Abstract

Background

Progress towards universal health coverage requires strengthening the country's health system. In developing countries, the increasing disease burden puts a lot of stress on scarce household finances. However, this burden is not the same for everyone. The economic burden varies across the disease groups and care levels. Government intervention is vital in formulating policies in addressing financial distress at the household level. In India, even when outpatient care forms a significant proportion of out-of-pocket expenditure, government schemes focus on reducing household expenditure on inpatient care alone. Thus, people resort to hardship financing practices like informal borrowing or selling of assets in the event of health shocks. In this context, the present study aims to identify the disease(s) that correlates with maximum hardship financing for outpatients and inpatients and to understand the change in hardship financing over time.

Methods

We used two waves of National Sample Survey Organisation’s data on social consumption on health- the 71st and the 75th rounds. Descriptive statistics are reported, and logistic regression is carried out to explain the adjusted impact of illness on hardship financing. Pooled logistic regression of the two rounds is estimated for inpatients and outpatients. Marginal effects are reported to study the changes in hardship financing over time.

Results

The results suggest that cancer had the maximum likelihood of causing hardship financing in India for both inpatients (Odds ratio 2.41; 95% Confidence Interval (CI): 2.03 - 2.86 (71st round), 2.54; 95% CI: 2.21 - 2.93 (75th round)) and outpatients (Odds ratio 6.11; 95% CI: 2.95 - 12.64 (71st round), 3.07; 95% CI: 2.14 - 4.40 (75th round)). In 2018, for outpatients, the hardship financing for health care needs was higher at public health facilities, compared to private health facilities (Odds ratio 0.72; 95% CI: 0.62 - 0.83 (75th round). The marginal effects model of pooled cross-section analysis reveals that from 2014 to 2018, the hardship financing had decreased for inpatients (Odds ratio 0.747; 95% CI:0.80 - -0.70), whereas it had increased for outpatients (Odds ratio 0.0126; 95% CI: 0.01 - 0.02). Our results also show that the likelihood of resorting to hardship financing for illness among women was lesser than that of men.

Conclusion

Government intervention is quintessential to decrease the hardship financing caused by cancer. The intra-household inequalities play an important role in explaining their hardship financing strategies. We suggest the need for more financial risk protection for outpatient care to address hardship financing.

Similar content being viewed by others

Introduction

In India, National Health Accounts for 2018-19 shows that the total health expenditure (THE) is estimated to be 3.16% of GDP (Rs.5,96,440 crores). Out of which, the government health expenditure accounts for 40.61% of THE. At the same time, about 48.21% of THE is met out of pocket by the households. Out-of-pocket expenditure (OOPE) also accounts for 53.32% of current health expenditure [1]. The OOPE is catastrophic when the household has to decrease its basic expenses to meet the cost of health care [2, 3]. At an arbitrarily set threshold of 10%, the incidence of household catastrophic health expenditure for households who accessed private hospitals are 43.99% [4]. Around one-third of all households suffering from non-communicable diseases (NCDs) have spent beyond the 10% threshold [5].

Globally, the rapid demographic transition from high to low birth and death rates is followed by a parallel epidemiological change, and the burden of diseases shifts from infectious to NCDs [6]. However, in some low and middle-income countries (LMIC), like India, there exists a dual burden of diseases [7,8,9], i.e. NCDs and the continuing prevalence of communicable diseases [10] that seem to co-exist. LMIC's share of the global burden of diseases (GBD) is disproportionately higher than the rich countries. However, their health spending is much lesser. About 90% of the GBD befalls developing countries, which will take a toll on scarce household and government resources [11].

A crucial attempt to bring financial protection to the poor was the introduction of the Rashtriya Swasthya Bhima Yojana (RSBY) in 2008 [12]. Along with many other drawbacks like low enrolment and utilisation, the scheme couldn't reduce people's OOPE. Like other schemes in the past, RSBY also focused on decreasing OOPE for inpatient care alone when OOPE is primarily borne by spending on drugs and outpatient care [13,14,15]. Set out to straighten the drawbacks of RSBY, in 2018, Ayushman Bharat was launched under the recommendation of the National Health Policy, 2017. The two components of this scheme are Pradhan Mantri Jan Arogya Yojana (PMJAY) and Health and Wellness Centre (HWC). PMJAY focuses on providing insurance for secondary and tertiary hospitalisation cases [16]. The financial coverage PMJAY aims to provide is 17 times better than RSBY [17]. The HWC aims to strengthen primary healthcare, including free preventive and basic curative services, primarily focusing on immunisation, maternal and child health, and communicable diseases [18]. The expanded range of services offered by HWCs is given in the appendix ( see Additional file 1: Appendix Table 1) [19].

Nevertheless, insuring expenditure against hospitalisation continues to be over-emphasised in India, and the PMJAY component has received priority over the HWC [20]. Also, the financing of health by the government is low in the country [21]. Thus, the overall financial protection offered by the government schemes is limited, putting a lot of stress on the limited household finances.

Evidence against the theory of full insurance

The coping strategies adopted by the households to finance health can be ex-ante or ex-post [22, 23]. Ex-ante strategies are risk management mechanisms to insure households against unanticipated events like illness shocks and thereby control income variability [24]. As per the theory of full insurance, a household is perfectly insured if, among other factors, the idiosyncratic unanticipated health shocks have no impact on household consumption [25, 26].

Some studies validate the existence of full insurance and the capacity of low-income households to insure consumption against health shocks decently well [22, 27, 28].

However, some studies find evidence against full insurance, especially when households face severe health shocks. Cochrane [26] finds evidence that in the United States, where disease episodes lasting more than 100 days and involuntary unemployment will hurt consumption levels. Gertler et al. [29] find that a decline in the health of the adult from significant health shocks results in their consumption decline.

In developing countries, financial constraints, coupled with the unpredictability of illness episodes, only a minority of the population resort to the ex-ante methods of insuring to meet the health shocks. The poor people who struggle to meet daily subsistence food consumption are incapable of insuring themselves from unexpected illnesses. In 2018, only about 14.1% of the rural and 19.1 % of the urban populations had insurance coverage [30]. Therefore people resort to ex-post coping mechanisms like using income savings, selling livestock or assets, and borrowing from family, friends or money lenders to smoothen consumption expenditure [24].

Measurement of health-related economic hardship

There are two approaches to examining health-related economic hardship, catastrophic health expenditure and hardship financing [31, 32]. When the OOPE on the household's health is above and beyond an arbitrarily set threshold of 10% or 40%, the household suffers from catastrophic health expenditure [5, 32,33,34,35].

An alternate approach is to assess the extent of hardship financing resulting from health shock. The various direct and indirect costs of seeking treatment force people to dissave, borrow, sell assets or undergo other informal mechanisms to meet the expenses [36, 37]. The inefficient government interventions force people to resort to these informal coping strategies [38]. Evidence suggests that about one-quarter of households in 40 LMIC resort to hardship financing [31]. Dercon finds that the risk protection offered by informal mechanisms is limited and exposes poor people to severe financial shocks [39]. Flores shows that in India, about three-quarters of healthcare costs in rural regions and two-thirds in urban areas are borne by income savings, borrowing, selling of assets and transfers [40]. Evidence suggests that informal transactions and mutual insurance primarily occur among family and friends [23, 38, 41,42,43]. Some studies identify borrowing as the most common strategy adopted to face healthcare shocks [31, 37, 44], and Islam and Maitra [45] identify selling livestock as essential. However, these strategies of borrowing and selling vary across the gender of the ill person. Across all age groups in Indian households, resorting to hardship financing for women's health needs is much lower than men's [46, 47].

Evidence of hardship financing in India

In India, many works have studied the impact of illness on hardship financing. Kastor and Mohanty assess the effects of diseases on hardship financing [32]. However, the study is cross-sectional and limited to inpatient care. Binnendijik et al. studied how various illnesses impact hardship financing for outpatient and inpatient care, but the investigation is limited to the poor in rural Orissa [48]. John and Kumar did a similar survey of the rural poor in Chhattisgarh [49]. Yadav et al., in 2019, used NSSO 71st round data to examine tuberculosis's impact on hardship financing [50]. Similarly, in 2021, Yadav et al. explored the effect of a single disease, delivery care, in hardship financing using NFHS-4 [51].

In this context, we strive to gather a better understanding of illness-related hardship financing in India. We focus on the impact of unexpected health expenditures, as they could be more difficult for households to insure against [25]. In our study, we define hardship financing as when ex-post informal coping strategies like selling livestock, or assets, informal borrowings from friends and family, and informal money lenders are used to meet the unanticipated financial cost of health shocks [31, 48,49,50,51]. The study has two primary objectives. Firstly, the study explores how hardship financing varies across diseases. We aim to identify the disease(s) that cause the largest hardship financing in India for hospitalisation and outpatient cases over time. Secondly, we focus on understanding how hardship financing in the country changed from 2014 to 2018. To our knowledge, it is a first-ever attempt to inquire into the variation in illness-related hardship financing with time in India.

Data and methods

Data source

The study uses large-scale unit level, nationally representative data published by the National Sample Survey Office (NSSO), Ministry of Statistics & Programme Implementation, Government of India. Two rounds of the repeated cross-section National Sample Survey (NSS), namely Survey on Social Consumption (71st round (Jan-Jun2014)) and Social Consumption in India: Health (75th round (July 2017- June 2018)), are used. The data provides quantitative details of the health sector. NSSO uses a stratified multi-stage method of sampling for data collection. Further details of the survey design and data collection can be found in the reports [30, 52].

The different spells of ailment or hospitalisation of the same individual are considered different units in NSSO data. For our analysis, cases of illnesses were categorised based on the level of care; inpatient or outpatient. The individuals who reported hospitalisation 365 days before the survey represented the inpatient cases. The 2014 and 2018 rounds provide information on 57,456 and 93,925 hospitalisation cases, respectively. For outpatients, NSSO has information on individuals who faced ailments (both hospitalisation and non-hospitalisation) in the 15 days before the survey. They provide information on 37,282 ailment cases in 2014 and 43,240 in 2018. This outpatient data is filtered to obtain information on non-hospitalised outpatient cases alone. Since the study focuses on unanticipated health shocks, financial hardship due to health expenses for childbirth is excluded from inpatient and outpatient cases, as they are anticipated expenditures. Thus we conduct our cross-sectional analysis using 40,456 and 63,785 hospitalisation cases and 26,763 and 38,217 outpatient cases for 2014 and 2018, respectively.

Variables description

Figure 1 gives an outline of the variables used in the study. The dependent variable of the study is hardship financing. NSSO provides information on the sources of financing expenditure for each case of an ailment [30]. They provide information on whether an individual resorted to savings, borrowings, sale of assets, contributions from friends or relatives, or other sources for each case of ailment for inpatient and outpatient care. Income-savings rates are low in LMIC [25, 31] and are considered less burdensome [48]. Therefore, the study does not consider resorting to savings as hardship financing. Hardship financing is a consequence of health shock when an individual has to either borrow money or sell physical assets or contributions from friends and relatives or other sources to meet healthcare expenditures. The study's dependent variable is binary and coded as an individual without hardship financing for the case of illness \((0=no)\) and an individual who resorted to hardship financing for the case of illness \((1=yes).\)

Previous studies have identified several factors influencing hardship financing in India [32, 48,49,50,51]. The primary explanatory variable of our analyses is the illnesses. We use self-reported disease occurrence as the indicator of individual inpatient and outpatient cases in the study. The diseases (excluding childbirth) were categorised into 16 groups per the nature of ailments reported in NSSO 71st and 75th rounds [30, 52]. The disease categories are infections, cancer, blood-related, Endocrine/Metabolic/Nutritional, Psychiatric and Neurological, Genito-urinary, Eye, Ear, Cardio-vascular, Respiratory, Gastro-intestinal, Skin, Musculoskeletal, Injuries and others. A detailed description of the diseases and their main symptoms as per NSSO reports are provided in the appendix (see Additional file 1: Appendix Table 2).

Various socio-economic and demographic variables are used in the study to see the adjusted impact of illness on hardship financing, all of which are categorical. The individual characteristics included in the analysis are the age group to which the person with illness belongs, sex, education status, type of employment, whether the person is suffering from any chronic diseases, type of medical institution approached during ailment, whether the person has received any fully or partially free medical advice, the marital, and insurance status of the person. We have not included an individual's insurance status as a control variable for outpatient care in India since outpatient cases often have limited insurance coverage. Various household characteristics are also included in the analysis. They are the household’s income quintile, living condition index, type of residence, religion, social group and state regions. The social group to which the household belongs is categorised as scheduled caste (SC), scheduled tribe (ST), other backward castes (OBC), and others. The living condition index is calculated using principle component analysis of information on the type of energy, drainage, latrine used, drinking water, and arrangement of disposal of garbage [5, 53]. The individual and household-level control variables used in the study can be summarised as given in the Additional file 1: Appendix Table 3.

Statistical methods

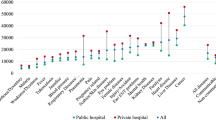

Descriptive statistics are reported, and multivariate analyses are carried out to explain the objectives. Firstly, descriptive statistics are used to get the preliminary results. Descriptive statistics are reported to understand the distribution of the study population. Graphical representation of the percentage distribution of hardship financing across disease groups (figure 2 and figure 3) and private and public health facilities (figure 4) are provided. The sample size and percentage distribution of each category of the independent variables are reported (Tables 1 and 2).

Secondly, logistic regression is estimated, and odds ratios are reported to understand the adjusted impact of illness on hardship financing. Regression analysis is done separately for the inpatient and outpatient cases who received medical attention at both periods. The regression models, namely model 1, model 2 for outpatients (in Table 3), model 4, and model 5 for inpatients (in Table 4), represent the cross-sectional regression models for 2014 and 2018, respectively.

Thirdly pooled logistic regression is conducted using the pooled cross-section data from 2014 to 2018 to check the robustness of the cross-sectional analyses (model 3 and model 6 for outpatients and inpatients, respectively). A year variable is introduced in this regression model to distinguish between the periods. The pooled logistic regression model can be summarised as in equation (1):

where \({p}_{i}=\) probability of success/ hardship financing (coded as1),

\(1-{p}_{i}=\) probability of failure/ no hardship financing (coded as 0),

\({X}_{ij}=\) classification of Illnesses,

\({Y}_{ij}=\) vector of individual characteristics,

\({Z}_{ij}=\) vector of household characteristics,

\({T}_{i}=\) year dummy,

\({\epsilon }_{0}=\) error term.

Fourthly the average marginal effects are calculated from the pooled models to understand the direction and magnitude of change in hardship financing from 2014 to 2018. Additional to the robustness of the model, we also tested for multicollinearity in the cross-sectional models and found that the mean-variance inflation factor is less than 3. Therefore our models do not suffer from severe multicollinearity issues. We have not used weights in the regression analysis as NSSO is large-scale data representing the nation. The statistical analyses in the study are performed using the STATA software version 12.0.

Results

Descriptive statistics

From 2014 to 2018, the rate of inpatient cases resorting to informal distress financing decreased from 29% to 18.47%, whereas the percentage of outpatients increased from 4.36% to 5.08%. Figures 2 and 3 display the percentage distribution of hardship financing among the disease groups for inpatients and outpatients, respectively, comparing the two periods. Around 44% of inpatient and 14% of outpatient cancer cases faced the highest percentage of hardship financing in India in 2014. From 2014 to 2018, the economic hardship across all the disease groups decreased for inpatients. Whereas for outpatients, the percentage change across diseases is not unidirectional. For some disease groups, namely infectious diseases, cancer, blood diseases, skin diseases, obstetrics, injuries and other illnesses, the percentage of the disease-specific cases suffering from hardship financing has decreased, whereas, for the rest of the disease groups, it has increased.

Figure 4 illustrates how the percentage of hardship financing varied across the people who accessed care in the private versus public sectors in the two periods. In 2014, the percentage of cases resorting to hardship financing in the public sector was lower than that of the private sector for inpatients and outpatients. In 2018 for inpatients, the hardship financing in the public sector (33.72%) was lower than in the private sector (66.28%). Whereas for outpatients in 2018, the percentage of cases resorting to hardship financing is higher in the public sector (52.36%) than in the private sector (47.64%).

Tables 1 and 2 give the socio-economic, demographic characteristics, and disease classification of outpatient and inpatient cases, respectively. In Table 1, there are 26,763 cases in the 71st round and 38,217 patients in the 75th round and the pooled data of both rounds have a sample size of 64,980. In Table 1, compared to infectious diseases, the reported number of cases for non-communicable illnesses like cancer was significantly less. After infectious diseases (27% in the 71st and 31% in the 75th round), the second biggest disease share of outpatients was cardiovascular diseases (around 15% in the 71st and 18% in the 75th round). It is followed by endocrine diseases (about 14% in the 71st round and 16% in the 75th round). More than half the cases of outpatients were women, around 55% in both rounds. The patients with no literacy or formal schooling were the highest (about 38% in 71st and 35% in the 75th round), and people with a graduation degree or above were the lowest (around 6% in 71st and 8% in the 75th round). There was a large proportion of self-employed adults, roughly 45%, in both rounds. Nearly 17% and 20% of people belonged to the poorest 20% quintile in rounds 71 and 75, respectively. Approximately 55% of outpatient cases suffered from chronic diseases in both periods. Roughly 78% of patients practised Hinduism, about 22% belonged to a Scheduled caste or tribe, and more than 60% belonged to the rural sector. About 70% of the cases approached the private sector for outpatient care, and around half of the patients in the 71st round had a low living condition index. About 53% of the working-age adults were in the study, and 57% were married in both rounds. Among the state regions, the south zone had the highest percentage of cases of illness (around 40% in the 71st and 31% in the 75th round), and approximately three out of four cases had not received free medical advice.

In Table 2 representing inpatient cases, about one out of four cases in the 71st round suffered from infectious diseases. After infectious diseases, the second most significant percentage of the study population had injuries (around 11%). It is followed by gastrointestinal diseases (11% in the 71st round and 10% in the 75th round). Approximately half the study population were women. The most significant number of cases were illiterate (37 % in the 71st round and 32 % in the 75th round), and the least were with graduate-level education or more (around 6%). Self-employment was the most usual type of employment among the ill population at approximately 48%. About 15% of cases belonged to people in the lowest 20% quintile, and about 55% of individuals had a low living condition index in the 71st round. About 75% and 80% of cases in the 71st and 75th rounds had not suffered from chronic conditions, and around 60% of the ill people approached the private sector for inpatient-level care. Uninsured individuals constituted three out of four inpatient cases. In the 71st round, only 35% of patients belonged to rural areas, whereas in 75th, 65% belonged there. Around 80% of inpatients follow Hinduism, and 1 out of 4 belonged to SC/ST social group. Approximately 62% belonged to the working age group, and the maximum number of cases were from the south zone. About 62% of patients are married people. Additionally, 62% and 54% of individual inpatient cases had not received free medical advice in 71st and 75th rounds, respectively.

Multivariate analysis

The regression analysis has more than one outcome variable and predictor variables, making it the multivariate multiple regression model [54]. Tables 3 and 4 are the logistic regression models which give the association between the explanatory variables and hardship financing for individual cases of illness.

Outpatient cases

The analysis shows that cancer cases compared to infectious diseases had higher odds of facing hardship financing (Odds ratio: 6.11 in 2014 and 3.07 in 2018) at a 1 per cent significance level. Women were less likely to incur hardship financing than men, at a 10 per cent significance level in 2018. In our results, the increase in education level made it less likely to face hardship financing. Compared to individuals with an education level of graduation or more, illiterate people were 2.29 times more likely in 2014 and 1.61 times more likely in 2018 to face hardship financing. In 2018, Hindus, Christians and Muslims had a significantly higher likelihood than other religions. Muslims were most likely to suffer from distress financing. And compared to SC/ST, OBC was 1.23 times more likely to face hardship financing in 2014. The working-age population and the elderly had a significantly higher likelihood than children to face hardship financing. Married people were significantly less likely to resort to hardship financing than unmarried. Compared to the southern zone, every other region in the country was considerably less likely to suffer from hardship financing.

Compared to households without income, regular-wage households were around 0.3 and 0.7 times less likely to suffer from hardship financing in 2014 and 2018, respectively. The household income quintiles and living condition index show a similar pattern here. Households from a wealthier quintile and better living condition index were less likely to suffer from hardship financing. The poorest quintile was 2.17 times more likely to suffer from hardship financing in 2014.

The likelihood of incurring hardship financing was 1.56 times more likely in 2014 and 0.3 times less likely in 2018 among people utilising private hospitals compared to public hospitals. And finally, those who did not get free medical advice were less likely to face hardship financing.

Inpatient cases

Compared to infectious diseases, the odds of facing hardship financing for cancer cases were 2.41 and 2.54 times more likely in 2014 and 2018, respectively. Individuals without chronic diseases were 0.3 times less likely to face hardship financing than those with chronic illnesses.

Women were 0.2 times less likely to face hardship financing compared to men. The higher the education level, the lower the likelihood of hardship financing. People in rural areas had a higher likelihood of hardship financing than in urban areas. Unmarried people were more likely to suffer than married people. Compared to Islam, every other religion was less likely to face distress financing in 2014. SC/ST population was more likely to suffer than other social groups, and the children and the elderly were less likely to suffer compared to the working-age group from hardship financing. The south zone had the highest likelihood of distress financing compared to other regions.

Like outpatient cases, with the increase in income, and better living condition index, the likelihood of hardship financing decreased. Households with regular wages were 0.3 times less likely to face hardship financing than casual labourers.

People who accessed private hospitals were more likely to suffer from hardship financing than those who used public hospitals. Uninsured individuals were less likely to have encountered hardship financing than insured cases. Unlike outpatient cases, people who did not receive free advice were 1.39 and 1.13 times more likely to face hardship financing than those who received it in 2014 and 2018, respectively.

Robustness of the model

Robustness analysis is done using pooled logistic regression [55]. The pooled cross-sectional analysis combines the information on two time periods separately for outpatients and inpatients, model 3 and model 6, from Tables 1 and 2, respectively. The results from these models suggest that most of the variables used in the analysis are relevant, and the results offered are similar to the cross-sectional models.

In the outpatient model, there was some ambiguity between the two time periods for the independent variables: treatment institution, ailment in the eye, chronic diseases and location of stay. Among treatment institutions, the likelihood of hardship financing among private institutions was higher than public institutions in 2014; however, the results show it was less likely to cause hardship financing in 2018. Compared to infectious diseases, the ailment of the eye was less likely to cause hardship financing in 2014. In contrast, in 2018, the likelihood of eye diseases causing hardship financing was the same as infectious diseases. Among cases of chronic diseases, in 2014, those who did not have a chronic illness were less likely to cause hardship financing than those who suffered, whereas, in 2018, the cases that did not suffer were more likely to cause it. The cases from rural areas in both 2014 and 2018 were slightly less likely to cause hardship financing than urban cases; however, the pooled regression shows more likelihood of hardship financing among rural cases. However, the odds ratios reported for chronic diseases and location of residence are insignificant. In the inpatient model, every variable is robust except for a predictor category household without income.

Marginal effects

Table 5 is a marginal effects model that gives the average marginal impact from 2014 to 2018. In the year 2018, the probability of hardship financing by inpatient cases decreased by 7.5%. In contrast, for outpatient cases, in the year 2018 the probability of hardship financing increased by 1.3%. Both results are highly statistically significant.

Discussion

The healthcare costs and the loss of health from sickness lead to poverty and often a medical poverty trap [36]. The rising dual burden of diseases in a predominantly developing country warrants looking into the disease-specific impact of illness and the informal financial mechanisms people adopt to cope with them over time. With the epidemiological transition, there has been a massive increase in cancer patients in India, and in 2018, an additional million new patients were identified [56]. Our study results show that of all the diseases, cancer was most likely to make people resort to hardship financing in India. We can find similar results in studies which point out that the highest hospitalisation expenditure is for cancer [32, 35, 57]. Since 2010, the government has launched programs at the district level for the prevention and control of Cancer, Diabetes, Cardiovascular Diseases and Stroke (NPCDCS) [58]. However, the failure of proper implementation and monitoring has left the program unable to improve its coverage [5].

When men and women are exposed to the same illness, the biological risk of contracting them varies across the sexes [59]. However, these biological differences are insufficient to explain the striking imbalance in the gendered response to illnesses[60, 61]. The statistics on higher life expectancy at birth for women mask the reality of high mortality rates among them [62,63,64,65]. The intra-household financial response to illnesses also varies across gender [66]. In our study, the percentage of ill women was approximately 50% or higher; however, illness episodes among men were more prone to hardship financing than women.

According to Wagstaff, in Vietnam, health shocks, especially the death of a working-age member had a severe negative impact on household income [67]. Kochar [22] points out that labour provided by a non-disabled male household member is a means of insurance against crop shock in the household. The present study agrees with this literature on the importance of the working-age population as an essential household income source. Approximately 53% of outpatient and 62% of inpatient cases belonged to the working-age population. Our results show that a health shock faced by the working-age population was more likely than among children or the elderly to cause hardship financing in India. Gertler & Gruber [25] point out that illness's impact on consumption is lesser when the head of the household is more educated. The results from our study show that with higher education, it is less likely for the illness to lead to distress financing compared to illiterate people.

In our results, households without an income source were most likely to face hardship financing in India. Also, people from the poorest quintile were more susceptible to hardship financing than rich households. Past works show similar findings where poor households were more vulnerable than rich households [5, 31, 37, 49, 68]. Our study suggests that cases in rural areas were more likely to cause distress financing. Verma et al. [5] find higher OOPE and distress financing among the rural population. There is evidence that state-sponsored health insurance schemes did not reduce the welfare loss arising from health shocks and increased the risk of catastrophic health spending among households with health insurance [69,70,71]. Our study results agree with these results from China and USA. In India, the coverage offered by insurance schemes was minimal. In our study for outpatient and inpatient cases, individuals with health insurance were more likely to face hardship financing when compared to uninsured individuals. According to Gertler and Gruber [25], the impact of illness on consumption depends on the intensity of illness shock. The significant and severe health shock often hinders households' ability to insure consumption. In India, chronic diseases aren't covered by many existing schemes and can result in catastrophic health expenditures [32]. Our results suggest that people who suffered from chronic diseases were more likely to incur hardship financing than those who did not.

In our marginal effects model, from 2014 to 2018, there had been a fall in the percentage of people resorting to hardship financing for inpatient cases. However, in the case of outpatients, the model shows that hardship financing has increased marginally. The National Health Policy 2017 recommends spending about 2/3rd of the health budget on primary healthcare [72]. The government health expenditure on inpatient and outpatient increased by almost 4% between 2014 and 2018 [1, 73]. In 2018, the share of government and compulsory contributory health care financing schemes on inpatient curative care was 11.6% of current health expenditure, and outpatient curative care was 10.32% of current health expenditure [1].

Our study results show that among outpatients in 2018, hardship financing was lower for people who went to private sector providers compared to the public sector. The literature indicates that the expenditure on drugs and pharmaceuticals must have contributed to the higher hardship financing in the public outpatient sector. The out-of-pocket payment for hospitalisation is not the primary cause of poverty in India. Expenditure on drugs is the primary cause, and 80 per cent of this expenditure falls on outpatient care and only about 20 per cent on inpatient care [15]. For outpatients, medicines contributed to a mean of 60.3% of OOPE [74]. In Odisha, out of all outpatient visits, 86% of them resorted to private sector pharmacies [75, 76]. Even when the public sector is supposed to provide medicine for free, about 70% of people who use public sector hospitals and primary health facilities have bought their medicines from private pharmacies [76].

We put forward some limitations of the study. Firstly, we have done a separate analysis for inpatient and outpatient cases. These results are not comparable because of the difference in their recall periods. For inpatients, the recall period last 365 days, whereas for outpatients, the recall period is only the previous 15 days. The recall bias could be higher for inpatients as the recall period is very long. Secondly, our data source only provides information on whether hardship financing was practised for a particular ailment. We do not have the amount of money that was raised by borrowing or selling. Thus, we are not able to quantify the extent of hardship financing. Thirdly, hardship financing is self-reported data and can be subject to bias. Evidence suggests that people are often reluctant to admit to mishandling their economic resources or confessing that they face financial problems [77, 78]. Fourthly, we have excluded cases reporting child delivery from our study. Our rationale for doing so is that childbirth is not an unanticipated health shock. Fifthly, reported cases of non-communicable diseases like cancer are very few for outpatients. When diseases are self-reported, there is a problem of under or over-estimation [25, 79, 80]. Evidence shows that outpatient care for NCDs is 50% more expensive than for communicable diseases [81]. Thus, there is a possibility of underreporting the cases due to foregone care because of the cost. Even the socio-economic background impacts the reporting of illness. Often, educated, wealthier, and socially advanced people are more likely to report symptoms of illness in the last month as they are more sensitive to the limitations of health loss [25, 82].

Conclusion and scope for future research

According to the evidence from the current study, cancer cases continue to result in the maximum hardship financing in India over the years. Conflicting results are drawn from the study on the direction of change in hardship financing in India between 2014 and 2018. While hardship financing has decreased for inpatients, it has increased for outpatient cases. Additionally, in 2018 among outpatients, the hardship financing among cases that relied on public health facilities is higher than those who approached the private health sector.

Thus, the government's attempts to counteract the financial risk to health seem insufficient, and people rely on informal coping mechanisms when they experience a health shock. Our empirical results are similar to the existing studies on hardship financing related to the evidence of high OOPE on outpatient medicine expenditure and urge policymakers to make outpatient care more financially accessible to the public.

The current evidence also shows that in Indian households, hardship financing for men's health care needs receives priority over women's. Future research can be focused on identifying inequalities among households and link with hardship financing. With available data, it would be essential to explain the intra-household differences in hardship financing related to various types of illness. Therefore it is pertinent to conduct further research to understand how the household’s strategies to borrow or sell vary across gender and other socioeconomic parameters.

Availability of data and materials

The data sets generated and/or analysed in the current study are available in the public domain. They can be downloaded on request from the National Data Archive of the Ministry of Statistics and Program Implementation, Government of India. The NSS 71st round data on Social Consumption: Health can be downloaded using the link: http://microdata.gov.in/nada43/index.php/catalog/135/get_microdata. And the NSS 75th round data on Household Social Consumption: Health can be downloaded from: http://microdata.gov.in/nada43/index.php/catalog/152.

References

National Health Systems Resource Centre. National Health Accounts Estimates for India (2018-19). New Delhi: Ministry of Health and Family Welfare, Government of India; 2022.

Xu K, Evans DB, Kawabata K, Zeramdini R, Klavus J, Murray CJ. Household catastrophic health expenditure: a multicountry analysis. The Lancet. 2003;362(9378):111–7.

Wyszewianski L. Financially Catastrophic and High-Cost Cases: Definitions, Distinctions, and Their Implications for Policy Formulation [Internet]. Vol. 23. 1986. Available from: https://www.jstor.org/stable/29771827

Sriram S, Albadrani M. A Study of Catastrophic Health Expenditure in India - Evidence from Nationally Representative Survey Data: 2014-2018. F1000Research. 2022;11.141.

Verma VR, Kumar P, Dash U. Assessing the household economic burden of non-communicable diseases in India: Evidence from repeated cross-sectional surveys. BMC Public Health. 2021;21(1).

Omran AR. The Epidemologic. Transition A Theory of the Epidemiology of Population Change. Milbank Mem Fund Q. 1971;49(4):509–38.

Chauhan L. Public health in India: Issues and Challenges. Indian J Public Health [Internet]. 2011 Apr 1;55(2):88–91. Available from: https://www.ijph.in/article.asp?issn=0019-557X

Yadav S, Arokiasamy P. Understanding epidemiological transition in India. Glob Health Action. 2014;7(1):23248.

Dandona L, Dandona R, Kumar GA, Shukla DK, Paul VK, Balakrishnan K, et al. Nations within a nation: variations in epidemiological transition across the states of India, 1990–2016 in the Global Burden of Disease Study. The Lancet. 2017;390(10111):2437–60.

Deodhar NS. Primary Health Care in India. J Public Health Policy. 1982;3(1):76–99.

Gottret PE, Schieber G. Health Financing Revisited: A Practioner’s Guide to Health Care. The World Bank Publications; 2006.

RSBY [Internet]. Ministry of Health and Family Welfare, Government of India. 2008 [cited 2020 Dec 5]. Available from: http://www.rsby.gov.in/how_works.html

Khetrapal S, Acharya A. Expanding healthcare coverage: An experience from Rashtriya Swasthya Bima Yojna. Indian J Med Res. 2019;149(3):369–75.

Malhi R, Goel D, Gambhir RS, Brar P, Behal D, Bhardwaj A. Rashtriya Swasthya Bima Yojana (RSBY) and outpatient coverage. J Family Med Prim Care. 2020;9(2):459–64.

Shahrawat R, Rao KD. Insured yet vulnerable: Out-of-pocket payments and India’s poor. Health Policy Plan. 2012;27(3):213–21.

PM-JAY. Official website of Pradhan Mantri Jan Arogya Yojana (PM-JAY) [Internet]. National Health Authority. 2021 [cited 2022 Aug 5]. Available from: https://pmjay.gov.in/

Lahariya C. ’Ayushman Bharat’ program and universal health coverage in India. Indian Pediatr. 2018;55:495–506.

Operational Guidelines For Comprehensive Primary Health Care Through Health And Wellness Centers, National Health Systems Resource Centre. Ministry of Health and Family Welfare; 2018. Available from: https://nhsrcindia.org/node/736.

Ayushman Bharat- Health and Wellness Center [Internet]. Ministry of Health and Family Welfare, Government of India. 2019 [cited 2020 Dec 5]. Available from: https://ab-hwc.nhp.gov.in/

Bhaduri SD. Ayushman Bharat and Universal Health Coverage in India: Is our approach ethical? Indian Journal of Medical Ethics. 2021;06(03):238–41.

Gupta M das, Muraleedharan VR. Universal Health Coverage: Reform of the Government System Better Than Quality Health Insurance. Econ Polit Wkly. 2014;49(33):29–32.

Kochar A. Explaining household vulnerability to idiosyncratic income shocks. American Economic Review. 1995;85(2):159–64.

Rosenzweig MR. Risk, Implicit Contracts and the Family in Rural Areas of Low-Income Countries. Econ J. 1988;98(393):1148–70.

Alderman H, Paxson CH. Do the poor insure? A synthesis of the literature on risk and consumption in developing countries. Economics in a Changing World. 1994;48–78.

Gertler P, Gruber J. Insuring consumption against illness. American Economic Review. 2002;92(1):51–70.

Cochrane JH. A Simple Test of Consumption Insurance. J Polit Econ. 1991;99(5):957–76.

Townsend RM. Risk and Insurance in Village India. Econometrica. 1994;62(3):539–91.

Genoni ME. Health shocks and consumption smoothing: Evidence from Indonesia. Econ Dev Cult Change. 2012;60(3):475–506.

Gertler P, Levine DI, Moretti E. Do microfinance programs help families insure consumption against illness? Health Econ [Internet]. 2009 [cited 2022 Aug 4];18(3):257–73. Available from: https://onlinelibrary.wiley.com/doi/full/https://doi.org/10.1002/hec.1372

NSSO. Key Indicators of Social Consumption in India: Health. 2019.

Kruk ME, Goldmann E, Galea S. Borrowing and selling to pay for health care in low- and middle-income countries. Health Aff. 2009;28(4):1056–66.

Kastor A, Mohanty SK. Disease-specific out-of-pocket and catastrophic health expenditure on hospitalization in India: Do Indian households face distress health financing? PLoS One [Internet]. 2018 May 1 [cited 2022 Aug 4];13(5):e0196106. Available from: https://journals.plos.org/plosone/article?id=https://doi.org/10.1371/journal.pone.0196106

Panikkassery AS. Impact of Out of Pocket Health Expenditure on Consumption Pattern of Below Poverty Line Households in India. Millennial Asia. 2020;11(1):27–53.

Xu K, Evans DB, Kawabata K, Zeramdini R, Klavus J, Murray CJL. Household catastrophic health expenditure: a multicountry analysis. Lancet. 2003;362(9378):111–7.

Yadav J, Menon GR, John D. Disease-Specific Out-of-Pocket Payments, Catastrophic Health Expenditure and Impoverishment Effects in India: An Analysis of National Health Survey Data. Appl Health Econ Health Policy. 2021;19(5):769–82.

McIntyre D, Thiede M, Dahlgren G, Whitehead M. What are the economic consequences for households of illness and of paying for health care in low- and middle-income country contexts? Soc Sci Med. 2006;62(4):858–65.

Sparrow R, de Poel E, van, Hadiwidjaja G, Yumna A, Warda N, Suryahadi A. Coping with the economic consequences of ill health in Indonesia. Health Economics (United Kingdom). 2014;23(6):719–28.

Wagstaff A, Lindelow M. Are health shocks different? Evidence from a multishock survey in Laos. Health Economics (United Kingdom). 2014;23(6):706–18.

Dercon S. Income Risk, Coping Strategies, and Safety Nets. World Bank Res Obs. 2002;17(2):141–66.

Flores G, Krishnakumar J, van Doorslaer E. Coping with Health-Care Costs: Implications for the Measurement of Catastrophic Expenditures and Poverty. 2011;698(June 2010):688–98.

Fafchamps M, Lund S. Risk-Sharing Networks in Rural Philippines. J Dev Econ. 2003;71(2):261–87.

Udry C. Credit Markets in Northern Nigeria : Credit as Insurance in a Rural Economy. World Bank Econ Rev. 1990;4(3):251–69.

Udry C. Risk and Insurance in a Rural Credit Market: An Empirical Investigation in Northern Nigeria. Rev Econ Stud. 1994;61(3):495–526.

Dhanaraj S. Economic vulnerability to health shocks and coping strategies: evidence from Andhra Pradesh. India Health Policy Plan. 2016;31(6):749–58.

Islam A, Maitra P. Health shocks and consumption smoothing in rural households: Does microcredit have a role to play? J Dev Econ [Internet]. 2012;97(2):232–43. Available from: http://dx.doi.org/https://doi.org/10.1016/j.jdeveco.2011.05.003

Asfaw A, Lamanna F, Klasen S. Gender gap in parents’ financing strategy for hospitalization of their children: Evidence from india. Health Econ. 2010;19(3):265–79.

Moradhvaj, Saikia N. Gender disparities in health care expenditures and financing strategies (HCFS) for inpatient care in India. SSM Popul Health. 2019;9.

Binnendijk E, Koren R, Dror DM. Hardship financing of healthcare among rural poor in Orissa, India. BMC Health Serv Res [Internet]. 2012 Jan 27 [cited 2022 Aug 4];12(1):1–14. Available from: https://link.springer.com/articles/https://doi.org/10.1186/1472-6963-12-23

John D, Kumar V. Exposure to Hardship Financing for Healthcare among Rural Poor in Chhattisgarh. India J Health Manag. 2017;19(3):387–400.

Yadav J, John D, Menon G. Out of pocket expenditure on tuberculosis in India: Do households face hardship financing? Indian Journal of Tuberculosis. 2019;66(4):448–60.

Yadav J, John D, Menon GR, Allarakha S. Out-of-Pocket Payments for Delivery Care in India: Do Households face Hardship Financing? J Health Manag. 2021;23(2):197–225.

NSSO. Key Indicators of Social Consumption in India Health. 2015.

Croft TN, Marshall AMJ, Allen CK. Guide to DHS Statistics DHS-7 [Internet]. 2020 [cited 2022 Aug 8]. Available from: https://dhsprogram.com/data/Guide-to-DHS-Statistics/Guide_to_DHS_Statistics_DHS-7.htm

UCLA Statistical Methods and Data Analytics. Multivariate Regression Analysis | Stata Data Analysis Examples [Internet]. [cited 2022 Oct 7]. Available from: https://stats.oarc.ucla.edu/stata/dae/multivariate-regression-analysis/

Shuvam S, Mohanty PC. Necessity or opportunity driven: Gender differentials and structural changes of proprietorship in the Indian Unorganized Enterprises. Global Business Review. 2020;097215091989509.

Smith RD, Mallath MK. History of the growing burden of cancer in India: From antiquity to the 21st century. J Glob Oncol. 2019;(5):1–15.

Sundararaman T, Muraleedharan VR. Falling Sick, Paying the Price: NSS 71st Round on Morbidity and Costs of Healthcare. Econ Polit Wkly. 2015;50(33):17–20.

Ministry of Health and Family Welfare. Directorate General Of Health Services [Internet]. Directorate General of Health Services. 2022 [cited 2022 Aug 12]. Available from: https://dghs.gov.in/content/1363_3_NationalProgrammePreventionControl.aspx

Colchero F, Rau R, Jones OR, Barthold JA, Conde DA, Lenart A, et al. The emergence of longevous populations. Proc Natl Acad Sci U S A. 2016;113(48):E7681–90.

Cullen MR, Baiocchi M, Eggleston K, Loftus P, Fuchs V. The weaker sex? Vulnerable men and women’s resilience to socio-economic disadvantage. SSM Popul Health. 2016;2:512–24.

Magar V. Gender, health and the Sustainable Development Goals. Bull World Health Organ. 2015;93(11):743.

Sudha S, Rajan SI. Female demographic disadvantage in India 1981–1991: Sex selective abortions and female infanticide. Dev Change. 1999;30(3):585–618.

Bongaarts J, Guilmoto CZ. How Many More Missing Women? Excess Female Mortality and Prenatal Sex Selection, 1970–2050. Popul Dev Rev. 2015;41(2):241–69.

Manandhar M, Hawkes S, Buse K, Nosrati E, Magar V. Gender, health and the 2030 agenda for sustainable development. Bull World Health Organ. 2018;96(9):644.

Canudas-Romo V, Saikia N, Diamond-Smith N. The contribution of age-specific mortality towards male and female life expectancy differentials in India and selected States, 1970-2013. Asia-Pac Popul J. 2015;30(2).

Saikia N, Bora JK. Gender difference in health-care expenditure: evidence from India human development survey. PloS one. 201611(7):e0158332.

Wagstaff A. The economic consequences of health shocks: Evidence from Vietnam. J Health Econ. 2007;26(1):82–100.

Tugwell P, de Savigny D, Hawker G, Robinson V. Applying clinical epidemiological methods to health equity: the equity effectiveness loop. BMJ. 2006;332(7537):358–61.

Wagstaff A, Lindelow M. Can insurance increase financial risk? The curious case of health insurance in China. J Health Econ. 2008;27(4):990–1005.

Waters HR, Anderson GF, Mays J. Measuring financial protection in health in the United States. Health Policy (New York). 2004;69(3):339–49.

Rubin RM, Koelln K. Determinants of household out-of-pocket health expenditures. Social science quarterly. 1993;74(4):721–35.

Ministry of Health and Family Welfare. National Health Policy 2017 [Internet]. 2017 [cited 2022 Aug 15]. Available from: https://www.nhp.gov.in/nhpfiles/national_health_policy_2017.pdf

National Health Systems Resource Centre. National Health Accounts Estimates for India (2014-15). New Delhi; 2017. Available from: https://nhsrcindia.org/national-healthaccounts-estimates-india-2014-15.

Ambade M, Sarwal R, Mor N, Kim R, Subramanian SV. Components of Out-of-Pocket Expenditure and Their Relative Contribution to Economic Burden of Diseases in India. JAMA Netw Open. 2022;5(5):e2210040.

Yip W, Kalita A, Bose B, Cooper J, Haakenstad A, Hsiao W, Woskie L, Reich MR. Comprehensive Assessment of Health System Performance in Odisha, India. Health Systems & Reform. 2022;8(1):2132366.

Haakenstad A, Kalita A, Bose B, Cooper JE, Yip W. Catastrophic health expenditure on private sector pharmaceuticals: a cross-sectional analysis from the state of Odisha. India Health Policy Plan. 2022;37(7):872–84.

Bauman K. Direct measures of poverty as indicators of economic need: Evidence from The Survey of Income and Program Participation. Population Division, US Bureau of the Census. Washington, DC: US Bureau of the Census. 1998.

Tucker-Seeley RD, Harley AE, Stoddard AM, Sorensen GG. Financial Hardship and Self-Rated Health Among Low-Income Housing Residents. Health Educ Behav. 2013;40(4):442–8.

Goyanka R. Economic and non-economic burden of cancer: A propensity score matched analysis using household health survey data of India. Cancer Research, Statistics, and Treatment. 2021;4(1):29.

Behera S, Pradhan J. Uneven economic burden of non-communicable diseases among Indian households: A comparative analysis. PLoS ONE. 2021;16(12): e0260628.

Haakenstad A, Coates M, Bukhman G, McConnell M, Verguet S. Comparative health systems analysis of differences in the catastrophic health expenditure associated with non-communicable vs communicable diseases among adults in six countries. Health Policy Plan. 2022;37(9):1107–15.

Schultz TP, Tansel A. Wage and labor supply effects of illness in Côte d’Ivoire and Ghana: Instrumental variable estimates for days disabled. J Dev Econ. 1997;53(2):251–86.

Acknowledgements

We want to acknowledge Pratap Chandra Mohanty, Associate Professor, IIT Roorkee, for clearing the doubts on methods.

Funding

The authors did not receive any funding for the completion of the present study.

Author information

Authors and Affiliations

Contributions

ART has contributed to the conceptualisation, analysis, interpretation of data, drafting of the work, and manuscript revision. UD has contributed to the interpretations of data and manuscript revision. SKS was involved in the analysis, interpretation of data, and manuscript revision. All authors contributed substantially to the research. The authors have read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable

Consent for publication

Not applicable

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/. The Creative Commons Public Domain Dedication waiver (http://creativecommons.org/publicdomain/zero/1.0/) applies to the data made available in this article, unless otherwise stated in a credit line to the data.

About this article

Cite this article

Thomas, A.R., Dash, U. & Sahu, S.K. Illnesses and hardship financing in India: an evaluation of inpatient and outpatient cases, 2014-18. BMC Public Health 23, 204 (2023). https://doi.org/10.1186/s12889-023-15062-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s12889-023-15062-7