Abstract

This study provides insight into sustainability challenges in Venezuela by exploring the causal interactions between oil price, energy consumption and carbon dioxide (CO2) emissions in Venezuela. Economic growth, government consumption expenditure and trade openness are included as additional determinants in the analysis. The auto-regressive distributed lag (ARDL) bounds approach to cointegration provides evidence of long-run relationship between the variables with the incorporation of structural breaks observed in the series. The estimates suggest that an increase in crude oil price significantly increases energy consumption, government consumption expenditure and energy consumption generate CO2 emissions, and CO2 emissions exert negative effects on economic growth in the oil-rich economy. This study further examined the direction of causality between the variables using the innovative accounting approach (IAA). The results suggest that crude oil price causes energy consumption in the economy. No significant causal relationship is found between energy consumption and economic growth. Energy consumption causes CO2 emissions in the economy. In addition, a unidirectional causality runs from CO2 emissions to economic growth. The response of economic growth to CO2 emissions indicates that more CO2 emissions in the economy would exert negative effects on economic growth. It is, therefore, expected that policy makers would consider energy diversification as a major component of economic diversification policies in Venezuela.

Similar content being viewed by others

1 Introduction

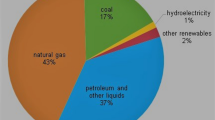

According to the Organization of Petroleum Exporting Countries (OPEC), the Bolivarian Republic of Venezuela has one of the world’s largest proven crude oil reserves with 302,809 million barrels (OPEC Annual Statistical Bulletin 2018). Using average daily crude oil production for 2017 (see Fig. 1a), it would take over 390 years for Venezuela to run out of crude oil. This means that Venezuela will remain as a major crude oil producing country for a long time. Looking at the way Venezuela has managed its vast oil wealth over the past decades raises some concern about the sustainability of economic activities and environmental quality in the oil-rich economy (see Pietrosemoli and Rodríguez-Monroy 2019). Figure 1a shows that the Venezuelan oil industry has not been able to achieve its 1971 production level in recent years despite having the number of proven crude oil reserves increasing to more than 10 times their size 40 years ago. Interestingly, Fig. 1b suggests a declining oil export, with the most recent peak in oil export achieved in 1998. It is also evident that the proportion of oil production consumed domestically has increased significantly in recent years (see Fig. 1c, d). Figure 1d shows that in 1971 only about 5.87 per cent of the total oil production were consumed domestically. In response to the demands of increasing economic activities, the amount increased to 29.16 per cent in 2013. The composition of energy consumption mix presented in Table 1 shows that fossil fuel energy sources contribute over 80 per cent of the total energy use in the Venezuelan economy. This holds serious consequences for environmental quality as highlighted by the high amount of carbon dioxide (CO2) emitted from the economy.

A crucial point from Fig. 1 and Table 1 is that the abundance of oil wealth has created economic and environmental policy challenges in the Venezuelan economy. According to OPEC Annual Statistical Bulletin (2018), crude oil now accounts for over 90 per cent of total export earnings in the Venezuelan economy. This means that fiscal spending that determines the demand for economic activities and the performance of various economic agents in the economy depends solely on the size of oil export receipts (Bjerkholt and Niculescu 2004; Villafuerte and Lopez-Murphy 2009; Di Bella et al. 2015). Higher crude oil prices would mean higher revenue, more economic and social activities and increased consumption expenditure in the economy. This particular economic condition suggests that with the increasing importance of energy in modern social, economic and technological activities, higher crude oil prices may result in rapid accumulation of energy-using technologies and more energy-intensive consumption in the economy. It is evident from Fig. 1 and Table 1 that over the years, only minimal proportion of oil receipts has been committed to enhancing the amount of low carbon and efficient energy sources in the economy (see Pietrosemoli and Rodríguez-Monroy 2019). Rather, the national oil company Petroleros de Venezuela (PDVSA), which guided Venezuela to the path of becoming oil-dependent economy (Mu and Hu 2018), spent much of the crude oil export receipts in financing consumption-based social programs such as National Development Fund (Fonden) created in 2005 (Gutiérrez 2017). While these social programs are designed to attend to the needs of the people, they may have also induced high demand for energy-intensive activities (Rogat 2007), given the extensive fossil fuel subsidies provided (Friedrichs and Inderwildi 2013; Moghaddam and Wirl 2018).

In the light of the above environmental and economic concerns, this study provides insight into sustainability challenges in Venezuela by exploring the causal interactions between oil price, energy consumption and CO2 emissions in Venezuela. Economic growth, fiscal spending (government consumption expenditure), and trade openness are included as additional determinants in the energy demand model. The introduction of these variables expands the scope of this study. This becomes necessary as crude oil price may have indirect effects on energy consumption and environmental quality through its influence on these variables (Boufateh 2019). The objectives are to determine the influence of crude oil price on energy consumption, its implications for the growth of economic activities and environmental quality, and the role of fiscal spending and trade in the current economic and environmental challenges in the oil-rich economy. Only few energy studies have examined the case of Venezuela (see Cheng 1997; Sari and Soytas 2009; Chang and Carballo 2011; Sheinbaum et al. 2011; Al-mulali et al. 2013; Robalino-López et al. 2015). These studies, however, focused on the causal interaction between economic growth, energy consumption and carbon dioxide (CO2) emissions in the economy. None considered the underlying role of oil price, fiscal spending, and trade in the causal interaction between economic growth, energy consumption and carbon dioxide (CO2) emissions in the oil-rich economy. The results of these studies, therefore, offer limited policy options in the face of the current economic and environmental challenges in the economy. Interestingly, empirical evidence from these studies suggests that substantial increase in the level of energy consumption in Venezuela may not likely generate significant growth in the level of economic activities (see Cheng 1997; Sari and Soytas 2009). The findings of Sheinbaum et al. (2011) and Al-mulali et al. (2013) reveal that an increase in energy consumption generates more emission of carbon dioxide (CO2) in the economy. From these suggestions, a comprehensive analysis of the drivers of growth–energy–CO2 emissions nexus in the economy is needed to uncover obstacles the Bolivarian Republic of Venezuela must overcome to ensure sustainability in its quest for socio-economic development.

This study provides robust empirical evidence on the drivers of energy consumption and environmental quality in the Bolivarian Republic of Venezuela. This is achieved by employing robust econometric techniques including (i) single and multiple structural break unit root tests, (ii) the auto-regressive distributed lag (ARDL) bounds testing approach for cointegration analysis, incorporating the presence of single and multiple structural breaks in the series, and (iii) the innovation accounting approach for Granger causality test. It is expected that the results of this study will offer appropriate policy options for achieving sustainable economic growth and improving environmental quality in Venezuela and possibly in other fossil-rich economies.

The remainder of this study is structured as follows: Sect. 2 provides a review of existing empirical literature. Section 3 presents the data and method of the empirical study. Section 4 presents the empirical results. Section 5 discusses the empirical results highlighting policy implications. Finally, Sect. 6 offers some concluding remarks on the findings.

2 A brief literature review

In the past few years, a considerable number of empirical studies have been devoted to understanding the drivers of energy consumption and environmental quality in different economies. Some of these studies specifically examined the causal effects of drivers of social, economic and technological activities on energy consumption (see Azam et al. 2015, 2016; Shahbaz et al. 2016; Mahalik et al. 2017; Danish et al. 2018; Saud and Chen 2018). Others extended the analysis with the inclusion of indicators of environmental degradation such as CO2 emissions (see Sari and Soytas 2009; Chang and Carballo 2011; Sheinbaum et al. 2011; Al-mulali et al. 2013; Shahbaz et al. 2013; Alshehry and Belloumi 2015; Robalino-López et al. 2015; Pablo-Romero and De Jesús 2016; Rafindadi 2016; Cetin et al. 2018; Ehigiamusoe and Lean 2019). The results of these studies in general show that the causal interaction between drivers of social, economic and technological activities, energy consumption and CO2 emissions varies among countries due to differences in economic, technological, institutional, political, and geographical conditions (Rahman and Kashem 2017).

Acar (2017) suggests that oil resource abundance (and dependence) contributes significantly to sustainability challenges in oil resource abundant (and dependent) economies. It is, however, surprising that only few of the existing studies have considered the causal influence of crude oil price on energy consumption and CO2 emissions in oil-resource-abundant economies, where oil export receipt is a critical source of fiscal spending that generates economic activities (see Bjerkholt and Niculescu 2004; Villafuerte and Lopez-Murphy 2009). Using Algeria, a heavily dependent net oil-exporting economy and Egypt, a semi oil-dependent economy, Fuinhas and Marques (2013) show that crude oil price not only determines energy demand but also influences the interaction between energy consumption and drivers of economic activities in oil-resource dependent economies. For Algeria, the study identified an absence of significant short-run effect, suggesting that a higher crude oil price does not result in an instant demand for energy in the economy. A significant long-run coefficient for crude oil price suggests that a 1 per cent increase in crude oil prices generates about 1.03 per cent increase in energy consumption in the Algerian economy in the long run. For Egypt, there is an absence of significant long-run and short-run crude oil price effects on energy consumption in the economy. In the case of the causal relationship between energy consumption and economic growth, the results identified a significant negative causal relationship for Algeria and a significant positive relationship for Egypt.

Alshehry and Belloumi (2015) incorporated crude oil price in the analysis of the causal relationship between energy consumption, carbon dioxide emissions and economic growth in Saudi Arabia. The variance decomposition analysis shows that substantial increase in the level of energy consumption may not likely generate significant growth in the level of economic activities but an increase in the level of CO2 emissions due to the underlying influence of oil wealth on economic activities in the oil-resource-dependent economy. Saboori et al. (2016) employed the autoregressive distributive lag (ARDL) approach to cointegration and the Toda-Yamamoto modified Wald test procedure for Granger causality analysis to examine the environmental Kuznets curve (EKC) hypothesis in 10 of the Organization of Petroleum Exporting Countries (OPEC) over the period 1977–2008. The study used ecological footprint to measure environmental quality and income, labor, capital, oil consumption and oil price as drivers of economic activities. The results show that in the case of Venezuela, ecological footprint increases significantly with economic growth and oil consumption and decreases significantly with an increase in crude oil price in the long run. The causality analysis, however, shows no significant causal relationship between ecological footprint, oil consumption and crude oil price. The study also documents a significant causal relationship from crude oil price to oil consumption for Algeria and United Arab Emirates (UAE). Nwani (2017) examined the causal relationship between crude oil price, energy consumption and CO2 emissions in Ecuador over the period 1971–2013 incorporating income per capita for economic growth. The short-run and long-run coefficients estimated through the application of autoregressive distributive lag (ARDL) model suggest that higher crude oil export receipts create economic conditions that generate more energy consumption, which contributes significantly to CO2 emissions in the Ecuadorean economy. Using Toda-Yamamoto Granger causality test procedure, the study identified a unidirectional causality running from crude oil price to both energy consumption and economic growth, bidirectional causality between energy consumption and CO2 emissions and a unidirectional causality that runs from CO2 emissions to economic growth through financial sector development.

There are also a number of recent studies confirming the decisive effects of crude oil price on economic growth and fiscal spending in net oil-exporting economies (see Bjerkholt and Niculescu 2004; Villafuerte and Lopez-Murphy 2009; Mehrara and Oskoui 2007; EL Anshasy and Bradley 2012; Nusair 2016). These variables have also been identified among major drivers of energy consumption and CO2 emissions in many economies (see Halkos and Paizanos 2013, 2016; Ali et al. 2016, 2017; Shahbaz et al. 2017; Cetin et al. 2018; Ehigiamusoe and Lean 2019; Salahuddin and Gow 2019). It is, therefore, quite plausible to expect that crude oil price will exert impact, indirectly, on energy consumption and CO2 emissions through these variables (Boufateh 2019; Friedrichs and Inderwildi 2013; Fuinhas and Marques 2013). Interestingly, the influence of crude oil price on the relationship between energy consumption and CO2 emissions may as well impact on economic growth (see Fuinhas and Marques 2013 for the case of Algeria). By incorporating economic growth, government consumption expenditure and trade openness in the causal analysis of the relationship between crude oil price, energy consumption and CO2 emissions in Venezuela, this study recognises the complexity of the role of crude oil price on economic activities in oil-dependent economies.

3 Data, empirical model and methodology

3.1 Definition of variables and data description

This study uses annual data covering the period from 1971 to 2013. Energy consumption is measured as energy use (kg of oil equivalent per capita). CO2 emissions which capture environmental pollution are measured in metric tons per capita. Real gross domestic product (GDP) per capita represents the growth of economic activities. International crude oil price is measured in US dollars per barrel. Fiscal expenditure is incorporated using general government final consumption expenditure. Table 2 presents the definition and data sources of all the variables used in this study, while the plots of the series are presented in Fig. 2.

(Data source: see Table 2)

Time series plot of the study variables

3.2 Empirical model and estimation method

This study implements the following log-linear models to examine empirically the relationship between crude oil price, energy consumption, carbon dioxide (CO2) emissions and economic growth in Venezuela.

Mode 1: energy consumption

Model 2: environmental Kuznets curve (EKC) hypothesis

Model 3: economic growth

where \(\varepsilon_{t }\) is the white noise error term. Oil, CO2, Engy, Rgdpc, GCE and Trd are as defined in Table 2. ‘ln’ indicates that all variables are in natural logarithm. The square of real GDP per capital \(({\text{lnRgdpc}}^{2} )\) is included in Eq. 2 to implement the environmental Kuznets curve (EKC) hypothesis augmented by oil price, energy consumption, government consumption expenditure, and trade openness. The EKC hypothesis suggests that an inverted u-shaped relationship exists between economic growth and environmental pollution, with economic growth causing increase in environmental pollution at the initial stages of development and after a turning point level of income, economic growth generates improvement in environmental quality (see Grossman and Krueger 1991; Shahbaz et al. 2017; Cetin et al. 2018; Karasoy 2019).

The autoregressive distributed lag testing approach to cointegration (ARDL-bounds) of Pesaran et al. (2001) is employed to examine the log-linear models. The ARDL approach provides valid results whether the variables are I(0) or I(1) or mutually cointegrated [I(0) and I(1)]. It also allows for simultaneous testing of the long-run and short-run relationships between variables in small and large sample sizes and provides unbiased coefficients of variables along with valid t-statistics even when the explanatory variables are endogenous (Pesaran et al. 2001). These statistical features have made ARDL bounds approach to cointegration popular among researchers in recent years (see Shahbaz et al. 2013; Ali et al. 2016, 2017; Mahalik et al. 2017; Rafindadi 2016; Khraief et al. 2018 among others). The implementation of ARDL bounds approach involves testing for the presence of a long-run relationship based on the log-linear specification in the four equations using a dynamic unrestricted error correction model (UECM) framework that integrates the short-run dynamics with the long-run equilibrium without losing any long-run information. The empirical formulation of ARDL bounds testing approach to cointegration is given in the equations below:

where \(\Delta\) is the difference operator, while \(\varepsilon_{t}\) is the white noise error term. p is the optimal lag length. TBrk is a dummy variable that captures the possibility of structural breaks in the data series. All the variables are as defined in Table 2. The null hypothesis of no cointegration among the variables in Eq. (4) \(H_{0} : \alpha_{7} = \alpha_{8} = \alpha_{9} = \alpha_{10} = \alpha_{11} = \alpha_{12} = 0\) is tested against the alternative hypothesis \(H_{1} : \alpha_{7} \ne \alpha_{8} \ne \alpha_{9} \ne \alpha_{10} \ne \alpha_{11} \ne \alpha_{12} \ne 0.\) In Eq. (5) the null hypothesis \(H_{0} : b_{8} = b_{9} = b_{10} = b_{11} = b_{12} = b_{13} = b_{14} = 0\) is tested against the alternative hypothesis \(H_{1} : b_{8} \ne b_{9} \ne b_{10} \ne b_{11} \ne b_{12} \ne b_{13} \ne b_{14} \ne 0.\) In Eq. (6) the null hypothesis \(H_{0} : \delta_{7} = \delta_{8} = \delta_{9} = \delta_{10} = \delta_{11} = \delta_{12} = 0\) is tested against the alternative hypothesis \(H_{1} : \delta_{7} \ne \delta_{8} \ne \delta_{9} \ne \delta_{10} \ne \delta_{11} \ne \delta_{12} \ne 0.\) The decision to reject or accept the null hypothesis \(H_{0}\) (no co-integration among the variables) is based on the following conditions:

-

i.

if the calculated F-statistics is greater than the upper critical bound, then \(H_{0}\) is rejected and the variables are co-integrated,

-

ii.

if the calculated F-statistics is less than the lower bound, then \(H_{0}\) is accepted and the variables are not co-integrated,

-

iii.

but if the calculated F-statistics remains between the lower and upper critical bounds then the decision is inconclusive (Pesaran et al. 2001).

The long-run and short-run coefficients of the variables are estimated once the null hypothesis of no cointegration is rejected and cointegration between the variables established. The error correction model (ECM) for the estimation of the short-run dynamics is formulated in the following equations below:

The coefficient of the lagged error correction term \(({\text{ECM}}_{t - 1} )\) indicates the rate at which the cointegration model corrects its previous period disequilibrium or speed of adjustment to restore the long-run equilibrium relationship. A negative and significant error correction coefficient implies that any short-term movement between the dependent and explanatory variables will converge back to the long-run relationship. Following Pesaran et al. (2001), the stability of long- and short-run estimates is examined by cumulative sum (CUSUM) and cumulative sum of squares (CUSUMSQ). The following relevant diagnostic tests are employed to assess the validity of the estimated equations: Jarque–Bera normality test; Breusch–Godfrey serial correlation LM test and ARCH test for heteroskedasticity.

3.3 Innovative accounting approach for Granger causality

Following Shahbaz et al. (2013), Alam et al. (2016), Mahalik et al. (2017), Rafindadi (2016), Cansino et al. (2018), Khraief et al. (2018), Imamoglu (2019), this study employs the innovative accounting approach (IAA) to examine the direction of causality between energy consumption, crude oil price, CO2 emissions, economic growth, government consumption expenditure and trade openness in Venezuela. IAA has some desirable features that overcome the limitations of traditional causality techniques such as the VECM Granger causality test. It avoids the problem of endogeneity and integration of the series and extents causal test beyond the selected sample period (Shahbaz et al. 2013; Mahalik et al. 2017; Rafindadi 2016). The IAA uses variance decomposition analysis (VDA) and impulse response function (IRF) in the VAR framework to test the strength of causal relationship between the variables. The VAR framework takes the form (see Shan 2005).

In Eq. (4) \(V_{t} = \left( {{\text{lnEngy}}, {\text{lnCrdOP}}, {\text{lnCO}}_{2} , {\text{lnRgdpc}}, {\text{lnGCE}}, {\text{lnTrd}}} \right),\) \(\varPhi_{i}\) are the estimated coefficients and \(e_{t}\) is a vector of error terms.

A shock in a particular variable will directly affect the variable and will also be transmitted to other variables in the system through the dynamic structure of the VAR system. Following a standard deviation shock to a specific variable, variance decomposition analysis (VDA) decomposes the variation in the variable to give the proportion that are due to its own shocks and to shocks in the other variables in the system (see Neusser 2016 Chapter 15). Thus, variance decomposition analysis can enable us to determine which series is strongly affected in the system and vice versa. For instance, a unidirectional causality from crude oil price to energy consumption exists if a shock in crude oil price has significant effect on the changes in energy consumption when a shock in energy consumption only account for insignificant proportion of the variations in crude oil price. Bidirectional causality is dictated when a shock in energy consumption also account for significant proportion of the changes in crude oil price. If shocks in crude oil price do not have any significant impact on the changes in energy consumption and shocks in energy consumption also explain insignificantly the changes in crude oil price, then there is no causality between the variables. Impulse responses (IRF) offer a slightly different method for examining VAR system dynamics. It traces the effects of a shock to one endogenous variable on to the other variables in the VAR. For each variable, a unit shock is applied to the error, and the effects upon the VAR system over time are identified. From this analysis, one can conclude that a strong and significant reaction of energy consumption to shocks in crude oil price implies that crude oil price causes energy consumption.

4 Empirical results

4.1 Preliminary investigation

Figure 3 presents the plots showing the partial correlations between crude oil price, energy consumption, CO2 emissions and economic growth in Venezuela. Crude oil price and per capita energy use are observed to be positively correlated (see Plot A). A positive correlation also exists between per capita energy use and per capita CO2 emissions (see Plot C). A negative correlation exists between per capita energy use and real GDP per capita (see Plot C). Another interesting revelation from Fig. 3 is the strong negative correlation between real GDP per capita and per capita CO2 emissions (see Plot D). These plots in general highlight the importance of exploring the causal interactions among these variables.

(Data source: see Table 2)

Scatter plots showing the partial correlations between crude oil price, energy consumption, CO2 emissions and economic growth in Venezuela

4.2 Unit root tests

Time series data analysis requires the investigation of the stationarity properties of the variables to decide the most appropriate cointegration test (Ali et al. 2017). The ARDL approach provides valid results whether the variables are I(0) or I(1) or mutually cointegrated [I(0) and I(1)]. The stationarity properties of all the variables are examined using Zivot and Andrews (1992) endogenous unit root test, designed to detect unknown single break in time series emanating from structural changes in the economy. The results in Table 3 suggest a structural break in 2004 for lnCO2, lnRgdpc and lnGCE. For energy use (lnEngy) and oil price (lnOil), a structural break is identified in 1987 and 1986, respectively. One major limitation of Zivot and Andrews (1992) unit root test is that it cannot identify more than one structural break in the series at a time. Therefore, Lee and Strazicich (2003) endogenous unit root test, designed to detect unknown two structural breaks is also implemented. This step is considered necessary given that Venezuelan economy experienced many policy changes along last decades. The results in Table 4 show two structural breaks in all the data series. For energy use (lnEngy), Lee and Strazicich (2003) endogenous unit root test suggests structural breaks in the series in 1978 and 2003. This means that energy demand observed significant policy shocks in 1978 and 2003. The stationarity properties show that all the series have unit root in their level form but stationary at their first differenced form. Hence, the ARDL bounds testing approach to cointegration can be employed to examine the causal interactions between the variables.

4.3 ARDL bounds test for cointegration

The results of the cointegration test based on the ARDL bounds testing method are presented in Table 5. The dummy variable TBrk incorporated into the ARDL specifications, takes the value one for the structural break dates and zero for all other years. The critical bounds generated by Pesaran et al. (2001) are not considered appropriate for this analysis given that they were estimated from a large sample (Narayan 2005) while this study uses a relatively small sample of 43 observations (1971–2013). Therefore, the critical values for the evaluation of the null hypothesis are taken from Narayan (2005). Narayan (2005) computed two sets of critical values: lower bounds I(0) and upper bounds critical I(1) for sample sizes ranging from 30 to 80. The results in Table 5 indicate that the F-statistic is greater than the upper critical bound from Narayan (2005) at 1% significance level for all the specifications of energy demand and economic growth models and the environmental Kuznets curve equation incorporating two structural break (specification 4 in Table 5). For the environmental Kuznets curve equation incorporating only one structural break (specification 3 in Table 5), cointegration is attained at 5% significance level. This study, therefore, rejects the null hypothesis of no cointegration among the variables. This shows that there is a long-run causal relationship among energy consumption, crude oil price, CO2 emissions, economic growth, government consumption expenditure and trade openness in Venezuela.

The diagnostic tests results in Table 6 show that error terms of all the specifications of the ARDL models are normally distributed and the residuals free from serial correlation and heteroscedasticity. Figures 3, 4, 5, 6 present the plots of structural break adjusted CUSUM and CUSUMSQ statistics. The figures are within the critical boundaries for the 5% level of significance indicating that the coefficients of the estimated ARDL model specifications are stable. Therefore, the estimated results can be used for policy implementation in the case of Venezuela.

4.4 Long-run and short-run estimates

The estimated short-run and long-run coefficients for the energy demand model are presented in Table 7. The results show that the effects of oil price on energy consumption are positive but insignificant in the short-run. In the long run, the coefficient of crude oil price is positive and statistically significant in the two specifications at 1% level, indicating that an increase in crude oil price significantly increases per capita energy consumption in the Venezuelan economy in the long run. From the long-run coefficients, a 1% increase in crude oil price significantly increases energy consumption by 0.10%. Both short-run and long-run coefficients support a statistically significant positive relationship between CO2 emissions and energy consumption in Venezuela. The coefficients of other variables in the two ARDL specifications including dummy variables that capture the structural breaks in the series are statistically insignificant. The coefficient of ECM (− 1) in the two specifications is negative and significant at 1% level with about 55% of the short-run disequilibrium corrected in the long-run.

Table 8 presents the results of the empirical investigation of the drivers of CO2 emissions in Venezuela based on the environmental Kuznets curve hypothesis. The short-run and long-run coefficients of real GDP per capital (\({\text{lnRgdpc}}\)) are positive but statistically insignificant. The coefficients of the square of real GDP per capital \(({\text{lnRgdpc}}^{2} )\) are negative and statistically insignificant. These results suggest that EKC hypothesis does not exist for Venezuela. From the results the key driver of CO2 emissions in Venezuela is identified to be energy consumption, government consumption expenditure and structural changes. The short-run and long-run coefficients of energy consumption (\({\text{lnEngy}}\)) are positive and statistically significant at 1% and 5% level, respectively. A 1% increase in energy consumption increases CO2 emissions in Venezuela by 0.54% in the short run and in the long run (see specification 2 in Table 8). The long-run impact of government consumption expenditure on CO2 emissions is positive and statistically significant at 1% level, with a 1% increase likely to generate about 0.32% increase in CO2 emissions in Venezuela (see specification 2 in Table 8). The short-run and long-run coefficients of the structural breaks are negative and statistically significant at 1% and 10% level, respectively. This suggests the importance of structural changes in the mitigation of the environmental effects of energy consumption in the Venezuelan economy. The coefficient of ECM (− 1) in the two specifications is negative and significant at 1% level with all the short-run disequilibrium corrected in the long run [see the coefficient of ECM (− 1) in specification 2 Table 8].

The effects of energy consumption, CO2 emissions, oil price, government consumption expenditure and trade openness on economic growth in Venezuela are presented in Table 9. Surprisingly, the short-run and long-run effects of oil price on real GDP per capital in the economy are statistically insignificant. Interestingly, both short-run and long-run coefficients of CO2 emissions are negative and statistically significant at 1% level. A 1% increase in CO2 emissions decreases real GDP per capital (economic growth) by 0.23% in the short run and 0.93% in the long run (see specification 2 in Table 9). The short-run and long-run coefficients of government consumption expenditure are positive and statistically significant at 1% level. The coefficients suggest that a 1% increase in government consumption expenditure increases real GDP per capital by 0.19% in the short run and 0.35% in the long run. The coefficient of ECM (− 1) in the two specifications is negative and significant at 1% level with about 46% of the short-run disequilibrium corrected in the long run (see the coefficient of ECM (− 1) in specification 2 Table 9).

4.5 Results of generalized variance decomposition and impulse response function

The direction of causality between energy consumption, crude oil price, CO2 emissions, economic growth, government consumption expenditure and trade openness in Venezuela is examined using the innovative accounting approach (IAA), which combines variance decomposition analysis (VDA) and impulse response function (IRF) to determine causality ahead of the sample period. Table 10 and Fig. 7 presents the results of the generalised variance decomposition analysis and generalised impulse response functions, respectively, over a range of 10-year period. The main reason for implementing the generalised variance decomposition analysis and generalised impulse response functions is that unlike orthogonalized forecast error variance approach, it is insensitive to the ordering of variables in the VAR system (Pesaran and Shin 1998).

The results in Table 10 show that about 75.69% and 58.78% of energy consumption is explained by its own innovative shocks in the 1st year and 5th year, respectively. One standard deviation shock in crude oil price explains energy consumption in the economy by 7.49% and 20.59% in the 1st year and 5th year, respectively. In the 10th year, one standard deviation shock in crude oil price explains energy consumption in the economy by about 23.23%. The contributions of economic growth, government consumption expenditure and trade openness to energy consumption in the 10th year are equal to 1.70%, 2.15% and 4.32%, respectively. The increasing influence of one standard deviation shock in crude oil price on energy consumption suggests that crude oil price causes energy consumption in the economy and the effect is greater in the long run. The variance decomposition of CO2 emissions shows that energy consumption contributes to CO2 emissions by 4.31% and 25.61% in the 1st year and 10th year. This result gives indication that energy consumption contributes to CO2 emissions both in the short run and in the long run. The contribution of government consumption expenditure to CO2 emissions in the 10th year is equal to 14.09%. About 68.37% of economic growth is explained by its own innovative shocks in the 1st year; while energy consumption, crude oil price, CO2 emissions and government consumption expenditure generate 0.006%, 0.54%, 16.06% and 14.09%, respectively. The contributions of CO2 emissions increased to 28.84% in the 10th year. The variance decomposition analysis of economic growth highlights the increasing influence of CO2 emissions on the growth of economic activities in the Venezuelan economy.

The impulse response function traces the responsiveness of a dependent variable due to shocks arising in the independent variables in the model. Figure 7 shows that the response of energy consumption due to one standard deviation shock in crude oil price is positive even at the 10th year. Interestingly, the response of CO2 emissions to one standard deviation innovations in energy consumption is positive until 10th year. Another interesting aspect of the results is that the response of CO2 emissions to one standard deviation innovations in government consumption expenditure is positive over the time horizon. The response of economic growth to one standard deviation innovations in energy consumption is negative, although the effect is minimal. The response of economic growth to one standard deviation innovations in CO2 emissions is negative and very strong over the time horizon. Not surprisingly the response of economic growth to one standard deviation innovations in both crude oil price and government consumption expenditure is positive and does not disappear in the long run. These results are consistent with the ARDL estimates in Tables 7, 8 and 9.

5 Discussion and policy implications

The schematic view of the results of this empirical study is presented in Fig. 8. The results show that oil resource abundance (and dependence) creates economic conditions that intensify energy consumption in the Venezuelan economy. The first economic condition is the income effect. Fiscal spending that determines the demand for economic activities and the performance of firms and households in the Venezuelan economy depends mainly on the volume of crude oil receipts (Bjerkholt and Niculescu 2004; Villafuerte and Lopez-Murphy 2009; Di Bella et al. 2015). The results of this empirical study, therefore, suggest that with higher crude oil prices, various economic units (households, firms and government agencies) increase their consumption on energy-intensive technologies such as buying more vehicles. The second economic condition is the institutionalization of energy consumption subsidies. The extensive subsidisation of energy consumption in Venezuela over the years as a means of sharing oil-resource wealth leads to overuse and waste of energy (Di Bella et al. 2015). According to Di Bella et al. (2015), the subsidization of energy consumption in the oil-dependent Latin American economies boosted by income from oil resource exports promoted the growth and development of energy-intensive sectors such as car manufacturing industry thereby increasing energy-intensive consumption. Similar economic conditions have been documented for other heavily dependent net oil-exporting economies, including Algeria (see Fuinhas and Marques 2013), Saudi Arabia (see Alshehry and Belloumi 2015) and Ecuador (see Nwani 2017). Regardless of good intentions, the results of this study show that the economic conditions created by fossil fuel subsidies and low fuel prices in Venezuela may have generated increased consumption of fossil fuels, thereby intensifying their negative effects on the environment by increasing CO2 emissions. It may have also imposed barriers to the development of energy efficiency measures and renewable energy sources in the economy.

Interestingly, the results of this empirical study show that an increase in the level of energy consumption does not significantly generate economic growth but an increase in the amount of CO2 emissions in the Venezuelan economy. Fuinhas and Marques (2013), Alshehry and Belloumi (2015) and Nwani (2017) document similar economic condition in the case of Algeria, Saudi Arabia and Ecuador, respectively. A further aspect of this empirical study that deserves attention is the causal impacts of fiscal spending on CO2 emissions and economic growth in the oil-dependent Venezuelan economy. The empirical results show that while government consumption expenditure significantly generates economic growth in the Venezuelan economy, it also creates economic conditions with adverse environmental consequences. This is not surprising given that the national oil company, Petroleros de Venezuela (PDVSA), has over the years spent much of the crude oil export receipts financing consumption-based social programs. While these social programs were designed to attend to the needs of the people, it may have also induced high demand for energy-intensive activities (Rogat 2007), given the extensive fossil fuel subsidies provided in the economy (Moghaddam and Wirl 2018). This condition is also heightened by the minimal development of low carbon and efficient energy sources in the economy (see Pietrosemoli and Rodríguez-Monroy 2019). The results of this study in general suggest that the abundance of oil has made the Venezuelan economy highly dependent on oil export receipts and the dependence of the economy on oil has introduced significant sustainability challenges in the economy.

These results have important policy implications for environmental and economic sustainability in Venezuela. Given that, energy is not an important source of economic growth in the Venezuelan economy, energy policies that aim to conserve energy consumption will not retard the growth of economic activities in the economy. It is, therefore, expected that policy makers would consider energy diversification a major component of economic diversification policies in Venezuela. Such policies should be designed to target reducing the proportion of fossil fuel energy in the energy consumption mix since it represents an important source of CO2 emissions, accelerating transition toward renewable energy and improving energy efficiency. All sectors of the economy, especially the energy-intensive ones should be encouraged to adopt advanced technologies that minimize pollution. Venezuela could benefit from solar and wind energy to increase access to clean forms of energy and lessen the influence of oil resource abundance (and dependence) on environmental quality in the economy. Interestingly, the income from oil exports could be used in the development of renewable energy sources in the economy. The development of solar and wind energy sources could increase access to clean forms of energy and lessen the accumulation of greenhouse gases (GHGs), which threatens environmental quality and sustainability. There is also every need for a well-articulated policy framework that will lessen the role of public sector in economic activities and enhance private sector activities in the Venezuelan economy. Private capital, technology and expertise could play an important role in strengthening research and development (R & D) in activities related to efficient energy sources, such as solar, wind, biomass and biogas, which could enhance energy substitution habit of households and firms in the economy. Reviewing the current fuel pricing policies in Venezuela to market-oriented and investor-friendly policies should be considered among top priority issues in the search for sustainable development in the oil-rich economy.

6 Conclusion

This study examined the causal interactions between crude oil price as an indicator of oil resource, energy demand and CO2 emissions in Venezuela over the period 1971–2013, incorporating real GDP per capita for economic growth, government consumption expenditure for fiscal spending and trade openness. The long-run relationship among the variables is examined using ARDL bounds testing approach to cointegration. The results provide evidence of cointegration between the variables with the incorporation of the presence of single and multiple structural breaks observed in the series. The ARDL estimates of the energy demand model suggest that an increase in crude oil price significantly increases energy consumption in the economy. In other words, higher crude oil receipts induce energy consumption in the economy. The estimates of the environmental pollution model indicate that energy consumption and government consumption expenditure generate CO2 emissions in the economy. The estimates of the economic growth model highlight the negative effects of CO2 emissions on the growth of economic activities in the oil-rich Venezuelan economy. This study further examined the direction of causality between the variables using the innovative accounting approach (IAA), which combines variance decomposition analysis (VDA) and impulse response function (IRF) to determine causality ahead of the sample period. The results suggest that crude oil price causes energy consumption in the Venezuelan economy. No significant causal relationship is found between energy consumption and economic growth. Energy consumption causes CO2 emissions in the economy. In addition, a unidirectional causality runs from CO2 emissions to economic growth. Not surprisingly, the response of economic growth to CO2 emissions indicates that more CO2 emissions in the economy would cause negative effects on economic growth.

Policy makers in Venezuela are, therefore, expected as part of the economic diversification strategy to channel income from crude oil exports into the development and provision of energy-saving and low carbon energy technologies. The economic diversification policies are also expected to incorporate strategies that will lessen the role of public sector in economic activities and enhance private sector activities in the Venezuelan economy. It is also expected that policy changes toward the current fuel pricing arrangements in Venezuela to allow for market-oriented and investor-friendly environment would be considered among top priority steps in the search for sustainable development in the oil-rich economy.

Data

Energy use (kg of oil equivalent per capita), CO2 emissions (metric tons per capita), GDP per capita (constant 2010 US$), General government final consumption expenditure (constant 2010 US$) and Trade (% of GDP) collected from The World development Indicators online database, World Bank. Available at https://databank.worldbank.org/data/source/world-development-indicators. Data on Crude oil price BP Statistical Review of World Energy June 2018. Available at http://www.bp.com/statisticalreview.

Abbreviations

- ARDL-bounds test:

-

autoregressive distributed-lag (ARDL) bounds test

- CO2 emissions:

-

carbon dioxide emissions

- CUSUM:

-

cumulative sum

- CUSUMSQ:

-

cumulative sum of squares

- ECM:

-

error correction model

- EKC:

-

environmental Kuznets curve

- Fonden:

-

National Development Fund

- GDP:

-

gross domestic product

- GHGs:

-

greenhouse gases

- IAA:

-

innovative accounting approach

- IRF:

-

impulse response function

- OPEC:

-

Organization of Petroleum Exporting Countries

- PDVSA:

-

Petroleros de Venezuela

- VAR:

-

vector autoregression

- VDA:

-

variance decomposition analysis

- WDI:

-

World Development Indicators

References

Acar S (2017) The curse of natural resources: a developmental analysis in a comparative context. Springer, New York

Alam MS, Shahbaz M, Paramati SR (2016) The role of financial development and economic misery on life expectancy: evidence from post financial reforms in India. Soc Indic Res 128(2):481–497

Ali HS, Law SH, Zannah TI (2016) Dynamic impact of urbanization, economic growth, energy consumption, and trade openness on CO2 emissions in Nigeria. Environ Sci Pollut Res 23(12):12435–12443

Ali W, Abdullah A, Azam M (2017) Re-visiting the environmental Kuznets curve hypothesis for Malaysia: fresh evidence from ARDL bounds testing approach. Renew Sustain Energy Rev 77:990–1000

Al-mulali U, Lee JY, Mohammed AH, Sheau-Ting L (2013) Examining the link between energy consumption, carbon dioxide emission, and economic growth in Latin America and the Caribbean. Renew Sustain Energy Rev 26:42–48

Alshehry AS, Belloumi M (2015) Energy consumption, carbon dioxide emissions and economic growth: the case of Saudi Arabia. Renew Sustain Energy Rev 41:237–247

Azam M, Khan A, Zaman K, Ahmad M (2015) Factors determining energy consumption: evidence from Indonesia, Malaysia and Thailand. Renew Sustain Energy Rev 42:1123–1131

Azam M, Khan AQ, Zafeiriou E, Arabatzis G (2016) Socio-economic determinants of energy consumption: an empirical survey for Greece. Renew Sustain Energy Rev 57:1556–1567

Bjerkholt O, Niculescu I (2004) Fiscal rules for economies with nonrenewable resources: Norway and Venezuela. Rules-based fiscal policy in emerging markets. Palgrave Macmillan, New York, pp 164–179

Boufateh T (2019) The environmental Kuznets curve by considering asymmetric oil price shocks: evidence from the top two. Environ Sci Pollut Res 26(1):706–720

Cansino JM, Sánchez-Braza A, Rodríguez-Arévalo ML (2018) How can Chile move away from a high carbon economy? Energy Econ 69:350–366

Cetin M, Ecevit E, Yucel AG (2018) The impact of economic growth, energy consumption, trade openness, and financial development on carbon emissions: empirical evidence from Turkey. Environ Sci Pollut Res 25(36):36589–36603

Chang CC, Carballo CFS (2011) Energy conservation and sustainable economic growth: the case of Latin America and the Caribbean. Energy Policy 39(7):4215–4221

Cheng BS (1997) Energy consumption and economic growth in Brazil, Mexico and Venezuela: a time series analysis. Appl Econ Lett 4(11):671–674

Danish S, Shah B, Muhammad Awais L (2018) The nexus between energy consumption and financial development: estimating the role of globalization in Next-11 countries. Environ Sci Pollut Res Int 25(19):11–8661

Di Bella MG, Norton ML, Ntamatungiro MJ, Ogawa MS, Samake I, Santoro M (2015) Energy subsidies in Latin America and the Caribbean: stocktaking and policy challenges. International Monetary Fund (WP/15/30), Washington, D.C

Ehigiamusoe KU, Lean HH (2019) Effects of energy consumption, economic growth, and financial development on carbon emissions: evidence from heterogeneous income groups. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-05309-5

El Anshasy AA, Bradley MD (2012) Oil prices and the fiscal policy response in oil-exporting countries. J Policy Model 34(5):605–620

Friedrichs J, Inderwildi OR (2013) The carbon curse: are fuel rich countries doomed to high CO2 intensities? Energy Policy 62:1356–1365

Fuinhas JA, Marques AC (2013) Rentierism, energy and economic growth: the case of Algeria and Egypt (1965–2010). Energy Policy 62:1165–1171

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement (No. w3914). National Bureau of Economic Research

Gutiérrez SA (2017) Venezuela’s economic and social development in the Era of Chavism. Latin Am Policy 8(2):160–188

Halkos GE, Paizanos EΑ (2013) The effect of government expenditure on the environment: an empirical investigation. Ecol Econ 91:48–56

Halkos GE, Paizanos EΑ (2016) The effects of fiscal policy on CO2 emissions: evidence from the USA. Energy Policy 88:317–328

Imamoglu H (2019) The role of financial sector in energy demand and climate changes: evidence from the developed and developing countries. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-05499-y

Karasoy A (2019) Drivers of carbon emissions in Turkey: considering asymmetric impacts. Environ Sci Pollut Res 26(9):9219–9231

Khraief N, Shahbaz M, Mallick H, Loganathan N (2018) Estimation of electricity demand function for Algeria: revisit of time series analysis. Renew Sustain Energy Rev 82:4221–4234

Lee J, Strazicich MC (2003) Minimum Lagrange multiplier unit root test with two structural breaks. Rev Econ Stat 85(4):1082–1089

Mahalik MK, Babu MS, Loganathan N, Shahbaz M (2017) Does financial development intensify energy consumption in Saudi Arabia? Renew Sustain Energy Rev 75:1022–1034

Mehrara M, Oskoui KN (2007) The sources of macroeconomic fluctuations in oil exporting countries: a comparative study. Econ Model 24(3):365–379

Moghaddam H, Wirl F (2018) Determinants of oil price subsidies in oil and gas exporting countries. Energy Policy 122:409–420

Mu XZ, Hu GW (2018) Analysis of Venezuela’s oil-oriented economy: from the perspective of entropy. Pet Sci 15(1):200–209

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37:1979–1990

Neusser K (2016) Time series econometrics. Springer Texts in Business and Economics. Springer, New York

Nusair SA (2016) The effects of oil price shocks on the economies of the Gulf Co-operation Council countries: nonlinear analysis. Energy Policy 91:256–267

Nwani C (2017) Causal relationship between crude oil price, energy consumption and carbon dioxide (CO2) emissions in Ecuador. OPEC Energy Rev 41(3):201–225

OPEC Annual Statistical Bulletin (2018) https://asb.opec.org/index.php/data-download

Pablo-Romero MDP, De Jesús J (2016) Economic growth and energy consumption: the energy-environmental Kuznets curve for Latin America and the Caribbean. Renew Sustain Energy Rev 60:1343–1350

Pesaran MH, Shin Y (1998) Impulse response analysis in linear multivariate models. Econ Lett 58:17–29

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of long run relationships. J Appl Econom 16:289–326

Pietrosemoli L, Rodríguez-Monroy C (2019) The Venezuelan energy crisis: renewable energies in the transition towards sustainability. Renew Sustain Energy Rev 105:415–426

Rafindadi AA (2016) Does the need for economic growth influence energy consumption and CO2 emissions in Nigeria? Evidence from the innovation accounting test. Renew Sustain Energy Rev 62:1209–1225

Rahman MM, Kashem MA (2017) Carbon emissions, energy consumption and industrial growth in Bangladesh: empirical evidence from ARDL cointegration and Granger causality analysis. Energy Policy 110:600–608

Robalino-López A, Mena-Nieto Á, García-Ramos JE, Golpe AA (2015) Studying the relationship between economic growth, CO2 emissions, and the environmental Kuznets curve in Venezuela (1980–2025). Renew Sustain Energy Rev 41:602–614

Rogat J (2007) The politics of fuel pricing in Latin America and their implications for the environment. Energy Environ 18(1):1–12

Saboori B, Al-mulali U, Bin Baba M, Mohammed AH (2016) Oil-induced environmental Kuznets curve in organization of petroleum exporting countries (OPEC). Int J Green Energy 13(4):408–416

Salahuddin M, Gow J (2019) Effects of energy consumption and economic growth on environmental quality: evidence from Qatar. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-05188-w

Sari R, Soytas U (2009) Are global warming and economic growth compatible? Evidence from five OPEC countries? Appl Energy 86(10):1887–1893

Saud S, Chen S (2018) An empirical analysis of financial development and energy demand: establishing the role of globalization. Environ Sci Pollut Res 25(24):24326–24337

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sustain Energy Rev 25:109–121

Shahbaz M, Mallick H, Mahalik MK, Sadorsky P (2016) The role of globalization on the recent evolution of energy demand in India: implications for sustainable development. Energy Econ 55:52–68

Shahbaz M, Bhattacharya M, Ahmed K (2017) CO2 emissions in Australia: economic and non-economic drivers in the long-run. Appl Econ 49(13):1273–1286

Shan J (2005) Does financial development ‘lead’ economic growth? A vector auto-regression appraisal. Appl Econ 37(12):1353–1367

Sheinbaum C, Ruíz BJ, Ozawa L (2011) Energy consumption and related CO2 emissions in five Latin American countries: changes from 1990 to 2006 and perspectives. Energy 36(6):3629–3638

Villafuerte M, Lopez-Murphy P (2009) Fiscal policy responses of oil producing countries to the recent oil price cycle. IMF Working Paper No. 10/28

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 10(3):251–270

Acknowledgements

Authors gratefully acknowledge the insightful comments and constructive suggestions from the Editorial Office of the journal and all anonymous referees that helped to improve the paper. The usual disclaimer applies.

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

TFA contributed to the drafting of the manuscript, reviewed the literature and revised the manuscript. NC drafted the manuscript, carried out the empirical analysis, interpreted the results and revised the manuscript. UIU revised the manuscript. LIA reviewed the literature. T-GCO garthered the data. IOO gathered the data. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Agbanike, T.F., Nwani, C., Uwazie, U.I. et al. Oil price, energy consumption and carbon dioxide (CO2) emissions: insight into sustainability challenges in Venezuela. Lat Am Econ Rev 28, 8 (2019). https://doi.org/10.1186/s40503-019-0070-8

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40503-019-0070-8

Keywords

- Energy consumption

- Carbon dioxide (CO2) emissions

- Crude oil price

- Venezuela

- ARDL-bounds test

- Economic growth

- Innovative accounting test

- Government consumption expenditure