Abstract

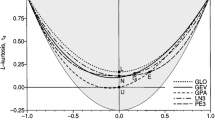

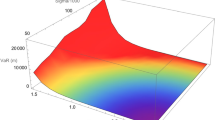

The extreme value theory (EVT) can be used to predict rare events and is a popular means for estimating the value at risk (VaR) by extrapolating the tails of a distribution. The focus of the present study is on one of the EVT methods, peak–over–threshold (POT). In this approach the thresholds of a generalized Pareto distribution (GPD) are assigned based on a Hill plot with shape parameter \((\xi)\) for various exceedance levels, where \((\xi)\) is estimated by applying Hill’s estimator based on the optimized \(k\) of the order statistics. A new approach for selecting \(k\) via Hill’s estimator obtained by using a type 8 quantile function is presented herein. The threshold obtained is then used to compute the VaR and the expected shortfall (ES) for an event. An illustration of the efficacy of the new approach based on real data obtained from Danish fire loss insurance claims is also included.

Similar content being viewed by others

REFERENCES

A. A. Balkema and D. H. Laurens, ‘‘Residual life time at great age,’’ Ann. Prob. 2, 792–804 (1974).

J. Beirlant, Y. Goegebeur, J. Teugels, and J. Segers, Statistics of Extremes (Wiley, Chichester, 2014).

A. R. Fisher and L. H. C. Tippett, Limiting Forms of the Frequency Distribution of the Largest or Smallest Member of a Sample (Cambridge Univ. Press, Cambridge, 1982).

B. V. Gnedenko, ‘‘Sur la distribution limite du terme maximum d́une serie aleatoire,’’ Ann. Math. 44, 423–453 (1943).

B. M. Hill, ‘‘A simple general approach to inference about the tail of a distribution,’’ Ann. Stat. 3, 1163–1174 (1975).

M. Pokorná, ‘‘Estimation and application of the tail index,’’ Bachelor Thesis (Univ. Charles, Prague, 2016).

A. J. McNeil, R. Frey, and P. Embrechts, Quantitative Risk Management: Concepts, Techniques and Tools (Princeton Univ. Press, Princeton, 2015).

S. I. Resnick, Heavy-Tail Phenomena: Probabilistic and Statistical Modeling (Springer Science, New York, 2007).

P. Embrechts, C. Kluüppelberg, and T. Mikosch, Modelling Extremal Events: For Insurance and Finance (Springer Science, New York, 2013).

J. Pickands III, ‘‘Statistical inference using extreme order statistics,’’ Ann. Stat. 3, 119–131 (1975).

R. J. Hyndman and Y. Fan, ‘‘Sample quantiles in statistical packages,’’ Am. Stat. 50, 361–365 (1996).

G. Ramazan and F. Selcuk, ‘‘Extreme value theory and value-at-risk: Relative performance in emerging markets,’’ Int. J. For. 20, 287–303 (2004).

K. Chinhamu, C. K. Huang, C. S. Huang, and D. Chikobvu, ‘‘Extreme risk, value-at-risk and expected shortfall in the gold market,’’ Int. Bus. Econ. Res. J. 14, 107–122 (2015).

M. Hanafy, ‘‘Application of generalized Pareto in non-Life Insurance,’’ J. Risk Finan. Manage. 9, 334–353 (2020).

J. Kołodziej and H. González-Vélez, High-Performance Modelling and Simulation for Big Data Applications: Selected Results of the COST Action IC1406 CHiPSet (Springer Nature, Cham, Switzerland, 2019).

J. Henning, ‘‘A survey of Hill’s estimator,’’ M. S. Thesis (Univ. Georgia, 2003).

M. F. Brilhantea, M. I. Gomes, and D. Pestana ‘‘A simple generalisation of the Hill estimator,’’ Comput. Stat. Data Anal. 57, 518–535 (2013).

S. Rydell, ‘‘The use of extreme value theory and time series analysis to estimate risk measures for extreme events,’’ M. S. Thesis (Univ. Umeå, 2013).

J. L. Petersen, ‘‘Estimating the parameters of a Pareto distribution,’’ Tech. Rep. (Univ. Montana, 2000).

J. D. Holmes and W. W. Moriarty, ‘‘Application of the generalized Pareto distribution to extreme value analysis in wind engineering,’’ J. Wind Eng. Ind. Aero. 83, 1–10 (1999).

M. A. J. van Montfort and J. V. Witter, ‘‘The generalized Pareto distribution applied to rainfall depths,’’ Hydro. Sci. J. 31, 151–162 (1986).

R. Nossenson and H. Attiya, ‘‘The distribution of file transmission duration in the web,’’ Int. J. Commun. Syst. 17, 407–419 (2004).

C. Scarrott and A. MacDonald, ‘‘A review of extreme value threshold estimation and uncertainty quantification,’’ REVSTAT Stat. J. 10, 33–60 (2012).

H. Centeno and M. Wang, ‘‘Value at risk in emerging markets: Empirical evidence from twelve countries,’’ M. S. Thesis (Univ. Simon Fraser, 2006).

E. Këllezi and M. Gilli, ‘‘Extreme value theory for tail-related risk measures,’’ Tech. Report (Univ. Geneva, 2000).

J. Mager, ‘‘Value-at-risk estimation in the Basel iii framework,’’ Bachelor Thesis (Univ. Tech., München, 2012).

N. Lertwattanasak, A. Leemakdej, and S. Mokkhavesa, ‘‘A VaR hedging: A copula-EVT framework,’’ Thammasat J. Business 32 (123), 35–54 (2009).

J. Boonradsamee, W. Bodhisuwan, and U. Jaroengeratikun, ‘‘A new selecting k method of Hill’s estimator,’’ Thai J. Math., 153–163 (2021).

F. Ren and D. E. Giles, ‘‘Extreme value analysis of daily canadian crude oil prices,’’ Appl. Fin. Econ. 20, 941–954 (2010).

ACKNOWLEDGMENTS

The authors thank King Mongkut’s University of Technology North Bangkok and Kasetsart University. Further, the authors are grateful to the reviewers for suggestions of the manuscript.

Author information

Authors and Affiliations

Corresponding author

Additional information

(Submitted by A. I. Volodin)

Rights and permissions

About this article

Cite this article

Boonradsamee, J., Jaroengeratikun, U. & Bodhisuwan, W. An Optimal Threshod Selection Approach for the Value at Risk of the Extreme Events. Lobachevskii J Math 43, 2397–2410 (2022). https://doi.org/10.1134/S1995080222120071

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1134/S1995080222120071