Abstract

Motivated by the importance of industry volatility and the profitability of industry momentum strategy, this study investigates the relationship between realised volatility and industry momentum returns. The analysis uses daily return data for 48 US industries from July 1969 to June 2021 to calculate realised volatility and to gauge the raw return effect on short- and medium-horizon double-sort momentum-trading strategies. The findings show that past volatility positively relates to industry momentum and that this relationship is stronger after controlling for common risk factors (market, size, value, investment, and profitability). Decomposing the realised total volatility into idiosyncratic and systematic components, this study reveals that both decomposed components are positively related to industry momentum returns. The findings are robust to alternative measures of volatility.

Similar content being viewed by others

Introduction

Momentum is a trading strategy whereby investors generate abnormal profits by buying (selling) stocks with the best (worst) returns over preceding months. The empirical evidence to date suggests that momentum is pervasive, with studies proving its worth to investment practitioners across markets, time, and asset classes (Li et al., 2010; Asness et al., 2013; Lin et al., 2016; Chen and Lu, 2017; Gao et al., 2018; Grobys et al., 2018; Zaremba, 2018). In doing so, momentum challenges finance theory in the form of the efficient market hypothesis and conventional asset pricing models, and is therefore a financial market phenomenon of acute academic interest. Interestingly, there are subtle variations in momentum-trading strategies, one being that investors could further improve firm-level momentum returns using additionally volatile stocks, and this is also addressed in the literature (Fuertesa et al., 2009; Jacobs et al., 2015; Wang and Xu, 2015). However, few studies link volatility to industry-level momentum, with one exception being Chen et al. (2017) reporting that oil return volatility predicts industry momentum in China.

We find this deficiency of more than passing interest. To start, although many investors prefer to hold individual stocks (Campbell et al., 2001), increasing numbers invest in industry funds, as these may also perform well (O’Neal, 2000; Berk and Van Binsbergen, 2015). Industry momentum strategies are particularly popular and profitable when trading sector funds or individual stocks across industries (Moskowitz and Grinblatt, 1999; Misirli, 2018). Volatility has also a long history in explaining stock returns or firm-level momentum. Barroso and Santa-Clara (2015), for example, report that momentum portfolios exhibit higher volatility than other trading portfolios, such as size and value mimicking portfolios. Interestingly, Campbell et al. (2001) find that individual stock volatility is closely related to industry or market volatility. More importantly, the role of industry volatility is even stronger than that of market volatility (Black et al., 2002; Morana and Sawkins, 2004; Ferreira and Gama, 2005). Noting that industry volatility is closely related to individual stock volatility, Badreddine and Clark (2021) conclude that industry-adjusted volatility is positively related to firm-level momentum returns in the UK.

We also know that stocks within the same industry have similar asset profiles and capital structures, employ comparable production technologies, and operate in like economic, financial, and regulatory environments. These can also translate to similar return distributions and comovements (Parsons et al., 2020; Chen et al., 2021, 2022). Compared with volatility calculated using individual data, industry volatility would then capture risks common to all stocks in the same industry (Wu and Mazouz, 2016). These undiversified industry portfolios typically earn greater gains and exhibit higher volatility risk (particularly idiosyncratic risk) than other well-diversified portfolios (Badreddine and Clark, 2021). Therefore, volatility may serve at the expense of industry momentum gains.

Motivated by the popularity of industry momentum strategy and the significant role of industry volatility, we construct sequential double sorts on 48 US industries following Amaya et al. (2015), Liu et al. (2016), Badreddine and Clark (2021), and Chen et al. (2022). We find that industry momentum returns increase with the level of realised volatility over multiple trading horizons. This relationship is robust to controlling for common risk factors, such as market, size, value, profitability, and investment, and to alternative measurements of volatility. Decomposing the realised total volatility into its idiosyncratic and systematic components, we find that both components are positively related to industry momentum returns. The volatility-adjusted industry momentum strategy following Barroso and Santa-Clara (2015) is also more profitable than the unadjusted strategy, suggesting that momentum gains are compensation for bearing high-volatility risk.

Our study contributes to the literature on three counts. First, while many studies identify a close relationship between volatility and momentum returns at the firm level (Fuertesa et al., 2009; Jacobs et al., 2015; Wang and Xu, 2015), there is less consideration of industry momentum. However, sector funds are increasingly common in the stock market (Kacperczyk et al., 2005) and industry momentum strategies exhibit strong profitability when trading industry portfolios or sector funds (Moskowitz and Grinblatt, 1999; Misirli, 2018). Although many firm-level studies have used volatility to explain momentum for individual stocks, few have focused on industry momentum. Our study therefore extends the existing firm-level results to investigate whether industry momentum returns could improve by using additionally volatile industry portfolios. We also use the method of Barroso and Santa-Clara (2015) to construct volatility-adjusted industry momentum, providing a more profitable momentum strategy with a lower crash risk for investors to secure higher gains. Such volatility-adjusted strategy deepens our understanding about the profitability of industry momentum.

Second, industry volatility plays a significant role in explaining firm and market level volatility (Black et al., 2002; Morana and Sawkins, 2004; Badreddine and Clark, 2021). Although the recent work by Badreddine and Clark (2021) uses industry-adjusted volatility to explain individual momentum returns in the UK, no study to our best knowledge has investigated this for industry momentum. As discussed, stock returns in the same industry display comovements (Parsons et al., 2020; Chen et al., 2021, 2022). Industry portfolios with higher gains also exhibit higher risk than other well-diversified trading portfolios (Badreddine and Clark, 2021). Incorporating industry volatility into industry momentum particularly fits the features of our sample data, thereby contributing majorly to the extant literature on industry volatility.

Finally, many firm-level studies focus only on systematic volatility, being the diversified component of volatility (e.g., Stivers and Sun, 2010; Wang and Xu, 2015), as they believe that unsystematic risks should, at least theoretically, be diversified away in an efficient market. However, markets are sometimes inefficient. For instance, Arena et al. (2008) and Liu et al. (2016) find that idiosyncratic volatility is closely related to momentum returns. Unlike most firm-level studies, the undiversified industry portfolios in our analysis are better test assets than individual stocks or other diversified portfolios in investigating idiosyncratic risk. Applying sorting strategies to the decomposed volatility, we find that both systematic and idiosyncratic volatility are closely related to industry momentum returns. This significant role of idiosyncratic component also well fits the features of our sample data. Our study thus contributes to the literature by providing a more suitable measurement for volatility, further deepening our understanding of the role of volatility in industry momentum through complementing other firm-level studies.

The rest of this study is organised as follows. Section ‘Data’ presents the data and Section ‘Methods’ specifies our methods, including the sequential double-sorting strategies, the measurement of volatility and of returns, common asset pricing models used to adjust returns, and the construction of volatility-adjusted industry momentum. Section ‘Empirical results’ discusses the empirical results. Section ‘Robustness’ provides robustness checks using an alternative measurement for volatility and Section ‘Conclusion’ concludes.

Data

Daily data on value-weighted industry returns of the 48 industry portfolios in the US stock market is sourced from the Kenneth French Data Library. This data has several advantages, including a long sample period to allow for better stability and unbiasedness of the estimates and widespread use to facilitate comparisons with existing work (Stivers and Sun, 2010; Chen et al., 2021, 2022). The sample period starts in July 1969 and ends in June 2021.

Table 1 reports the summary statistics for the selected 48 industries, including the average monthly mean and excess returns (in percentages), and realised volatility (not the dispersion of returns from the mean, rather the distance of returns from zero), skewness, as well as kurtosis calculated on monthly returns over the sample period. Other than Coal, Real Estate, and Others, all industries exhibit positive excess returns.

To ascertain whether common asset pricing models [including the Capital Asset Pricing Model (CAPM) and the Fama–French three- and five-factor models] explain the relationship between realised volatility and momentum returns, we source common risk factors, including market, size, value, profitability, and investment factors, from the Kenneth French data library. If the relationship remains significant after controlling for these conventional factors, realised volatility may also be of use for predicting and enhancing industry momentum returns.

Methods

Trading strategy

We follow previous studies (e.g., Amaya et al., 2015; Liu et al., 2016; Badreddine and Clark, 2021; Chen et al., 2022) and employ a double-sorting strategy to rank industries based on past volatility and then past returns. For each month t, we rank industries into three groups based on their past realised volatility over the E-month (E = 1, 3, 6, 9, 12, 24) estimation period. Within each volatility-based group, we rank industries into four groups based on their past estimation-period mean returns.

We then form a momentum portfolio based on the second ranking of the past mean returns and hold these positions over the following H-months (H = 1, 3, 6, 9, 12, 24). We calculate equal-weighted raw and adjusted returns over these different holding periods. If momentum returns increase (decrease) as volatility increases, investors may enhance (reduce) the volatility level of their holding portfolios to generate higher industry momentum returns.

Volatility

Following Chen et al. (2021), we transform the raw industry returns into log returns to reflect the dollar value of the returns generated by investors over multiple investment horizons:

where xi,t is the daily raw return in percentage as provided in the French Data Library and ri,t is the log return of industry i at day t.

Following Amaya et al. (2015), we use realised volatility to measure the variance of past returns over the estimation period as follows:

where ri,t is the daily log return for each industry i on each trading day t and N is the number of observations over an estimation period T. The estimation-period realised volatility is the standard deviation of the sum-squared daily returns.

The main justification for the choice of realised volatility is that it outperforms any alternatives. For example, model-dependent methods, such as autoregressive conditional heteroskedasticity and stochastic volatility models, require many parameter assumptions, whereas realised volatility is a model-free method that reduces estimation errors (Yin et al., 2016), save when the number of observations within the estimation period is very small. In our analysis, this is for the one-month estimation period only, as the other estimation periods exceed three months and contain more than 60 observations.

Although unsystematic risks theoretically should be diversified away in an efficient market, markets are sometimes inefficient. More importantly, stock returns in the same industry show comovements, so industry portfolios are normally undiversified (Parsons et al., 2020; Chen et al., 2021, 2022). We therefore decompose the realised total volatility into idiosyncratic and systematic volatility to further examine which component better drives the relationship between volatility and industry momentum returns. Following Bali and Cakici (2008), we apply the CAPM over each estimation period as follows:

where Ri,t − Rf,t is the excess return of industry i, Rm,t − Rf,t is the market premium, and βi is the sensitivity to the market risk. εi,t is an error term that measures idiosyncratic return. For each estimation period, realised idiosyncratic volatility is the realised volatility of idiosyncratic return (εi,t). We then measure another component, systematic volatility, as total realised volatility minus realised idiosyncratic volatility.

Raw returns

We obtain the estimation or holding-period log returns by simply adding daily excess returns (daily returns exceeding the risk-free rate of return) together within that period:

where \(\overline r _{i,T}\) is the average monthly excess return of industry i over the estimation (or holding) period, N is the number of trading days in that trading period, and T is the number of months over the estimation or holding period.

Adjusted returns

Following Conrad et al. (2013), Amaya et al. (2015), and Chen et al. (2021), we adjust the raw momentum returns for common risk factors. We commence with the CAPM:

where Ri,T − Rf,T here is the holding-period monthly excess return of the industry momentum portfolio.

Given the CAPM’s restrictive assumptions and traditional failure to explain returns, Fama and French (1992, 1993) construct their three-factor model by adding size and value factors, as both empirically closely relate to returns:

where SMBT is the size mimicking portfolio return, and HMLT is the value mimicking portfolio return.

To even better price expected returns, Fama and French (2015) extend the three-factor model to a five-factor model by adding profitability and investment factors. This accords well with the dividend discount model in that both help determine dividends:

where RMWT is the profitability mimicking portfolio return, and CMAT is the investment mimicking portfolio return.

In brief, if we obtain significant abnormal returns (αi) with these models, common risk factors do not fully capture the relationship between realised volatility and momentum returns at the industry level.

Volatility-adjusted industry momentum

As momentum gains are related to volatility, Barroso and Santa-Clara (2015) adjust firm-level momentum returns using realised volatility and find higher gains for their measure of risk-managed momentum. We follow their method to construct volatility-adjusted industry momentum, scaling the industry momentum portfolio by its realised volatility to obtain constant volatility over time.

We rank the industries based on their past returns into six groups to construct an industry momentum portfolio of buying the highest return group and selling the lowest return group. Following Barroso and Santa-Clara (2015), the ranking is based on the returns from month t – 12 to t – 2. We then scale the industry momentum return using realised volatility as follows:

where rrml,t is the unscaled excess return of industry momentum; \(\mathrm{\widehat {RVOL}}_t\) is a realised volatility of momentum calculated at each month t by using daily returns over the past 6 months. RVOLtarget is a target constant volatility around 13%, measured as the annualised volatility, and this target volatility is close to that used for individual momentum (12%) in Barroso and Santa-Clara (2015). If volatility-adjusted industry momentum excess return (\(r_{wml,\,t}^ \ast\)) is higher than the unscaled return, managing realised volatility can enhance industry momentum gains.

Empirical results

Realised total volatility and industry momentum returns

To test the relationship between realised volatility and industry momentum, we sort the industries into three groups using the terciles of realised volatility over the estimation periods (first or highest, second, and third or lowest terciles), and then construct momentum strategies within each volatility group. If there is a significant relationship between volatility and raw industry momentum returns and after controlling for common risk factors, volatility may explain these returns. This suggests that investors may enhance momentum returns by observing the pattern of past volatility.

Table 2 reports the relationship between the realised total volatility and industry momentum returns. Overall, industry momentum returns increase with the level of volatility over most tested trading periods, except for the 1/1 (1-month estimation and 1-month holding) trading strategy. Most raw returns of the zero-cost portfolios with high volatility are significant, except those of the 1/3, 24/1, and 24/24 trading horizons. For instance, the high-volatility portfolio of the 12/1 trading strategy generates a 1.004% momentum return per month, which is significant at the 5% level. Sharpe ratios adjusting for standard deviation (Sharpe, 1998) also show similar patterns: Sharpe ratios of the momentum portfolios under the high-volatility tercile are higher than those under the low-volatility tercile over most trading horizons, except for the 1/1 and 24/1 trading strategies. Those results indicate a positive relationship between realised total volatility and industry momentum returns.

Table 3 presents the momentum returns adjusted for the common risk factors. Consistent with the raw results shown in Table 2, adjusted momentum returns of the high-volatility groups are higher than those of the low-volatility groups over most trading horizons. Most adjusted returns of momentum portfolios with high volatility are significant at the 5% level, except for the returns adjusted by the CAPM of the 12/24 and 24/24 trading strategies. Some even display very large t-statistics, such as those of the 12/12, 24/12, and 24/24 trading strategies. Those risk-adjusted results indicate that common risk factors cannot explain the positive relationship between realised total volatility and industry momentum returns, and therefore, additionally volatile industries could enhance industry momentum returns.

Table 3 also shows that adjusted momentum returns are even stronger than raw results reported in Table 2. The greater sensitivity to the common risks of high-volatility loser industries may explain the stronger positive relationship between volatility and momentum returns after controlling for common risk factors shown in Table 3 (Rouwenhorst, 1998; Jegadeesh and Titman 1993; Arena et al., 2008). The returns of high-volatility losers may be lower after controlling for common risk factors if they are sensitive to risk factors, resulting in higher momentum returns of high-volatility groups. These results indicate that momentum returns compensate for bearing high-volatility risk. Investors may then profitably select high-volatility industries when constructing momentum-trading strategies to secure larger abnormal returns.

Realised decomposed volatility and industry momentum returns

Industry portfolios are normally undiversified, so we then decompose the realised total volatility into idiosyncratic and systematic volatility to examine which component best drives the relationship between volatility and industry momentum returns. Table 4 provides the Sharpe ratios and raw/adjusted returns for momentum portfolios under each idiosyncratic volatility group over selected trading horizons. The results for additional trading horizons are unreported but available upon request. Consistent with the results for total volatility, Table 4 shows that both the raw and adjusted momentum returns of the high idiosyncratic volatility group are higher and more significant than those of the low-volatility group over most trading horizons, except for the 1/1 trading window. The Sharpe ratios also yield similar patterns, except for the 1/1 and 1/3 trading horizons. These results suggest that idiosyncratic volatility matters for industry momentum returns, even after controlling for common risk factors.

Table 5 reports the results for systematic volatility over selected trading horizons. Once again, both the raw and adjusted momentum returns of the high systematic volatility group are higher and more significant than those of the low-volatility group over most trading horizons, except for those of the 24/24 trading strategy, which are insignificant. The Sharpe ratios also increase with the level of systematic volatility over most tested trading periods, except for the 1/1 and 1/3 trading strategy where the middle-ranked volatility groups earn the highest Sharpe ratios for momentum portfolios. These results indicate that systematic volatility is positively related to industry momentum returns, even after controlling for common risk factors.

As unsystematic risks theoretically should be diversified away in an efficient market, many firm-level studies focus only on systematic volatility (e.g., Stivers and Sun, 2010; Wang and Xu, 2015). However, markets are sometimes inefficient. For instance, Arena et al. (2008) and Liu et al. (2016) find that idiosyncratic volatility matters, and it is closely related to momentum returns. More importantly, stocks in the same industry exhibit comovements and similar characteristics, so industry portfolios are normally undiversified (Parsons et al., 2020; Chen et al., 2021, 2022). Therefore, the findings that both systematic and unsystematic volatility can enhance industry momentum returns fits the features of our sample data.

The finding of this positive relationship between realised industry volatility and industry momentum returns is consistent with the results explaining firm-level momentum gains using volatility. For example, both total and idiosyncratic volatility are positively related to firm-level momentum formed on Islamic stocks (Narayan and Phan, 2017). Arena et al. (2008) find comparable results by focusing on idiosyncratic volatility for individual stock momentum. Measuring industry volatility, recent work by Badreddine and Clark (2021) suggests that momentum returns increase with the levels of industry-adjusted volatility, even after controlling for the varying levels of liquidity in the UK.

These studies suggest some potential explanations for the positive relationship. For instance, Zhang (2006) finds that volatile stocks underreact to news, and therefore, return spreads between past winners and losers will be wider. In addition, high volatility is associated with the limits to arbitrage (Cao and Han, 2016; Guidolin and Ricci, 2020). For instance, risk-averse investors are unwilling to engage in arbitrage with high-volatility stocks, leading to stronger price persistence and momentum effects (Arena et al., 2008; Liu et al., 2016).

Other explanations relate to the relationship between idiosyncratic volatility and momentum returns. From an investment perspective, for example, Arena et al. (2008) find that momentum is related to underreaction to firm-specific information. Similar arguments by Rachwalski and Wen (2016) also indicate that investors may underreact to unsystematic volatility risk, and therefore, the slow price correction mechanism will result in stronger momentum returns for securities with high unsystematic volatility. Chan (2003) also argues that stronger momentum effects result from more news arriving. As idiosyncratic volatility is a proxy of firm-specific news, higher volatility may lead to higher momentum returns.

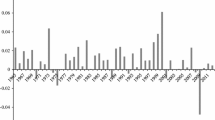

Volatility-adjusted industry momentum

As industry momentum is related to volatility, we follow Barroso and Santa-Clara (2015) to adjust industry-level momentum returns using realised volatility. Table 6 compares the unscaled industry momentum with the volatility-adjusted results. Consistent with firm-level results in Barroso and Santa-Clara (2015), Table 6 shows that the volatility-adjusted industry momentum return is much higher with a larger t-statistic than the unscaled return. Volatility adjustment also reduces left skewness from −0.254 to –0.015 and kurtosis from 3.036 to 0.546. These results indicate that adjusting realised volatility enhances industry momentum gains and reduces the crash risk. The results are also in line with our portfolio sorting results discussed previously where momentum return represents a compensation for bearing high-volatility risk.

Robustness

Given realised volatility assumes a zero mean, drift-adjusted realised volatility is an alternative that adjusts daily returns by the mean return (Amaya et al., 2015):

where ri,t is the daily log excess return for each industry i in each trading day t and N is the number of observations over an estimation period T.

Table 7 provides the results of the relationship between drift-adjusted volatility and industry momentum returns over selected trading horizons. The results of drift-adjusted volatility are broadly like those obtained with realised volatility in Tables 2 and 3. Most momentum returns for the high-volatility group exceed those for the low-volatility groups, except for the 1/1 trading strategy. The strongest momentum effect is over the 9/9 trading strategy with a 0.797% momentum return for the high drift-adjusted volatility group.

Conclusion

Given the demonstrated interest in momentum-trading strategies, it is of importance to gauge whether realised volatility can enhance the performance of these strategies. Extant studies consider only firm-level relationships, despite strong investor interest in industry-level findings. Using a comparable approach, we find that selecting industries based on their realised volatility (and its decomposed idiosyncratic and systematic volatility) have positive and economically significant impacts on raw and risk-adjusted abnormal returns when employing momentum strategies over 1–24 months estimation and holding periods. The findings are robust to the use of the drift-adjusted realised volatility. The volatility-adjusted industry momentum strategy is also more profitable than the unadjusted results, suggesting that industry momentum gains are compensations for bearing high-volatility risk.

Data availability

The datasets analysed during the current study are available in the Kenneth French Data Library: https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.

References

Amaya D, Christonerson B, Jacobs K, Vasquez A (2015) Does realized skewness predict the cross-section of equity returns? J Financ Econ 118(1):135–167

Arena MP, Haggard KS, Yan XS (2008) Price momentum and idiosyncratic volatility. Financ Rev 43(2):159–190

Asness CS, Moskowitz TJ, Pedersen LH (2013) Value and momentum everywhere. J Finance 68(3):929–985

Badreddine S, Clark E (2021) The asymmetric effects of industry specific volatility in momentum returns. Int J Finance Econ 26(4):6444–6458

Bali TG, Cakici N (2008) Idiosyncratic volatility and the cross section of expected returns. J Financial Quant Anal 43(1):29–58

Barroso P, Santa-Clara P (2015) Momentum has its moments. J Financ Econ 116(1):111–120

Berk JB, Van Binsbergen JH (2015) Measuring skill in the mutual fund industry. J Financ Econ 118(1):1–20

Black A, Buckland R, Fraser P (2002) Changing UK stock market sector and sub-sector volatilities 1968–2000. Manag Finance 28(8):26–43

Campbell JY, Lettau M, Burton GM, Xu Y (2001) Have individual stocks become more volatile? An empirical exploration of idiosyncratic risk. J Finance 56:l–43

Cao J, Han B (2016) Idiosyncratic risk, costly arbitrage, and the cross-section of stock returns. J Bank Fince 73:1–15

Chan WS (2003) Stock price reaction to news and no-news: Drift and reversal after headings. J Finance 56(2):1075–1094

Chen CD, Cheng CM, Demirer R (2017) Oil and stock market momentum. Energy Econ 68:151–159

Chen Z, Lu A (2017) Slow diffusion of information and price momentum in stocks: Evidence from options markets. J Bank Fince 75:98–108

Chen X, Li B, Worthington AC (2021) Higher moments and US industry returns: Realised skewness and kurtosis. Rev. Account. Finance 21(1):1–22

Chen X, Li B, Worthington AC (2022) Higher moments and industry momentum returns. Invest Anal J. https://doi.org/10.1080/10293523.2022.2090078

Conrad J, Dittmar RF, Ghysels E (2013) Ex ante skewness and expected stock returns. J Finance 68(1):85–124

Fama EF, French KR (1992) The cross-section of expected stock returns. J Finance 47(2):427–465

Fama EF, French KR (1993) Common risk factors in the returns on stocks and bonds. J Financ Econ 33(1):3–56

Fama EF, French KR (2015) A five-factor asset pricing model. J Financ Econ 116(1):1–22

Ferreira MA, Gama PM (2005) Have world, country, and industry risks changed over time? An investigation of the volatility of developed stock markets. J Financial Quant Anal 40(1):195–222

Fuertesa AM, Miffreb J, Ta WH (2009) Momentum profits, nonnormality risks and the business cycle. Appl Financ Econ 19(12):935–953

Gao L, Han Y, Li SZ, Zhou G (2018) Market intraday momentum. J Financ Econ 129(2):394–414

Grobys K, Heinonen JP, Kolari J (2018) Return dispersion risk in FX and global equity markets: Does it explain currency momentum? Int Rev Financ Analy 56:264–280

Guidolin M, Ricci A (2020) Arbitrage risk and a sentiment as causes of persistent mispricing: the European evidence. Quart Rev Econ Fin 76:1–11

Jacobs H, Regele T, Weber M (2015) Expected skewness and momentum. Dissertation, University of Duisburg

Jegadeesh N, Titman S (1993) Returns to buying winners and selling losers: Implications for stock market efficiency. J Finance 48(1):65–92

Kacperczyk M, Sialm C, Zheng L (2005) On the industry concentration of actively managed equity mutual funds. J Finance 60(4):1983–2011

Li B, Qiu J, Wu Y (2010) Momentum and seasonality in Chinese stock markets. J Money Invest Bank 17(5):24–36

Lin C, Ko KC, Feng ZX, Yang NT (2016) Market dynamics and momentum in the Taiwan stock market. Pac-Bas Fin J 38:59–75

Liu B, Iorio AD, Silva AD (2016) Equity fund performance: can momentum be explained by the pricing of idiosyncratic volatility? Stud Econ Finance 33(3):359–376

Misirli EU (2018) Productivity risk and industry momentum. Financ Manage 47(3):739–774

Morana C, Sawkins J (2004) Stock market volatility of regulated industries: an empirical assessment. Port Econ J 3:189–204

Moskowitz TJ, Grinblatt M (1999) Do industries explain momentum? J Finance 54(4):1249–1290

Narayan PK, Phan DHB (2017) Momentum strategies for Islamic stocks. Pac-Bas Fin J 42:96–112

O’Neal ES (2000) Industry momentum and sector mutual funds. Financial Anal J 56(4):37–49

Parsons CA, Sabbatucci R, Titman S (2020) Geographic lead-lag effects. Rev Financ Stud 33(10):4721–4770

Rachwalski M, Wen Q (2016) Idiosyncratic risk innovations and the idiosyncratic risk-return relation. Rev Asset Pricing Stud 6(2):303–328

Rouwenhorst KG (1998) International momentum strategies. J Finance 53(1):267–284

Sharpe WF (1998) The Sharpe ratio. In: Bernstein PL, Fabozzi FJ (ed.) Streetwise–the best of the journal of portfolio management. Princeton University Press, Princeton, pp. 169–185

Stivers C, Sun L (2010) Cross-sectional return dispersion and time variation in value and momentum premiums. J Financ Quant Analy 45(4):987–1014

Wang KQ, Xu J (2015) Market volatility and momentum. J Empiric Fin 30:79–91

Wu Y, Mazouz K (2016) Long-term industry reversals. J Bank Financ 68:236–250

Yin Z, O’Sullivan C, Brabazon A (2016) An analysis of the performance of genetic programming for realised volatility forecasting. J Art Intel Soft Comp Res 6(3):155–172

Zaremba A (2018) The momentum effect in country-level stock market anomalies. Econ Res 31(1):703–721

Zhang X (2006) Information uncertainty and stock returns. J Finance 61:105–136

Author information

Authors and Affiliations

Contributions

All authors significantly contributed to the article and approved the submitted version. Contributed to the conception or design of the work: XC, BL, ACW. Contributed to analysis and interpretation of data for the work: XC. Drafting the work or revising it critically for important intellectual content: XC, BL, ACW. Final approval of the version to be published: XC, BL, ACW. Agreement to be accountable for all aspects of the work in ensuring that questions related to the accuracy or integrity of any part of the work are appropriately investigated and resolved: XC, BL, ACW.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

Not required for this study. This article does not contain any studies with human participants performed by any of the authors.

Informed consent

Not required for this study. This is because this article does not contain any studies with human participants performed by any authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Chen, X., Li, B. & Worthington, A.C. Realised volatility and industry momentum returns. Humanit Soc Sci Commun 9, 287 (2022). https://doi.org/10.1057/s41599-022-01309-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-022-01309-y

- Springer Nature Limited