Abstract

Background

The Chinese government implemented the first round of National Centralized Drug Procurement (NCDP) pilot (so-called “4 + 7” policy) in mainland China in 2019. This study aims to examine the impact of “4 + 7” policy on the price of policy-related drugs.

Methods

This study used drug purchasing order data from the Centralized Drug Procurement Survey in Shenzhen 2019, covering 24 months from January 2018 to December 2019. “4 + 7” policy-related drugs were selected as study samples, including 25 drugs in the “4 + 7” procurement list and 57 alternative drugs that have an alternative relationship with “4 + 7” List drugs in clinical use. “4 + 7” List drugs were then divided into bid-winning and bid-non-winning products according to the bidding results. Single-group Interruption Time Series (ITS) analysis was adopted to examine the change of Drug Price Index (DPI) for policy-related drugs.

Results

The ITS analysis showed that the DPI of winning (− 0.183 per month, p < 0.0001) and non-winning (− 0.034 per month, p = 0.046) products significantly decreased after the implementation of “4 + 7” policy. No significant difference was found for the immediate change of DPI for alternative drugs (p = 0.537), while a significant decrease in change trend was detected in the post-“4 + 7” policy period (− 0.003 per month, p = 0.014). The DPI of the overall policy-related drugs significantly decreased (− 0.261 per month, p < 0.0001) after “4 + 7” policy.

Conclusions

These findings indicate that the price behavior of pharmaceutical enterprises changed under NCDP policy, while the price linkage effect is still limited. It is necessary to further expand the scope of centralized purchased drugs and strengthen the monitoring of related drugs regarding price change and consumption structure.

Similar content being viewed by others

Introduction

Worldwide, many countries are facing the challenge of ever-increasing pharmaceutical expenditures [1, 2], and the global pharmaceutical market reached $955 billion in 2019 [3]. In China, the total health expenditure increased from 145.4 billion yuan in 2008 to 5799.8 billion yuan in 2018, with an average compound annual growth rate of 13.4% [4]. In 2018, the total pharmaceutical expenditure was 1914.89 billion yuan in China, accounting for 32.39% of the total health expenditure [5], which was much higher than the average level of 17% in the Organization for Economic Co-operation and Development (OECD) countries [6].

It is common practice worldwide that lowering drug prices and reducing drug expenditures by volume-based drug procurement [7, 8]. During the past 10 years, centralized drug procurement at the provincial level has been the dominant form of drug procurement of public hospitals in mainland China. Under this procurement environment, the issue of inflated drug prices, drug rebates, drug shortages, etc. has been widespread [9, 10]. Since 2015, several cities (Sanming, Shanghai, etc.) started the reform and pilot of volume-based drugs procurement, which accumulated practical experiences [11]. In January 2019, the General Office of the State Council of the People’s Republic of China (PRC) implemented the National Centralized Drug Procurement (NCDP) policy [12]. In the first round of the NCDP pilot, four municipalities and seven sub-provincial cities in mainland China were selected as pilot cities, thus, the first round of NCDP pilot is also known as “4 + 7” policy. In the policy, original branded drugs, as well as generic drugs that have passed the consistency evaluation of quality and efficacy are assigned as the criteria for participating national volume-based procurement [13]. One of the highlights of “4 + 7” policy lies in “trade-for-price” [14]. Under “4 + 7” policy, each public medical institution in pilot cities was required to submit the agreed procurement volume of each drug in the procurement list (called “4 + 7” List drug) to the National Health Security Administration (NHSA). The agreed procurement volume is the expected annual procurement volume of a certain “4 + 7” List drug (by generic name) estimated with reference to the use volume in the previous year. Then, NHSA organized competitive bidding and price negotiation based on the overall annual agreed procurement volume of 11 pilot cities. For each drug substance, the pharmaceutical manufacturer with the lowest bid price won the bid. On December 17, 2018, the bid winning results were announced, with an average price reduction of 52% for 25 bid-winning drugs [15].

Under volume-based procurement at the national level, the market structure of policy involved drugs was reshaped, and the demand and consumption structure of policy-related drugs would inevitably change [16]. Driven by the “price reduction and volume increment” of bid-winning drugs, the prices of other policy-related drugs, such as bid-non-winning drugs and drugs that have an alternative relationship with bid-winning drugs in clinical use, would inevitably change. A study based on national drug procurement data reported that, after the implementation of “4 + 7” policy, the daily cost of bid-winning original and generic drugs, as well as non-winning original drugs, significantly decreased by 33.20, 75.74, and 5.35%, while the daily cost of bid-non-winning generic drugs prominently increased by 73.66% [17]. Wang et al.’s study [18] in Shanghai found that the daily cost of branded and generic cardiovascular drugs fell by 66.45 and 24.24% after the implementation of “4 + 7” policy. Yang et al. [19] indicated that the price of bid-non-winning antipsychotic drugs decreased by more than 10% as the results of “4 + 7” policy, while the price of other drug substances dropped by less than 5%. Similary, Chen et al.’s study [20] in Shenzhen, China revelved that the price of alternative drugs (i.e. drug substances that have an alternative relationship with bid-winning drugs) decreased significantly after policy intervention. However, Ye et al. [21] reported opposite results that the daily cost of bid-non-winning products and alternative drugs increased by 17.43 and 7.68%, respectively.

In summary, previous findings regarding the impact of “4 + 7” policy on drug prices have been controversial. In the present study, following a quasi-natural experiment design, we examine the impact of “4 + 7” policy on the change of policy-related drug prices.

Methods

Data sources

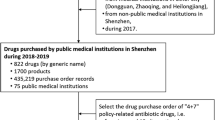

This study used data from the Centralized Drug Procurement Survey in Shenzhen 2019 (CDPS-SZ 2019) [20]. In China, the CDPS-SZ 2019 was organized and conducted by the Global Health Institute of Wuhan University between December 2019 and January 2020. The survey aimed to evaluate the effect of drug-related policies in Shenzhen, China, and collected monthly drug purchase order data between 2018 and 2019. In the CDPS-SZ 2019 database, each purchase order record included purchase date, generic name, dosage form, specification, pharmaceutical manufacturer, price per unit, purchase volume, purchase expenditures, etc. A general database containing 963,127 monthly aggregated purchase order records was established, involving 1079 drug subtances (by generic name), 346 medical institutions, 857 pharmaceutical manufacturers. The total purchase expenditures reached 20.87 billion Chinese Yuan.

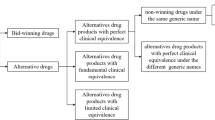

The purpose of this study is to examine the impact of “4 + 7” policy on prices of policy-related drugs. Thus, we included samples with the following criteria: (a) the drug scope was “4 + 7” policy-related drugs [14, 17], including 25 drugs involved in the “4 + 7” procurement list (called “4 + 7” List drugs) and their alternative drugs (supplementary Table 1). The alternative drug refers to drug substances that have an alternative relationship with “4 + 7” List drugs in clinical use, which was determined according to the Monitoring Plan Work of National Centralized Drug Procurement and Use issued by the NHSA of the PRC [22]. The document provided a list of alternative drugs for each of the 25 drugs. “4 + 7” List drugs were divided into bid-winning and bid-non-winning products according to the bidding results. Bid-winning products referred to products that won the tender in “4 + 7” policy, otherwise they were deemed to be non-winning products. (b) the time period between January 2018 and December 2019; and (c) the medical institution covered all the public medical institutions in Shenzhen, China. Finally, 47,163 purchase order records of 82 drug substances (by generic name) were included in the analysis. Figure 1 presents the flow chart of sample screening.

Outcome variables

Drug Price Index was used as outcome variable in this study, which is a common indicator reflecting the trend of drug price change over different periods [23, 24]. This study applied three commonly used DPI: Laspeyres Price Index (LP), Paasche Price Index (PP), and Fisher Price Index (FP).

LP is calculated as the ratio of price in reporting period and the price in baseline period, weighted by the quantity in baseline period. This method assumes that the consumption structure of drugs remains unchanged in different periods, and is applicable to reflect the pure price change of drugs. LP is calculated as follows:

PP is calculated as the ratio of price in reporting period and the price in base-period, weighted by the quantity in reporting period. The index reflects the increase or decrease in drug costs due to the price change when the quantity and consumption structure has changed. PP is calculated as follows:

FP is calculated as the geometric mean of LP and PP, which was weighted by the quantity in both baseline period and reporting period. Thus, FP can equalize and average the biases of LP and PP. Theoretical researches showed that FP is an optimal form of price index, and is called “the ideal index” [24]. FP is calculated as follows:

In the above Formula (1)–(3), P means the price, P0 and P1 refer to price per Defined Daily Doses (DDDs) of each product in baseline- and reporting period. Q means purchasing quantity, Q0 and Q1 refer to DDDs of each product in baseline- and reporting period. DDDs is the ratio of the quantity of drug utilization and Defined Daily Dose (DDD) [25]. If the drug price index > 1, it indicates the increase of drug price in the reporting period when compared with the base-period; If the drug price index =1, it means that drug prices remain unchanged over the two periods; If the drug price index < 1, it means that drug prices in the reporting period decrease compared with the base period.

LP and PP assume that consumption structure of the “basket” of drugs remains unchanged in baseline or reporting period, while in reality, the consumption structure of medicines always changes. Therefore, the price levels measured by LP and PP are always biased against the reality. FP averages the different biases between LP and PP, and the calculation result lies between the above two. Previous studies pointed out that FP is a better form of price index, also known as the Fisher ideal index [26]. Thus, we applied FP as the outcome indicator when conducted segmented linear regression.

In this study, January to June 2018 was assigned as the baseline period, and July 2018 to December 2019 was assigned as the reporting periods to calculate drug price indexes of each month (18 months).

Statistical analysis

Firstly, descriptive statistics were applied to describe the change of DPI of policy-related drugs under “4 + 7” policy. In Shenzhen, “4 + 7” policy was implemented on March 25, 2019, thus 8 months (July 2018 to February 2019) was assigned as the pre-“4 + 7” policy period and 10 months (March to December 2019) as post-“4 + 7” policy period.

Secondly, a single group-interrupted time-series analysis was designed to quantity the impact of “4 + 7” policy on FP [27, 28]. The monthly time series of FP was constructed invlolving 18 time points between July 2018 and December 2019, including 8 points pre-intervention and 10 points post-intervention. Segmented linear regression model with two interruption points were formulated to detect the effect on FP, as follows [29]:

In the Formula (4), Yt is the FP in month t. Tt indicats time in months at time t from the start of the observation period, which values from 1 to 18. Xt is an indicator for time t in the pre-“4 + 7” policy period (coded 0) and post-“4 + 7” policy period (coded 1). TtXt indicats months in the post-“4 + 7” policy period (time in the pre-“4 + 7” policy period is coded 0).

In the above model, β0 estimates the baseline level of the FP. β1 estimates the linear trend of FP in the pre-“4 + 7” policy period. β2 estimates the change in level after the “4 + 7” policy. β3 estimates the change in trend in the post-“4 + 7” policy period compared with the pre-“4 + 7” policy period. εt is an estimate of the random error at time t. Durbin-Watson test was performed to test the presence of first-order auto-correlation (a value around 2 indicates no sign of auto-correlation). Stata version 16.0 was used to perform the ITS analysis. A p-value < 0.05 was considered statistically significant.

Results

Descriptive analysis

Descriptive analysis was conducted to compare the change of LP, PP, and FP in the pre- and post-“4 + 7” policy periods. Table 1 lists the results of winning and non-winning products. After the implementation of “4 + 7” policy, the LP, PP, and FP of bid-winning drugs decreased by 56.37, 57.45, and 81.35%, respectively. The FP of bid-winning products declined from 0.50 (SD = 0.01) in pre-“4 + 7” policy period to 0.09 (SD = 0.01) in post-“4 + 7” policy period. The LP, PP, and FP of non-winning products decreased by 2.32, 9.91, and 11.96%, respectively. The FP of non-winning products declined from 0.49 (SD = 0.01) in pre-“4 + 7” policy period to 0.43 (SD = 0.03) in post-“4 + 7” policy period.

Table 2 summarizes the results of “4 + 7” List drugs and alternative drugs. After the implementation of “4 + 7” policy, the LP, PP, and FP of “4 + 7” List drugs decreased by 58.95, 60.68, and 83.38%, respectively. The FP of “4 + 7” List drugs dropped from 0.48 (SD = 0.02) in pre-“4 + 7” policy period to 0.08 (SD = 0.03) in post-“4 + 7” policy period. The LP, PP, and FP of alternative drugs decreased by 2.30, 2.11, and 4.34%, respectively. The FP of alternative drugs dropped from 0.49 (SD = 0.01) in pre-“4 + 7” policy period to 0.47 (SD = 0.02) in post-“4 + 7” policy period. For the overall of “4 + 7” List drugs and alternative drugs, the LP, PP, and FP decreased by 35.83, 41.49, and 62.21%, respectively. The FP of the overall drugs dropped from 0.48 (SD = 0.01) in pre-“4 + 7” policy period to 0.18 (SD = 0.03) in post-“4 + 7” policy period.

ITS analysis

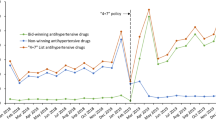

Bid-winning and non-winning drugs

The results of ITS analysis for bid-winning and non-winning products are presented in Table 3 and Fig. 2. The FP of winning products significantly declined (− 0.0.391 per month, 95% CI = − 0.411 to − 0.370, p-value < 0.001) in the start of the “4 + 7” policy implementation, while no significant difference was found in the slope between pre- and post-“4 + 7” policy periods (p-value =0.280). In the start of the “4 + 7” policy implementation, significant decrease (− 0.034 per month, 95% CI = − 0.067 to − 0.001, p-value =0.046) was found in FP of non-winning products. However, the change in the pre- and post-“4 + 7” policy slopes had no significant difference (p-value =0.262).

“4 + 7” list drugs and alternative drugs

The ITS results of “4 + 7” List drugs and alternative drugs are presented in Table 4 and Fig. 3. The FP of “4 + 7” List drugs significantly declined (− 0.347 per month, 95% CI = − 0.395 to − 0.299, p-value < 0.001) in the start of the “4 + 7” policy implementation. However, no statistically significant difference was found in the trend change between the pre- and post-“4 + 7” policy periods (p-value = 0.761). Significant decline (− 0.003 per month, 95% CI = − 0.006 to − 0.001, p-value = 0.014) in FP of alternative drugs was found between the pre- and post-“4 + 7” policy slopes. For the overall of “4 + 7” List drugs and alternative drugs, the FP significantly decreased (− 0.261 per month, 95% CI = − 0.298 to − 0.223, p-value < 0.001) at the start of the “4 + 7” policy implementation, while the change in the pre- and post-“4 + 7” policy slopes had no significant difference (p-value = 0.268).

Discussion

This study aims to analyze the impact of NCDP on the prices of policy-related drugs. Overall, we found that the price of winning products decreased markedly and the prices of non-winning products dropped slightly after the implementation of “4 + 7” policy, while the price change of alternative products had no statistical difference. For the overall drugs of “4 + 7” List and alternative, the comprehensive effect of “4 + 7” policy on price reduction was significant, but the long-term effect of the policy was not obvious.

In the NCDP policy, 60–70% of the market in pilot cities was assigned to conduct volume-based procurement, so as to relieve the artificially high drug prices by “group purchase” [30]. In this study, a notably direct effect of price reduction for winning products was observed, the FP decreased by 79.02% and showed significant difference between the pre- and post-“4 + 7” policy periods. Tan et al. [31] reported similar results that 25 winning drugs dropped by 51.88% in Guangzhou when compared with the pre-intervention period, among which the price of atorvaststin (10 mg*7 tablets) dropped by 85.7%. “4 + 7” winning products covered original branded drugs and generic drugs that had passed consistency evaluation of quality and efficacy, which had large clinical demand and quality assurance. Thus, the decline in drug prices might effectively alleviate the medication burden of patients.

With the announcement of “4 + 7” bid-winning results, pharmaceutical enterprises related to bid-winning products made adjustments in pricing strategy and sales model [32]. It is reported that enterprises of non-winning products lowered the prices consciously to save the market [11]. In the present study, we found that the FP of non-winning products dropped by 11.96% after “4 + 7” policy in Shenzhen and showed statistically significant. Previous studies reported similar findings [19, 33]. Zhang & Wang [33] found that the price of non-winning antihypertensive drugs showed a gradient decline, with the fall ranging from 1 to 52%. Yang et al. [19] reported that the prices of three non-winning antidepressant drugs dropped by 12.67% on average. These findings indicated that the implementation of NCDP policy was conducive to improve market competitiveness and reshaping the competitive pattern of the pharmaceutical industry. However, ITS results of this study showed that there was no statistical difference in the changes of DPI slope of non-winning products between the pre- and post-“4 + 7” policy periods, indicating that the price reduction of non-winning products might just be a temporary response of pharmaceutical enterprises during the implementation of policy.

In this study, the FP of alternative products fell slightly by 4.34% in Shenzhen, while ITS analysis showed no statistical difference. Chen et al. [20] and Yang et al. [19] reported consistent results as this study. On the one hand, the price of alternative drugs did not change significantly (such as price increase) during the implementation of “4 + 7” policy, indicating that the national monitoring did play an important role [22]. On the other hand, this study indicated that the effect of price reduction triggered by 25 “4 + 7” List drugs was limited, and could not make a further impact on the market pattern. Furthermore, this study also found that the DPI slope of alternative products dropped markedly after the implementation of “4 + 7” policy, indicating that the policy might help slow the growth of alternative drug prices and reduce the burden of patients.

Several potential limitations should be mentioned regarding the present study. Firstly, when it comes to policy effect evaluation, difference-in-difference (DID) or a multiple-group ITS are of superiority than single-group ITS design, for they involved a control group and could effectively identify the net effect of a certain intervention. However, due to the accessibility of data, we are unable to obtain additional data to assign a suitable control group so as to conduct DID analysis or multiple-group ITS, leading to certain defect in this study. Secondly, only one of the 11 pilot cities was included in the study (i.e. Shenzhen City), the results of this study may not fully represent the overall implementation effect of “4 + 7” policy in China, caution should be exercised in generalizing the findings. In spite of this, single-group ITS is also a widely recognized and commonly applied method in drug utilization research [27, 34]. Following a quasi-natural experiment design, single-group ITS study can identify policy effects through self pre-and post-intervention comparison. Furthermore, the present study is the first one to comprehensively examine the price change of policy-related drugs under the implementation of “4 + 7” volume-based procurement policy in China. The findings of this study might have reference value for subsequent policy practice.

Conclusion

This study analyzed the impact of NCDP on the price of policy-related drugs in Shenzhen. The FP of 25 winning products notably decreased by 79.02%. Under the NCDP policy, the market behavior of pharmaceutical enterprises of policy-related drugs changed. The FP of non-winning products dropped by 11.96% after the implementation of the policy, while the long-term trend of price reduction was not observed. In terms of alternative drugs, the price reduction at the start of the implementation of “4 + 7” policy had no statistical difference. However, a trend of price growth slowing down for alternative drugs was observed in the post-“4 + 7” policy period. In the future, on the one hand, it is necessary to expand the scope of “4 + 7” List drugs, so as to trigger the linkage effect of price reduction in a larger scope and to a greater extent. On the other hand, it is essential to strengthen the continuous monitoring of changes in the price and consumption structure of policy-related drugs, ensuring the accessibility and rationality of medications for patients.

Availability of data and materials

The datasets used and/or analysed during the current study are available from the corresponding author on reasonable request.

Abbreviations

- CDPS-SZ 2019:

-

Centralized Drug Procurement Survey in Shenzhen 2019

- DDD:

-

Defined Daily Dose

- DDDc:

-

Defined daily dose cost

- DPI:

-

Drug price index

- ITS:

-

Interruption time series

- L P :

-

Laspeyres Price Index

- P P :

-

Paasche Price Index

- F P :

-

Fisher Price Index

- NCDP:

-

National Centralized Drug Procurement

- OECD:

-

Organization for Economic Co-operation and Development

References

Parkinson B, Sermet C, Clement F, Crausaz S, Godman B, Garner S, et al. Disinvestment and value-based purchasing strategies for pharmaceuticals: an international review. Pharmacoeconomics. 2015;33(9):905–24. https://doi.org/10.1007/s40273-015-0293-8.

Smith C. Retail prescription drug spending in the national health accounts. Health Aff. 2004;23(1):160–7. https://doi.org/10.1377/hlthaff.23.1.160.

The IQVIA Institute. Global medicine spending and usage trends outlook to 2024. 2020. https://www.iqvia.com/insights/the-iqvia-institute/reports/global-medicine-spending-and-usage-trends. Accessed 11 Jan 2021.

The Central People’s Government of the People’s Republic of China. 2019 statistical bulletin of China’s health development. 2020. http://www.gov.cn/guoqing/2021-04/09/content_5598657.htm. Accessed 25 Apr 2021.

Zhai T, Zhang Y, Wan Q, Chai P, Guo F, Li Y, et al. The results and analysis of national health accounts in China in 2018. Chin Health Econ. 2020;39(6):5–8. https://doi.org/10.7664/CHE20200601.

National Health Development Research Center of the National Health Commission. 2018 China total health expenditure research report. Beijing: Institute of health and economy press; 2018.

Dylst P, Vulto A, Simoens S. Tendering for outpatient prescription pharmaceuticals: what can be learned from current practices in Europe? Health Policy. 2011;101(2):146–52. https://doi.org/10.1016/j.healthpol.2011.03.004.

Seidman G, Atun R. Do changes to supply chains and procurement processes yield cost savings and improve availability of pharmaceuticals, vaccines or health products? A systematic review of evidence from low-income and middle-income countries. BMJ Glob Health. 2017;2(2):e243. https://doi.org/10.1136/bmjgh-2016-000243.

Mao Z, Shen X, Wang Q. Retrospective study on drug’s centralized purchasing system of healthcare institutions in China. Chin J Health Policy. 2014;7(10):5–10. https://doi.org/10.3969/j.issn.1674-2982.2014.10.002.

Zhang R, Qiao J, Mao Z, Cui D. A review on the current situation of centralized drug procurement in China’s public medical institutions. Chin J Pharmacoepidemiol. 2019;28(03):199–204.

Mao Z, Yang Y, Chen L. Reform of drug supply and guarantee system in China: policy measures and effects. In: Wang C, Liang W, editors. Development report on health reform in China (2020). Beijing: Social Sciences Academic Press; 2020. p. 96–123.

General Office of the State Council of the People’s Republic of China. Pilot program for national centralized drug procurement and use. 2019. http://www.gov.cn/zhengce/content/2019-01/17/content_5358604.htm. Accessed 9 Jan 2021.

General Office of the State Council of the People’s Republic of China. Opinions on promoting the normalization and institutionalization of centralized drug procurement. 2021. http://www.gov.cn/zhengce/content/2021-01/28/content_5583305.htm. Accessed 25 Mar 2021.

Yang Y, Chen L, Ke X, Mao Z, Zheng B. The impacts of Chinese drug volume-based procurement policy on the use of policy-related antibiotic drugs in Shenzhen, 2018-2019: an interrupted time-series analysis. BMC Health Serv Res. 2021;21(1):668. https://doi.org/10.1186/s12913-021-06698-5.

Shanghai Joint Procurement Office. Announcement of the results of the planned selection of centralized drug procurement in 4+7 cities. 2018. http://www.smpaa.cn/gjsdcg/2018/12/07/8531.shtml. Accessed 25 Dec 2020.

Hu S. The health economics theoretical basis and improvement suggestions for the national centralized drug procurement. Chin Health Resour. 2021:1–4. https://doi.org/10.13688/j.cnki.chr.2021.200942.

Wang J, Yang Y, Xu L, Shen Y, Wen X, Mao L, et al. The impact of National Centralized Drug Procurement policy on the use of policy-related original and generic drugs in public medical institutions in China: a difference-in-difference analysis based on national database. medRxiv. 2021:2021.06.21.21256568 https://doi.org/10.1101/2021.06.21.21256568.

Wang H, Li X, Chen J. Impact of “4+7” City Drug Centralized Procurement Program on the utilization of original and generic cardiovascular drugs in a tertiary hospital. J Pharm Pract. 2020;38(04):373–8. https://doi.org/10.12206/j.issn.1006-0111.202001054.

Yang Q, Guo W, Liu S. Effects of procuring with target quantity on using antipsychotics at a hospital. Chin J Hosp Pharm. 2020:1–6. https://doi.org/10.13286/j.1001-5213.2021.04.13.

Chen L, Yang Y, Luo M, Hu B, Yin S, Mao Z. The impacts of National Centralized Drug Procurement policy on drug utilization and drug expenditures: the case of Shenzhen, China. Int J Environ Res Public Health. 2020;17(24). https://doi.org/10.3390/ijerph17249415.

Ye S, Kang Q, Gao J, Chen Q, Hu S, Cai H, et al. Study of drug price index in evaluating implementation effect of “4+7” drug centralized procurement policy in Fujian. China Health Insur. 2020;(08):35–9. https://doi.org/10.19546/j.issn.1674-3830.2020.8.008.

Wang Y, Wu Z. Keypoint analysis of monitoring plan for centralized drug purchase and use project pilot launched organized by state. China Pharm. 2019;30(17):2317–22. https://doi.org/10.6039/j.issn.1001-0408.2019.17.03.

Ma F, Wu J. Methodological selection strategy analysis on medicine price index. Chin J Health Policy. 2015;8(07):61–7. https://doi.org/10.3969/j.issn.1674-2982.2015.07.010.

Chen W, Cheng X. Discussion on the methodology of compiling drug price index. Chin Health Econ. 1995;08:29–31.

WHO Collaborating Centre for Drug Statistics Methodology. Guidelines for ATC classification and DDD assignment 2021. 2021. http://www.whocc.no. Accessed 6 Mar 2021.

Diewert WE. Fisher ideal output, input, and productivity indexes revisited. J Prod Anal. 1992;3(3):211–48. https://doi.org/10.1007/BF00158354.

Jandoc R, Burden AM, Mamdani M, Lévesque LE, Cadarette SM. Interrupted time series analysis in drug utilization research is increasing: systematic review and recommendations. J Clin Epidemiol. 2015;68(8):950–6. https://doi.org/10.1016/j.jclinepi.2014.12.018.

Lagarde M. How to do (or not to do) ... Assessing the impact of a policy change with routine longitudinal data. Health Policy Plan. 2011;27(1):76–83. https://doi.org/10.1093/heapol/czr004.

Wagner AK, Soumerai SB, Zhang F, Ross-Degnan D. Segmented regression analysis of interrupted time series studies in medication use research. J Clin Pharm Ther. 2002;27(4):299–309. https://doi.org/10.1046/j.1365-2710.2002.00430.x.

Chang F. Analysis on the core elements of centralized drug procurement. Chin Health Resour. 2021:1–5. https://doi.org/10.13688/j.cnki.chr.2021.200774.

Tan Q, Yang S, Li W, Zhang W. Effects, key issues and countermeasures of “4+7” drug volume-based purchasing—practice based on Guangzhou. Health Econ Res. 2020;37(04):46–50. https://doi.org/10.14055/j.cnki.33-1056/f.2020.04.027.

Tan Z, Fan S. Challenges and countermeasures of pharmaceutical enterprises under the background of centralized purchasing of drugs “4+7”. Health Econ Res. 2019;36(08):13–5. https://doi.org/10.14055/j.cnki.33-1056/f.2019.08.004.

Zhang Y, Wang M. Analysis of the influence of “4 +7” on the use of ACEI antihypertensive drugs. J Hunan Norm Univ (Med Sci). 2021;18(01):189–92.

Ariel L. Conducting interrupted time-series analysis for single- and multiple-group comparisons. Stata J. 2015;15(2):480–500. https://doi.org/10.1177/1536867X1501500208.

Acknowledgements

Not applicable.

Funding

This work was supported by the Global Health Institute, Wuhan University, China. The role of the funding body included designing the study, the analysis and interpretation of data, and writing the manuscript.

Author information

Authors and Affiliations

Contributions

Conceptualization, Y.Y. and D.C.; methodology, N.W. and Y.Y.; software, Y.Y.; formal analysis, N.W. and Y.Y.; investigation, N.W., Y.Y., L.X. and Z.M.; resources, Z.M. and D.C.; data curation, Y.Y. and Z.M.; writing—original draft preparation, N.W., Y.Y. and L.X.; writing—review and editing, N.W., Y.Y., L.X., Z.M. and D.C.; supervision, Z.M. and D.C.; project administration, D.C.; funding acquisition, Z.M. and D.C. All authors have read and agreed to the published version of the manuscript.

Corresponding authors

Ethics declarations

Ethics approval and consent to participate

This study was conducted in accordance with the Declaration of Helsinki. The study protocol was reviewed and approved by the Institutional Review Board of School of Health Sciences, Wuhan University. In this research, we only included the medication procurement information and all the information was anonymous. Neither patients nor the public were involved in this research. Thus, according to the Institutional Review Board of School of Health Sciences, Wuhan University, the requirement for patient consent was waived.

Consent for publication

Not applicable.

Competing interests

The authors declare no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Additional file 1: Supplementary Table 1.

The list of included drugs in this study. Supplementary Figure 1. Monthly change trends of fisher price index of policy-related drugs between July 2019 and December 2019.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/. The Creative Commons Public Domain Dedication waiver (http://creativecommons.org/publicdomain/zero/1.0/) applies to the data made available in this article, unless otherwise stated in a credit line to the data.

About this article

Cite this article

Wang, N., Yang, Y., Xu, L. et al. Influence of Chinese National Centralized Drug Procurement on the price of policy-related drugs: an interrupted time series analysis. BMC Public Health 21, 1883 (2021). https://doi.org/10.1186/s12889-021-11882-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s12889-021-11882-7