Abstract

This study uses the intrinsic bubbles detection method to identify housing bubbles in the Hong Kong residential property market. By using sample period data from 1993 to 2019, the empirical results show evidence of intrinsic bubbles. Based on the unit root and co-integration tests, I found that there are no rational speculative bubbles in the Hong Kong residential property market. Furthermore, by using the Granger causality tests of the corresponding asymmetric VECM specification, there is no causality from lagged changes in the rental price returns to changes in the property price returns. However, there is strong evidence to show that changes in the property price index returns can Granger cause changes in the rental price index returns.

Similar content being viewed by others

Introduction

Over the past two decades, both developed and developing countries have suffered serious financial crises, including the Asian Financial Crisis, the Dot-Com Crisis, the Global Financial Crisis, and the European Debt Crisis. These crises were caused by the collapse of price bubbles, such as those in stock markets, housing markets, and asset markets. The Hong Kong residential property market is one of the most volatile real estate markets in the world, and it has experienced a few interesting episodes over the last 20 years. For example, after the Asian Financial Crisis in 1998, the property market collapsed and by September 1998, residential property prices shed more than half of their respective values. However, after the Global Financial Crisis, there was a significant price rise in both the residential property market and the rental market. Especially in 2018, the residential property market was buoyant in the first half of the year, fuelled by encouraging sales response to new projects and positive sentiment. As a result, the Hong Kong Rating and Valuation Department records the domestic price rocketed 11.9% in the first 7 months of the year. However, the market underwent a consolidation in the latter half of the year attributable to various uncertainties, including the US-China trade friction, continued U.S. interest rate hikes, increases in local best-lending rates in September, and fluctuations in the global assets markets. Also according to the Hong Kong Rating and Valuation Department record, the residential property price culminated in August and ended the 28-month upward trend by a 9% drop at the end of the year. The rental market also lost momentum towards the end of the year. Compared with the third quarter, prices and rents slid down 6.2% and less than 1.0% respectively in the fourth quarter of 2018. Meanwhile, the price indices continued to show a declining trend in the first 2 months of 2019. Nevertheless, overall flat prices in the fourth quarter gained 5.9% over the same quarter in 2017, whereas overall rents during the same period increased by 4.6%. Therefore, it is important to examine if there is a bubble in the Hong Kong residential property market. Shiller (2000) gives examples of different periods of the U.S. stock market history when earnings growth and price growth do not correspond well. There is also considerable conflicting evidence on whether changes in the rental price index returns can predict changes in the property price index returns.

The literature on bubbles include research on rational speculative bubbles and intrinsic bubbles. Rational speculative bubbles are generated by extraneous events or rumors which have nothing to do with the fundamentals. There are many empirical studies devoted to rational speculative bubbles in the financial market (e.g., Blanchard and Watson 1982; Brock 1982; Flood and Garber 1980; Obstfeld and Rogoff 1983; Tirole 1982, 1985). The present value model and assumption of a rational speculative bubble have been used for bubble detection. Blanchard and Watson (1982) indicate that in an environment with no rational bubble, the price of a financial asset is the present value of future revenue. This can be considered as the fundamental part of the asset price. When investors want to pay more than the fundamental value in the future, then a rational bubble arises. The asset price in the future can be considered as the fundamental and the bubble components. Shiller (1981) develops a variance bound test to check for rational bubbles in the financial market. He theorizes that the variance of observed asset prices will exceed the bounds imposed by the variance of the fundamental value when there is a rational bubble. In earlier work by West (1987), a two-step test is proposed which requires the detailed specification of an underlying equilibrium model of asset prices. The test compares and contrasts the estimated impact of the fundamental value on the asset price with a simple linear model which considers that there are no bubbles. Diba and Grossman (1988) indicate that a rational bubble cannot start; thus, if it exists now, it must always have existed. They use the unit root test and co-integration test to identify the bubble. Unlike rational bubbles, Froot and Obstfeld (1991) introduce intrinsic bubbles which depend exclusively on exogenous fundamentals. They find significant evidence to support their model based on estimations of the U.S. stock market. They conclude that asset prices can overreact to changes in fundamentals. Duration dependence is used to examine a new testable implication for bubbles, as developed by McQueen and Thorley (1994), who suggest that the probability that a run of positive abnormal return ends should decline with the length of the run (negative hazard function).The unit root, co-integration, and duration dependence tests have been widely applied to detect housing price speculative bubbles in the US during the last two decades. For example, Jirasakuldech et al. (2006) use the unit root test and co-integration procedures and find no evidence of rational speculative bubbles in the REIT (real estate investment trust) market in the US. They also use the duration dependence test to directly examine the return series and find no evidence of rational speculative bubbles in the REIT market either. Arshanapalli and Nelson (2008) use a co-integration test to identify a housing bubble in the mid-2000s in the U.S. housing market. Lai and van Order (2010) use the Gordon growth model to examine the housing market in the US with rental income, discount rate and the expected rental income growth. In their empirical results, they find that the U.S. housing bubbles occurred predominantly after 2003.

In addition, many researchers have used the present value model to examine the relationship between the cost of renting and potential mispricing in the housing market (e.g., Ambrose et al. 2013; Ayuso and Restoy 2006; Cutts et al. 2005; Feng and Wu 2015). This pricing strategy is similar to the Gordon growth model for the stock market, except that the return to the housing is the rent-to-price ratio. Scholars further consider whether property price changes could be predicted by the fundamental value of the rental price, and they utilize the rental price index and the property price index to examine mispricing in the housing market. For example, Gallin (2008) states that the housing price index is unmatched to the rental price index in the US. Glaeser and Gyourko (2007), as a further example, explain that the property price index failed to accurately match with the rental price index. Nneji et al. (2011) use the intrinsic bubbles method to detect the housing market situation in the US, and by using the Granger causality test to examine whether or not the changes in rent can predict returns in the housing market; they then conclude that the changes in rents could predict future returns in the housing market only when intrinsic bubbles exist in the U.S. market. Gali (2014) explains bubbles are affected by the monetary policy since the discount factor is related to the real interest rate. Barlevy et al. (2017) improve Gali’s (2014) model and explain that an increase in interest rates can be effective against bubbles and policymakers’ effective interventions can make society better off. Hu and Oxley (2018) apply the generalized ADF test to examine bubbles in the U.S. housing market from 1975 to 2014. Their results show that there are many local bubbles in different states but no sign of a nationwide housing bubble. Furthermore, Awwal and Bidarkota (2019) use the annual U.S. stock prices and dividends data to test the intrinsic bubbles in the DJIA and S&P 500 stock indices, the results of which reject the absence of a bubble component in both series. Therefore, the intrinsic bubble detection method is an important method for examining bubbles in both the stock and the housing markets.

Martin and Ventura (2017) state the macroeconomic applications of the theory of rational bubbles, and conclude that rational bubbles can be explained by the standard macroeconomic model. The scholars summarize over seventy studies on bubbles from which it can be seen that the literature on bubble detection has been well-developed in the Western countries. However, there are still very few studies in the Hong Kong residential property market. Therefore, the objective of this study is to use the framework of intrinsic bubbles by Froot and Obstfeld (1991) to identify bubbles in the Hong Kong residential property market. It will also be determined whether or not changes in the rental price index returns can Granger cause changes in the property price index returns and vice versa. The contributions of this paper to the literature on the Hong Kong residential property market are two-fold. First, it uses the most recent years’ data (1993–2019) and intrinsic bubble method to identify the intrinsic bubbles existing in the Hong Kong residential property market. Since the Hong Kong residential property market is one of the most volatile real estate market in the world, it is important to investigate the existence of bubbles in recent years. The second contribution of this paper is that it is the first of its kind because there is no existing Hong Kong literature studying whether the power of rental price index returns can Granger cause property price index returns and vice versa. This result can aid investors, researchers and policy makers in better understanding that property price index returns can positively affect rental price index returns. Consumer price index and lending rate affect the property price index returns as well; therefore, the changes in the rental price index returns cannot Granger cause the changes in the property price index returns.

The following paper is structured as follows: Section “Data” describes the data; Section “Research method” reviews the intrinsic bubble model and Granger causality test model; Section “Empirical results” conducts the empirical results; and Section “Conclusion” provides the conclusion.

Data

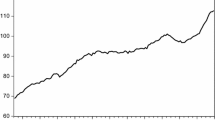

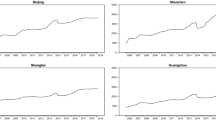

Figure 1 displays the time series plot of the monthly rental and residential property price indices of Hong Kong (January 1993 to February 2019). Data source on property price and rental price indices come from the Rating and Valuation Department (R&VD) of Hong Kong, and data of CPI and lending rate come from the CEIC database. As shown in Fig. 1, the Hong Kong residential property market experienced a strong price run up between the end of 1995 and the beginning of 1997. Several months later, the prices dropped dramatically due to the Asian Financial Crisis occurring in 1998. This downward movement was connected with the price deflation and the economic recession that lasted until 2003. During the Global Financial Crisis, the property market was seriously hit, causing housing prices to drop in mid-2008 as well. However, a large amount of money entered into Hong Kong from early 2009. Based on an analysis by Norman Chan in November 2012, the Chief Executive of the Hong Kong Monetary Authority, there was over HK$500 billion capital inflow from the fourth quarter of 2008. This number grew to HK$640 billion by the end of 2009. Since “Hot Money” inflows were invested into the Hong Kong asset market, some concerns about the risk of inflation and asset bubbles formation. As previously stated, the residential property price and rental price indices both demonstrate an increasing trend after the Global Financial Crisis. It is necessary to examine if the bubbles exist in the Hong Kong residential property market.

Figure 2 depicts the price–rent ratio of the overall Hong Kong residential property market. The ratio after 2008 is much higher than the peak of those in 1997; additionally, huge amount of capital inflows were invested into Hong Kong and ran up the property price. An additional reason is that the lending rate dropped a great deal after 2008 (Fig. 3), and based on the Gordon growth model, it can be understood that in the long run, the residential property price is positively affected by the downward movement of interest rates. Therefore, it is necessary to detect the existence of bubbles in the Hong Kong residential property market for investors, researchers and policymakers.

Research method

Intrinsic bubbles test

In this paper, the intrinsic bubble method is utilized to test the Hong Kong residential property market. Intrinsic bubbles are driven by fundamental value alone in a nonlinear way, thereby entailing a nonlinear relationship between the property price index and the rental price index. The model indicates a simple condition that links the time-series of real property prices to the time-series of real rent payments when the expected rate of return is constant. To test the bubbles in the Hong Kong residential property market, I use rental price index as the fundamental value of property price index, following the Froot and Obstfeld’s (1991) approach, but replacing dividends with rental price index, and stock prices with property price index. In notations, if Pt is the real property price index at the beginning of the period t, Dt is the real rental price index paid at the end of period t, and r is the constant real rate of lending, then the present value (PV) model of property price index can be written as:

where Et(.) is the market’s expectation conditional on information known at the beginning of the period t.

Under this condition, \( {P}_t^{PV} \) is the present value of the property price index in period t can be written as:

Froot and Obstfeld (1991) demonstrate that if a bubble exists, and \( {P}_t={P}_t^{PV}+{B}_t \) is a solution to Eq. (1), then real property price index Pt can be thought of as the sum of present value \( {P}_t^{PV} \) and a bubble Bt which is the difference between the actual price and the fundamental value.

The intrinsic bubble model states that bubbles are generated by a nonlinear function of rents. Therefore, the intrinsic bubbles are function of rental price index satisfies the following:

where c is an arbitrary and λ is the positive root of a quadratic equation.

When the process of log rental price index dt = ln(Dt) must follow a random walk with a drift μ,

And residual of regression ξt + 1~N(0, σ2) is a normal random variable with conditional zero mean and standard deviation σ, the present value of the property price index becomes directly proportional to the rental price index during period t:

where \( k={\left({e}^r-{e}^{\mu +{\sigma}^2/2}\right)}^{-1} \). It follows that, if the sum in Eq. (2) converges, the expression μ + σ2/2 will be smaller than r. If there is a bubble present, the observed property price index can be thought of as the sum of present value \( {P}_t^{PV} \) and a bubble Bt:

And

Under this setup, the inequality r > μ + σ2/2 implies λ must be greater than 1, and it is an explosive nonlinear relation between bubbles and the rental price index, so the property price index may overreact to information about the rental price index. Empirically, Froot and Obstfeld (1991) divide Eq. (7) by Dt because of collinearity among the explanatory variables:

To test for bubbles, the null hypothesis of no bubble implies that c1 =0, whereas the bubble alternative in Eq. (9) predicts that c0 = k and c1 > 0.

Granger causality test

To interpret the results as to whether changes in the rental price index returns can influence changes in the property price index returns and vice versa, first, co-integration between these variables needs to be tested. If co-integration exists, the Granger causality test can be used to determine whether changes in the rental price index return can predict changes in the property price index returns in the Hong Kong residential property market. Prior work suggests property price movements are closely related to a common set of macroeconomic variables. Iacoviello (2005) uses a structural VAR approach, and identifies that U.S. monetary policy impacted real estate prices during 1974Q1 to 2003Q2. Giuliodori (2005) provides quantitative and qualitative evidence of the interaction between property price and monetary transmission mechanisms across nine European countries. Ahearne et al. (2005) study the property prices in 18 advanced economies and also conclude that there is a link between monetary policy and housing prices. Taylor (2007) provides an early example of a study that ascribes a substantial role to overly-loose monetary policy in the US after the recession, in which an overly low interest rate irritated housing activity. Taylor (2008, 2009) also suggests that loose monetary policy is the primary cause of bubbles in property prices and activity. In the wide selection of empirical papers, the majority of researchers conclude that loose monetary policy is a primary cause of bubbles in the property prices of Western countries. Koivu (2010) studies the wealth effect in China, and uses a VAR model and finds that loose monetary policy actually leads to higher asset prices, especially house prices. Yao et al. (2011) use monthly data from June 2005 to September 2010 to investigate the long-run relationship between monetary policy and asset prices in China. Their empirical results show that monetary policy has little effect on residential prices. Regarding the selection of variables for the factor analysis, the most recent research papers have chosen the past rent price or rental price index changes and changes in interest rates as the explanatory variables. For example, Lai and van Order (2010) use the Gordon growth model to express the housing market in the US with rental income, discount rate and the expected rental income growth; Nneji et al. (2011) use past price changes, changes in interest rates and the unemployment rate to determine the change in property price. Baltagi and Li (2015) use the rental price index and the home purchase index to examine the relationship between them in the Singapore residential property market. In this paper, the following main macroeconomic variables are used: (1) Property Price Index (Pt); (2) Rental Price Index (Dt); (3) Lending Rate (Rt); and (4) Consumer price index (It). The analyses in the paper are then carried out using these monetary and economic variables under a VAR/VECM framework.

The Granger (1969) causality test is a well-known test for causality and is usually conducted in the context VAR. For the causality tests used in this paper, I use the following VAR equations which do not impose common lags across all variables,

The null hypothesis that changes in rental price index returns do not Granger cause changes in the property price index returns are tested by \( {H}_0:{\alpha}_{2{k}_2}=0 \), for all k2 in Eq. (10a). Also the null hypothesis that changes in property price index returns do not Granger cause changes in the rental price index returns are tested by \( {H}_0:{\beta}_{1{k}_5}=0 \), for all k5 in Eq. (11b). If co-integration exists among these variables, an error correction term (ECT) is required in testing Granger causality as shown below,

in which γp, γd, γr, and γi denote speeds of adjustment, zt represents the deviation from the long-run relation among variables.

The null hypothesis that changes in rental price index returns do not Granger cause changes in the property price index returns in this study is tested by H0 : γp = 0 and \( {\alpha}_{21}={\alpha}_{22}=\dots ={\alpha}_{2{k}_2} \) =0. Also the null hypothesis that changes in the property price index returns do not Granger cause changes in the rental price index returns in this study is tested by H0 : γd = 0 and \( {\beta}_{11}={\beta}_{12}=\dots ={\beta}_{1{k}_4}=0 \).

Empirical results

Intrinsic bubbles test

First, the existence of intrinsic bubbles over the entire sample period from January 1993 to February 2019 is tested. Following the method of Froot and Obstfeld (1991), the parameter μ in Eq. (5) is estimated at − 0.012, and σ, the standard deviation of residual of log-rental price regression is estimated at 0.126. From Eq. (6), a dollar change in rental price index should raise the property price index by k dollars. Using the er = 1.086, we get

The positive value of k indicates that as the rental price index increases, the property price index increases at a faster rate than rental growth. This shows more evidence to support the presence of intrinsic bubbles in the Hong Kong residential property market. Eq. (8) gives the positive root λ = 1.14.

Table 1 reports the estimates of Eq. (9) using OLS. The regression was estimated by constraining λ equal to 1.14. The results are c0 = − 3.27 (t-statistics − 19.006), and c1 = 5.10 (t-statistics 19.449). These estimated coefficients are both statistically significant at 1% level of significance. The no intrinsic bubble null hypothesis c1 =0, is strongly rejected.

As previously mentioned, after the Global Financial Crisis, hot money poured into Hong Kong and caused inflation and asset bubble formation. The intrinsic bubble method indicates that property price is diverged from the fundamental value because investors believed that the property prices would continue rising due to the increases in the rental prices. Additionally, because the lending rate shows a decreasing trend, it makes investors or homebuyers borrow money from banks and prefer to own rather than rent.

Unit root and co-integration tests

Diba and Grossman (1988) indicate that a rational speculative bubble can only be found on the first day of trading. With the use of Dickey-Fuller tests, they find that both dividends and stock prices are stationary in first difference. They show that being non-stationary in the level form is caused by market fundamentals, not by speculative bubbles. In this study, Phillips and Perron (PP) (1988) unit root tests are applied to measure the stationary level of the price of Hong Kong residential property and macroeconomic variables. Following this, a co-integration analysis is used to test for rational speculative bubbles. According to Diba and Grossman (1988), if there is a long-term relationship between property price and fundamental values, there will be evidence against the presence of a bubble.

Table 2 shows the results from the PP unit root test. The null hypothesis that (1) Property Price Index (Pt); (2) Rental Price Index (Dt); (3) Lending Rate (Rt); and (4) Consumer price index (It) contain unit root cannot be rejected when the variables are measured at levels, while the null hypothesis that their first differences contain unit root is rejected at 1% significant level.

Based on the unit root test results, there is no evidence of rational speculative bubbles in the Hong Kong residential property market from January 1993 to February 2019. Since it is evident that all of the variables are stationary at their first difference rather than in their level form, it is possible to establish a long-run relationship between property price and fundamental values, which is against the presence of a rational speculative bubble.

Based on test results, the variables are differenced and Johansen and Juselius (1990) co-integration test (see Table 3) is applied here to confirm if there is a long-run relationship among these variables. If they are co-integrated, there exists no bubble (Diba and Grossman 1988). The test is based on the following VAR model:

In Eq. (12), Yt is a vector of the non-stationary variables and Yt = (Pt, Dt, Rt, It), Ap is the K × K matrix which contains information about the relationships among these variables. Johansen and Juselius (1990) provide maximum eigenvalue and trace tests to examine the number of co-integrating vectors among these variables. The null hypothesis of the maximum eigenvalue test is that there are at most r co-integrating vectors. The null hypothesis of the trace test is that the number of co-integrating vectors is less than or equal to r.

When applying the co-integration test, all of the variables in the VAR model should be non-stationary. Table 2 shows that all of the variables have unit roots at their levels. Table 3 shows the results for the rank tests by using the Johansen and Juselius co-integration method. The λtrace and λmax are based on 10 lags for the entire period. Evidence shows that there is more than one co-integrating relationship for property price index and fundamental variables. Both λtrace and λmax statistical tests reject the null hypothesis of r = 0 according to r ≤ 1 at the 5% and 1% significance level; therefore, the null hypothesis of no integration is rejected by both the trace and max-eigenvalue statistics at the 5% and 1% significance value. The results show the property price index and the fundamental variables are co-integrated over the entire period. This implies that there is a long-run relationship between property price index and fundamental variables. Thus, I conclude that there are no speculative bubbles in the Hong Kong residental property market.

Table 4 provides the full sample results, and demonstrates the following situations. Granger causality tests of the corresponding asymmetric VECM specification find there is no causality from lagged changes in the rental price index returns to changes in the property price index returns. However, there is strong evidence to show that changes in the property price index returns can Granger cause changes in the rental price index returns. This result confirms the intrinsic bubbles theory of Froot and Obstfeld (1991), which explains the asset prices diverge from their fundamental values due to an overreaction to changes in the values of the dividends or rental prices. This result also confirms the speculative bubble theory of Diba and Grossman (1988), which explains that a rational bubble that can only be found on the first day of stock trading and being non-stationary in the level form is caused by market fundamentals rather than speculative bubbles. In the speculative bubble model, lending rate is also one of the key fundamental variables for property price index returns. The decrease in the lending rate in the Hong Kong residential property market leads investors or homebuyers to borrow money and buy the property. The strong demand for residential property causes increases in property prices too. Therefore, this situation can explain why the lagged changes in the rental price index returns cannot Granger cause changes in the property price index returns.

Conclusion

Unlike rational speculative bubbles, this paper considers whether the bubbles are driven by fundamentals alone. By using Froot and Obstfeld’s (1991) intrinsic bubble method, the no intrinsic bubbles null hypothesis c1 =0, is strongly rejected. The results show that the property price index is greatly deviated from its fundamental values. The rental price index cannot fully explain the property price index. Previous research papers only discuss the rational speculative bubbles, and find property prices are greatly deviated from fundamental values in the Hong Kong residential property market (e.g., Kalra et al. 2000; Peng 2002; Xiao and Liu 2010; Yiu et al. 2012). By employing the unit root and co-integrating test, this study shows that there is a long-run equilibrium relationship between returns on property price index and fundamental variables, and that no speculative bubbles existed from 1993 to 2019. The results also support the theory designed by Diba and Grossman (1988), which indicates that a rational bubble that can only be found on the first day of stock trading and being non-stationary in the level form is caused by market fundamentals, not by speculative bubbles. The results also explain that if a long-run relationship exists among the variables, there will be no rational speculative bubbles. An additional goal of this paper is to determine whether changes in the property price index returns can Granger cause changes in the rental price index returns. The results from joint tests show that in the period with intrinsic bubbles, changes in the property price index returns can Granger cause changes in the rental price index returns. However, changes in the rental price index returns cannot Granger cause changes in the property price index returns. This result confirms the intrinsic bubble theory of Froot and Obstfeld (1991), which explains that asset prices diverge from their fundamental values due to an overreaction to changes in the values of the dividends or rental prices. In the speculative bubble model, I find that lending rate is also one of the key fundamental variables for property price index returns. The decreases in the lending rate in Hong Kong lead investors or homebuyers to borrow money and buy the property. Therefore, this situation can explain why the lagged changes in the rental price index returns cannot Granger cause changes in the property price index returns.

From the results obtained in this research paper and much evidence from the econometric analysis results and data factors, I can conclude that in Hong Kong residential property market, with continuing increases in property prices, the property price index is greatly deviated from its fundamental values. This means intrinsic bubbles exist. Yet no rational speculative bubbles occur in the market. The macroeconomic variables used in the model specified in this study contribute to a partial macroeconomic model as the research did not include a full investigation of other indirect influences on property prices such as income, population and land prices. Assumptions and specifications are however necessary for empirical purposes, which means there is room for future research to address these shortcomings. The findings indicate that there is a long-run relationship between property price and its fundamentals in the Hong Kong residential property market. However, property price index is greatly deviated from rental price index due to the intrinsic bubble problem. Additionally, compared to the low lending rate, a higher return from investing in the property market causes investors or homebuyers to take more risks and to expect the property price to increase continuously. Therefore, the rental price index cannot Granger cause the property price index.

Developments in Hong Kong have a significant impact on property market volatility and returns as well; unexpected returns that rise or decline in the property market are associated with political news. The results of this paper therefore have several implications for policymakers on the efficiency of the Hong Kong residential property market so that they can provide guidance to investors to act rationally by adjusting prices in the future. In order to control abnormal increases in the residential property prices, the best policy framework that achieves price and economic stability is to maintain a residential property balance of supply and demand. Hong Kong is one of the most densely populated cities in the world. At the end of 2018, there were 7.45 million people living in Hong Kong. Planning Department (2017) indicates Hong Kong is 1108 km2, of which 80% is mountainous. The built up areas occupy 24% of the total land, and only 7% of the total land is for residential purpose. Thus, the demand for residential property is surplus to the supply. Chang (2018) states that Hong Kong is an immigrant city, and the government strictly controls the supply of public housing. Therefore, new immigrants are unable to apply for public housing, and must compete for housing in the private market; this further increases the price of residential housing. Therefore, the government should consider the supply side of residential property and provide available residential properties for Hong Kong residents and new immigrants. A further consideration is to use monetary instruments carefully. The government and policy makers should strictly control the hot money inflows into the residential property market as it can cause serious inflation problems. If residential property prices increase too much, policy makers should adjust the interest rate to offset the incipient inflationary pressure.

Availability of data and materials

Rating and Valuation Department, Census and Statistics Department of HKSAR.

CEIC Database.

References

Ahearne, A. G., Ammer, J., Doyle, B. M., Kole, L. S., & Martin, R. F. (2005). Monetary policy and house prices: A cross-country study. International Finance Discussion Papers, 841, 65–78.

Ambrose, B. W., Eichholtz, P., & Lindenthal, T. (2013). House prices and fundamentals: 355 years of evidence. Journal of Money, Credit and Banking, 45, 477–491.

Arshanapalli, B., & Nelson, W. (2008). A co-integration test to verify the housing bubble. International Journal of Applied Economics, 5(1), 85–100.

Awwal, F. M., & Bidarkota, P. V. (2019). Intrinsic bubbles in stock prices under persistent dividend growth rates. SSRN Electronic Journal. www.researchgate.net/profile/Faisal_Awwal.

Ayuso, J., & Restoy, F. (2006). House prices and rents: An equilibrium asset pricing approach. Journal of Empirical Finance, 13, 371–388.

Baltagi, B. H., & Li, J. (2015). Cointegration of matched home purchases and rental price indexes: Evidence from Singapore. Regional Science and Urban Economics, 55, 80–88.

Barlevy, G., et al. (2017). On interest rate policy and asset bubbles. In 2017 meeting papers. Society for Economic Dynamics.

Blanchard, O. J., & Watson, M. W. (1982). Bubbles, rational expectations and financial markets. In P. Wachtel (Ed.), Crises in the economic and financial system. Lexington: Lexington Books.

Brock, W. A. (1982). In J. J. McCall (Ed.), Asset prices in a production economy, in The Economics of Information and Uncertainty. Chicago: University of Chicago Press.

Chang, Z. (2018). Immigration and the neighborhood: New evidence from recent immigrants in Hong Kong. International Real Estate Review, 21(4), 549–566.

Cutts, A., Green, R., & Chang, Y. (2005). Did changing rents explain changing house prices during the 1990s? American real estate and urban economics association 2004 annual meetings.

Diba, B. T., & Grossman, H. L. (1988). Explosive bubbles in stock markets. American Economic Review, 78, 520–530.

Feng, Q., & Wu, G. L. (2015). Bubble or riddle? An asset-pricing approach evaluation in China’s housing market. Economic Modelling, 46, 376–383.

Flood, R. P., & Garber, P. M. (1980). Market fundamentals versus price-level bubbles: The first tests. Journal of Political Economy, 88, 745–770.

Froot, K. A., & Obstfeld, M. (1991). Intrinsic bubbles: The case of stock prices. American Economic Review, 81, 1189–1214.

Galí, J. (2014). Monetary policy and rational asset price bubbles. American Economic Review, 104(3), 721–752.

Gallin, J. (2008). The long-run relationship between house prices and rents. Real Estate Economics, 36, 635–658.

Giuliodori, M. (2005). The role of house prices in the monetary transmission mechanism across European countries. Scottish Journal of Political Economy, 52(4), 519–543.

Glaeser, E. L., & Gyourko, J. (2007). Arbitrage in housing markets. NBER working paper series.

Granger, C. W. J. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica, 37, 424–438.

Hu, Y., & Oxley, L. (2018). Bubbles in US regional house prices: Evidence from house price-income ratios at the state level. Applied Economics, 50(29), 3196–3229.

Iacoviello, M. (2005). House prices, borrowing constraints, and monetary policy in the business cycle. American Economic Review, 95(3), 739–764.

Jirasakuldech, B., Campbell, R. D., & Knight, J. R. (2006). Are there rational speculative bubbles in REITs? Journal of Real Estate Finance and Economics, 32, 105–127.

Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration-with application to the demand for money. Oxford Bulletin of Economics and Statistics, 52(2), 169–210.

Kalra, S., Mihaljek, D., & Duenwald, C. (2000). Property prices and speculative bubbles: Evidence from Hong Kong SAR. Working paper no. WP/00/2, International Monetary Fund.

Koivu, T. (2010). Monetary policy, asset prices and consumption in China. European Central Bank, working paper series, no. 1240, ECB.

Lai, R. N., & van Order, R. A. (2010). Momentum and house price growth in the United States: Anatomy of bubble. Real Estate Economics, 38, 753–773.

Martin, A., & Ventura, J. (2017). The macroeconomics of rational bubbles: A user’s guide. Barcelona GSE working paper series, no.989.

McQueen, G., & Thorley, S. (1994). Bubbles, stock returns, and duration dependence. Journal of Financial and Quantitative Analysis, 29, 379–401.

Nneji, O., Brooks, C., & Ward, C. (2011). Intrinsic and rational speculative bubbles in the U.S. housing market 1960–2009. ICMA Centre Discussion Papers in Finance, 35(2), 121–152.

Norman, C. (2012). The recent inflow of funds into Hong Kong and operation of the linked exchange rate system. Hong Kong Monetary Authority. https://www.hkma.gov.hk/eng/news-and-media/insight/2012/11/20121109/.

Obstfeld, M., & Rogoff, K. (1983). Speculative hyperinflations in maximizing models: Can we rule them out? Journal of Political Economy, 91, 675–687.

Peng, W. (2002). What drives the property price in Hong Kong. Hong Kong Monetary Authority. Quarterly Bulletin, 2002, 19–33.

Phillips, P., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrica, 75, 335–346.

Planning Department. (2017). The government of the Hong Kong special administrative region. Land utilization in Hong Kong, 2017. www.pland.gov.hk/pland_en/info_serv/statistic/landu.html.

Shiller, R. J. (1981). Do stock prices move too much to be justified by subsequent changes in dividends? American Economic Review, 71, 421–436.

Shiller, R. J. (2000). Irrational exuberance. Princeton: Princeton University Press.

Taylor, J. B. (2007). Housing and monetary policy. NBER working paper series 13682. Cambridge: National Bureau of Economic Research.

Taylor, J.B. (2008). The financial crisis and the policy responses: An empirical analysis of what went wrong. Speech delivered at a festschrift in honor of David Dodge’s contributions on Canadian public policy at the Bank of Canada.

Taylor, J. B. (2009). The financial crisis and the policy responses: An empirical analysis of what went wrong. NBER working paper series 14631. Cambridge: National Bureau of Economic Research.

Tirole, J. (1982). On the possibility of speculation under rational expectations. Econometrica, 50, 1163–1181.

Tirole, J. (1985). Asset bubbles and overlapping generations. Econometrica, 53, 1071–1100.

West, K. D. (1987). Specification test for speculative bubbles. Quarterly Journal of Economics, 102(3), 553–580.

Xiao, Q., & Liu, Y. (2010). The residential market of Hong Kong: Rational or irrational? Applied Economics, 42(7), 923–933.

Yao, S. J., Luo, D., & Luo, L. X. (2011). On China’s monetary policy and asset prices. Discussion paper 71. The University of Nottingham, China Policy Institute. https://doi.org/10.2139/ssrn.1788064.

Yiu, M. S., Yu, J., & Jin, L. (2012). Detecting bubbles in Hong Kong residential property market. Research Collection School of Economics, 28, 1–21.

Acknowledgements

This research paper was presented in front of my Supervisor and committee members at University of Macau before; they gave me some comments and suggestions. Therefore, I would like to thanks Professor Jacky SO, Professor Rose Lai and Professor Zhang Yang, Professor Maggie Fu, and Professor Yuan Jia. I also need to thank two anonymous reviewers and editor who provide detailed suggestions to my manuscript and let me improve it in order to meet the journal publishing requirement.

Author information

Authors and Affiliations

Contributions

The author read and approved the final manuscript.

Authors’ information

Ting Lan, Associate Professor, Department of Accounting and Financial Management, Institute of Accounting and Finance, Beijing Institute of Technology.

Corresponding author

Ethics declarations

Competing interests

The author declares no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Lan, T. Intrinsic bubbles and Granger causality in the Hong Kong residential property market. Front. Bus. Res. China 13, 17 (2019). https://doi.org/10.1186/s11782-019-0064-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s11782-019-0064-z