Abstract

This study examines the time-varying asymmetric interlinkages between nine US sectoral returns from January 2020 to January 2023. To this end, we used the time-varying parameter vector autoregression (TVP-VAR) asymmetric connectedness approach of Adekoya et al. (Resour Policy 77:102728, 2022a, Resour Policy 78:102877, 2022b) and analyzed the time-varying transmitting/receiving roles of sectors, considering the positive and negative impacts of the spillovers. We further estimate negative spillovers networks at two burst times (the declaration of the COVID-19 pandemic by the World Health Organization on 11 March 2020 and the start of Russian-Ukrainian war on 24 February 2022, respectively). Moreover, we performed a portfolio back-testing analysis to determine the time-varying portfolio allocations and hedging the effectiveness of different portfolio construction techniques. Our results reveal that (i) the sectoral return series are strongly interconnected, and negative spillovers dominate the study period; (ii) US sectoral returns are more sensitive to negative shocks, particularly during the burst times; (iii) the overall, positive, and negative connectedness indices reached their maximums on March 16, 2020; (iv) the industry sector is the largest transmitter/recipient of return shocks on average; and (v) the minimum correlation and connectedness portfolio approaches robustly capture asymmetries. Our findings provide suggestions for investors, portfolio managers, and policymakers regarding optimal portfolio strategies and risk supervision.

Similar content being viewed by others

Introduction

The tight interconnectedness among global financial markets propels rapid risk transmission, rendering it crucial to understand how information is propagated. Moreover, the connectedness and co-movements between financial markets are prone to notably amplify around financial burst episodes (Diebold and Yilmaz 2014), thereby a comprehensive understanding of risk propagation and monitoring leads to a better establishment of policies, the regulatory framework for it, optimal asset allocations, and hedging effectiveness. In this context, an abundant and rich literature on stock market connectedness has proliferated over the last decade and progressed with the emergence of the COVID-19 pandemic (Youssef et al. 2021; Benlagha and El Omari 2022; Vidal-Llana et al. 2023). However, most of these studies have focused on stock market connectedness from a global perspective (i.e., between regions, continents, and states) and have not considered the asymmetric effects. This suggests that the literature on sectoral connectedness at the country level that considers asymmetric effects is still in its infancy.

Intuitively, discrepancies between positive and negative equity returns can occur in equity markets, and investors can be more sensitive to asymmetric returns. For example, hedgers and profit-maximizing agents can benefit more from negative sentiment under bullish/bearish market conditions (Beber and Brandt 2010). The ongoing COVID-19 pandemic sets an example of this, and strong and pervasive shock spillovers occur from hedge funds to financial assets, particularly for the future (Noori and Hitaj 2023). Although pioneering studies have reported the inherency of asymmetries in returns/volatilities (Christie 1982; French et al. 1987), only a few have examined static asymmetric return/volatility connectedness in financial markets (Baruník et al. 2016; Wang and Wu 2018; Iqbal et al. 2022; Mensi et al. 2021a, b). To fill this gap, our study delves into the time-varying asymmetric connectedness among sectoral returns at the country level.

An in-depth and accurate understanding of sectoral connectedness would provide valuable insights for portfolio managers, investors, and stakeholders in constructing portfolio allocations and making diversification and hedging decisions. In addition, a profit-maximizing agent does not process similar perceptions of positive and negative information, inducing a larger relative effect of negative sentiment spillovers than that of positive sentiment spillovers on financial markets (Mensi et al. 2021a, b). Therefore, a comprehensive understanding of time-varying asymmetric sectoral connectedness would help portfolio managers diversify portfolios in a timely and efficient manner, which, in turn, would strengthen the soundness of the financial system by reducing systemic risk.

As extensively reported by scholars, geopolitical/financial risks have prominently shaped the global economy (Sharif et al. 2020; Youssef et al. 2021; Tang et al. 2023) and have occasioned the intensification of connectedness among various asset classes. In this vein, abundant literature has augmented financial connectedness around financial/geopolitical bursts, such as the ongoing pandemic (Bouri et al. 2021; So et al. 2021; Costa et al. 2022; Antonakakis et al. 2023), the Russian-Ukrainian conflict (Adekoya et al. 2022a; Umar et al. 2022; Shahzad et al. 2023) and determined amplified interconnectedness among the assets. However, to the best of our knowledge, no study has examined the time-varying asymmetric connectedness among sectoral returns at the country level considering these two geopolitical upheavals and focusing on the hedging effectiveness of various portfolio construction methodologies. Our study contributes to the literature by examining the dynamic asymmetric sectoral connectedness of the US, which ranks as the largest world economy in terms of gross domestic product (GDP) and has been markedly influenced by the ongoing pandemic.

Recent studies have extensively examined intrasectoral connectedness in advanced economies, particularly in the US (Ahmad et al. 2021; Choi 2022; Hernandez et al. 2022). Understanding information transmission patterns in these economies is of paramount importance because they are a source of market contagion, especially during burst episodes (Boubaker et al. 2016; Apergis et al. 2019; Pino and Sharma 2019; Akhtaruzzaman et al. 2021; Choudhury and Daly 2021; Mensi et al. 2021a, b).

The US economy accounted for 24.7% of the global economy in 2022 in nominal terms,Footnote 1 with a stock market capitalization of $40,511 billion.Footnote 2 In addition, the US market is tightly connected to global financial markets through various channels, such as trade, commodities, derivatives, and forex rates, which propel rapid risk transmission from the US markets to the global financial markets. A comprehensive perception of interlinkages in the US stock market, particularly at the sectoral level, would enable policymakers to enact timely regulatory norms, especially if they know the asymmetric spillovers in each sector. Likewise, investors can better manage their portfolio decisions and hedging effectiveness if they know the time-varying asymmetric return spillovers at the sectoral level (Mensi et al. 2021a, b). This is the motivation for our study.

Despite the substance of sectoral connectedness, the literature does not address the dependencies across time-varying asymmetries and market conditions. Therefore, this study addresses the following questions: (i) what proportion of return shocks does each sector propagate to itself (intra-sector transmission) and to other sectors? (inter-sector transmission); (ii) which sectors (aggressive or defensive) act as net receivers or transmitters?; (ii) how does US sectoral asymmetric connectedness evolve over time?; (iv) on average, what are the optimal weights of sectoral returns under different portfolio construction scenarios and what is their hedging effectiveness when considering asymmetry?

To achieve this, we adopted the novel methodology of Adekoya et al. (2022b), which uses the TVP-VAR-based asymmetric connectedness approach in the spirit of the methodology of Antonakakis et al. (2020). We employed nine S&P 500 sectoral return indices in the analysis, with the data spanning from January 2, 2020 to January 26, 2023.

This study contributes to the existing literature in three ways. First, it examines the time-varying asymmetric connectedness among S&P 500 sectoral returns using a novel approach. By doing so, we not only focus on the dynamic nature of the asymmetric connectedness between sectors but also analyze the net transmission/recipient roles of sectors. Second, it investigates the asymmetric sectoral return connectedness for the US over the course of the COVID-19 pandemic by capturing well-known geopolitical/financial stress incidents. In turn, it provides insights into whether investors are more sensitive to asymmetric shocks. Finally, it investigates the optimal portfolio weights under different portfolio construction techniques and their hedging effectiveness by considering asymmetry.

The remainder of this paper is organized as follows. In section "Literature review" presents a literature review. In section "Data" presents the data and methodology used in the study. In section "Empirical results" presents and discusses the empirical results. In section "Time-varying portfolio analysis" presents the main findings and concludes.

Literature review

The growing pace of financial market integration and financial liberalization has precipitated expeditious information transmission, inducing a contagion impact. The interdependence between asset returns and volatilities is prone to augmenting market crashes and creating a stronger reaction to negative sentiment (Wu 2001). Thus, portfolio managers and financial investors need to accurately model their portfolio construction decisions and diversification policies. This requires a comprehensive understanding of the transmission between financial markets to hedge positions, particularly during turbulent times (Mensi et al. 2021a, b). This not only enhances portfolio managers’ portfolio management strategies but also lessens the systemic/systematic risk of markets, which is crucial for policymakers to ensure financial soundness.

Systemic risk is associated with the potential failure of a company, event, or shock that can trigger the widespread collapse of the entire financial system. The notion of systemic risk highlights the importance of understanding and managing interdependencies and vulnerabilities within complex systems to prevent potential collapse. Nevertheless, understanding or encapsulating systemic risk using conventional methods is challenging. Therefore, the recent literature has focused on the prediction and/or measurement of systemic risk by employing engineered methods, including machine learning techniques. A detailed survey of this research line can be found in Kou et al. (2019).

Kou et al. (2021a) introduced a bankruptcy prediction model for small and medium-sized enterprises (SMEs) using transactional data and payment network-based variables under the scenario of no financial (accounting) data. Their results validate the forecasting ability and economic advantage of variables derived from transactional data. Likewise, Kou et al. (2021b) examined fintech-based investments in European banking services by employing a novel methodology that amalgamates interval type-2 (IT2) fuzzy decision-making trial and evaluation laboratory and IT2 fuzzy TOPSIS models. Payment and money transfer systems were determined to be the most important fintech investment alternatives based on their results.

Some scholars have used cluster algorithms to examine patterns in financial data or risks. Kou et al. (2016) introduced a multiple-criteria decision making (MCDM)-based approach to rank-clustering algorithms in financial risk analysis. Their findings highlight the efficacy of MCDM techniques in evaluating clustering algorithms. Similarly, Li et al. (2021) developed an integrated method for identifying clusters in financial data. Their results using 10 financial datasets showed the efficiency of the algorithm in identifying a reasonable number of clusters.

The growing integration of international equity markets, driven by globalization and financial liberalization, has engendered many studies on equity market connectedness. Scholars have utilized various econometric methods to compute interlinkages among stock markets, such as correlations (Virk and Javed; 2017; Wang et al. 2019; Ren et al. 2021), ARCH/GARCH models (Hung 2021; Hung et al. 2022; Zheng et al. 2022), copulas (Wen et al. 2019; Mandacı et al 2020; Zhang et al. 2022), wavelet analysis (Sharif et al. 2020; Younis et al. 2020; Karamti and Belhassine 2022), and VAR or TVP-VAR-based static/dynamic connectedness approach in the spirit of the Diebold–Yilmaz (DY) approach (Diebold and Yilmaz 2014; Maghyereh et al. 2016; Chow 2017; Youssef et al 2021; Chatziantoniou et al. 2022; Costa et al. 2022; Aharon et al. 2023). It is worth remarking that most of these studies have determined strengthening static/dynamic connectedness among equity markets with the emergence of financial/geopolitical bursts, and downturns.

However, most of the aforementioned connectedness studies have concentrated on return or volatility transmissions among global equity market indices, and only a limited number have examined the intra-sectorial connectedness for emerging/developed economies. Ahmad et al. (2021) examined connectedness among the US equity sectors and implied volatilities of oil, gold, and the Chicago Board Options Exchange Volatility Index (VIX) between April 2008 and March 2020 by employing time- and frequency-based connectedness approaches. The results of the study indicated that the spillovers of US sectoral equities amplified around the COVID-19 outbreak, and VIX is the largest transmitter of spillovers to the equity sectors, followed by the industry. Similarly, Choi (2020) analyzed volatility spillovers for the S&P 500 sectors during the COVID-19 pandemic by implementing the DY methodology. The findings suggested that the pandemic propelled a sudden increase in volatility spillovers, a large portion of which stemmed from the energy sector. Costa et al. (2022) examined volatility connectedness among 11 US sectoral indices between early 2013 and the end of 2020 using the DY approach. Their results showed that pairwise connectedness notably changed at the onset of the pandemic and that the industry sector was the largest net transmitter of shocks before and during the pandemic. Hernandez et al. (2022) studied the spillovers for US sectoral returns under low/high volatility regimes by performing the regime-switching autoregressive model and Granger causality test from May 2007 to February 2020. This study determined strengthening spillovers following the outbreak of the pandemic and the largest transmitter/recipient of shocks in the energy sector. Intra-sectoral connectedness studies are not limited only to the US, but they address emerging economies such as China (Wu et al. 2019; Zhang et al. 2020; Cui and Zou 2022), Turkey (Alkan and Çiçek 2020), and India (Chatziantoniou et al. 2022).

Despite asymmetries having long been tackled as a stylized fact in financial markets (Black 1976; Christie 1982; French et al. 1987) and investors’ perception discrepancies against negative/positive news, studies on the asymmetric connectedness of returns or volatilities of sectoral equities are quite limited and still in their infancy. In this strand, Baruník et al. (2017) investigated asymmetric volatility spillovers among the seven most liquid US sectors in August 2004 and December 2011 and reported evidence of asymmetry for most US sectors. However, they found no evidence of the dominance of negative spillovers over positive spillovers. Chen et al. (2019) examined sectoral volatility connectedness in the Chinese stock market between July 2007 and June 2016 by employing the same approach as Baruník et al. (2017) and determined that bad volatility spillovers dominated the study episode. Likewise, Wen et al. (2019) examined the impact of retail investor sentiment on the Chinese stock market crash using firm-level data for 2007 and 2017. Their results indicated a negative association between retail investor attention and firm-level crash. Similarly, Mensi et al. (2021a, b) explored time-varying asymmetric spillovers between commodity and 10 sectors in the Chinese equity market between January 2005 and May 2020 using the DY approach. The results suggest that negative spillovers are larger relative to positive spillovers, and the industrial and consumer discretionary sectors are the largest transmitters and receivers of spillovers in the system.

More recently, Adekoya et al. (2022a, b) examined time-varying asymmetric return spillovers among oil prices and Daw Jones Islamic stock indices between April 2013 and September 2021. They introduced a new time-varying asymmetric connectedness methodology based on the TVP-VAR connectedness approach of Antonakakis et al. (2020). Furthermore, they performed a dynamic portfolio exercise following Broadstock et al. (2022). Their findings revealed that except for the early stage of the pandemic, negative spillovers dominated the study episode, and the minimum connectedness portfolio analysis captured the asymmetry efficiently.

It is worth mentioning that recent studies have focused on the asymmetric connectedness among various financial assets (Suleman et al. 2021; Cao et al. 2022; Mensi et al. 2022; Abdullah et al. 2023; Alshater et al. 2023). Table 1 summarizes the aforementioned studies on asymmetric connectedness.

Data

We employed S&P 500 daily sectoral indices, namely Industrials (IND), Utilities (UTI), Energy (EN), Materials (MET), Consumer Staples (CS), Health Care (HC), Financials (FIN), Information Technology (IT), and Real Estate (RE).Footnote 3 We sourced data from the investing database, and the sample period ranged from January 2, 2020 to January 26, 2023.

We followed Adekoya et al. (2022a, b) and split the returns into positive and negative constituents as follows:

whereby, \({x}_{t}^{+}\), and \({x}_{t}^{-}\) denote the positive and negative returns.

We employed the log daily returns of the S&P 500. Table 2 and Fig. 1 present the descriptive statistics of the price series and their plots, respectively.

We determined that, on average, all series provide positive returns. Moreover, EN is characterized by the highest return, followed by IT and MAT, while RE and UTI report the lowest average returns. As expected, and in line with the risk-return trade-off notion, EN reports the highest volatility. This finding also underpins the notable impact of the study period on the volatility of energy stemming from geopolitical stress incidents, such as the COVID-19 pandemic and the Russian-Ukrainian War (RUW). Except for UTI, all return series displayed a leftward-tailed distribution. All the series exhibited leptokurtic distributions, and the JB values indicate that they are abnormally distributed. Furthermore, all returns are significantly autocorrelated and display ARCH/GARCH errors. The correlation results indicate that the series are positively correlated.

Daily S&P 500 sectoral returns exhibited noteworthy spikes in March 2020, particularly around the proclamation of the COVID-19 pandemic. EN, HC, and FIN sharply fluctuated on November 9, 2020, owing to Pfizer’s announcement that the vaccine candidate was more than 90% effective against SARS-CoV-2.Footnote 4 Moreover, sharing a common trend, the return series remarkably elevated in November 2022, where the sectoral indices recorded monthly increases, owing to the expectation that the Federal Reserve Bank (FED) would slow its interest rate hikes.Footnote 5

Methodology

Asymmetric connectedness

Adekoya et al. (2022a, b) present a TVP-VAR-based asymmetric connectedness methodology that uses positive and negative absolute returns. This methodology relies on the TVP-VAR connectedness method of Antonokakis et al. (2020), which is an extension of Diebold and Yilmaz’s (2014) methodology.

Let us define the \(TVP-VAR(p)\) as follows:

with

where \({\Omega }_{t-1}\) denotes all information available until \(t-1\), and \({x}_{t}\) and \({y}_{t}\) denote \(n\times 1\) and \(np\times 1\) vectors. \({A}_{t}\) and \({A}_{it}\) are \(n\times np\) and \(np\times 1\) dimensional matrices, \({\varepsilon }_{t}\) and \(\gamma_{t}\) are \(n\times 1\) and \({n}^{2}p\times 1\) dimensional vectors, and \({\Sigma }_{t}\) and \({\Xi }_{t}\) are \(n\times n\) and \(np\times {n}^{2}p\) dimensional matrices, respectively.

The vector moving average (VMA) representation of \({y}_{t}\) is provided as \({\sum }_{j=0}^{\infty }{B}_{jt}{\mu }_{t-j}\), where \({B}_{jt}\) is the \(n\times n\) dimensional matrix.

\(GIRF\left({\Psi }_{ij,t}\left(H\right)\right)\) is introduced as follows:

where \({e}_{j}\) denotes an \(n\times 1\) selection vector. \(GFEVD\left({\widetilde{\Phi }}_{ij,t}\left(H\right)\right)\) is estimated based on \({\widetilde{\Phi }}_{ij,t}\left(H\right)\) as follows:

with \({\sum }_{j=1}^{n}{\widetilde{\Phi }}_{ij,t}\left(H\right)=1\), and \({\sum }_{i,j=1}^{n}{\widetilde{\Phi }}_{ij,t}\left(H\right)=n\).

The total connectedness index (TCI) is defined as

Overall directional connectedness to others is defined as

Overall directional connectedness from others is defined as

and net total directional connectedness as

Chatziantoniou and Gabauer (2021) improve this connectedness measure, and adjusted the TCI as follows:

Dynamic portfolio approach

Following Broadstock et al. (2022), we employ multivariate portfolio construction methodologies and examine hedging effectiveness of them.

Minimum variance portfolio (MVP)

This approach aims to maximize the expected portfolio return while minimizing the portfolio risk. The MVP constitutes an optimal trade-off between risk and return (Markowitz, 1952). The portfolio allocations are calculated as:

Here, \({w}_{t}\) is \(m\times 1\) dimensional portfolio weight vector, \(I\) is an n-dimensional unit vector, and \({\sum }_{t}\) is an \(n\times n\) dimensional conditional variance–covariance matrix.

Minimum correlation portfolio (MCP)

The correlation matrix is given as follows:

\({R}_{t}\) is an \(n\times n\) dimensional matrix. The portfolio weights are computed as:

Minimum connectedness portfolio (MCoP)

The MCoP is introduced by the pairwise connectedness indices (Broadstock et al. 2022). The portfolio weights are calculated as below:

where \({PCI}_{t}\) is the pairwise connectedness index matrix.

Empirical results

Average interconnectedness findings

We present the average symmetric, positive, and negative connectedness results in Table 3.

It should be noted that the off-diagonal values in Table 3 indicate the shocks from the \(i\)th element to the \(j\)th element in the network. The symmetric connectedness results imply that S&P 500 sectoral returns have an average symmetric interlinkage level of 73.27%, indicating strong connectedness of sectoral returns. The largest transmitter/recipient of return shocks is IND (97.39, and 79.52, respectively), followed by MAT (90.12, and 78.34, respectively). This finding is consistent with that of Costa et al. (2022) and underpins the prominent role of the industry sector over the study period. In addition, UTI, EN, HC, and IT are net recipients of shocks, while the remaining returns are net transmitters.

The rest of Table 2 presents the average connectedness findings for the positive/negative returns. Positive/negative spillovers are, on average, similar in sign and magnitude. It is worth remarking that the total connectedness index (TCI) for the negative returns (74.53%) is higher than the TCI for the positive returns (70.57%). Regarding the net transmitting/receiving role of the returns, only CS becomes a net recipient of positive/negative return shocks, while the other nodes maintain their transmitting/receiving roles of shocks.

Time-varying asymmetric connectedness

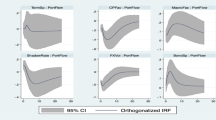

To focus on the time-varying nature of asymmetric connectedness, we plot it in Fig. 2.Footnote 6

Symmetric TCI oscillated between 57 and 88% over the study period and reached its maximum (87.56%) on March 16, 2020, shortly after the pandemic was announced. The index gradually plummeted until November 22, 2021 and hit its trough (57.59%). It moderately escalated afterward and hit approximately 79% by the end of January. Noticeably, the TCI sharply escalated from November 11, 2021 to December 7, 2021 and from April 17, 2022 to June, 15 2022, probably triggered by reaching the bull/bear market territories.Footnote 7 The TCIs for positive and negative returns displayed similar motifs and peaked on March 16, 2020 (86.62% and 87.45%, respectively). Moreover, the TCI for the negative returns dominated the study period, while that for positive returns was higher in March–April 2022 and on September 28, 2022 onward. The S&P 500 reached its lowest intraday level on September 28, 2022 since 2020.Footnote 8

Dynamic net directional connectedness

We continue our analysis by focusing on the net directional connectedness of the S&P 500 sectoral returns to detect their transmitter/receiver roles over the study period. Figure 3 shows countries’ net directional connectedness.Footnote 9

IND, MAT, and FIN maintained their roles as net transmitters of return shocks throughout most of the episode. In line with our previous findings, positive return spillovers were stronger than negative return spillovers from November 2021 to January 2022 because the market entered a bullish state. In contrast, UT, IT, and EN were net recipients of shocks over the study period—a finding consistent with Broadstock et al. (2022). Prominently, the discrepancies between positive and negative return spillovers started to surge in most sectors from late 2022. Furthermore, CS, HC, and RE were net transmitters/receivers of shocks depending on the period, while negative spillovers based on their returns dominated the study period.

Dynamic net pairwise connectedness

Next, we estimate the net pairwise connectedness among the sectoral returns and depict them in Fig. 4.

Several results based on the pairwise directional spillovers are noteworthy. First, pairwise asymmetric spillovers exhibited huge spikes in early 2020, coinciding with the proclamation of the pandemic. Second, negative pairwise spillovers dominated the study period. Third, pairwise spillovers were prone to escalation starting in early 2022. Fourth, negative and positive spillovers displayed similar patterns over most of the study period.

Network analysis

In this section, we perform a connectedness network analysis and estimate the interlinkages among sectoral returns at two burst times: the official declaration of the COVID-19 pandemic on March 11, 2020 and the start of the Russian invasion of Ukrainian (RIU) on February 24, 2022. Since negative spillovers dominate the study period, we compute networks of negative connectedness among the sectoral returns on March 11, 2020 and February 24, 2022 and depict them in Fig. 5.Footnote 10

Negative connectedness networks indicate the following results. First, IND is the largest node transmitting negative return shocks in both networks.Footnote 11 This finding is consistent with the findings of Costa et al. (2022) and reveals the prominent role of the IND sector in transmitting negative shocks during burst periods. Second, the network estimated on the declaration of the pandemic is characterized by strong negative interlinkages among sectoral returns, underlying the deleterious impacts of the pandemic on US sectors. Third, the magnitudes of directional spillovers in the second network (estimated on February 24, 2022) are stronger compared to the sizes of the connections in the first network.

Robustness test

Following Nham (2022), we conduct a diagnostic check for our asymmetric connectedness results by setting up different forecast horizons, decay factors (\({\kappa }_{1}\), and \({\kappa }_{2})\)Footnote 12 in our TVP-VAR asymmetric connectedness model and plot TCIsFootnote 13 estimated by them along with our original TCIs in Fig. 6.

TCIs estimated with alternative model parameters displayed similar patterns and peaks around the same time intervals during the study episode, demonstrating the accuracy of our results with alternative model settings.

Time-varying portfolio analysis

Dynamic portfolio analysis for US sectoral returns

We continue our analysis by focusing on the dynamic portfolio weights estimated using the MVP, MCP, and MCoP approaches. To this end, we compute the portfolio performance of each methodology by considering the overall returns (black lines) and positive/negative returns (green/red lines, respectively) and plot them in Fig. 7.

The trends in the time-varying portfolio weights in terms of overall, positive, and negative returns estimated by MVP, MCP, and MCoP exhibit similar patterns. Additionally, they provide evidence of asymmetry, particularly throughout the study period. Unsurprisingly, under the MVP method, the portfolio weights of HC and CS were higher than those of the other sectors in early 2020 probably due to the pandemic outbreak. The dynamic portfolio weights for sectoral returns under these three different techniques tended to increase considerably in the 2022–2023 period.

Next, we examine the hedging effectiveness of each portfolio construction methodology (MVP, MCP, and MCoP) and present them in Table 4, 5 and 6.

The results in Table 4 suggest that if, on average, we invest 9% in IND, 5% in UTI, 4% in EN, 5% in MAT, 43% in CS, 25% in HC, 4% in FIN, 1% in IT, and 4% in RE, then the proportions of volatilities in the portfolio will be statistically significant (except for CS), decreasing by 45% for IND, 43% for UTI, 78% for EN, 48% for MAT, -4% for CS, 12% for HC, 59% for FIN, 60% for IT, and 50% for RE. A negative CS value indicates that if we invest in this stock, the volatility of each stock in the portfolio would increase. As for the results for the positive and negative returns, it should be noted that the average weights and hedging effectiveness are quite similar and statistically significant, except for CS. Our results align with those of Broadstock et al. (2022) and suggest that positive and negative returns have similar weights on average.

Portfolio weights based on the MCP technique propose that if, on average, we invest in 0% in IND, 20% in UTI, 30% in EN, 5% in MAT, 7% in CS, 7% in HC, 6% in FIN, 20% in IT, and 5% in RE, then the proportion of volatilities in the portfolio will be statistically significant (except for IND, UTI, and MAT), lowered by 3% from IND, 0% from UTI, 61% from EN, 8% from MAT, -83% from CS, -54% from HC, 27% from FIN, 29% from IT, and 12% from RE. However, the values for IND, UTI, and MAT are not statistically significant. Moreover, the values for positive and negative returns have statistically significant contrasts and asymmetries. For example, the portfolio weights for the positive returns of IND, UTI, and MAT are statistically significant, while those for the negative returns are not. Furthermore, the weights suggest asymmetries in the magnitudes and signs between positive and negative returns.

The findings in Table 6 suggest that, on average, we invest 0% in IND, 19% in UTI, 26% in EN, 7% in MAT, 8% in CS, 8% in HC, 8% in FIN, 19% in IT, and 7% in RE; then the contribution volatility of each asset in the portfolio will be statistically significant (except for IND, UTI, and MAT), reduced by 7% from IND, 3% from UTI, 63% from EN, 12% from MAT, − 76% from CS, − 49% from HC, 30% from FIN, 32% from IT, and 15% from RE. Similar to the findings in Table 5, the portfolio weights and HE for IND and UTI are not statistically significant (while they are significant for MAT at the 10% significance level). Overall, the results obtained by the minimum connectedness approach are similar in magnitude and sign and indicate asymmetries between positive and negative returns.

The findings suggest the following policy recommendations. First, our findings on asymmetric sectoral connectedness can help investors and stakeholders implement portfolio diversification strategies and determine optimal portfolio allocations in a timely manner. Furthermore, the dominance of negative connectedness—particularly during heightened distress—and the discrepancies among asymmetric spillovers paraphrase an exemplary and robust risk-monitoring framework for policymakers to ensure the soundness of financial markets.

Dynamic portfolio analysis for US sectoral returns and different asset classes

In the final phase of the study, we examine dynamic portfolio weights of the US sectoral returns along with different asset classes (crude oil-WTI, gold, Bitcoin-BTC)Footnote 14 estimated by MVP, MCP, and MCoP approaches. Since IND, MAT, and FIN are the largest transmitter of symmetric and asymmetric connectedness on average, we use these sectoral returns in the portfolio analysis. We compute the portfolio performances of each methodology considering the symmetric returns (black lines), and positive/negative returns (green/red lines, respectively), and plot them in Fig. 8.

The MVP results suggest that the dynamic optimal portfolio weights are allocated to WTI, gold, BTC, and GB, while the highest proportion is obtained for GB and followed by gold. However, the dynamic portfolio allocations of the US sectoral return are found to be zero throughout the episode and the optimal portfolio only consist of WTI, gold, BTC, and GB. On the other hand, dynamic portfolio weights estimated by the MCP and MCoP exhibit similar patterns which align with the findings of Broadstock et al. (2022). Additionally, the asymmetry is evident in both the MCP and the MCoP approaches.

Average portfolio allocations and the hedging effectiveness of each portfolio construction methodology (MVP, MCP, and MCoP, respectively) are given in Tables 7, 8, and 9, respectively.

MVP allocations of assets indicate that if on average we invest in WTI 2%, in gold 7%, in BTC 1%, and in GB 8%, and the US sectoral returns 0%, then the proportions of volatilities in the portfolio will be statistically significant lowered by 97% from WTI, 54% from gold, 97% from BTC, and 100% in US sectoral returns. However, if we invest in GB then the volatility of each stock in the portfolio would increase. The results for the positive and negative returns are very similar to the symmetric results and statistically significant.

The MCP and MCoP techniques suggest more diversified portfolios. Moreover, the results are statistically significant, and negative HE for some asset classes indicates that if we invest in these assets then the volatility of each stock in the portfolio would increase. Corroborating our previous results and different than the MVP, the asymmetry is evident in the MCP and MCoP approaches.

Conclusion

In this work, we examined asymmetric time-varying connectedness between nine S&P 500 sectoral returns between 2020:1 and 2023:1. To this end, we implemented a newly engineered approach—asymmetric TVP-VAR connectedness—and focused on the time-varying transmitting/receiving roles of S&P 500 sectoral returns by considering the asymmetric (positive/negative) impacts of spillovers. Furthermore, we performed a portfolio backtesting analysis to detect the hedging effectiveness of different portfolio construction techniques (MVP, MCP, and MCoP) in the presence of asymmetry.

The time-varying asymmetric connectedness results suggest that the sectoral return indices are strongly interconnected on average, and connectedness based on negative returns dominates the study period. This finding underlines that S&P 500 sectoral returns are more sensitive to negative shocks, particularly during crisis episodes, which is in line with previous studies (Baruník et al. 2017; Adekoya et al. 2022a, b). Moreover, the industrial sector is the largest transmitter/recipient of overall positive and negative return shocks.

Time-varying connectedness indices exhibited similar patterns throughout the study episode and hit their apex on March 16, 2020, shortly after the pandemic was officially declared. This result points to the noteworthy impact of the COVID-19 pandemic on the overall and asymmetric connectedness of S&P 500 sectoral returns, which is consistent with the findings of previous studies (Bouri et al. 2021; So et al. 2021; Bossman et al. 2022; Umar et al. 2022). Moreover, TCIs experienced noteworthy surges in November–December 2021 and April–June 2022, which also coincided with bullish/bearish market episodes.

In line with our average connectedness results, time-varying pairwise asymmetric spillovers indicate the dominance of negative spillovers over the study period, suggesting that investors and hedgers are more reactive to negative news. Moreover, we found that the industry, utilities, and energy sectors were mainly net receivers of return shocks, while sectors such as consumer staples, health care, and real estate shifted between net recipients and net transmitters over the course of the study period. Moreover, this asymmetry has become more evident since late 2022.

Additionally, we estimate networks of negative interlinkages among sectoral returns at two burst times (declaration of the pandemic and the RIU). Our network connectedness results indicate that IND is the largest node in propagating shocks in both networks and the COVID-19 network is featured by tighter interdependencies between sectoral returns compared to the network estimated for RIU. The TCIs computed with alternative model parameters exhibit similar motifs and intensify/alleviate around time intervals, indicating the robustness of our results with alternative model settings.

In the final stage of the study, we investigated the hedging effectiveness of different portfolio construction approaches and dynamic portfolio weights considering the asymmetric effects. The minimum variance portfolio approach didn’t suggest a sharp statistically significant differences and asymmetry, while the other two methodologies (the MCP, and MCoP) provided similar results in terms of signs and magnitude of findings and reported evidence for asymmetry.

Furthermore, we compute dynamic optimal portfolio weights and hedging effectiveness for different asset classes (WTI, gold, BTC, and iShares USD Green Bond ETF) along with the US sectoral returns. Our findings propose more diversified portfolios the MCP and MCoP techniques and report the asymmetry for the MCP and MCoP techniques.

The findings of this study suggest the following policy recommendations. First, our finding in terms of asymmetric sectoral connectedness can help investors and stakeholders in performing their portfolio diversification strategies and determining optimal portfolio allocations in a timely manner. Furthermore, the dominance of negative connectedness particularly over the course of heightened distress, and the discrepancies among the asymmetric spillovers paraphrase an exemplary and robust risk monitoring framework for policymakers to ensure the soundness of financial markets.

Availability of data and materials

The data of the study has been collected from the Investing database and publicly available.

Notes

The tickers for the S&P 500 sectoral indices are as follows, respectively: SPLRCI, SPLRCU, SPNY, SPLRCM, SPLRCS, SPSY, SPLRCT, and SPLRCREC.

The black shaded region represents the asymmetric total connectedness, and the green/red line exhibit the dynamics of TCIs for positive and negative returns, respectively.

Positive/negative values denote the transmitters/recipients in the system.

This figure shows the negative connectedness networks on March 11, 2020 and February 24, 2022, respectively. Arrows represent the direction of connections; the magnitude and color of the lines indicate the size of the connections, and the sizes of the vertices denote the total TO spillovers from that node.

The sizes of nodes (IND, UTI, EN, MAT, CS, HC, FIN, IT, and RE) at the networks estimated on March 11, 2020 and February 24, 2022 are as follows: 81.13, 63.16, 84.98, 85.36, 83.71, 80.09, 85.99, 82.85, 70.13, and 27.82, 8.24, 36.02, 48.98, 48.048, 43.28, 40.24, 45.25, 41.36, respectively.

We selected forecast horizons (H = 10, and 30), and decay factors \({\kappa }_{1}\)= 0.99 and \({\kappa }_{2}=0.99\) as alternative model settings.

TC1, TCI_N, TCI_P: TCI estimations with lag 1, a 20-step ahead FEVD, decay factors \({\kappa }_{1}\)= 0.99 and \({\kappa }_{2}=0.96\), TC11, TCI1_N, TCI1_P: TCI with lag 1, a 30-step ahead FEVD, and \({\kappa }_{1}, {\kappa }_{2}\)= 0.99, and TC12 TCI2_N, and TCI2_P: TCI estimations with lag 1 (BIC), a 30-step ahead FEVD, and \({\kappa }_{1}, {\kappa }_{2}\)= 0.99.

The data set has been collected from the Investing database.

Abbreviations

- TVP-VAR:

-

Time-varying parameter vector autoregression

- TCI:

-

Total connectedness index

- DY:

-

Diebold–Yilmaz

- GDP:

-

Gross domestic product

- IND:

-

Industrials

- UTI:

-

Utilities

- EN:

-

Energy

- MET:

-

Materials

- CS:

-

Consumer staples

- HC:

-

Health care

- FIN:

-

Financials

- IT:

-

Information technology

- RE:

-

Real estate

References

Abdullah M, Chowdhury MAF, Sulong Z (2023) Asymmetric efficiency and connectedness among green stocks, halal tourism stocks, cryptocurrencies, and commodities: Portfolio hedging implications. Resour Policy 81:103419

Adekoya OB, Oliyide JA, Yaya OS, Al-Faryan MAS (2022a) Does oil connect differently with prominent assets during war? Analysis of intra-day data during the Russia-Ukraine saga. Resour Policy 77:102728

Adekoya OB, Akinseye AB, Antonakakis N, Chatziantoniou I, Gabauer D, Oliyide J (2022b) Crude oil and Islamic sectoral stocks: asymmetric TVP-VAR connectedness and investment strategies. Resour Policy 78:102877

Aharon DY, Kizys R, Umar Z, Zaremba A (2023) Did David win a battle or the war against Goliath? Dynamic return and volatility connectedness between the GameStop stock and the high short interest indices. Res Int Bus Financ 64:101803

Ahmad W, Hernandez JA, Saini S, Mishra RK (2021) The US equity sectors, implied volatilities, and COVID-19: What does the spillover analysis reveal? Resour Policy 72:102102

Akhtaruzzaman M, Boubaker S, Sensoy A (2021) Financial contagion during COVID–19 crisis. Financ Res Lett 38:101604

Alkan B, Çiçek S (2020) Spillover effect in financial markets in Turkey. Central Bank Review 20(2):53–64

Alshater MM, Alqaralleh H, El Khoury R (2023) Dynamic asymmetric connectedness in technological sectors. J Econ Asymmetries 27:e00287

Antonakakis N, Chatziantoniou I, Gabauer D (2020) Refined measures of dynamic connectedness based on time-varying parameter vector autoregressions. J Risk Financ Manag 13(4):84

Antonakakis N, Cunado J, Filis G, Gabauer D, de Gracia FP (2023) Dynamic connectedness among the implied volatilities of oil prices and financial assets: new evidence of the COVID-19 pandemic. Int Rev Econ Financ 83:114–123

Apergis N, Christou C, Kynigakis I (2019) Contagion across US and European financial markets: evidence from the CDS markets. J Int Money Financ 96:1–12

Baruník J, Kočenda E, Vácha L (2016) Asymmetric connectedness on the US stock market: bad and good volatility spillovers. J Financ Markets 27:55–78

Baruník J, Kočenda E, Vácha L (2017) Asymmetric volatility connectedness on the forex market. J Int Money Financ 77:39–56

Beber A, Brandt MW (2010) When it cannot get better or worse: the asymmetric impact of good and bad news on bond returns in expansions and recessions. Rev Financ 14(1):119–155

Benlagha N, El Omari S (2022) Connectedness of stock markets with gold and oil: new evidence from COVID-19 pandemic. Financ Res Lett 46:102373

Black F (1976) Studies of stock price volatility changes. In: Proceedings of the 1976 meetings of the American statistical association, business and economical statistics section, pp. 177–181

Bossman A, Junior PO, Tiwari AK (2022) Dynamic connectedness and spillovers between Islamic and conventional stock markets: time-and frequency-domain approach in COVID-19 era. Heliyon 8(4):e09215

Boubaker S, Jouini J, Lahiani A (2016) Financial contagion between the US and selected developed and emerging countries: the case of the subprime crisis. Q Rev Econ Financ 61:14–28

Bouri E, Cepni O, Gabauer D, Gupta R (2021) Return connectedness across asset classes around the COVID-19 outbreak. Int Rev Financ Anal 73:101646

Broadstock DC, Chatziantoniou I, Gabauer D (2022) Minimum connectedness portfolios and the market for green bonds: advocating socially responsible investment (SRI) activity. Applications in energy finance: the energy sector, economic activity, financial markets and the environment. Springer International Publishing, Cham, pp 217–253

Cao G, Xie W (2022) Asymmetric dynamic spillover effect between cryptocurrency and China’s financial market: evidence from TVP-VAR based connectedness approach. Financ Res Lett 49:103070

Chatziantoniou I, Gabauer D (2021) EMU risk-synchronisation and financial fragility through the prism of dynamic connectedness. Q Rev Econ Finan 79:1–14

Chatziantoniou I, Gabauer D, Marfatia HA (2022) Dynamic connectedness and spillovers across sectors: evidence from the Indian stock market. Scottish J Polit Econ 69(3):283–300

Chen Y, Li W, Qu F (2019) Dynamic asymmetric spillovers and volatility interdependence on China’s stock market. Physica A: Stat Mech Appl 523:825–838

Choi SY (2020) Industry volatility and economic uncertainty due to the COVID-19 pandemic: evidence from wavelet coherence analysis. Financ Res Lett 37:101783

Choi SY (2022) Dynamic volatility spillovers between industries in the US stock market: evidence from the COVID-19 pandemic and black monday. North Am J Econ Financ 59:101614

Choudhury T, Daly K (2021) Systemic risk contagion within US states. Stud Econ Financ 38(4):836–860

Chow HK (2017) Volatility spillovers and linkages in Asian stock markets. Emerg Mark Financ Trade 53(12):2770–2781

Christie AA (1982) The stochastic behavior of common stock variances: value, leverage and interest rate effects. J Financ Econ 10(4):407–432

Costa A, Matos P, da Silva C (2022) Sectoral connectedness: new evidence from US stock market during COVID-19 pandemics. Financ Res Lett 45:102124

Cui J, Zou H (2022) Coherence, connectedness, dynamic linkages among oil and China’s sectoral commodities with portfolio implications. J Syst Sci Complex 35(3):1052–1097

Diebold FX, Yılmaz K (2014) On the network topology of variance decompositions: measuring the connectedness of financial firms. J Economet 182(1):119–134

French KR, Schwert GW, Stambaugh RF (1987) Expected stock returns and volatility. J Financ Econ 19(1):3–29

Hernandez JA, Shahzad SJH, Sadorsky P, Uddin GS, Bouri E, Kang SH (2022) Regime specific spillovers across US sectors and the role of oil price volatility. Energy Econ 107:105834

Hung NT (2021) Bitcoin and CEE stock markets: fresh evidence from using the DECO-GARCH model and quantile on quantile regression. Eur J Manag Bus Econ 30(2):261–280

Hung NT, Nguyen LTM, Vo XV (2022) Exchange rate volatility connectedness during Covid-19 outbreak: DECO-GARCH and transfer entropy approaches. J Int Finan Markets Inst Money 81:101628

Iqbal N, Naeem MA, Suleman MT (2022) Quantifying the asymmetric spillovers in sustainable investments. J Int Finan Markets Inst Money 77:101480

Karamti C, Belhassine O (2022) COVID-19 pandemic waves and global financial markets: evidence from wavelet coherence analysis. Financ Res Lett 45:102136

Kou G, Ergu D, Lin C, Chen Y (2016) Pairwise comparison matrix in multiple criteria decision making. Technol Econ Dev Econ 22(5):738–765

Kou G, Chao X, Peng Y, Alsaadi FE, Herrera Viedma E (2019) Machine learning methods for systemic risk analysis in financial sectors

Kou G, Xu Y, Peng Y, Shen F, Chen Y, Chang K, Kou S (2021a) Bankruptcy prediction for SMEs using transactional data and two-stage multiobjective feature selection. Decis Support Syst 140:113429

Kou G, Olgu Akdeniz Ö, Dinçer H, Yüksel S (2021b) Fintech investments in European banks: a hybrid IT2 fuzzy multidimensional decision-making approach. Financ Innov 7(1):39

Li T, Kou G, Peng Y, Philip SY (2021) An integrated cluster detection, optimization, and interpretation approach for financial data. IEEE Trans Cybern 52(12):13848–13861

Maghyereh AI, Awartani B, Bouri E (2016) The directional volatility connectedness between crude oil and equity markets: new evidence from implied volatility indexes. Energy Econ 57:78–93

Mandacı PE, Cagli EÇ, Taşkın D (2020) Dynamic connectedness and portfolio strategies: energy and metal markets. Resour Policy 68:101778

Mensi W, Al Rababa’a AR, Vo XV, Kang SH (2021a) Asymmetric spillover and network connectedness between crude oil, gold, and Chinese sector stock markets. Energy Econ 98:105262

Mensi W, Maitra D, Vo XV, Kang SH (2021b) Asymmetric volatility connectedness among main international stock markets: a high frequency analysis. Borsa Istanbul Rev 21(3):291–306

Mensi W, Shafiullah M, Vo XV, Kang SH (2022) Asymmetric spillovers and connectedness between crude oil and currency markets using high-frequency data. Resour Policy 77:102678

Nham NTH (2022) An application of a TVP-VAR extended joint connected approach to explore connectedness between WTI crude oil, gold, stock and cryptocurrencies during the COVID-19 health crisis. Technol Forecast Soc Chang 183:121909

Noori M, Hitaj A (2023) Dissecting hedge funds’ strategies. Int Rev Financ Anal 85:102453

Pino G, Sharma SC (2019) On the contagion effect in the US banking sector. J Money Credit Bank 51(1):261–280

Ren Y, Zhao W, You W, Zhai K (2021) Multiscale and partial correlation networks analysis of risk connectedness in global equity markets. Phys A 573:125911

Shahzad U, Mohammed KS, Tiwari S, Nakonieczny J, Nesterowicz R (2023) Connectedness between geopolitical risk, financial instability indices and precious metals markets: novel findings from Russia Ukraine conflict perspective. Resour Policy 80:103190

Sharif A, Aloui C, Yarovaya L (2020) COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: fresh evidence from the wavelet-based approach. Int Rev Financ Anal 70:101496

So MK, Chu AM, Chan TW (2021) Impacts of the COVID-19 pandemic on financial market connectedness. Financ Res Lett 38:101864

Stock J, Elliott G, Rothenberg T (1996) Efficient tests for an autoregressive unit root. Econometrica 64(4):813–836

Suleman MT, McIver R, Kang SH (2021) Asymmetric volatility connectedness between Islamic stock and commodity markets. Glob Financ J 49:100653

Tang Y, Chen XH, Sarker PK, Baroudi S (2023) Asymmetric effects of geopolitical risks and uncertainties on green bond markets. Technol Forecast Soc Chang 189:122348

Umar Z, Polat O, Choi SY, Teplova T (2022) The impact of the Russia-Ukraine conflict on the connectedness of financial markets. Financ Res Lett 48:102976

Vidal-Llana X, Uribe JM, Guillén M (2023) European stock market volatility connectedness: the role of country and sector membership. J Int Finan Markets Inst Money 82:101696

Virk N, Javed F (2017) European equity market integration and joint relationship of conditional volatility and correlations. J Int Money Financ 71:53–77

Wang X, Wu C (2018) Asymmetric volatility spillovers between crude oil and international financial markets. Energy Econ 74:592–604

Wang B, Wei Y, Xing Y, Ding W (2019) Multifractal detrended cross-correlation analysis and frequency dynamics of connectedness for energy futures markets. Phys A 527:121194

Wen F, Yang X, Zhou WX (2019) Tail dependence networks of global stock markets. Int J Financ Econ 24(1):558–567

Wu G (2001) The determinants of asymmetric volatility. Rev Financ Stud 14(3):837–859

Wu F, Zhang D, Zhang Z (2019) Connectedness and risk spillovers in China’s stock market: a sectoral analysis. Econ Syst 43(3–4):100718

Younis I, Longsheng C, Basheer MF, Joyo AS (2020) Stock market comovements among Asian emerging economies: a wavelet-based approach. PLoS ONE 15(10):e0240472

Youssef M, Mokni K, Ajmi AN (2021) Dynamic connectedness between stock markets in the presence of the COVID-19 pandemic: does economic policy uncertainty matter? Financ Innovat 7(1):13

Zhang W, Zhuang X, Wang J, Lu Y (2020) Connectedness and systemic risk spillovers analysis of Chinese sectors based on tail risk network. North Am J Econ Financ 54:101248

Zhang X, Zhang T, Lee CC (2022) The path of financial risk spillover in the stock market based on the R-vine-Copula model. Physica A 600:127470

Zheng B, Zhang YW, Qu F, Geng Y, Yu H (2022) Do rare earths drive volatility spillover in crude oil, renewable energy, and high-technology markets?—A wavelet-based BEKK-GARCH-X approach. Energy 251:123951

Acknowledgements

Not applicable.

Funding

This research received no external funding.

Author information

Authors and Affiliations

Contributions

Conceptualization, methodology, data analysis, original draft writing were conducted by the corresponding author. The author read and approved the paper.

Corresponding author

Ethics declarations

Competing interests

The author declares that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Polat, O. Interlinkages across US sectoral returns: time-varying interconnectedness and hedging effectiveness. Financ Innov 10, 51 (2024). https://doi.org/10.1186/s40854-023-00581-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40854-023-00581-4