Abstract

We investigate whether, and to what extent, banks exploit their discretion over loan loss provisions to achieve their management purposes during the pandemic. Using a sample of US banks during the current COVID-19 outbreak, we find that banks are more eager to use discretionary loan loss provisions in response to the worsening pandemic situation. We find in particular that banks use discretionary loan loss provisions to manage regulatory capital, smooth income and signal private information to outsiders. Overall, this paper enriches the literature on bank discretionary behaviour during the difficult time, especially during the current COVID-19 pandemic, and therefore, it has important implications for banking supervisor and bank stakeholders.

Similar content being viewed by others

Introduction

This paper examines how banks exploit their discretion over loan loss provisions (LLPs) to achieve management purposes in response to the intense crisis. LLPs are critical for bank safety and soundness as they are a means of mitigating default and systemic risks (Beatty and Liao 2014). Nonetheless, since LLPs are heavily dependent on bank manager’s judgement, they can be opportunistically exploited by bank managers to pursue proprietary goals, rather than to purely represent a bank’s expected future credit losses (Kanagaretnam et al. 2005; Curcio and Hasan 2015; Tran et al. 2019). Arguably, when banks manipulate their LLPs, it could lead to a serious misinformation problem for shareholders, bank supervisors and the general market, especially in a recession period when economic uncertainty arises (El Sood 2012).

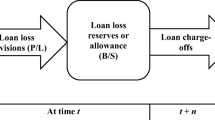

Given the importance of LLPs to the financial stability of banks, the strand of research revolving around bank LLPs has attracted much attention from policymakers and academics (Lobo and Yang 2001). Prior work documents that LLPs comprise two components: non-discretionary LLPs and discretionary LLPs (Kanagaretnam et al. 2004; Curcio and Hasan 2015). On the one hand, the non-discretionary component of LLPs is associated with banks’ credit risk, and it therefore reflects their actual performance (Wu et al. 2016). This component aims to cover expected future losses on banks’ loan portfolios (Beaver and Engel 1996). On the other hand, discretionary LLPs are subject to managers’ judgement and can be exploited as a tool to smooth income, signal private information and manage regulatory capital (Kanagaretnam et al. 2005; Curcio and Hasan 2015; Laeven and Majnoni 2003; Leventis et al. 2011).

In this paper, we exploit the exogenous nature of the current COVID-19 pandemic as a setting to test whether, and to what extent, banks exploit their discretion over LLPs in response to the intense crisis. Arguably, the COVID-19 pandemic is an unprecedented health and economic shock that was entirely unexpected and out of the control of all economic entities, including banks. This shock is driven by a global public health crisis, not by bad economic and financial conditions. In addition, the severity of the pandemic also varies across time and geographic locations. Such variations make COVID-19 an ideal setting that meets the purpose of our study. In fact, recent empirical economics and finance studies have actively exploited this shock for analysis (Colak and Öztekin 2021; Ren et al. 2021; Zhang and Hu 2021).

To empirically examine the effects of the COVID-19 pandemic on banks’ discretionary use of LLPs, we first construct the measure of the COVID-19 exposure experienced by individual banks during each particular period of time. To do so, we follow a three-step approach. In the first step, we calculate the market share for each bank in each state in 2019. Then, we collect the quarterly number of new COVID-19 confirmed cases by state and normalise them by the state population. Finally, these quotients are weighted by the bank market shares calculated in the first step. This measure allows us to take into account the cross-sectional variation in the degree of exposure to COVID-19 across different banks and quarters. Given that the COVID-19 pandemic has imposed a purely exogenous shock to the financial system worldwide, it provides a unique setting that enables us to better establish the causal impact of bad times on banks’ management of LLPs.

Drawing on a sample of 262 US bank holding companies from 2020Q1 to 2021Q2, we find that banks suffering more from the COVID-19 pandemic are more eager to exploit their discretion over LLPs. This result is robust to different alternative model specifications (i.e. different fixed effects models and clustering methods) and to the addition of various macro-control variables.

We further utilise difference-in-difference (DiD) estimators to alleviate some endogeneity concerns and ensure the validity of our results. Since the severity of the pandemic is heterogenous across states and time, there is a variation in the degree of exposure for each bank. That is, some banks may suffer seriously from the pandemic, while others may experience little impact. Based on that feature, we construct a DiD estimation that analyses how the most severely affected banks use discretionary LLPs relative to those least affected by the pandemic prior to and after the pandemic outbreak in 2020Q1. We find that COVID-19-induced treated banks engage more in the manipulation of LLPs than control banks.

Next, we conduct several additional analyses, aiming to obtain an insight into the motives behind banks’ use of discretionary LLPs. Prior studies suggest that banks can exploit their discretion over LLPs to smooth income, signal private information and manage regulatory capital (Lobo and Yang 2001; Kanagaretnam et al. 2005; Morris et al. 2016). Our additional analyses confirm these findings. We show that during an intense pandemic, banks increasingly use discretionary LLPs to smooth income, signal private information to outsiders and manage their capital requirements.

This paper makes important contributions to the literature in two main ways. First, we contribute to the broad literature that investigates the drivers of banks’ use of discretionary LLPs for management purposes (e.g. Cheng et al. 2011; Jin et al. 2018; Jutasompakorn et al. 2021). This literature documents that while LLPs are a significant accrual meant to reflect the risk of banks’ loan portfolios, bank managers can exploit the discretion they are given when estimating LLPs for management objectives (e.g., Curcio and Hasan 2015; Tran et al. 2019). We contribute to this literature by addressing the question of whether and to what extent the exposure to a severe pandemic induces banks to exploit LLPs. In this regard, we add to the specific stream of studies examining banks’ financial report manipulation behaviour during a crisis (e.g., Flannery et al. 2013; Iatridis and Dimitras 2013; Pettinicchio 2020). We document that banks use LLPs for management purposes (i.e. income smoothing, signalling and capital management) during difficult times.

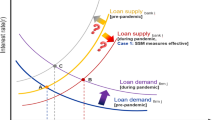

Second, we augment the recently emerging line of literature on the impacts of the COVID-19 pandemic on the banking industry. Given that banks are expected to play an active and indispensable part in supporting governments in the economic recession caused by such a pandemic (Elnahass et al. 2021), it is of paramount importance to investigate how the banking industry is affected and its responses. Prior studies have documented that the COVID-19 pandemic has led to a reduction in bank performance and stability (Elnahass et al. 2021), a contraction in bank lending (Colak and Öztekin 2021) and an increase in interest spreads (Hasan et al. 2020). Nevertheless, to the best of our knowledge, no empirical work has been dedicated to examining how bank managers manipulate financial reports in response to the severity of the COVID-19 pandemic. Thus, this paper is conducted in an attempt to bridge the gap in the literature.

The remainder of this paper is organised as follows. Section 2 reviews the relevant literature, and Sect. 3describes the model specifications, data and sample selection. Section 4 discusses the main results and presents the robustness tests, Sect. 5 provides some additional analyses, and Sect. 6 concludes the paper.

Literature review

LLPs are one of the main accrual expenses for banks and thus significantly affect banks’ incomes and regulatory capitals. In principle, LLPs are supposed to reflect a bank’s estimate of future expected credit losses. However, since it is infeasible for banks to precisely match current provisions with future expected credit losses, banks are given a wide latitude for discretion when estimating their provisions (Beatty et al. 1995; Curcio and Hasan 2015).

As a result, bank LLPs are often dichotomised into two components: non-discretionary LLPs and discretionary LLPs (Kanagaretnam et al. 2004; Curcio and Hasan 2015). While the former component is related to identified future credit losses and is added to specific reserves, the second component is open to managerial judgement and can be used by bank managers to achieve their management objectives (Curcio and Hasan 2015; Zhang and McIntyre 2021). Arguably, when banks exploit this discretion to opportunistically achieve their management objectives, it raises the concern of moral hazard and misbehaviour, which could obscure bank fundamentals and harm shareholders’ wealth (Laeven and Majnoni 2003).

Prior literature illustrates that banks have a high incentive to manage LLPs for income smoothing purposes (Collins et al. 1995; Pérez et al. 2008; Leventis et al. 2011). This can help banks to reduce income volatility and thus meet bank regulations and shareholders’ expectations. Specifically, given that LLPs and bank expenses are directly related, banks can overstate LLPs to contain the reported income figure when the pre-managed income is perceived to be high. By contrast, they can understate LLPs in periods of low actual income to boost the reported income figures (Laeven and Majnoni 2003; El Sood 2012; Morris et al. 2016; Skała, 2021).

Banks can also exploit their discretion over LLPs to signal private information to outsiders. The extant literature documents a positive relationship between DLLPs and stock returns, suggesting that both investors and bank managers perceive LLPs as a channel to signal private information about banks’ future performance (Kanagaretnam et al. 2003; Tran et al. 2019). In fact, an increase in LLPs can be perceived positively by investors, who interpret a high provision as a signal of good news rather than a signal of a negative future outlook (Elliott et al. 1991). This is because high LLPs may imply that the bank is able to deal sufficiently with future loan default problems (Beaver and Engel 1996; Curcio and Hasan 2015). Lobo and Yang (2001) and Morris et al. (2016) provide support for this view and document that bank managers tend to increase discretionary LLPs to convey positive future cash flow prospects. Overall, high LLPs may well indicate that banks can absorb a greater reduction in future earnings caused by loan defaults and they express bank managements’ confidence in their future performance.

Another strand of literature proposes that banks can alter LLPs to manage regulatory capital (Collins et al. 1995; Lobo and Yang 2001; Anandarajan et al. 2007). Anecdotal evidence shows that, when regulatory capital is perceived to be low, banks tend to overstate LLPs to boost their capital (Beatty et al. 1995). However, subsequent studies often found no evidence of capital management via LLPs once the Basel regulations (i.e. Basel I and II accords) came into effect (Pérez et al. 2008; Leventis et al. 2011; Curcio and Hasan 2015). This is because, prior to the implementation of the Basel regulations, LLPs were included in the calculation of primary capital. Under the guidance of the Basel accords, LLPs are no longer included in the calculation of Tier-1 capital, and they now only account for an insignificant proportion of the total capital (within Tier-2 capital). Thus, adjusting LLPs has little influence on the capital adequacy ratio.

Data and model specification

Data construction

In this study, we integrate data from three sources. First, we obtain the financial data of all the operating US bank holding companies (banks hereafter) from the FR Y-9C quarterly reports.Footnote 1 Our sample spans over a six-quarter period, from 2020Q1 to 2021Q2. We chose this sampling period because the COVID-19 pandemic started breaking out in early 2020, and 2021Q2 is the latest quarter for which data are available. We commence our sample construction by removing all observations that have missing necessary accounting information. We also limit the sample to banks incorporated in the fifty US states. Thus, banks incorporated in US territories such as Guam and Puerto Rico are excluded. To this end, our final sample includes 1039 bank-quarter observations from 262 unique banks over a six-quarter period.

To estimate each bank’s level of exposure to the COVID-19 pandemic, we require data that capture the severity of the pandemic at the geographic location where each bank is incorporated. Hence, the second set of data used in our study details the daily COVID-19 pandemic situation across the US states. We retrieve these data from the Centers for Disease Control and Prevention (CDC) website.Footnote 2 The CDC website is a trusted, rich source of information about the COVID-19 pandemic, including the current number of confirmed COVID-19 cases and COVID-19-related deaths at the state level. It also contains information on COVID-19-related hospitalisations, vaccinations and testing, etc. We collect the number of new cases of COVID-19 daily from23 January 2020 to 30 June 2021 and then aggregate these data to obtain the quarterly number of cases for each state.

Finally, we retrieve quarterly state-level macro-economic data (i.e. real GDP and population) for the corresponding period from 2020Q1 to 2021 Q2 from the Bureau of Economic Analysis (BEA). The definitions of the main variables used in this study are exhibited in Table 1.

Measuring bank discretionary LLPs

LLPs consist of two components: non-discretionary and discretionary (Kanagaretnam et al. 2004; Curcio and Hasan 2015). Therefore, in order to evaluate the extent to which the COVID-19 pandemic affects banks’ discretionary use of LLPs, we must disentangle the discretionary component of LLPs from the non-discretionary component. To do so, we follow the prior literature and estimate the discretionary component of LLPs as the absolute value of the residual obtained from the following model, regressing LLPs on a set of their normal determinants (Cheng et al. 2011; Beatty and Liao 2014; Tran et al. 2019; Jin et al. 2018)Footnote 3:

where i denotes bank and t denotes quarter. \({\text{LLPs}}_{i,t}\) is the ratio of a bank’s LLPs to the beginning gross loans for bank i in quarter t (Kanagaretnam et al. 2004; Jin et al. 2018). \(\Delta {\text{NPA}}_{i,t - 1}\) is the change in non-performing assets during quarter t-1 normalised by the beginning total assets; \(\Delta {\text{NPA}}_{i,t}\) is the change in non-performing assets during quarter t normalised by the beginning total assets; and \(\Delta {\text{NPA}}_{i,t + 1}\) is the one-period ahead change in non-performing assets normalised by the beginning total assets. These three variables are included because LLPs can be adjusted by bank managers based on historical, current and forward-looking information on asset quality (McIntyre and Zhang 2020). In addition, we also take into account the growth rate of gross loans (\(\Delta {\text{Loan}}_{i,t}\)), measured as the change in gross loans during quarter t scaled by the beginning total assets, as a rapid acceleration in loans may worsen loan quality and ultimately lead to a rise in bank LLPs (Kanagaretnam et al. 2003). \(\Delta {\text{COs}}_{i,t}\) is the change in a bank’s charge-offs during quarter t scaled by the beginning total assets. Changes in loan charge-offs can affect managerial expectations of collecting current loans, and thus influence current LLPs (Jin et al. 2018). Finally, we cluster the standard errors at the state of incorporation level.

Measuring COVID-19 exposure

Arguably, banks operating in different geographic locations experience homogenous exposure to the COVID-19 pandemic. Given that each bank can operate in a number of states, it is necessary for us to calculate an aggregated COVID-19 exposure index, capturing the severity of the pandemic facing banks across US states.

To do so, we adopt a three-step approach. In the first step, we identify the market share of each individual bank across the US states, using information on the proportion of the total bank branch’s deposit in each state. Specifically, we retrieve information on bank branch deposits in the year 2019 from the SNL Financial database. Then, for each branch of any given bank, we calculate the proportion of bank branch deposits to the bank’s total deposits. This allows us to evaluate bank market share in each state where they operate. In the second step, we calculate the level of COVID-19 severity in each state. To do so, we follow prior literature (i.e. Dursun-de Neef and Schandlbauer 2021) and normalise the quarterly number of new COVID-19 confirmed cases by the state population to account for differences in state sizes. Finally, in the third step, to measure the geographic exposure to COVID-19 pandemic for each bank, we calculate the weighted average number of COVID-19 cases per 100,000 people. The bank market shares drawn from the first step are employed as weights. Taken together, the level of COVID-19 that each individual bank is exposed to is calculated as follows:

where i denotes bank, j denotes branch, and t denotes quarter. \({\text{Covid}}_{i,j,t}\) is the number of new COVID-19 cases per 100,000 people in the state where branch j of bank i operates in quarter t. Collectively, \({\text{Covid Exposure}}_{i,t}\) allows us to take into account the cross-sectional variation in the degree of geographic exposure to COVID-19 across different banks.

Model specification

Our primary goal is to examine whether, and to what extent, banks manipulate their financial reports during a pandemic through the use of discretionary LLPs. To do so, we employ the following regression model:

where i denotes banks and t denotes quarter. The dependent variable is \({\text{Discretionary}} {\text{LLP}}_{it}\), which is the absolute value of the residuals from Eq. (1) as described in Sect. 3.2. Our primary variable of interest is \({\text{Covid Exposure}}_{{{\text{i}},{\text{t}}}}\). The coefficient \(\beta_{1}\) indicates the extent to which the COVID-19 pandemic affects banks’ discretionary LLPs. Specifically, a positive (negative) \(\beta_{1}\) implies that banks suffering more severely from the COVID-19 pandemic are more (less) eager to exploit their discretion over LLPs.

We follow prior literature (i.e. Kanagaretnam et al. 2004; Jiang et al. 2016; Jin et al. 2018; Tran et al. 2019) and include a number of control variables capturing bank characteristics that could possibly affect their discretionary LLPs. In particular, we consider bank size (Size) using the natural logarithm of total assets. Larger banks are expected to have fewer discretionary LLPs as they tend to be more diversified and they show less earnings volatility (Dechow and Dichev 2002). We also control for bank regulatory capital (Tier-1 capital), measured as the ratio of a bank’s Tier-1 capital to total assets. Banks that violate the regulatory capital requirement (i.e. lower Tier-1 capital ratio) are more likely to manage LLPs to avoid the excessive regulatory costs (Leventis et al. 2011). We then control for bank profitability, measured as return on assets (ROA), and expect that bank profitability and discretionary LLPs are positively related. This is in line with prior literature contending that banks experiencing a decrease in income may have lower discretionary LLPs to write off bad debts and smoothen earnings (Leventis et al. 2011; El Sood 2012).

We further control for bank credit risk (Risk), which is measured by the ratio of non-performing loans to gross loans. Arguably, banks experiencing a high credit risk and a low-quality loans portfolio are likely to have high discretionary LLPs for income smoothing purposes (Pérez et al. 2008). We also include the ratio of bank loans to total deposits (Fund) in our baseline model to control for the need for external financing. Given that the demand for external financing is a crucial motivation for income smoothing, banks that are reliant on borrowing to finance their loan portfolios tend to engage in more financial report manipulation than those that are not reliant on borrowing (Kanagaretnam et al. 2004). Finally, we control for bank liquidity, measured by the ratio of total cash and non-interest-bearing deposits to total assets. Consistent with prior literature (i.e. Jin et al. 2018), we expect that banks with larger liquid assets are likely to exhibit larger discretionary LLPs.

In this paper, we construct a panel dataset by compiling quarterly data corresponding to 262 US banks across US states over six quarters from 2020Q1 to 2021Q2. The use of panel data allows for a concomitant increase in the degrees of freedom and therefore mitigates the collinearity issues and improves the accuracy of the estimates (Hsiao 2003). In addition, we use the fixed effect regression model for panel data to take advantage of longitudinal data and control the effect of unobserved heterogeneity that could lead to estimation bias. For this reason, prior literature studying bank’s discretionary behaviour often uses fixed effect models to eliminate any time-invariant unobserved bank specific characteristics factors that could otherwise lead to biased estimates (Leventis et al. 2011; Bouvatier et al., 2014; Curcio and Hasan 2015).

To mitigate the potential endogeneity concern, we follow the common practice in the empirical banking literature and lag all control variables by one quarter (Tran et al. 2019; McIntyre and Zhang 2020). As an additional attempt to mitigate the potential endogeneity issue arising from omitted variable bias, we further control for bank and quarter fixed effects in our model. These fixed effects allow us to capture the average impact of the unobserved time-invariant characteristics of each bank and the omitted time-variant economy-wide characteristics on our dependent variable. Finally, we cluster the standard errors at the bank level to take into account the possibility of within-cluster serial correlation in the error term (Petersen 2009).

Empirical results

Correlation matrix and descriptive statistics

Table 2 reports the descriptive statistics of all the main variables of interest. During the COVID-19 pandemic (i.e. from 2020Q1 to 2021Q2), the mean of DLLP is 0.001. On average, the value of our independent variable (i.e. Covid Exposure) that captures the degree of COVID-19 exposure by banks and is measured as the number of COVID-19 confirmed cases per 100,000 people weighed by bank market shares, is 0.023.

As for our control variables, the mean value of bank size (measured as the natural logarithm of bank total assets) is 16.115. Overall, the profitability of banks in our sample is relatively low, with the mean value of ROA being only 0.3%. However, during the sample period, banks were well capitalised as Tier-1 capital accounts for 9.4% of total assets (i.e. Tier1 Capital). Our sample banks also seem to be in good health, as indicated by the fact that only around 1.0% of their loan portfolios are non-performing. On average, the bank loan-to-deposit ratio (i.e. Fund) is 82.7%, and liquid assets account for 1.2% of banks’ total assets (i.e. Liquidity).

Table 3 provides the correlation matrix for the main variables used in our analysis along with the variance inflation factor (VIF) test. As can be seen from this table, Weighted COVID-19 Cases is positively correlated with Discretionary LLP (0.029). In a similar vein, Size, Tier-1 capital, ROA, Risk and Liquidity are also positively correlated with Discretionary LLP, while Fund and Discretionary LLP are negatively correlated. Overall, the correlation coefficients amongst independent variables are relatively low. The highest correlation is 0.517, between ROA and Tier-1 capital. We then carry out a VIF test to test for the potential multicollinearity issue. The test result provided in the last column of Table 3 shows that all of the VIFs are smaller than 2, thereby implying that our analysis is presumably not affected by the multicollinearity problem.

Baseline results

Table 4 exhibits the main regression results for Eq. (3) to examine the impact of exposure to the COVID-19 pandemic on banks’ DLLPs. Column 1 displays the results from the model using bank fixed effects, while column 2 shows the results after controlling for both bank and quarter fixed effects.

Overall, the results appear to be consistent in both columns. The estimated coefficients on Covid Exposure always load positive and are statistically significant. This illustrates that banks that are more severely exposed to the COVID-19 pandemic are more eager to exploit their discretion over LLPs. Our results provide support for the proposition by Flannery et al. (2013) and Pettinicchio (2020) that banks’ accounting information becomes non-transparent or even misleading to investors in times of crisis. In addition, this study corroborates recent research highlighting the devastating impacts of the COVID-19 pandemic on financial institutions (i.e. Colak and Öztekin 2021;Duan et al. 2021; Elnahass et al. 2021).

The results of the other control variables also provide some important insights. Specifically, we find that, during the COVID-19 pandemic, larger banks and those that are well capitalised use fewer discretionary LLPs, as indicated by the negative and statistically significant coefficients on Size and Tier-1 capital. Meanwhile, we find evidence that riskier banks (indicated by a larger share of non-performing loans in their loan portfolios) tend to manage their LLPs more aggressively, which is consistent with the prior finding by Tran et al. (2019). We find that banks’ profitability, liquidity and external funding have hardly any significant effect on their discretionary LLPs for the sample and period of study.

Robustness tests

In Table 5, we perform a number of robustness tests to check for the sensitivity of our baseline results.

First, in addition to the bank and quarter fixed effects, we further employ the state-quarter trend fixed effects model to control for state-level pre-trends in the data. Second, given that in the baseline model, we cluster standard errors at the bank level to correct for within-bank correlation, in the next two columns, we use different clustering methods to ensure the robustness of our estimations. Specifically, in column 2, we cluster standard errors at the state level. This helps to mitigate the issue of potential time-varying autocorrelations in unobserved variables that could heterogeneously affect different banks incorporated in the same state (Bertrand et al. 2004). In column 3, standard errors are double-clustered at both bank and quarter levels to concomitantly control for temporal and cross-sectional correlation (Petersen 2009). Overall, our main findings hold across different alternative model specifications.

Next, in order to mitigate the impact of potential outliers, we winsorise all the continuous variables at the top and bottom 1% of the distribution and re-estimate baseline model 3 accordingly. The result is presented in column 4 and it is consistent with those reported earlier.

Finally, to obtain a more comprehensive analysis of factors affecting bank DLLPs and to mitigate the concern that our result could be affected by omitted variable issues, we incorporate into our model specification several state-level macro-economic controls. Specifically, we incorporate the quarterly growth rate of real GDP and the quarterly population growth rate. Data for the two above-mentioned variables are retrieved from the BEA. As can be seen from column 5, the result remains quantitatively unchanged.

Difference-in-difference specification

In this section, we attempt to further validate the causal relationship between the degree of exposure to the COVID-19 pandemic and banks’ accounting manipulation behaviour. Specifically, we follow prior literature (i.e. Colak and Öztekin 2021; Zhang and Hu 2021), and use the pandemic as a natural experiment in our DiD model. DiD is a popular and effective econometric technique to deal with endogeneity concerns, and it is thus extensively used in empirical economics and finance studies (Roberts and Whited 2013). Technically, this identification strategy allows us to compare the treated banks (those most severely exposed to the COVID-19 shock) with their control peers (those that are least affected) before and after the pandemic occurs. As a result, the DiD methodology also helps us alleviate the omitted variable bias by ruling out the impacts of unobserved trends that could affect all the sample banks (Colak and Öztekin 2021). To this end, we introduce the DiD model by modifying Eq. (3) as follows:

where i denotes banks and t denotes quarter. \({\text{Treated}}_{i,t}\) is an indicator variable equal to 1 for treated banks and 0 for control banks. To identify treated and control banks, we first sort our sample bank-quarter observations into quartiles based on the weighted average number of COVID-19 cases per 100,000 people. Accordingly, treated (control) banks are those who consistently belong to the top (bottom) 25th quartile during the whole sample period. \({\text{Post}}_{t}\) is a dummy variable taking the value of 1 for the period from Q1 2020 to Q2 2021 and 0 for the pre-COVID period between Q3 2018 and Q4 2019. \({\text{Affected}}_{i,t} \times {\text{Post}}_{t}\). is the DiD term and \(\gamma_{3}\) illustrates how the differences in bank DLLPs between treated and control groups changed after the outbreak of the COVID-19 pandemic.

We incorporate the same set of control variables as in Eq. (3). We also control for bank and quarter fixed effects. Finally, the standard errors are clustered at the bank level. We display the regression results in Table 6. Column 1 displays the results from the model using bank fixed effects, while column 2 shows the results after controlling for both bank and quarter fixed effects.

As can be seen from the table, the coefficients on \({\text{Affected}}_{i,t} \times {\text{Post}}_{t}\) are always positive and statistically significant. This illustrates that treated banks (i.e. those most severely affected by the pandemic) have engaged more aggressively in DLLP than control banks (i.e. those least severely affected by the pandemic) since the COVID-19 outbreak. Overall, these results reaffirm our main findings that the pandemic has forced banks to more aggressively exploit their discretion over LLPs.

Bank motives for LLPs manipulation

So far, we have found evidence that banks most seriously exposed to the COVID-19 pandemic are more eager to use DLLPs. In this section, we further investigate the motives behind such behaviour. Previous studies have documented that banks can use LLPs to smooth income, signal private information and manage regulatory capital (Lobo and Yang 2001; Kanagaretnam et al. 2005; Morris et al. 2016). Thus, in this section, we attempt to examine whether the COVID-19 pandemic induced banks to manipulate LLPs to achieve these management purposes.

Income smoothing

LLPs are an important accrual at bank managers’ disposal. Hence, bank managers can easily report lower (higher) LLPs when incomes are low (high). This allows banks to stabilise their net profits and meet opportunistic financial reporting goals or prudential regulatory objectives (Collins et al. 1995). This is referred to as the income smoothing hypothesis.

To test the above-mentioned proposition, we follow prior studies and introduce the \({\text{EBIT}}_{i, t}\) variable, measured as the earnings before income taxes scaled by total assets, into our baseline model (Anandarajan et al. 2007; Leventis et al. 2011). Furthermore, we interact this variable with \({\text{Covid Exposure}}_{i,t}\). A positive and significant coefficient on \({\text{Covid Exposure}}_{i,t} \times {\text{EBIT}}_{i, t}\) would imply bank income smoothing behaviour during the COVID-19 pandemic. The amended model to examine the income smoothing motive shall be specified as follows:

The regression results of model 5 are displayed in Table 7. Column 1 shows the results from the model using bank fixed effects, whereas column 2 reports the results of the model after controlling for both bank and quarter fixed effects. As can be seen from both columns, the estimated coefficients on \({\text{Covid Exposure}}_{i,t} \times {\text{EBIT}}_{i, t}\) are always positive and strongly significant. This indicates that banks that are more severely impacted by the COVID-19 are more eager to use LLPs to smooth their income.

Signalling

Banks can also exploit their discretion over LLPs to communicate private information to outsiders (Beaver and Engel, 1996). Although the abnormal (i.e. discretionary) component of bank LLPs may imply managerial uncertainty over future losses, empirical research shows that bank stock returns are positively associated with abnormal LLPs (Bouvatier and Lepetit 2008). This is because bank clients and investors tend to consider a rise in LLPs as “good news” (Beaver and Engel, 1996). This is because high LLPs may reflect the fact that a bank’s earning power is strong enough to absorb future losses (Lobo and Yang 2001). In addition, increased LLPs can also signal good-quality bank loan portfolios and future earnings prospects (Vishnani et al. 2019).

We attempt to test whether banks signal private information via LLPs during the COVID-19 pandemic. To do so, we follow the previous literature (Anandarajan et al. 2007; Bouvatier and Lepetit 2008) and modify Eq. (3) by adding the variable \(\Delta {\text{EBIT}}_{i, t + 1}\) (measured by the change in earnings before income taxes and LLPs in the year ahead). We further include the interaction term between \({\text{Covid Exposure}}_{i,t}\) and \(\Delta {\text{EBIT}}_{i, t + 1}\) in the modified model. A positive and statistically significant coefficient on this interaction term would signify bank signalling motives when experiencing a severe exposure to the COVID-19 pandemic. Our modified model is specified as follows:

We report the regression results in Table 8. The results of the model using bank fixed effects, and both banks and quarter fixed effects are presented in columns 1 and 2, respectively. As can be seen from both columns, the estimated coefficients on \({\text{Covid Exposure}}_{i,t} \times \Delta {\text{EBIT}}_{i, t + 1}\) always load positive and are statistically significant. Thus, these results show that banks more severely exposed to the COVID-19 pandemic are more eagle to signal their private information through LLPs.

Capital management

Banks failing to meet capital requirements may face onerous penalties, including stakeholder disciplinary action and supervisory enforcement actions (Collins et al. 1995). Thus, bank managers tend to have a strong incentive to manipulate LLPs to prevent their capital ratios from falling below the minimum required level (Beatty et al. 1995; Curcio and Hasan 2015).

We examine whether banks use DLLP to manage regulatory capital when exposed to an intense pandemic. To do so, we interact the variable measuring the extent to which a bank is exposed to the COVID-19 pandemic (i.e. Covid Exposure) with bank Tier-1 capital ratio (i.e. Tier1 Capital). A positive coefficient on this interaction term (i.e. \({\text{Covid Exposure}}_{i,t} \times {\text{Tier1 Capital}} _{i,t - 1}\)) would illustrate that banks more exposed to the COVID-19 pandemic are more eager to manage LLPs to meet capital requirements. Our model is specified as follows:

The regression results are exhibited in Table 9. Column 1 reports the result of the model using bank fixed effects, while the result of the model using both bank and quarter fixed effects is presented in column 2. Overall, the estimated coefficients on the interaction term \({\text{Covid Exposure}}_{i,t} \times {\text{Tier1 Capital}} _{i,t - 1}\) in both columns are all positive and statistically significant. This result corroborates our proposition that banks more severely affected by the COVID-19 pandemic increasingly exploit their discretion over LLPs as a tool for capital management.

Conclusion

This study examines an important question of whether, and to what extent, banks exploit their discretion to achieve management purposes in response to an intense pandemic. We exploit the variation in the level of COVID-19 exposure across US states and construct a COVID-19 exposure index reflecting the severity of the pandemic facing each bank over the period from 2020Q1 to 2021Q2. The empirical results show that banks are more eager to exploit their discretion over LLPs when they experience an intense COVID-19 exposure. This result is consistent across different model specifications, as well as after controlling for other factors that could possibly affect bank provisioning practices. Furthermore, we find that banks use discretionary LLPs to smooth income, signal private information and manage regulatory capital.

Overall, this study contributes to fostering the understanding of the factors that shape bank discretionary behaviour and reporting quality during the pandemic period. By documenting the evidence for banks using discretionary LLPs to achieve their management objectives, we also provide support to the earlier research which argues that bank accounting information becomes non-transparent or even misleading to outsiders in times of crisis (i.e. Flannery et al. 2013; Pettinicchio 2020). Therefore, banking supervisors responsible for maintaining the compliance, safety and soundness of banks should impose sound accounting principles and additional supervisory standards to limit banks’ discretionary behaviour during the crisis. Given that accounting discipline and regulatory requirements help to eliminate earnings opacity and enhance transparency in the banking industry (Jungherr 2018), these measures may also strengthen the resilience of banks in adverse economic conditions. Furthermore, policymakers should pay attention to the information disclosure standards in order to clarify the flow and use of funds of commercial banks. This both helps regulators to understand how effectively commercial banks adhere to regulations and also helps investors to determine the true financial condition of the banks.

Nevertheless, the results reported herein should be considered in the light of some limitations. First, the results of this study pertain to the US context and are not necessarily generalisable to other nations. For this reason, future research could extend the research question to other countries to examine the reliability of our results across varied regulatory environments and with different levels of exposure to catastrophes. Second, the explanatory power of the models could be enhanced by incorporating some corporate governance variables (e.g. board structure and independence, foreign directorship, CEO tenure and duality) and ownership structure variables in the analysis. For instance, prior literature has documented that the behaviour of banks during economic downturns may vary with bank ownership (Cull and Martínez Pería 2013; Fungáčová et al. 2013; Wu et al. 2021). Brei and Schclarek (2015) also conclude that the credit supply of private banks declines to a more significant extent than that of public banks, indicating that bank ownership affects lending behaviour in response to adverse economic shocks. To this extent, future studies could investigate whether these impacts differ for these different corporate government and ownership types.

Notes

FR Y-9C is the consolidated financial statements for holding companies, which is a regulatory report form submitted to the Federal Reserve each quarter by bank holding companies in the US.

See: Trends in number of COVID-19 cases and deaths in the US reported to CDC, by State/Territory. [Online] Available at: https://covid.cdc.gov/covid-data-tracker/#trends_dailycases.

The fitted value from the LLPs prediction model represents the non-discretionary LLPs as it captures the notionally correct LLPs (Jin et al. 2018). Hence, the residuals (i.e., the unexplained portion in the model) shall be taken as discretionary LLP since it indicates a bank’s deviation from its normal level of LLPs (Kanagaretnam et al. 2009; Zhang and McIntyre 2021).

References

Anandarajan, A., I. Hasan, and C. McCarthy. 2007. Use of loan loss provisions for capital, earnings management and signalling by Australian banks. Accounting and Finance 47 (3): 357–379.

Beatty, A., and S. Liao. 2014. Financial accounting in the banking industry: A review of the empirical literature. Journal of Accounting and Economics 58 (2–3): 339–383.

Beaver, W.H., and Engel, E.E. 1996. Discretionary behavior with respect to allowances for loan losses and the behavior of security prices. Journal of Accounting and Economics 22 (1–3): 177–206.

Beatty, A., S.L. Chamberlain, and J. Magliolo. 1995. Managing financial reports of commercial banks: The influence of taxes, regulatory capital, and earnings. Journal of Accounting Research 33 (2): 231–261.

Bertrand, M., E. Duflo, and S. Mullainathan. 2004. How much should we trust differences-in-differences estimates? The Quarterly Journal of Economics 119 (1): 249–275.

Bouvatier, V., and L. Lepetit. 2008. Banks’ procyclical behavior: Does provisioning matter? Journal of International Financial Markets, Institutions and Money 18 (5): 513–526.

Bouvatier, V., L. Lepetit, and Strobel. F. 2014. Bank income smoothing, ownership concentration and the regulatory environment. Journal of Banking & Finance 41: 253–270.

Brei, M., and A. Schclarek. 2015. A theoretical model of bank lending: Does ownership matter in times of crisis? Journal of Banking and Finance 50: 298–307.

Cheng, Q., T. Warfield, and M. Ye. 2011. Equity incentives and earnings management: Evidence from the banking industry. Journal of Accounting, Auditing and Finance 26 (2): 317–349.

Colak, G., and O. Oztekin. 2021. The impact of covid-19 pandemic on bank lending around the world. Journal of Banking Finance 133: 106207.

Collins, J., D. Shackelford, and J. Wahlen. 1995. Bank differences in the coordination of regulatory capital, earnings and taxes. Journal of Accounting Research 33 (2): 263–292.

Cull, R., and M.S. Martínez Pería. 2013. Bank ownership and lending patterns during the 2008–2009 financial crisis: Evidence from Latin America and Eastern Europe. Journal of Banking & Finance 37 (12): 4861–4878.

Curcio, D., and I. Hasan. 2015. Earnings and capital management and signaling: The use of loan-loss provisions by European banks. The European Journal of Finance 21 (1): 26–50.

Dechow, P.M., and I.D. Dichev. 2002. The quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review 77(s–1): 35–59.

Duan, Y., S. El Ghoul, O. Guedhami, H. Li, and X. Li. 2021. Bank systemic risk around COVID-19: A cross-country analysis. Journal of Banking and Finance 133: 106299.

Dursun-de Neef, H.Ö., and A. Schandlbauer. 2021. COVID-19 and lending responses of European banks. Journal of Banking & Finance 133: 106236.

Elliott, J., J. Hanna, and Shaw, W. 1991. The evaluation by the financial markets of changes in bank loan loss reserve levels. The Accounting Review 66: 847–861.

El Sood, A.H. 2012. Loan loss provisioning and income smoothing in US banks pre and post the financial crisis. International Review of Financial Analysis 25: 64–72.

Elnahass, M., V.Q. Trinh, and T. Li. 2021. Global banking stability in the shadow of Covid-19 outbreak. Journal of International Financial Markets, Institutions and Money 72: 101322.

Flannery, M.J., S.H. Kwan, and M. Nimalendran. 2013. The 2007–2009 financial crisis and bank opaqueness. Journal of Financial Intermediation 22 (1): 55–84.

Fungáčová, Z., R. Herrala, and L. Weill. 2013. The influence of bank ownership on credit supply: Evidence from the recent financial crisis. Emerging Markets Review 15: 136–147.

Hasan, I., Politsidis, P., and Sharma, Z. (2020). Bank lending during the COVID-19 pandemic. MPRA Paper No. 103565.

Hsiao, C. 2003. Analysis of panel data. Cambridge: Cambridge University Press.

Iatridis, G., and A.I. Dimitras. 2013. Financial crisis and accounting quality: Evidence from five European countries. Advances in Accounting 29 (1): 154–160.

Jiang, L., R. Levine, and C. Lin. 2016. Competition and bank opacity. Review of Financial Studies. 29 (7): 1911–1942.

Jin, J.Y., K. Kanagaretnam, and Y. Liu. 2018. Banks’ funding structure and earnings quality. International Review of Financial Analysis 59: 163–178.

Jungherr, J. 2018. Bank opacity and financial crises. Journal of Banking and Finance. 97: 157–176.

Jutasompakorn, P., C.Y. Lim, T. Ranasinghe, and K.O. Yong. 2021. Impact of Basel III on the discretion and timeliness of Banks’ loan loss provisions. Journal of Contemporary Accounting and Economics 17 (2): 100255.

Kanagaretnam, K., G.J. Lobo, and R. Mathieu. 2003. Managerial incentives for income smoothing through bank loan loss provisions. Review of Quantitative Finance and Accounting 20 (1): 63–80.

Kanagaretnam, K., G.J. Lobo, and R. Mathieu. 2004. Earnings management to reduce earnings variability: Evidence from bank loan loss provisions. Review of Accounting and Finance 3 (1): 128–148.

Kanagaretnam, K., G.J. Lobo, and D.H. Yang. 2005. Determinants of signaling by banks through loan loss provisions. Journal of Business Research 58 (3): 312–320.

Kanagaretnam, K., G.V. Krishnan, and G.J. Lobo. 2009. Is the market valuation of banks’ loan loss provision conditional on auditor reputation? Journal of Banking and Finance 33 (6): 1039–1047.

Kanagaretnam, K., C.Y. Lim, and G.J. Lobo. 2014. Effects of international institutional factors on earnings quality of banks. Journal of Banking and Finance 39: 87–106.

Laeven, L., and G. Majnoni. 2003. Loan loss provisioning and economic slowdowns: Too much, too late? Journal of Financial Intermediation 12 (2): 178–197.

Leventis, S., P.E. Dimitropoulos, and A. Anandarajan. 2011. Loan loss provisions, earnings management and capital management under IFRS: The case of EU commercial banks. Journal of Financial Services Research 40 (1–2): 103–122.

Lobo, G.J., and D.H. Yang. 2001. Bank managers’ heterogeneous decisions on discretionary loan loss provisions. Review of Quantitative Finance and Accounting 16 (3): 223–250.

McIntyre, M.L., and Y. Zhang. 2020. Depositors’ discipline, banks’ accounting discretion, and depositors’ expectations of implicit government guarantees. Journal of Banking Regulation 21 (3): 256–277.

Morris, R.D., H. Kang, and J. Jie. 2016. The determinants and value relevance of banks’ discretionary loan loss provisions during the financial crisis. Journal of Contemporary Accounting and Economics 12 (2): 176–190.

Pérez, D., V. Salas-Fumas, and J. Saurina. 2008. Earnings and capital management in alternative loan loss provision regulatory regimes. European Accounting Review 17 (3): 423–445.

Petersen, M.A. 2009. Estimating standard errors in finance panel data sets: Comparing approaches. Review of Financial Studies 22 (1): 435–480.

Pettinicchio, A. 2020. SEC supervisory activity in the financial industry. Journal of Accounting, Auditing and Finance 35 (3): 607–636.

Ren, Z., X. Zhang, and Z. Zhang. 2021. New evidence on COVID-19 and firm performance. Economic Analysis and Policy 72: 213–225.

Roberts, M.R., and T.M. Whited. 2013. Endogeneity in empirical corporate finance1. In Handbook of the economics of finance, vol. 2, 493–572. Armsterdam: Elsevier.

Skała, D. 2021. Loan loss provisions and income smoothing: Do shareholders matter? International Review of Financial Analysis 78: 101909.

Tran, D.V., M.K. Hassan, and R. Houston. 2019. Activity strategies, information asymmetry, and bank opacity. Economic Modelling 83: 160–172.

Vishnani, S., S. Agarwal, R. Agarwalla, and S. Gupta. 2019. Earnings management, capital management and signalling behaviour of Indian banks. Asia-Pacific Financial Markets 26 (3): 285–295.

Wu, Y.C., W.K. Ting, W.M. Lu, M. Nourani, and Q. L. Kweh. 2016. The impact of earnings management on the performance of ASEAN banks. Economic Modelling 53: 156–165.

Wu, J., et al. 2021. Economic uncertainty or financial uncertainty? An empirical analysis of bank risk-taking in Asian emerging markets. Finance Research Letters 39: 101542.

Zhang, H., and Z. Hu. 2021. How does COVID-19 affect firms’ short-term financial pressure? Evidence from China. Applied Economics Letters 9: 1–7.

Zhang, Y., and M.L. McIntyre. 2021. Discretionary loan loss provisioning and stock trading liquidity. Journal of Banking Regulation 22 (2): 97–111.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Nguyen, TA., Nguyen, P.H., Luu, H.N. et al. Bank provisioning practice during the pandemic: evidence from the COVID-19 outbreak. Int J Discl Gov 20, 248–260 (2023). https://doi.org/10.1057/s41310-022-00169-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41310-022-00169-x