Abstract

Background

Out-of-pocket (OOP) payments for healthcare services potentially have severe consequences on households, especially among the poor. Under certain circumstances, healthcare payments are financed through selling household assets, or borrowings. This certainly could influence households’ decision, which likely resorts to forgoing healthcare services. Thus, the focal point of this study is aimed to identify the inequalities and determinants of distress financing among households in Malaysia.

Methods

This study used secondary data from the National Health and Morbidity Survey (NHMS) 2019, a national cross-sectional household survey that used a two-stage stratified random sampling design involving 5,146 households. The concentration curve and concentration index were used to determine the economic inequalities in distress financing. Whereas, the determinants of distress financing were identified using the modified Poisson regression model.

Results

The prevalence of borrowing without interest was the highest (13.86%), followed by borrowing with interest (1.03%) while selling off assets was the lowest (0.87%). Borrowing without interest was highest among rural (16.21%) and poor economic status (23.34%). The distribution of distress financing was higher among the poor, with a concentration index of -0.245. The modified Poisson regression analysis revealed that the poor, middle, rich, and richest had 0.57, 0.58, 0.40 and 0.36 times the risk to develop distress financing than the poorest socio-economic group. Whereas, the presence of one and two or more elderly were associated with a 1.94 and 1.59 times risk of experiencing distress financing than households with no elderly members. The risk of developing distress financing was also 1.28 and 1.58 times higher among households with one and two members receiving inpatient care in the past 12 months compared to none.

Conclusions

The findings implied that the improvement of health coverage should be emphasized to curtail the prevalence of distress financing, especially among those caring for the elderly, requiring admission to hospitals, and poor socio-economic groups. This study could be of interest to policymakers to help achieve and sustain health coverage for all.

Similar content being viewed by others

Introduction

Households are subjected to out-of-pocket (OOP) health spending when they use or receive any health care services. These include promotive, preventive, curative, rehabilitative, palliative (or long-term), or laboratory services [1]. OOP payments for healthcare services can potentially lead to adverse consequences on the patients and their families, especially in the absence of health protection mechanisms. High OOP health spending is often associated with increased poverty and mental health problems such as depression, anxiety and stress [2, 3]. Without adequate cash in hand, people are constrained to various methods to finance healthcare, such as selling assets, borrowing, reducing foods consumption, withdrawing children from schools, and even foregoing or delaying seeking medical care. [4, 5].

A distress or hardship health financing occurs when someone turns to either borrowing or selling assets to finance their healthcare expenses [6]. High OOP health expenditure, low insurance coverage as well as limited government expenditure on health are some of the causes of distress financing [7]. Studies among low- and middle-income countries found that borrowing or selling assets occurs at an average of 22% and 10%, respectively [8]. In desperate situations, people can resort to borrowing with or without interest taking into consideration their socio-economic status, repayment period, and the nature of the loan [9]. According to several studies done in the low- and middle-income countries, familiar sources of distress financing can be in the form of borrowing with or without interest, either from a financial institution, friends, or family members, selling assets such as crops and livestock as well as mortgaging assets [10, 11]. Out of these, borrowing with interest tends to cause tremendous economic hardship than borrowing without interest due to the large sum of money they need to repay. [12]. Prior studies conducted in Argentina, India, Tanzania and rural China found that distress financing was unequally distributed and mainly affected the poor [9, 13].

Apart from poor socio-economic status, indebtedness may also have detrimental effects on physical and mental health. This frequently leads to worsening financial problems, thus creating a vicious cycle of health demands and indebtedness. The reason could conceivably be the additional healthcare needs as well as the inability to work and gain income. Studies found that indebtedness and the failure to repay loans can lead to depression, stress, and poor health [14,15,16]. Stress was found to influence health-related behaviours and cause psychological changes, which are significant in various disease processes, such as cardiovascular and metabolic diseases [17, 18]. High-interest borrowing and debt can also have a multiplier effect on health, especially among those unable to repay their debt [15].

Studies on the determinants of distress health financing were relatively limited. Past studies found that distress financing is determined by the household’s socio-economic status, household size, and the use of inpatient and outpatient care, especially in the private health sectors [19]. Households in the lower socio-economic group tend to resort to borrowing and often end up unable to pay off their debt [19]. Besides, borrowing was also common among those with bigger household sizes and higher health expenses [8]. Distress financing also was more common among those admitted to the hospital, having to care for their elderly parent, seeking maternity care, using private health care facilities, and having family members with non-communicable diseases (NCDs) [6, 20]. Studies also found that those living in urban areas tend to have minimal risk of financial distress due to the widely available healthcare services [21]. In addition, the availability of medical protection plans and initiatives such as private insurance, government guarantee letters, panel clinics, and others seem to reduce the incidence of distress financing among households [22].

World Health Organization (WHO) has highlighted the importance of the country’s healthcare systems to provide essential health services to all without financial hardship through Universal Health Coverage (UHC) [23]. Nevertheless, many countries still opted for the least sustainable option to finance healthcare through the OOP mechanism [23]. This was made worse by the never-ending issue of equity in health service delivery [24]. This includes the issue of inequality in distress health financing among households, which could also hinder the country’s effort in achieving UHC. The term ‘inequalities’ often describes the variation of health status among different socio-economic statuses, geographic locations, employment status, gender and ethnicity [25]. The health financing system of a country among others would set the provision of health service delivery and thus, become the main factor in making sure equality in population health status. There are various methods for measuring inequalities such as concentration curve, concentration index, Gini coefficients, and others. The concentration index measures horizontal health inequalities based on socio-economic status and is calculated from the concentration curve by quantifying the disparity of one variable against the distribution of another selected variable [26]. It is one of the common measures of socio-economic health-related inequalities [27, 28].

The issue of inequality is not limited to one but all countries including Malaysia. The two-tier healthcare system in Malaysia is provided by both the highly subsidised public sector and pay-for-service in the private service sector. The Ministry of Health only recouped 2–3% of the total patient charges. While the health services such as hospital admission in the public sector only require patients to bear the minimal cost, it acts as the safety net by ensuring minimal possible financial risk to access health services [29]. Hence, patients who could not afford private healthcare charges will opt for public healthcare services. Overall, the high utilization of health services in Malaysia was equally distributed across socio-economic groups. Studies found that the use of private health services in Malaysia increases with household income, while the use of public health services is more pro-poor [30]. The latest data showed that outpatient healthcare services in Malaysia are composed of 64.3% public and 35.7% private sector [31]. Whereas, public health sectors contribute about 75.5% and 79.5% to inpatient and oral health care, respectively [31]. Medical private insurance in Malaysia is voluntary and only covers health expenses in private health sectors. Other medical protection programmes include, but are not limited to; (1) Social Security Organisation (SOCSO) and Employee Provident Funds (EPF), which are two social security funds in Malaysia that provide health coverage for employees working in the private sector; (2) employer insurance scheme, which is provided by some employers in private sectors to their employees; and (3) guarantee letters for the government servants, which allows free health provision among the government servants [32]. Other health financing initiatives provided by the governments for accessing healthcare services include those catered for the bottom 40% of population (B40) groups such as Skim Peduli Kesihatan for the B40 (PeKa B40) and mySalam [33].

Despite this, the Malaysia National Health Account (MNHA) reported that Malaysia’s OOP expenditure remains high at around 30–40% of total health expenditure [34]. This is well beyond WHO’s suggestion of 15–20% [35, 36]. This is also comparatively higher than most OECD countries [37]. However, high OOP expenses are more prevalent among households in high socio-economic groups [37]. While the OOP expenditure did not show a reduction trend albeit higher cost of care over the years, concerns were raised about the sustainability of the government to continue with the current health financing system and the need for healthcare reforms [34]. Despite that, the incidence of catastrophic health expenditure (CHE) in Malaysia was relatively low. The Malaysia Health Care Demand Analysis using 2009/10 data reported that the incidence of households spending more than 10% of the total household expenditure was around 1.44% [38]. In comparison, the incidence of households spending more than 25% of household expenditure was around 0.16%. This is relatively low compared to the neighbouring countries such as Thailand, Vietnam, Indonesia and others. Overall, the financial risk protection in Malaysia has improved over the last decades with the prevalence dropping more than 50% [38].

It is also suggested that 5–6% of Gross Domestic Product (GDP) is required to provide UHC assuming a single public financing health system [39, 40]. Hence, Malaysia’s government spending at around 2% of GDP provides additional challenges to achieving equal access to healthcare services. Nevertheless, a report showed that the Kakwani’s progressivity index for the tax-financed system in Malaysia was slightly progressive with an index value of 0.186. The progressive finance sources include direct taxes, private insurance, OOP and contributions to EPF and SOCSO [41].

Given this backdrop, the present study contributes to two dimensions. First, to the policymakers and stakeholders by providing guides on the current achievement of UHC and a piece of evidence on the effectiveness of financing health systems in Malaysia. Secondly, this study also contributes to the literature on OOP expenditure by extending the current knowledge on the determinants of household distress financing and their level of inequalities in middle-income countries, especially in Malaysia.

There are relatively no documented studies exploring distress health financing in terms of the determinants and inequality in Malaysia. This kind of study is beneficial to the decision-makers as a guide to improving the health financing systems in Malaysia. Hence, this study aims to identify inequalities and determinants of distress financing among the households in Malaysia to provide a better understanding especially to the policymakers for a better improvement of UHC in Malaysia.

Methods

Data sources

This study used cross-sectional datasets from the National Health and Morbidity Survey (NHMS) 2019, a national household survey that targeted all non-institutionalised populations residing in Malaysia. The NHMS (2019) sampled a cross-section of households in all 13 states and three federal territories in Malaysia using a two-stage proportionate to size cluster sampling to achieve national representativeness. The stratification was performed by states and federal territories constituting the primary stratum, followed by urban and rural within the primary stratum as the secondary stratum [31]. Department of Statistics Malaysia (DOSM) defines urban as “any gazetted areas plus their adjoining built-up areas, of which the combined population is at least 10,000 during census 2010 or any special development areas with a population of more than 10,000, of which at least 60% (15 years and above) involved in non-agricultural activities” [42].

First, all Enumeration Blocks (EBs) were randomly selected by the probability proportional to the size sampling method. A total of 350 EBs were selected for urban areas, and 113 EBs were for rural areas, yielding a total of 463 EBs. Subsequently, 14 Living Quarters (LQs) were randomly selected from each selected EB. This random selection of EBs and LQs was performed and provided by the DOSM. All households within the selected LQs were included. In this study, a household is defined as individuals living together in the same house and having common arrangements for basic domestic activities such as cooking and eating.

Data collection

Data were collected from July to October 2019. A face-to-face interview was conducted by the trained personnel using a bilingual (Malay and English), structured, and validated questionnaire [43, 44]. NHMS 2019 official report described the methodology and sampling in detail [31]. A total of 5,206 households were interviewed (3,196 in urban and 1,950 in rural). Missing data were handled by the listwise deletion method. Since this study has a large sample size and the data is Missing Completely at Random (MCAR), the power is not an issue, thus listwise deletion is a reasonable strategy to be adopted [45, 46]. After removing missing data, 5,146 households were included in the analysis.

Variables Descriptions

Dependent variable

The dependent variable of interest used in this study was distress financing. It was a binary variable that shows the likelihood of a household using sales of assets, borrowing without interest (from family and friends), and borrowing with interest as a source of financing.

Explanatory variables

Several explanatory variables were identified for the analysis (Fig. 1). Household demographic characteristics included were household location (urban, rural), a total of household members aged 65 years and older (0, 1, 2, more than 2), a total of household members aged less than five years (0, 1, 2, more than 2) and household size (less than 5, 5 or more). The socio-economic status of the household was calculated based on monthly household income, ranked, and classified into a wealth quintile of poorest (1st quintile), poor (2nd quintile), middle (3rd quintile), richer (4th quintile), and richest (5th quintile). The explanatory variables used to measure health service utilisation were the total of household members who received outpatient care in the past two weeks, the total of household members who received inpatient care in the past 12 months, and the total of household members who received oral healthcare in the past 12 months. Supplementary health coverage refers to the number of supplementary financial health coverage received by the households or household members seeking health services (no health coverage, one health coverage, more than one health coverage). In Malaysia, these supplementary health coverages include government guarantee letters, private insurance, employer insurance, SOCSO, and others. The OOP expenditure for health in the past 12 months was calculated based on the cumulative self-reported OOP spending for each household member. Household OOP expenditures were grouped into five categories, namely less than Malaysian Ringgit (MYR) 100, MYR 100 to < 200, MYR 200 to < 300, MYR 300 to < 400, and MYR 400 and more, wherein MYR 1.00 ~ USD 0.24 [47].

Explanatory variables associated with distress financing (adapted from Ir et al.) [19]

Statistical analysis

The data were analysed using Stata software version 14 (Stata Corp, College Station, Texas, USA) and Microsoft Excel 2016. Initial descriptive statistics were performed to explain the characteristics of households with distress financing. Subsequently, analysis was conducted to determine the prevalence of distress financing among different household locations and socio-economic statuses. The prevalence of households having distress financing was measured by dividing the total number of households with distress financing by the total number of households [48].

Concentration curve and concentration index were often used for determining the economic inequalities in distress financing. This study used both methods to estimate the economic inequality in distress financing. The concentration curve of distress financing and various sources of financing were visualised by a graphical representation of the cumulative proportion of distress sources of financing (y-axis) against the cumulative proportions of the population ranked by the household’s socio-economic status (x-axis). The concentration curve will coincide with the line of equality if distress financing or the various sources of financing is evenly distributed across the socio-economic status. However, if the concentration of distress financing belongs to the higher (lower) socio-economic status, the concentration curve would fall below (above) the line of equality [28]. The concentration index is derived from the concentration curve and calculated as twice the area between the equality line and the concentration curve. Concentration index value ranges from − 1 to + 1. The negative value signifies the distress financing is concentrating on the poor, while, the positive value reflects concentration among the rich. The zero concentration index indicates no inequality in the distribution of distress financing.

The concentration index, C can be measured using the following formula [49]:

In Eq. (1), pT is the cumulative proportion of the sample ranked by socio-economic status in group T, and LT is the corresponding cumulative proportion of the health variables, which is the distress health financing and the various sources of financing. In this study, the concentration indices were calculated using the CONCINDC module in Stata software [50, 51].

The determining factors of distress financing were identified using bivariate and multivariate statistical analysis. Potential variables were initially identified through bivariate analysis with explanatory variables of p-value < 0.25 were incorporated into the modified (or robust) Poisson regression model. The modified Poisson model was generally preferable because it provided unbiased estimates of relative risks (or risk ratios) especially in dealing with model misspecification [52]. Unlike the log-binomial model, the modified Poisson model does not frequently result in a non-convergence problem. The robust variance estimation (or classical sandwich estimator) used could prevent over-estimation of the standard errors of parameters estimates [53].

The mathematical model of the study is written as the following:

In Eq. (2), Yi is the binary outcome of having distress financing. X1 refers to household location, X2 is the total of household members aged 65 years and older, X3 is the total of household members aged less than five years, X4 is household size, X5 is the socio-economic status, X6 is the total of household members received outpatient care in the past two weeks, X7 is the total of household members received inpatient care in the past 12 months, X8 is the total of household members received oral healthcare in the past 12 months, X9 is the supplementary health coverage, X10 is the OOP expenditure for health in the past 12 months, ui is the random error term, i is the household (cross-section), and β is a beta coefficient to be estimated. The Eq. (2) can also be expressed as below:

The Relative Risk (RR) is given by \({e}^{\beta }\) as shown in Eq. (3).

The modified Poisson regression model adopts a classical sandwich estimator under the generalized estimation equation (GEE) framework in providing accurate standard errors for the parameter estimates [54]. The variance-covariance matrix can be explained by the following:

Where \({I}_{i}\left(\beta \right)=-\frac{\partial {S}_{i}\left(\beta \right)}{\partial \beta }\) denotes information matrix. By evaluating the variance-covariance matrix at \(\widehat{\beta }\), a consistent estimate of the variance can be achieved.

For the modified Poisson regression model, a p-value of less than 0.05 is considered statistically significant.

Ethics

NHMS 2019 follows the tenets of the Declaration of Helsinki throughout the conduct of the study. Before the interview, written informed consent was obtained from all participants. Ethics clearance was obtained from Medical Research and Ethics Committee (MREC), Ministry of Health Malaysia (MOH) Malaysia, and registered under National Medical Research Register, MOH Malaysia (NMRR-18-3085-44207).

Results

Prevalence of various sources of financing

Table 1 shows the prevalence of various sources of distress financing by household location and socio-economic status in Malaysia. The results showed that the prevalence of borrowing without interest was the highest at 13.86%, followed by borrowing with interest (1.03%) while selling off assets was the lowest at 0.87%. The prevalence of borrowing without interest was higher among households living in the rural area (16.21%) while the sale of assets was higher among households living in the urban area (0.97%). The prevalence of borrowing with interest was similar among households living in urban and rural areas at 1.03%.

In terms of socio-economic status, households in the middle (1.06%) and poorest (1.05%) economic groups have the highest prevalence of selling assets. Otherwise, households in rich and poor economic groups have the lowest selling assets with 0.69% and 0.73%, respectively. The prevalence of borrowing without interest was the highest among households in the poorest economic status at 25.54%. In comparison, households in the rich and the richest economic groups have the lowest prevalence at 7.44% and 6.19%, respectively. The results also showed that borrowing with interest was the highest among households in the middle economic group (1.59%) and the lowest among households in the poorest economic group (0.56%).

Household Characteristics

Table 2 demonstrates the households characteristics and the relationship of distress financing between the variables. About 62.1% of households lived in the urban area, while the remaining 37.9% lived in the rural area. Of the total number of households, about 25.1% have at least one family member aged 65 years and older. The percentage of households with at least family members aged less than five years was about 18.7%. About 79.3% have a household size of less than five, while the remaining 20.7% have a household size of five or more. In terms of socio-economic status, about 27.7% of households were in the poorest socio-economic group. Whereas, only about 15.7% were in the richest socio-economic group.

Results also showed that about 24.7% of households had at least one member who visited outpatient care in the past two weeks. In comparison, only about 15.6% of households had at least one member who sought inpatient care in the past 12 months. The percentage of households that had at least one member received oral healthcare in the past 12 months was 44.8%. Also, about 67.4% of households had received at least one supplementary health financial coverage. About 84.5% of the households had OOP spending on health less than MYR 100 in the past 12 months, while only 9.3% of households spent OOP MYR 400 or more.

There were significant differences on distress financing according to household location (χ2 = 12.34, p < 0.001), total of household members 65 years and older (χ2 = 186.93, p < 0.001), total of household members aged less than five years (χ2 = 13.27, p = 0.001), household size (χ2 = 4.16, p = 0.041), socio-economic status (χ2 = 203.32, p < 0.001), total of household members received inpatient care in the past 12 months (χ2 = 10.32, p = 0.016), total of household members received oral healthcare in the past 12 months (χ2 = 18.66, p < 0.001) and supplementary health coverage (χ2 = 63.70, p < 0.001).

There was no significant difference between distress financing with the total of household members who received outpatient care in the past two weeks (χ2 = 4.89, p = 0.180) and OOP expenditure on health in the past 12 months (MYR) (χ2 = 2.88, p = 0.577).

Level of inequality for distress financing and various sources of financing

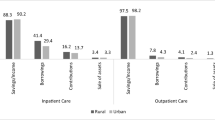

Figure 2; Table 3 show the concentration curve and concentration index of distress financing and various sources of financing among the socio-economic group. The results revealed that the distribution of distress financing was higher among the poor, with the curve extended above the equality line, portrayed by a concentration index value of -0.245. Borrowing without interest followed the same trend, in which the curve stretched above the equality line with a concentration index value of -0.284. Results also showed that the concentration of household selling assets was slightly higher among the poor, with a concentration index value of -0.065. However, the concentration curve for the prevalence of borrowing with interest fell below the equality line, indicating a higher distribution among the rich. The concentration index value for borrowing with interest was 0.184.

Concentration curves for distress financing and various sources of financing in Malaysia. A Concentration curve for distress financing. B Concentration curve for Selling assets. C Concentration curve for borrowing without interest. D Concentration curve for borrowing with interest. The blue line signifies the concentration curve, while the orange line represents the equality line

Determinants of distress financing

Table 4 shows the results of the modified Poisson regression model of the distress financing determinants among the households in Malaysia. The model incorporates nine explanatory variables. These variables were the household location, a total of household members aged 65 years and older, a total of household members aged less than five years, household size, socio-economic status, a total of household members who received outpatient care in the past two weeks, a total of household members who received inpatient care in the past 12 months, a total of household members who received oral healthcare in the past 12 months and supplementary health coverage. The model encompassing all the nine explanatory variables was statistically significant, χ2 = 347.91, p < 0.001. The model explained 4.9% (Cox-Snell R squared) to 8.4% (Nagelkerke R squared) of the variance in distress financing. The results showed that only four variables were statistically significant to determine distress financing, namely the total of household members aged 65 years and older, the total of household members aged less than five years, socio-economic status, and the total of household members who received inpatient care in the past 12 months. Households in poor, middle, rich, and richest socio-economic groups had 0.57, 0.58, 0.40 and 0.36 times the risk to experience distress financing than households in the poorest socio-economic group. The presence of one and two or more household members aged 65 and older were associated with a 1.94 and 1.59 increase in the risk of developing distress financing compared to households with no members aged 65 years and older. The risk of developing distress financing with households having one and two members who received inpatient care in the past 12 months was 1.28 and 1.58 times that of the household with no members who received inpatient care in the past 12 months. Having one household member with an age less than five years also was associated with 0.79 times the risk to develop distress financing than a household without any member aged less than five years.

Discussions

The present study revealed that the prevalence of borrowing without interest was the highest among various sources of financing at 13.86%, which includes borrowing from friends and family members. Compared to other sources of distress financing, borrowing without interest is considered low risk. Studies also found that selling assets are less common than borrowing since it could push household into poverty [6, 12, 55]. Borrowing is a much more common source of healthcare financing among low- and middle-income countries. However, the prevalence shown in this study was relatively low compared to other countries such as India and Cambodia, of which the prevalence was around 42.2% and 22.5% respectively [19, 48]. The low prevalence of distress financing in Malaysia is aligned with the healthcare financing system in Malaysia, which is mainly tax-based. By subsidising healthcare delivery, the government of Malaysia has provided relatively cheap and universal access to health. The latest analysis showed that Malaysia has a UHC effective coverage index higher than the neighbouring countries such as Indonesia, Myanmar and others [56]. Few initiatives were also implemented to reduce the financial barrier to healthcare such as the PeKa B40, mySalam, Bantuan Sara Hidup (BSH) programme, and others which are directly and indirectly cater to the needs of the population to seek healthcare [33].

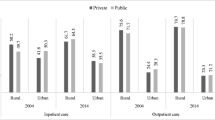

It is no surprise that the results of the current study showed that the prevalence of distress financing is more concentrated among poor households. This finding is similar to other studies done in Vietnam, Indonesia, India, Myanmar, Nepal, and Ethiopia [11, 57,58,59,60]. This current study also found that borrowing without interest was more common among the poor (25.5%) while borrowing with interest was more prevalent among the middle to richest socio-economic groups (1.4–1.6%). The concentration curves and the concentration indices for all sources of financing further explain the differences and unequal distribution of various methods of financing among different socio-economic groups.

Past studies found that households with higher income had a higher level of debt due to confidence in taking a loan [61, 62]. Since access to borrowing without interest greatly depends on social trust, it is more likely to occur among the poor, with the option to borrow with interest being limited [63]. For example, in Southeast India, the ability of a poor household to access borrowing with a low-interest rate depends on their social networks [64]. Notwithstanding the above, the prevalence of borrowing without interest at 13.86% in this current study is almost similar to Cambodia, with 20.8% and 10.9% in 2009 and 2014, respectively [19]. However, the prevalence of borrowing with interest in this current study (1.03%) is much lower compared to Cambodia (69.9%) [19]. Hence, explains the occurrence of inequality among those who borrow with interest. Nevertheless, the prevalence of selling assets was distributed almost equally among the poor and the rich. This is probably due to the low prevalence of selling assets among the households in Malaysia; plus, having no reasons to do so since they have an option to go to public health sectors, which act as the safety net for healthcare delivery in Malaysia. [38].

The presence of family members aged 65 years and older were also associated with the occurrence of distress financing among households. This result is comparable to other studies done in China, India, Cambodia, and Vietnam [65,66,67,68,69,70,71]. The presence of the elderly among household members increases the health financial dependency since they are prone to suffer from illnesses and disabilities [72, 73]. Studies have shown that even in high-income countries, the elderly tend to develop distress financing and CHE due to chronic diseases such as diabetes mellitus and cardiovascular diseases [71, 74]. According to NMHS 2019, the elderly contributes to 40.0% of outpatient care and 16.6% of inpatient care utilisation in Malaysia [75].

Analysis of different socio-economic groups revealed that households in the poor socio-economic group were prone to distress financing due to insufficient resources. The socio-economically vulnerable groups, especially the poor, would rely on financing sources such as borrowing and selling assets to get medical treatment [6, 76]. Hence, forcing them to be placed in a very disadvantageous situation and trapped in the vicious cycle of poverty, health, and indebtedness [6].

Spending nights in hospitals can also result in households resorting to distressed sources of financing. This is seemingly related to the increased cost of illness during hospital stays [77]. For example, any illness among family members such as injuries or NCDs, that requires admission will incur an additional economic burden to the respective household, especially when the family’s sole breadwinner is the one affected. This leaves them with limited choices to finance their healthcare costs by either borrowing or selling their assets [78]. Inpatient care is known to cost more to the patient and their family than outpatient care inconsequential either in private or public healthcare facilities [19].

This study also found that the presence of a child aged less than five years old was less likely to results in the household opting for distressed sources of financing. In most countries, maternity and child health services would incur higher costs to the family compared to those who received free-of-charge health services [79]. Perhaps, this additional cost is not significant for a newly formed family especially when both are working parents. Besides, the decreasing trend of mortality and morbidity among children in Malaysia may suggest lower financial demand to care for them [80].

This is the first study looking into the inequality and determinants of households’ financial distress in Malaysia. While determinants of financial distress were the main focus of this study, equality analysis of financial distress and their various sources of financing gives a better understanding of the current financial distress and UHC situation in Malaysia. Rather than using binomial logistic regression, this study adopted Modified Poisson regression to estimate the relative risk. It is the preferable choice of analysis for binomial outcomes in providing unbiased estimates of relative risk when dealing with model misspecification [52]. The causes of model misspecification may include omission of important explanatory (or independent) variables, exclusion of non-linear components or critical interaction terms, or measurement errors [52]. Hence, adopting modified Poisson regression could avoid biased estimates and misleading conclusions. This study also used national household survey data, providing a better representation of the overall financial distress situation among households in Malaysia. The results of this study can be used as a guide to better improve healthcare delivery in Malaysia. While this study revealed that borrowing with interest and selling assets is very low in Malaysia, the prevalence of borrowing without interest was relatively high, especially among the poor socio-economic group and those living in rural areas. Despite the government subsidising the public healthcare sector and providing almost free healthcare services to all citizens, it only covers the costs of treatment and management in hospitals and clinics [24]. Hence, the direct non-medical costs such as transportation costs are still incurred by the patients and their family members. A unique financial initiative such as PeKa B40 which covers the costs of transportation is a good start to improve the situation, but the provision is only limited to the lowest 40% of the income group and the uptake rate was still debatable [81]. Expansion of the programme will ultimately improve the financial distress situation in Malaysia. Particular attention should be given to the elderly, those admitted to the hospitals, and the poor socio-economic group. Since the poor socio-economic groups are more prone to health morbidities, it is imperative that they are being protected financially. Financial distress among the poor would create unequal access to healthcare and subsequently affect their health status. Thus, removing the financial distress could potentially improve their health status and remove the inequalities gap, which is the core to achieving UHC.

Nevertheless, this study is not without limitations. Since this study used cross-sectional data, the results could not provide a causal relationship between independent variables and distress financing. In addition, the trend of financial distress over the years also could not be examined. Changes in financial distress trends are a good indicator to measure the progression of the country’s healthcare systems towards achieving UHC. Using secondary data also limits the analysis to data availability. Variables that are important and necessary but not available could not be incorporated into the analysis [82,83,84]. Future studies of distress health financing trends will provide a better understanding of the UHC progression in Malaysia and a sustainability gauge for the current healthcare financing systems. In addition, the future study also should explore in-depth reasons and factors behind patients or households resorting to distress financing.

Conclusions

The prevalence of financial distress in Malaysia can be considered low in Malaysia compared to the neighboring countries reflecting tax-based financial healthcare systems, provision of UHC and additional financial incentives through various government initiatives. Similar to other countries, heavy dependence on financial distress was determined by socio-economic status, the presence of household members aged 65 and older, the presence of household members aged less than five, and the presence of household members who received inpatient care. While the prevalence of financial distress is more concentrated among the poor, the prevalence of much risky behaviour of borrowing with interest was more concentrated towards the rich suggesting a limited source of financing among the poor. The findings presented in this study could pave the way for policymakers to strengthen the healthcare systems by narrowing the socio-economic gap and social security safety nets for a better improvement of healthcare coverage. This study also reiterates that special attention to financial coverage should be given to those households caring for the elderly, requiring admission to hospitals, and lower socio-economic groups.

Availability of data and materials

The data used and generated in this study is derived from the Healthcare Demand module under NHMS 2019. The data is not publicly available to protect the participants’ privacy. The data may be requested from the corresponding author and Head of Centre for Biostatistics & Data Repository, National Institutes of Health, Ministry of Health Malaysia on reasonable request and with permission from the Director General of Health, Malaysia.

Abbreviations

- B40:

-

bottom 40% of population

- BSH:

-

Bantuan Sara Hidup

- CHE:

-

catastrophic health expenditure

- DOSM:

-

Department of Statistics Malaysia

- EB:

-

Enumeration Block

- EPF:

-

Employee Provident Funds

- GDP:

-

Gross Domestic Product.

- GEE:

-

generalized estimation equation

- LQ:

-

Living Quarter.

- MCAR:

-

Missing Completely at Random

- MNHA:

-

Malaysia National Health Account

- MYR:

-

Malaysian Ringgit

- NCD:

-

Non-Communicable Disease

- NHMS:

-

National Health and Morbidity Survey

- OOP:

-

Out-of-pocket

- PeKa B40:

-

Skim Peduli Kesihatan for the B40

- SOCSO:

-

Social Security Organisation

- UHC:

-

Universal Health Coverage

- WHO:

-

World Health Organization

References

Koris R, Mohamed Nor N, Azizah Haron S, Wana Ismail N, Mohamed Aljunid Syed Junid S, Muhammad Nur A, et al. Socio-demographic, Cognitive Status and Comorbidity Determinants of Catastrophic Health Expenditure among Elderly in Malaysia [Internet]. Vol. 11, Int J Econ Manag J homepage. 2017. Available from: http://www.econ.upm.edu.my/ijem.

Sirag A, Mohamed Nor N Out-of-Pocket Health Expenditure and Poverty: Evidence from a Dynamic Panel Threshold Analysis. Healthcare. 2021;9(5):536.

Ashhari ZM, Faizal DR, Wen TP. The Effects of Private Health Financing towards the Prevalence of Mental Health Problems: Case Study in Malaysia. Int J Acad Res Business Soc Sci. 2020;10(7):432–45.

Kalousova L, Burgard SA. Debt and Foregone Medical Care. J Health Soc Behav. 2013;54(2):204–20.

McIntyre D, Thiede M, Dahlgren G, Whitehead M. What are the economic consequences for households of illness and of paying for health care in low- and middle-income country contexts? Social Sci Med. 2006;62(4):858–65.

Joe W. Distressed financing of household out-of-pocket health care payments in India: incidence and correlates. Health Policy Plan. 2015;30(6):728–41.

Mishra S, Mohanty SK. Out-of-pocket expenditure and distress financing on institutional delivery in India. Int J Equity in Health. 2019;18(1):99.

Kruk ME, Goldmann E, Galea S. Borrowing And Selling To Pay For Health Care In Low- And Middle-Income Countries. Health Affairs. 2009;28(4):1056–66.

Ir P, Jacobs B, Meessen B, van Damme W. Toward a typology of health-related informal credit: an exploration of borrowing practices for paying for health care by the poor in Cambodia. BMC Health Services Research. 2012;12(1):383.

Daivadanam M, Thankappan KR, Sarma PS, Harikrishnan S. Catastrophic health expenditure & coping strategies associated with acute coronary syndrome in Kerala, India. Indian J Med Res. 2012 [cited 2021 Jul 9];136:585–92. Available from: https://pdfs.semanticscholar.org/3fff/3b33656a116006392f8d99ccb477b7f76942.pdf?_ga=2.3133680.1918627863.1625803888-56639320.1622099203.

Onarheim KH, Sisay MM, Gizaw M, Moland KM, Norheim OF, Miljeteig I. Selling my sheep to pay for medicines – household priorities and coping strategies in a setting without universal health coverage. BMC Health Services Research. 2018;18(1):153.

Quintussi M, van de Poel E, Panda P, Rutten F. Economic consequences of ill-health for households in northern rural India. BMC Health Services Research. 2015;15(1):179.

Huffman MD, Rao KD, Pichon-Riviere A, Zhao D, Harikrishnan S, Ramaiya K, et al. A Cross-Sectional Study of the Microeconomic Impact of Cardiovascular Disease Hospitalization in Four Low- and Middle-Income Countries. PLoS ONE. 2011;14(6):e20821.

Sweet E, Nandi A, Adam EK, McDade TW. The high price of debt: Household financial debt and its impact on mental and physical health. Soc Sci Med. 2013;91:94–100.

Turunen E, Hiilamo H. Health effects of indebtedness: a systematic review. BMC Public Health. 2014;14(1):489.

Clayton M, Liñares-Zegarra J, Wilson JOS. Does debt affect health? Cross country evidence on the debt-health nexus. 130: Soc Sci Med; 2015.

McEwen BS. Protective and Damaging Effects of Stress Mediators. New England J Med. 1998;338(3):171–9.

McEwen BS. Central effects of stress hormones in health and disease: Understanding the protective and damaging effects of stress and stress mediators. Eur J Pharmacol . 2008 [cited 2021 Jul 9];583(2–3). Available from: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2474765/.

Ir P, Jacobs B, Asante AD, Liverani M, Jan S, Chhim S, et al. Exploring the determinants of distress health financing in Cambodia. Health Policy Plan. 2019;34(Supplement_1):i26–37.

Berman P, Ahuja R, Bhandari L. The impoverishing effect of healthcare payments in India: new methodology and findings. Econ Political Weekly. 2010;45(16):17–23.

Fernandes Antunes A, Jacobs B, de Groot R, Thin K, Hanvoravongchai P, Flessa S. Equality in financial access to healthcare in Cambodia from 2004 to 2014. Health Policy and Planning. 2018;33(8):906–19.

Flores G, Ir P, Men CR, O’Donnell O, van Doorslaer E. Financial protection of patients through compensation of providers: The impact of Health Equity Funds in Cambodia. J Health Economics. 2013;32(6):1180–93.

Azzani M, Roslani AC, Su TT. Determinants of Household Catastrophic Health Expenditure: A Systematic Review. Malaysian J Med Sci. 2019;26(1):15–43.

WHO. The World Health Report. 2013: Research for universal health coverage. [Internet]. Geneva, Switzerland; 2013 [cited 2021 Jul 9]. Available from: https://www.who.int/publications/i/item/9789240690837.

Crombie IK, Irvine L, Elliott L, Wallace H. Closing the Health Inequalities Gap: An International Perspective. 2005.

Kakwani N, Wagstaff A, van Doorslaer E. Socioeconomic inequalities in health: Measurement, computation, and statistical inference. J Econometrics. 1997 ;77(1).

Wagstaff A, Paci P, van Doorslaer E. On the measurement of inequalities in health. Soc Sci Med. 1991;33(5).

O’Donnell O, van Doorslaer E, Wagstaff A, Lindelow M. Analyzing health equity using household survey data: A guide to techniques and their implementation [Internet]. The World Bank; 2008 [cited 2021 Jul 9]. Available from: https://openknowledge.worldbank.org/bitstream/handle/10986/6896/424800ISBN978011OFFICIAL0USE0ONLY10.pdf?sequence=1&isAllowed=y.

Ministry of Health Malaysia. Harvard TH. Chan School of Public Health HU. Malaysia Health Systems Research Volume I - Contextual Analysis of the Malaysian Health System, March 2016 [Internet]. 2016 [cited 2021 Jul 22]. Available from: https://www.moh.gov.my/moh/resources/Vol_1_MHSR_Contextual_Analysis_2016.pdf.

Rannan-Eliya RP, Anuranga C, Manual A, Sararaks S, Jailani AS, Hamid AJ, et al. Improving Health Care Coverage, Equity, And Financial Protection Through A Hybrid System: Malaysia’s Experience. Health Affairs. 2016;35(5):838–46.

Institute for Health Systems Research, Institute for Public Health. National Health and Morbidity Survey. 2019 (NHMS 2019) Vol. II: Healthcare Demand. [Internet]. 2020 [cited 2021 Jul 9]. Available from: http://www.ihsr.moh.gov.my/images/publication_material/NHMS2019/hcd2019_report.pdf.

World Health Organization. Malaysia Health System Review [Internet]. Vol. 3. 2013 [cited 2021 Dec 7]. Available from: file:///C:/Users/User/Desktop/Malaysia%20Health%20System%20Review.pdf.

Yap S-L, Wong SS-L, Chew K-S, Kueh JS-H, Siew K-L. Assessing the Relationship between Socio-demographic, Clinical Profile and Financial Toxicity: Evidence from Cancer Survivors in Sarawak. Asian Pacific J Cancer Prevention. 2020;21(10):3077–83.

Ministry of Health Malaysia. Malaysia National Health Account: Health Expenditure Report 1997–2019 [Internet]. Putrajaya; 2021 [cited 2021 Dec 9]. Available from: https://www.moh.gov.my/moh/resources/Penerbitan/Penerbitan%20Utama/MNHA/MNHA_Health_Expenditure_Report_1997-2019_02092021.pdf.

Ashraf A, Ong SC. Malaysia healthcare system: Protect the public or the industry? Health Promotion Perspectives. 2021;11(2):117–8.

Xu K, Saksena P, Jowett M, Indikadahena C, Kutzin J, Evans DB. Exploring the thresholds of health expenditure for protection against nancial risk [Internet]. 2010 [cited 2021 Dec 3]. Available from: https://www.who.int/healthsystems/topics/financing/healthreport/19THE-thresv2.pdf.

Institute for Health Systems Research. Malaysia Health Care Demand Analysis: Inequalities in Healthcare Demand & Simulation of Trends and Impact of Potential Changes in Healthcare Spending. 2013.

Health Policy Research Associates, Institute for Health Systems Research, Institute for Health Policy Sri Lanka. Malaysia Health Care Demand Analysis, Inequalities in Healthcare Demand & Simulation of Trends and Impact of Potential Changes in Healthcare Spending. 2013.

World Health Organization. The world health report: health systems financing: the path to universal coverage [Internet]. World Health Organization; 2010. Available from: http://edeltripp.daportfolio.com.

Sustainable Development Solutions Network. Financing Universal Health Coverage in the Post-2015 Agenda [Internet]. Paris; 2015. Available from: http://www.thelancet.com/journals/lancet/article/PIIS0140-.

Yu CP, Whynes DK, Sach TH. Equity in health care financing: The case of Malaysia. Int J Equity Health. 2008;7(1):15.

Hasan AR, Nair PL. Urbanisation and Growth of Metropolitan Centres in Malaysia. Malaysia Malaysian J Econ Stud. 2014;51(1):87–101.

Chong DWQ, Jawahir S, Tan EH, Sararaks S. Redesigning a Healthcare Demand Questionnaire for National Population Survey: Experience of a Developing Country. Int J Environ Res Public Health. 2021;18(9).

Institute for Health Systems Research. Revision of Healthcare Demand Questionnaire for National Health and Morbidity Survey (NHMS) 2019. Shah Alam; 2018.

Kang H. The prevention and handling of the missing data. Korean J Anesthesiology. 2013;64(5):402.

Curley C, Krause RM, Feiock R, Hawkins C. v. Dealing with Missing Data: A Comparative Exploration of Approaches Using the Integrated City Sustainability Database. Urban Affairs Review. 2019;55(2):591–615.

Bank Negara Malaysia. Exchange Rates [Internet]. 2021 [cited 2021 Jul 22]. Available from: https://www.bnm.gov.my/exchange-rates?p_p_id=bnm_exchange_rate_display_portlet&p_p_lifecycle=0&p_p_state=normal&p_p_mode=view&_bnm_exchange_rate_display_portlet_monthStart=6&_bnm_exchange_rate_display_portlet_yearStart=2021&_bnm_exchange_rate_display_portlet_monthEnd=6&_bnm_exchange_rate_display_portlet_yearEnd=2021&_bnm_exchange_rate_display_portlet_sessionTime=1200&_bnm_exchange_rate_display_portlet_rateType=MR&_bnm_exchange_rate_display_portlet_quotation=fx.

Sangar S, Dutt V, Thakur R. Distress financing of out-of-pocket health expenditure in India. Review of Development Economics. 2019;23(1).

Fuller MF, Lury DA. Statistics Workbook: For Social Science Students. Allan; 1977.

Bilger M, Kruger EJ, Finkelstein EA. Measuring Socioeconomic Inequality in Obesity: Looking Beyond the Obesity Threshold. Health Economics. 2017;26(8).

O’donnell O, O’neill S, Ourti T van. Walsh B. conindex: Estimation of concentration indices. Vol. 16, The Stata Journal. 2016.

Chen W, Qian L, Shi J, Franklin M. Comparing performance between log-binomial and robust Poisson regression models for estimating risk ratios under model misspecification. BMC Med Res Methodol. 2018;22(1):63. 18(.

Yelland LN, Salter AB, Ryan P. Performance of the Modified Poisson Regression Approach for Estimating Relative Risks From Clustered Prospective Data. Am J Epidemiol. 2011;15(8):984–92. 174(.

Zeger SL, Liang K-Y. Longitudinal Data Analysis for Discrete and Continuous Outcomes. Biometrics. 1986;42(1):121.

Hoque ME, Dasgupta SK, Naznin E, al Mamun A. Household coping strategies for delivery and related healthcare cost: findings from rural Bangladesh. Tropical Medicine & International Health. 2015;20(10).

Lozano R, Fullman N, Mumford JE, Knight M, Barthelemy CM, Abbafati C, et al. Measuring universal health coverage based on an index of effective coverage of health services in 204 countries and territories, 1990–2019: a systematic analysis for the Global Burden of Disease Study 2019. Lancet. 2020;396(10258):1250–84.

Sparrow R, Poel E van, Hadiwidjaja G, Yumna A, Warda N, Suryahadi A. Coping With The Economic Consequences Of Ill Health In Indonesia. Health Economics. 2014;23(6).

Nguyen KT, Hai Khuat OT, Ma S, Pham DC, Hong Khuat GT, Ruger JP. Coping with health care expenses among poor households: Evidence from a rural commune in Vietnam. Social Sci Med. 2012;74(5).

Mohanty SK, Kastor A. Out-of-pocket expenditure and catastrophic health spending on maternal care in public and private health centres in India: a comparative study of pre and post national health mission period. Health Economics Review. 2017;7(1).

Mohanty SK, Agrawal NK, Mahapatra B, Choudhury D, Tuladhar S, Holmgren EV. Multidimensional poverty and catastrophic health spending in the mountainous regions of Myanmar, Nepal and India. Int J Equity Health. 2017;16(1).

Meng X, Hoang NT, Siriwardana M. The determinants of Australian household debt: A macro level study. J Asian Econ. 2013;29.

Mokhtar M, Ismail A. Shariah Issues in Managing Household Debt: The Case of Malaysia (Isu-isu Shariah dalam Pengurusan Pinjaman Seisi Rumah: Kes Malaysia) [Internet]. Vol. 37, Jurnal Pengurusan. 2013 [cited 2021 Jul 9]. Available from: https://core.ac.uk/download/pdf/19790554.pdf.

Woolcock M. Social capital and economic development: Toward a theoretical synthesis and policy framework. Theory Soc. 1998;27(2).

Bhukuth A, Ballet J, Radja K. An Analysis of Social Proximity and Interest Rate in Rural South India. Econ Sociol. 2018;11(1).

van Minh H, Kim Phuong NT, Saksena P, James CD, Xu K. Financial burden of household out-of pocket health expenditure in Viet Nam: Findings from the National Living Standard Survey 2002–2010. Social Sci Med. 2013;96.

Kien VD, van Minh H, Giang KB, Dao A, Tuan LT, Ng N. Socioeconomic inequalities in catastrophic health expenditure and impoverishment associated with non-communicable diseases in urban Hanoi, Vietnam. Int J Equity Health. 2016;15(1).

Shahrawat R, Rao KD. Insured yet vulnerable: out-of-pocket payments and India’s poor. Health Policy Plan. 2012;27(3).

Pandey A, Ploubidis GB, Clarke L, Dandona L. Trends in catastrophic health expenditure in India: 1993 to 2014. Bulletin of the World Health Organization. 2018;96(1).

You X, Kobayashi Y. Determinants of Out-of-Pocket Health Expenditure in China. Applied Health Economics and Health Policy. 2011;9(1).

Kumar K, Singh A, Kumar S, Ram F, Singh A, Ram U, et al. Socio-Economic Differentials in Impoverishment Effects of Out-of-Pocket Health Expenditure in China and India: Evidence from WHO SAGE. PLOS ONE. 2015;10(8).

Jacobs B, de Groot R, Fernandes Antunes A. Financial access to health care for older people in Cambodia: 10-year trends (2004-14) and determinants of catastrophic health expenses. Int J Equity Health. 2016;15(1).

Brinda EM, Rajkumar AP, Enemark U, Prince M, Jacob KS. Nature and determinants of out-of-pocket health expenditure among older people in a rural Indian community. Int Psychogeriatrics. 2012;24(10).

Ha NT, Le NH, Khanal V, Moorin R. Multimorbidity and its social determinants among older people in southern provinces, Vietnam. Int J Equity Health. 2015;14(1).

Yardim MS, Cilingiroglu N, Yardim N. Catastrophic health expenditure and impoverishment in Turkey. Health Policy. 2010;94(1).

Institute for Public Health. National Health and Morbidity Survey (NHMS). 2019: Non-communicable diseases, healthcare demand, and health literacy—Key Findings [Internet]. Shah Alam; 2020 [cited 2021 Jul 9]. Available from: https://iptk.moh.gov.my/images/technical_report/2020/4_Infographic_Booklet_NHMS_2019_-_English.pdf.

Singh EN. Rural savings and its investment in Manipur: A case study of formal finance vis-à‐vis Marups. Business. 2012.

Lee Peng F, Zurina Hamzah H, Mohamed Nor N, Said R. Medical Costs of Overweight and Obesity in Public Hospital [Internet]. Vol. 11, International Journal of Economics and Management Journal homepage. 2017. Available from: http://www.econ.upm.edu.my/ijem.

Das S, Morbidity, Household Spending and the Burden of Health Care on the Urban Poor in Orissa. Journal of Health Management. 2012;14(2).

World Health Organization. Regional Office for the Western Pacific. Malaysia Health System Review [Internet]. Vol. 3. Manila; 2013 [cited 2021 Jul 9]. Available from: https://apps.who.int/iris/handle/10665/206911.

Abd Nasir NF, Muzaffar AN, Rahmat SNE, Wan Husin WZ, Zainal Abidin NS. Forecasting Malaysia Under-5 Mortality Using State Space Model. Journal of Physics: Conference Series. 2020;1496.

OECD. Economic Surveys OECD: Malaysia 2019 [Internet]. 2019. Available from: www.oecd.org/eco/surveys/economic-survey-malaysia.htm.

Boslaugh S. Secondary Data Sources for Public Health. Cambridge: Cambridge University Press; 2007.

Doolan DM, Froelicher ES. Using an Existing Data Set to Answer New Research Questions: A Methodological Review. Research and Theory for Nursing Practice. 2009;23(3).

Xaquín PS. Secondary Data. In: The SAGE Encyclopedia of Communication Research Methods. 2455 Teller Road, Thousand Oaks California 91320: SAGE Publications, Inc; 2017.

Acknowledgements

The authors would like to acknowledge the Director General of Health Malaysia for permitting the publication of this article. Acknowledgement also to the Director of Institute for Health Systems Research for providing support and guidance. Credit also to the NHMS 2019 team members and all the respondents involved in this study.

Funding

This research was supported by the MOH Malaysia (NMRR-18-3085-44207) and received funding from the National Institutes of Health, MOH Malaysia research grant. The funding sources had no involvement in study design, study conduct, analysis of the results, writing of this manuscript, and the decision to submit this topic for publication.

Author information

Authors and Affiliations

Contributions

NZ: writing-original draft preparation, formal analysis and visualisation. NZ and ZA: software. NZ and MJ: conceptualization. NZ, MJ, FI and SJ: methodology and data curation. SJ, NA and MJ: investigation. MJ, NA, FA, FI, SJ and ZA: validation and writing-reviewing and editing. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

NHMS 2019 follows the tenets of the Declaration of Helsinki throughout the conduct of the study. Before the interview, written informed consent was obtained from all participants. Ethics clearance was obtained from the Medical Research and Ethics Committee (MREC), Ministry of Health (MOH) Malaysia KKM/NIHSEC/P182325(11)], and NHMS 2019 was registered in the National Medical Research Register, MOH Malaysia (NMRR-18-3085-44207). Anonymity and confidentiality of respondents in this study were assured, with no personal identifiers collected. Administrative permission to access and use the data was granted by the Centre for Biostatistics & Data Repository, National Institutes of Health, Ministry of Health Malaysia.

Consent for publication

Not applicable.

Competing interests

The author(s) declared no conflicts of interest concerning the research, authorship, and/or publication of this article.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/. The Creative Commons Public Domain Dedication waiver (http://creativecommons.org/publicdomain/zero/1.0/) applies to the data made available in this article, unless otherwise stated in a credit line to the data.

About this article

Cite this article

Mohd Hassan, N.Z.A., Mohd Nor Sham Kunusagaran, M.S.J., Zaimi, N.A. et al. The inequalities and determinants of Households’ Distress Financing on Out-off-Pocket Health expenditure in Malaysia. BMC Public Health 22, 449 (2022). https://doi.org/10.1186/s12889-022-12834-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s12889-022-12834-5