average, acted as the prominent emitter of volatility shocks from all other cryptocurrencies, and the most dominant shock transmitter to Bitcoin was Binance, followed by Ethereum. Thus, combining these assets into a portfolio would diminish any diversification benefits. Consistent with the findings reported in previous sections, Binance was a persistent volatility shock transmitter for all other cryptocurrencies. Although Ethereum acted as a net receiver of volatility shocks from Binance, it was a transmitter in other pairings most of the time. Cardano dominated the volatility spillovers to Ripple, whereas Litecoin dominanted by Ripple. These findings confirm the dominance of Binance and Ethereum in transmitting volatility shocks during periods of higher cryptocurrency market volatility. Similar to the findings reported in Fig. 5, the strength of volatility spillover effects was higher during turbulent times.

Net Pairwise Volatility Spillovers for Bitcoin, Ethereum, Binance Coin, Cardano, Litecoin, and Ripple. The figure shows net pairwise volatility connectedness obtained from a TVP-VAR approach. A positive value for the spillover index indicates that the former of a pair is the net shock transmitter and that the latter is the receiver. In contrast, a negative value for the spillover index indicates that the former of a pair is the net shock receiver and that the latter is the transmitter. The x-axis reports years and quarters, and the y-axis reports net pairwise connectedness. The TVP-VAR coefficients are plotted in dark blue, whereas the red dashed line shows zero

Figure 9 plots the net pairwise skewness spillovers among each pair of cryptocurrencies. The plots for pairwise skewness shocks were higher during the initial days of COVID-19, the crash of May 2021, and, for several cases, the collapse of Luna. These patterns confirm that our realized skewness measures captured systematic crash risk transmissions during those periods. Notably, Bitcoin and Ethereum were net receivers of skewness shocks in most pairs, confirming the findings reported in previous sections. On average, Litecoin was the dominant net transmitter of crash risk to other cryptocurrencies.

Net Pairwise Skewness Spillovers for Bitcoin, Ethereum, Binance Coin, Cardano, Litecoin, and Ripple. The figure shows net pairwise skewness connectedness obtained from a TVP-VAR approach. A positive value for the spillover index indicates that the former of a pair is the net shock transmitter and that the latter is the receiver. In contrast, a negative value for the spillover index indicates that the former of a pair is the net shock receiver and that the latter is the transmitter. The x-axis reports years and quarters, and the y-axis reports net pairwise connectedness. The TVP-VAR coefficients are plotted in dark blue, whereas the red dashed line shows zero

According to the plots of pairwise kurtosis spillovers provided in Fig. 10, Bitcoin and Ethereum were dominant net receivers of extreme return shocks during the cryptocurrency market crash. In contrast, Bitcoin and Ethereum acted as net transmitters. Litecoin also dominated others as a net transmitter of kurtosis shocks, implying that Litecoin dominated the network of systematic fat-tail risk connectedness during extreme returns. The pairwise indices for kurtosis shocks further captured the impact of the Russia–Ukraine War based on the elevated NPDC measures around that time.

Net Pairwise Kurtosis Spillover for Bitcoin, Ethereum, Binance Coin, Cardano, Litecoin, and Ripple. The figure shows net pairwise kurtosis connectedness obtained from a TVP-VAR approach. A positive value for the spillover index indicates that the former of a pair is the net shock transmitter and that the latter is the receiver. In contrast, a negative value for the spillover index indicates that the former of a pair is the net shock receiver and that the latter is the transmitter. The x-axis reports years and quarters, and the y-axis reports net pairwise connectedness. The TVP-VAR coefficients are plotted in dark blue, whereas the red dashed line shows zero

In summary, our findings indicate systematic dependencies among cryptocurrencies in terms of realized volatility, skewness, and kurtosis, implying that higher moments matter for cryptocurrencies. This supports the findings of Ahmed and Mafrachi (2021). Our results also extend the results of Hasan et al. (2021) by revealing the higher-moment connectedness among cryptocurrencies and those of Cui and Maghyereh (2022) by including higher-frequency data and documenting connectedness structure for high algorithmic trading. Further, our sample period includes a pandemic, a cryptocurrency market rally, several market crashes, a war, and for the first time, the collapse of Luna. Specifically, we have noted that different estimators can capture information transmissions among cryptocurrencies during different periods, confirming the predictions of Bouri et al (2021).

Additional tests

This section performs additional tests to examine whether the TVP-VAR-based connectedness approach of Antonakakis et al. (2019) can capture the time-varying dynamics of connectedness better than the standard VAR-based connectedness estimators of Diebold and Yilmaz (2012, 2014) and the quantile VAR (QVAR) approach of Ando et al (2022).

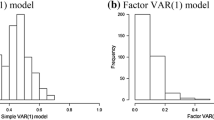

Initially, the TCIs of cryptocurrencies among the volatility, skewness, and kurtosis indicators were calculated using the VAR-based connectedness approach of Diebold and Yilmaz (2012, 2014) using a 200-day rolling window.Footnote 10 One drawback of the standard rolling-window VAR-based connectedness approach is its sensitivity to outliers, given that its estimates depend on the conditional-mean function (Antonakakis et al. 2019). Accordingly, we also tested the conditional median-based QVAR of Ando et al (2022) to overcome the outlier sensitivity problem. The QVAR connectedness was estimated for the 50% quantile (median).Footnote 11

The results of the dynamic TCI for realized volatility estimation, calculated by utilizing TVP-VAR, VAR, and QVAR connectedness approaches, are provided in Fig. 11. The plots demonstrate that the evolutionary trends of TCI calculated using the VAR and QVAR-based approaches were similar. The TVP-VAR-based TCI plot was more responsive and adjusted more quickly or important events than the other two. This feature is desirable for investors concerned with systematic risk transmissions among financial assets and risk management at higher-frequency scales. The results related to the TCIs of realized skewness (see Fig. 12) and kurtosis (see Fig. 13) were more striking and highlighted the dynamics missed or understated by VAR- and QVAR-based approaches. Overall, rolling-window-based connectedness procedures understates systematic risk transmissions relative to TVP-VAR, which is undesirable when the aim is to reveal higher-frequency dynamics for frequent trading and portfolio optimization.

Robustness tests

In this section, we conduct several robustness tests, beginning with an estimation of the TVP-VAR model according to different assumptions about selecting prior hyperparameters. The primary TVP-VAR analysis utilized herein was estimated using a Bayesian VAR procedure with 200 days as the hyperparameter estimation size. Because TVP-VAR results rely heavily on this selection, we tested whether the results obtained in the main empirical tests would be sensitive to different prior sizes. Accordingly, dynamic TCI values for realized volatility, skewness, and kurtosis were recalculated using Bayesian prior sizes of 100, 150, 250, and 300 days, including an uninformative prior selection approach. Based on the results in Appendix Figs. 17, 18, and 19, which respectively report dynamic TCI for realized volatility (Fig. 17), realized skewness (Fig. 18), and realized kurtosis (Fig. 19), respectively, the main findings were robust against the selection of different Bayes prior sizes (i.e. informative prior hyperparameter estimation approach), including the uninformative prior assumption. In all cases, the evolution of the dynamic TCI values was highly consistent. These observations align with those of Antonakakis et al. (2019).

Second, we tested whether the main results were sensitive to different lag orders. Thus, the TVP-VAR connectedness specification was re-estimated for lag orders of 1–4 for each of the three realized estimators. The findings reported in Appendix Figs. 20, 21 and 22 demonstrate that the connectedness plots of different lag orders were highly similar for realized volatility (Fig. 20), realized skewness (Fig. 21) and realized kurtosis (Fig. 22). The analysis of different lag orders showed consistent evolutionary trends and the TCIs were highly responsive to significant events, including cryptocurrency market crashes, as documented in the main analysis.

Finally, the robustness of the results was tested against different forecast horizon selections. To this end, the TVP-VAR-based connectedness analysis was replicated using horizon values of 50, 75, 125, and 150 days. The results reported in Figs. 23, 24, 25 strongly confirm the TCIs of realized volatility (Fig. 23), realized skewness (Fig. 24), and realized kurtosis (Fig. 25) obtained by the primary analysis, which used a 100-day forecast horizon. Accordingly, the results obtained from the TVP-VAR analysis are robust against different assumptions related to prior hyperparameter estimations, lag selections, and forecast horizon selections.

Conclusion

This study used 1-min price data to examine the dynamics of realized volatility, skewness, and kurtosis connectedness among six leading cryptocurrencies (i.e. Bitcoin, Ethereum, Binance, Litecoin, Cardano, and Ripple) over the period from February 10, 2020, to August 20, 2022. Daily realized second-, third-, and fourth-moments were calculated using 1-min returns, which were then utilized to estimate systematic risk spillovers among the cryptocurrencies using a TVP-VAR-based connectedness approach. The main objective was to uncover the dynamics of systematic risk transmissions using high-frequency data via the analysis of volatility and high-order moments (i.e. skewness and kurtosis) during both normal stressful times. The aim of the analysis was to reveal possible hidden linkages about high-frequency trading, including algorithm-guided trading, thus aiding portfolio optimization and risk management decisions for those wishing to craft high-frequency trading strategies. Moreover, we expect policymakers to benefit from our analysis while designing policies around the attainment of financial stability under stressful conditions.

The findings of this study can be summarized as follows. The total dynamic systematic risk transmissions through all three realized estimators were significantly high with our high-frequency data compared with the findings of previous studies that used lower-frequency price data. In addition, the systematic volatility, crash, and fat-tail risk spillovers among cryptocurrencies were time dependent and affected by significant events, such as the COVID-19 pandemic, the market crash on May 19, 2021, and the collapse of Luna. Moreover, different estimators were shown to capture different features of shock transmissions among cryptocurrencies during different periods. For instance, net directional volatility spillovers were the highest in absolute terms in early 2021, when the cryptocurrency market experienced a rally. However, net directional skewness spillovers were the highest in absolute terms during the early pandemic period, demonstrating higher transmissions of systematic crash risks. Additionally, net directional kurtosis spillovers were the highest in absolute terms during the market crash of May 2021, showing a period of higher transmissions of systematic extreme return (fat-tail) risks. We further documented that connectedness through realized volatility channels is more substantial than skewness and kurtosis, confirming the findings of previous studies on higher-frequency data domains. Systematic risk transmissions through skewness and kurtosis channels were also high. Thus, our findings clarify the importance of systematic risk spillovers among cryptocurrencies through higher-order moments. Furthermore, our findings from the net directional spillover analysis show that Bitcoin is losing its status as the leading transmitter of shocks within cryptocurrencies’ connectedness systems. Binance was a net shock transmitter of volatility, skewness, and kurtosis shocks, dominating the volatility connectedness network. In contrast, skewness and kurtosis connectedness networks were dominated by Litecoin. Thus, our findings indicate that the cryptocurrency markets' higher-frequency (minute-by-minute trading) trading domain has several unique features.

These findings offer important implications for cryptocurrency investors, portfolio managers, and policymakers. First, investors and portfolio managers should analyze systematic risk transmissions using high-order moments (skewness and kurtosis) when optimizing their portfolios and managing risk exposure, especially during turbulent times. Our analysis of dynamic total and net directional risk transmission through higher moments revealed that cryptocurrencies are prone to systematic transmissions of crash risk (asymmetric returns or skewness) and fait-tail risk (extreme returns or kurtosis). Therefore, investors and portfolio managers should formulate risk management policies for adjusted risk exposure through technical diversification according to their risk tolerance. Given that cryptocurrencies are volatile assets that may result in significant losses, understanding the evolutionary trends in cryptocurrency connectedness through second- and higher-order moments by investors and portfolio managers will enable them to more readily identify diversification opportunities and limit the impact of significant shocks. The current findings concerning higher-moment risk transmission channels can be used to guide optimal portfolio construction. Traditionally, investors optimize for mean–variance in the spirit of Markowitz (1952). However, the current findings demonstrate that investors should consider how skewness and kurtosis interact with returns and whether mean-skewness and mean-kurtosis trade-offs satisfy their utility.

Second, the current findings can be used to guide policymakers formulating policies to avoid systematic shocks under stressful market conditions, which may lead to contagion. It has been shown that cryptocurrencies transmit systematic risk not only through second-order moments but also through third- and fourth-order moments. Thus, policymakers must also focus on higher moments to better understand risk transmission channels and formulate control policies. Monitoring market activities and formulating policies to address volatility, crash, and extreme-return risk spillovers are necessary. Specifically, we identified Binance and Litecoin as the main transmitters of systematic shocks within the connectedness systems of cryptocurrencies; thus, policymakers should pay close attention to these cryptocurrencies, specifically during turbulent times. This information will also aid investors and policymakers in achieving better risk monitoring and portfolio management. Investors and portfolio managers are advised to hold net shock transmitters and avoid net shock receivers (Bouri et al 2021). Because fewer risk sources influence net shock transmitters than net shock emitters, the net directional shock transmission analysis provided in this paper can be used to guide investors’ diversification decisions (Mensi et al 2019). For instance, if a cryptocurrency is resilient to shocks transmitted by a shock-transmitting cryptocurrency, the two can be combined to achieve diversification benefits.

Finally, given the time-varying nature of risk transmissions, policymakers should formulate risk assessments and monitoring strategies to adjust risk exposure dynamically. The VAR-based approach used in this study can be used to identify connectedness and contagion risks (Mensi et al 2021). Our analysis of risk spillovers also provides essential implications for portfolio managers and investors. Moreover, identifying probable contagion sources (i.e. cryptocurrencies that are net shock contributors in connectedness systems) can guide policymakers in formulating financial risk management strategies.

The present study is limited in several aspects that may guide future research agendas. For instance, studying dynamic connectedness at higher moments among the largest and micro-cap cryptocurrencies can enrich the current understanding of systematic risk transmission among cryptocurrencies. Another important venue for future research is multilayer network analysis. Furthermore, an analysis of network interactions can help determine whether and how volatility, skewness, and kurtosis networks are also connected.

Availability of data and materials

The datasets used and analyzed during the current study are available from the corresponding author upon reasonable request.

Notes

Interested readers should refer to https://www.statista.com/statistics/730876/cryptocurrency-maket-value/.

Fang et al. (2022) offer an extended survey of profitable trading strategies using technical trading, algorithms, and automated trading systems.

Harvey and Siddique (2000) provide a theoretical justification for the role of conditional skewness in the pricing of risky assets.

Stable coins, Tether (USDT) and USD Coin (USDC), are excluded since they are not suitable for a spillover analysis.

Existing literature on the dynamic connectedness between cryptocurrencies during the Russia-Ukraine war is available only during the initial two months of the war (e.g. see Cui and Maghyereh 2022). The current study extends the findings of this literature by offering a longer-term analysis of the war period. This issue is important given the role of cryptocurrencies in this war as the means of war aid, a way to move citizens’ wealth out of the Russian banking system and overcome the sanctions of western economies on the payment systems of Russia.

For the details of the Kelman filter algorithm please refer to Antonakakis et al. (2020).

The QVAR of Ando et al (2022) is also capable of estimating tail-based connectedness. Although estimating the tail-based connectedness is beyond the scope of the current study, it may provide an interesting venue for future research.

Abbreviations

- TVP-VAR:

-

Time-varying vector autoregression

- DCC-GACRH:

-

Dynamic conditional correlation generalized autoregressive conditional heteroscedasticity

- RVOL:

-

Realized volatility

- RSKEW:

-

Realized skewness

- RKURT:

-

Realized volatility

- J–B:

-

Jarque–Bera

- ADF:

-

Augmented Dickey Fuller

- GIRF:

-

Generalized impulse response function

- GFEVD:

-

Generalized forecast error variance decomposition

- NPDC:

-

Net pairwise directional connectedness

- AIC:

-

Akaike information criterion

- VAR:

-

Vector autoregression

- QVAR:

-

Quantile vector autoregression

- EWMA:

-

Exponentially weighted mowing average

References

Aharon DY, Umar Z, Vo XV (2021) Dynamic spillovers between the term structure of interest rates, bitcoin, and safe-haven currencies. Financ Innov 7:59

Ahmed M, Al Mafrachi M (2021) Do higher-order realized moments matter for cryptocurrency returns? Int Rev Econ Financ 72:483–499

Ahn Y (2022) Asymmetric tail dependence in cryptocurrency markets: a model-free approach. Financ Res Lett 47:102746

Akhtaruzzaman M, Sensoy A, Corbet S (2020) The influence of bitcoin on portfolio diversification and design. Financ Res Lett 37:101344

Al-Shboul M, Assaf A, Mokni K (2022) When bitcoin lost its position: cryptocurrency uncertainty and the dynamic spillover among cryptocurrencies before and during the COVID-19 pandemic. Int Rev Financ Anal 83:102309

Amaya D, Christoffersen P, Jacobs K, Vasquez A (2015) Does realized skewness predict the cross-section of equity returns? J Financ Econ 118(1):135–167

Ando T, Greenwood-Nimmo M, Shin Y (2022) Quantile connectedness: modeling tail behavior in the topology of financial networks. Manage Sci 68(4):2401–2431

Antonakakis N, Chatziantoniou I, Gabauer D (2019) Cryptocurrency market contagion: market uncertainty, market complexity, and dynamic portfolios. J Int Financ Mark I 61:37–51

Antonakakis N, Chatziantoniou I, Gabauer D (2020) Refined measures of dynamic connectedness based on time-varying parameter vector autoregressions. J Risk Financ Manag 13(4):84

Baek C, Elbeck M (2015) Bitcoins as an investment or speculative vehicle? A First Look Appl Econ Lett 22(1):30–34

Baillon A (2017) Prudence with respect to ambiguity. Economic J 127(604):1731–1755

Balli F, de Bruin A, Chowdhury H, Naeem A (2020) Connectedness of cryptocurrencies and prevailing uncertainties. Appl Econ Lett 27(16):1316–1322

Ballis A, Drakos K (2020) Testing for herding in the cryptocurrency market. Financ Res Lett 33:101210

Baur G, Hong K, Lee D (2018) Bitcoin: medium of exchange or speculative assets? J Int Financ Mark I 54:177–189