Abstract

This study analyzes the effect of government spending on income distribution in Chile for 2016 using a multiplier model with the Social Accounting Matrix. The results indicate that increasing fiscal expenditure has a regressive effect on the income share of households in the richest quintile and widens the income gap between the two poorest quintiles and the third and fourth quintiles. When the effect of fiscal expenditure is measured by its nominal impact, households with the highest income receive approximately ten times more income than those with the lowest income. Thus, the regressivity of the income share of the richest households conceals an unequal distribution of the nominal income generated by the fiscal expenditure. Using counterfactual simulations, we suggested that fiscal expenditures could become more equalitarian through policies affecting the distribution of labor payments.

Similar content being viewed by others

1 Introduction

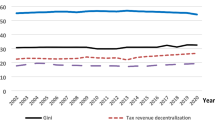

The social outbreak in Chile in 2019 originated from numerous political, social, and economic transformations that occurred in the country over the past 30 years, as indicated by Peña (2020) and Haind et al. (2020). Although there is insufficient evidence to agree on the origin of the crisis, one of the key factors is that the Chilean government has a poor effect on the market’s unequal income distribution. Figure 1 demonstrates that in 2017, the market income inequality, as measured by the Gini coefficient, was approximately 50 points, and government intervention reduced it to 47 points. This is in contrast to the redistributive effect in the majority of Organization for Economic Cooperation and Development (OECD) countries, where government intervention reduces inequality by more than 10 points on average.Footnote 1

The government affects the distribution of income through a variety of instruments, which can be summed up as taxation, government intervention in markets, and public spending (Papadimitriou 2006; Osberg et al. 2004). This study examines the relationship between government fiscal expenditure and income distribution in Chile. To capture the direct and indirect effects of fiscal expenditures, we constructed the Social Accounting Matrix (SAM) for 2016 and employed a multiplier model to provide an analytical framework.

The paper’s method and technique are complementary to the vast majority of literature on income distribution in Chile. The method is an additional perspective to the computable general equilibrium, partial equilibrium, and reduced-form models developed by Mardones (2010), Engel et al. (1999), and Urzua et al. (2014). The SAM organizes the flow of income at a meso-level, building a useful bridge between the macro and a more specific description of the institutions. The SAM illustrates the circular flow within the economy by depicting the generation of income by commodity-producing activities, the distribution of income to factor households, and the subsequent expenditure of income by households.

Compared to other methods, the use of SAM income multipliers is based on two key assumptions (Rubio Sanz and Perdiz 2003). First, the agents lack a behavioral model, and second, there are no supply constraints. These assumptions simplify the functioning of the economy to highlight the income flows among the major agents and accounts of the economic system. The income multipliers of a SAM provide a framework for analyzing the redistributive impact of various exogenous income injections on the multisectoral structure of the economy, as described by Pyatt and Round (1977, 1979).

De Miguel and Perez (2006) used a SAM for the economy of Extremadura, Spain, to study how exogenous injections affect income inequality, highlighting two results. First, increases in final demand have a negative impact on the poorest quintiles, thereby widening the inequality gap. Second, direct transfers from households with higher incomes to those with lower incomes narrow the inequality gap. Reich (2018) utilized the SAMs as the statistical foundation to extend the techniques of Input–Output analysis from the realm of product transactions to the realm of income transactions, explaining the composition of primary income (wages, profits, and taxes) contained in the disposable income of any institutional sector of the economy. He applied the method to Canada, Germany, and Portugal to illustrate the disparities in income distribution between economies. Using the SAM of the Vietnamese economy, Civardi et al. (2010) showed that there are characteristics of the system that favor the accumulation of income by a certain group of people. Therefore, some policies intended to benefit the poorest may end up enhancing the condition of middle- and high-income households. They found that policies focused on the agricultural sector will have a greater effect on reducing income inequality.

Most of the research on the effects of the Chilean government on income inequality has focused on taxation. For instance, Mardones (2010) employed a model of general equilibrium to demonstrate that a 20% reduction in the value-added tax (VAT) rate and a 40% increase in the income tax for households in the highest income quintile would produce only modest improvements in poverty and income distribution. Moreover, Engel et al. (1999) indicated that, between increasing the progressivity of a progressive tax in collection, such as the income tax, and increasing a regressive tax rate, such as VAT, the second option may end up being more beneficial to low-income sectors because the latter collects a greater proportion of income from higher-income households. Martinez-Aguilar et al. (2018) provide a comprehensive analysis of the impact of fiscal policy in Chile using the method proposed by the Commitment to Equity Institute and outlined in Lustig and Higgins (2013). The authors provide evidence that Chile’s fiscal system is characterized by regressive but equalizing indirect taxes. This counterintuitive result occurs because indirect taxes have a greater equalizing effect than progressive direct taxes and direct transfers.

This study adds a new perspective to the analysis of government effects on the income distribution in Chile by examining the circuits of income flows triggered by government spending. The results indicate that when government spending flows through the entire payment system of the economy, it ultimately benefits the highest income quintiles in nominal terms. Comparing what households receive from fiscal expenditures to their share of total income reveals that fiscal expenditures are regressive for the wealthiest quintile. Using two counterfactual scenarios, we proposed that fiscal expenditure could be more progressive if the distribution of factor payments was to become more progressive.

The remainder of this paper is structured as follows. Section 2 presents the multipliers model. Section 3 explains how the SAM 2016 for the Chilean economy was calculated, describing the primary information sources used in its preparation. Section 4 applies the analysis of multipliers with the SAM and develops the two counterfactual experiments. Section 5 discusses the limitations of the results. Finally, Sect. 6 provides a summary of the main conclusions.

2 The multiplier model

The analysis begins with the SAM and the computation of multipliers affecting income distribution. The SAM data are used to analyze the distribution of household income within the framework elaborated by Pyatt and Round (1979).

Following Polo et al. (1990), Roland-Holst and Sancho (1992), and De Miguel and Perez (2006), we assumed that the number of institutions in the SAM is \(n\) which can be divided into \(s\) and \(k\) endogenous and exogenous institutions, respectively. Let \({Y}_{ij}\) be the income flow between institution \(i\) and \(j\). Given that each institution has its own budget constraint, it can be aggregated into:

with \(i=1...n\).

Let \({a}_{ij}=\frac{{Y}_{ij}}{{Y}_{j}}\) be the proportion of average expenditures and substituted into Eq. (1), so that

This can be decomposed into the \(s\) endogenous institutions and the \(k\) exogenous institutions, so that

with \(i=1..n\).

Equation (1) can be expressed with matrix notation as \(Y=AY\), and its decomposition as

where \({Y}_{s}\) and \({Y}_{k}\) represent the income of the \(s\) endogenous and \(k\) exogenous institution, respectively. \({A}_{ij}\) denotes the submatrices with the proportion of average expenditure in each case.

The effect of exogenous institutions on endogenous institutions can be expressed by Eq. (2):

or

with \(M={\left(I-{A}_{ss}\right)}^{-1}\) and \(x={A}_{sk}{Y}_{k}\).\(M\) is a matrix of multipliers with s endogenous accounts where \({m}_{ij}\in M\) represents how much income in the account \(i\) generates a change in the account \(j\) and \(x\) is a vector representing the changes produced into the exogenous institutions expressed in terms of the endogenous institutions.

Following Roland-Holst and Sancho (1992), we can define the relative income vector as

or

with \({e}^{^{\prime}}\) a unitary row vector. Using matrix differentiation and Eq. (3),we can express a redistribution model as

where \(\mathrm{d}{y}_{s}\) represents the distributional effects on the endogenous accounts, generated by the change in the exogenous account \(\mathrm{d}x\); \(M\) is the matrix of multipliers that capture the direct and indirect effects when the flow of income goes through the economy; and the income generated is distributed into the endogenous account through the distribution matrix \(R\left(x\right)={\left({e}^{^{\prime}}{Y}_{s}\right)}^{-1}\left[I-{Y}_{s}{\left({e}^{^{\prime}}{Y}_{s}\right)}^{-1}{e}^{^{\prime}}\right]\).

In this paper, \(\mathrm{d}x\) is a column vector representing how the government expenditure is distributed throughout the endogenous accounts. The terms in the vector \(M\mathrm{d}x\) can be expressed as

and the redistribution that the expenditure of government generates into the account \(i\) becomes

The sign and intensity of \(\mathrm{d}{y}_{i}\) determine whether government expenditure is beneficial to the endogenous account \(i\). The effect depends on the interaction between the income generated into the institution \(i\) by the fiscal expenditure \({(M\mathrm{d}x)}_{i}\) and the participation \({y}_{i}\) on the total income generated by the fiscal expenditure in the economy \(\sum_{j=1}^{s}{(M\mathrm{d}x)}_{j}\). Therefore, fiscal spending is progressive (regressive) over institution i, if what i obtains directly from fiscal expenditure is greater (lower) than what it would obtain from the entire economy.

In Eq. (4), it is assumed that changes in \(\mathrm{d}x\) do not affect the expenditure patterns of the agents, so the multipliers M remain constant. This assumption is supported by the consistency of the aggregate multipliers found in Wood (2011) and Dietzenbacher and Hoen (2006). The stability is due to two factors: first, the intensity of the change in \(\mathrm{d}x\) is insufficient to affect the behavior of the agents, and second, the aggregation level of the analysis conceals the change in micro behavior. If the expenditure patterns of the agents are stable for all values of \(\mathrm{d}x\), the proportion of income attributable to \({y}_{i}\) of each quintile depends on the multipliers. Thus, when \(d{y}_{i}=0\), the share of income of the quintile i is given by \({y}_{i}^{*}=\frac{{\left(M\mathrm{d}x\right)}_{i}}{\sum_{j=1}^{s}{\left(M\mathrm{d}x\right)}_{j}}\). For this value, the fiscal expenditure is neutral to the income distribution.

3 Building the SAM for Chile

Various Social Accounting Matrices have been developed over time for Chile’s entire economy and subeconomies (regional economies). Venegas (1995) constructed one of the first SAMs for the year 1986, and Venegas (2013) created a comprehensive SAM based on the official data from Chile’s national accounts published in 2011 and 2012. Moreover, Fuentes (2017) built a SAM for 2014.

To analyze accounting multipliers, Rojas (2009) built a regional SAM for the Metropolitan region. Meanwhile, Mardones and Saavedra (2011) conducted an economic analysis of the Bio-Bio region using an environmentally extended SAM. Ormazabal et al. (2015) estimated a SAM for the Antofagasta region. Mardones and Brevis (2020) built a SAMEA to analyze Chilean environmental policies.

These matrices were constructed for various purposes, and the method used in the present study to build the SAM was enriched by the experiences gained from each of these works.

The five main data sources that are used in this study are: (i) the Integrated Economics Accounts, (ii) the Supply and Use Tables (SUT), (iii) the Input–Output matrices for 2016 from the Central Bank of Chile, (iv) the VII Family Budget Survey 2016–2017 (FBS), and (v) the National Socioeconomic Characterization Survey (CASEN) from the National Institute of Statistics (INE).

The SUT table was applied to 12 economic sectors, and 1.190 products of the FBS were tailored to the 12 goods and sectors.Footnote 2 The Input–Output tables were utilized to obtain information about household income for each activity. The households were categorized into quintiles based on their disposable income with imputed rent; the average disposable income for each quintile is presented in Table 1.

The FBS was used to characterize household income due to the wealth of information it provides regarding household consumption. To achieve a concordance of the data from the different sources, we used the National Socioeconomic Characterization Survey (CASEN) with the adjustments made by the Economic Commission for Latin America and the Caribbean, to connect the CASEN data with those of the national accounts. The latter has a record of various sources of income, each with a specific value, whereas CASEN has a record for the same items. If both items differ, the data from the sources provided by CASEN are multiplied by a factor (Fuentes 2017). Following the adjustment described, this work uses the proportions of each source of income and account data from the FBS, which are multiplied by the total income data from the Central Bank of Chile.

The total income received by households is distributed in various ways to the rest of the economy’s institutions, such as the government, for taxes, activities, concepts of final consumption of goods and services, and the capital account, for savings. The information for this distribution was allocated using the FBS.

The SAM was constructed using 41 accounts or organizations. Table 10 in the Appendix provides the list of accounts. Account 41 captures errors and omissions made within the table and will be considered an exogenous account.

Table 2 presents the 41 accounts estimated for 2016 in the SAM. Three salient features are noted.

First, the data disaggregation was made according to different sources of information: FBS, CASEN and Supply and Use Tables. We keep consistency with all these sources when we open the accounts of the aggregate SAM. This decision implied that relatively large values for the Errors and Omissions column would be accepted. To verify the robustness of the survey consistent SAM, the algorithm of minimum cross entropy was used in the Additional files 1 and 2: Online AppendixFootnote 3 to reduce the differences in Errors and Omissions. The Additional files 1 and 2: Online Appendix demonstrates that the multipliers derived from the two matrices are comparable.

Second, the distribution of income is different according to the source of income. The different sources of household income are represented by quintiles in Table 3.

The largest source of income is labor income. Capital income consists of net income from self-employment, gross income from retirement and/or old-age pensions, income from other self-employment, income from properties, and income from financial instruments. The government transfers to households are equal to the sum of the liquid amount received for pensions, the average amount received from the state as a family allowance, study scholarships, and other forms of assistance, as well as the value of the species received from the government. The aggregate government transfers to households is fairly uniform across quintiles. Nevertheless, the composition of transfers to each quintile varies. Although the poorest quintiles receive primarily transfers associated with welfare, the richest quintiles receive transfers associated with military and law enforcement pensions, as well as pensions for former state officials. Gálvez and Kremerman (2019) illustrated the differences in the composition of government-funded pensions.

Foreign transfers are the sum of transfers from abroad and foreign cash transfers and donations. There is a large value of foreign transfers to the third quintile. This value was reported to the National Institute of Statistic (INE). They sustain that the survey follows the appropriate statistical technique for capturing the data. In the Additional files 1 and 2: Online Appendix, we run simulations adjusting the value of the foreign transfer of the third quintile, and we did not distinguish differences in the results.

The table illustrates how poorly income is distributed in the country. Twenty percent of the wealthiest households in Chile receive 54.4% of the income generated by wages, whereas 20% of the poorest households receive only 2.5% of the income generated. The ratio between the fifth and first quintiles is almost 22 times. This inequality is less pronounced when capital account income is considered, where the ratio between the richest and poorest quintiles is approximately 9.5.

The third salient feature of the SAM is the difference in saving capacities of the households represented in Table 4. Other reports, such as the XV Informe de Deuda Personal Universidad San Sebastián-Equifax, have illustrated the large savings disparity between the first three and fifth quintiles.

According to the Central Bank’s 2014 Household Financial Survey, 73% of Chilean households are in debt. Meanwhile, the VIII Survey of Family Budgets made by INE indicates that more than 60% of households were in debt between 2016 and 2017. This asymmetry in saving capacity across income quintiles is also reported by Gandelman (2017) for many Latin American countries.

4 Results

The reader can revise the computations presented in this paper with the files available at the repository https://github.com/nicogarrido/IncomeInequality.

In Table 5, the decomposition of Eq. (4) illustrates the impact of fiscal expenditure on the proportion of income earned by each quintile. Column 3 demonstrates that fiscal expenditure is only regressive for quintile 5, and it widen the gap between the two poorest quintiles and quintiles 3 and 4.

The high share, 6.6% in column (5), of the total multiplier of column (6) that the richest families retain explains the regressivity. Equation (4) shows that the fiscal expenditure is regressive because the fifth quintile households receive less directly from the fiscal multiplier than they do from the rest of the economy. This regressivity hides the unequal distribution of the fiscal multipliers of column (4). The fifth quintile receives more than ten times as much from an increase in fiscal expenditures as the poorest quintile.

Column 2 indicates the intensity of the fiscal expenditure’s effect on the redistribution of the income share. As the fifth quintile’s income share decreases, the redistributive effect will eventually become neutral. The share of income that makes neutral the impact of the fiscal expenditure is \({y}_{5}^{*}=\frac{2.557}{40.04}=6.3\%\). Approximately US$38 billion in additional fiscal expenditures are required to reduce the share of the richest quintile from 6.6% to 6.3%. Given that fiscal expenditures in 2016 totaled close to US$64 billion, this would represent an increase of nearly 50%. Assuming the stability of the multipliers, this increase in government spending could be spread over a number of years.

Column 5 of Table 6 indicates how much the government must spend to reach a level of income distribution where its effect is neutral. After US$55 billion, the poorest household would have 0.5% of the income, which is almost 12 times less than the richest household’s income share. These figures show that fiscal multipliers determine the limits of government spending to increase the share of income.

Examining \({A}_{sk}\) provides information on how the fiscal expenditures propagated throughout the economy to generate fiscal multipliers. One dollar of fiscal expenditure is allocated 77% to final demand, 16% to household transfers, and 7% to the capital account.

Final demand fiscal expenditure is concentrated mainly in two sectors, Personal ServicesFootnote 5 (51%) and Public AdministrationFootnote 6 (45%). The multiplier effect of the channels through which fiscal expenditure affects the quintile distribution is displayed in Table 7. In the majority of cases, the impact of channels favors an unequal distribution of multipliers. Notice that in all the cases, the fifth quintile experiences the greatest effect.

4.1 Counterfactual scenarios

This section analyzes how the structure of the flows in the SAM may affect the distribution of income. In this study, two counterfactual scenarios are examined: in the first scenario, government transfers are modified so that the poorest quintiles receive higher transfers, and in the second, labor market payments are modified to benefit the poorest quintiles. These two scenarios modify the fiscal multipliers to make fiscal expenditure more capable of improving the income distribution.

Both scenarios have different implementation costs, and it is beyond the scope of this paper to fully characterize the policy instruments required for their implementation.

In the first scenario, the government implements a policy of redistributive transfer. The households in the poorest quintile receive the highest transfer, whereas the households in the richest quintile receive the smallest transfer. In this redistributive scenario, rather than focusing on the various categories of transfers for transfer distribution, as analyzed by Causa and Hermansen (2020), we focus on the total transfer to the quintiles of households. There are numerous transfer redistribution options. According to Causa and Hermansen (2020), the dependence of the two poorest quintiles on transfer income is highly variable across OECD countries. For example, In Ireland, it represents more than half of disposable income, whereas in Italy, it represents less than 10% of the disposable income.

The result of this scenario is shown in Table 8. Columns (2) and (3) illustrate the baseline distribution of the total transfer in 2016 and the multipliers for each quintile’s fiscal expenditure.

There exists an infinite set of alternative transfer distributions, but only two extreme cases are illustrated. In Case 1, presented in columns (4) and (5), it is assumed that the bottom 40% of households receive 90% of the transfers. Column (5) displays the multipliers associated with these transfers. Meanwhile, Case 2, in columns (6) and (7), shows an alternative transfer distribution and its impact on multipliers. Even though the two cases represent an extreme redistribution of transfers relative to the baseline, their effect on the multipliers is negligible. The nominal difference between the richest quintile and the base line multipliers is 0.03 or approximately 1% in relative terms. These results imply that the political efforts required to alter the transfers would not be justified by the long-term results on income distribution.

The second counterfactual illustrates the impact of the change in labor payments on the distribution of fiscal expenditures. As shown in Table 3, labor payment is the most important source of income for the average Chilean household. In this scenario, Chile’s distribution of labor payments is assumed to resemble that of Uruguay’s labor market in 2016 due to a combination of education policies and labor market reforms in 2016. According to the data from the World Bank,Footnote 7 Uruguay had the most equalitarian distribution of labor income in Latin America in 2016.

The baseline distribution of payments to the labor factor in 2016 is shown in column (2) of Table 9. The richest quintile obtained 22 times more than the poorest quintile. The multipliers associated with this baseline scenario and the values of the income share of the neutral fiscal effect are displayed in columns (3) and (4). If a combination of education and labor market policies could distribute labor payments as proposed for Uruguay in column (5), fiscal expenditure would be distributed according to the fiscal multipliers in column (6). If the share of labor payments in the first quintile were doubled, the fiscal multipliers would increase from 0.22 to 0.28.

5 Discussion

The counterfactual exercises help elucidate how to enhance the fiscal expenditure’s redistributive impact. The results indicate that, even when fiscal expenditure can reduce income disparities in the short term, if the distribution of labor market income does not become more equalitarian, the long-term redistributive impact of the fiscal effort is limited. Thus, progress toward a more equitable income distribution would result from public policies aimed at narrowing the labor income gap between households.

These results are contingent on two crucial assumptions regarding the stability of the multipliers. First, the multipliers of the SAM do not change when an exogenous variation exists in fiscal expenditure, and second, when there is a change in the endogenous flow of income, as in the two counterfactual scenarios, only the fiscal multipliers are affected.

The first assumption is standard in the analysis of an economy based on national accounts. The empirical observations of Wood (2011) and Dietzenbacher and Hoen (2006) indicate that the multipliers of the economies they analyze are stable over time, even during periods of crisis. Thus, exogenous variations in final demand have no effect on multipliers.

The second assumption, regarding the stability of the majority of multipliers when the flow between endogenous accounts varies, requires additional consideration. This assumption means that when the income of the households in the poorest quintile is increased, as in the first counterfactual analysis, the households in that quintile do not change their behavior on the labor market or their consumption pattern. The stability of the multipliers over time, as demonstrated by Wood (2011) and Dietzenbacher and Hoen (2006), supports this assumption once more. Over time, in the economies analyzed by the authors, there have been endogenous variations in the flow of payments between agents, but these variations have not resulted in significant changes in the multipliers. However, the results presented here should be viewed as exploratory attempts to understand why fiscal expenditure has a limited effect on income distribution. A policy proposal should also include assumptions regarding expected changes in economic agent behavior.

The results presented in this paper are complementary to those obtained using other techniques, such as computable general equilibrium, which are not devoid of critical assumptions that condition the interpretation of the results (see Heertje 2002).

6 Conclusion

This study explores the effect of government expenditure on the income distribution of Chilean households. The analysis is conducted using the multipliers of the SAM for the year 2016, along with counterfactual exercises to explore how fiscal expenditure could have a better redistributive effect.

The results indicate that, based on the flow of payments captured by the SAM in 2016, fiscal expenditure in Chile does not significantly contribute to reducing the income disparity between the poorest and richest households. The fiscal expenditure is smoothly regressive for the richest quintile, but it widens the gap between the two poorest and the third and fourth quintiles.

Each time the government invests in the economy, the wealthiest households benefit more than the lower-income households. Even though the government transfers more money to the poorest households, the government’s additional expenditures are ultimately distributed according to the labor market’s distribution. These results align with those of Contreras (1999) and Repetto (2016). For a more equalitarian fiscal expenditure, public policies that reduce the wage and capital gaps produced by the market are required.

These conclusions are in line with the information reported in the UNDP (2017): to decrease wage inequality between 2003 and 2015, the number of highly educated workers must increase. This trend, according to Sapelli (2016), is attributable to the expansion of education coverage since 1990, which has decreased the disparity between years of schooling and income from work among younger cohorts. Since the late 1990s, inequality as measured by the Gini coefficient has decreased, a trend that is more attributable to the narrowing of the market income gap than to a greater redistributive capacity of the tax and transfer system, as mentioned by Martner (2018).

Availability of data and materials

All the dataset used during the current study are available from the corresponding author on request.

Notes

As shown in Fig. 1, the other two Latin-American countries in the OECD, namely, Mexico and Brazil, are not represented. This is because they do not have data for year 2017 in the OECD Income Distribution Database. However, Mexico has data for year 2016, where the Gini before and after are 0.47 and 0.45, respectively. Brazil has data for year 2013 with 0.575 and 0.47 as the Gini before and after, respectively.

Personal services includes the activities of organizations (trade unions, religious and political organizations, research institutes and associations of a cultural, recreational and artisan type), artistic, entertainment and recreation activities (gaming and betting, theatrical, musical and other services, libraries, museums and others), and other personal service activities (e.g., gymnasium, sports clubs, and stadiums).

It consists of the services provided by the central government, municipal activities and pension institutions. In terms of production destination, the services of the public administration are for the most part intended for the consumption of the government itself.

Abbreviations

- OECD:

-

Organization for Economic Cooperation and Development

- SAM:

-

Social Accounting Matrix

- VAT:

-

Value-added tax

References

Causa O, Hermansen M (2020) Income redistribution through taxes and transfers across OECD countries. In: OECD Economic Department, Working Paper No. 1743:29–4 OECD Publishing, Paris

Civardi M, Pansini RV, TargettiLenti R (2010) Extensions to the multiplier decomposition approach in a SAM framework: an application to Vietnam. Econ Syst Res 22:111–128

Contreras D (1999) Distribución del ingreso en Chile. Nueve Hechos y Algunos Mitos Perspectivas 2:311–332

de Miguel Vélez FJ, Pérez-Mayo J (2006) Linear SAM models for inequality changes analysis: an application to the Extremadurian economy. Appl Econ 38:2393–2403

Dietzenbacher E, Hoen AR (2006) Coefficient stability and predictability in input-output models: a comparative analysis for the Netherlands. Constr Manag Econ 24:671–680

Engel EMRA, Galetovic A, Raddatz CE (1999) Taxes and income distribution in Chile: some unpleasant redistributive arithmetic. J Dev Econ 59:155–192

Fuentes R (2017) Metodología para la construcción de la matriz de contabilidad social 2014, Memoria para optar al título de Ingeniero Civil Industrial Universidad de Chile

Gandelman N (2017) Do the rich save more in Latin America? J Econ Inequal 15:75–92

Gálvez Carrasco R, Kremerman Strajilevich M (2019) Pensiones por la fuerza. Resultados del sistema de pensiones de las Fuerzas Armadas y de Orden. Ideas para el buen vivir n°17. Santiago de Chile: fundación SOL

Haindl E, van Nievelt H, Merbilhá M, León C (2020) Nuestro octubre rojo. El Libero

Heertje A (2002) Recent criticism of general equilibrium theory. In: Hommes CH, Ramer R, Withagen CA (eds) Equilibrium, markets and dynamics. Springer, Berlin

Lustig N, Higgins S (2013) Estimating the incidence of social spending, subsidies and taxes. CEQ Working Paper No. 1 (CEQ Institute, Tulane University)

Martinez-Aguilar S, Fuchs A, Ortiz-Juarez E, Del Carmen G (2018) The impact of fiscal policy on inequality and poverty. https://commitmentoequity.org/wp-content/uploads/2020/01/1.-CEQ-Handbook-2018-Nora-Lustig-Editor.pdf#page=651. In: Commitment to Equity Handbook: estimating the Impact of fiscal Policy on Inequality and Poverty edited by Nora Lustig

Martner GD (2018) Desigualdades globales y políticas de atenuación de la desigualdad de ingresos: el caso de Chile, p 1990–2015

Mardones C, Lipski M (2020) A carbon tax on agriculture? A CGE analysis for Chile. Econ Syst Res 32:262–277

Mardones C, Saavedra J (2011) Matriz de contabilidad social extendida ambientalmente para análisis económico de la Región del Bío. Rev Anal Econ 26:17–51

Mardones Poblete C (2010) Evaluando reformas tributarias en Chile con un modelo CGE. Estud Econ 37:243–284

Ormazabal F, Avello J, Trigueros D, Escudero C (2015) Estimación de Matriz de Contabilidad Social para la Región de Antofagasta

Osberg LS, Smeeding TM, Schwabish JA (2004) Income distribution and public social expenditure: theories, effects and evidence. In: Neckerman K (ed) Social inequality. Russsell Sage Foundation, New York, pp 821–859

Papadimitriou D (2006) The distributional effects of government spending and taxation. Palgrave Macmillan, UK

Peña C (2020) Pensar el malestar: la crisis de octubre y la cuestión constitucional. Taurus, India

Polo C, Roland-Holst D, Sancho F (1990) Distribución de la renta en un modelo SAM de la economía española. Estadística Española 32:537–567

Pyatt G, Round JI (1977) Social accounting matrices for development planning. Rev Income Wealth 23:339–364

Pyatt G, Round JI (1979) Accounting and fixed price multipliers in a social accounting matrix framework. Econ J 89:850–873

Reich UP (2018) Who pays for whom? Elements of a macroeconomic approach to income inequality. Econ Syst Res 30:201–218

Repetto A (2016) Crecimiento, pobreza y desigualdad: la vía chilena. Econ y Política 3:71–101

Roland-Holst DW, Sancho F (1992) Relative income determination in the United States: a social accounting perspective. Rev Income Wealth 38:311–327

Rojas GC (2009) Matriz de contabilidad social y análisis de multiplicadores contables para la Región Metropolitana de Santiago.

Rubio Sanz MT, Vicente Perdiz J (2003) SAM multipliers and inequality measurement. Appl Econ Lett 10:397–400

Sapelli C (2016) Chile: ¿más equitativo? Una mirada a la dinámica social del Chile de ayer, hoy y mañana. Santiago: Ediciones UC

UNDP (2017) Desiguales. Orígenes, cambios y desafíos de la brecha social en Chile. Santiago de Chile Programa de las Naciones Unidas para el Desarrollo

Urzua S, Rodriguez J, Contreras D (2014) On the origins of inequality in Chile

Venegas J (1995) Matriz de cuentas sociales 1986: una SAM para Chile. Serie de Estudios de Economía No. 39. Central Bank of Chile

Venegas J (2013) SAM 2008 para Chile. Una presentación matricial de la Compilación de Referencia 2008 (No. 95). Central Bank of Chile

Wood R (2011) Construction stability and predictability of an Input-Output Time-Series for Australia. Economic Systems Research 23(2):175–211

Acknowledgements

We would like to thank the two anonymous referees for their useful comments and suggestions. Their meticulous feedback has been instrumental in refining our research. Also, a big thanks to everyone who participated in the REDNIE seminars, as well as the seminar at Chilean Society of Economics (SECHI). Their thoughtful discussions and constructive criticism have helped shape our analysis and interpretations. The Article Processing Charge was covered by the funds of PAPAIOS and JSPS (KAKENHI Grant Number JP 21HP2002).

Funding

The Article Processing Charge was covered by the funds of PAPAIOS and JSPS (KAKENHI Grant Number JP 21HP2002).

Author information

Authors and Affiliations

Contributions

JM has performed algorithm and computation associated with the SAM’s production. NG has made the computations related to the multipliers and wrote the article. All of the manuscript’s conclusions and verifications were made concurrently.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

All the authors of this paper agree to the submission and publication. We confirm that the material is original and has not been published elsewhere.

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Additional file 1.

Algorithm for the computation of the multipliers.

Additional file 2.

Social Accounting Matrix for the analysis.

Appendix

Appendix

This is the list of the accounts/institutions included in the Social Accounting Matrix used in the paper (Table

10).

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Garrido, N., Morales, J. An analysis of the effect of fiscal expenditure on the income distribution of Chilean households. Economic Structures 12, 8 (2023). https://doi.org/10.1186/s40008-023-00302-1

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40008-023-00302-1