Abstract

As global economies strive for post-COVID recovery, stock market reactions to reopening announcements have become crucial indicators. Though previous research has extensively focused on COVID’s detrimental impact on stock markets, the effects of reopening remain underexplored. This study provides the first causal analysis of the effect of easing restrictions on Chinese firms’ stock prices following the end of China’s three-year Zero-COVID policy. Utilizing regression-discontinuity design, we find that most relaxed measures had minimal or negative impact. However, stock prices jumped 1.4% immediately after the full reopening announcement on December 26, 2022. Using a difference-in-differences approach, we also note a 1.6% increase in the stock prices of Mainland China firms relative to firms in other districts on the Hong Kong stock market two months post-reopening. Our findings offer key insights for policymakers and contribute significantly to academic discourse on the causal relationship between reopening policies and stock market performance.

Similar content being viewed by others

Introduction

The COVID-19 pandemic and subsequent lockdown measures have profoundly affected both public health (Ge et al. 2022; Romano et al. 2022) and global economies (Li et al. 2021). Extensive research highlights the pandemic’s disruptive impact on various economic sectors, including production, distribution, and supply chains (Austermann et al. 2020). Additionally, the pandemic has substantially altered consumer behavior (Chen et al. 2021), investor psychology (Sun et al. 2021), and the broader business climate (Olkiewicz, 2022), generating a cascading effect on the global economy. The pandemic has not only undermined consumption and production but has also intensified sentiment-driven fears, culminating in economic volatility (Baker et al. 2020; Caggiano et al. 2020).

This period of turbulence has manifested in global financial markets, epitomized by dramatic drops in stock prices (Hassan and Riveros Gavilanes, 2021). For example, Mazur et al. (2021) recorded a sharp 26% decline in the Dow Jones Industrial Average over just four trading days during the March 2020s crash. European markets similarly suffered, with the FTSE All-Share price index plummeting 35% in the week following the UK’s social distancing mandate (Griffith et al. 2020). China’s stock market also encountered multiple downturns during this period (Liu et al. 2021).

The advent of vaccines and expanded coverage initiated a societal resurgence. Yet, many businesses hesitated to reopen due to the looming threat of more stringent restrictions, bleak market forecasts, and limited resources (Bella-Elliott et al. 2021; Pronk and Kassler, 2020). For small and medium-sized enterprises (SMEs), governmental assistance proved instrumental in shaping their reopening strategies (Ludvig, 2021). Rambaud et al. (2022) posited that staggered loans could serve as financial lifebuoys for struggling SMEs, while Tang et al. (2021) found that entrepreneurs with high alertness were less inclined to resume operations.

While several studies have explored the stock market’s reaction to pandemic-related reopening announcements, these have focused primarily on the period of the pandemic itself (Xie et al. 2022). These analyses, therefore, reflect the uncertain landscape where lockdowns could be reinstated depending on the pandemic’s severity. In contrast, no study has focused on the impact of reopening announcements on the stock market after the pandemic. There is a need for definitive studies exploring the causality between reopening policies and stock market recovery post-pandemic.

Our research question examines how and to what extent post-pandemic reopening announcements affect stock prices. To address this question and fill existing knowledge gaps, our study aims to estimate the causal impact of China’s reopening policies enacted in late 2022 on Chinese stock prices.

Among other nations, China was the last to reopen its society. Having maintained a Zero-COVID policy for nearly 3 years, China faced rising unemployment, reduced household income, and a spike in small business closures (Chen et al. 2022; Liang et al. 2022). These strict measures also negatively impacted the Chinese stock market (Huo and Qiu, 2020; Li et al. 2022; Shen and Zhang, 2021). Confronted by overwhelming societal and economic costs, the Chinese government incrementally relaxed its Zero-COVID measures post-pandemic.

In late 2022, China unveiled a series of unanticipated policy shifts aimed at mitigating pandemic-related restrictions. These policy announcements serve as a fertile backdrop for assessing the direct impact of reopening strategies on stock prices. Our methodological framework encompasses two key stages. Initially, we ascertain which policy enactment most positively influenced corporate stock values. Utilizing a regression discontinuity design (RD), we determined that the December 26, 2022, policy announcement buoyed Chinese stock prices by approximately 1.4%. Subsequently, employing a series of difference-in-differences (DID) regressions, we found that Chinese firms outperformed their counterparts in Hong Kong by a margin of 1.6% two months post-announcement.

This study contributes significantly to existing literature. Firstly, our paper is the first to measure the impact of reopening announcements on firms’ stock prices post-pandemic, thereby filling a knowledge gap. Secondly, China’s Zero-COVID policy was extreme in intensity and duration compared to those of other nations. China’s reopening policy affects not only its own domestic economic recovery but also those of numerous trading partners. Based on the efficient market hypothesis (Fama, 1965), a firm’s stock price reflects all available information and future expectations. Thus, understanding the impacts of reopening policies on stock prices has wider economic implications for many countries. Thirdly, while studies like Xie et al. (2022) suggest a relationship between policy announcements and stock market reactions, it is not causal. We employ both an RD and a DID method to explore the causal impact of reopening announcements on stock prices in the short and medium term in the Mainland China and Hong Kong markets, respectively. This methodology can be used in other studies. Finally, in contrast to the sharp stock price decline triggered by the lockdown, we found that some reopening announcements did not increase the stock price at all. The stock price response to the complete reopening announcement made on 26th December was also moderate, suggesting a longer recovery period and the necessity of rebuilding market confidence.

The remainder of this paper is structured as follows: the ‘Background’ section elaborates on China’s Zero-COVID policy and late 2022 control relaxations; the ‘Hypothesis’ section posits our expected impact on stock prices; the ‘Method’ section details the RD and DID frameworks; the ‘Data’ section explains our data sources and summarizes statistics; ‘Empirical Results’ discuss the impact of reopening on stock prices from the Mainland China and Hong Kong Stock Markets; the ‘Discussion’ section interprets our findings, and the ‘Conclusion’ section wraps up the paper.

Background: Zero-Covid policy and reopening announcements in China

The Zero-Covid public health policy, implemented in several countries during the COVID-19 pandemic, included measures such as contact tracing, mass testing, quarantine, and lockdowns aimed at curbing COVID-19 transmission. The ultimate goal of the Zero-Covid strategy was to attain zero new infections within a specific region and resume normal economic and social activities. Several countries and districts, such as Australia, China, New Zealand, Northern Ireland, Singapore, Scotland, and Vietnam, adopted this strategy to varying extents. However, since late 2021, in light of new Omicron variants and vaccine developments, many countries phased out their Zero-Covid strategies, with China being the last one to do so in December 2022.

Although the Zero-Covid policy came at a substantial cost, research suggests that it saved approximately 1 million lives compared with the global average mortality of COVID-19 (Chen and Chen, 2022). As the Omicron variant exhibited high infection rates but low mortality rates, the social costs of the Zero-Covid strategy no longer outweighed its benefits. With vaccine coverage in China surpassing 85% in 2022, scholars predicted the imminent abolition of the Zero-Covid strategy (Chen and Chen, 2022). The Chinese government, acknowledging growing public discontent with the Zero-COVID policy, gradually phased it out towards the end of 2022.

This policy adjustment transpired over a series of critical time windows. On 11 November 2022, the Chinese government announced 20 new measures to optimize China’s pandemic control policy, relaxing some pandemic control measures and shortening the quarantine period. Some experts, however, interpreted these measures as a continuation of the Zero-COVID approach rather than a move towards phasing it out (Gunia, 2022).

On 7 December 2022, the State Council announced ten additional control measures to further lift restrictions. These measures reduced nucleic acid testing for domestic travelers and permitted infected individuals with mild symptoms to be quarantined at home. This signified a pivot in the Chinese government’s approach, moving away from its Zero-COVID policy. Unexpectedly relaxed controls caused concern among many residents, particularly unvaccinated individuals vulnerable to the virus. As China braced for an unprecedented wave of infections spreading from its major cities to rural areas, searches for ‘funeral homes’ by Beijing residents in Baidu have hit a record high since the pandemic began (Gan and Cheng, 2022).

On 26 December 2022, the Chinese government announced the reclassification of COVID-19 from a Class A to a Class B infectious disease, effective from 8 January 2023. This change eliminated quarantine requirements for incoming travelers and removed the sealed control of COVID-19 cases. This new policy signaled China’s full reopening. On the first day of the new COVID policy (8 January 2023), China registered over 250,000 inbound passenger trips (Xinhua, 2023).

The public largely did not anticipate these three reopening announcements; thus, they can be considered natural experiments. They provide an ideal setting to examine the causal impact of reopening policies on stock prices.

Hypothesis

Distinct from existing research that assessed the relatively modest impact of reopening measures on firm activities and stock valuations during the pandemic, our study aims to rigorously evaluate the causal relationship between post-pandemic reopening announcements and stock performance. Before we delve into the empirical examination, we put forth the following hypotheses:

Hypothesis 1: The reopening announcements in China are likely to generate a significant positive impact on the stock market in general.

Hypothesis 2: The three reopening announcements are likely to have different impacts on stock prices, depending on the varying levels of relaxation in control measures and the public’s interpretation of these policies.

Hypothesis 3: Unlike restrictive measures such as lockdown policies, which substantially drive down stock prices, reopening policies may not cause a substantial boost in stock prices over a short period.

The following sections will outline the research method and conduct empirical examinations to test these hypotheses.

Method

The previous section outlined four critical time windows for the lifting of restrictions and reopening policies. First, we examine how the Chinese stock market reacted to these exogenous reopening policy announcements. Given that all stocks in the Chinese market were affected by these policy announcements, we employed an RD framework to explore the unexpected policy impact on stock prices. In the face of a quasi-experimental shock, RD provides a credible way to draw causal inferences (Hausman and Rapson, 2018; Imbens and Lemieux, 2008). The identification assumption is that government announcements are the only reason for stock price discontinuities on or near the announcement date. The standard RD regression is illustrated in Eq. (1):

where \(p_{it}\) is the natural logarithm of the average stock price for firm i at time t. \({\rm{after}}_t\) is a binary variable equal to 1 after government announcements and 0 otherwise. \({\rm{day}}_t\) is a running variable normalized to 0 on the announcement date. \({\rm{day}}_t\) × \({\rm{after}}_t\) is an interaction term. To capture the potential nonlinearity of the price trend, we add the quadratic and cubic forms of the running variables and their interaction terms, as suggested by Imbens and Lemieux (2008). High-order polynomial time trends are popular in the RD design (Davis, 2008). Finally, we controlled for firm, monthly, and weekday fixed effects,Footnote 1 and εit is an error term. The standard errors are clustered at the firm level.

One limitation of the RD method is that it can only reveal price changes close to the announcement dates. To estimate the medium-term effect, we adopted the DID method, a popular causal inference tool widely used to estimate the effects of public policies on asset prices (Chang and Diao, 2022; Chang and Li, 2018). We are interested in estimating the relative price changes for Chinese firms versus firms outside Mainland China due to policy announcements. This examination applies to stock prices in the Hong Kong stock market. Equation (2) illustrates the standard two-way fixed-effects DID regression.

where \({\rm{treat}}_i\) is a dummy variable that equals 1 if firms listed on the Hong Kong stock market are in mainland China and 0 otherwise. In addition to controlling for the firm fixed effect, we control for the month and date fixed effects to capture all temporal variations common to all stocks. The other variables are the same as in Eq. (1). The prerequisites for a valid DID regression rely on the pre-policy parallel trends assumption, where the stock prices of firms from Mainland China and those in other districts share a similar trend before the announcement date. To examine the parallel trend assumption, we adopt the standard event study method, as illustrated in Eq. (3).

where \(1\left[ {j = T} \right]\) is an event study date dummy that equals one for each pre- and lag-trading date before and after the event date. All other variables are the same as those in Eq. (2). To visualize price changes, we include 5 trading days before and 20 trading days after the policy implementation. We consider the date before the reopening policy (\(j = - 1\)) as a reference.

Data

We obtained stock price and company information for firms listed on the stock markets in Mainland China and Hong Kong from the Wind Economic Database, a popular data vendor for economic research. Our study period spans from 1 November 2022 to 28 February 2023.Footnote 2 For the Mainland stock market, the dataset includes 4976 Chinese listed firms, all of which are located in Mainland China. For the Hong Kong stock market, the data covers 2557 firms, of which 1087 firms (42.51%) are located in Mainland China.Footnote 3 The data includes each firm’s average daily stock price, trading date, company name, office address, and the firm’s industry code. Table 1 presents the variable definitions and summarizes the statistics. Panel A provides the statistics for the variables within ten trading days of policy announcements in the Chinese stock market. Panel B illustrates the statistics for the variables for the 46 trading days surrounding 26 December 2022 in the Hong Kong stock market.Footnote 4

Empirical results

The stock market in Mainland China

We first conduct the RD regressions to examine the impact of reopening policies on the stock price of firms in the stock market in Mainland China. Before examining the regression results, we illustrate a few price variation patterns among the four different time windows: 11 November, 7 December, 26 December, and 8 January. Figure 1 displays the general stock price trend from 1 November 2022 to 28 February 2023, which covers 80 trading days. It shows that the stock market was quite volatile during this period. Moreover, it appears that prices do not react significantly to the reopening announcements, except for the announcement made on 26 December 2022.

To demonstrate the pattern more closely, we illustrate the average stock prices within five and ten trading days before and after the announcements, respectively. Figure 2 summarizes these patterns. Figure 2a illustrates the stock price change on 11 November 2020, when the Chinese government announced 20 new measures. This suggests that stock prices were decreasing leading up to the announcement day. However, afterward (0,5), there is a clear positive market response with rising stock prices. Figure 2b shows the price trend near 7 December 2022, when ten new measures were announced. Here, stock prices are increasing in the five days leading up to the announcement date, which suggests a positive market response in advance of this news. After the announcement, stock prices decreased slightly and declined substantially over the next ten trading days. Figure 2c demonstrates the stock price change around 26 December, when China decided to fully reopen by lifting quarantine policies. This announcement shows the most dramatic response, with strong rising stock prices leading up to the announcement. Afterward, there is an immediate price hike or jump. This announcement’s effect on rising stock prices completely reversed the price trend in the Chinese stock market. Figure 2d illustrates the trend around 8 January 2023, when the government implemented the reopening policy. Again, the price continues to show positive upward momentum after the policy date.

This stylized pattern is suggestive, and we ran the RD regressions using Eq. (1). We chose two time windows (five and ten trading days) around the four policy dates. The regression results are presented in Table 2.

The first two columns illustrate the results of the stock price changes on 11 November 2022. Using five and ten trading days as bandwidths, the stock price declined by approximately 3.94% and 2.61%, respectively, suggesting that investors became more pessimistic after the announcement of the 20 new measures. Columns (3) and (4) also illustrate a negative price change owing to the announcement of the ten new measures on 7 December 2022. Columns (5) and (6) illustrate the stock price changes on 26 December 2022. The stock price increased by approximately 1.4% and 2.5% using five and ten trading days as the bandwidth, respectively. The last two columns illustrate that stock prices barely changed when the full reopening policy was implemented on 8 January 2023.

The stock market in Hong Kong

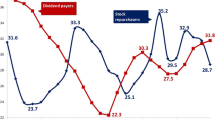

The RD regression can reveal stock price changes only near announcement dates. To evaluate the medium-term effect of the reopening policy on the stock price, we adopt a DID regression to estimate the price changes of Chinese domestic firms relative to firms outside Mainland China in the Hong Kong stock market. Figure 3 shows the price variation for firms conducting business in China versus other firms listed on the Hong Kong stock market. It demonstrates that stock prices varied greatly for Chinese firms during our study period. In contrast, the stock prices for firms outside Mainland China remained relatively stable.

We choose 26 December as the critical reopening policy date.Footnote 5 We define the ‘before the policy period’ as five trading days before 26 December 2022. The ‘before’ period cannot be long because other policy announcements were made in late 2022. We extend the ‘after’ periods from 10 to 40 trading days to capture the short-to-medium-run price changes. These results are summarized in Table 3.

As shown in column (1), we found that the average stock price of domestic Chinese firms increased by 1.16% within ten trading days. The coefficients are approximately 1.78% after 20 and 30 trading days, as illustrated in columns (2) and (3), respectively. Finally, the average stock price for Chinese firms increased by approximately 1.6% over 40 trading days (more than two months after the reopening). As firms in the control group in the Hong Kong stock market are largely from Hong Kong, Macau, Taiwan, and other districts in Asia, the Chinese reopening policy could also affect their stock prices because many of these firms conduct business in China. Thus, the results in Table 3 provide the lower bounds.

As discussed in the previous section, the validity of DID regression relies on the parallel trend assumption. We conducted an event study using Eq. (3), considering the date (j = −1) as a reference. The coefficients for the other dates, with the corresponding 95% confidence intervals, are plotted in Fig. 4. We found that the parallel trend assumption holds. Moreover, we observed a steady growth trend in stock prices during the post-policy period.

Discussion

The results derived from the RD regressions largely align with the preliminary stylized patterns observed. Many have interpreted the announcement of 20 new measures on November 11 as a signal that the government was poised to retain the ‘Zero COVID’ policy (Gunia, 2022), which provides context to the subsequent drop in stock prices. The unanticipated lifting of restrictions brought on by the ten new measures announced on December 7 initially induced panic due to the sudden surge in infection rates. This initial panic, tied to the abrupt relaxation of control measures, accounts for the downturn in prices following the announcement of ten new measures. As the infection rates increased, leading to a greater number of recoveries, the fear of mass infections gradually abated. This set the stage for the full reopening decision announced on December 26, 2022, which gave a boost to the stock market. However, the actual reopening date of January 8, 2023, did not significantly influence stock prices.

As for insights, the stock market’s recovery from the COVID pandemic has proven to be a gradual process. It took three reopening announcements before a recovery trajectory became evident. In contrast, the announcement of COVID restrictions had a dramatically negative effect on stock market prices. As Bai et al. (2023) observe, positive financial market sentiment can play a role in mitigating the losses caused by the shock of COVID. We propose that the sequence of four successive reopening events contributed to this positive sentiment, offering an explanation for the mitigation of losses observed in our results.

Complementing the findings from the RD regression within the Chinese stock market, our DID method considers reopening as a treatment variable for firms listed in Hong Kong’s stock market. We thereby demonstrate a causal effect, showing that the process of reopening has a positive impact on stock prices. Our study on reopening diverges from the research conducted by Xie et al. (2022), who examined reopening during the ongoing crisis in March 2020. Our focus is the phasing out of China’s Zero-COVID policy.

Overall, the findings from our two causal inference methods, RD and DID, are consistent, supporting our initial hypothesis. The differential effects on stock prices across various announcement dates suggest investors may interpret reopening policies differently. The full reopening announcement removed all lingering uncertainty regarding potential future lockdowns, resulting in the most significant boost in stock prices. However, the moderate increase in stock prices over the medium term suggests that a complete economic recovery requires an extended period.

Conclusion

This paper presents a pioneering study measuring the causal impact of reopening announcements on the stock prices of Chinese firms during the Chinese government’s decision to fully reopen society at the end of 2022. We utilized the RD approach to ascertain whether reopening policy announcements generated significant effects on stock prices. Our findings indicate that the announcement made on December 26, 2022, had a positive impact on Chinese stock prices, while other restriction-lifting policies had either negligible or negative short-term impacts on stock prices.

We also scrutinized the medium-term price reactions to the reopening policy by contrasting the stock prices of Chinese firms with those from outside Mainland China. Using a set of DID regressions, we discovered that the reopening policy elevated the stock price of Chinese firms by approximately 1.6% 40 trading days post-policy announcement. Although the full reopening policy announcement made on December 26 improved the stock price, the effect was moderate, suggesting a longer duration is needed to rebuild market confidence and revive the economy.

Our study provides insights for policymakers and researchers regarding how a series of reopening policies implemented over time contribute to stock market recovery. While the evidence surrounding reopening has shown mixed effects on stock prices, our study demonstrates that the reopening effect in China is decidedly positive. As society urgently requires its stock market to rebound from the COVID pandemic, effective reopening policies are of paramount importance. This study contributes to filling the knowledge gap, offering a “success story” on COVID recovery.

The study’s findings have multiple policy implications concerning the management of the economic aftermath of the COVID-19 pandemic and the implementation of reopening policies. Firstly, it sheds light on the effectiveness of reopening policies. The evidence suggests that these policies have been effective in reviving economic activity, indicating that similar strategies could be advantageous in future crises. However, it’s worth noting that reactions to reopening announcements have been mixed, suggesting the timing, messaging, and context of these announcements are pivotal in shaping market expectations and responses.

Secondly, it offers insights into the role of government announcements in market influence. The observation that stock prices respond to government reopening announcements underscores their role in shaping market sentiments. Hence, governments should meticulously strategize their communication to manage market expectations and reactions during uncertain times.

Thirdly, it provides implications for long-term economic recovery. The relatively moderate response of stock prices to China’s full reopening announcement suggests that recovery from a severe economic shock, such as a pandemic, may require a longer-than-expected timeframe. This implies that policymakers should prepare for an extended period of economic recovery and develop strategies to support long-term economic stability and growth.

Fourthly, our findings carry global implications. Given China’s position as the world’s second-largest economy, its policy decisions impact not only its own economy but also those of several trading partner countries. Policymakers worldwide should thus monitor policy developments in major economies and consider their potential global implications.

Lastly, we acknowledge several limitations and analytical challenges in our study. First, we primarily focus on stock price reactions without delving into the underlying reasons for these fluctuations. Factors such as investor sentiment, industry-specific impacts, and macroeconomic indicators might offer a clearer picture. Second, our research did not dissect the differences between individual firms; aspects like firm size, financial health, and the sector could influence their reactions to reopening announcements. Third, we did not explore how these announcements might have affected other aspects of firms’ operations, including employee productivity, recruitment strategies, or supply chain dynamics. We lack the sufficient data to address these limitations. Future studies could build on these limitations. It would be valuable to delve deeper into how firm characteristics influence their stock price reactions and to investigate the broader economic impacts of reopening announcements. Expanding upon our work in this way can provide a more comprehensive understanding of the intricate interplay between policy decisions and economic outcomes in a post-pandemic world.

Data availability

Our data is from the Wald Database. We are not allowed to share the data based on the agreement.

Notes

We cannot control the month and date fixed effect because it is perfectly collinear with the running variable.

As the 20th National Congress of the Chinese Communist Party, which took place from October 16 to 22, 2022, may have impacted Chinese stock prices, we selected November 1, 2022, as our starting point.

In the Hong Kong stock market, firms located in Mainland China were designated as the treatment group within the DID framework, given their direct impact from the reopening announcement.

There are five trading days before the policy announcement and 40 trading days afterward. The ending date is February 28, 2023.

We also ran DID regressions using other announcement dates. However, none of the results satisfied the parallel trend assumption. One possible explanation is that there were other policy shocks affecting stock prices in the Hong Kong market. For this reason, we only report the results using the full reopening date (December 26) as the announcement event.

References

Austermann F, Shen W, Slim A (2020) Governmental responses to COVID-19 and its economic impact: a brief Euro-Asian comparison. Asia Eur J 18(2):211–216. https://doi.org/10.1007/s10308-020-00577-0

Baker SR, Bloom N, Davis SJ, Terry S (2020) COVID-induced economic uncertainty. National Bureacheu of Economic Research. Report No. w26983. https://doi.org/10.3386/w26983

Bai C, Duan Y, Fan X, Tang S (2023) Financial Market Sentiment and Stock Return during the COVID-19 Pandemic. Finance Research Letters, 54. https://doi.org/10.1016/j.frl.2023.103709

Bella-Elliott D, Cullen Z, Glaeser E, Luca M, Stanton C (2021) Business Reopening during the COVID-19 Pandemic. Harvard Business School Entrepreneurial Management Working Paper: 20–132. https://ssrn.com/abstract=3634162. Accessed 15 July 2022

Caggiano G, Castelnuovo E, Kima R (2020) The global effects of Covid-19-induced uncertainty. Econ Lett 194:109392

Chang Z, Diao M (2022) Inter-city transport infrastructure and intra-city housing markets: estimating the redistribution effect of high-speed rail in Shenzhen, China. Urban Stud 59(4):870–889. https://doi.org/10.1177/00420980211017811. Available from

Chang Z, Li J (2018) The impact of in-house unnatural death on property values: evidence from Hong Kong. Reg Sci Urban Econ 73:112–126. https://doi.org/10.1016/j.regsciurbeco.2018.08.003. Available from

Chen JM, Chen YQ (2022) China can prepare to end its zero-COVID policy. Nat Med 28(6):1104–1105. https://doi.org/10.1038/s41591-022-01794-3

Chen J, Cheng Z, Gong RK, Li J (2022) Riding out the COVID-19 storm: how government policies affect SMEs in China. China Econ Rev 75:101831. https://doi.org/10.1016/j.chieco.2022.101831

Chen H, Qian W, Wen Q (2021) The impact of the COVID-19 pandemic on consumption: learning from high-frequency transaction data. AEA Pap Proc 111:307–311. https://doi.org/10.1257/pandp.20211003

Davis LW (2008) The effect of driving restrictions on air quality in Mexico City. J Polit Econ 116(1):38–81. https://doi.org/10.1086/529398

Fama EF (1965) The behavior of stock-market prices. J Bus 38(1):34–105. https://doi.org/10.1086/294743

Gan N, Cheng C (2022) China could see near a million deaths as it exits zero-Covid, study says. CNN news. https://edition.cnn.com/2022/12/19/china/china-covid-study-one-million-deaths-intl-hnk-mic/index.html. Accessed 19 Dec 2022

Ge Y, Liu M, Hu S, Wang D, Wang J, Wang X, Qader S, Cleary E, Tatem A, Lai S (2022) Who and which regions are at high risk of returning to poverty during the COVID-19 pandemic? Hum Soc Sci Commun 9(1):183. https://doi.org/10.1057/s41599-022-01205-5

Griffith R, Levell P, Stroud R (2020) The impact of COVID-19 on share prices in the UK. Fisc Stud 41(2):363–369. https://doi.org/10.1111/1475-5890.12226. Available from

Gunia A (2022) China just relaxed some pandemic measures, but experts suggest ‘zero-COVID’ probably won’t be going away anytime soon. Time. https://time.com/6233563/china-zero-covid-end/. Accessed 14 Nov 2022

Hassan SM, Riveros Gavilanes JM (2021) First to react is the last to forgive: evidence from the stock market impact of COVID 19. J Risk Financ Manag 14(1):26. https://doi.org/10.3390/jrfm14010026

Hausman C, Rapson DS (2018) Regression discontinuity in time: considerations for empirical applications. Annu Rev Resour Econ 10:533–552. https://doi.org/10.1146/annurev-resource-121517-033306

Huo X, Qiu Z (2020) How does China’s stock market react to the announcement of the COVID-19 pandemic lockdown? Econ Polit Stud-EPS 8(4):436–461. https://doi.org/10.1080/20954816.2020.1780695

Imbens GW, Lemieux T (2008) Regression discontinuity designs: a guide to practice. J Econ 142(2):615–635. https://doi.org/10.1016/j.jeconom.2007.05.001

Li RYM, Yue X, Crabbe MJC (2021) COVID-19 in Wuhan, China: pressing realities and city management. Front Public Health 8:596913. https://doi.org/10.3389/fpubh.2020.596913

Li Z, Feng L, Pan Z, Sohail HM (2022) ESG performance and stock prices: evidence from the COVID-19 outbreak in China. Hum Soc Sci Commun 9(1):1–10. https://doi.org/10.1057/s41599-022-01259-5

Liang X, Rozelle S, Yi H (2022) The impact of COVID-19 on employment and income of vocational graduates in China: Evidence from surveys in January and July 2020. China Econ Rev 75:101832. https://doi.org/10.1016/j.chieco.2022.101832

Liu Z, Huynh TLD, Dai PF (2021) The impact of COVID-19 on the stock market crash risk in China. Res Int Bus Financ 57:101419. https://doi.org/10.1016/j.ribaf.2021.101419

Ludvig S (2021) Everything you need to know about Coronavirus federal small business stimulus aid programs. U.S. Chamber of Commerce. 2021. https://www.uschamber.com/co/start/strategy/federal-small-business-stimulus-aid-programs-guide Accessed July 15, 2022

Mazur M, Dang M, Vega M (2021) COVID-19 and the March 2020 stock market crash. Evidence from S&P1500. Financ Res Lett 38:101690. https://doi.org/10.1016/j.frl.2020.101690

Olkiewicz M (2022) The impact of economic indicators on the evolution of business confidence during the COVID-19 pandemic period. Sustainability 14(9):5073. https://doi.org/10.3390/su14095073

Pronk N, Kassler W (2020) Balancing health and economic factors when reopening business in the age of COVID-19. J Occup Environ Med 62(9):e540–e541. https://doi.org/10.1097/JOM.0000000000001955

Rambaud S, Pascual J, Santandreu E (2022) Staggered loans: a flexible modality of long-term financing for SMEs in global health emergencies. Quant Financ Econ 6:553–569. https://doi.org/10.3934/QFE.2022024

Romano V, Ancillotti M, Mascalzoni D, Biasiotto R (2022) Italians locked down: people’s responses to early COVID-19 pandemic public health measures. Hum Soc Sci Commun 9(1):1–9. https://doi.org/10.1057/s41599-022-01358-3

Shen D, Zhang W (2021) Stay-at-home stocks versus go-outside stocks: the impacts of COVID-19 on the Chinese stock market. Asia Pac Financ Mark 28:305–318. https://doi.org/10.1007/s10690-020-09322-4

Sun Y, Wu M, Zeng X, Peng Z (2021) The impact of COVID-19 on the Chinese stock market: sentimental or substantial? Financ Res Lett 38:101838. https://doi.org/10.1016/j.frl.2020.101838

Tang J, Zhang SX, Lin S (2021) To reopen or not to reopen? How entrepreneurial alertness influences small business reopening after the COVID-19 lockdown. J Bus Ventur Insights 16:e00275. https://doi.org/10.1016/j.jbvi.2021.e00275

Xie L, Wang M, Huynh TLD (2022) Trust and the stock market reaction to lockdown and reopening. Financ Res Lett 46:102361. https://doi.org/10.1016/j.frl.2021.102361

Xinhua (2023) China receives over 250,000 inbound passenger trips on first day of new COVID policy. China Daily. https://www.chinadaily.com.cn/a/202301/09/WS63bc12bfa31057c47eba88e2.html. Accessed Jan 9, 2023

Acknowledgements

This research was supported by student research grants and start-up research grants (UICR0700063-23) from the Faculty of Business and Management, BNU-HKBU United International College.

Author information

Authors and Affiliations

Contributions

Z.C.: Concept, research design, methodology, empirical analysis, writing, revising, and final approval. A.W.F.N.G.: Concept, methodology, writing, and revision. S.P.: Concept, data collection, and analysis. D.S.: Concept, Data collection, and analysis.

Corresponding author

Ethics declarations

Ethical approval

Ethical approval was not required as the study did not involve human participants.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Competing interests

The author(s) declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Chang, Z., NG, A.W.F., Peng, S. et al. Stock price reactions to reopening announcements after China abolished its zero-COVID policy. Humanit Soc Sci Commun 11, 58 (2024). https://doi.org/10.1057/s41599-023-02589-8

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-023-02589-8

- Springer Nature Limited