Abstract

Across the globe, a rise in income inequality has been experienced for the last two decades, particularly in developing countries. This problem of income inequality poses a challenge to Africa’s ability to attain the United Nations (UN) Sustainment Development Goals (SDGs) of reduced inequalities (SDG-10). Against this backdrop, there is a need to harness the potential of financial development to reduce income inequality in Africa. Therefore, this study empirically examines how financial development affects income inequality in Africa. Financial development dimensions, access, depth, efficiency, and stability were considered to achieve the study’s objective. The study applied the system generalized method of moments (SGMM) to analyse data and the findings showed that each dimension of financial development had a varying impact on income inequality. Access, stability and efficiency components of financial development reduce income inequality, while the depth dimension of financial development exacerbates income inequality in Africa. Therefore, the study recommends that policymakers should not neglect other dimensions of finance in facilitating economic development.

Similar content being viewed by others

Introduction

The negative impact of income inequality on development has prompted much research to be devoted to find ways to eradicate the problem. Income inequality is as much social problem as an economic problem (Martin et al., 2021). The result of persistent income inequality can lead to civil wars, some of which have been witnessed in African countries such as the Arab spring revolution (Nabi, 2015). Therefore, income inequality is a multidimensional problem that cannot continue unaddressed. More so, the continuous rise in income inequality across the globe, particularly in Africa, poses a threat to the actualization of the United Nations (UN) sustainable development goals (SDGs) reduction in inequalities (SDG-10). Thereby, the study of income inequality has gained relevance in recent literature as income inequality threatens the development process of an economy. On this note, financial development is being proposed to alleviate income inequality. This is because financial development has to do with capital allocation.

The development of the financial system can lead to the relaxation of constraints that hinders capital redistribution, thereby causing the poor to access funds for productive activities which in turn promotes income inequality reduction. However, the reality is contradictory to the theory. Economies that have been witnessing steady financial development have recorded increasing income inequality. One such economy is South Africa, which is the most unequal sub-Saharan African country as of 2017 despite having a mature financial system (United Nations Development Programme, 2017).

According to Demirgüç-Kunt et al. (2017), the poor and most vulnerable people are highly excluded from the financial system. The poor and less privileged are most likely to get funds for business and entrepreneurship from informal savings clubs (Thornton and Tommaso, 2020). Most literature on financial development has focused on the depth dimension of financial development. Focusing on the depth dimension of financial development is a narrow way to examine financial development. Makhlouf et al. (2020) showed that financial development widened income inequality in advanced countries, while Seven and Coskun (2016) found that financial development exacerbated income inequality in low-income and emerging countries. Kim and Lin (2011) indicated that the financial development stage could affect how finance affected income inequality. However, Altunbaş and Thornton (2019) used total financial development covering access, efficiency and depth and found that financial development facilitated income inequality reduction in the upper middle and low-income countries. Following these contradicting results, it is essential to evaluate the effect of financial development on income inequality in Africa by considering the dimensions.

Čihák et al. (2012) categorized financial development into four dimensions: access, depth, efficiency, and stability. Access explains the ability of people to receive funds whenever and wherever they need it. The depth dimension describes the volume of the financial system; efficiency illustrates the ability of the financial system to perform its functions of mobilization of funds and capital allocation at minimum cost, while stability captures the likelihood of the financial system to default. These dimensions characterize a well-developed financial system. Thus, focusing on one aspect of this dimension in understanding the effect of financial development on income inequality would not holistically explain financial development.

Furthermore, the rate of technological development across the globe has led to more focus on the effect of financial inclusion on income inequality (Erlando et al., 2020; Menyelim et al., 2021; Omar and Inaba, 2020). The drive for financial inclusion has led to notable increases in the participation of the poor and vulnerable in the financial system (World Bank, 2018). Thus, increased access to financial products and services could increase the usage of financial products by the poor and vulnerable, leading to a more efficient capital allocation that can facilitate income inequality reduction. This was supported by the study of Babajide et al. (2015), which found financial inclusion to be a significant determinant of factor productivity.

Neaime and Gaysset (2018) indicated that financial inclusion enables a more even distribution of income in MENA countries. Nonetheless, the drive for financial inclusion could threaten the stability of the financial system. Fouejieu et al. (2020) pointed out that increased access to financial products and services could make the financial system more liable to shocks, thus putting the financial stability dimension in question. Hence, all four dimensions of financial development play a significant role. Therefore, this study evaluates financial development based on the dimensions classified by (Čihák et al., 2012).

In addition to the dearth of literature on financial development and income inequality in Africa, previous studies reported mixed findings and focused on a single dimension of financial development. This, therefore, calls for more research on the subject, which forms the basis of this study. This study considers the multidimensional aspect of financial development that has been omitted in the extant literature and pays attention to the peculiarity of Africa on the subject of income inequality. To control for the problem of endogeneity, the study applied the systems generalized method of moments and the result revealed that except financial depth, financial access, financial stability, and financial efficiency significantly contribute to income inequality reduction in Africa. The study is structured into six sections. Following this introductory section is a review of related literature, which is enshrined in the section “Literature review”. Section “Methodology” comprises the methodology, results presentation, and discussion in section “Results” and “Discussion”, while the study concludes with the section “Summary and conclusion”.

Literature review

How finance can reduce income inequality has been the subject of argument in the literature. Theory regarding financial development and income inequality proposed that there can be a finance income inequality-narrowing hypothesis that occurs when financial development leads to income inequality reduction (Banerjee and Newman, 1993; Galor and Zeira, 1993; Johansson and Wang, 2014). Other proponents suggested the finance-income inequality-widening hypothesis (Gimet and Lagoarde-Segot, 2011; Jauch and Watzka, 2012; Rajan and Zingales, 2003). The hypothesis proposed that the development of the financial system widens income inequality as the provision of financial products and services will only be improved for those already using financial products and services. There also exists the financial Kuznets hypothesis developed by Greenwood and Jovanovic (1990) based on the Kuznets inverted U-curve hypothesis. It is postulated that the relationship between financial development and income inequality is nonlinear. That is, at the initial stage of financial development, income inequality would increase as only the rich have access to financial products, and this will continue until financial development reaches a certain level of development where the poor begin to have easier access to finance (Greenwood and Jovanovic, 1990; Shahbaz et al., 2015). Thus, depicting an inverted U-curve as Kuznets hypothesis of economic development.

Still on the nonlinear concept of the finance-inequality relationship, Tan and Law (2012) suggested the existence of a U-curve relationship instead. Accordingly, it is perceived that the early stages of financial development would facilitate income inequality reduction, but when the development gets to a certain stage, it begins to widen income inequality (Chiu and Lee, 2019; Tan and Law, 2012). Thus, there is no consensus on how financial development affects income inequality; however, the evaluation of the financial development dimensions can split the effect of financial development on income inequality.

Kim and Lin (2011) put forward that the impact of finance on income distribution depends on the financial development prevalent in that economy. However, this study focused on the depth dimension of financial development. Limiting the study to an emerging economy, China, Jung and Vijverberg (2019) engaged the spatial dependence analysis for 29 Chinese provinces to examine how financial development influenced income inequality and came to the same conclusion that financial development leads to a decline in income inequality.

Inekwe et al. (2018) examined income inequality in emerging markets using SWIID data for 39 countries while employing the instrumental variable (IV)-generalized method of moments (GMM) and found that financial integration reduces market income inequality, not net income inequality. However, this study focused on the depth dimension of financial development. Also focusing on the depth dimension of financial development, Makhlouf et al. (2020) observed that finance reduced income inequality in the short run but not in the long run.

On the other hand, it was revealed that financial liberalization engendered a more even distribution of income by Bumann and Lensink (2016), where a study focused on examining the income distribution of 106 countries from 1973 to 2008. After implementing the GMM analytical technique and using capital account openness to capture capital account liberalization, it was discovered that countries with high financial depth led to income inequality reduction, thereby favouring the finance-inequality narrowing hypothesis. However, Adams and Klobodu (2017) also focused on capital account liberalization and discovered that finance had no significant impact on income inequality in 21 Sub-Saharan African (SSA) countries.

De Haan and Sturm (2017), using ordinary least squares (OLS), found that financial development increases income inequality. On the contrary, Moradi et al. (2016) found that bank-based financial development led to a decline in income inequality. This result corresponded with the findings of D’Onofrio et al. (2019), who discovered that local bank development enhanced the decline in income inequality in Italy after examining income distribution and bank development in the local province of Italy.

Adeleye (2020) revealed that structural breaks accounted for how bank credit affected income inequality. Taking into consideration the four dimensions of financial development, Kavya and Shijin (2020) developed a financial development index that captured all dimensions for both financial intermediaries and financial markets. The result revealed that finance was harmful to income inequality. The use of the index fails to determine the specific effect of the financial development dimensions on income inequality. Meniago and Asongu (2018) disaggregated these dimensions and discovered that for 48 African countries, financial activity and efficiency enhanced the redistribution of income regardless of the measure of income inequality. Financial depth only had an equalizing effect on income inequality when measured by the Gini coefficient, and financial stability only escalated income inequality. The difference in outcome can be traced to the disaggregation of the various dimensions of financial development, which best gives the combination of finance to aid the even distribution of income. Although financial stability is logically expected to promote an even distribution of income by making the financial system more robust improving the regulatory quality in the financial system without a commensurate effort in the macroeconomic environment can be ineffective because the financial system is endogenous and affected by the activities in the economy.

Destek et al. (2020) findings show that banking sector development engendered more income inequality at the early stage, while stock market development reduced income inequality in Turkey. Similarly, Hsieh et al. (2019), using an index for financial development that captured the size and activity of the banking sector, discovered that income inequality in OECD countries was exacerbated by financial development. Extant studies reviewed reported mixed findings. This study has taken a new direction by considering the multidimensional aspect of financial development that has been omitted in the extant literature and pays attention to the peculiarity of Africa on the subject of income inequality.

Adeleye et al. (2017) revealed that financial development had no significant effect on income inequality in Africa after capturing financial development with domestic credit to the private sector, which covers the depth dimension of financial development. This suggests that the larger size of the financial system may not be sufficient to guarantee income inequality reduction.

The gaps from the previous literature form the rationale for this study to expand the frontiers of knowledge. One of the main limitations of prior studies is that few empirical studies focused on financial development and income inequality in Africa. Second, studies focused on financial development and income inequality engaged a single indicator of financial development. Therefore, this study fills this gap by providing answers to the following research questions: (i) What are the effects of financial development on income inequality in Africa? (ii) How do the respective dimensions of financial development (access, efficiency, stability and depth) asymmetrically impact income inequality?

Methodology

Theoretical underpinning and estimated model

The study is hinged on financial imperfection theory. The financial imperfection theory was proposed by Galor and Zeira (1993). The theory is premised on the existence of constraints in the market economy that hinder access to finance. These constraints exist in the form of transaction and information costs and it limit people’s access to finance, and these constraints arise because of imperfections in the market system. Therefore, financial imperfection causes financial development to negatively affect income inequality (Mookerjee and Kalipioni, 2010). This theory points to the need for differentiating between financial access and financial depth (mostly used to capture financial development) dimensions. Thus, the presence of financial constraints is harmful as it can be responsible for excluding people from accessing financial products and services, which affects the ability of an individual to invest in human capital, thereby leading to persistence in income inequality (Kling et al., 2022).

Proponents (Banerjee and Newman, 1993; Galor and Moav, 2004; Galor and Zeira, 1993) of the theory offered that financial constraints will be eased as the financial system develops, thereby improving access to finance. Consequently, the development of the financial system should not be solely based on the evaluation of the size of the financial system. Financial development without increased access to finance would foster income inequality. In this vein, financial development could facilitate capital allocation efficiency (Thornton and Tommaso, 2020; Zhang and Naceur, 2019). Therefore, this study evaluates how financial development dimensions affect income inequality in Africa.

\({\rm {lnGini}}_{it}\) represents the natural logarithm of the Gini index of country i at time t. \({\rm {lnGini}}_{it - 1}\) captures the natural logarithm of the lagged Gini index of country i at time t. Given that income inequality is also determined by past income inequality levels; hence, the inclusion of the lag of the Gini coefficient. On the other hand, FDit stands for the financial development index of country i at time t. ϕ show the dimension of financial development which is 1–4 for access, depth, stability and efficiency. \(\mathop {\sum }\nolimits_{j = 1}^4 \lambda _jX_{it}^j\) is the summation of the parameters of the vector \(Z_{it}^j\) where j is 1–4. These control variables are other factors that affect income inequality based on the review of other studies.

Following Fouejieu et al. (2020), education captures population heterogeneity, age dependency is used to capture the demographic of the population, trade openness captures macroeconomic activities, and mobile subscription explains the level of technology adaptation in an economy. λj is the parameter for the control variable j. α1, α1, and α2 are parameters and eit is the error term. To show how the financial dimensions affect income inequality, the model for each dimension is described in Eq. (2).

Equation (2) indicates that income inequality measured by the Gini coefficient is a function of financial access. Where \({\rm {lnGini}}_{it}\) is the dependent variable being the log of the Gini coefficient of country i at time t, \({\rm {lnGini}}_{it - 1}\) is the lag of the dependent variable, \({\rm {lnFA}}_{it}\) is the natural logarithm of financial access measured by Bank branches (per 100,000 adults), \(\mathop {\sum }\nolimits_{j = 1}^4 \lambda _jX_{it}^j\) is as explained earlier.

Equation (3) illustrates that income inequality is measured by the Gini coefficient as a function of financial depth. Where \({\rm {lnGini}}_{it}\) is the dependent variable being the log of the Gini coefficient of country i at time t, \({\rm {lnGini}}_{it - 1}\) is the lag of the dependent variable, \({\rm {lnFDe}}_{it}\) is the natural logarithm of financial depth measured by credit to private sector (% of GDP) of country i at time, t and \(\mathop {\sum }\nolimits_{j = 1}^4 \lambda _jX_{it}^j\) is as explained earlier.

From Eq. (4) \({\rm {lnGini}}_{it}\) is the dependent variable being the log of the Gini coefficient of country i at time t, \({\rm {lnGini}}_{it - 1}\) is the lag of the dependent variable, \({\rm {lnFE}}_{it}\) is the natural logarithm of financial efficiency measured by bank cost to income ratio (% of total assets) of country i at time \(t.\mathop {\sum }\nolimits_{j = 1}^4 \lambda _jX_{it}^j\) is as explained earlier.

From Eq. (5) \({\rm {lnGini}}_{it}\) is the dependent variable being the log of the Gini coefficient of country i at time t, \({\rm {lnGini}}_{it - 1}\) is the lag of the dependent variable, \({\rm {lnFS}}_{it}\) is the natural logarithm of financial stability measured by bank Z-score of country i at time, t and \(\mathop {\sum }\nolimits_{j = 1}^4 \lambda _jX_{it}^j\) is as explained earlier.

The Gini coefficient index is the dependent variable that captures income inequality. This is the most commonly used measure of income inequality (Kokas et al., 2021; Odusola et al., 2017; Tchamyou et al., 2019). This measure shows how income is distributed across the population. The Gini coefficient estimates personal income distribution within the households of a given country (Gründler and Scheuermeyer, 2018). Credit to the Private Sector is a measure of the volume of funds given to the private sector. This is a common measure used to capture the size of the financial system. Most studies use it as a measure of financial development. This is also a common measure to measure the financial depth or financial deepening as seen in the literature (Meniago and Asongu, 2018; Odhiambo et al., 2019; Ogundipe et al., 2021; Okafor et al., 2021). Following this theory, it is evident that the financial system expansion is insufficient to guarantee income inequality reduction. This is because the presence of financial market imperfection can ensure that those who already have access to finance will have more access to finance, causing inefficiency in capital allocation.

Thus, it is important to separately evaluate the effect of financial access, which is captured by bank branches (per 100,000 adults). Bank branches are the number of commercial bank branches per 100,000 adults. According to Fouejieu et al. (2020), this measure covers the geographical coverage and availability of financial services to individuals and firms. Other studies (Emara and El Said, 2021; Hasan et al., 2020; Mushtaq and Bruneau, 2019) also employed this variable to measure financial access. Improved access to finance will ensure that the vulnerable and poor in society have access to capital for productive uses (Matthew et al., 2020; Osabohien et al., 2020), boosting their income and leading to a more even income distribution. Increased financial access implies easing the financial imperfection in the economy due to financial development (Fouejieu et al., 2020). The financial efficiency variable included in the analysis is the bank cost-to-income ratio. The bank cost-to-income ratio is the operating expense of financial institutions as a share of the net interest income (Demirgüç-Kunt et al., 2019). This determines how well the financial system can perform its functions. The primary function of a financial institution is to move financial products and services from where they are surplus to where it is a deficit. The financial system is efficient by performing this function at the lowest possible cost. If performing this function becomes expensive, the financial system might be subject to provide services and products only to the rich that can afford to pay. Eventually, the poor will be marginalized from the financial system.

Bank Z-score measures how susceptible the financial institutions (banks) are to risks and shocks. This variable is necessary for explaining the financial environment. In addition, in the case of financial crises or shocks, the poor and vulnerable suffer the most (Fouejieu et al., 2020). Furthermore, improved financial access can subject the financial system to being vulnerable (Abdulkarim and Ali, 2019; Bolarinwa et al., 2021; Yoshino and Morgan, 2018). Vulnerability of the financial system can cause the poor to lose trust in seeking financial products and services from the financial system that can be used for productive ventures, thereby exacerbating income inequality.

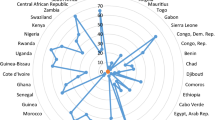

The study analysed data from 48 African countries for the period 1996 to 2018. The countries are Algeria, Angola, Benin, Botswana, Burkina Faso, Burundi, Cameroon, Cape Verde, Central Africa Republic, Chad, Comoros, Congo-Brazzaville, Congo-Kinshasa, Djibouti, Egypt, Eswatini and Ethiopia. Others are Gabon, Gambia, Ghana, Guinea, Guinea-Bissau, Kenya, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mauritius, Morocco, Mozambique, Namibia, Niger, Nigeria, Rwanda, Sao Tome, Senegal, Seychelles, Sierra Leone, South Africa, Sudan, Tanzania, Togo, Tunisia, Uganda and Zambia.

Data and data sources

Data used in this study were gathered from World Development Indicators (WDI) developed by the World Bank, Global Financial Development Database (GFDD), and Global Consumption and Income Project (GCIP) by Lahoti et al. (2016). The income inequality variable, the Gini coefficient, was sourced from GCIP, the financial dimensions variable was sourced from GFDD, and the control variables were obtained from WDI. Table 1 gives a summarized description of the variables.

Estimation techniques

Pooled Ordinary Least Squares

The pooled ordinary least squares (OLS) assume that the intercept and coefficient of the slope are constant over time and across countries. It, therefore, treats all the explanatory variables as exogenous and assesses their impact on the dependent variable. This technique is considered relevant because it allows for time and space in data analysis. In addition, this technique not only captures the variation across the time and space of the data but also simultaneously (Pennings et al., 2006). Most studies treat the Pooled OLS estimator as the baseline estimator and then proceed to other panel data estimators. This is because the results of pooled OLS can be affected by the problems associated with panel data analysis such as endogeneity. More so, when there are country-specific and time-specific effects on data, the pooled OLS tends not to be reliable as the estimator does not capture the country-specific effects (Aggarwal and Padhan, 2001). In the same way, the pooled OLS does not address issues of heterogeneity (Adeleye et al., 2020). Hence, the pooled OLS is not a sufficient estimator as the result can be biased. The pooled OLS linear model is given in Eq. (6)

where \({\rm {In}}Y_{it}\) is the natural logarithm of the dependent variable, α is the constant term, i capture countries, 1,2…N, t, time, 1,2… T, \(X_{it}^\prime\) is the vector of observed time-variant factors whereas β is the coefficient; ∂t is the unobserved time-variant effects, while ηi and εit capture the unobserved country-specific effects and the unobserved error term, respectively.

System Generalized Method of Moments

The generalized method of moments (GMM) is a more efficient estimation technique when analysing panel data with endogeneity tendencies. The technique was developed by Arellano and Bond (1991); however, the system-GMM was proposed by Arellano and Bover (1995) and Blundell and Bond (1998) as a more reliable technique when dealing with weak instruments. The presence of the lagged dependent variable as part of the independent variable gave rise to the use of this technique for this study. The system-GMM has been attributed to catering for this kind of bias that could arise because of the lagged dependent correlating with other variable explanatory (Neaime and Gaysset, 2018; Ouyang and Li, 2018). More so, the system-GMM addresses the problem of endogeneity (Kam and Tse, 2020). For instance, the financial development variable is sometimes regarded as ‘weakly exogenous’ (Effiong, 2015), but more occasionally, it is viewed as an endogenous variable (Wang et al., 2018).

For the system-GMM, an extra level of instrumentation is done where the original levels are instrumented with differences (Arellano and Bover, 1995). This is also known as a two-step transformation which prevents data loss associated with the difference GMM (Ullah et al., 2018).

Results

Descriptive analysis of variables

This subsection entails the summary statistics of the variables adopted for this empirical analysis. The summary statistics help summarize the large panel observations for ease in studying the trends and behavioural tendencies of the variables of focus. It also gives a quick view into the characteristics of the variables. The summary statistics of the variables are therefore presented in Table 2. The table shows different properties used to understand the trend of variables. These properties include mean, median, standard deviation, minimum, and maximum.

The summary statistics presented in Table 2 contain the variables’ mean, standard deviation, and minimum and maximum values. The variables included the Gini coefficient (measure of income inequality), bank branch (per 100,000 adults, measure of financial access), domestic credit to the private sector (as a measure of financial depth, bank Z-score (measure of financial stability), education (primary school enrolment as a % gross enrolment), mobile subscription (per 100 individuals), age dependency (younger than 15 or older than 64) to the working age population (between 15 and 64) and trade openness.

Regression results

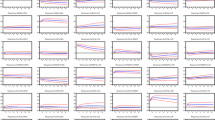

The result for the pooled OLS is presented in Table 3. The result, as presented in Table 3, shows that financial access has a negative and significant effect on income inequality. Bank branches per 100,000 have a coefficient of −0.0207, which suggests that as the Bank branches per 100,000 adults rise by a percentage point, income inequality could be reduced by ~0.0207% in Africa at a 5% significance level. This outcome corresponds to the a priori expectations that financial access should reduce income inequality.

The financial efficiency dimension measured by the bank cost-to-income ratio had a positive significance with a coefficient of 0.235 at 5% significance. This happens to be a favourable outcome as the result indicates that as a rise in bank cost-to-income ratio, suggesting bank inefficiency could encourage income inequality to increase by ~0.235%. As the bank cost-to-income ratio increases, it indicates the income derived by the bank is less than the cost of making funds. Therefore, the higher the ratio, the more inefficient the bank is. Thus, the positive effect of the bank cost-to-income ratio on income inequality is a favourable outcome.

Financial stability also has a favourable outcome that corresponds with a priori expectations. The coefficient of financial stability which is −0.0240, is also significant, as seen in column [3], which indicates that a percentage increase in bank Z-score could reduce income inequality by about 0.02%. On the contrary, the financial depth dimensions of financial development positively and significantly affected income inequality at a 5% level.

This outcome indicates that the financial depth exacerbates income inequality. For the control variables, education had a significant and positive effect on income inequality regardless of the dimension of financial development that was considered, except for the financial depth dimension when education was positive. This implies that education fosters income inequality in African countries. It is expected that as people get an education, investment is made in human capital, which could lead to reduced income inequality. This is because education empowers the populace to be productive and earn income, leading to a more even distribution of income. However, the result shows that a percentage increase in education could lead to 0.0161% and 0.0251% increases in income inequality when financial access and financial efficiency are considered, respectively.

Trade is seen to have a varying effect on income inequality across various financial dimensions. When financial efficiency was considered, trade had no significant effect on income inequality. For financial stability and financial depth, trade had positive effects on income inequality while negatively affecting income inequality when financial access was considered. From Table 3, Column [1], it is evident that a percentage increase in trade openness could lead to an ~0.01% decline in income inequality. However, for columns [3] and [4], a percentage increase in trade led to a 0.0154% and 0.0131% increase in income inequality, respectively.

Similar to trade, age dependency is seen to have varying effects on income inequality across the columns. Age dependency had a significant and positive effect on income inequality in columns [1], [3], and [4] but had a negative and significant effect on income inequality in column [2] when the financial efficiency dimension was considered. The rise in the dependent population could further expand the disparity in income inequality as the percentage of those that earn income will be smaller than those that do not earn income, which will expand income inequality. Meanwhile, the estimates of mobile subscriptions per 100 persons conform to a priori expectations by negatively affecting income inequality across all columns.

System generalized method of moments result

The System GMM is considered most appropriate to give unbiased results for the dynamic panel and to control for endogeneity. The System GMM estimates are presented in Table 4. The result shows that income inequality for the previous year contributes significantly to the current year’s inequality. It is evident that the financial variables had a significant effect on income inequality. Similar to the result for the pooled OLS presented in Table 3, the estimates for System GMM in Table 4 show that financial access has a negative and significant effect on income inequality. From the result in column [1], Table 4, it is evident that a percentage increase in bank branches per 100,000 led to about a 0.023% decline in income inequality. This implies that access to finance facilitated income inequality reduction in Africa.

In column [2] of the same table, the coefficient of the financial efficiency variable is seen to have a positive and significant effect on income inequality in Africa. This outcome suggests that a percentage increase in the bank cost-to-income ratio could lead to about a 0.02% increase in income inequality, which is expected. This shows that as financial institutions fund high operational expenses, there will be little or no funds available to loan out to people for productive use. More so, in such instances, the funds available could be given to only those who can afford it, thereby marginalizing financial resources and fostering income inequality. Hence, this result conforms to a priori expectations.

However, the result of the financial depth dimension on income inequality does not correspond to the a priori expectation. From column [3], it is evident that domestic credit has a positive and significant effect on income inequality. That is, an increase in the domestic credit by a percentage could lead to a proportionate widening of income inequality by about 0.021%. This outcome supports the finance-income inequality-widening hypothesis. On the other hand, the result of the regression based on the financial stability dimension revealed that financial stability encouraged income inequality reduction. From the result, as seen in column [4], Table 4, bank Z-score could lessen income inequality by ~0.019% following a percentage increase in bank Z-score. This outcome corresponds with a priori expectation that the stability of the financial system would boost people’s confidence in going to formal financial institutions to seek financial products and services.

Looking at the control variables, it can be inferred that a percentage increase in education could lead to a decline in income inequality by at least 0.02% in column [1] and 0.002% in column [3] when the financial access and depth dimensions were considered, respectively. This result for education conforms to the a priori expectation, as it is expected that an increase in the level of education will enhance opportunities that could bridge the income inequality gap. With education have a negative relationship with income inequality in Table 4 compared to the outcome in Table 3, which means that education results in a reduction in income inequality.

Estimates of mobile subscriptions per 100 persons also conformed to a priori expectations by having a negative significant effect on income inequality regardless of the financial development dimension that was measured in Table 4. In contrast to mobile subscriptions, age dependency did not conform to the a priori expectation across all columns when different dimensions of financial development were engaged. The estimates in Table 4 indicate that age dependency has a negative and significant effect on income inequality, which is not favourable outcome. Trade, on the other hand, was seen to have an income inequality-reducing effect only when financial efficiency was considered.

The result of the System GMM analysis presented in Table 4 corresponds with the pooled OLS results presented in Table 3 regarding the effect of financial development dimensions on income inequality in Africa. However, the outcome of the control variables differs. Furthermore, the results of the diagnostic tests of the System GMM analysis further validate the results. With the results of the Sargan tests across all columns being >0.05, the null hypothesis that stipulates the absence of instrument proliferation must be accepted. Thus, the instruments used were valid. As expected, AR(1) is rejected.

Discussion

This study focused on assessing the effects of financial development dimensions on income inequality in Africa. The study proposed that for the effect of financial on income inequality to be adequately captured, financial development needs to be evaluated holistically. To accomplish this, the study empirically analysed the effect of four financial development dimensions on income inequality using the pooled OLS and SystemGMM techniques to ensure the validity of the results.

The findings revealed that financial development can have varying effects on income inequality depending on the dimension of focus. The results of the effect of financial development on income inequality in Africa are presented in Tables 3 and 4. Financial access, financial efficiency, and financial stability are observed to have an income inequality-reducing effect from the pooled OLS and System GMM estimations. These outcomes agree with the a priori financial development engendering income inequality reduction in Africa.

Therefore, as financial products and services are more accessible, there would be a high chance of reducing income inequality as capital allocation would be done more efficiently. This is because accessibility to financial products and services signifies the alleviation of costs for the poor and vulnerable in society to participate in financial resource allocation. In the same vein, this outcome supports the findings of Neaime and Gaysset (2018) and Omar and Inaba (2020) that financial access has a significant and negative effect on income inequality. Similarly, from the efficiency point of view, financial development facilitated income inequality reduction in Africa as the findings reveal that financial inefficiency encourages income inequality (Weychert, 2020; Zhang and Naceur, 2019).

More so, relative to the stability dimension, it was revealed that financial development had an income inequality-reducing effect. This contradicts the findings of Meniago and Asongu (2018), that found bank stability widened income inequality in Sub-Saharan Africa. Weychert (2020) also found stability to be an income inequality enhancer in European countries, although the author employed bank concentration as a measure of bank stability. Regardless, the finding of this study conforms with that of Zhang and Naceur (2019), that financial to have a significant adverse effect on income inequality. Furthermore, the outcome supports the theory by Rajan (2010) that a financial crisis fosters uneven income distribution.

However, the financial depth dimension showed that financial development could exacerbate income inequality in Africa. In contrast, Meniago and Asongu (2018) found that financial depth encouraged a reduction in income inequality in Sub-Saharan countries when financial depth was measured by broad money. It is expected that as financial institutions provide more resources to private individuals, income inequality would be reduced as individuals could use the funds to either invest in human capital, which would lead to equipping the individuals with skills that encourage multiple income streams, or individuals could use the funds to start a business that increases income. Nonetheless, this finding supports the income inequality widening hypothesis (de Haan and Sturm, 2017).

The results show that it is not the volume of money in the financial system that matters but the accessibility of the funds by individuals that would eventually foster income inequality reduction in Africa. The control variables show that the education estimates do not portray the a priori expectation; it is probable for education to facilitate income disparity in Africa since there is a phenomenon of education inequality. That is, the existence of bias in access to quality education in Africa could encourage income inequality disparity.

Summary and conclusion

Rising income inequality in the world is a concern, and Africa is topping the charts for this rising income inequality. It has been posed that even with the ‘Africa rising’ theme, the eradication of poverty by 2030 is an ambiguous attempt. Nonetheless, a reduction in income inequality in the continent can not only facilitate the reduction of income inequality in the world but also accelerate the attainment of poverty eradication in Africa. The study employed the system GMM estimation technique to control for endogeneity. The study revealed that financial depth, financial stability, financial access, and financial efficiency significantly contribute to income inequality reduction in Africa. Therefore, policies should be aimed at ensuring that all dimensions of financial development experience development. Priority should not only be placed on how broad the financial system is but also on how efficiently the responsibility of the financial system is carried out; how accessible are the financial products and services being offered, and how effectively can the financial system withstand shock.

Data availability

Data used in this study are publicly available online. Data were sourced from the World Bank’s World Development Indicators, World Governance Indicators, and Global Financial Development Database. The income inequality data were sourced from the Global Consumption and Income Project.

References

Abdulkarim FM, Ali HS (2019) Financial inclusions, financial stability, and income inequality in OIC countries: a Gmm and quantile regression application. J Islam Monetary Econ Fin5(2):419–438. https://doi.org/10.21098/JIMF.V5I2.1069

Adams S, Klobodu EKM (2017) Capital flows and the distribution of income in sub-Saharan Africa. Econ Anal Policy 55:169–178. https://doi.org/10.1016/j.eap.2017.05.006

Adeleye BN (2020) Unbundling interest rate and bank credit nexus on income inequality: structural break analysis from Nigeria. J Financ Regul Compliance 29(1):63–78. https://doi.org/10.1108/JFRC-04-2020-0035

Adeleye BN, Gershon O, Ogundipe A, Owolabi O, Ogunrinola I, Adediran O (2020) Comparative investigation of the growth–poverty–inequality trilemma in Sub-Saharan Africa and Latin American and Caribbean Countries. Heliyon 6:e05631. https://doi.org/10.1016/j.heliyon.2020.e05631

Adeleye N, Osabuohien E, Bowale E (2017) The role of institutions in the finance-inequality nexus in sub-Saharan Africa. J Context Econ 137(1–2):173–192. https://doi.org/10.3790/schm.137.1-2.173

Aggarwal D, Padhan PC (2001) Impact of capital structure on firm value: evidence from Indian hospitality industry. Theor Econ Lett 7:982–1000. https://doi.org/10.4236/tel.2017.74067

Altunbaş Y, Thornton J (2019) The impact of financial development on income inequality: a quantile regression approach. Econ Lett 175:51–56. https://doi.org/10.1016/j.econlet.2018.12.030

Arellano M, Bond S (1991) Some tests of specification for panel data: monte carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68:29–51

Babajide AA, Adegboye FB, Omankhanlen AE (2015) Financial inclusion and economic growth in Nigeria. Int J Econ Financ Issues 5(3):629–637. https://doi.org/10.38157/business-perspective-review.v2i2.149

Banerjee AV, Newman AF (1993) Occupational choice and the process of development. J Political Econ 101(2):274–298. https://doi.org/10.1086/261876

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87:115–143

Bolarinwa ST, Adegboye AA, Vo XV (2021) Is there a nonlinear relationship between financial development and poverty in Africa. J Econ Stud 48(7):1245–1266. https://doi.org/10.1108/JES-10-2019-0486

Bumann S, Lensink R (2016) Capital account liberalization and income inequality. J Int Money Finance 61:143–162. https://doi.org/10.1016/j.jimonfin.2015.10.004

Chiu YBin, Lee CC (2019) Financial development, income inequality, and country risk. J Int Money Finance 93:1–18. https://doi.org/10.1016/j.jimonfin.2019.01.001

Čihák M, Demirgüç-Kunt A, Feyen E, Levine R, Demirguc-Kunt A, Feyen E, … Levine R (2012) Benchmarking financial systems around the world. Policy research working paper no. 6175. Washington, DC. http://econ.worldbank.org

D’Onofrio A, Minetti R, Murro P (2019) Banking development, socioeconomic structure and income inequality. J Econ Behav Organ 157:428–451. https://doi.org/10.1016/j.jebo.2017.08.006

de Haan J, Sturm JE (2017) Finance and income inequality: a review and new evidence. Eur J Political Econ 50:171–195. https://doi.org/10.1016/j.ejpoleco.2017.04.007

Demirgüç-Kunt A, Cihak M, Feyen E, Beck T, Levine R (2019) Financial development and structure dataset. World Bank, Washington, DC

Demirgüç-Kunt A, Klapper L, Singer D (2017) Financial inclusion and inclusive growth: a review of recent empirical evidence. Policy Research Working Paper. pp. 1–27

Destek MA, Sinha A, Sarkodie SA (2020) The relationship between financial development and income inequality in Turkey. J Econ Struct 9(1):11. https://doi.org/10.1186/s40008-020-0187-6

Effiong EL (2015) Financial development, institutions and economic growth: evidence from Sub-Saharan Africa. Munich Personal RePEc Archive

Emara N, El Said A (2021) Financial inclusion and economic growth: the role of governance in selected MENA countries. Int Rev Econ Finance 75:34–54. https://doi.org/10.1016/j.iref.2021.03.014

Erlando A, Riyanto FD, Masakazu S (2020) Financial inclusion, economic growth, and poverty alleviation: evidence from eastern Indonesia. Heliyon 6(10):e05235. https://doi.org/10.1016/j.heliyon.2020.e05235

Fouejieu A, Sahay R, Cihak M, Chen S (2020) Financial inclusion and inequality: a cross-country analysis. J Int Trade Econ Dev 15(2):1018–1048. https://doi.org/10.1080/09638199.2020.1785532

Galor O, Moav O (2004) From physical to human capital accumulation: inequality and the process of development. Rev Econ Stud 71:1001–1026. https://academic.oup.com/restud/article/71/4/1001/1564178

Galor O, Zeira J (1993) Income distribution and macroeconomics. Rev Econ Stud 60:35–42. https://doi.org/10.2307/2297811

Gimet C, Lagoarde-Segot T (2011) A closer look at financial development and income distribution. J Bank Finance 35(7):1698–1713. https://doi.org/10.1016/j.jbankfin.2010.11.011

Greenwood J, Jovanovic B (1990) Financial development, growth, and the distribution of income. J Political Econ 98(5):1076–1107. https://doi.org/10.1086/261720

Gründler K, Scheuermeyer P (2018) Growth effects of inequality and redistribution: what are the transmission channels. J Macroecon 55:293–313. https://doi.org/10.1016/j.jmacro.2017.12.001

Hasan I, Horvath R, Mares J (2020) Finance and wealth inequality. J Int Money Finance 108:102161. https://doi.org/10.1016/j.jimonfin.2020.102161

Hsieh J, Chen TC, Lin SC (2019) Financial structure, bank competition and income inequality. North Am J Econ Finance 48:450–466. https://doi.org/10.1016/j.najef.2019.03.006

Inekwe JN, Jin Y, Valenzuela MR (2018) A new approach to financial integration and market income inequality. Emerg Mark Rev 37:134–147. https://doi.org/10.1016/j.ememar.2018.07.002

Jauch S, Watzka S (2012) Financial development and income inequality: a panel data approach. Empir Econ 51(1):291–314. https://doi.org/10.1007/S00181-015-1008-X

Johansson AC, Wang X (2014) Financial sector policies and income inequality. China Econ Rev 31(2014):367–378. https://doi.org/10.1016/j.chieco.2014.06.002

Jung SM, Vijverberg CPC (2019) Financial development and income inequality in China—a spatial data analysis. N Am J Econ Finance 48:295–320. https://doi.org/10.1016/j.najef.2019.03.001

Kam OY, Tse CB (2020) The trend of foreign direct investment movement: did unintended nation brand of legal-families play an instrumental role. J Bus Res 116(8):745–762. https://doi.org/10.1016/j.jbusres.2018.01.008

Kavya TB, Shijin S (2020) Economic development, financial development, and income inequality nexus. Borsa Istanbul Rev 20(1):80–93. https://doi.org/10.1016/j.bir.2019.12.002

Kim DH, Lin SC (2011) Nonlinearity in the financial development-income inequality nexus. J Comp Econ 39(3):310–325. https://doi.org/10.1016/j.jce.2011.07.002

Kling G, Pesqué-Cela V, Tian L, Luo D (2022) A theory of financial inclusion and income inequality. Eur J Finance 28(1):137–157. https://doi.org/10.1080/1351847X.2020.1792960

Kokas D, El Lahga AR, Lopez-Acevedo G (2021) Poverty and inequality in Tunisia: recent trends. SSRN Electron J (14597). https://doi.org/10.2139/ssrn.3900859

Lahoti R, Jayadev A, Reddy S (2016) The Global Consumption and Income Project (GCIP): An Overview. J Glob Dev 7(1):61–108. https://doi.org/10.1515/jgd-2016-0025

Makhlouf Y, Kellard NM, Vinogradov DV (2020) Finance–inequality nexus: the long and the short of it. Econ Inq 58(4):1977–1994. https://doi.org/10.1111/ecin.12918

Matthew O, Adeniji A, Osabohien R, Olawande T, Atolagbe T (2020) Gender inequality, maternal mortality and inclusive growth in Nigeria. Soc Indic Res 147:763–780. https://doi.org/10.1007/s11205-019-02185-x

Martin M, Walker J, Obeng KW, Hallum C (2021) The West Africa Inequality Crisis: fighting austerity and the pandemic. In: Commitment to reducing inequality index. Oxfam International, Oxford, UK

Meniago C, Asongu SA (2018) Revisiting the finance-inequality nexus in a panel of African countries. Res Int Bus Finance 46(2018):399–419. https://doi.org/10.1016/j.ribaf.2018.04.012

Menyelim CM, Babajide AA, Omankhanlen AE, Ehikioya BI (2021) Financial inclusion, income inequality and sustainable economic growth in Sub-Saharan African countries. Sustainability (Switzerland) 13(4):1–15. https://doi.org/10.3390/su13041780

Mookerjee R, Kalipioni P (2010) Availability of financial services and income inequality: the evidence from many countries. Emerg Mark Rev 11(4):404–408. https://doi.org/10.1016/j.ememar.2010.07.001

Moradi ZS, Mirzaeenejad M, Geraeenejad G (2016) Effect of bank-based or market-based financial systems on income distribution in selected countries. Procedia Econ Finance 36(16):510–521. https://doi.org/10.1016/s2212-5671(16)30067-3

Mushtaq R, Bruneau C (2019) Microfinance, financial inclusion and ICT: implications for poverty and inequality. Technol Soc 59:101154. https://doi.org/10.1016/J.TECHSOC.2019.101154

Nabi MS (2015) Equity-financing, income inequality and capital accumulation. Econ Model 46:322–333. https://doi.org/10.1016/j.econmod.2014.12.030

Neaime S, Gaysset I (2018) Financial inclusion and stability in MENA: evidence from poverty and inequality. Finance Res Lett 24:199–220. https://doi.org/10.1016/j.frl.2017.09.007

Odhiambo NM, Nyasha S, Zerihun MF, Tipoy C (2019) Financial development in Africa: is it demand-following or supply-leading? In: Makina D (ed) Extending financial inclusion in Africa. Elsevier Inc., pp. 37–60

Odusola A, Bandara A, Dhiliwayo R, Diarra B (2017) Inequalities and conflict in Africa: an empirical investigation. In: Odusola A, Cornia GA, Bhorat H, Conceição P (eds) Income inequality trends in sub-Saharan Africa: divergence, determinants and consequences. United Nations Development Programme (UNDP) Regional Bureau for Africa, New York, pp. 220–242

Ogundipe AA, Okafor V, Bowale E, Maijeh P-DC (2021) Financial deepening and manufacturing sector performance in Nigeria: evidence from bank, non-bank and external financing sources. Afr J Bus Econ Res 2021(si1):203

Okafor V, Bowale E, Onabote A, Afolabi A, Ejemeyovwi J (2021) Financial deepening and economic growth in Nigeria: a Johannsen and error correction model techniques. Int J Financ Res 12(2):263. https://doi.org/10.5430/ijfr.v12n2p263

Omar MA, Inaba K (2020) Does financial inclusion reduce poverty and income inequality in developing countries? A panel data analysis. J Econ Struct 9(1):1–25. https://doi.org/10.1186/S40008-020-00214-4/TABLES/7

Osabohien R, Matthew O, Ohalete P, Osabuohien E (2020) Population–poverty–inequality nexus and social protection in Africa. Soc Indic Res 151(2):575–598. https://doi.org/10.1007/s11205-020-02381-0

Ouyang Y, Li P (2018) On the nexus of financial development, economic growth, and energy consumption in China: new perspective from a GMM panel VAR approach. Energy Econ71:238–252. https://doi.org/10.1016/j.eneco.2018.02.015

Pennings, P, Keman, H, Kleinnijenhuis J (2006) Doing research in political science, 2nd edn. SAGE Publications Ltd, London

Rajan R (2010) Fault lines how hidden fractures still threaten the world economy. Princeton University Press, Princeton, NJ

Rajan RG, Zingales L (2003) The great reversals: the politics of financial development in the twentieth century. J Financ Econ 69(1):5–50. https://doi.org/10.1016/S0304-405X(03)00125-9

Seven U, Coskun Y (2016) Does financial development reduce income inequality and poverty? Evidence from emerging countries. Emerg Mark Rev 26:34–63. https://doi.org/10.1016/j.ememar.2016.02.002

Shahbaz M, Loganathan N, Tiwari AK, Sherafatian-Jahromi R (2015) Financial development and income inequality: is there any financial Kuznets curve in Iran? Soc Indic Res 124(2):357–382. https://doi.org/10.1007/S11205-014-0801-9/METRICS

Tan HB, Law SH (2012) Nonlinear dynamics of the finance-inequality nexus in developing countries. J Econ Inequal 10:551–563

Tchamyou VS, Erreygers G, Cassimon D (2019) Inequality, ICT and financial access in Africa. Technol Forecast Soc Change 139:169–184. https://doi.org/10.1016/j.techfore.2018.11.004

Thornton J, Tommaso CDI (2020) The long-run relationship between finance and income inequality: evidence from panel data. Finance Res Lett 32:101180. https://doi.org/10.1016/j.frl.2019.04.036

Ullah, Akhtar, Zaefarian (2018) Dealing with endogeneity bias: the generalized method of moments (GMM) for panel data. Ind Mark Manag 71:69–78. https://doi.org/10.1016/j.indmarman.2017.11.010

United Nations Development Programme (2017) Income inequality trends in sub-Saharan Africa. In: Odusola A, Cornia GA, Bhorat H, Conceição P (eds) Income inequality trends in sub-Saharan Africa: divergence, determinants and consequences. United Nations Development Programme (UNDP) Regional Bureau for Africa, New York. http://www.africa.undp.org/content/dam/rba/docs/Reports/Overview-Income inequality Trends SSA-EN-web.pdf%0Aafrica.undp.org

Wang P, Wen Y, Xu Z (2018) Financial development and long-run volatility trends. Rev Econ Dyn 28:221–251. https://doi.org/10.1016/j.red.2017.08.005

Weychert E (2020) Financial development and income inequality. Cent Eur Econ J 7(54):84–100. https://doi.org/10.2478/CEEJ-2020-0006

World Bank (2018) The little data book on financial inclusion. World Bank, Washington, DC

Yoshino N, Morgan PJ (2018) Financial inclusion, financial stability and income inequality: introduction. Singap Econ Rev 63(1):1–7. https://doi.org/10.1142/S0217590818020022

Zhang R, Naceur SBen (2019) Financial development, inequality, and poverty: Some international evidence. Int Rev Econ Finance 61:1–16. https://doi.org/10.1016/j.iref.2018.12.015

Acknowledgements

This article draws from the first author’s doctoral thesis. The comments received from the examiners and scholars at the various presentations made, are well appreciated. The authors use this opportunity to thank Covenant University Centre for Research, Innovation and Discovery for the financial support in the publication of this paper.

Author information

Authors and Affiliations

Contributions

VIO: conceive and design the experiment; methodology; analysed and interpreted the data; writing-original draft preparation; contributed analysis tools and data. IOO: supervision; writing-review and editing; validation. EB: supervision; resources; writing- review and editing. RO: methodology; formal analysis; writing-original draft preparation.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

Ethical approval did not apply in this study as the research did not include any human or animal participants.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Okafor, V.I., Olurinola, I.O., Bowale, E. et al. Financial development and income inequality in Africa. Humanit Soc Sci Commun 10, 305 (2023). https://doi.org/10.1057/s41599-023-01810-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-023-01810-y

- Springer Nature Limited

This article is cited by

-

Assessing the effect of financial inclusion on human capital in West Africa: an heterogeneous analysis based on income level

SN Business & Economics (2023)