Abstract

The main purpose of this paper is to build a family of tutorial Goodwinian (essentially Marxist) models of capital accumulation through industrial cycles that are less complicated than the author’s models of the extended capitalist reproduction in the USA already published. The subordinate purpose is to advance refinement of these models from the standard “neoclassical” assumptions that distort the generic structures determining perpetual disequilibrium in the reproduction of the aggregate social capital. The ascending from abstract to concrete applies the notion of twofold nature of capitalist production as creation of use value and labour value (prioritizing surplus value). This approach reveals substantial facets of endogenous increasing returns and technological progress induced by capitalist production relations. A three-dimensional Goodwinian model L-1, containing the greed feedback loops, reflects destabilizing cooperation and stabilizing competition of investors. Monopoly capital implements proportional and derivative control over the capital accumulation rate. The growth rate of output per worker directly depends on the growth rates of capital intensity and employment ratio in a technical progress function, whereas the capital-output ratio is constant. Oscillations imitating growth cycles are endogenous. A recession (mild crisis) is a manifestation of relative and absolute over-accumulation of capital. A knife-edge limit cycle maintains a growth cycle with the Kondratiev duration; a more solid limit cycle with a period of about 7.5 years upholds a business cycle with a recession without reduced net output. These limit cycles result from the subsequent supercritical Andronov–Hopf bifurcations. The transformation of the growth cycle into industrial cycle gives credit to raising status of capital-output ratio from auxiliary in L-1 to the level (phase) variable in four-dimensional L-2. A mechanization (automation) function mirrors induced technical progress. L-2 embraces new 11 intensive feedback loops involving capital-output ratio. Proportional and derivative control over this ratio by monopoly capital is taken into account. Pair of supercritical Andronov–Hopf bifurcations gives birth to two limit cycles. The second is a remote analogue for Kuznets cycle with the period of about 18 years; the first upholds the industrial cycle with period of about 7 years and declining net output in the outright crisis. Besides relative and absolute over-accumulation of capital, the specific positive and negative feedback loops containing capital-output ratio are required for crises in industrial cycles. Long-term enhancement of monopoly profit through lowering a targeted domestic capital accumulation rate and diminishing a targeted output-capital ratio is substantiated analytically and validated by computer simulations. The gained insights highlight caveats for hastily policy recommendations.

Similar content being viewed by others

1 Introduction

The Marxist theory of extended capitalist reproduction together with the advanced system dynamics methodology presented in Rahmandad et al. (2015) provides theoretical guidelines for the research, maintained by the mathematical bifurcation theory stated in Kuznetsov (1998) as well. The development of the Marxist theory necessitates a continuation of polemics with the “neoclassical” conceptions.

The scientific term industrial cycle is the close substitute for the common term business cycle. Industrial cycles are based on the turn-over of industrial capital as the unity of productive capital and capital of circulation in industry, agriculture and other sectors. This paper is focused on the productive capital in a closed economy placing capital of circulation, governmental activity and ecological aspects outside the explicit consideration.

The industrial cycles are middle-term cycles with oscillations of investments into fixed production assets (commonly named after Clément Juglar) with typical duration roughly between 5 and 12 years. They are characterized not only by regular fluctuations of the positive growth rate of investment, employment, net output and some other indicators but also by decline of these indicators in crises.

Albert Einstein once noticed: “Make everything as simple as possible, but not simpler”. The main purpose of this paper is to present a family of tutorial Goodwinian (essentially Marxist) models of capital accumulation through industrial cycles that are less complicated than the author’s Marxist models of the extended capitalist reproduction in the USA previously published in Ryzhenkov (2009, 2018) among other publications on the same subject matter. This simplification (universalization) still does not go excessively far in order to achieve the main and related purposes of this research. This avoids, in particular, substitution of output-capital ratio for employment ratio (or vice versa) that may be justified in other inquiries into increasing returns and business cycles.

The proposed tutorial models of increasing returns and industrial cycles uncover substantial generic structures of capital accumulation with a help of stock-and-flow diagrams and feedback sequencing (similar in certain aspects to nucleotide sequencing in microbiology). Still they do not reflect endogenous quasi-logistic supply of labour force, disregards employment ratio as an immediate factor of growth rate of capital intensity, do not apply discontinuity of the first kind in the equations for growth rates of real wage and capital intensity, discount discontinuity of the second kind in partial derivatives of technical progress and investment functions. Instead of combination of extended Kalman filtering with maximum likelihood in the probabilistic setting within more realistic models, the tutorial models assume on the current stage a purely deterministic form, abstracting from observation errors and stochastic elements in the equations of motion. The experience of lecturing confirms that reasonable simplifications at the proper stages of education empower learning and stimulate new steps by students themselves.

The studied original models are a convincing alternative to real business cycle models developed within the framework of the “neoclassical” concept of general economic equilibrium. They can also replace the model of cyclical fluctuations from Samuelson (1939a, b), which is undeservedly rooted in macroeconomics courses at universities, as logically contradictory and inconsistent with the facts.

Models of the real business cycle, as well as the superficial models of the multiplier accelerator in Samuelson (1939a, b), mostly ignore the indisputable fact that the extraction of monopoly profits increases inequality in the primary distribution of national income between classes and restrains the increase in investment necessary to solve socio-economic and geopolitical tasks. The recent Economic Report of the President (2022) reviews these and other relevant aspects (avoiding the very notion of the state-monopoly capitalism and research on the subject matter in the prolific Marxist literature). The report’s inference that strengthening monopoly power promotes profits and sharpens inequality in primary distribution of national income corresponds to proposed elucidation of the same conclusion in the present paper.

Names of models (Z-1, L-2, etc.) are used through the text exclusively for brevity. The given explanations help to avoid confusing and ambiguity.

A model denoted as Z-1 in Ryzhenkov (2016) has been developed as a dialectical negation of the “neoclassical” models in Ploeg (1985) and Aguiar-Conraria (2008) that, although having contributed to understanding of growth cycles, have implicitly claimed business cycles and Marx accumulation theory dead. Marx’ theory, immensely supported by stubborn and too often inconvenient facts, helped reveal the greed feedback loops, as well as the destabilizing cooperation and stabilizing competition of investors in Z-1.

In Z-1, as a system of three ODEs, the rate of capital accumulation has become the new phase variable. Targeted long-term increase of the stationary rate of capital accumulation reduces stationary profit rate together with raising stationary relative wage. Here and below ODE briefly stands for an ordinary differential equation.

Oscillations imitating industrial cycles are endogenous. A crisis is a manifestation of relative and absolute over-accumulation of capital. A supercritical Andronov–Hopf bifurcation (see, particularly, Gandolfo 2010; Fanti and Manfredi 1998; Kuznetsov 1998), abbreviated as AHB through this paper, unleashes limit cycle with a period of about 6 years.Footnote 1

The subordinate purpose of this paper is to advance refinement from the standard “neoclassical” assumptions that distort the generic structures determining perpetual disequilibrium in capital accumulation. The listing of what the prototypical model Z-1 denies so far is the following: centrality of “perfect competition” with general economic equilibrium, profit maximization equating wage with imaginary marginal labour productivity, balanced growth path related to stationary (locally or even globally) equilibrium and “pendulum with friction” analogy for a capitalist economy experiencing business cycles.

Now it is the turn for a liberating of the Goodwinian models from the efficiency wage hypothesis, underlying production function with constant elasticity of factors substitution, in Arrow et al. (1961). The divergence between trends of net total economic productivity and hourly pay for the typical worker in the USA since the end of 1970s up to 2020 is emphasized in the section Labour Market Inequality in Chapter 5 of the Economic Report of the President (2022). Thus, the efficiency wage hypothesis, unsound theoretically, is empirically refuted by this divergence, detrimental for typical workers, in the real life and in statistical data. These data are updated by the Productivity–Pay Tracker of the Economic Policy Institute (see Appendix 4).

Boggio (2006) modified a classical model from Goodwin (1972). A constant capital-output ratio was retained. Increasing returns were introduced by means of the Kaldor–Verdoorn empirical law. After the setting of dependence of a growth rate of output per worker on a growth rate of fixed production assets, a non-trivial stationary state in this Boggio’s model (tagged as B-1 in the present paper) becomes unstable. Boggio (2006) did not suggest how stability could be re-established in that model with rather superficial treatment of increasing returns criticized in Ryzhenkov (2009). The reply in Boggio (2010) deserves a further discussion.

Section 2 recalls the properties of the famous model of cyclical growth in Goodwin (1972). The addition of the scale effects to this model leads to negation of the conservative fluctuations substituted by either explosive long waves or by monotonous departure from an economic area. Under reasonable parameters’ magnitudes a neutral centre–unstable focus bifurcation takes place.

The notion of increasing returns (economy of scale) is reconsidered as a manifestation of reinforcing direct and roundabout scale effects built into feedback loops of different order and polarity. Section 2 utilizes definitions of increasing returns proposed in Ryzhenkov (2009) that distinguish between (type I) and type II: the growth rate of output per worker depends positively on the employment ratio or, correspondingly, on the growth rate of this ratio. This section extends these definitions: the growth rate of output per worker depends negatively on the capital-output ratio (type I m) or, correspondingly, on the growth rate of this ratio (type II m).

The technical progress function proposed reflects the essence of Kaldor’s idea on technical progress embodied in fixed production assets per labourer. The growth rate of the latter is the factor of the growth rate of output per worker. This growth rate depends positively additionally on the growth rate of employment ratio that accounts for the increasing returns of type II. This technical progress function refines and generalizes the scale effect contained in the Kaldor–Verdoorn empirical law of increasing returns refining the initially given form of B-1.

Two-dimensional Goodwinian model B-1 in the refined form contains feedback loops that either reinforce or weaken direct economy of scale (type II). Gains in unit value of labour power are mostly detrimental for technological progress. In result, B-1 in its both initial and refined forms generates explosive dynamics that are not contained in the economic area.

Section 3 grasps three-dimensional Goodwinian model with Leontiev technology L-1. Monopoly capital implements proportional and derivative control over the capital accumulation rate that becomes a third phase variable in addition to the relative wage (unit value of labour power) and the employment ratio.

An unstable focus in L-1 is qualitatively similar to an unstable focus in B-1; diverging fluctuations leave the economic space in both although the fluctuations differ in frequency and amplitude. Unlike B-1, L-1 is able to generate growth cycles contained in the economic space. These cycles have typically lower relative variation of main indicators than industrial cycles. L-1, containing the greed feedback loops, reflects destabilizing cooperation and stabilizing competition of investors. This model is the refined case of Z-1 freed from the efficiency wage hypothesis. This refinement is achieved at cost: unlike the “mother” model Z-1, the “daughter” possesses a constant capital-output ratio—consequently, the industrial cycles are not generated anymore and typically only growth cycles run.

This limitation requires the augmentation of L-1 by an alternative hypothesis on a partial dynamic law governing the capital-output ratio in Sect. 4. A reasonable mechanization (automation) function reflects technical progress induced by production relations in L-2. The unit value of labour power and variable capital-output ratio endogenously co-determine the growth rate of capital intensity thereby.

Section 4 develops L-1 into four-dimensional model of industrial cycles L-2. This model is presented as unity of Phillips Eq. (7), technical progress function (23), mechanization (automation) function (37) and capital accumulation rate function (41). The logistic component in (41) plays a significant role in the cyclical pattern with core asymmetry in movements of the partial derivative of net change of accumulation rate with respect to accumulation rate, laid bare in Appendix 3.

It is demonstrated additionally that L-2 matches the macroeconomic regularities known as technical progress induced by production relations, the Kaldor–Verdoorn empirical law and the Okun rule. Equation (40) for a net change of employment ratio in L-2 extends the Okun rule (29) in L-1 by a second term related to a deviation of capital-output ratio from its stationary magnitude. An adjustment parameter’s magnitude at a first term related to a deviation of a growth rate of net output from its stationary growth rate is higher in L-2 than in L-1.

Relative over-accumulation of capital and absolute over-accumulation of capital take place in both L-1 and L-2; however, only the latter, containing new pertinent feedback loops, generates declines in net output in acute or moderate crises of industrial cycles. A set of appropriate feedback loops with pertinent loop gains is revealed.

A number of feedback loops in L-2 is greater than that in two previous models, the order of some of them is also higher and the gain of a particular feedback loop differs from that in either in B-1 or in L-1. Each of several feedback loops from B-1 and L-1 involving a growth rate of output per worker is transformed into a loop with an opposite polarity because the impact of an increment in a growth rate of fixed production assets on a growth rate of capital intensity turns to the opposite (from positive to negative). Such dialectical “mutations” and emergent properties reflect the evolution of capitalist production relations necessitated and maintained by the technological development that in turn is compelled by these relations within capitalist mode of production.

The paper explores how state-monopoly regulation of capital accumulation progresses through changes in the main production relationships. The classes of capitalists and workers learn from experience that greater investment flexibility (as in L-2 against B-1) in reasonable bounds is beneficial for capital accumulation and wealth creation. In the process of learning, the society invents new behavioural competitive-cooperative algorithms that generally foster organizational complexity (through new feedback loops and by reshaping former loops in L-2 in relation to L-1 and B-1).

The emphasized changes in socio-economic relations are based on technological progress and reinforced by advance in technology. However, the very evolution of capital accumulation grasped in B-1 through L-2 inevitably brings new sources of instability that can become dominant under certain conditions exposed.

The remaining part of this paper is organized in the following way. Appendixes 1, 2 and 3 explain details of the essential properties of B-1, L-1 and L-2. Although balanced growth path is possible in L-2 as in the preceding models, the economy cyclically bounces back and forth. Still the existence of balanced growth path is required analytically for the all bifurcations investigated in this paper. The reader will find elaboration of Proposition 1 for B-1 from Sect. 2.2 in Appendix 1; Propositions 2–4 for L-1 are given in Appendix 2. For L-2, Sect. 4.3 comments on Proposition 6; Appendix 3 elucidates Propositions 5, 7 and 8; it ascertains certain relations between the logistic component in the equation for the net change of capital accumulation rate, on one hand, and the structurally stable limit cycle, on the other.

Appendix 4 shows the interrelated patterns of behaviour, elucidated in L-2, for selected economic indicators observed in the US economy. Data embodied in Figs. 16 and 17 in Appendix 4 are from the official statistical sources.

2 How conservative oscillations in Goodwin’s model (M-1) were destabilized through increasing returns in B-1

2.1 Goodwin’s model (M-1)

A time derivative of a variable, say, x is indicated by a dot directly above it \(\dot{x} = \frac{\partial x}{{\partial t}}\), whereas its growth rate is similarly marked by a hat \(\hat{x} = \frac{{\dot{x}}}{x} = \frac{1}{x}\frac{\partial x}{{\partial t}}\). Growth rate \(\hat{x}\) equals the time derivative of ln(x). Table 1 lists variables of the models presented.

At the chosen level of abstraction, ecological aspects, international politico-economic relations and the state economic activity are not explicit. Investment delays as well as discrepancies between orders and inventories are not reflected.

For a national economy with a generalized Leontiev technology (in the meaning that it permits variable input–output coefficients), net output is equivalently determined either as a product of output per worker and employment or as a product of output-capital ratio and fixed production assets:

Exogenously determined is exponential growth of labour force and of output per worker with correspondent growth rates:

and

Material balance Eq. (4), where C is non-productive consumption, shows the end use of net product q:

net formation of fixed production assets equals net investment:

where (α + β)s < z ≤ 1, 0 < zinfimum < z ≤ 1; an explicit zinfimum will follow.

The left boundary for z is set to avoid a non-positive stationary relative wage. M-1 and original B-1 assume that z = 1. Ryzhenkov (2009, 2018) explored how long-term decline in this ratio mitigates the tendency of profit rate to fall in the USA, Italy and, by the same reason, still hypothetically in other industrialized countries.

The price of produced commodity is identically one. Therefore, surplus product (1 − u)q equals total profit M that can be not only invested but also be used to cover personal expenses of the bourgeoisie and via implicit taxes for unspoken public consumption.

A simplified Phillips equation defines the growth rate of wage as a non-linear function of employment ratio

where \(f^{\prime}(v) > 0,\) for \(v \, \to 1 \, f(v) \to \infty .\)

For certainty, a specification satisfying these requirements is applied in the models

where g > 0, r > 0.

The Phillips equation is maintained by assumption of bargaining strength of the workers’ movement in Ploeg (1985, p. 222). Thus, at least, a countervailing power of trade unions against monopoly and firms’ monopsony on the labour market is recognizable (cf. Robinson 1969, p. xvii). This recognition is not followed in Ploeg (1985) and other “neoclassical” papers by investigation of monopoly capitalism in depth. Therefore, applying the profit maximization condition developed for “perfect” competition creates unresolved logical inconsistencies in the Solow (1956), Ploeg (1985) and Aguiar-Conraria (2008) models as Ryzhenkov (2016) demonstrates.

Besides epistemological (theoretical and logical) objections, these “neoclassical” models are short of empirical confirmation. Their profit maximization condition equates the magnitude of the “marginal product of labour” with the wage rate under “perfect” competition that is excessively strong idealization even for free competition. Besides, as Chapter 5 of Economic Report of the President (2022) emphasizes, perfect competition does not describe most labour markets because of market power of employers—be it monopsony or monopoly (oligopoly) or a synthesis of both. Still the same report makes a logically contradictory concession to “neoclassical” school referring to marginal productivity of workers (ibid, p. 168). The reader hopes that next report will overcome this eclecticism.

According to Goodwin (1972), an intensive form of M-1 consists of two non-linear ODEs. Here this system is generalized for 0 < zinfimum = (α + β)s < z ≤ 1 in relation to the original form (for z = 1) and for non-linear Phillips equation as in B-1:

A non-trivial stationary state of the system (8)–(9) is defined as

such that \(1 > u_{{\text{G}}} = 1 - \frac{(\alpha + \beta )s}{z} > 0,\;0 < v_{{\text{G}}} = f^{ - 1} (\alpha ) < 1,\;0 < (\alpha + \beta )s < z \le 1, \;s > 1.\) Mathematically, EG is a neutral centre. A closed orbit is crossing initial point (u0, v0).

The left boundary for z is set to avoid a non-positive stationary relative wage. Indeed, zinfimum = (α + β)s = z(1–uG); zinfimum = z for uG = 0. So the stationary share of investment in net output that equals zinfimum is to be lower than stationary rate of capital accumulation z (as 0 < uG < 1).

The right boundary on z is, honestly, over-stretched for comparison with other academic models that assume possibility of z = 1 A reader of a popular textbook on macroeconomics, for example, could remember the “golden rule of accumulation” in the “neoclassical” models that maximize per head consumption requiring the investment of total profit in the fixed production assets. This insufficiently elaborated rule overlooks the twofold nature of capital production and accumulation discovered by K. Marx. Simulation runs in Sect. 4.3 highlight the contradiction between this controversial rule lowering the profit rate and the vested interests in the higher profitability.

Capitalist production relations set a maximal level for the rate of capital accumulation z that is flexible for different countries and historical periods. In an open capitalist economy it is even possible for net investment to be higher than total domestic profit. The chosen level of abstraction avoids these significant aspects.

Stationary state EG (10) and stationary states in the subsequent models correspond to the notion of balanced growth path. It has the following properties in M-1: a stationary positive growth rate of output per worker and growth rate of wage equals α; a stationary growth rate of fixed production assets and net product is \(\hat{k}_{{\text{G}}}\) = \(\hat{q}_{{\text{G}}}\) = α + β; a stationary rate of surplus value is \(m_{{\text{G}}}^{\prime } = {{(1 - u_{{\text{G}}} )} \mathord{\left/ {\vphantom {{(1 - u_{{\text{G}}} )} {u_{{\text{G}}} }}} \right. \kern-\nulldelimiterspace} {u_{{\text{G}}} }}\); a stationary profit rate is (1 − uG)/s = \({{(\alpha + \beta )} \mathord{\left/ {\vphantom {{(\alpha + \beta )} z}} \right. \kern-\nulldelimiterspace} z}\), where α > 0, β ≥ 0.

Defining the labour share in net output precedes finding the stationary capital-output ratio and stationary capital accumulation rate in the “neoclassical” model assuming “perfect competition” in Solow (1956). The order of reasoning is opposite in M-1 and the subsequent models in this paper. This reverse logic is more appropriate for the state-monopoly capitalism, where monopoly capital is able to set targets for the rate of capital accumulation and capital-output ratio shifting primary income distribution in its own favour.

All considered models (M-1 through L-2, on one hand, and the Solow (1956) model, on the other) still have a common property: the stationary growth rates of net output and output per worker are defined independently of the stationary share of investment in net output that equals zinfimum. Later “neoclassical” models, attempting to embrace endogenous technical change, have been struggling with this independence. A critical review of these models in the standard textbooks on macroeconomics and in a related literature deserves another voluminous paper.

Equation for net change of relative wage (8) is a manifestation of proportional control over relative wage since f(vG) = α > 0. Typically, the higher is \(f^{\prime}(v_{{\text{G}}} )\) the faster is adjustment speed of u. A more sophisticated state-monopoly regulation of primary income distribution would apply a derivative form and possibly an integral form in addition to a proportional form of control.

Equation (11) being equivalent for (9) reflects proportional control over the net change of employment ratio

The higher is z/s the faster is adjustment speed of v.

The period of conservative fluctuations along a closed orbit crossing initial (u0, v0) is narrowly approximated as

For plausible magnitudes of the parameters TM-1 is greater than a period of industrial cycle.

It is reasonable and possible to split net changes of each of the main variables into two parts with unambiguous signs of partial derivatives applying (2), (3), (7), (8) and (9):

where \(\dot{u}_{{{\text{in}}}} = \frac{ru}{{(1 - v)^{2} }},\;\frac{{\partial \dot{u}_{{{\text{in}}}} }}{\partial u} > 0,\;\frac{{\partial \dot{u}_{{{\text{in}}}} }}{\partial v} > 0,\;\dot{u}_{{{\text{out}}}} = (g + \alpha )u,\;\frac{{\partial \dot{u}_{{{\text{out}}}} }}{\partial u} > 0,\;\frac{{\partial \dot{u}_{{{\text{out}}}} }}{\partial v} = 0.\)

where \(\dot{v}_{{{\text{in}}}} = \frac{z(1 - u)}{s}v,\;\frac{{\partial \dot{v}_{{{\text{in}}}} }}{\partial v} > 0,\;\frac{{\partial \dot{v}_{{{\text{in}}}} }}{\partial u} < 0,\;\dot{v}_{{{\text{out}}}} = (\alpha + \beta )v,\;\frac{{\partial \dot{v}_{{{\text{out}}}} }}{\partial v} > 0,\;\frac{{\partial \dot{v}_{{{\text{out}}}} }}{\partial u} = 0.\)

With the gained knowledge on these partial derivatives, Fig. 1 and Table 2 exhibit a stock-and-flow structure of M-1. A sign of each first partial derivative is given at an arrow head.

The stock-and-flow diagram is not confusing and corresponds, in the author’s view, to the system dynamics method detailed in Sterman (2000, pp. 139, 145–147). Especially, the requirement is satisfied: all causative links have unambiguous polarities.Footnote 2 Loop dominance for u among B1 and R1 and for v among B2 and R2 is determined by a greater corresponding magnitude either of inflow or of outflow in agreement with Richardson (1995).

If \(\dot{u}_{{{\text{in}}}} > \dot{u}_{{{\text{out}}}}\) then \(\frac{{\partial \dot{u}}}{\partial u} > 0\); therefore, R1 dominates. Conversely, if \(\dot{u}_{{{\text{in}}}} < \dot{u}_{{{\text{out}}}}\) then \(\frac{{\partial \dot{u}}}{\partial u} < 0\); therefore, B1 dominates. Similarly, if \(\dot{v}_{{{\text{in}}}} > \dot{v}_{{{\text{out}}}} ,\) then \(\frac{{\partial \dot{v}}}{\partial v} > 0\); therefore, R2 dominates. Contrariwise, if \(\dot{v}_{{{\text{in}}}} < \dot{v}_{{{\text{out}}}} ,\) then \(\frac{{\partial \dot{v}}}{\partial v} < 0\); therefore, B2 dominates.

When the both magnitudes are equal loop dominance vanishes, particularly, at a stationary state. If \(\dot{u}_{{{\text{in}}}} = \dot{u}_{{{\text{out}}}}\), then \(\frac{{\partial \dot{u}}}{\partial u} = 0\); in the same way, if \(\dot{v}_{{{\text{in}}}} = \dot{v}_{{{\text{out}}}}\), then \(\frac{{\partial \dot{v}}}{\partial v} = 0\). The elements on the main diagonal of the Jacobi matrix for ODEs (8) and (9) correspond to these partial derivatives. The other two partial derivatives of the same Jacobi matrix reveal a competitive relationship between employment ratio v as prey and relative wage u as predator.

Look at negative feedback loop B3: a higher relative wage (“predator”), at first, slows an inflow and later causes a decrease in an employment ratio (“prey”); the lower employment ratio, in turn, hinders, at first, advances and later causes a decline in relative wage. Correspondingly, in the Jacobi matrix, \(\frac{{\partial \dot{u}}}{\partial v} > 0\) and \(\frac{{\partial \dot{v}}}{\partial u} < 0\).

A template in Richardson (1995) prompts a shorter presentation of the first order loops, each with shifting polarity, for relative wage u and employment ratio v. Such a condensed presentation is located in the two summarizing columns of Table 2 on the right. The similar convention for depicting the loops of the first order in another two-dimensional Goodwinian model is used, for example, in Ryzhenkov (2021, p. 435).

First, consider relative wage u and define the polarity of the feedback loop linking the inflow rate \(\dot{u}\) and the level u as \({\text{sgn}} \left( {\frac{{\partial \dot{u}}}{\partial u}} \right) = {\text{sgn}} (\hat{u}) = {\text{sgn}} (\dot{u}) = {\text{sgn}} (\hat{w} - \hat{a}) = {\text{sgn}} [f(v){-}f(v_{{\text{G}}} )].\) Clearly, the polarity of loop linking the inflow rate \(\dot{u}\) and the level u shifts at the particular magnitude of u, where \(\dot{u}\) = 0 and where employment ratio v equals stationary vG in agreement with (8)–(11).

Second, pay attention to employment ratio v and define the polarity of the feedback loop linking the inflow rate \(\dot{v}\) and the level v as \({\text{sgn}} \left( {\frac{{\partial \dot{v}}}{\partial u}} \right) = {\text{sgn}} (\hat{v}) = {\text{sgn}} (\dot{v}) = {\text{sgn}} (u_{{\text{G}}} {-}u).\) Therefore, the polarity of loop linking the inflow rate \(\dot{v}\) and the level v shifts at the specific magnitude of v, where \(\dot{v}\) = 0 and where relative wage u is stationary in agreement with (8)–(11) again.

2.2 Negation of M-1 in B-1

Next model extends the previous one by endogenous growth of output per worker. With the reference to the Kaldor–Verdoorn empirical law, the growth rate of output per worker is assumed in Boggio (2006) to be a linear function of a growth rate of fixed production assets for a constant capital-output ratio postulated for simplicity

where 0 < γ < 1. Consequently, the growth rate of net output is

Differently from an application of the Kaldor–Verdoorn empirical law with a help of logistic function in Lordon (1995), this simplification avoids the problem of multiple equilibria for the growth rate of fixed production assets that Ryzhenkov (2021) reconsiders.

An integration of (14) yields implicit production function

where \(c_{0} = \frac{{q_{0} }}{{l_{0} k_{{^{0} }}^{\gamma } }} = \frac{{a_{0} }}{{k_{{^{0} }}^{\gamma } }}.\)

Production function (15) is characterized by increasing returns to scale (according to the standard “neoclassical” definition) with respect to the arguments k and l. The degree of homogeneity is 2 > 1 + γ > 1 for this function. Thus, according to the Euler theorem on homogeneous functions, net output cannot be imputed to fixed production assets and labour power according to their imaginary marginal productivities as the “neoclassical” school commonly suggests violating the very essence of technology and ignoring the twofold nature of capital production. Fixed production assets being a part of constant capital (included in productive capital) do not produce value (containing surplus value) contrary to variable capital (in the shape of the labour power as the key element of productive capital).

The growth rate of capital intensity is identical to the growth rate of output per worker as capital-output ratio s = const

Retaining the all relevant equations of M-1, the system of two non-linear ODEs (17) and (18) represents intensive form of B-1:

The system (17)–(18) has non-trivial stationary state (19) that differs from non-trivial stationary state EG (10) in M-1

where \(0 < u_{{\text{p}}} = 1{-}\frac{{d_{{\text{p}}} s}}{z} < 1\), \(d_{{\text{p}}}\) is defined in (21), \(z_{{{\text{infimum}}}} = d_{{\text{p}}} s < z \le 1\), \(0 < v_{{\text{p}}} = f^{ - 1} (\hat{a}_{{\text{p}}} ) < 1\) and 0 < γ < \(\gamma_{\sup } = 1 - \frac{s(\alpha + \beta )}{z}\) < 1. We see that \(d_{{\text{p}}}\) and vp depend on γ positively contrary to a negative dependence of up on this parameter.

It is noted that zinfimum = z(1–up). So the stationary share of investment in net output is to be lower than stationary rate of capital accumulation z (as 0 < up < 1) similar to M-1. Besides that, for 1 > γ ≥ \(\gamma_{\sup } = 1 - \frac{s(\alpha + \beta )}{z}\) a non-trivial stationary state does not exist since the stationary relative wage leaves the meaningful economic area.

The stationary rate of growth of output per worker, capital intensity and wage is defined differently than in M-1 as

The stationary rate of growth of fixed production assets and net product is determined:

The stationary profit rate is specified as

Increases in γ facilitate the stationary growth rate of output per worker that equals the stationary growth rate of wage and that of capital intensity. There is the stationary employment ratio–stationary relative wage trade-off in B-1: the higher γ < γsup, the higher is the first and the lower is the second (Fig. 2, Table 3).

The higher is rate of capital accumulation z, the higher is stationary relative wage up and the lower is stationary profit rate Rp; the higher is capital-output ratio s, the lower is stationary relative wage up; still stationary profit rate Rp does not depend on s.

Let us split net changes of each of the main variables into two parts with unambiguous signs of partial derivatives with respect to (13)–(18) in B-1 similar to splitting done for M-1 above:

where \(\dot{u}_{{{\text{in}}}} = \frac{ru}{{(1 - v)^{2} }} + \gamma \frac{{zu^{2} }}{s},\;\frac{{\partial \dot{u}_{{{\text{in}}}} }}{\partial u} > 0,\;\frac{{\partial \dot{u}_{{{\text{in}}}} }}{\partial v} > 0,\)

and \(\dot{v} = \dot{v}_{{{\text{in}}}} - \dot{v}_{{{\text{out}}}} ,\)

where \(\dot{v}_{{{\text{in}}}} = (1 - \gamma )\frac{z(1 - u)}{s}v,\;\frac{{\partial \dot{v}_{{{\text{in}}}} }}{\partial v} > 0,\;\frac{{\partial \dot{v}_{{{\text{in}}}} }}{\partial u} < 0,\;\dot{v}_{{{\text{out}}}} = (\alpha + \beta )v,\;\frac{{\partial \dot{v}_{{{\text{out}}}} }}{\partial v} > 0,\;\frac{{\partial \dot{v}_{{{\text{out}}}} }}{\partial u} = 0.\)

A shorter presentation of the first-order loops, each with shifting polarity, for relative wage u and employment ratio v for B-1 is constructed based on the same template in Richardson (1995) again. First, consider relative wage u and define the polarity of the feedback loop linking the inflow rate \(\dot{u}\) and the level u as \({\text{sgn}} \left( {\frac{{\partial \dot{u}}}{\partial u}} \right) = {\text{sgn}} (\hat{u}) = {\text{sgn}} (\dot{u}) = {\text{sgn}} (\hat{w} - \hat{a}).\) Therefore, the polarity of loop linking the inflow rate \(\dot{u}\) and the level u, in agreement with (17)–(22), shifts at the magnitude of u, where \(\dot{u}\) = 0 and where growth rate of wage equals growth rate of output per worker; here employment ratio v is not equal stationary vp (still v is rather close to vp).

Second, attention is paid to employment ratio v and the polarity of the feedback loop linking the inflow rate \(\dot{v}\) and the level v is defined as \({\text{sgn}} \left( {\frac{{\partial \dot{v}}}{\partial u}} \right) = {\text{sgn}} (\hat{v}) = {\text{sgn}} (\dot{v}) = {\text{sgn}} (u_{p} {-}u).\) Therefore, the polarity of loop linking the inflow rate \(\dot{v}\) and the level v shifts at the magnitude of v, where \(\dot{v}\) = 0 and where relative wage u equals stationary up according to (17)–(22).

We see that a particular feedback loop in B-1 has the same polarity as that in M-1. The stock-and-flow condensed structure of B-1 remains the same (Fig. 1 and Table 2). Still feedback gain for each of these loops is specific for the particular model.Footnote 3 Contrary to M-1, the positive feedback loop R1 is dominant in B-1. Being unchecked, this loop creates the systemic risk and leads to a socio-economic collapse (see Corollary to Proposition 1).

This loop dominance manifests itself in growing amplitude of fluctuations in B-1 with the progress of time: the deviation from the stationary state becomes greater and greater (Figs. 3 and 4).

Summary statistics also confirms the run-away nature of fluctuations in B-1 compared to steadiness of structurally unstable closed orbits in M-1 for the same initial u0 and v0 (Table 3).

Instability of non-trivial stationary state Ep (19) is exposed in Boggio (2006) without mentioning the revealed possibility of multiple equilibria in B-1 depending on parameter γ. M-1 is not to be considered as a special case of B-1 as their properties differ substantially.

Table 4 shows the comparison of signs of partial derivatives at unstable Ep in B-1 with those at unstable EG in M-1. Three signs are the same, only instead of \(\frac{{\partial \dot{u}}}{\partial u} = 0\) in M-1 there is \(\frac{{\partial \dot{u}}}{\partial u} > 0\) that reflects the workers cooperation in relation to relative wage, which is destabilizing in B-1.

Proposition 1

E p is unstable focus for 0 < γ < γ sup < 1 in the economic area.

Corollary 1

Dynamics for 1 > γ ≥ γ sup > 0 in B-1 are outside the economic area as relative wage is not strictly positive any more.

Figure 4 displays dynamics diverging > from the unstable focus and leaving the economic area in B-1 compared with conservative oscillations around the neutral centre in M-1. B-1 generates perpetual (and explosive) oscillations for γ < γsup and monotonous decline of u to uinf = 0 and w to winf = 0 for 1 > γ ≥ γsup abstracting from an inevitable working class unrest in between.

The following models’ calibrating is purely illustrative: u0 = 0.7804, v0 = 0.9127, z = 0.06575; common parameters, α = 0.00586, β = 0, g = 0.06828, r = 0.0005, s = 2.17, stationary dG = α + β = 0.00586, uG ≈ 0.8063 and vG ≈ 0.9179; additionally in B-1, γ = 0.4043 < γsup = 0.8063, stationary dp = (α + β)/(1 − γ) = 0.00985, up = 0.6749 < uG and vp = 0.92 > vG.

2.3 The system dynamics refinement of the notion of increasing return

In agreement with the Boggio (2006) and (2010) interpretation, Table 5 exposes intended reinforcing economy of scale through extensive feedback loops of growth rate of output per worker \(\hat{a}\) (1a, 2a) involving relevant stocks and flows in initial B-1.

The standard “neoclassical” definition of economy of scale ignores the twofold nature of capital production and accumulation. Particularly, “neoclassical” assumptions of constant or increasing returns to scale and widespread atomistic (“perfect”) competition are not compatible as Ryzhenkov (2016) explains; it is necessary from the very beginning to assume a dynamic—not a static—substitution between labour force and fixed production assets that implies refined extensive feedback loops between growth rate of output per worker and other variables. Taking these feedback loops into account results in the deeper definition of economy of scale in Ryzhenkov (2009).

Without going into excessive details, direct economy of scale (direct increasing return) manifests itself in a positive partial derivative of growth rate of output per worker \(\hat{a}\) with respect to employment ratio v or growth rate of employment ratio \(\hat{v}\): \(\frac{{\partial \hat{a}}}{\partial v} > 0\) (type I) or \(\frac{{\partial \hat{a}}}{{\partial \hat{v}}} > 0\) (type II). Roundabout economy of scale (roundabout increasing return) manifests itself in a positive partial derivative of growth rate of output per worker with respect to employment ratio v or growth rate of employment ratio \(\hat{v}\) intermediated by other variable or variables (\(x_{i}\)): \(\frac{{\partial \hat{a}}}{{\partial x_{1} }}\frac{{\partial x_{1} }}{\partial v} > 0{\text{ or }}\frac{{\partial \hat{a}}}{{\partial x_{1} }}...\frac{{\partial x_{i} }}{\partial v} > 0,\) \(\frac{{\partial \hat{a}}}{{\partial x_{1} }}\frac{{\partial x_{1} }}{{\partial \hat{v}}} > 0{\text{ or }}\frac{{\partial \hat{a}}}{{\partial x_{1} }}...\frac{{\partial x_{i} }}{{\partial \hat{v}}} > 0,\) \(i \in \{ 2,\ldots,I \}.\)

Economy of scale (increasing return) is reinforcing if a positive feedback loop connects the growth rate of output per worker with employment ratio and (or) its growth rate. Economy of scale (increasing return) is weakening if a negative feedback loop connects the growth rate of output per worker with employment ratio and (or) its growth rate.

Similarly, direct diseconomy of scale (direct decreasing return) manifests itself in a negative partial derivative of growth rate of output per worker (\(\hat{a}\)) with respect to employment ratio (v) or growth rate of employment ratio (\(\hat{v}\)): \(\frac{{\partial \hat{a}}}{\partial v} < 0\)(type I) or \(\frac{{\partial \hat{a}}}{{\partial \hat{v}}} < 0\) (type II). Again these two derivatives have different meanings and different modelling consequences.

Roundabout diseconomy of scale (roundabout decreasing return) manifests itself in a negative partial derivative of growth rate of output per worker with respect to employment ratio (v) or growth rate of employment ratio (\(\hat{v}\)) intermediated by other variable or variables (\(x_{i}\)): \(\frac{{\partial \hat{a}}}{{\partial x_{1} }}\frac{{\partial x_{1} }}{\partial v} < 0{\text{ or }}\frac{{\partial \hat{a}}}{{\partial x_{1} }}...\frac{{\partial x_{i} }}{\partial v} < 0,\) \(\frac{{\partial \hat{a}}}{{\partial x_{1} }}\frac{{\partial x_{1} }}{{\partial \hat{v}}} < 0{\text{ or }}\frac{{\partial \hat{a}}}{{\partial x_{1} }}...\frac{{\partial x_{i} }}{{\partial \hat{v}}} < 0,\) \(i \in \{ 2,\ldots,I\}.\)

A positive feedback loop connecting the growth rate of output per worker with employment ratio and (or) its growth rate reinforces direct or roundabout diseconomy of scale. A negative feedback loop connecting the growth rate of output per worker with employment ratio and (or) its growth rate weakens direct or roundabout diseconomy of scale.

For state-monopoly capitalism, above definitions from Ryzhenkov (2009) need augmentation. Under state-monopoly control over the employment ratio with a rather high target for this variable, the targeting of rate of capacity utilization by monopoly capital is not publically explicit. The output-capital ratio is a proxy for rate of capacity utilization: the higher is the latter the higher is the former, and vice versa (Fig. 16a). The purposeful restriction of the capacity utilization rate is motivated by capital interest in monopoly profit.

Stronger capital monopoly power unchecked by the society leads to long-term decline in relative labour compensation, rate of capital accumulation and output-capital ratio. This necessitates hardening labour countervailing strength for turning these tendencies around.

Direct economy of scale (direct increasing return) manifests itself in a negative partial derivative of growth rate of output per worker \(\hat{a}\) with respect to capital-output ratio s or growth rate of capital-output ratio \(\hat{s}\): \(\frac{{\partial \hat{a}}}{\partial s} < 0\) (type I m) or \(\frac{{\partial \hat{a}}}{{\partial \hat{s}}} < 0\) (type II m). Roundabout economy of scale (roundabout increasing return) manifests itself in a negative partial derivative of growth rate of output per worker with respect to capital-output ratio s or growth rate of capital-output ratio \(\hat{s}\) intermediated by other variable or variables (\(x_{i}\)): \(\frac{{\partial \hat{a}}}{{\partial x_{1} }}\frac{{\partial x_{1} }}{\partial s} < 0{\text{ or }}\frac{{\partial \hat{a}}}{{\partial x_{1} }}...\frac{{\partial x_{i} }}{\partial s} < 0,\) \(\frac{{\partial \hat{a}}}{{\partial x_{1} }}\frac{{\partial x_{1} }}{{\partial \hat{s}}} < 0{\text{ or }}\frac{{\partial \hat{a}}}{{\partial x_{1} }}...\frac{{\partial x_{i} }}{{\partial \hat{s}}} < 0,\) \(i \in \{ 2,\ldots,I\} .\)

Economy of scale (increasing return) is reinforcing if a positive feedback loop connects the growth rate of output per worker with capital-output ratio and (or) its growth rate. Economy of scale (increasing return) is weakening if a negative feedback loop connects the growth rate of output per worker with capital-output ratio and (or) its growth rate.

Similarly, direct diseconomy of scale (direct decreasing return) manifests itself in a positive partial derivative of growth rate of output per worker (\(\hat{a}\)) with respect to capital-output ratio s or growth rate of capital-output ratio \(\hat{s}\): \(\frac{{\partial \hat{a}}}{\partial s} > 0\) (type I m) or \(\frac{{\partial \hat{a}}}{{\partial \hat{s}}} > 0\) (type II m). Again these two derivatives have different meanings and different modelling consequences.

Roundabout diseconomy of scale (roundabout decreasing return) manifests itself in positive partial derivative of growth rate of output per worker (\(\hat{a}\)) with respect to capital-output ratio s or growth rate of capital-output ratio \(\hat{s}\) intermediated by other variable or variables (\(x_{i}\)): \(\frac{{\partial \hat{a}}}{{\partial x_{1} }}\frac{{\partial x_{1} }}{\partial s} > 0{\text{ or }}\frac{{\partial \hat{a}}}{{\partial x_{1} }} \cdots \frac{{\partial x_{i} }}{\partial s} > 0,\) \(\frac{{\partial \hat{a}}}{{\partial x_{1} }}\frac{{\partial x_{1} }}{{\partial \hat{s}}} > 0{\text{ or }}\frac{{\partial \hat{a}}}{{\partial x_{1} }} \cdots \frac{{\partial x_{i} }}{{\partial \hat{s}}} > 0,\) \(i \in \{ 2,\ldots I \}.\)

Diseconomy of scale (decreasing return) is reinforcing if a positive feedback loop connects the growth rate of output per worker with capital-output ratio and (or) its growth rate. Diseconomy of scale (decreasing return) is weakening if a negative feedback loop connects the growth rate of output per worker with capital-output ratio and (or) its growth rate.

These definitions of scale effects will be applied to B-1 and subsequent models. Moreover, a reference to Foley et al. (2019) will be helpful in uncovering factors for induced technological progress and their effects. The main idea, expressed shortly as possible, assumes that increases in value of labour power u facilitate gains in capital intensity and subsequently promote induced technological progress embodied in new technology directly or (and) in roundabout manner. On the other hand, surges in value of labour power u hinder induced technological progress if they are detrimental for the growth of capital intensity. The models considered account for these dialectical aspects.

Paradoxically, instead of only intended increasing returns, reflected in Table 5, Ryzhenkov (2009) has revealed reinforcing roundabout diseconomy of scale of types I and II (loop 2a) in initial B-1 that was objected in Boggio (2010). This objection deserves respect and requires reconsideration.

Keeping the intensive form of B-1, we refine initial B-1 by reshaping key equations. The growth rate of output per worker is determined by growth rates of capital intensity and employment ratio in the specific (augmented Kaldorian) technical progress function:

Correspondingly, the growth rate of employment ratio is defined as

Equations (23) and (24) are rather restrictive and can be generalized in a subsequent research.

Table 6 sheds light on endogenous growth of output per worker based on the proposed definitions of the scale effects as feedback loops of different nature involving the growth rate of output per worker. Loop r1 reinforces direct economy of scale (type II), whereas b1 weakens direct economy of scale (type II) illustrated by the first panel of Fig. 5. There is mostly retarding of technological progress by gains in unit value of labour power u exemplified by the second panel of Fig. 5 with a non-economic region included, where u ≥ 1. This outcome (basically preserved in L-1 in a cyclical form) is replaced by the distinct induced technological progress in L-2 below.

Run-away dynamics with increasing returns and technological progress retarded by gains in unit value of labour power in B-1, years 0–300: panel 1—scatter graphs for growth rates of net output (1) and output per worker (2) vs growth rate of employment ratio; panel 2—growth rates of capital intensity (1), and output per worker (2) vs relative wage

The refinement of initial B-1 (with s = const) enables a thoughtful comparison of the competing interpretations of increasing returns paying attention to technological progress induced or retarded by primary distribution of national income. Still the problem remains: how to solve the problem of instability due to increasing returns in theoretical models of capital accumulation and industrial cycles? Next sections contribute to the required solution.

3 The model of growth cycles L-1

3.1 The extensive form of L-1

Extensive L-1 augments refined B-1. It is assumed additionally for the state-monopoly capitalism that achieving a target employment ratio X requires, as a rule, adding a control parameter ω in (7):

where

Clearly (7) becomes a particular case of (25) for ω = 0 throughout the rest of this paper. Ryzhenkov (2013, 2021) elaborates the issue of employment targeting together with workers’ organic profit sharing.

The following soon ODE (27), first, takes into account, in agreement with Marx (1867) and Marx (1863–1883), that net change of the share of investment in the surplus product has an opposite sign in response to relative wage gains. The negative feedback of the 3rd order containing the rate of accumulation z, employment ratio v and labour value u, was implicitly expressed by Marx (1867, p. 413) as explained in Ryzhenkov (2018).

Net change of the share of investment in surplus product, first, has the same sign in response to profitability gains as surmised in (27). This equation, second, reflects capitalists’ soft targeting of the rate of capital accumulation at \(z_{{\text{b}}} = z_{{{\text{goal}}}}\); the restriction p > 0 is a prerequisite for proportional control under state-monopoly capitalism. It permits accounting for the real long-term tendency of capital accumulation rate z to decline domestically.

Third, product z(Z − z) reflects logistic dependence of \(\dot{z}\) on z that bounds trajectories in the economic phase space while a magnitude of Z codetermines amplitude of fluctuations. More complicated patterns in fluctuations of \(\frac{{\partial \dot{z}}}{\partial z}\) compared to fluctuations of z, facilitating structural stability of the first limit cycle in L-1, are matured in L-2 as Appendix 3 reveals at the end.

It is possible that in the long-term decrease (increase) of Z and z can be coordinated. However, at present, such coordination has not yet been reliably disclosed. Taking all these considerations together, ODE for capital accumulation rate z is defined as

where b ≥ 0, p > 0, \(z_{{{\text{infimum}}}} < z_{{\text{b}}} < Z \le 1\).

L-1 possesses the three extensive feedback loops involving growth of output per worker laid bare in refined B-1 (Table 6). Besides that it contains new nine extensive feedback loops due to z ≠ const defined by (27). The economic meaning is explicitly shown in Table 7.

The evolution of capitalist production relation goes through creation of new feedback loops. It also modifies a gain of a particular existing loop as well as turns a polarity of an earlier emerged loop into its opposite at a higher stage of development.

3.2 The intensive form of L-1

The intensive form of L-1 is a system of three ODEs for the relative wage u, employment ratio v and rate of capital accumulation z (27). The ODEs for u and v follow:

where again Eq. (7) is applied.

The starting form of (29) as well as the finishing approximation of (40) for L-2 below shows that these models are congruent with the macroeconomic regularity commonly named as the Okun rule. The latter states that the deviation of the growth rate of net output from its stationary magnitude regulates the net change in employment ratio. It is a form of proportional control.

The system of (28), (29) and (27) has non-trivial stationary state

where \(0 < u_{{\text{b}}} = 1 \, {-}\frac{ds}{{z_{{\text{b}}} }} < 1\), \(z_{{{\text{infimum}}}} = sd = z_{{\text{b}}} (1{-}u_{{\text{b}}} ) < z_{{\text{b}}} < Z \le 1\), \(v_{{\text{b}}} = f^{ - 1} (\hat{a}_{{\text{b}}} )\). The stationary share of investment in net output that equals zinfimum is to be lower than stationary rate of capital accumulation zb (as 0 < ub < 1).

The stationary rate of growth of output per worker, capital intensity and wage is defined as

The stationary rate of growth of fixed production assets and net product is

The constant capital-output ratio and stationary profit rate are specified as

There is the stationary employment ratio–stationary relative wage trade-off in L-1: the higher γ, the higher is the first and the lower is the second. For specification (7) of (6), we have \(\frac{{\partial v_{{\text{b}}} }}{\partial g} > 0\) and \(\frac{{\partial v_{{\text{b}}} }}{\partial r} < 0\).

An increase in stationary rate of economic growth d, ceteris paribus, affects relative wage \(u_{{\text{b}}}\) negatively; \(u_{{\text{b}}} < 1\) is true only if d > 0. The higher is rate of capital accumulation \(z_{{\text{b}}}\), the higher is stationary relative wage \(u_{{\text{b}}}\) and the lower is stationary profit rate \(R_{{\text{b}}}\). The higher is capital-output ratio s, the lower is stationary relative wage \(u_{{\text{b}}}\); still stationary profit rate Rb does not depend on s.

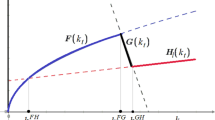

Figure 6 as well as Tables 8 and 9 reveals a condensed stock-and-flow structure of L-1 near unstable \(E_{{\text{b}}}\) (30) undergoing the first AHB. Otherwise on the place of R2 there would be a negative feedback loop of the same order. Initial vector x0 = (u0, v0, z0) is not depicted for brevity.

A condensed stock-and-flow diagram of L-1 at \(E_{{\text{b}}}\) (30) undergoing the first AHB; a total number of feedback loops is 7: first order—2 (positive), second order—3 (2—negative, 1—positive), third order—2 (2—negative)

Only one feedback loop in L-1 at the unstable stationary state for the second AHB at b = b3 differs from the first AHB at b = b0: the negative first-order feedback loop \(z\mathop{\longrightarrow}\limits^{ - }\dot{z}\) substitutes R2 \(z\mathop{\longrightarrow}\limits^{{}}\dot{z}\). Table 10 reports on quantitative differences in the most relevant partial derivatives.

3.2.1 Relative and absolute over-accumulation of capital

Positive declining profit rate \(R \, = \frac{1 - u}{s}\) (\(\hat{R} < 0\)) is the indicator for a relative excess of capital. The latter can be secular and/or cyclical.

A fundamental analysis in Marx (1863–1883) distinguishes two forms of absolute excess of capital:

-

1)

of type 1, if the fall in the profit share (unit surplus value) is not compensated through the mass of surplus labour, when the increased capital produced just as much, or even less, surplus value than it did before its increase;

-

2)

of type 2, if the fall in the profit share (unit surplus value) is not compensated through the mass of profit, when the increased capital produced just as much, or even less, profit than it did before its increase.

We will establish that relative and absolute capital over-accumulation (Fig. 17) is the necessary still not sufficient conditions for a slump in a proper crisis of industrial cycle in L-2. The scrupulous revealing of pertinent feedback loops is indeed prerequisite for the accomplishment.

3.3 Supercritical Andronov–Hopf bifurcations and self-sustained growth cycles

Parameter b from (27) has been taken as the bifurcation parameter.Footnote 4 Stable limit cycles in the economic phase space differ from each other by period and amplitude depending on a particular magnitude of the chosen control parameter.

Proposition 2 states that \(E_{{\text{b}}}\) (30) is locally asymptotically stable for 0 < b3 < b < b0. Proposition 3 establishes that the first AHB takes place at \(E_{{\text{b}}}\) for bcritical > b0 and the second one at \(E_{{\text{b}}}\) for bcritical < b3 in the system of (28), (29) and (27) (see Appendix 2 based on Ryzhenkov (2016)).

The first AHB is considered. According to simulation runs, a supercritical AHB occurs for bcritical > b0 ≈ 120.170. Then growth cycles with a period of a typical business cycle shape the economic dynamics on the transient to a closed orbit as a periodic attractor in the phase space.

It is noted that the second AHB, related to 0 < bcritical < b3 ≈ 0.675, brings about a remote analogue of the Kondratiev cycle. In this case, the limit cycle is the knife-edge property of dynamics for a particular magnitude of the control parameter very close to b3 from the left (see Table 18). The shorter limit cycle in L-1 is structurally stable contrary to the longer one (see Proposition 4).

The plausible common parameters’ magnitudes have served in simulation runs: α = 0.00586, β = 0, γ = 0.4043, p = 0.2, g = 0.06828, r = 0.0005, d = 0.00985, u0 = 0.7804 > ub = 0.6749, v0 = 0.9127 < vb = 0.92, z0 = 0.1014 < zb = 0.06575 < Z = 0.25, and s = 2.17.

In the absence of exogenous shocks supposed, fixed production assets and net output do not absolutely decline in L-1. Phases of the growth cycle will be delineated based on the profit. This aggregate reaches its local maximum on completion of the boom with the onset of the recession. Ending its fall expresses completion of recession, whereas achieving the pre-recession peak completes recovery. Depression is defined as a phase starting at the end of the recession and ending before recovery when unemployment ratio 1 – v becomes (locally) maximal.

For chosen b = bcritical = 150 > b0 ≈ 120.2, there is a movement along limit cycle from the initial phase vector x0. The period of oscillations either close to the initial vector or near \(E_{{\text{b}}}\) is about 7.5 < \(2\pi /\sqrt {a_{1} (b_{0} )}\) ≈ 8.843 (years).

Net investment is at the peak in 1.75 y. The boom ends with the highest profit in 2.5 y., the recession continues until 5.5 y., whereas the depression, as next phase, continues until the locally minimal employment ratio is reached in 7.5 y. Passing of the pre-recession local maximum of profit happens at the very end of the recovery in 8.25 y. The new boom continues until next maximum of profit in 10 y. The previous locally maximal employment ratio of 3.25 y. is observed during the recession in 10.75 y., this phase lasts until 13 y.

Investment behaviour of capitalists looks like anticipatory—the peak of investment in 1.75 y. precedes onset of relative over-accumulation in 2 y., accompanied by absolute over-accumulation judged by surplus value in 2.25 y. and absolute over-accumulation judged by profit in 2.5 y. The bottoming of investment opens the way to increases in profit rate, surplus value, profit and employment. The employment ratio lags behind these four indicators (investment, profit rate, surplus value and profit). Figure 7 and Table 11 reflect these processes for next similar cycles.

The upward arc of the profit cycle comprises 60 per cent of the cycle’s length (20.5–25 y.), the downward arc (17.5–20.5 y.)—the remaining 40 per cent. Such asymmetry is a common property of realistic business cycles models emphasized by Blatt (1983).

According to Table 11, the full cycle stretches from the 1 quarter of 10 y. through second quarter of 17.5 y. for about 7.5 years. Relative capital over-accumulation encompasses 17.25–20.5 y., absolute capital over-accumulation of type 1 presides over 17.25–20.75 y. and absolute capital over-accumulation of type 2 continues during 17.5–20.5 y. A succession of local extrema of indicators’ growth rates over 8–20 y. is presented in Fig. 7.

Why investments lead profit? It may be a shortcoming of L-1. Still capitalists can reduce investment in their anticipation of a soon onset of the recession. A competing view, not fully excluding the previous one, understands such a reduction as the manifestation of a hidden over-production and over-accumulation. Similarly, capitalists can forestall the resumption of growth of profit by fostering investment in advance accumulating fixed production assets as the precondition both for preserving and for increasing of profit.

Recall that capital is the central production relation. The very notion of capital as self-accruing value assumes a time gap between advancing capital and reaping surplus value in the money form of profit. Consequently, the capitalists’ investment behaviour is to some extent guided by their expectation (foresight) of the course of the cycle and of general long-term trend in the economic growth. Proportional control in (27) reflects this aspect. An argument on long-sightedness of the monopoly capital activity is supported by simulation experiments in Sect. 4.3.

From the other standpoint, current profits are the ultimate source of capitalists’ investment and beacon for the investment decisions. Equation (5) and derivative control in (27) mirror these aspects. Still turning profits into investments involves construction and other material delays neglected in this paper. Therefore, revealing interactions of anticipatory decisions with past decisions in capital accumulation needs more research.

In conclusion to this section, we observe that in L-1 increasing returns and technological progress hindered by gains in unit value of labour power prevail, as in refined B-1 (Fig. 8). Still instead of run-away fluctuations, the growth cycles approaching the attracting limit cycle are generated via the first AHB.

The growth cycle with increasing returns and technological progress retarded by gains in unit value of labour power in L-1, years 10–17.5; panel 1—scatter graph for growth rate of employment ratio vs growth rate of net output (1) and growth rate of output per worker (2); panel 2—scatter graph for relative wage u vs the growth rate of output per worker (1) and growth rate of capital intensity (2)

Transforming constant capital-output ratio into a phase variable is a necessary step in ascending from abstract to concrete that will deepen knowledge of increasing returns, induced technological progress and the origins of industrial cycle. Consequently, three-dimensional L-1 becomes four-dimensional L-2 that reflects the developed capitalist reality substantially better.

4 The industrial cycle in L-2

4.1 The L-2 extensive form with additional feedback loops

The well-known fact of macroeconomics is close negative relation between growth rates of the employment ratio and the capital-output ratio: slack in employment is accompanied by low rate of capacity utilization (reflected by output-capital ratio); tight labour market and high capacity utilization also complement each other.

In special cases, the rate of capacity utilization (or output-capital ratio) is adopted as a proxy for the employment rate (ratio) or the tightness of labour market. As Franke and Asada (1994) suggests, this procedure can save one state variable (employment rate), and “this simplification is justified by the high correlation of the two variables over the cycle” (Franke and Asada 1994, p. 277; see also Asada and Yoshida 2007, p. 446).

These relations are partially and rather crudely maintained as in Fig. 16. Results of elaborated statistical and modelling reality checks in Ryzhenkov (2018) uphold the existence of close negative relation between the growth rates of employment ratio and capital-output ratio among the other relations outlined. Still with the intention to dig deeper into relations between the employment ratio and the capital-output ratio over the cycle, the transformation of the latter into the phase variable is not a means for discarding the former in the present paper.

Besides that, similar to the target rate of capital accumulation, a target capital-output ratio suggests itself. Here the proportional control (mostly by monopoly capital) is likely weaker than in the previous case. These working hypotheses determine a new equation for the growth rate of the capital-output ratio (35) and corresponding ODE (36):

where \(- 1 < j_{1} < 0,\;j_{2} > 0.\) Therefore, the following mechanization (automation) function defines growth rate of capital intensity

where \(\gamma + j_{1} < 0\).

Equation (35) is taken into account in derivation of ODEs for the employment ratio and the capital accumulation rate below reflected in the extensive feedback loops for the growth rate of output per worker. Unlike B-1 and L-1, where the growth rate of output per worker equals the growth rate of capital intensity, these two variables will have counter-phases through an industrial cycle in L-2.

For defining a loop polarity the following partial derivatives of the growth rate of capital intensity are used in agreement with mechanization (automation) function (37):

By continuing differentiating (38) we get \(\frac{{\partial (k\hat{/}l)}}{{\partial \hat{k}}}\frac{{\partial \hat{k}}}{\partial u} = - \frac{{\gamma + j_{1} }}{{1 + j_{1} }}\frac{z}{s} > 0\). So the higher is the unit value of labour power the higher is the growth rate of capital intensity. Equation (39) means the higher is the capital-output ratio the lower is the growth rate of capital intensity that in turn, particularly, slows down the growth rate of output per worker in technical progress function (23).

We remember that there are one the same as well as two transformed loops involving \(\hat{a}\) from B-1 (and L-1) in L-2 (Table 6). Similarly, there are three the same as well as six transformed loops involving \(\hat{a}\) from L-1 in L-2 (Table 7). There are also four additional feedback loops involving \(\hat{a}\) in L-2 in relation to L-1—one loop due to variable capital-output ratio s and three thanks to interacting variables s and capital accumulation rate z—in L-2 (Table 12). Simulations assist in finding the resultant of all the interwoven loops together (Fig. 12).

Stabilizing positive dependence of the growth rate of capital intensity on the employment ratio, associated with competition for jobs, developed in Ryzhenkov (2009, 2018), is omitted. Stabilization of a limit cycle in L-2 could be achieved especially through increases in a magnitude of parameter j2 in (35)–(37) as stated in Proposition 8 (Appendix 3).

4.2 The L-2 intensive form and properties of its stationary state

ODE for the relative wage u (28) for s = const from L-1 is implicitly affected by the addition of ODE (36) for s, its previous form is retained in L-2 (now with s ≠ const). This extension by ODE (36) for s transforms overtly ODEs for employment ratio v and rate of capital accumulation z:

where d (32) is the stationary growth rate of net output and fixed production assets,

Correspondingly, the growth rate of profit rate is

The starting form of (40) may be considered as an extension of the Okun rule by the second proportional term related to a deviation of capital-output ratio s from its stationary magnitude sb that cannot be neglected for a high enough magnitude of j2. The finishing approximation of (40) \(\dot{v} \approx \frac{{1{-}\gamma }}{{1 + \gamma j_{1} }}(\hat{q} - \, d)v\) is the better the lower is a magnitude of j2 > 0. This approximation differs from the starting form of (29) in L-1 by a higher adjustment parameter’s magnitude \(\frac{{1{-}\gamma }}{{1 + \gamma j_{1} }} > 1{-}\gamma > 0\) at a first term related to a deviation of a growth rate of net output from its stationary growth rate.

An intensive deterministic form of L-2 uses one equation of intensive form of L-1 (now with variable s) for relative wage u (28), it replaces Eq. (29) with Eq. (40) for employment ratio v, the Eq. (41) substitutes (27), and finally, L-2 becomes four-dimensional after gaining the new level variable s that represents the capital-output ratio in ODE (36).

A positive non-trivial stationary state is defined in the system of (28), (40), (36) and (41) as

It has equivalent counterparts from Eb (30) in L-1. It is assumed for an illustrative purpose that \(s_{{\text{b}}}\) in (43) and s = const in (33) for L-1 are equal to each other. The qualitative characteristics of Eb (30) and those of Xb (43) are mostly the same. The deep-rooted interest of monopoly capital in lowering target zb and increasing target sb is illustrated below (Table 17, Fig. 13).

The control (bifurcation) parameter b in L-2 plays the similar role as b in L-1.Footnote 5 The stationary growth rates of labour force, employment, output per worker, capital intensity, net output, fixed production assets, wage, profit and surplus value are the same as in L-1 for s = sb. Tables 13 and 14 inform the reader about the new eleven feedback loops for level s in L-2 in relation to L-1 with auxiliary s = const.

The following peculiarities attract attention: there are opposite signs in the partial derivatives of \(\dot{u}\) and \(\dot{z}\), \(\dot{v}\) and \(\dot{s}\); the columns for s and u have the same signs; the opposite signs in the columns for s and u vs the column for z at the unstable equilibrium undergoing the first AHB. Besides, there is a single difference in signs of \(\frac{{\partial \dot{z}}}{\partial z}\) for the two considered AHBs—look at Table 19 and Fig. 14 in Appendix 3. Whereas stabilizing competition is a characteristic of the second limit cycle, the first limit cycle involves transition of competition to its opposite (cooperation) and back.

The same plausible parameters’ magnitudes from L-1 are applied in simulation runs with the modifications, r = 0.0004 and g = 0.05266, and extensions, j1 = − 0.82 and j2 = 0.001. The magnitudes of control parameter b are posted in Table 20.

4.3 Two typical Andronov–Hopf bifurcations and industrial cycle in L-2

The parameter b is chosen as the control parameter again. Using the Liénard–Chipart criterion, the conditions of local asymptotic stability of Xb (43) are determined after routine calculations. Using the Liénard–Chipart criterion as in Liu (1994), the author has established analytically for 0 < sbd < zb < 1 the following mathematical statement. It is recalled that a “simple” Andronov–Hopf bifurcation means that all the characteristic roots except a pair of purely imaginary ones have negative real parts.

Proposition 6

When a magnitude of the control parameter b becomes critical (twice), inequality (44) turns into equality, formerly locally asymptotically stable (LAS) stationary state Xb (43) loses stability and a closed orbit is born as a result of a simple Andronov–Hopf bifurcation (twice):

where a1, a2, a3 and a4 are parameters of the given polynomial (see Appendix 3).

A mathematical proof of this Proposition applies the results from Liu (1994) and Asada and Yoshida (2003). A supercritical nature of these both Andronov–Hopf bifurcations, although not proven analytically, is recognized in multiple simulation runs for L-2 maintained by Vensim.

This pair of supercritical AHBs causes two limit cycles. The second is a remote analogue for Kuznets cycle with the period of about 18 years; the first upholds the industrial cycle with period of about 7 years and declining net output in the outright crisis. Similar to L-1, the shorter limit cycle in L-2 is structurally stable contrary to the longer one (see Proposition 7).

Table 20 informs about the roots of the characteristic equation related to unstable stationary state Xb (43) in L-2. The trajectories, in result of the first simple AHB at Xb, approach a stable limit cycle for a very wide set of initial values in multiple simulation experiments.

Investment leads boom in crisis, yet profit rate, surplus value and profit slightly lead investment out of crisis—this lead and lag are within 1 quarter. Also within 1 quarter, employment ratio v leads net output q from boom into crisis; q slightly leads v out of crisis.

Depression is defined now as a cycle’s phase starting at the end of the crisis and ending before recovery when capital-output ratio s is (locally) maximal (Fig. 9). The leads and lags of the indicators in L-2 are in good agreement with the scientifically held view (Fig. 10). The duration of a particular cycle and its phases are in the required bounds (Table 15 and Fig. 11).

The drop of employment ratio v heralds the onset of the crisis (within 1 quarter) with a decline in net output q; on the other hand, the bottoming of net output opens the way to increases in employment ratio (within 2 quarters). The time measures in L-2 are independent of those in L-1.

Relative capital over-accumulation encompasses 291.5–294 y.; absolute capital over-accumulation of type 1 presides over the same period and absolute capital over-accumulation of type 2 continues during 291.5–293.75 y. (Table 16). A succession of local extrema of indicators’ growth rates over 291–299 y. is presented in Table 16.

Figure 12 reflects the industrial cycle properties to be compared with the run-away dynamics in B-1 on Fig. 5 and the growth cycle properties in L-1 on Fig. 8.

The industrial cycle with increasing returns and induced technological progress in L-2, years 292.25–299: panel 1—growth rate of employment ratio vs growth rate of net output (1) and growth rate of output per worker (2); panel 2—relative wage u vs growth rate of output per worker (1) and growth rate of capital intensity (2)

We see that oscillations unbound in B-1 are tamed in L-2 thanks to the enhanced role of induced technological progress maintained by the endogenous capital accumulation rate and the endogenous capital-output ratio. Still amplitude of oscillations is higher in L-2 than in L-1.

The deep-rooted interest of monopoly capital in lowering targeted zb and increasing targeted sb, stated above, can be easily simulated in L-2 as Fig. 13 and Table 17 exemplify for the three simulation runs.

The step-wise change in a parameter magnitude takes place in year t = 0. The combined effect of these two parametric changes is stronger than each separate effect. Therefore, monopoly profit expansion with a great logical certainty facilitates the observed long-term decline in the rate of capital accumulation, in the output-capital ratio (capacity utilization rate) as well as in the unit value of labour power opposing to the “neoclassical golden rule of accumulation”. These considerations also challenge the rather widespread (still hardly correct) view that short-sightedness prevails in behaviour of the capitalist class.

The empirical illustrations on Figs. 16 and 17 are rather supportive for the given descriptions of the industrial cycles and long-run tendencies. This crude resemblance does not pretend to be a substitute for sophisticated statistical tests of the congruity between L-2 and reality. Ryzhenkov (2018) reports on elaborated statistical and modelling checks through the more advanced system dynamics’ technique.

5 Conclusion

The dynamics in the Goodwin two-dimensional model M-1 without induced technical progress and without increasing returns undergo conservative cyclic oscillations around a stationary state of the centre type. The dynamics in refined two-dimensional B-1 initially from Boggio (2006) with increasing returns yet with technical progress hindered by gains in unit value of labour power undergoes divergent oscillations around a stationary state of the unstable focus type.

Enrichment of B-1 by the endogenous capital accumulation rate makes it more realistic. A number of new feedback loops reflects additional scale effects and different ways of a roundabout fostering (or retarding) of induced technological progress in three-dimensional L-1.

Technological progress induced by production (particularly distributive) relations affects the stability properties of the capital accumulation system. It usually has dual effect on economic dynamics: stabilizing through the uncovered certain feedback loops and destabilizing through other revealed feedback loops. Overly aggressive substitution of machines (automats) for living labour as stabilization policy can have the opposite unintended effect of destabilization.

The research is liberated from the outlined standard “neoclassical” assumptions (on “perfect competition” and the other that together regretfully twist the objective reality, particularly, the increasing returns and induced technological progress). The selected analytical methods of system dynamics and the mathematical theory of bifurcations provide support for the Marxist theory of capitalist accumulation moving ahead.

The investigation carried out on these foundations reveals profounder aspects of the increasing returns connected to capital-output ratio and its rate of change besides employment ratio and its rate of change considered in the earlier research of the present author. The feedback loops retarding induced technological progress as well as the loops fostering induced technological progress are uncovered. These loops depend on primary income distribution that in turn is co-determined by these loops. Setbacks in unit value of labour power facilitate the same growth rate of capital intensity and of output per worker in B-1 and L-1.