Abstract

This study extends the current New Keynesian modeling framework by changing one crucial aspect: it replaces the general equilibrium assumption by the arguably more realistic assumption of macroeconomic disequilibrium. As a result, more complex and less smooth macroeconomic adjustment dynamics result, as it is not necessary to assume that goods and labor markets continuously clear. The disequilibrium dynamics in the form of regime-dependent output-, employment-, price- and wage fluctuations complicate the decision making problems faced by the fiscal and monetary policy makers substantially. In particular, the possibility of (multiple) regime switches implies the need for deeper analysis and careful monitoring of the disequilibrium mechanisms and dynamics when designing and implementing monetary and fiscal policies.

Similar content being viewed by others

1 Background

Some theorists seem to think that full market clearing not only provides an unavoidable analytical hypothesis in general theories but also is a universal feature in market economies. Once the meaning of market clearing is explained, most laymen will have difficulty in understanding such a position, particularly in Europe. Malinvaud (1982, p. 870).

The global financial crisis that has struck in 2008 and the ensuing global recession of 2009–2012 have led to a renewed interest in macroeconomic adjustment and macroeconomic management. At a paradigmatic level, standard approaches—be they more of a neo-classical or Keynesian nature—appear to be inadequate to explain the complete patterns and persistence of fluctuations seen during the crisis. Even the recent generation of New Keynesian [including the s.c. dynamic stochastic general equilibrium (DSGE)] models appears to be able to deliver only partially adequate explanations for the observed adjustments as a result of the financial crisis. At the policy level, unconventional monetary and fiscal policy measures, like the ultra-loose quantitative easing in the USA and the large fiscal stringency plans in Europe, appeared to not have had the desired effects and are widely held to have inadequate policy responses.

In light of these experiences, this paper seeks to fill a lacuna by integrating the earlier literature on disequilibrium analysis into modern dynamic macroeconomics, resulting in a New Keynesian disequilibrium model. The strengths of disequilibrium macroeconomics are that it does not need to rely on general equilibrium principles and allows for the possibility that the economy is moving through different disequilibrium regimes over time.

The motivation of this paper is not only to analyze the interesting results of such an integration of disequilibrium analysis into modern dynamic macroeconomics. Using this approach, we also want to provide the reader with new perspectives when studying the current financial and economic crisis and the policy reactions observed. In fact, it is quite possible we like to argue that the large macroeconomic adjustments and the less effective policy strategies we observe are also caused by regime switches that occur along the way. For example, an expansionary fiscal policy that would seem effective in a Keynesian-oriented regime becomes rather ineffective in a neo-classical-oriented regime, and a fiscal consolidation regime could be counter-productive in a Keynesian-oriented regime but has more positive effects in a neo-classical-oriented regime. Moreover, such regime switches should not be seen as rare events, but can take place quite frequently our examples suggest. Regime switches imply that we do not observe the smooth, intuitive adjustment dynamics, typical for New Keynesian models, but rather non-smooth saw-toothed adjustments that are hard to predict and complicate economic policies.Footnote 1

Section 2 summarizes the main principles from the literature on disequilibrium macroeconomics. Section 3 develops a model that incorporates disequilibrium analysis into a stylized New Keynesian model. Section 4 uses simulation examples to study the dynamic properties of the macroeconomic fluctuations produced by macroeconomic shocks in the presence of such short-term macroeconomic disequilibria. Section 5 considers the effects of varying the rigidity of prices versus the rigidity of wages, one of the crucial factors in the adjustment dynamics of the model. The conclusion of the paper summarizes its main findings.

2 Disequilibrium macroeconomics: an overview

The non-Walrasian, disequilibrium approach to macroeconomics received a significant, but relatively short-lived interest in the 1970s and early 1980s, after which it became forgotten as macroeconomic research shifted again its interest to (neo-)Classical and (new/neo) Keynesian models based on the assumption of market clearing. Neo-classical models assume price and wage flexibility, while New Keynesian models assume some degree of (downward) rigidity in prices and/or wages, leading to short-run fluctuations in output and unemployment around their potential. The now standard DSGE models provide the New Keynesian model further theoretical and empirical rigor in its applications by working out microeconomic foundations and including rational agents.Footnote 2 It enables to study in detail the theoretical, empirical and policy implications of nominal rigidities in the economy. Recently, also real rigidities in labor markets and financial markets are receiving more attention, think, e.g., of the important role of labor market frictions and credit market imperfections.

However, one limitation of DSGE models remains their strict reliance on the general equilibrium assumption: these models assume equality of supply and demand and thereby disregard the possibility of (potentially persistent) disequilibria in labor and goods markets—implying rationing by the short side of the market—as exactly stressed in the earlier disequilibrium models. In particular, in the short run the assumption of macroeconomic market clearing—exemplified by the s.c. AD–AS model—is essentially a generalization of the microeconomic s.c. law of supply and demand to the macro-level.Footnote 3 In particular, in the short run the general equilibrium assumption, however, appears unrealistic and the presence of rationing more realistic. An interesting question therefore is whether we can enrich these modern mainstream macroeconomic models with the insights from the earlier disequilibrium literature, circumventing in this manner the unrealistic general equilibrium assumption.

The disequilibrium approach does not rely on the general equilibrium assumption and instead considers the possibility of significant non-market clearing—i.e., persistent divergence between supply and demand, implying rationing by the short side of the market—to explain unemployment and business cycle fluctuations.Footnote 4 It defines regimes of disequilibrium and analyses disequilibria as a result of shocks, policy adjustments and wage and price adjustments. The disequilibrium approach includes wage and price rigidities similar as these in the DSGE models, even if interpretations are different given the presence of different disequilibrium regimes: in the absence of the Walrasian auctioneer, persistent wage and price rigidities exist in the short run. Prices and wages will follow the law of supply and demand in the longer run: prices eventually increase when demand exceeds supply, and fall when there is excess supply, implying that the amount of rationing reduces over time.

It seems interesting and useful to extend the disequilibrium approach also to New Keynesian models given that these rely on the restrictive and unnecessary general equilibrium assumption, implying absence of rationing, viz. equality of demand and supply in the goods and labor market. In addition, the principles of disequilibrium are intuitive and straightforward to implement in the basic New Keynesian model as we show.

The basic disequilibrium framework in the labor market is given by the (notional) labor demand and labor supply functions, the short-side principle determining actual employment, and a nominal wage adjustment equation that incorporates the excess labor as its main element. For the goods market, a similar setup combines the (notional) aggregate demand and supply functions, the short-side principle to determine output, and a price adjustment function. The short-side principle requires that effective employment and production are determined by the minimum of supply and demand in the labor viz. goods market. Excess demand (supply) is the amount by which demand (supply) exceeds supply (demand).

The nominal wage adjustment (price adjustment) function determines that wages adjust to any (ex-ante) excess demand or supply in the labor market. Similarly, prices adjust to an excess demand or supply in the goods market.Footnote 5 This process of adjustment of wages and prices to disequilibria is sometimes referred to as the Bowden-process, after Bowden (1978). Important for the adjustment dynamics is also knowledge about the adjustment speed of prices relative to wages. In the orthodox Keynesian case, prices adjust faster than wages, while in the Neo-Keynesian case, wages adjust faster than prices. Clearly, both cases differ as a result in the adjustment of real wages after a shock, as we show in Sect. 5.

Disequilibrium analysis distinguishes four different macroeconomic regimes: (1) Keynesian Unemployment (KU) is characterized by excess supply in the goods and labor market, (2) Classical Unemployment (CU) is characterized by excess demand in the goods market and excess supply in the labor market,Footnote 6 (3) Repressed Inflation (RI) occurs in case of excess demand in both the goods and labor market and (4) Labor Hoarding/Underconsumption (LH) results in case of excess supply in the goods market and excess demand in the labor market. Concerning goods market conditions, (1) and (4) reflect Keynesian—and (2) and (3) neo-classical paradigms.

Each regime has also its own policy prescriptions. The Keynesian unemployment regime focuses on monetary and fiscal stimuli to increase output and employment back to equilibrium as it presumes that the equilibrating force from adjustment of prices and wages is inherently slow. The classical unemployment regime concentrates on reducing real wages to increase employment; reducing taxes on labor income, e.g., contributes to this. The repressed inflation regime requires restrictive monetary and fiscal policies to reduce inflation. The labor hoarding regime needs an increase in real wages to restore equilibrium in goods and labor markets.

Complications for the policy makers also arise from the possibility (or rather likeliness) that the economy moves over time from one regime to another, implying that policies that would seem adequate before become much less so after the switch. We find indeed that regime switches occur quite often in our model even in case of simulations of only small shocks and that the regime shocks change the adjustment dynamics in significant manners. A disequilibrium model with regime switches behaves in an intrinsically nonlinear manner due to the occurrence of regime switches. Its adjustment dynamics are therefore qualitatively different from the smooth adjustment dynamics of a typical DSGE model, and it produces as a result also very different policy prescriptions.

3 A stylized New Keynesian model with disequilibrium regimes

The previous section summarized the main principles of disequilibrium analysis. In this section, we build these principles into a stylized New Keynesian model. New Keynesian models work out three basic building blocks: (1) aggregate demand: the dynamic IS curve, (2) short-run aggregate supply fluctuation around the natural rate of output: the New Keynesian Phillips curve, and (3) macroeconomic policy management: in particular the well-known Taylor rules of monetary and fiscal policies. See, e.g., Sbordone et al. (2010) and Erceg et al. (2000) for an insightful introduction to New Keynesian modeling. Note that small-sized DSGE models also can be summarized by the same three dynamic relations (DSGE models having then a full underlying structural modeling-based microeconomic foundations). See, e.g., Svensson (2000), Jensen (2002) and Soederstroem et al. (2005) for insightful examples that are our point of reference here.

The dynamic IS curve summarizes the aggregate goods demand in the economy:

in which y denotes (real) output, i the short-term nominal interest rate, \(\pi\) the rate of inflation in the general price level. The primary fiscal balance, \(d^{\mathrm{P}}\), equals government revenues, f, minus (non-interest) government spending, g: \(d^{\mathrm{P}}=f-g\). \(\overline{r}\) is the equilibrium real interest rate. \(v^{\mathrm{d}}\) is an aggregate demand shock. Variables are given in logarithms and refer to linearized deviations from an initial steady-state. The subscript t refers to period t.

In this reduced form, output depends on past output, expected future output, the real interest rate (expressed as a deviation from the equilibrium real interest rate), net government spending, and a demand shock.Footnote 7 The backward-looking component in the IS curve results from habit formation in consumption decisions.Footnote 8 The forward-looking part is produced by rational, inter-temporally maximizing agents that apply the principles of optimal consumption smoothing and seek to optimize their labor and leisure choice.

Aggregate supply of goods is produced using a linear production function. Since capital is held constant for simplicity, labor, \(l_t\), is the only flexible input in the production function; in addition, supply is subject to stochastic technology/productivity shocks, \(v^a\),

Disequilibrium analysis allows that aggregate demand and supply do not match. Instead, output is determined by the minimum rule/short-side principle referred to in Sect. 2: actual production is determined by the short side of the goods market (implying that demand or supply is effective or notional depending on whether it is rationed or not):

The difference between demand and supply is referred to as excess supply. It acts as a measure of the degree of disequilibrium/rationing in the goods market:

In the labor market, similar mechanisms operate as in the goods market, including the disequilibrium dynamics. Labor demand and labor supply result from profit maximization by producers and utility maximization on part of consumers, respectively. Labor demand depends negatively on the producer gross (i.e., pre-tax) real wage costs and positively on output and a stochastic disturbance, \(v^{l_{{{\mathrm{d}}}}}\). Labor supply depends positively on consumers net (i.e., post-tax wage) real wage and a stochastic disturbance, \(v^{l_{{\rm s}}}\):

Actual employment is determined by the short side of the labor market (implying that labor demand or supply is effective or notional depending on whether it is rationed or not):

The difference between labor demand and labor supply is referred to as excess labor supply. It acts as a measure of the degree of disequilibrium/rationing in the labor market viz. unemployment:

The Walrasian general equilibrium only occurs when any excess supply or demand in the labor and goods market is removed (\(y^{\mathrm{exc}}_t=l^{\mathrm{{exc}}}_{t}=0\)).Footnote 9 In the absence of further shocks, prices and wages in the Walrasian equilibrium remain constant.

Outside the Walrasian equilibrium, disequilibrium analysis relates price and wage adjustment to the disequilibria in the goods and labor market as defined above. It predicts that in principle prices will rise (decrease) as a reaction to excess demand (supply) in the goods market. Similarly, in the labor market, wages will rise (decrease) as a reaction to excess demand (supply) in the labor market. Depending upon the size of the elasticity of prices (wages) to excess supply in the goods (labor) market, this adjustment may take a shorter or longer period of time and be complicated by regime switches that could occur.

The excess goods supply and excess labor supply variables, \(y^{\mathrm{exc}},l^{\mathrm{exc}}\), are useful summary indicators of the degree of disequilibrium in goods and labor markets and the distance of the disequilibrium model with the standard NK/DSGE model: with small disequilibria the model will closely resemble a the standard NK model, but at larger disequilibria the model behaves increasingly different.

We can summarize the price and wage adjustment/setting behavior in the form of Phillips curve-type relations that are similar to the ones standard in the New Keynesian framework. Price inflation is given by a hybrid Phillips curve which contain elements of both forward- and backward-looking price setting. In addition, demand-pull and cost-push factors (in particular increases in taxes) may affect inflation,

Inflation equals the first difference of the general price level, p, and is assumed to be a function of past inflation, expected future inflation, excess demand (4),Footnote 10—reflecting demand-pull inflation—tax increases, and cost-push (or mark-up) shocks, \(v_t^{\mathrm{p}}\).Footnote 11

Wage inflation/wage setting, πw, is given by a similar hybrid Phillips curve,

where \(v_t^{\mathrm{w}}\) denotes a wage shock. Monetary policy is set according to a standard simple Taylor rule of the following form:

with the target interest rate being equal to the equilibrium real interest plus the inflation target: \(\overline{i}=\overline{r}+\overline{\pi }\). \(v_t^i\) denotes an interest rate shock. The feedback on the output gap (i.e., the difference between current output and the potential output level),Footnote 12 and inflation are standard arguments in the Taylor rule. The preference for instrument smoothing is measured by the value of \(\lambda _i\), where \(0 \le \lambda _i \le 1\). If \(\lambda _i\) goes to zero, the original Taylor rule, which ignores instrument-smoothing objectives, is obtained. If \(\lambda _i\) goes to one, monetary policy no longer reacts to current inflation and output.

Concerning fiscal policy, we assume that government spending and tax revenues are also determined by simple autoregressive fiscal policy rules that relate government spending/fiscal revenues to past levels, to current output viz. the cyclical fiscal stance—measuring the automatic stabilizers—the level of government debt, b, and the occurrence of spending and revenue shocks, \(u^g\) and \(u^f\):

where \(0\le \lambda _{g,f} \le 1\).

The fiscal policy rules enables to represent in the model—albeit in a highly stylized way—the various budgetary rules and strategies one may observe in practice (think, e.g., of the EUs Stability and Growth Pact). If \(\lambda _{g,f} = 0\) fiscal flexibility at a maximum and the fiscal balance only driven by the automatic stabilizers. If \(\lambda _{g,f}\) increases, fiscal flexibility declines implying more persistence in fiscal adjustments. In the limiting case where \(\lambda _{g,f} = 1\), fiscal deficits do not adjust at all over time. The budgetary target \(\overline{f}-\overline{g}\) can be thought, e.g., as being the close-to balance or in surplus medium term objective, reflecting a preference for long-run sustainability and neutrality. The concern about debt stabilization is reflected in the \(\delta _{g,f}\)’s that measure the feedback of the debt level on government primary spending and revenues.

Finally, debt dynamics are determined by the dynamic government budget constraint which relates the stock of government debt to its past level and the deficit d. The deficit consists of by definition of the interest payments plus the primary deficit, the difference between government spending (excl. interest payments) and revenues,

Interest payments (in real terms) on government debt equal the stock of outstanding debt at the start of the period times the difference between the nominal interest rate and inflation.Footnote 13

4 Simulations with the NK disequilibrium model

This section uses simulations to illustrate a number of insights that can be obtained from the macroeconomic disequilibrium model introduced in Sect. 3. In these simulations, we in particular want to obtain insights into the possible effects of fiscal consolidation strategies and macroeconomic shocks. First, we simulate the effects of various macroeconomic shocks: (1) fiscal policy innovations, (2) monetary policy shocks, (3) wage shocks and, (4) productivity shocks. All shocks will be unanticipated, one percent in size and hit the economy in period 1. All effects imply percentage deviations from an initial steady state. Measurement is in percentage points, so a value of 0.01 implies a one percentage deviation.

The impulse response functions of the shocks provide insights into the propagation dynamics of the shocks, including the transmission of macroeconomic policies. Variances and welfare losses resulting from the shocks can be used to analyze volatility and efficiency. We also look at the effects of varying the degree of price flexibility relative to the degree of wage flexibility. As noted in the literature, this aspect is of importance in the controversy between orthodox and Neo-Keynesians. We find that this also is of importance in the disequilibrium model.

Underlying all the simulations in this section is a set of baseline model parameters; see Table 1. In the absence of estimated parameters of our model, we rely on this set of baseline guesstimates of these parameters, having the euro area economy in mind as an example. So while this analysis did not attempt to estimate the model for the euro area, we choose this set of baseline parameters that would broadly consistent with estimated New Keynesian euro area models such as the ECBs Area-Wide Model (Dieppe and Henry 2004; Coenen et al. 2008) and the Smets and Wouters (2003) model.

The baseline parameters concern: (1) the hybrid IS and Phillips curves (lines 1, 3 and 4), (2) labor demand and supply (line 2), (3) parameters that characterize monetary policy (line 5) and fiscal policy rules (lines 6 and 7), (4) assumptions on policy preferences (line 8) and variances and autocorrelations of shocks (line 9). Empirical studies suggest that the euro area economy is characterized by a (1) substantial degree of backward lookingness in output and inflation, (2) a substantial degree of deficit and interest rate smoothing in the policy rules, government revenues and spending that are strongly dependent on output and fiscal multipliers that are close to but smaller than 1; see, e.g., European Commission (2005) for empirical estimates on budgetary elasticities and Spilimbergo et al. (2009) on fiscal multipliers.

Naturally, outcomes may be more or less specific to this set of baseline assumptions. In case of small changes in the parameters, the differences compared to the baseline are typically of a quantitative nature rather than a qualitative nature. If changes get larger, the results can also change qualitatively. Many parameters have been estimated in other papers so that for most parameters there is certainly an amount of empirical plausibility to these values.

4.1 A government revenue shock

A first interesting example concerns the effects produced in the model by a temporary one percent increase in government revenue, introduced, e.g., in the form of a fiscal consolidation effort. The budgetary shock is implemented as a one-time, one percent innovation.Footnote 14 Figure 1 gives the adjustment dynamics that result.

Increases in taxation do not only improve fiscal balances and reduce debt accumulation, but also produce a mix of negative Keynesian type of spending effects in the goods market and negative neo-classical type labor market effects in the short run: output and employment decline in the short run.

Interestingly, adjustment is far from the smooth patterns that the standard New Keynesian/DSGE model will produce after the same macroeconomic shock. The underlying reason is that several regime switches that occur: the different type of regimes alternate fairly quickly as a function of the changing disequilibrium conditions: regime switches result when the excess labor supply and/or excess goods supply variables change sign. This alternating regimes produces nonlinearities in the adjustment dynamics: after a regime switch the economy adjusts in a decisively different manner than before the regime switch. The regime switches, in other words, imply that the economy adjusts fundamentally different than general equilibrium models like a comparable DSGE model.Footnote 15 Instead of the smooth adjustment typical of DSGE models, regime switches lead to a non-smooth, saw-toothed adjustment behavior.

Prices and wages start to adjust due to the disequilibria in goods and labor markets. Prices and nominal wages—and therefore—real wages are important drivers of the dynamic adjustments and regime switches. In our parameter setting, prices are somewhat more sensitive to excess supply and taxation than wages, resulting in stronger adjustment and initial real wage decreases.

Because of the presence of the different disequilibrium regimes, the model while continuous—displays non-symmetric, nonlinear saw-toothed behavior as the economy moves from one regime to another. Also, a positive shock is unlikely to display the opposite behavior of a negative shock of the same size since it is highly unlikely that the economy would only remain in the same disequilibrium regime during the entire adjustment process produced by these shocks.Footnote 16

Designing optimal monetary and fiscal policies/policy rules is one of the most often addressed research questions in DSGE models (together with other aspects concerning efficiency). In the presence of regime switches, this is even more complicated as the dynamics are even more complex and essentially non-differentiable at the time of a regime switch.

4.2 A monetary policy shock

A second interesting policy innovation is a monetary policy shock. Figure 2 displays the impact of a temporary positive monetary shock (in the form of a one-time negative one percent innovation to the interest rate in period 1).

The economy is stimulated by this monetary impulse, but also price and wage inflation pick up, so that initially a repressed inflation regime results. In the labor market, the real wage reduction depresses labor supply and employment declines as labor demand is rationed throughout the adjustment. Also this shock gives rise to alternating disequilibrium conditions and saw-toothed adjustment as the economy and policies adjust to the shock over time. Note that the reduction of interest rates also has an additional impact on public finances, as it reduces the interest burden and therefore the fiscal balance and debt accumulation.

4.3 Effects of wage shocks

Wage and price adjustments in reaction to disequilibrium conditions are at the core of the disequilibrium model. In combination, they determine the real wage that is a crucial factor in the adjustment of the labor market. It is therefore interesting to consider the impact of wage and price shocks and trace their effects. In this third example, we focus our attention on wage shocks: wage shocks (or wage policies for that matter) are indeed an important source of macroeconomic shocks and fluctuations in practice. Figure 3 displays the effects of a temporary one percent wage increase.

The wage shock moves the economy into the neo-classical regime where the increase of real wage costs is the source of a depressed labor market. Labor supply is clearly rationed by the lack of demand. This also depresses the goods market where supply declines and rations the increased demand. Interest rates rise because of inflation and the fiscal balance deteriorates somewhat because of the fall in output. Over time, the economy moves essentially between the neo-classical and Keynesian regime. Clearly, the positive wage shock in this setting is not an efficient instrument to stimulate the economy. In fact a form of stagflation is produced in the short run: higher unemployment and inflation result, compared to the initial equilibrium.

4.4 Effects of productivity shocks

Productivity shocks of all sorts are continuously impacting the economy. These supply-side shocks have the special feature of lifting output supply as productivity of workers is higher. In Fig. 4, the effects of a persistent increase in productivity here by one percent are displayed (a shock persistency parameter of 0.9 is assumed, a value that is close to values that empirical studies on productivity shock typically find and in the range of values that is also used in many DSGE models).

The positive productivity shock places the economy initially in the Keynesian regime as demand trails the increase in supply. Interest rates decline initially as inflation declines due to the excess supply in the goods market. Prices and wages decline as supply exceeds demand. Also in this case, the adjustment dynamics result in a sequence of regime changes inducing the saw-toothed adjustment patterns and adjustments that are quite different from results of a persistent productivity shock in a comparable DSGE model.

4.5 Varying price versus wage flexibility: real rigidities

Price and wage rigidities play a crucial role in the adjustment dynamics produced by macroeconomic shocks. The omnipresence of contracts, customer relations, kinked demand curves and menu costs are the most important theoretical explanations for the occurrence of rigidities in prices and wages. A recent large-scale research project has studied in detail the extent of rigidities in prices and wages at the micro-level in the Euro Area (Hoeberichts et al. 2006; Bertola et al. 2012).

Wage and price dynamics are regime dependent in the disequilibrium model: wages and prices adjust depending on the current regime, and over time regime switches may occur which will imply a change in the adjustment dynamics of wages and prices, due to the changes in the rationing conditions in goods and labor markets.

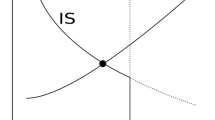

Wages and prices also enable to determine the regimes and regime switches in case wage or prices change. Figure 5 characterizes the rationing regimes in terms of alternative price-wage combinations.

Price and wage dynamics will ultimately steer the economy toward the Walrasian equilibrium W, but this may take a long time and take the goods—and labor through a series of regime switches. Formal dynamic analysis in the model with regime switches is clearly more complicated than in the standard NK model. In principle, dynamics depending on the model parameters may take a variety of forms: from globally stable, saddle-point stable to globally unstable.Footnote 17

In the model, price and wage rigidities were reflected by (1) the parameters \(\omega ^{\mathrm{p}},\omega ^{\mathrm{w}}\) which measure the nominal price and wage rigidities, viz. the degree of backward-looking in price and wage setting, and (2) the parameters \(\gamma ^{\mathrm{p}},\gamma ^{\mathrm{w}}\) which measure the adjustment of prices and wages to excess supply in the goods and labor markets respectively, these are measures of real rigidities in prices and wages. In the context of disequilibrium, in particular real rigidities in goods and labor market are an interesting aspect as these make that the adjustment toward the long-run Walrasian equilibrium depends on the different disequilibrium regimes after the economy is hit by various types of shocks.

In our examples, so far nominal rigidities of prices and wages were equal at a value of 0.5, and we assumed that real wage rigidities are stronger than real price rigidities: we assumed that \(\gamma ^{\mathrm{p}}=0.2\) and \(\gamma ^{\mathrm{w}}=0.04\). While it is often considered more realistic that wages are more rigid than prices, it could also be relevant/interesting to consider the implications of higher rigidities in prices than in wages, e.g \(\gamma ^{\mathrm{p}}=0.04\) and \(\gamma ^{\mathrm{w}}=0.2\). To illustrate the effects of changing the parameters in this way, we rerun the example of the wage shock above so that we can compare with this new case with higher price rigidity (or lower price flexibility for that matter) with the previous case of higher wage rigidity. Figure 6 shows the adjustments produced by the same one-time one percent positive wage shock.

Compared to Fig. 3, it is seen that quite different adjustments are produced by the same wage shock in case different assumptions concerning price and wage rigidity are chosen. While there is similarity in direction of effects, timing and size of adjustments and regime alternations are quite different in both cases.

5 Conclusion

The global financial and economic crisis poses formidable tasks and responsibilities on the shoulders of policy makers. Economists have been blamed for not being able to explain or to have foreseen the impact and unfolding of the macroeconomic shocks and to deliver adequate policy analysis.

Aim of this paper was to contribute to a better understanding of macroeconomic fluctuations and the dynamics of the economic and financial crisis: our contribution focused on dropping the general equilibrium assumption and introducing disequilibrium analysis into a stylized New Keynesian model. A weakness or limitation of the standard New Keynesian model lies possibly exactly in the excluding of disequilibrium/rationing in goods and labor markets. Disequilibrium models on their turn focus exactly on such disequilibria and consider the possibility of rationing and regime switches explicitly.

Disequilibrium analysis complicates considerably the dynamics and analysis compared to the standard New Keynesian model. The presence of different disequilibrium regimes implies that the dynamics of the model are dependent on the disequilibrium regime. This impacts, e.g., on the transmission of shocks and the transmission of macroeconomic policies. Our examples of fiscal and monetary policy innovations, wage, and productivity shocks found that regime switches occur easily and frequently and that adjustment behavior as a result is typically of a saw-toothed nature and asymmetric rather than the familiar smooth and symmetric adjustment patterns that the same shocks produce in DSGE models.

Relating back to the economic and financial crisis, our results hint at the possibility that considering regime switches may be helpful for a better understanding of the complex adjustments produced by the global financial crisis. It seems unlikely that the shocks and their transmissions produced by the global financial crisis can only be understood from either a Keynesian or neo-classical perspective and in fact may have produced a series of regime switches as disequilibrium conditions change over time.

Much work would remain to be done to work an in-depth analysis of the financial and economic crisis with the model: a full empirical estimation would be required and simulations of multiple shocks and policy scenarios be worked out to take more into account the complexity of it. A robustness analysis would also need to be considered as it is very unclear how robust the complex dynamics produced by the regime switches are with respect to small parameter changes. Our example with the change in rigidities of prices and wages suggested already that adjustment behavior changes considerably from a change the assumptions of the relative rigidities in wage and prices, since a change disequilibrium dynamics changes also the timing of regime switches. Work is also required to take into account the financial sector and the possibility of financial frictions and financial accelerator mechanisms.

Designing optimal monetary and fiscal policy (rules) would be another formidable challenge for the model. While it appears feasible in principle to design also here optimal policies, the possibility of regime switches of course complicates greatly the tasks for monetary and fiscal policy makers when designing and implementing their strategies. The complexity introduced by regime switches seems to increase even more the need to avoid policy errors since largely unintended effects may be produced. In that respect, the unorthodox policy measures implemented to combat the global economic and financial like the quantitative easing policy in the USA and fiscal austerity in Europe—crisis need to remain subject of close scrutiny as this margin to commit policy errors without substantive consequences appears even smaller in a disequilibrium setting.

Notes

In the original disequilibrium literature, Hool (1980) focuses on the complications of disequilibrium for monetary and fiscal management.

See, e.g., Clarida et al. (1999) and Woodford (2003) for all details on DSGE models and their empirical verification. It is important to note that the general equilibrium assumption, apart from its theoretical appeal and consistency, also at the same time enables the researcher to solve important identification problems concerning demand and supply at the empirical level.

It goes without saying that the general equilibrium (aka Walrasian or market clearing) theory is the dominant research paradigm in economics to describe and understand the workings of market economies. Much effort has been devoted on questions relating to the existence, uniqueness, stability and efficiency of general equilibrium. Clearly, we can not summarize here all features and results of this research program. For a detailed epistemological account of general equilibrium theory, see, e.g., Bryant (2010).

See, e.g., Barro and Grossman (1971), Grossman (1971, 1973), Benassy (1975), Malinvaud (1982), German (1982) and Cuddington et al. (1984) on the foundations of disequilibrium analysis. A fully worked out macro-econometric disequilibrium model is found in Arcand and Brezis (1993). Benassy (1993) attempts to fit the disequilibrium approach into a general equilibrium model with Keynesian and imperfect competition elements, seeking to creating a synthesis of Walrasian, Keynesian, and imperfect competition paradigms. This, however, amounts in the end to imposing again the general equilibrium assumption/removing the possibility of rationing. Disequilibrium in money and capital markets (credit rationing) can also be included in the disequilibrium model as, e.g., in Varian (1977) and Sealey (1979). Empirical applications of disequilibrium theory are found in Broer and Siebrand (1985) (on the Netherlands), Sneessens and Dreze (1986) (on Belgium), Franz and Koenig (1990) (on Germany) and Lambert (1990) (on France).

Including disequilibria in the capital market as a third source of disequilibria would further extend and complicate the analysis and will not be considered here.

The extreme form of the Classical unemployment regime represents stagflation with increasing unemployment and high inflation.

All macroeconomic shocks—demand shocks (\(v^{\mathrm{d}}\)), cost-push shocks (\(v^{\mathrm{p}}\)), wage shocks (\(v^{\mathrm{w}}\)) fiscal shocks (\(v^{\mathrm{f}},v^{{g}}\)), supply shocks (\(v^a\)), labor demand and labor supply shocks, (\(v^{\mathrm{ld}},v^{\mathrm{ls}}\)) and interest rate shocks (\(v^{\mathrm{i}}\))—are all assumed to follow stationary AR(1) processes, where all innovations are white noise innovations, and all innovations are assumed to be contemporaneously uncorrelated.

Clearly, one would like to think of the Walrasian equilibrium as an unique and stable steady-state of the model, and the economy would reach in the long run. In the absence of externalities, coordination failures and other types of inefficiencies it would result from the invisible hand of the Walrasian auctioneer and would also act as a Nash equilibrium. Picard (1993) reviews in detail the microeconomic foundations of disequilibrium models and the stability of adjustment in different regimes.

The role of excess supply is here therefore relatively similar as the role of the output gap in the standard New Keynesian Phillips curves in the literature.

If \(\omega\) = 0, we obtain the backward-looking Phillips curve, if \(\omega\) = 0; on the other hand, we obtain the forward-looking New Keynesian Phillips curve, and the hybrid Phillips curve results if \(\omega\) lies in between 0 and 1. It assumes that both backward- and forward-looking price setting are present, reflecting, e.g., learning effects, staggered contracts or other institutional arrangements that affect pricing behavior.

Potential output equals the equilibrium amount of output that can be produced given the current technology with production factors used at full capacity, \(\overline{y}_t=\overline{l}+v_t^a\) where \(\overline{l}\) denotes the full employment level of employment. DSGE models analyze the fluctuations around potential output in the presence of price and wage rigidities but maintaining a general equilibrium assumption, in contrast to disequilibrium macroeconomics where fluctuations are not limited by the general equilibrium assumption and regimes of rationing operate in the short run in goods and labor markets as explained in Sect. 2.

A risk premium on government debt could be added to (14) if government solvency issues would start to matter with growing debt, we abstain from this possibility here, though.

One-time shocks have the advantage that shock and transmission can be clearly distinguished, in case of persistent shocks such a distinction is no longer feasible.

This is seen in the adjustment dynamics produced in the graphs: while continuous, the model is non-differentiable at regime switches. This gives the characteristic non-smooth, nonlinear saw-toothed adjustment in the graphs.

This therefore in contrast to the linear New Keynesian/DSGE models who always a “symmetric” adjustment where the effects of a positive shock mirror the effects of a negative shock of the same size.

In the presence of regime switches, the proper stability concept is the s.c. Filippov (in)stability solution, see Cuddington et al. (1984).

References

Arcand J, Brezis E (1993) Disequilibrium dynamics during the great depression. J Macroecon 15(3):553–589

Barro R, Grossman H (1971) A general disequilibrium model of income and employment. Am Econ Rev 61(1):82–93

Benassy J (1975) Neo-Keynesian disequilibrium theory in a monetary economy. Rev Econ Stat 42(4):503–523

Benassy J (1993) Nonclearing markets: microeconomic concepts and macroeconomic applications. J Econ Lit 31(2):732–761

Bertola G, Dabusinskas A, Hoeberichts M, Izquierdo M, Kwapil C, Montorns J, Radowski D (2012) Price, wage and employment response to shocks: evidence from the WDN survey. Labor Econ 19(5):783–791

Bowden R (1978) Specification, estimation and inference for models of markets in disequilibrium. Int Econ Rev 19(3):711–726

Broer D, Siebrand J (1985) A macroeconometric disequilibrium model of product market and labor market for the Netherlands. Appl Econ 17:633–646

Bryant W (2010) General equilibrium. Theory and evidence. World Scientific Publishing Co, Singapore

Clarida R, Gali J, Gertler M (1999) The science of monetary policy: a New-Keynesian perspective. J Econ Lit 37:1661–1707

Coenen G, Mohr M, Straub G (2008) Fiscal consolidation in the euro area: long-run benefits and short-run costs. Econ Model 25(2):912–932

Cuddington J, Johansson P, Loefgren K (1984) Disequilibrium macroeconomics in open economies. Basil Blackwell, Oxford

De Grauwe P (2009) DSGE-modelling when agents are imperfectly informed. ECB Working Paper Series no. 897. European Central Bank, Frankfurt

Dieppe A, Henry J (2004) The euro area viewed as a single economy: how does it respond to shocks? Econ Model 21(5):833–875

Erceg C, Henderson D, Levin A (2000) Optimal monetary policy with staggered wage and price contracts. J Monet Econ 46:281–313

European Commission (2005) New and updated budgetary sensitivities for the EU budgetary surveillance. European Commission Directorate General Economic and Financial Affairs, Brussels

Franz W, Koenig H (1990) A disequilibrium approach to unemployment in the Federal Republic of Germany. Eur Econ Rev 34:413–422

German I (1982) Disequilibrium dynamics and the stability of quasi equilibria. Q J Econ 100(3):571–596

Grossman H (1971) Money, interest and prices in market disequilibrium. J Polit Econ 79(5):954–961

Grossman H (1973) Aggregate demand, job search, and employment. J Polit Econ 81(6):1353–1369

Hoeberichts M, Ivarez LJ, Dhyne E, Kwapil C, Le Bihan H, Lnnemann P, Martins F, Sabbatini R, Stahl H, Vermeulen P, Vilmunen J (2006) Sticky prices in the euro area: a summary of new micro-evidence. J Eur Econ Assoc 4:575–584

Hool B (1980) Monetary and fiscal policies in short run equilibria with rationing. Int Econ Rev 21:301–316

Jensen H (2002) Targeting nominal income growth or inflation? Am Econ Rev 92(4):928–956

Lambert J (1990) The French unemployment problem. Lessons from a rationing model relying on business survey information. Eur Econ Rev 34:423–433

Malinvaud E (1982) Macroeconomic theory. Volume B: economic growth and short-term equilibrium. Elsevier Advanced Textbooks in Economics, vol 35. New York

Milani F (2009) Adaptive learning and macroeconomic inertia in the Euro Area. J Common Mark Stud 47(3):579–599

Picard P (1993) Wages and unemployment. A study in non-Walrasian macroeconomics. Cambridge University Press, Cambridge, ISBN 0521350573

Sbordone AM, Tambalotti A, Rao K, Walsh K (2010) Policy analysis using DSGE models: an introduction. Econ Policy Rev 16(2):21

Sealey C (1979) Credit rationing in the commercial loan market: estimates of structural model under conditions of disequilibrium. J Financ 34(3):689–702

Smets F, Wouters R (2003) An estimated stochastic dynamic general equilibrium model of the Euro Area. J Eur Econ Assoc 1(3):1123–1175

Sneessens H, Dreze J (1986) A discussion of Belgian unemployment combining traditional concepts and disequilibrium econometrics. Economica 53:S89–S119

Soederstroem U, Soederlind P, Vredin A (2005) New-Keynesian models and monetary policy: a re-examination of the stylized facts. Scand J Econ 107(3):521–546

Spilimbergo A, Symansky S, Schindler M (2009) Fiscal multipliers. IMF Staff Position Note SPN/09/11, New York

Svensson L (2000) Open-economy inflation targeting. J Int Econ 50(2):155–183

Varian H (1977) The stability of a disequilibrium IS-LM model. Scand J Econ 79:260–270

Woodford M (2003) Interest and prices: foundations of a theory of monetary policy. Princeton University Press, Princeton, ISBN 0691010498

Acknowledgements

I would like to thank Dominik Hirschbuehl, an anonymous referee and seminar participants at Statec and Muenster University for insightful remarks on the subject matter.

Competing interests

The author declares that he has no competing interests.

Funding

The author declares that no funding was obtained.

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

van Aarle, B. Macroeconomic fluctuations in a New Keynesian disequilibrium model. Economic Structures 6, 10 (2017). https://doi.org/10.1186/s40008-017-0070-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40008-017-0070-2