Abstract

The purpose of the study was to identify the factors that influence senior management for adopting blockchain technology in the banking industry in general and Islamic banking in particular. Furthermore, the research addressed the moderating role of technological turbulence as it holds a significant hindering role. This study employed the analytical approach, and the data were collected through questionnaires distributed to several senior management employees in both the Jordan Islamic Bank and the Islamic Arab Bank. The research instrument was developed and confirmed by the experts in the field. For identifying the significance of the variables incorporated in the researchers applied structural equation modeling technique. The findings revealed that economic efficiency, bank security, customer expectations, education, training and preparation all are significant predictors of readiness for implementing blockchain technology in the Islamic banks in Jordan. The study concluded that blockchain technology should be adopted by all Islamic banks because of its advantages and also the management needs to be educated regarding the same; they should be provided appropriate training.

Similar content being viewed by others

Introduction

Data science is considered an inter-disciplinary field, and it is now experiencing a quantum shift with the arrival of deep learning technology. Deep learning uses multiple layers to extract valuable information from structured, semi-structured, and even from unstructured data. The communications and information technology sector has witnessed rapid and successive developments including the emergence of the Internet (Asad et al., 2020), artificial intelligence (Fadhel et al., 2022; Ganguly, 2022), smart contracts, and open-source software (Asif et al., 2021b), which can all be used and adapted within the Sharia provisions to serve business organizations in general and Islamic banking in particular (Asad et al., 2018a). It needs to be considered that any prevailing option may not be available in future especially the advantageous cost effects and the competitive nature of efficiency which can be achieved through the use of these technologies which are now a days crucial for the banking safety (Alsmadi et al., 2022). These advantages triggered many banks and companies in different sectors in the Western world to apply this technology as quickly as possible (Damer et al., 2021). This is due to the advantages provided by these technologies (Abdennadher et al., 2022), whether at the level of services to customers (Amir & Asad, 2018), or in the implementation of commercial operations, or in enhancing confidence between the parties involved in Islamic banking (Kakkattil, 2019).

Information technology has numerous advantages including in terms of reducing costs (Khalil et al., 2018), assisting the government sector in digital transformation processes (Majali et al., 2022), achieving transparency and banking safety (Asad et al., 2021c), and monitoring account holders and deposits for the businesses practiced by the management of Islamic banks towards investing their money efficiently and safely (Lukonga, 2021). Despite the great importance of information technology and its impact on the business and services provided by banks to customers, there is still a slowdown in the response to the application of this technology among management officials in Islamic banks (Al-Okaily et al., 2022).

Another important aspect which should not be ignored is related to the turbulent environment (Asad et al., 2021c). In the era of technological advancement or informational technological advancement, the acceptability, and the sustainability of blockchain technology along with all other factors is highly dependent over the technological factor specifically informational technological turbulence considering as Technological Turbulence (Chatterjee et al., 2022) and Banking sector are relatively more exposed to it as they are highly linked than other organizations (Asad et al., 2018a). However, technological turbulence is incapable of directly influencing the mindset (Chatterjee et al., 2021), but can influence the relationship between factors influencing the adoption of blockchain technology and adoption of blockchain technology (Malik et al., 2021a, 2021b).

The main reason behind lack of using any latest technology in any organization is the backward mindedness of the leadership (Asif et al., 2021a) at the same time technological turbulence also influence the impact of factors that promotes adoption of blockchain technology (Hammami et al., 2021; Ullah, et al., 2021a, 2021b). Therefore, ignoring the use of these technologies, Islamic banks are lagging far behind in real competition with traditional banks (Hasan et al., 2020). Hence, lack of quick adoption despite proved benefits, shows the lack of willingness of the leadership towards adoption of blockchain technology, which needs to be investigated. Therefore, the purpose of the current research is to identify those factors which influence the application of blockchain technology by the senior management and also to identify the moderating role of technological turbulence in strengthening or weakening the impact over adoption of blockchain technology. Based on the review of the literature economic efficiency, bank security, customer expectations, education, training, and perception are considered as the main factor that influence the senior leadership of the Islamic banks to adopt blockchain technology (Asad et al. 2021b, Asif et al. 2021a, b, Hair et al. 2010, Sulaiman and Asad 2023). The study uses the theoretical lenses of technological–organizational–environmental framework commonly known as TOE Model and contingency theory. Thus, expanding the body of knowledge in the field of blockchain technology by linking it with Islamic banking and critical examining and confirming the factors that actually influence the readiness of senior management towards adoption of blockchain technology in the Islamic banks in Jordan.

The study is theoretical and especially practically important in the field of technology and innovation. Although blockchain technology is considered one of the major topics of interest for researchers and those interested in the banking industry, the researcher noticed a lack of empirical research in understanding the factors that influence adoption of blockchain technology, especially in the field of Islamic banking. Hence, the current research will fill the theoretical gap by confirming the factors that influence senior management readiness towards adoption of blockchain technology and by merging the two different theories linked over the same factor. As for the practical aspect, a realistic and applied study on Jordanian Islamic banks is needed to determine the extent of the senior management's perception of the advantages provided by blockchain technology, the Sharia law’s view of this technology, and the readiness to apply this technology. Sharia’s law in Jordan refers the adoption of laws relating to Islamic banking and finance that refer to fiqh and Sharīʿah as the basis for pertinent transactions (Bashayreh, 2019).

Literature and framework development

Blockchain technology is a form of human creativity and innovation based on digital technology for making a fundamental change in the work of various sectors (e.g., financial, commercial, transport, media, government) in order to fulfill the expectations of customers or citizens in terms of speed, transparency, and safety (Malik et al., 2021a, 2021b). This technology was invented by Harber and Storneta in 1991, and it takes the form of a decentralized digital record consisting of interconnected and increasing databases so that the data cannot be changed (Taylor et al., 2020; Ullah, et al., 2021a, 2021b).

In a more precise definition, blockchain technology is an advanced digital technology made available to all, which is used to prove that a real process has taken place, and of which allows the simultaneous transfer of valuable assets between parties without cost or mediation, in the form of interconnected, incremental, and encrypted databases to achieve a high degree of safety (Abdennadher et al., 2022; Beck et al., 2017; Xie, et al., 2023). This technological revolution has provided many advantages to many sectors; however, it also poses many challenges, by transferring valuable assets, it represents a qualitative development on the first digital revolution, which only specializes in transferring information (Damer et al., 2021).

Role of blockchain in Islamic Sharia standpoint

Since Islamic banks must use Sharia-acceptable means in their business, it is imperative to know the Sharia law’s standpoint on this technology because preserving funds and developing them in a Sharia way is one of the most important aims of Islam (Khan & Rabbani, 2022). In Jordan Sharia’s law is the adoption of laws relating to Islamic banking and finance that refer to fiqh and Sharīʿah as the basis for pertinent transactions of banks in the country (Bashayreh, 2019). Islam allows changes to keep pace with current developments. Accordingly, Islam facilitates the achievement of public and private interests (Hamza, 2020). If conflict arises between the two interests, then priority is given to public interest over the private. Islam urges the attainment of knowledge and action (Bilal & Sulaiman, 2021; Hasan et al., 2020; Zuhaib et al., 2022). Accordingly, advantages of this technology are many and beneficial to the business of banks, yet we find that these technologies in general cannot be given a single common judgment due to the large number of programs and utilities that can emerge from it (Alam et al., 2019). Hence, it is necessary to look at the extent to which these technologies agree with the provisions of Sharia and the public’s interest, and the extent to which their ruling is determined by permissibility, prohibition, and the implementation of related rules and jurisprudence (Muneeza & Mustapha, 2019).

Economic efficiency and adoption of blockchain technology

This technology has been completed for its use in various economic fields (Alkhwaldi & Aldhmour, 2021), such as the energy sector (Wang & Su, 2020), in addition to the health sector (Balasubramanian et al., 2021), however financial sector especially the Islamic banks still have a lot of margin (Yaseen et al., 2022). The multiplicity of business sectors for this technology has created another challenge represented by the government’s practice of monitoring and regulating in light of its interest, which represents the public’s interest (Alkhwaldi & Aldhmour, 2021). For the banking sector, especially Islamic banks, which is the subject of this study, digital technology in general is an important tool for serving and facilitating the banking business, as digital technology has contributed to enhancing financial opportunities, raising operating efficiency and increasing competitive advantage, linking banks, and exchanging information and data (Rahmayati, 2021). Hence, economic efficiency is a significant factor which needs to be confirmed towards its importance behind adoption of blockchain technology. Therefore, the proposed hypothesis for empirical testing is as follows:

H1: Economic efficiency has a significant impact over adoption of block chain technology.

Bank security and adoption of blockchain technology

With sufficient laws and supported by technology that can track the transfer process, this technology facilitates the tracking of these crimes and the arrest of the perpetrators (Albayati et al., 2020). Therefore, in such a case, it is recommended that companies use this type of technology alongside known and trustworthy participants until the development of related laws (Asad et al., 2018a). Another one of the advantages of this technology is that it facilitates the implementation of green policies (Afum et al., 2021) and strategies in digital transformation (Asad et al., 2020) and the achievement of partnerships between the public and private sectors (Tolstolesova et al., 2021) in the field of services and revenue sharing, due to its capability in protecting large data (Asad et al., 2022a), removing bureaucracy and corruption, and evading slow response (Nagi & Hamdan, 2009). Hence ensuring bank security is the core aim behind adopting blockchain technology by the banks in Jordan. Hence, based on the above discussion the following hypothesis is proposed:

H2: Bank security has a significant impact over adoption of block chain technology.

Customer expectations and adoption of blockchain technology

The advantages of blockchain technology surpass that of others because it is not specific to banks alone. It also extends to customers in terms of these key advantages like cost saving (Cocco et al., 2017), by eliminating the paper-based system used in credits, transfers, and so on, as well as reducing the risks of parties to documentary credits, by taking advantage of the consensus feature so as to ensure the authenticity of the documents. A major advantage which attract customers is speed and transparency, blockchain technology is designed to reduce the volume of interventions and obstacles created by the Internet system, which the financial systems of banks depend on, by canceling the intermediation system and adopting the peer-to-peer system at the same time (Allam et al., 2021; Kaur et al., 2020). Therefore, consumers are critical to the adoption of blockchain technology. So, based on the above discussion the following hypothesis has been proposed:

H3: Customer expectations have a significant impact over adoption of block chain technology.

Education and adoption of blockchain technology

Nevertheless, the researcher agrees with the opinion that private networks should be adopted in the initial application of this technology by the bank or establishment until the spread of this technology and the integration of its system. Banking increases the added value through the development of new products and applications, in addition to liberating and easing the administrative and paper burdens of employees (Asad et al., 2021a; Vahdat, 2022), and motivating them to pay attention to the quality of services provided to customers (Allam et al., 2022; Chong, 2021). Considering challenges, the most important strategy is to adopt an appropriate approach that simulates the developments that have occurred in this technology (Koroma, et al., 2022). Education and communication serve as the main element for renewal and development, in addition to raising the level of competence of workers in business organizations through discussions, meetings, memos, and conferences (Sulaiman & Ahmed, 2017), and providing and updating individuals with the information they need to perform their work (Chethiyar et al., 2019). Thus, to motivate them educating them and guiding them to educate the consumers is critical for the success of blockchain technology adoption. Therefore, based on the above discussion over education the following hypothesis is proposed:

H4: Education has a significant impact over adoption of block chain technology.

Training and adoption of blockchain technology

Extremist groups are keen on obtaining financial resources to achieve their goals, and they are also very keen on not being detected and tracked by governments or banks (Mohammed, 2017). The property tracking of funds provided by this technology, the availability of some local and international laws to protect these assets (Sulaiman, 2002), and the cooperation between law enforcement agencies are capable of providing security and security immunization. Achieving these targets are impossible without skilled employees, hence training in this regard supports the adoption and blockchain and achieving the targeted objectives. The provision of training develops the necessary skills to cope with the changes occurring in the market (Khan et al., 2021), or through the opportunities and fields offered by this technology, prior to the preparation of technology operations with the help of specialized companies and the senior management who is responsible for arranging procedures and amending organizational structures to start work (Chong, 2021). Thus, the strategic role of training towards adoption of blockchain technology cannot be ignored. Hence, as discussed above about the role of training the following hypothesis is proposed:

H5: Training has a significant impact over adoption of block chain technology.

Perception and adoption of blockchain technology

The banks should adopt private networks for the technology instead of public ones in the settlement processes between banks to utilize the benefits of using blockchain technology (Dahdal et al., 2022). However, the perception of the users of blockchain technology play a very critical role in this regard. Reducing systemic risks (Avgouleas & Kiayias, 2019), such as political risks and economic embargoes, which some countries practice on other countries, by controlling cash transfers through central banks and the cash transfer system (swift) through decentralized data that does not pass-through intermediaries, giving security immunization against crimes (Hassani et al., 2018; Victor et al., 2021). The reasons for relying on this technology are the principles and features of this technology, and some of its applications in addition to the most important obstacles that prevent its application (Aysan & Unal, 2021). Therefore, the following hypothesis is proposed regarding the importance of perception:

H6: Perception has a significant impact over adoption of block chain technology.

Moderating role of technological turbulence

Technological turbulence is concerned with the problem linked with employees who face the dilemma of rapid advancement of technology. It is considered as a variable factor that holds moderating effect over the relationship between organizational and personal factors and blockchain technology adoption (Chatterjee et al., 2021). Whenever relationship between two constructs is not obvious, a third variable impacting the relationship might facilitate the strength of the relationship or can weaken the relationship, and even in some cases, it can reverse the direction of the relationship, this variable is the moderating variable as in this case technological turbulence (Malik et al., 2021a, 2021b).

In the present study, since technological turbulence is known to have a negative effect towards adopting a new technology, thus, is perceived to have a negative moderating influence. Initiatives in technological development are adversely affected by technology turbulence, which lowers the speed of technological growth and adoption of blockchain technology. It also impacts on practices that banks follow for adopting technological changes to mitigate the negative effect of new technology.

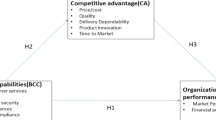

The literature has shown significant advantages of adopting blockchain technology, however, various researchers have focused over different aspects of blockchain technology, moreover in the available literature, hardly any study has been observed that has collectively analyzed the combined effect of organizational as well as personal level factors that influence the adoption of blockchain technology. Using the theoretical lenses of TOE model, blockchain theory, and contingency theory, the current study proposed the following model as shown in Fig. 1.

The above-mentioned framework uses TOE model and theory of block chain technology as theoretical lenses for developing the relationship between the factors that influence adoption of blockchain technology and the adoption of blockchain technology in Islamic banks. TOE model is used to explain the adoption of blockchain technology in a highly volatile dynamic environment as is the case of banking industry in the current era. Likewise, technological turbulence used the theoretical lens of contingency theory as a supporting theory. The theories have widely been used for supporting blockchain technology usage (Mukherjee et al., 2022; Park, 2020), however, there are limited studies that have been conducted over banks, especially linking the personal characteristics like education training, and preparation. Similarly the moderating role of technological turbulence is expected to be a major theoretical contribution of the study. Hence considering the moderating role of technological turbulence, the following hypotheses have been proposed:

H7: Technological turbulence significantly moderates the relationship between economic efficiency and adoption of block chain technology.

H8: Technological turbulence significantly moderates the relationship between bank security and adoption of block chain technology.

H9: Technological turbulence significantly moderates the relationship between customer expectations and adoption of block chain technology.

H10: Technological turbulence significantly moderates the relationship between education and adoption of block chain technology.

H11: Technological turbulence significantly moderates the relationship between training and adoption of block chain technology.

H12: Technological turbulence significantly moderates the relationship between perception and adoption of block chain technology.

Methodology and analysis

To achieve the aim of the study, Partial Least Square Structural Equation Modeling (PLS-SEM) technique has been applied using SMART PLS 3 by the researcher as it is considered as best for theory building and theory testing (Asad, et al., 2022a, 2022b; Hair et al., 2012). For the analysis, the researcher collected the data using a questionnaire as the study instrument. The questionnaire items were measured using the five-point Likert scale (Bilal & Sulaiman, 2021) whereby 1 = strongly agree, 2 = agree, 3 = neutral, 4 = disagree, and 5 = strongly disagree. The instrument has been developed based on the literature reviewed. Therefore, initially the questionnaire was distributed to five faculty members from different universities to verify the face validity of its content and the appropriateness of each item used in the questionnaire. Some amendments were made to the formulation of the items in light of the opinions and observations of the experts, so as to make the items clearer and more accurate.

The researcher employed a random sampling method for sampling purposes (Hair et al., 2010a, 2010b; Ullah, et al., 2021a, 2021b). The sample consisted of 327 employees working in higher management because they have a responsibility to keep up with developments and changes as well as make decisions that are believed to be in the best interest of the banks. A sample of 372 employees was chosen based on the G Power (Sarstedt et al., 2022; Faul et al., 2009). Accordingly, 400 questionnaires were distributed unequally to these employees, depending on the size and extent of the spread of banks in Jordan. The number of distributed and retrieved questionnaires that are valid for analysis was 327 which was relatively a less number, however, as a non-parametric test has been used, therefore, the sample size was sufficient (Hair et al., 2012). After collection of the data measurement model was applied over the collected data to ensure that the instrument was reliable, valid, and holds sufficient discriminant validity (Henseler, et al., 2014). For the said purpose, initially item loadings have been analyzed. All the items having a loading value below 0.7 should be eliminated from the model, however, in the current data, none of the items showed a loading value below 0.7, hence all the items were kept in the model. The results are mentioned in Table 1.

From Table 1 it is evident that the items used to test the variables have sufficient item loading value and none of the items should be removed from further analysis. After ensuring the item loadings the next step is to analyze the reliability and validity of the instrument. Initially reliability and validity are measured followed by the discriminant validity. The results of reliability and validity are mentioned in Table 2.

The calculated values in Table 2 show that values for Cronbach’s Alpha are above 0.7 which shows that the instrument is reliable, likewise the value for composite reliability is also above 0.7 which shows strong composite values and likewise the value of average variance extracted is above 0.6 which confirms that variables holds sufficient power to cause variation in the dependent variable (Hair et al., 2013). The next step is to ensure discriminant validity which confirms that items used to measure one construct are significantly different from the items used to measure any other construct for the said purpose Fornell–Larcker criterion has been applied and the results are mentioned in Table 3.

Another method to confirm the discriminant validity is Heterotrait–Monotrait Ratio (HTMT) which further supplements the results and confirms that the items used for measuring one construct are discriminant from the items used for measuring of the second construct (Ringle et al., 2023). In HTMT some authors suggest the cut-off value for 1 and some suggest that 0.85 shows lack of discriminant validity (Henseler et al., 2015). The results of the tests are mentioned in Table 4

It has been observed that for technological turbulence, the calculated values are below for some variables however, the items used in the construct are entirely different, thus as per the recommendations of Ringle, Sarstedt, Sinkovics, and Sinkovics (2023) if the items are different and measuring an entirely different concept then the value can be ignored. Therefore, after ensuring that the instrument used for collecting the data is reliable and valid in all respects, structural equation modeling has been conducted to identify the relationships and to confirm the significance of the independent variables that have been chosen based on the reviewed literature and TOE Model. In order to test the framework, the collected data are analyzed using a bootstrapping sample of 5000. The dependent variable is readiness towards adoption of blockchain technology represented by (RBCT). The results of the direct effects are mentioned in Table 5.

The above-mentioned results revealed that the variables chosen on the basis of prior literature and TOE Model have shown significant impact over readiness of top management towards adoption of blockchain technology. The influence of attention to customers over readiness of top management towards adoption of blockchain technology is significant (β = 0.662, t = 3.109, p = 0.001). These results are in consistent with the prior literature where it is confirmed that if the businesses pay significant attention towards customers (Asad & Abid, 2018). The influence of bank security over readiness of top management towards adoption of blockchain technology is significant (β = 0.447, t = 3.039, p = 0.002). The influence of economic efficiency over readiness of top management towards adoption of blockchain technology is significant (β = 0.531, t = 1.987, p = 0.039). Economic efficiency is the main concern in the current competitive era, the results of the current study strengthen the prior literature (Asheim & Isaksen, 2002; Fadhel et al., 2022). The major reason behind the lack of willingness of the top management is their lack of willingness towards learning and adopting new technology. Thus educating the employees and the top management may have a strong positive influence over the adoption of blockchain technology, thus, the influence of education over readiness of top management towards adoption of blockchain technology is also found to be significant (β = 0.350, t = 2.025, p = 0.035). Another important element which motivates the management to adopt blockchain technology or to invest in the same is their preparation for adopting innovation in their organization (Asad et al., 2018a, 2018b). The influence of preparation over readiness of top management towards adoption of blockchain technology, therefore, is also found to be significant (β = 0.362, t = 2.367, p = 0.008). The last element is training, which is considered as a must behind any innovation or any change. Training plays a significant role in the success of any business (Haider et al., 2015). The influence of training over readiness of top management towards adoption of blockchain technology is significant (β = 0.305, t = 2.241, p = 0.025).

After ensuring that all the relationships are significant, another important aspect that significantly influence adoption or it would be better to say restrict the adoption of blockchain technology adoption is technological turbulence. Hence, technological turbulence was introduced in the model and interaction terms were introduced over all the relationships. The findings are mentioned in Table 6 below.

The introduction of interaction term proved a significant negative influence. The moderating role of technological turbulence is negative for all the relationships and at the same time it causes the direct relationships insignificant as well. Thus, the findings are consistent with the prior literature that moderating role of technological turbulence is negative and technological turbulence acts as a hindrance for the adoption of blockchain technology (Chatterjee et al., 2022).

After analyzing the direct and moderating effects another valuable tool to ensure the predictive relevance of the model is measuring construct cross-validated redundancy. The researchers applied blindfolding process for analyzing construct cross-validated redundancy. The analysis of Stone–Geisser test to calculate Q2, of endogenous latent construct. If the calculated value of Q2 is above zero it shows that model has sufficient predictive relevance (Henseler et al., 2015). The results of Stone–Geisser test are mentioned in Table 7.

The findings of the predictive relevance confirmed the predictive power of the table which is calculated above zero which shows that the model holds predictive power.

Discussion

The findings in the study are mostly consistent with the prior studies as the framework was based on the prior literature and TOE Model. The findings have revealed that all the variables have a significant direct as well as moderating impact over adoption of blockchain technology. The impact of economic efficiency over readiness of top management towards adoption of blockchain technology is significant because economic efficiency is the main concern. Because of excessive competition, banks are more interested in adopting cost saving tactics to increase the profits and to provide cheaper services to consumers (Abdennadher et al., 2022). The current study strengthen the prior literature that investment in blockchain technology is one time investment which brings economy in the expenses in the long run (Asheim & Isaksen, 2002; Fadhel et al., 2022).

Another reason why banks prefer block chain technology is that it is considered as safe and improves the bank security (Garg, et al., 2021). The influence of bank security over readiness of top management towards adoption of blockchain technology, as per the findings of the current study is significant because top management is highly concerned about the security of the information of their clients, they prefer to invest in blockchain technology to keep the records of the clients and other banks’ information secrete, which further strengthen the security concerns of the banks (Huh & Seo, 2018).

The influence of customer expectations over readiness of top management towards adoption of blockchain technology in this research is shown as significant. These results are also in accordance with the prior literature where it is confirmed that if the businesses pay significant attention towards customers, they put resources in information technology to develop databases to address the customers concerns (Asad & Abid, 2018). Furthermore, when consumers are given preference, they enhance the businesses of the banks because of being satisfied (Wang et al., 2022).

Educating the employees and the top management may have a strong positive influence over the adoption of blockchain technology, thus, the influence of education over readiness of top management towards adoption of blockchain technology is also found significant as per the findings of this research. The mean reason is that lack of willingness of the top management is because of lack of education of the top management and the employees about block chain technology (Yaseen et al., 2022). When top management and the employees are given proper training then they prefer to adopt the smart technologies like block chain technology (Wang et al., 2022).

As discussed above that education play a key role, similarly, to educate the employees and the top management training is mandatory. Training is considered as a must behind adoption of any innovation or change. Training plays a significant role in the success of any adoption of any new technology in the business (Attaran & Gunasekaran, 2019). The findings of this research also confirms that training plays a significant role over readiness of top management towards adoption of blockchain technology is significant. Because when they are trained they are informed about the benefits and likewise they are trained to use the new technology (Jain et al., 2021; Zhou et al., 2020).

Another important element which motivates the management to adopt blockchain technology or to invest in the same is their perception for adopting blockchain technology in their banks (Asad et al., 2018a, 2018b). The influence of perception as per the findings of the current research over readiness of top management towards adoption of blockchain technology is also found significant. Here an important observation which must be mentioned is that investing or adopting blockchain technology is a costly activity, which requires support of the top management (Al-Okaily et al., 2022; Alsmadi et al., 2022; Chatterjee et al., 2022).

Similarly, the major hurdle in investment in any new technology is the pace of change for the technological innovations. Hence, it would be better to say that adoption of blockchain technology adoption is restricted by technological turbulence or technological turbulence play a retarding role towards the adoption of blockchain technology. The findings of the current research showed that introduction of interaction term of technological turbulence showed a negative but significant impact over adoption of blockchain technology. The moderating role of technological turbulence is negative for all the relationships and at the same time it causes the direct relationships insignificant as well. Thus, the findings are consistent with the prior literature that moderating role of technological turbulence is negative and technological turbulence acts as a hindrance for the adoption of blockchain technology (Chatterjee et al., 2022).

Conclusions and recommendations

Blockchain is one of the next-generation digital innovations just like the internet of things, that has attracted worldwide attention in recent years. However, despite numerous benefits offered by blockchain technology, its adoption especially in Jordan remains at the early stages. The nexus between the numerous benefits and the lack of expertise is evident in the banking sector where most managers have little or no knowledge about blockchain and technological turbulence even further act as a hindrance in adoption of this technology.

In the current competitive era blockchain technology is a revolutionary digital technology that has changed the rules of financial dealings as it has advantages and characteristics that are preferred by everyone who deals with financial intermediaries (banks), the most important of which are transparency, safety, and speed. There are many benefits to this technology in the financial field as well as in solving some problems facing Islamic banking, such as capture and possession. In addition, the application of this technology is not limited to the financial field; it can also be applied to other fields, which prompted governments to pay further attention to it. The advantages of this general technology are consistent with the purposes of the Sharia law in improving and facilitating the conditions of people in their daily lives. Nevertheless, the programs of this technology cannot be given a unified ruling. Rather, it is necessary to ensure that it is consistent with the provisions of the Sharia and the rules of interest, as well as considering the public interest as determined by the ruler.

The senior management of Jordanian Islamic banks is aware of the advantages and importance of blockchain technology and its impact on banking in general and Islamic banking in particular, in order to meet the needs of customers and to realize its impact on Islamic banking operations. The readiness of senior management of Jordanian Islamic banks to implement this technology is limited to merely teaching their employees about this technology from a theoretical standpoint and does not go beyond proper training. This is because Islamic banks have not yet rid themselves of the mantle of simulation of traditional banking applications of financial technologies, tools and products before they start to apply it (Ta’Amnha et al., 2023). Therefore, based on the advantages and the current prevailing situations the researcher recommends adopting private networks for the initial application of this technology in the banks until the spread of this technology and the integration of its system. At the very least, the banks could emulate and imitate the experiences of other Islamic banks in the Arab Gulf countries towards preparing for broader applications in the future.

Theoretical and practical implications

Based on the TOE theoretical framework and contingency theory, this study analyzed a new and suitable research framework relevant to the context of Jordanian Islamic banking sector in successfully adopting blockchain technologies. This would give a better understanding of the blockchain and address issues concerning its adoption as an outcome in the Islamic banking sector. Interestingly, the findings of this study presented that the adoption of blockchain technologies in the Islamic banks particularly in Jordan is still in the early stage, which shows that there is relatively slow rate of blockchain adoption, especially from emerging economies. Hence, the study will not only enrich the TOE model by adding technological turbulence as a moderator, but also enrich practical implications by the provision of empirical research in the context of Islamic banking in Jordan.

From a practical/managerial perspective, the findings are believed to be able to assist Islamic banking management, blockchain service providers, and government agencies to precisely focus on the highly ranked critical factors and the factors that may minimize negative influence of technological turbulence inferred from this study in order to successfully adopt of blockchain. This study outcome may be applicable to other Islamic banking industry of the emerging and developing economies and contexts that might be interested in the digitization of their operations to ensure transparency and increase competitiveness, reaffirming their usefulness. Hence, this study provides a foundation for further investigation of the use of blockchain technologies in various industrial sectors to maintain a competitive edge in this digitization era.

Limitations of the study

The limitations of the current study are similar to other primary studies except the one. First of all like any primary study, this study also has the limitations of primary data collection, because the perceptions of personal biasness of the respondents towards blockchain technology may also influence the responses and the results of the study; however, enough diagnostic tests have been applied. Another limitation of the study is that the governments throughout the world are now a days forcing the banking industry to move towards blockchain technology to avoid any kind of frauds. However, in this study this aspect has not been catered. Secondly, the study has been conducted after post-COVID-19; the banking and other activities were already moving towards automation and this aspect has also been ignored, which is another limitation of this study.

Recommendations for future

Based on the study findings and the limitations of the research, it is recommended that in future, the researchers should try to collect secondary data based on the data available with the bank. Secondly, the role of other intervening variables needs to be identified. Like technological turbulence plays a negative role, likewise, the other variables which may strengthen the relationship between the motivating factors and the implementation of blockchain technology should also be identified. Finally, there is a need to show the outcomes of implementing blockchain technology, which can have a significant theoretical as well as practical importance. Finally, there is a necessity to conduct more studies to show the importance of applying this technology from the standpoint of Sharia auditing and oversight by the holders of investment accounts on the business of banks.

Data availability

Not applicable.

References

Abdennadher, S., Grassa, R., Abdulla, H., & Alfalasi, A. (2022). The effects of blockchain technology on the accounting and assurance profession in the UAE: An exploratory study. Journal of Financial Reporting and Accounting, 20(1), 53–71. https://doi.org/10.1108/JFRA-05-2020-0151

Afum, E., Sun, Z., Agyabeng-Mensah, Y., & Baah, C. (2021). Lean production systems, social sustainability performance and green competitiveness: The mediating roles of green technology adoption and green product innovation. Journal of Engineering, Design and Technology. https://doi.org/10.1108/JEDT-02-2021-0099

Alam, N., Gupta, L., & Zameni, A. (2019). Application of blockchain in Islamic finance landscape. Fintech and Islamic Finance. https://doi.org/10.1007/978-3-030-24666-2_5

Albayati, H., Kim, S. K., & Rho, J. J. (2020). Accepting financial transactions using blockchain technology and cryptocurrency: A customer perspective approach. Technology in Society, 62, 1–14. https://doi.org/10.1016/j.techsoc.2020.101320

Alkhwaldi, A. F., & Aldhmour, F. M. (2021). Beyond the Bitcoin: Analysis of challenges to implement Blockchain in the Jordanian public sector. Convergence of Internet of Things and Blockchain Technologies. https://doi.org/10.1007/978-3-030-76216-2_13

Allam, Z., Asad, M., Ali, A., & Ali, N. (2021). Visualization of knowledge aspects on workplace spirituality through bibliometric analysis. In Z. Allam (Ed.), 2021 International conference on decision aid sciences and application (DASA) (pp. 446–450). IEEE. https://doi.org/10.1109/DASA53625.2021.9682372

Allam, Z., Asad, M., Ali, N., & Malik, A. (2022). Bibliometric analysis of research visualizations of knowledge aspects on burnout among teachers from 2012 to January 2022. In Z. Allam (Ed.), 2022 International conference on decision aid sciences and applications (DASA) (pp. 126–131). IEEE. https://doi.org/10.1109/DASA54658.2022.9765200

Al-Okaily, A., Al-Okaily, M., Teoh, A. P., & Al-Debei, M. M. (2022). An empirical study on data warehouse systems effectiveness: The case of Jordanian banks in the business intelligence era. EuroMed Journal of Business. https://doi.org/10.1108/EMJB-01-2022-0011

Alsmadi, A., Alfityani, A., Alhwamdeh, L., Al-hazimeh, A., & Al-Gasawneh, J. (2022). Intentions to use fintech in the Jordanian banking industry. International Journal of Data and Network Science, 6(4), 1351–1358. https://doi.org/10.5267/j.ijdns.2022.5.016

Amir, A., & Asad, M. (2018). Consumer’s Purchase Intentions towards automobiles in Pakistan. Open Journal of Business and Management, 6, 202–213. https://doi.org/10.4236/ojbm.2018.61014

Asad, M., & Abid, U. (2018). CSR practices and customer’s loyalty in restaurant industry: Moderating role of gender. NUML International Journal of Business & Management, 13(2), 144–155.

Asad, M., Ahmad, I., Haider, S. H., & Salman, R. (2018a). A critical review of islamic and conventional banking in digital era: A case of Pakistan. International Journal of Engineering & Technology, 7(47), 57–59.

Asad, M., Altaf, N., Israr, A., & Khan, G. U. (2020). Data analytics and SME performance: A bibliometric analysis. In M. Asad (Ed.), 2020 International conference on data analytics for business and industry: Way towards a sustainable economy (ICDABI) (pp. 1–7). IEEE. https://doi.org/10.1109/ICDABI51230.2020.9325661

Asad, M., Asif, M. U., Allam, Z., & Sheikh, U. A. (2021a). A mediated moderated analysis of psychological safety and employee empowerment between sustainable leadership and sustainable performance of SMEs. In M. Asad (Ed.), 2021 International conference on sustainable islamic business and finance (pp. 1–5). IEEE. https://doi.org/10.1109/IEEECONF53626.2021.9686340

Asad, M., Asif, M. U., Allam, Z., & Sheikh, U. A. (2021b). A mediated moderated analysis of psychological safety and employee empowerment between sustainable leadership and sustainable performance of SMEs. In M. Asad (Ed.), 2021 International conference on sustainable islamic business and finance (pp. 33–38). IEEE. https://doi.org/10.1109/IEEECONF53626.2021.9686340

Asad, M., Asif, M. U., Bakar, L. J., & Altaf, N. (2021c). Entrepreneurial orientation, big data analytics, and SMEs performance under the effects of environmental turbulence. In M. Asad (Ed.), 2021 International conference on data analytics for business and industry (ICDABI) (pp. 144–148). IEEE. https://doi.org/10.1109/ICDABI53623.2021.9655870

Asad, M., Asif, M. U., Khan, A. A., Allam, Z., & Satar, M. S. (2022a). Synergetic effect of entrepreneurial orientation and big data analytics for competitive advantage and SMEs performance. In M. Asad (Ed.), 2022 International conference on decision aid sciences and applications (DASA) (pp. 1192–1196). IEEE. https://doi.org/10.1109/DASA54658.2022.9765158

Asad, M., Kashif, M., Sheikh, U. A., Asif, M. U., George, S., & Khan, G. U. (2022b). Synergetic effect of safety culture and safety climate on safety performance in SMEs: Does transformation leadership have a moderating role. International Journal of Occupational Safety and Ergonomics, 28(3), 1858–1864. https://doi.org/10.1080/10803548.2021.1942657

Asad, M., Shabbir, M. S., Salman, R., Haider, S. H., & Ahmad, I. (2018b). "Do entrepreneurial orientation and size of enterprise influence the performance of micro and small enterprises? A study on mediating role of innovation. Management Science Letters, 8(10), 1015–1026. https://doi.org/10.5267/j.msl.2018.7.008

Asheim, B. T., & Isaksen, A. (2002). Regional innovation systems: The integration of local “sticky” and global “ubiquitous” knowledge. The Journal of Technology Transfer, 27(1), 77–86.

Asif, M. U., Asad, M., Bhutta, N. A., & Khan, S. N. (2021a). Leadership behavior and sustainable leadership among higher education institutions of Pakistan. In M. U. Asif (Ed.), Sustainable leadership and academic excellence international conference (SLAE) (pp. 1–6). IEEE Xplore. https://doi.org/10.1109/SLAE54202.2021.9788081

Asif, M. U., Asad, M., Kashif, M., & Haq, A. U. (2021b). Knowledge exploitation and knowledge exploration for sustainable performance of SMEs. In M. U. Asif (Ed.), 2021 Third international sustainability and resilience conference climate change (pp. 29–34). IEEE. https://doi.org/10.1109/IEEECONF53624.2021.9668135

Attaran, M., & Gunasekaran, A. (2019). Implementing blockchain in your enterprise. Applications of Blockchain Technology in Business. https://doi.org/10.1007/978-3-030-27798-7_14

Avgouleas, E., & Kiayias, A. (2019). The promise of blockchain technology for global securities and derivatives markets: The new financial ecosystem and the “holy grail” of systemic risk containment. European Business Organization Law Review, 20, 81–110. https://doi.org/10.1007/s40804-019-00133-3

Aysan, A. F., & Unal, I. M. (2021). A bibliometric analysis of fintech and blockchain in Islamic finance. Efil Journal of Economic Research, 4, 1–27.

Balasubramanian, S., Shukla, V., Sethi, J. S., Islam, N., & Saloum, R. (2021). A readiness assessment framework for Blockchain adoption: A healthcare case study. Technological Forecasting and Social Change, 165, 120536. https://doi.org/10.1016/j.techfore.2020.120536

Bashayreh, M. H. (2019). Non-Codified Sharīʿah as a state law governing Islamic banking and finance in Jordan. Arab Law Quarterly, 33(4), 334–359.

Beck, R., Avital, M., Rossi, M., & Thatcher, J. B. (2017). Blockchain technology in business and information systems research. Business & Information Systems Engineering, 59, 381–384. https://doi.org/10.1007/s12599-017-0505-1

Bilal, Z. O., & Sulaiman, M. A. (2021). Factors persuading customers to adopt islamic banks and windows of commercial banks services in Sultanate of Oman. Review of International Geographical Education (RIGEO)., 11(4), 651–660. https://doi.org/10.33403/rigeo.800679

Chatterjee, S., Chaudhuri, R., Galati, A., & Vrontis, D. (2021). Adoption of ubiquitous CRM for operational sustainability of the firms: Moderating role of technology turbulence. Sustainability., 13(18), 1–18. https://doi.org/10.3390/su131810358

Chatterjee, S., Chaudhuri, R., Vrontis, D., & Papadopoulos, T. (2022). Examining the impact of deep learning technology capability on manufacturing firms: moderating roles of technology turbulence and top management support. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04505-2

Chethiyar, S. D., Asad, M., Kamaluddin, M. R., Ali, A., & Sulaiman, M. A. (2019). Impact of information and communication overload syndrome on the performance of students. Opción, 24, 390–405.

Chong, F. H. (2021). Enhancing trust through digital Islamic finance and blockchain technology. Qualitative Research in Financial Markets, 13(3), 328–341. https://doi.org/10.1108/QRFM-05-2020-0076

Cocco, L., Pinna, A., & Marchesi, M. (2017). Banking on blockchain: Costs savings thanks to the blockchain technology. Future Internet, 9(3), 1–25. https://doi.org/10.3390/fi9030025

Dahdal, A., Truby, J., & Ismailov, O. (2022). The role and potential of blockchain technology in Islamic finance. European Business Law Review, 33(2), 175–192. https://doi.org/10.54648/eulr2022005

Damer, N., Al-Znaimat, A. H., Asad, M., & Almansour, A. Z. (2021). Analysis of motivational factors that influence usage of Computer Assisted Audit Techniques (CAATs) auditors in Jordan. Academy of Strategic Management Journal, 20(Special issue 2), 1–13.

Fadhel, H. A., Aljalahma, A., Almuhanadi, M., Asad, M., & Sheikh, U. (2022). Management of higher education institutions in the GCC countries during the emergence of COVID-19: A review of opportunities, challenges, and a way forward. The International Journal of Learning in Higher Education, 29(1), 83–97. https://doi.org/10.18848/2327-7955/CGP/v29i01/83-97

Faul, F., Erdfelder, E., Buchner, A., & Lang, A.-G. (2009). Statistical power analyses using G*Power 3.1: Tests for correlation and regression analyses. Behavior Research Methods, 41, 1149–1160.

Ganguly, K. K. (2022). Understanding the challenges of the adoption of blockchain technology in the logistics sector: the TOE framework. Technology Analysis & Strategic Management. https://doi.org/10.1080/09537325.2022.2036333

Garg, P., Gupta, B., Chauhan, A. K., Sivarajah, U., Gupta, S., & Modgil, S. (2021). Measuring the perceived benefits of implementing blockchain technology in the banking sector. Technological Forecasting and Social Change, 163, 1020407. https://doi.org/10.1016/j.techfore.2020.120407

Haider, S. H., Asad, M., & Aziz, A. (2015). A survey on the determinants of entrepreneurial training effectiveness among micro finance institutions of Malaysia. Mediterranean Journal of Social Sciences, 6(6 S4), 396–403. https://doi.org/10.5901/mjss.2015.v6n6s4p396

Hair, J. F., Black, B., Babin, B., & Anderson, R. E. (2010a). Multivariate data analysis. Pearson Education International.

, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2010b). Multivariate data analysis a global perspective. Pearson Prentice Hall.

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice, 19(2), 139–152.

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2013). Editorial-partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long Range Planning, 46(1), 1–12.

Hair, J. F., Sarstedt, M., Ringle, C. M., & Mena, J. A. (2012). An assessment of the use of partial least squares structural equation modeling in marketing research. Journal of the Academy of Marketing Science, 40(3), 414–433. https://doi.org/10.1007/s1147-0261-6

Hammami, S. M., Ahmed, F., Johny, J., & Sulaiman, M. A. (2021). Impact of knowledge capabilities on organisational performance in the private sector in Oman: An SEM approach using path analysis. International Journal of Knowledge Management (IJKM), 17(1), 15–18. https://doi.org/10.4018/IJKM.2021010102

Hamza, O. (2020). Smart Sukuk structure from Sharia perspective and financing benefits: Proposed application of smart Sukuk through blockchain technology in Islamic banks within Turkey. European Journal of Islamic Finance. https://doi.org/10.13135/2421-2172/3983

Hasan, R., Hassan, M. K., & Aliyu, S. (2020). Fintech and Islamic finance: Literature review and research agenda. International Journal of Islamic Economics and Finance., 1(2), 75–94. https://doi.org/10.18196/ijief.2122

Hassani, H., Huang, X., & Silva, E. (2018). Banking with blockchain-ed big data. Journal of Management Analytics, 5(4), 256–275. https://doi.org/10.1080/23270012.2018.1528900

Henseler, J., Dijkstra, T. K., Sarstedt, M., Ringle, C. M., Diamantopoulos, A., Straub, D. W., Ketchen, D. J., Hair, J. F., Tomas, G., Hult, M., & Calantone, R. J. (2014). Common beliefs and reality about PLS: Comments on Rönkkö and Evermann. Organizational Research Methods, 17(2), 182–209.

Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115–135. https://doi.org/10.1007/s11747-014-0403-8

Huh, J.-H., & Seo, K. (2018). Blockchain-based mobile fingerprint verification and automatic log-in platform for future computing. The Journal of Supercomputing, 75, 3123–3139. https://doi.org/10.1007/s11227-018-2496-1

Jain, G., Sharma, N., & Shrivastava, A. (2021). Enhancing training effectiveness for organizations through blockchain-enabled training effectiveness measurement (BETEM). Journal of Organizational Change Management, 34(2), 439–461. https://doi.org/10.1108/JOCM-10-2020-0303

Kakkattil, S. K. (2019). Blockchain technology in managing halal cryptocurrency. Halal Cryptocurrency Management. https://doi.org/10.1007/978-3-030-10749-9_5

Kaur, A., Nayyar, A., & Singh, P. (2020). Blockchain: A path to the future. Cryptocurrencies and Blockchain Technology Applications. https://doi.org/10.1002/9781119621201.ch2

Khalil, R., Asad, M., & Khan, S. N. (2018). Management motives behind the revaluation of fixed assets for sustainability of entrepreneurial companies. International Journal of Entrepreneurship, 22, 1–9.

Khan, A. A., Asad, M., Khan, G. U., Asif, M. U., & Aftab, U. (2021). Sequential mediation of innovativeness and competitive advantage between resources for business model innovation and SMEs performance. In A. A. Khan (Ed.), 2021 International conference on decision aid sciences and application (DASA) (pp. 724–728). IEEE. https://doi.org/10.1109/DASA53625.2021.9682269

Khan, S., & Rabbani, M. R. (2022). In-depth analysis of blockchain, cryptocurrency and sharia compliance. International Journal of Business Innovation and Research, 29(1), 1–15. https://doi.org/10.1504/IJBIR.2022.125657

Koroma, J., Rongting, Z., Muhideen, S., Akintunde, T. Y., Amosun, T. S., Dauda, S. J., & Sawaneh, I. A. (2022). Assessing citizens’ behavior towards blockchain cryptocurrency adoption in the Mano River Union States: Mediation, moderation role of trust and ethical issues. Technology in Society, 68, 1–9. https://doi.org/10.1016/j.techsoc.2022.101885

Lukonga, I. (2021). Fintech and the real economy: Lessons from the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region. In M. Pompella & R. Matousek (Eds.), The Palgrave Handbook of FinTech and Blockchain (pp. 187–214). Palgrave Macmillan. https://doi.org/10.1007/978-3-030-66433-6_8

Majali, T., Alkaraki, M., Asad, M., Aladwan, N., & Aledeinat, M. (2022). Green transformational leadership, green entrepreneurial orientation and performance of SMEs: The mediating role of green product innovation. Journal of Open Innovation: Technology, Market, and Complexity, 8(191), 1–14. https://doi.org/10.3390/joitmc8040191

Malik, S., Chadhar, M., Vatanasakdakul, S., & Chetty, M. (2021a). Factors affecting the organizational adoption of blockchain technology: Extending the technology–organization–environment (TOE) framework in the Australian context. Sustainability, 13(16), 1–31. https://doi.org/10.3390/su13169404

Malik, S., Chadhar, M., Vatanasakdakul, S., & Chetty, M. (2021b). Factors affecting the organizational adoption of blockchain technology: Extending the technology–organization–environment (TOE) framework in the Australian context. Sustainability. https://doi.org/10.3390/su13169404

Mohammed, H. (2017). Bitcoin and its role in financing terrorist movements. King Faisal center for research and Islamic studies.

Mukherjee, S., Chittipaka, V., & Baral, M. M. (2022). Addressing and modeling the challenges faced in the implementation of blockchain technology in the food and agriculture supply chain: A study using TOE framework. Blockchain Technologies and Applications for Digital Governance. https://doi.org/10.4018/978-1-7998-8493-4.ch007

Muneeza, A., & Mustapha, Z. (2019). Blockchain and its Shariah compliant structure. Halal Cryptocurrency Management. https://doi.org/10.1007/978-3-030-10749-9_6

Nagi, E. A., & Hamdan, M. (2009). Computerization and e-Government implementation in Jordan: Challenges, obstacles and successes. Government Information Quarterly, 26(4), 577–583. https://doi.org/10.1016/j.giq.2009.04.003

Park, K. O. (2020). A study on sustainable usage intention of blockchain in the big data era: Logistics and supply chain management companies. Sustainability, 12(24), 1–15. https://doi.org/10.3390/su122410670

Rahmayati, R. (2021). Strengthening Islamic banking services In Indonesia through blockchain technology: The anp-step approach. At-Tijaroh Jurnal Ilmu Manajemen Dan Bisnis Islam, 7(2), 259–272.

Ringle, C. M., Sarstedt, M., Sinkovics, N., & Sinkovics, R. R. (2023). A perspective on using partial least squares structural equation modelling in data articles. Data in Brief, 48, 109074. https://doi.org/10.1016/j.dib.2023.109074

Sarstedt, M., Hair, J. F., Pick, M., Liengaard, B. D., Radomir, L., & Ringle, C. M. (2022). Progress in partial least squares structural equation modeling use in marketing research in the last decade. Psychology & Marketing, 39(5), 1035–1064. https://doi.org/10.1002/mar.21640

Sulaiman, M. A. (2002). How to attract foreign direct investment: The case of Oman. Oxford Brookes University.

Sulaiman, M. A., & Ahmed, M. N. (2017). The essential elements of organized retail stores in influencing customers to stores. International Journal of Applied Business and Economic Research, 15(6), 1–6.

Sulaiman, M. A., & Asad, M. (2023). Organizational learning, innovation, organizational structure and performance: Evidence from Oman. In M. A. Sulaiman (Ed.), ISPIM Conference Proceedings (pp. 1–17). ISPIM.

Ta’Amnha, M. A., Magableh, I. K., Asad, M., & Al-Qudah, S. (2023). Open innovation: The missing link between synergetic effect of entrepreneurial orientation and knowledge management over product innovation performance. Journal of Open Innovation: Technology, Market, and Complexity, 9(4), 1–9. https://doi.org/10.1016/j.joitmc.2023.100147

Taylor, P. J., Dargahi, T., Dehghantanha, A., Parizi, R. M., & Choo, K.-K.R. (2020). A systematic literature review of blockchain cyber security. Digital Communications and Networks, 6(2), 147–156. https://doi.org/10.1016/j.dcan.2019.01.005

Tolstolesova, L., Glukhikh, I., Yumanova, N., & Arzikulov, O. (2021). Digital transformation of public-private partnership tools. Journal of Risk and Financial Management, 14(3), 1–16. https://doi.org/10.3390/jrfm14030121

Ullah, Z., Otero, S. Á., Sulaiman, M. A., Sial, M. S., Ahmad, N., Scholz, M., & Omhand, K. (2021a). Achieving organizational social sustainability through electronic performance appraisal systems: The moderating Influence of transformational leadership. Sustainability, 13(10), 1–14. https://doi.org/10.3390/su13105611

Ullah, Z., Sulaiman, M. A., Ali, S. B., Ahmad, N., Scholz, M., & Han, H. (2021b). The effect of work safety on organizational social sustainability Improvement in the healthcare sector: The case of a public sector hospital in Pakistan. International Journal of Environmental Research and Public Health, 18(12), 1–18. https://doi.org/10.3390/ijerph18126672

Vahdat, S. (2022). The role of IT-based technologies on the management of human resources in the COVID-19 era. Kybernetes, 51(6), 2065–2088. https://doi.org/10.1108/K-04-2021-0333

Victor, S., Haq, M. A., Sankar, J. P., Akram, F., & Asad, M. (2021). Paradigm shift of promotional strategy from celebrity to social CEO. In S. Victor (Ed.), 2021 International conference on decision aid sciences and applications (DASA) (pp. 1016–1023). Zallaq: IEEE.

Wang, Q., & Su, M. (2020). Integrating blockchain technology into the energy sector—from theory of blockchain to research and application of energy blockchain. Computer Science Review, 37, 100275. https://doi.org/10.1016/j.cosrev.2020.100275

Wang, Z., Li, M., Lu, J., & Cheng, X. (2022). Business Innovation based on artificial intelligence and Blockchain technology. Information Processing & Management, 59(1), 102759. https://doi.org/10.1016/j.ipm.2021.102759

Xie, Z., Qalati, S. A., Limón, M. L., Sulaiman, M. A., & Qureshi, N. A. (2023). Understanding factors influencing healthcare workers’ intention towards the COVID-19 vaccine. PLoS ONE, 18(7), e0286794. https://doi.org/10.1371/journal.pone.0286794

Yaseen, S. G., Qirem, I. A., & Dajani, D. (2022). Islamic mobile banking smart services adoption and use in Jordan. ISRA International Journal of Islamic Finance. https://doi.org/10.1108/IJIF-04-2021-0065

Zhou, Y., Soh, Y. S., Loh, H. S., & Yuen, K. F. (2020). The key challenges and critical success factors of blockchain implementation: Policy implications for Singapore’s maritime industry. Marine Policy, 122, 104265. https://doi.org/10.1016/j.marpol.2020.104265

Zuhaib, Z., Wenyuan, L., Sulaiman, M. A., Siddiqu, K. A., & Qalati, S. A. (2022). Social entrepreneurship orientation and enterprise fortune: An Intermediary role of social performance. Frontiers in Psychology, 12, 1–17. https://doi.org/10.3389/fpsyg.2021.755080

Acknowledgements

We would like to acknowledge all the participants who responded to the questionnaires we gave to them.

Funding

This research received no external funding.

Author information

Authors and Affiliations

Contributions

IRA has compiled the over research and has supervised the entire work.

Corresponding author

Ethics declarations

Informed consent

All the participants were fully informed that their names will be kept anonymous, and the research purpose was informed to them by the cover letter, the use of data and confidentiality was ensured.

Competing interests

The author declares no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Alnsour, I.R. Technological turbulence as hindrance between factors influencing readiness of senior management and implementing blockchain technology in Jordanian Islamic banks: a structural equation modeling approach. J Innov Entrep 13, 18 (2024). https://doi.org/10.1186/s13731-024-00377-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s13731-024-00377-5