Abstract

Using the micro data of Chinese manufacturing firms, this study analyzes the impact of financial constraints on firms’ markup and their influence mechanism. The findings suggest that financial constraints significantly reduce firms’ markup. The result is still valid after a series of robustness tests, such as key indicator substitution, analysis of endogeneity problems, controlling for other policy changes, dynamic panel model estimation, and quantile regression. An analysis of the influence mechanism shows that, on the one hand, financial constraints inhibit the improvement of firms’ production efficiency and reduce its markup through the productivity channel; on the other hand, financial constraints also reduce firms’ market pricing power and exert a significant negative impact on firms’ markup through the market pricing channel. At the same time, significant heterogeneity exists in the negative impact of financial constraints among different firm types. This paper not only enriches our understanding of the relationship between financial constraints and firms’ markup, but also provides a new perspective for a more comprehensive grasp of the micro economic effects of financial constraints.

Similar content being viewed by others

Introduction

Chinese-specific financial constraints have existed since the reform and opening up as a result of the government’s improper and excessive interference in the financial system during the transition from a planned economy to a market economy. A majority of firms are facing financing difficulties while financial constraints are turning into common constraints on the development of Chinese firms. According to a World Bank report, three-quarters of Chinese non-financial listed companies among the enterprises surveyed held the view that financial constraints are major obstacles to the growth of the company (Claessens and Tzioumis, 2006). Financial constraints originate from high external financial cost and distorted resource allocation resulting from an implemented market, resulting in firms failing to reach their optimal level (Fazzari et al., 1988). Although the revolution of the Chinese financial system has been pushing forward in recent years and has had remarkable achievements, the financial market is still implemented compared to those in developed countries. The allocation of credit funds, which are greatly affected by non-market factors, remains a prominent problem, and some firms, especially private and small- and medium-sized firms, are confronted with severe financial constraints. Financial constraints greatly depress firms’ research and development (R&D) investment, reduce R&D vitality and independent innovation ability (Hall et al., 2016), and increase the risk of investment. These effects, in turn, change firms’ investment and export decision-making (Hasan and Sheldon, 2016), cause distorted resource allocation (Caggese and Cuñat, 2013; Galle, 2020), and lower their productivity levels (Viet et al., 2020). Meanwhile, many firms adopt a “small profits but quick turnover” business philosophy under consideration of financial constraints, an approach that might limit the increase of their market competitiveness and markup. An important metric of the market influence and profitability of firms is markup, which measures the difference between the product price and the marginal cost. Additionally, it provides a concentrated example of how firms are divided up along the global value chain. The amount of a country’s welfare in international trade is even determined by export firms’ markup (Edmond et al., 2015). How do financial constraints affect firms’ markup? Do financial constraints restrain the increase of firms’ markup?

In this study, the micro data set of Chinese manufacturing enterprises from 1999 to 2007 was used to estimate the markup of firms by the method of De Loecker and Warzynski (2012), and the influence of financial constraints on firms’ markup and its influencing mechanism was discussed in detail. At present, China’s manufacturing industry is in the critical stage of growing from large to strong and realizing the rising status of the global value chain. An in-depth analysis of the internal relationship between financial constraints and firms’ markup is clearly of great significance to better understand and promote the deepening reform of China’s financial sector. This analysis can help continuously enhance the market competitiveness of enterprises and realize the upgrading of the manufacturing industry.

The literature closely related to this study includes the following two categories. The first type is about the impact of financing constraints on firm performance. Currently, most studies mainly focus on analyzing the impact of financial constraints on firm productivity, R&D investment and innovation, and export decision-making, among others. First, numerous studies found that financial constraints inhibit firms’ productivity. Examples include Gatti and Love (2008) for Bulgarian firms; Moreno Badia and Miranda (2009) for Estonian firms; Altomonte et al. (2016) for French, German, Italian, and Spanish firms; Satpathy et al. (2017) for Indian firms; Manaresi and Pierri (2017) for Italian firms; Cao and Leung (2020) for Canadian firms; and Viet et al. (2020) for Vietnamese firms. Second, numerous studies found that financial constraints inhibit firms’ R&D investment, which is detrimental to firms’ innovation activities. Brown et al. (2009) found that financial constraints significantly reduce the R&D and innovation activities of manufacturing firms in the United States. Aghion et al. (2012) also reached similar conclusions based on their research of French firms. Caggese and Cuñat (2013) used data of Italian manufacturing firms and found that financial constraints significantly constrain their technological innovation. Similar studies include Howell (2016), Lin et al. (2017), and Hall et al. (2016).

Financial constraints likewise greatly affect firms’ export activities. Chaney (2016) introduced financial constraints in the framework of a heterogeneous firm model and analyzed the impact of financial constraints on firms’ export behavior. Entering the export market requires paying a certain fixed cost, and thus firms facing more severe financial constraints will not be able to export. Only those firms with more liquid assets can export, while those with higher productivity can accumulate more liquid assets when serving the domestic market and are thus more likely to export. Based on the data from Chinese firms, Tang and Zhang (2012) found that financial constraints significantly reduce the export probability of state-owned enterprises (SOEs) and foreign-funded firms. From the panel data of multinational firms, Fauceglia (2015) found that financial constraints significantly reduce the export probability and export income of firms, and financial development can effectively alleviate the detrimental effects of financial restrictions on firms’ export. Hasan and Sheldon (2016) introduced financial constraints into Melitz’s (2003) model and showed that the financial constraints faced by firms depend on their initial productivity and financial costs. Firms affected by financial constraints cannot enter foreign export markets due to their inability to reach the minimum critical productivity level. Further empirical analysis based on firm-level panel data from six Latin American countries/regions suggested that financial constraints hurt firms’ export. Feenstra et al. (2014), Manova et al. (2015), and Padmaja and Sasidharan (2020) also found that financial constraints significantly affect firms’ export activities. In addition, some studies explored the impact of financial constraints on the related performance of firms from the perspectives of export product quality (Fan et al., 2015) and overseas investment (Sasidharan and Padmaja, 2018; Yan et al., 2018).

The second is the body of literature that examines the variables affect firms’ markup. Currently, a large number of relevant research are underway. The primary focus of the early study is on how productivity and exports affect firms’ markup. Bernard et al. (2003) investigated the connection between firms’ export activity and their productivity and markup under the framework of an imperfectly competitive model. Their findings demonstrated that businesses with high production are better equipped to set a high markup. On the other hand, Melitz and Ottaviano (2008) internalized firms’ markup into the model by introducing a quasi-linear demand system, which theoretically demonstrated that firms with higher productivity have a higher markup. Görg and Warzynski (2003) examined the impact of firms’ export on markup using data from companies in the British manufacturing industry and discovered that firms’ export activities are conducive to the improvement of markup. Later, the studies of Kugler and Verhoogen (2008) for Colombian firms, De Loecker and Warzynski (2012) for Slovenian firms, Kato (2014) for Japanese manufacturing firms, and Bellone et al. (2016) for French firms all found that firms’ export significantly improves markup. In addition to focusing solely on the influence of firms’ export on markup, several studies also examined the effect of the export mode of firms (Feenstra and Hanson, 2004) and their choice of the export destination nations (Manova and Zhang, 2009; Kilinç, 2019) on markup.

Meanwhile, academics also started to examine the influence of relevant factors on firms’ markup from multiple perspectives. Sembenelli and Siotis (2008) investigated the impact of foreign direct investment (FDI) on firms’ markup by using firm-level data from Spain. They found that FDI has a long-term improvement effect on firms’ markup. Based on firm-level data from China, Du and Wang (2020) conducted an empirical analysis of the effect of minimum wage on firms’ markup and they discovered that minimum wage has a significantly positive influence on firms’ markup via channels like fostering firms’ innovation activities, enhancing TFP, and the efficiency of labor resource allocation. Other studies discuss the effects of relevant factors on the firms’ markup from diverse perspectives, such as import competition (Meinen, 2016; Caselli and Schiavo, 2020), trade liberalization (De Loecker et al., 2016; Xiang et al., 2017; Fan et al., 2018), and exchange rate shock (Weinberger, 2020).

Some studies have started to concentrate on how financial constraints affect the firms’ markup. For instance, Du et al. (2022) analyzed the effect of financial constraints and economic policy uncertainty on firms’ markup according to the data of Chinese manufacturing firms, and Altomonte et al. (2020) studied the interaction between financial constraints and intangible asset investment decision making in manufacturing firms and its impact on the dynamics of markup. However, these two studies concentrate more on the impact of the interaction between financial constraints and another variable (e.g., economic policy uncertainty and intangible asset investment) on firms’ markup and not on the research perspective of financial constraints. They don’t carry out a systematic and in-depth analysis of how financial constraints affect firms’ markup.

The contribution of the present study to the literature is as follows. Firstly, this study integrates financial constraints and firms’ markup into a unified analytical framework and makes a detailed investigation of how financial constraints affect firms’ markup by using the micro data set of Chinese manufacturing firms. This study verifies the conclusion that financial constraints significantly reduce firms’ markup after a series of robustness tests, such as endogeneity problem treatment, key indicator substitution, dynamic panel model estimation, quantile regression, and controlling for other policy changes, thereby enriching the existing literature on the examination of the relevant influencing elements of firms’ markup. Secondly, this study examines the mechanism of how financial constraints affect firms’ markup via the channels of production efficiency and market pricing. On the one hand, financial constraints inhibit the increase of the production efficiency of firms and reduce firms’ markup through this channel. On the other hand, financial constraints also decrease firms’ market pricing power (i.e., the price level of firms’ products) and have a considerable negative effect on firms’ markup through the market pricing channel. The relationship between financial constraints and firms’ markup can be better understood by doing an in-depth analysis of the influencing mechanism. Finally, the heterogeneous effect of financial constraints on the markup of diverse types of firms is also covered in this article (different industry types, different scale types, different ownership types, export firms and non-export firms). This paper offers a richer viewpoint for a more thorough comprehension of the markup effect caused by financial constraints through the analysis from multiple perspectives.

The rest of this paper is structured as follows. “Empirical model and data” introduces the empirical model and the data sources. “Analysis and discussion of empirical results” show the empirical results. “Influence mechanism analysis and heterogeneity test” investigates the mechanism of financial constraints affecting firms’ markup and explores the heterogeneous effect of financial constraints on the markup of different types of firms. “Conclusions” provides conclusions.

Empirical model and data

Empirical model setting

To examine the impact of financial constraints on firms’ markup, following the similar studies of Lu and Yu (2015), Xiang et al. (2017), and Du et al. (2022), this paper sets the baseline regression model as follows:

In Eq. (1), subscripts i, j, k, and t represent firm, industry, region (province), and year. The explained variable \(\ln (markup_{ijkt})\) is the logarithm of the markup of the firm i in industry j in region k in period t. The core explanatory variable \(CC_{ijkt}\) represents the degree of financial constraints that the firm i in industry j in region k in period t faces. \(X_{ijkt}\) includes a set of other control variables, \(\upsilon _t\) denotes the year fixed effect, \(\lambda _j\) denotes the industry fixed effect, \(\gamma _k\) denotes the region (province) fixed effect, \(\eta _i\) denotes the firm fixed effect, and \(\mu _{ijkt}\) denotes random disturbance term. \(\beta _1\) measures the effect of financial constraints on firms’ markup.

\(X_{ijkt}\) represents the set of other control variables. Specifically, the control variables introduced in Eq. (1) are as follows: ①firm size (Size), which is measured using the logarithm of firm sales; ②factor intensity (Kl), which is calculated by the logarithm of the ratio of capital to labor; ③average wage (Wage), which is determined as the logarithm of the ratio of total wages payable to the number of employees; ④firm age (Age), which is determined using the logarithm of the number of years since the firm was founded; ⑤government subsidies (Subsidy), which is measured as the ratio of subsidies that firms receive from the government to firms’ sales; and ⑥industry concentration, which is determined by the Herfindahl–Hirschman index (HHI).

Measures of major variables

The dependent variable in Eq. (1) is the logarithm of firms’ markup, so we have to estimate firm-level markup first. Based on the approach of De Loecker and Warzynski (2012), our definition of firm-level markup is the proportion of product price to marginal cost. The markup \(\mu _{it}\) of the firm i during the period t is defined as:

where \(\alpha _{it}^v\) is the percentage of the total expenditure of variable input (\(v\)) in the total sales revenue of the firm. Typically, \(\alpha _{it}^v\) can be calculated directly from the production data of the firm. Thus, in order to measure the firm-level markups, only the output elasticity (\(\theta _{it}^v\)) of one (or several) variable input(s) in the production needs to be estimated.

In order to get the output elasticity of a variable input in the firm’s production, it is imperative to estimate the firm’s production function. However, the endogeneity between factor input and TFP makes OLS ineffective when estimating the production function. In this study, the endogeneity problem in the process of estimating the production function is resolved by using the semi-parameter estimation method (ACF method for short) developed by Ackerberg et al. (2015). In particular, the ACF method is used to estimate the following translog production function:

where \(y_{it}\) represents the logarithm of the total output of the firm i in the year t, lit represents the logarithm of labor input, \(m_{it}\) represents the logarithm of intermediate inputs, \(k_{it}\) represents the logarithm of capital stock, \(\omega _{it}\) represents the TFP, and \(\varepsilon _{it}\) represents the random error term. Lu and Yu (2015) assert that labor is not a variable input for Chinese firms, especially for SOEs. Since capital is a dynamic input, firms’ markup must be calculated by estimating the output elasticity \(\theta _{it}^m\) of the intermediate inputs (\(m_{it}\)). The output elasticity of intermediate inputs can be easily derived from Eq. (3):

Firms’ markup can be estimated using Eq. (2) and Eq. (4).

Existing literature includes many methods for measuring financial constraints. The first common method is to use a single financial index to measure; its advantage is that it is easy to calculate and relevant data can be directly obtained from the balance sheet of firms. For example, some scholars use liquidity indicators (measured by the firms’ current assets minus current liabilities divided by total assets), leverage ratio (measured by the proportion of firms’ current liabilities with current assets), and the ratio of accounts receivable (measured by the ratio of accounts receivable to current assets) to measure firms’ financial constraints (Greenaway et al., 2007; Ding et al., 2013; Manova and Yu, 2016). However, the disadvantages of using a single financial indicator for measurement are also obvious. The degree of financial constraints faced by firms may be difficult to reflect comprehensively and accurately when a single variable is used. At the same time, different scholars often have differences in constructing a single financial indicator, which makes it difficult to compare relevant results. The second common method is to construct a comprehensive index to measure financial constraints. For example, Kaplan and Zingales (1997) used firms’ financial indicators to construct a KZ index to measure the firms’ financial constraints, and Moreno Badia and Miranda (2009) proposed the BS index to measure firms’ financial constraints based on the “investment-cash flow sensitivity” framework established by Fazzari et al. (1988). The above indexes are constructed using various financial constraint information of firms and can thus reflect the financial constraint status of firms more comprehensively. However, note that in the construction process of these indexes, variables with strong endogeneity (e.g., cash flow), are used, and the existence of endogeneity is likely to lead to deviation in the measurement results. To avoid endogenous interference as much as possible, Hadlock and Pierce (2010) proposed the SA index to measure firms’ financial constraints. The construction of the SA index is mainly based on the two strong exogenous variables of firm size and firm age, which can avoid the interference of endogenous problems to a great extent. As the measurement method of the index is relatively simple, it has been widely used.

For this reason, this paper mainly uses the SA index to measure firms’ financial constraints. Other indicators are also used to measure financial constraints in the subsequent robustness analysis. According to Hadlock and Pierce’s (2010) research, we performed the following calculations to determine the SA index:

in Eq. (5), S and A are the firms’ size and age, respectively. The SA index is negative, and the higher its absolute value is, the more severe the financial constraints the firm is facing. For the convenience of explanation, the absolute value of the SA index is used for the regression analysis in the subsequent analysis.

Data

The firm-level micro data used in this article is from the Annual Survey of Industrial Firms (ASIF) compiled by the National Bureau of Statistics of China. ASIF covers all state-owned industrial firms and other ownership types with sales over RMB 5 million. Taking into account the continuity of relevant indicators and the dependability of the research results, this paper selects the manufacturing firms in the ASIF database from 1999 to 2007 as the research samples, which is similar to the previous relevant studies. Following the studies of Feenstra et al. (2014) and Xiang et al. (2017), when processing the industrial firm data, we exclude firms that lack variables, have fewer than 8 employees, and violate accounting common sense (e.g., total assets less than the net fixed assets, and paid-in capital less than or equal to zero).

To get the firm-level markup, it is necessary to estimate the firm-level production function. All firms are categorized in accordance with the two-digit industry code of the ASIF database to reflect the differences in production technology between industries accurately. Then the ACF method is used to estimate the production function for each industry as shown in Eq. (3). According to the estimated production function, the output elasticity of intermediate inputs can be simply obtained from Eq. (4). On this foundation, Eq. (2) can be used to further determine firm-level markups. And the average markups (simple average) and quantiles for each two-digit code industry during the sample period are presented in Table 1. It is observed that all industries have markups that range between 1 and 2. Table 2 presents the summary statistics of the main variables used in our regressions. Table 3 presents the correlation matrix of main variables. The correlation coefficients between the core explanatory variable (SA) and control variables are lower than 0.5, which indicates that the correlation between the main variables is not large.

Analysis and discussion of empirical results

Baseline regression results

Using the micro data set of China’s manufacturing firms from 1999 to 2007, we estimate Eq. (1) and report the corresponding regression results in Table 4. All regressions include firm fixed effect, province fixed effect, industry fixed effect, and year fixed effect. In Column (1), the firm-level markup is used directly to regress the firms’ financial constraints (measured by the SA index) without any control variables. The results demonstrate that the estimated coefficient of the SA index is both negative and significant, indicating that firms facing more serious financial constraints have lower markups. In other words, financial constraints have a significant negative impact on firms’ markup. In Column (2), the regression results are comparable to those in Column (1), when we add five control variables at the firm level, such as firm size, firm age, factor intensity, average wage, and government subsidies. The estimated coefficient of the SA index is still significantly negative, indicating that financial constraints considerably reduce firms’ markup. In Column (3), we further add the control variable (HHI) at the industry level and the results show that the negative effect of financial constraints on firms’ markup remains significant. In detail, the regression results in Column (3) demonstrate that the estimated coefficient of the SA index is −0.0011, which is significant at the 1% level, indicating that every 1% increase in the SA index will reduce the enterprise’s markup by 0.11%.

In terms of other control variables, Column (3) demonstrates that the estimated coefficient of firm size (Size) is significantly positive, showing that larger-scale firms will have comparatively higher markups. This result is easy to understand: Large-scale firms are more likely to have monopoly power and maintain relatively high markup. Although the estimated coefficient of factor intensity (Kl) is positive, it is not significant, indicating that the factor intensity of firms will not have a significant impact on markup. The estimated coefficient of average wage (Wage) is significantly positive, which means that the higher the average salary is, the higher the markup will be. One possible explanation is that the average wage can be thought of as an approximate substitute for labor quality. Firms with higher average wages are better equipped to attract employees with superior production and management skills. The participation of more highly skilled labor will be conducive to improving productivity and thus reducing marginal production cost and markup increase. The estimated coefficient of firm age (Age) is significantly negative, which means that the older the firm is, the lower the markup is. The estimated coefficient of government subsidy (Subsidy) is positive but not significant, indicating that the government subsidy will not significantly affect firms’ markup. The estimated coefficient of HHI is positive, but not significant, indicating that the industry concentration will not have a significant impact on firms’ markup.

The above analysis is based on unbalanced panel data. Unbalanced panel data has large numbers of firms’ entry and exit behaviors, which may affect the accuracy of the previously estimated results. For this reason, in Columns (4) to (6) of Table 4, we construct the balance panel data tore-estimate Eq. (1) by retaining only the firms that exist throughout the sample period. The estimated results show that the estimated coefficients of the SA index are significantly negative, similar to the previously estimated results based on unbalanced panel data. This outcome indicates that the previously estimated results may not be affected by firms’ entry and exit. From the results in Table 4, the sign and significance of coefficients remain the same for both balanced and unbalanced panel data estimates, and even the control variables’ addition will only change the size of the estimated coefficient of the SA index. This conclusion indicates that the negative impact of financial constraints on firms’ markup is robust and will not change with the change of control variables.

Endogeneity test

This paper mainly discusses the effect of financial constraints on firms’ markup. The firm fixed effect, province fixed effect, industry fixed effect, and year fixed effect are controlled in the previous regression. Although the inclusion of these fixed effects can reduce the endogeneity problems caused by missing variables to some extent, financial constraints may be endogenous. On the one hand, there may be a reverse causality between financial constraints and markup (financial constraints affect firms’ markup and, conversely, the higher the markup, the higher the profit margins of firms, which can alleviate the financial constraints). On the other hand, financial constraints and markup may be affected by other factors simultaneously, thus causing a synchrony bias. Therefore, the existence of these potential endogeneity problems may cause great interference with the previous estimation results. To avoid the effect of these possible endogeneity problems on the previous estimation results, in this section, we will construct the corresponding instrumental variables (IVs) to re-estimate Eq. (1).

Firstly, according to Fisman and Svensson (2007), we construct an IV, using the industry-region-level mean of the endogenous explanatory variable. In detail, we used the mean of financial constraints of all firms in each province and industry as the IV of the financial constraints to re-estimate Eq. (1). Columns (1) and (2) of Table 5 displayed the corresponding results. Secondly, taking into account that the problem of missing variables may still exist in the regression in Columns (1) and (2), we further estimate the first-order difference model of Eq. (1) by using the industry-region-level mean of firms’ financial constraints as an IV. The related outcomes are reported in Columns (3) and (4) of Table 5. Finally, we re-estimate Eq. (1) by using the lag period of firms’ financial constraints to construct the IV. The results are shown in Columns (5) and (6) of Table 5. The under-identification test, weak identification test, and over-identification test (see Sargan test) of the IVs in Table 5 all show that the selection of the corresponding IV is reasonable. Overall, whether we use the industry-region-level mean of financial constraints to construct IV or use the lag period of financial constraints to construct IV; whether we estimate the original Eq. (1) or the corresponding first-order difference equation; and whether we use the balanced panel or unbalanced panel data to estimate, the estimated coefficient of the SA index remains significantly negative, similar to the previous benchmark regression results. The results of IV regression further demonstrate that financial constraints significantly reduce firms’ markup. Therefore, the previous benchmark regression results are robust.

More robustness tests

Using the accounting method to estimate firms’ markup

In the above analysis, we estimated the firm-level markups based on the method of De Loecker and Warzynski (2012). Since the method mainly relies on the estimation of the production function, it is also called the production method. In the current literature, the accounting method is another widely used method to estimate firms’ markup. This method primarily uses financial indicators such as industrial added value, wage input, and cost of intermediate inputs to calculate the markup of firms. Among the two methods, the accounting method is simpler than the production method, and the required financial index data are relatively easy to obtain. As a result, it is frequently used in relevant studies. In this section, we also use the accounting method to calculate firms’ markup as a robustness test. Under the study of Domowitz et al. (1986), we represent firms’ markup in the following form:

where markupit is for the markup of firm i in period t, p for the price of products, c for the marginal cost, va for the industrial added value, pr for the cost of wages, and ncm for the cost of intermediate inputs.

Using the markup estimated by the accounting method, we re-estimate Eq. (1). The results given in Columns (1) and (2) of Table 6 show that the estimation coefficient of the SA index is still significantly negative regardless of whether the balanced panel data or non-balanced panel data are used for estimation, which indicates that the previous benchmark regression results are robust even if we use the accounting method to calculate firms’ markup.

Excluding the impact of China’s accession to the WTO

This paper’s sample period runs from 1999 to 2007. At the end of 2001, China formally joined the WTO at this time. Since then, China’s trade liberalization was further accelerated. However, import competition caused by trade liberalization significantly decreased the markup of Chinese firms (Xiang et al., 2017), which may affect the previous analysis results. For robustness, in this section, we attempt to construct a new subsample to exclude the influence of China’s accession to the WTO on the previous regression results. The post-WTO accession subsample only included firm data in 2002 and subsequent years. The outcomes in Columns (3) and (4) of Table 6 suggest that the estimated coefficient of the SA index is still significantly negative, which is similar to the results of the previous benchmark regression. Overall, the previous analysis results have good robustness and are less likely to be affected by the potential policy changes of China’s accession to the WTO.

Estimation based on the dynamic panel model

Firms’ markup may have dynamic continuity, and the previous period’s markup may have an impact on the current markup. To capture this effect, we additionally estimate the corresponding dynamic panel model using the system GMM method in this section. Columns (5) and (6) of Table 6 obtained the estimation results. The estimated coefficient of markup with a lag period is shown to be significantly positive, which indicates that the markup with a lag period does have a significant positive effect on the current markup. More importantly, the estimated coefficient of the SA index remains significantly negative, indicating that financial constraints significantly reduce firms’ markup. There is no significant difference between the estimated results of the dynamic panel model and the previous benchmark regression results, indicating that the results of the previous benchmark regression are robust.

Alternative financial constraint measures

The previous analysis lays emphasis on using the SA index to assess the degree of firms’ financial constraints. However, as mentioned above, many indicators are used to measure financial constraints. For the sake of robustness, in this part, we also re-measure the financial constraints faced by firms using several alternative indicators to investigate whether the prior benchmark regression results are robust. Specifically, following the studies of Greenaway et al. (2007), Ding et al. (2013), and Manova and Yu (2016), we use the following replacement indicators to measure financial constraints: leverage ratio (Leverage), which is expressed by the ratio of current liabilities and current assets of firms; interest payment ratio (Interest), which is expressed as the ratio of the interest expenditure to the total debt in the current year; asset–liability leverage ratio (Debt_ratio), which is expressed as the ratio of total liabilities to total assets; accounts receivable ratio (Accounts_R), which is expressed by the ratio of accounts receivable to current assets; and liquidity index (Liquidity), which is expressed as the current assets minus the current liabilities divided by the total assets. Table 7 reports the estimation results of Eq. (1) using the replacement measure of financial constraints. The table shows that the higher the leverage ratio, the higher the interest payment ratio; the higher the asset–liability leverage ratio, and the higher the proportion of accounts receivable, the lower the markup; and the higher the liquidity, the higher the markup. All these results indicate that financial constraints have a significant negative impact on firms’ markup and again verify the reliability of the previous benchmark regression results.

Quantile regression

The previous analysis relied on the results of “mean regression,” which are easily influenced by extreme values (Koenker and Bassett, 1978). Therefore, we further consider the quantile regression to minimize the impact of the presence of extreme values on previous benchmark regression results as much as possible and more thoroughly examine how financial constraints affect the entire conditional distribution of markup. Table 8 reports the corresponding regression results. The results demonstrate that the effect of financial constraints on markup is almost negative at different quantiles, similar to the outcomes of the previous benchmark regression. Meanwhile, with the increase in the quantile, the absolute value of quantile regression coefficient of the SA index increased first and then decreased. This finding indicates that the effect of financial constraints on the middle part of the conditional distribution of markup is greater than at both ends. Specifically, the more serious the financial constraints firms face, the smaller the negative impact on the firms with low and high markups, and the larger the negative impact on the firms with intermediate markups. These results indicate that the prior benchmark regression results are robust, even taking into account the effect of financial constraints on the markup of firms with different quantiles.

Influence mechanism analysis and heterogeneity test

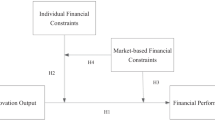

Mechanism analysis of financial constraints affecting firms’ markup

The previous analysis shows that financial constraints significantly reduce firms’ markup. In accordance with the study of De Loecker and Warzynski (2012), we define markup as the proportion of product price to marginal cost, that is, \(Markup = P/MC\). The marginal cost of production and the product’s price level are the key determinants of markup. And the marginal cost of production is largely driven by production efficiency, while the price level of the product is mostly decided by its market pricing power. Under the condition of the same production efficiency, better market pricing power will result in higher markup and higher market profits for firms. Firms with higher production efficiency have lower marginal costs and a higher markup when the market pricing ability is certain. As a result, any factor that influences firms’ pricing and production efficiency (i.e., marginal cost of production) will also have an effect on their markup, which can be summed up as the “market pricing” and “production efficiency” channels respectively that affect firms’ markup. Then, we delve deeper into the mechanism of financial constraints influencing firms’ markup from the market pricing and production efficiency channels.

The ASIF provided the data for this study. Since this database does not directly include information about the price and marginal cost of firms’ products, we adopt the similar method of De Loecker and Warzynski (2012) to investigate the production efficiency and market pricing channels of financial constraints affecting firms’ markup indirectly. The marginal cost of firm production, according to De Loecker and Warzynski (2012), is primarily determined by productivity. Therefore, from the perspective of firm productivity, we can identify the production efficiency channel where financial constraints affect markup. Meanwhile, De Loecker and Warzynski (2012) claimed that \(lmp = \ln \left( {Markup} \right) = \ln P - \ln MC\). The difference in the marginal cost of firms can be controlled and the differences in product prices can be identified indirectly when firm productivity is controlled in the regression model. Therefore, by including their TFP in the benchmark regression Eq. (1) as the control variable, we can indirectly determine the market pricing channels where financial constraints affect firms’ markup. The following is the corresponding econometric model:

where tfpijkt is the logarithm of TFP of firm i in industry j in province k in period t, and all other variables have the same definitions as before. We estimate TFP of firms using the ACF method.

Table 9 reports the estimated results for Eqs. (7) and (8). In Column (1), we use firms’ TFP as the dependent variable and conduct regression analysis on the financial constraints faced by firms. The estimated coefficient of the SA index is significantly negative, indicating that financial constraints are not conducive to the enhancement of firms’ productivity, which is identical to the conclusions of Aghion et al. (2012), Caggese and Cuñat (2013), Howell (2016), and Hall et al. (2016). These studies discovered that financial constraints inhibit firms’ R&D investment and are not conducive to the improvement of their productivity. Low production efficiency represents that the marginal cost of production is high, which is detrimental to the increase in firms’ markup. As a result, financial constraints lower firms’ markup through the production efficiency channel. In Column (2), we take markup as the dependent variable and regress the markup under the financial constraints by adding the TFP as the control variable to control the influence of financial constraints on production efficiency. The estimated coefficient of the SA index is shown to be significantly negative, which indicates that financial constraints have a significant negative impact on the market pricing power of firms. That is, financial constraints significantly reduce the price of products and thus reduce firms’ markup. The possible explanation for this result is that financial constraints force firms to obtain cash flow as fast as feasible, and firms are more likely to adopt the business strategy of “small profit but high turnover”. At the same time, with the intensification of market competition, the increase in financial constraints may lead to the loss of firms’ pricing power, which will lead to the further reduction of its product price. In sum, when the cost of production is the same, the reduction of product pricing will decrease firms’ markup. Hence, financial constraints reduce firms’ markup through the market pricing channel.

Based on unbalanced panel data, the estimated results are listed in Columns (1) and (2). We also use the balanced panel data to estimate Eq. (7) and Eq. (8) in Columns (3) and (4) in order to avoid the influence of the entry and exit behaviors of a large number of firms on the estimated results in the unbalanced panel data. At the same time, considering that the potential endogeneity problem may also affect the previously estimated results, we carry out IV regression in Columns (5) and (6). We use the industry-region-level mean of firms’ financial constraints as IVs to estimate the first-order difference model of Eqs. (7) and (8). Whether the balanced panel data or the IV regression is used for estimation, the estimated coefficient of the SA index is significantly negative, similar to the previous benchmark regression results. Specifically, financial constraints have a significant negative impact on firms’ production efficiency and market pricing power, thus reducing their markup. In general, we find that both production efficiency and market pricing channels are significant channels for financial constraints to reduce firms’ markup in accordance with the regression results in Table 9.

Heterogeneous effects of financial constraints on the markup of different types of firms

Analysis of different industry types

Due to the different characteristics of different industries, particularly the huge differences in production technology between various industries, the effect of financial constraints on firms’ markup in various industries may be different. Therefore, according to the industry codes in the ASIF database, we divide all the two-digit code industries in the sample into three types: labor-intensive, capital-intensive, and technology-intensive industries. Using the subsamples of labor-intensive, capital-intensive, and technology-intensive industries, we re-estimate Eq. (1) to examine if there are notable variations in the effect of financial constraints on the markup of firms in various industries. Columns (1) to (3) of Table 10 list the related results. For the technology-intensive, labor-intensive, and capital-intensive industries, the estimated coefficients of the SA index are all significantly negative, indicating that financial constraints have a significant negative impact on firms’ markup in these three industries. In terms of the specific impact coefficient, the negative effect of financial constraints on the markup of firms in labor-intensive industries is relatively greater than that in capital-intensive and technology-intensive industries.

Analysis of different scale types

In view of the huge differences between firms of different sizes in production efficiency, risk tolerance, market monopoly power, and so forth, financial constraints may have a dramatically varying effect on the markup of firms of different sizes. As a consequence, we divide the sample into large-scale and small-scale firms using the median size of firms in the sample as the critical value, and re-estimate Eq. (1). The regression results in Columns (4) and (5) of Table 10 demonstrate that financial constraints considerably reduce the markup for small firms, and have no significant impact on the markup of large-scale firms. The possible reason is that compared with large-scale firms with stronger strength and more established management experience, small-scale firms are generally in the initial stage or rapid growth period and tend to need more funds to expand. However, due to their low production efficiency, weak risk tolerance, and insufficient innovation ability, small-scale firms often encounter difficulty in obtaining bank credit support and often face a serious shortage of funds (Beck et al., 2007). The lack of funds hinders the development of firms and the improvement of production efficiency. Therefore, the effect of financial constraints on small firms’ markup is more significant.

Analysis of different ownership types

Currently, China is transforming into a market economy, and there are obvious differences in the production and operation of firms with different ownership types. For instance, SOEs enjoy better preferential treatment than private firms in terms of government policy support and bank credit support. The ownership structure is a major factor determining the performance of Chinese firms due to China’s unique institutional setting (Hu and Liu, 2014). So, we categorize all firms into SOEs, private enterprises, and foreign-funded enterprises according to the percentage of registered capital in order to examine whether the effects of financial constraints on the markup differ for firms with different ownership types. We re-estimate Eq. (1) using the subsamples composed of firms with different ownership types. The corresponding results are reported in Columns (1) to (3) of Table 11. For private firms and foreign-funded firms, the estimated coefficients of the SA index are significantly negative, while for SOEs, the estimated coefficient of the SA index is also negative but not significant. This result indicates that financial constraints mainly significantly reduce the markup of private and foreign-funded firms, but do not significantly affect the markup of SOEs. The primary explanation may be that SOEs can easily receive financial support from the financial system dominated by state-owned banks. Additionally, as the implicit guarantee of national credit for their capacity to repay debt, SOEs can acquire adequate and relatively low-cost financial support and are usually not subject to financial constraints. Therefore, the effect of financial constraints on SOEs’ markup is not significant. Meanwhile, in terms of the impact coefficient, the negative effect of financial constraints on private firms’ markup is comparatively greater than the markup of foreign-funded firms. The reason may be that most private firms are small-scale firms with low management levels, low technical levels, and high operational risk. These characteristics make it difficult for private firms to obtain financial support from banks. Even if they do obtain financial support from banks, the cost is relatively high. Therefore, a large number of private firms often face serious financial constraints, and the negative impact of financial constraints on private firms’ markup will be relatively more obvious.

Analysis of export firms and non-export firms

The domestic market is the first one that firms serve, according to the classical heterogeneous firm trade theory. Only firms that are more productive will opt to serve the domestic market and export simultaneously (Melitz, 2003). Therefore, compared with non-export firms (i.e., purely domestic firms), export firms need to further bear the cost of developing export markets and may thus face more serious financial constraints. This situation may lead to significant differences in the effect of financial constraints on the markup of exporters and non-exporters. For this reason, the sample firms in this paper are divided into export firms and non-export firms based on whether they export or not. And we re-estimate Eq. (1) using the subsamples consisting of these two types of firms. As can be seen from the results in Columns (4) and (5) of Table 11, the estimated coefficients of the SA index are significantly negative for both export and non-export firms, demonstrating that the markup of these two types of firms is significantly reduced by financial constraints. However, in terms of the impact coefficient, the markup of export firms is negatively impacted by financial restrictions more than that of non-export firms. As mentioned earlier, exporters may face more serious financial constraints than non-exporters do. In addition to bearing the cost of the domestic market, exporters also face the cost of market research in the export market and the establishment of a distribution network (Manova, 2013). Therefore, the negative effect of financial constraints on the markup of export firms is relatively more obvious.

Conclusions

From the perspective of financial constraints, using the micro data of Chinese manufacturing enterprises, this paper conducts in-depth and systematic analysis of how financial constraints affect firms’ markup. Results show that, on the one hand, financial constraints inhibit the improvement of firm production efficiency and thus reduce the markups of firms (production efficiency channel); on the other hand, financial constraints weaken firms’ ability to set prices for their items on the market, which has a significant negative effect on the markups of firms (market pricing channel). Overall, financial constraints significantly reduce Chinese manufacturing firms’ markup through the channels of production efficiency and market pricing. This conclusion remains true after a range of robustness tests, including endogeneity problem treatment, key indicator substitution, dynamic panel model estimation, quantile regression, and controlling for other policy changes.

Moreover, the diverse impact of financial constraints on the markup of various types of firms (different industry types, different scale types, different ownership types, export firms, and non-export firms) is also covered in this paper. The results show that, first, compared with capital-intensive and technology-intensive industries, the negative effect of financial constraints on the markup of firms in labor-intensive industries is relatively greater. Second, the markup of small-scale firms is primarily reduced by financial constraints, whereas the impact on the markup of large-scale firms is not significant. Third, financial constraints primarily decrease private firms’ markups, while the markups of foreign-funded firms are only slightly adversely affected. Meanwhile, financial constraints do not have a significant impact on the markup of SOEs. Fourth, financial constraints primarily severely reduce the markup of export firms, while the negative influence on the markup of non-export firms is relatively minor.

This paper not only offers a fresh perspective for comprehending the micro economic effects of financial constraints, but also has important policy implications. Markup, as a crucial index to measure the firms’ market power and profitability, reflects the dynamic competitiveness of firms. It is essential to promote the improvement of firms’ markup for improving the competitiveness and profitability of firms, as well as achieving sustained and steady development. This paper shows that easing financial constraints is beneficial to improving firms’ markup and is an important way to enhance firms’ market power and competitiveness. Therefore, to effectively alleviate the inhibiting effect of financial constraints on firms’ markup and promote the improvement of markup, the government should further improve the financial market system, continue to deepen the reform of the financial system, and promote the construction of relevant laws and regulations in the financial field. Moreover, it should release the vitality of the market, try to allow qualified private capital to set up financial institutions to expand external credit supply and the financial channels of firms, and effectively reduce the financial cost. This study also shows that the effect of financial constraints on the markup of different types of firms is different and that significant heterogeneity exists. For example, financial constraints mainly reduce the markup of private firms and small-scale firms. Therefore, when promoting the reform of the financial system, the government should also emphasize the establishment of a fair and effective financial system and change the credit discrimination against private firms and small-scale firms. Effectively alleviating the financing difficulties of private firms and small-scale firms can better promote the enhancement of the markup of private firms and small-scale firms.

It should be noted that the data used in this study came from the ASIF compiled by the National Bureau of Statistics of China. The sample spans from 1999 to 2007. Due to the limitation of data, this paper cannot use the latest data to study the effect of financial constraints on the markup of Chinese firms, which has to be said to be a major limitation of this study. Therefore, in future research, using the latest data to analyze the effect of financial constraints on firms’ markup will undoubtedly provide more timely policy implications.

Data availability

The datasets analyzed during the current study are available from the corresponding author upon reasonable request.

References

Ackerberg DA, Caves K, Frazer G (2015) Identification properties of recent production function estimators. Econometrica 83(6):2411–2451

Aghion P, Askenazy P, Berman N et al. (2012) Credit constraints and the cyclicality of R&D investment: evidence from France. Eur Econ Assoc 10(5):1001–1024

Altomonte C, Gamba S, Mancusi ML et al. (2016) R&D investments, financing constraints, exporting and productivity. Econ Innov New Technol 25(3):283–303

Altomonte C, Favoino D, Morlacco M et al (2020). Markups, Intangible Capital and Heterogeneous Financial Frictions. Working Paper. Available at: http://www.tommasosonno.com/docs/MarkupsIntangibles_AFMS.pdf

Beck T, Demirguc-Kunt A, Laeven L et al. (2007) Finance, firm size, and growth. J Money, Credit Bank 40(7):1379–1405

Bellone F, Musso P, Nesta L et al. (2016) International trade and firm-level markups when location and quality matter. J Econ Geogr 16(1):67–91

Bernard AB, Eaton J, Jensen JB et al. (2003) Plants and productivity in international trade. Am Econ Rev 93(4):1268–1290

Brown JR, Fazzari SM, Petersen BC (2009) Financing innovation and growth: cash flow, external equity, and the 1990s R&D boom. J Financ 64(1):151–185

Caggese A, Cuñat V (2013) Financing constraints, firm dynamics, export decisions, and aggregate productivity. Rev Econ Dyn 16(1):177–193

Cao S, Leung D (2020) Credit constraints and productivity of SMEs: evidence from Canada. Econ Model 88:163–180

Caselli M, Schiavo S (2020) Markups, import competition and exporting. World Econ 43(5):1309–1326

Chaney T (2016) Liquidity constrained exporters. J Econ Dyn Control 100(72):141–154

Claessens S, Tzioumis K (2006). Measuring Firms’ access to Finance. Paper prepared for Conference: Access to Finance: Building Inclusive Financial Systems, organized by the Brooking Institution and the World Bank in Washington, D.C., May 30–31

De Loecker J, Warzynski F (2012) Markups and firm-level export status. Am Econ Rev 102(6):2437–2471

De Loecker J, Goldberg PK, Khandelwal AK et al. (2016) Prices, markups, and trade reform. Econometrica 84(2):445–510

Ding S, Guariglia A, Knight J (2013) Investment and financing constraints in china: does working capital management make a difference? J Bank Financ 37(5):1490–1507

Domowitz I, Hubbard RG, Petersen BC (1986). Market structure and cyclical fluctuations in US Manufacturing. National Bureau of Economic Research Working Paper No. 2115

Du X, Luan W, Lu Y (2022) Impact of economic policy uncertainty and financial constraints on firms’ markups: evidence from China. Appl Econ Lett 29(1):30–34

Du P, Wang S (2020) The effect of minimum wage on firm markup: evidence from China. Econ Modell 86:241–250

Edmond C, Midrigan V, Xu DY (2015) Competition, markups, and the gains from international trade. Am Econ Rev 105(10):3183–3221

Fan H, Lai ELC, Li YA (2015) Credit constraints, quality, and export prices: theory and evidence from China. J Comp Econ 43(2):390–416

Fan H, Gao X, Li YA et al. (2018) Trade liberalization and markups: micro evidence from China. J Comp Econ 46(1):103–130

Fauceglia D (2015) Credit constraints, firm exports and financial development: evidence from developing countries. Q Rev Econ Finance 55:53–66

Fazzari S, Hubbard RG, Petersen BC (1988) Financing constraints and corporate investment. Brookings Pap Econ Act 1:141–195

Feenstra RC, Hanson GH (2004) Intermediaries in entrepot trade: Hong Kong re‐exports of Chinese Goods. J Econ Manag Strategy 13(1):3–35

Feenstra RC, Li Z, Yu MJ (2014) Exports and credit constraints under incomplete information: theory and evidence from China. Rev Econ Stat 96(4):729–744

Fisman R, Svensson J (2007) Are corruption and taxation really harmful to growth? Firm level evidence. J Dev Econ 83(1):63–75

Galle S (2020). Competition, financial constraints and misallocation: plant-level evidence from indian manufacturing. Available at SSRN 3267397

Gatti R, Love I (2008) Does access to credit improve productivity? Evidence from Bulgarial. Econ Transit 16(3):445–465

Greenaway D, Guariglia A, Kneller R (2007) Financial factors and exporting decisions. J Int Econ 73(2):377–395

Görg H, Warzynski F (2003). Price cost margins and exporting behaviour: evidence from firm level data. German Institute for Economic Research, Discussion Papers of DIW No. 365

Hadlock CJ, Pierce JR (2010) New evidence on measuring financial constraints: moving beyond the KZ index. Rev Financ Stud 23(5):1909–1940

Hall BH, Moncada-Paternò-Castello P, Montresor S et al. (2016) Financing constraints, R&D investments and innovative performances: new empirical evidence at the firm level for Europe. Econ Innov New Technol 25(3):183–196

Hasan S, Sheldon I (2016) Credit Constraints, Technology Choice and Exports: A Firm-level Study for Latin American Countries. Rev Dev Econ 20(2):547–560

Howell A (2016) Firm R&D, innovation and easing financial constraints in china: does corporate tax reform matter? Res Policy 45(10):1996–2007

Hu AG, Liu Z (2014) Trade liberalization and firm productivity: evidence from chinese manufacturing industries. Rev Int Econ 22(3):488–512

Kaplan SN, Zingales L (1997) Do investment-cash flow sensitivities provide useful measures of financing constraints?. Q J Econ 112(1):169–215

Kato A (2014). Does Export Yield Productivity and Markup Premiums? Evidence from the Japanese Manufacturing Industry. Research Institute of Economy, Trade and Industry (RIETI), No.14e037

Kilinç U (2019) Export destination characteristics and markups: the role of country size. Economica 86(341):116–138

Koenker R, Bassett Jr G (1978) Regression quantiles. Econometrica 46(1):33–50

Kugler M, Verhoogen E (2008). The quality-complementarity hypothesis: theory and evidence from Colombia. NBER Working paper, No. w14418

Lin ZJ, Liu S, Sun F (2017) The impact of financing constraints and agency costs on corporate R&D investment: evidence from China. Int Rev Financ 17(1):3–42

Lu Y, Yu L (2015) Trade liberalization and markup dispersion: evidence from China’s WTO Accession. Am Econ J Appl Econ 7(4):221–253

Manaresi F, Pierri N (2017). Credit constraints and firm productivity: evidence from Italy. Mo. Fi. R. Working Papers, No. 137

Manova K (2013) Credit constraints, heterogeneous firms, and international trade. Rev Econ Stud 80(2):711–744

Manova K, Wei SJ, Zhang Z (2015) Firm exports and multinational activity under credit constraints. Rev Econ Stat 97(3):574–588

Manova K, Zhang Z (2009). Quality heterogeneity across firms and export destinations. NBER Working Paper, No.15342

Manova K, Yu Z (2016) How firms export: processing vs. ordinary trade with financial frictions. J Int Econ 100:120–137

Meinen P (2016) Markup responses to Chinese imports. Econ Lett 141(April):122–124

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1695–1725

Melitz MJ, Ottaviano GIP (2008) Market size, trade, and productivity. Rev Econ Stud 75(1):295–316

Moreno Badia M, Miranda V (2009). The missing link between financial constraints and productivity. IMF Working Papers

Padmaja M, Sasidharan S (2020) Financing constraints and exports: evidence from India. J Econ Financ 45(1):1–28

Sasidharan S, Padmaja M (2018) Do financing constraints impact outward foreign direct investment? Evidence from India. Asian Dev Rev 35(1):108–132

Satpathy L, Chatterjee B, Mahakud J (2017) Financial constraints and total factor productivity evidence from indian manufacturing companies. J Manag Res 17(3):146–162

Sembenelli A, Siotis G (2008) Foreign direct investment and markup dynamics: evidence from Spanish firms. J Int Econ 76(1):107–115

Tang H, Zhang Y (2012). Exporting behavior and financial constraint of Chinese Firms. Dynamics of firm selection process in globalized economies, ERIA Research Project Report, No. 3: 13–33

Viet H, Quynh H, Trung T (2020) Impact of financial constraints on the development of Vietnam’s firms. Manag Sci Lett 10(8):1683–1692

Weinberger A (2020) Markups and misallocation with evidence from exchange rate shocks. J Dev Econ 146:102494

Xiang X, Chen F, Ho CY et al. (2017) Heterogeneous effects of trade liberalisation on firm‐level markups: evidence from China. World Econ 40(8):1667–1686

Yan B, Zhang Y, Shen Y et al. (2018) Productivity, financial constraints and outward foreign direct investment: firm-level evidence. China Econ Rev 47:47–64

Acknowledgements

Youth Science Fund Project of National Science Foundation of China, Grant/Award Number: 7190307.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Yue, W., Li, X. Financial constraints and firms’ markup: evidence from China. Humanit Soc Sci Commun 10, 140 (2023). https://doi.org/10.1057/s41599-023-01630-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-023-01630-0

- Springer Nature Limited