Abstract

The article explores the possibilities and limitations for transition to a progressive scale of personal income tax in Kazakhstan (individual income tax). It is assumed that the optimal progressive scale should be selected based on the balance of interests of the state and employees. During the study of the wage sector, its main characteristics were identified: a high level of differentiation and “gaps” in wage levels, a significant share of low-paid workers (“working poor”), a high gap between the minimum wage (MW), median and mode from the average monthly wage value. These features create limitations when deciding on the possibility of transition to a progressive scale of individual income tax in Kazakhstan. A number of new potential risks have been identified: a reduction in local budget revenues in regions with low wages, tax evasion, and an increase in additional costs for new tax administration. Statistical calculations were carried out to develop possible income tax scales with different tax rates.

Similar content being viewed by others

REFERENCES

A. B. Laffer, “Government exactions and revenue deficiencies,” Cato J. 1 (1), 1–21 (1981). https://object.cato.org/sites/cato.org/files/serials/files/cato-journal/ 1981/5/cj1n1-1.pdf.

I. Szarowská, “Personal income taxation in a context of a tax structure,” Procedia Econ. Fin. 12, 662–669 (2014). https://doi.org/10.1016/S2212-5671(14)00391-8

R. H. Gordon and W. Kopczuk, “The choice of the personal income tax base,” J. Publ. Econ. 118 (C), 97–111 (2014). https://www.nber.org/papers/w20227.

M. Morini and S. Pellegrino, “Personal income tax reforms: A genetic algorithm approach,” Eur. J. Oper. Res. 264 (3), 994–1004 (2018). https://doi.org/10.1016/j.ejor.2016.07.059

Yu. G. Tyurina and L. A. Napol’skikh, “The effect of personal income tax on the standard of living of the population,” Ekon. Vchera Segodnya Zavtra, Nos. 7–8, 31–51 (2012). https://elibrary.ru/item.asp?id=18046189.

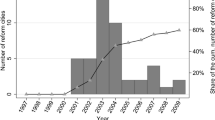

K. S. Peter, S. Buttrick, and D. Duncan, “Global reform of personal income taxation 1981–2005: Evidence from 189 Countries,” Natl. Tax J. 63 (3), 447–478 (2010). https://EconPapers.repec.org/RePEc:ntj:journl:v:63:y: 2010:i:3:p:447-78.

R. M. Bird and E. M. Zolt, “The limited role of the personal income tax in developing countries,” J. Asian Econ. 16, 928–946 (2005). http://isiarticles.com/bundles/Article/pre/pdf/47970.pdf.

J. Alm, G. H. McClelland, and W. D. Schulze, “Why do people pay taxes?,” J. Publ. Econ. 48 (1), 21–38 (1992). https://doi.org/10.1016/0047-2727(92)90040-M

D. McBarnett, “When compliance is not the solution but the problem: From changes in law to changes in attitude,” in Taxing Democracy: Understanding Tax Avoidance and Evasion, Ed. by V. A. Braithwaite (Ashgate Publishing Ltd., Aldershort, 2003), pp. 229–244. https://www.worldcat.org/title/taxing-democracy-understanding-tax-avoidance-and-evasion/oclc/51461155.

R. Carroll, “Do taxpayers really respond to changes in tax rates? Evidence from the 1993 Tax Act,” Working Paper 79 (U.S. Department of the Treasury, Office of Tax Analysis, 1998). https://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/ WP-79.pdf.

B. Chiarini, E. Marzano, and F. G. Schneider, “Tax rates and tax evasion: An empirical analysis of the structural aspects and long-run characteristics in Italy,” IZA Work. Pap., No. 3447 (2008). https://ssrn. com/abstract=1136252.

R. Fisman and Shang-Jin Wei, “Tax rates and tax evasion: Evidence from “missing imports” in China,” J. Polit. Econ. 112, 471–496 (2004). https:// www.nber.org/papers/w8551.

OECD. November 2010, Information Note. Understanding and Influencing Taxpayers ’Compliance Behavior, Forum on Tax Administration: Small/Medium Enterprise (SME) Compliance Subgroup. https:// www.oecd.org/ctp/administration/46274793.pdf.

Taxes in the World, Global Tax Systems. http://worldtaxes.ru/nalogi-v-mire/.

GINI index (World Bank estimate). https://data. worldbank.org/indicator/SI.POV.GINI?end=2017 andstart=1987andview=chart.

Instruction No. 40 On the Procedure for Calculating and Paying Individual Income Tax, approved by the Order of the Ministry of State Duma of the Republic of Kazakhstan of June 22, 1995, No. 153. http://adilet.zan.kz/rus/docs/V950000073_.

The State Revenue Committee of the Ministry of Finance of the Republic of Kazakhstan. http:// kgd.gov.kz/en.

“A progressive income tax scale will drop Kazakhstan’s GDP,” Accounting, Accountant Tools, Sept. 3 (2010). http://uchet.kz/news/progressivnaya-shkala-podokhodnogo-naloga-uronit-vvp- kazakhstana/.

The Statistics Committee of the Ministry of National Economy of the Republic of Kazakhstan. http:// stat.gov.kz.

The Website of the Prime Minister of the Republic of Kazakhstan (2018), Five Social Initiatives of the President of Kazakhstan. https://primeminister.kz/en/news/ sotsialnaya_sfera/pyat-sotsialnih-initsiativ-prezidenta-kazahstana.

D. Vaughan-Whitehead, R. Vazquez-Alvarez, and N. Maitre, “Is the world of work behind middle class reshuffling?,” International Labor Organization. https://www.ilo.org/wcmsp5/groups/public/—europe/—ro-geneva/—ilo-brussels/documents/genericdocument/wcms_455740.pdf.

Funding

The study was carried with grant financing from the Ministry of Education and Science of the Republic of Kazakhstan for scientific and (or) scientific and technical projects for 2018–2020 on the topic: “Research and assessment of the effects of the state and government spending on factors of long-term economic growth of Kazakhstan (labor, capital, aggregate factor productivity) using econometric models and a model of intersectoral balance”, IRN AP05132465.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

The authors declare that they have no conflicts of interest.

Additional information

Translated by S. Avodkova

Rights and permissions

About this article

Cite this article

Alpysbaeva, S.N., Stroeva, G.V., Shuneev, S.Z. et al. Transition to the Progressive Scale of Individual Income Tax in Kazakhstan: Opportunities and Limitations. Stud. Russ. Econ. Dev. 31, 120–127 (2020). https://doi.org/10.1134/S1075700720010025

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1134/S1075700720010025