Abstract

We present a model of bank risk taking and government guarantees. Levered banks take excessive risk as their actions are not fully priced at the margin by debt holders. The impact of government guarantees on bank risk taking depends critically on the portion of bank investors that can observe bank behavior and hence price debt at the margin. Greater guarantees increase risk taking (moral hazard) when informed investors hold a sufficiently large fraction of liabilities. But, otherwise, they reduce risk taking by increasing the profits of the bank (franchise value effect). The results extend to the case in which information disclosure and, thus, the portion of informed investors is endogenous but costly. The model also shows that, when bank capital is endogenous, public guarantees lead unequivocally to an increase in bank leverage and an associated increase in risk taking. The analysis points to a complex relationship between prudential policy and the institutional framework governing bank resolution and bailouts.

Similar content being viewed by others

Notes

This is equivalent to saying that for the fraction \(\theta \) of debt holders, bank portfolio risk is contractible, so that the pricing of their debt claim can be made contingent on the bank’s choice of risk. Instead, for other debt holders, the pricing of their claims cannot be made explicitly contingent on the bank’s chosen level of risk, even if the risk is correctly priced in equilibrium.

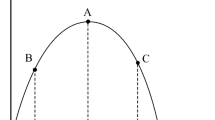

Equivalently, the framework can be seen as a portfolio choice problem for the bank: The bank chooses a portfolio on the efficient frontier that repays \(R-\frac{c}{2}q\) with probability q and thus must trade off greater returns with greater risk.

Since investors are all risk-neutral, there is no risk premium associated with equity and hence \(r_{E}\) needs not be affected by leverage changes within the bank. Nevertheless, \(r_{E}\) may be strictly greater than \(\overline{r}\) to the extent that banks face difficulties in raising capital due to asymmetric information, issuance costs, dilution of existing shareholders, etc.

For instance, imagine that at stage 0 the bank sells a portion \(1-\theta \) of its debt to investors. At stage 1, the bank chooses q, which is observed by all agents. At stage 2, the bank sells the remaining portion \(\theta \) of debt. And finally, at stage 3 projects are realized. It is immediate to see that the equations describing the pricing of the two portions of bank debt would be identical to what we have in our model.

This condition is, of course, only a sufficient one, and a solution may exist even under weaker conditions.

It would, however, reduce the burden on the deposit insurance fund.

Note that under the alternative assumption that “opaqueness” is costly, this would not happen. In this model, banks benefit from transparency as it allows them to reduce the cost of their liabilities. Hence, if disclosure were free, banks would choose full information disclosure irrespective of expectations of government bailouts.

One could also imagine that investors/depositors can make investments in information acquisition about the bank, or in monitoring the bank, and such decisions may well interact with the bank’s decision of how transparent to make its balance sheet. We abstract from such considerations here, in order to focus purely on the bank’s incentives to both disclose and monitor its portfolio.

Remember that, from (A.1), \(c>R\).

Min (2015) provides a comprehensive discussion of market discipline and its failures.

Because it occurs in the same asset classes and thus does not affect the CAR.

References

Acharya, Viral, and Tanju Yorulmazer. 2007. Too Many to Fail: An Analysis of Time Inconsistency in Bank Closure Policies. Journal of Financial Intermediation 16 (1): 1–31.

Allen, Franklin, Elena Carletti, Itay Goldstein and Agnese Leonello. 2013. Government Guarantees and Financial Stability. Working Paper, University of Pennsylvania.

Allen, Franklin, Elena Carletti, and Robert Marquez. 2011. Credit Market Competition and Capital Regulation. Review of Financial Studies 24 (4): 983–1018.

Berger, Allen N., et al. 2016a. Bank Liquidity Creation Following Regulatory Interventions and Capital Support. Journal of Financial Intermediation 26: 115–141.

Berger, Allen N., Raluca A. Roman, and John Sedunov. 2016. “Do Bank Bailouts Reduce or Increase Systemic Risk? The Effects of TARP on Financial System Stability,” The Federal Reserve Bank of Kansas City Research Working Paper 16-08.

Baer, Herbert, and Elijah Brewer. 1986. Uninsured Deposits as a Source of Market Discipline: Some New Evidence. Economic Perspectives 10 (5): 23–31.

Beirne, John, and Marcel Fratzscher. 2013. The Pricing of Sovereign Risk and Contagion During the European Sovereign Debt Crisis. Journal of International Money and Finance 34: 60–82.

Bianchi, Javier. 2012. “Efficient Bailouts?”, NBER Working Paper 18587.

BIS [Bank for International Settlements]. 2010. “Basel III: A Global Regulatory Framework for More Resilient Banks and Banking Systems,” http://www.bis.org/publ/bcbs189.htm.

Bliss, Robert R., and Mark J. Flannery. 2002. Market Discipline in the Governance of US Bank Holding Companies: Monitoring Versus Influencing. European Finance Review 6 (3): 361–396.

Bliss, Robert R., 2004. “Market Discipline: Players, Processes, and Purposes,” Market Discipline Across Countries and Industries, ed. W. Hunter, G. Kaufman, C. Borio, and K. Tsatsaronis, MIT Press, Boston, 37–53.

Calormiris, Charles W., and Berry Wilson. 1998. Bank Capital and Portfolio Management: The 1930’s Capital Crunch and Scramble to Shed Risk. No. w6649. National Bureau of Economic Research.

Cordella, Tito, Giovanni Dell’Ariccia, and Robert Marquez. 2017. “Government Guarantees, Transparency, and Bank Risk-Taking”, World Bank Policy Research Working Paper 7971.

Cordella, Tito, and Eduardo Levy Yeyati. 2002. Financial Opening, Deposit Insurance, and Risk in a Model of Banking Competition. European Economic Review 46 (3): 471–485.

Cordella, Tito, and Eduardo Levy Yeyati. 2003. Bank Bailouts: Moral Hazard vs. Value Effect. Journal of Financial Intermediation 12 (4): 300–30.

Corsetti, Giancarlo, Bernardo Guimaraes, and Nouriel Roubini. 2006. International Lending of Last Resort and Moral Hazard: A Model of IMF’s Catalytic Finance. Journal of Monetary Economics 53 (3): 441–471.

Dam, Lammertjan, and Michael Koetter. 2012. Bank Bailouts and Moral Hazard: Evidence from Germany. Review of Financial Studies 25 (8): 2343–2380.

Dell’Ariccia, Giovanni, and Robert Marquez. 2006. Lending Booms and Lending Standards. Journal of Finance 61 (5): 2511–2546.

Dell’Ariccia, Giovanni, and Lev Ratnovski. 2013. “Bailouts and Systemic Insurance” IMF Working Paper No. 13/233.

Dell’Ariccia, Giovanni, Luc Laeven and Robert Marquez. 2014. “Real Interest Rates, Leverage, and Bank Risk-Taking,” Journal of Economic Theory.

Dell’Ariccia, Giovanni, Caio Ferreira, Nigel Jenkinson, Luc Laeven, Camelia Minoiu, Alberto Martin, and Alex Popov. 2017. “Managing the Sovereign-Bank Nexus,” unpublished manuscript, IMF.

Demirgüç-Kunt, Asli, and Harry Huizinga. 2004. Market Discipline and Deposit Insurance. Journal of Monetary Economics 51 (2): 375–399.

Dornbusch, Rudiger. 1999. “Commentary: Monetary Policy and Asset Market Volatility” Federal Reserve Bank of Kansas City, Proceedings - Economic Policy Symposium - Jackson Hole, pp. 129-135.

Duchin, Ran, and Denis Sosyura. 2014. Safer Ratios, Riskier Portfolios: Banks’ Response to Government Aid. Journal of Financial Economics 113 (1): 1–28.

Farhi, Emmanuel, and Jean Tirole. 2012. Collective Moral Hazard, Maturity Mismatch, and Systemic Bailouts. American Economic Review 102 (1): 60–93.

Flannery, Mark J., and Sorin M. Sorescu. 1996. Evidence of Bank Market Discipline in Subordinated Debenture Yields: 1983–1991. Journal of Finance 51 (4): 1347–1377.

Freixas, Xavier, and Christian Laux. 2012. “Disclosure, Transparency, and Market Discipline,” in Dewatripont, M and X Freixas (eds), The Crisis Aftermath: New Regulatory Paradigms, London: Centre for Economic Policy Research, 69–104.

Goldberg, Lawrence G., and Sylvia C. Hudgins. 1996. Response of Uninsured Depositors to Impending S&L Failures: Evidence of Depositor Discipline. The Quarterly Review of Economics and Finance 36 (3): 311–325.

Gropp, Reint, Christian Gruendl, and Andre Guettler. 2013. The Impact of Public Guarantees on Bank Risk-taking: Evidence from a Natural Experiment. Review of Finance 18 (2): 457–488.

Hadad, Muliaman D., et al. 2011. Market Discipline, Financial Crisis and Regulatory Changes: Evidence from Indonesian Banks. Journal of Banking & Finance 35 (6): 1552–1562.

Hellman, Thomas, Kevin Murdoch, and Joseph Stiglitz. 2000. Liberalization, Moral Hazard in Banking, and Prudential Regulation: Are Capital Requirements Enough? American Economic Review 90: 147–165.

Laeven, Luc and Fabian Valencia. 2010. “Resolution of Banking Crises: The Good, the Bad, and the Ugly,” IMF Working Paper No. 10/146.

Matutes, Carmen, and Xavier Vives. 2000. Imperfect Competition, Risk Taking, and Regulation in Banking. European Economic Review 44: 1–34.

Martinez Peria, Maria Soledad, and Sergio L. Schmukler. 2001. Do Depositors Punish Banks for Bad Behavior? Market Discipline, Deposit Insurance, and Banking Crises. Journal of Finance 56 (3): 1029–1051.

Min, David. 2015. “Understanding the Failure of Market Discipline,” Washington University Law Review 92.6.

Morgan, Don. 2002. “Rating Banks: Risk and Uncertainty in an Opaque Industry,” American Economic Review 92, Sept. pp. 874–888.

Schenck, Natalya A., and John H. Thornton Jr. 2016. Charter Values, Bailouts and Moral Hazard in Banking. Journal of Regulatory Economics 49 (2): 172–202.

Stephanou, Constantinos. 2010. “Rethinking Market Discipline in Banking: Lessons from the Financial Crisis,” World Bank Policy Research Working Paper Series 5227.

Author information

Authors and Affiliations

Corresponding author

Additional information

The views expressed in this paper are those of the authors and do not necessarily represent those of the IMF the World Bank or their Executive Boards. The authors would like to thank Oliver Masetti, Patricia Mosser, Pau Rabanal, Damiano Sandri, and two anonimous reviewers for useful comments. Tito Cordella is an Adviser at The World Bank (Development Economics), Giovanni Dell’Ariccia is Deputy Director of the Research Department at the IMF. Robert Marquez is a Professor of Finance at the University of California, Davis.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix: Proofs

Appendix: Proofs

1.1 Proposition 1

Proof

Differentiating (5) with respect to \(\gamma \), we have that

with \(\Phi \equiv \sqrt{\left( R-\gamma (1-k)r\right) ^{2}-4cr\left( 1-\gamma \right) \left( 1-\theta \right) \left( 1-k\right) }\ge 0\). At \(\theta =0\),

which is positive when parameters are such that q admits an internal solution so that (16) is always positive. At \(\theta =1\), (A.1), instead, implies that (16) is always negative. Thus, to complete the proof, it is enough to show that \(\frac{\partial ^{2}q^{*}}{\partial \theta \partial \gamma }<0\). Differentiating (16) with respect to \(\gamma \), we obtain:

with

To show that \(\frac{\partial ^{2}q^{*}}{\partial \theta \partial \gamma }<0,\) it is enough to show that \(\Psi >0\). Since \(\Psi \) is a linear function of \(\gamma \), to prove that it is positive for any \(\gamma \), it is enough to show that it is positive at \(\gamma =0\), and \(\gamma =1\) (for any k and \(\theta \)). When \(\gamma =0\), we have that

Since (19) is an increasing function of k and \(\theta \), if we know that if it is positive at \(k=0\) and \(\theta =0\), then it is positive for all k and \(\theta \). We thus have that

However, since from (A.1), we know that \(R<c\) a sufficient condition for the inequality to hold is that

or

which is always satisfied if (A.1) holds. This, in turn, implies that a single \(\widehat{\theta }\in (0,1)\) exists such that \(\frac{\partial q^{*} }{\partial \gamma }>0\), if \(\theta<\) \(\widehat{\theta }\); and \(\frac{\partial q^{*}}{\partial \gamma }<0\), if \(\theta >\widehat{\theta }\). \(\square \)

1.2 Lemma 1

Proof

Define

Note that

where \(\frac{\hbox {d}H}{\hbox {d}\theta }<0\) from the second-order conditions. Then, we have that \(\frac{\hbox {d}\theta }{\hbox {d}\gamma }\) will have the same sign as \(\frac{\hbox {d}H}{\hbox {d}\gamma } \). We can write:

where \(A=q\sqrt{\left( R-\gamma (1-k)\overline{r}\right) ^{2}-4c\overline{r}\left( 1-\gamma \right) \left( 1-\theta \right) \left( 1-k\right) }.\) Now:

which, after substituting, gives us

So \(\frac{\hbox {d}H}{\hbox {d}\gamma }\) will have the opposite sign of

expression that we can rewrite as

The first term is just \(A^{2}/q>0.\) A sufficient condition for the second term to be positive is that \(R>2r\), which is always verified from our other restrictions. It follows that \(B>0\) and that \(\frac{\hbox {d}H}{\hbox {d}\gamma }<0\), which, in turn, implies that \(\frac{\hbox {d}\theta }{\hbox {d}\gamma }<0.\) \(\square \)

1.3 Proposition 2

Proof

From (5), we have that

Let now define \(\overline{\theta }\) as the value of \(\theta \) such that \(q_{0}^{*}=q_{1}^{*}\), or

which gives

The first-order condition of (7) with respect to \(\theta \) can be written as

and, using (5):

When \(\gamma =0\), the expression becomes:

If now we substitute \(\overline{\theta }\) from (24) into (27), we obtain:

However, at \(\theta =\overline{\theta }\), \(q_{0}^{*}=q_{1}^{*} =\frac{R-(1-k)r}{c}\) so that we can rewrite (28) as

Solving for \(\varphi \), we obtain

Notice that, by construction, \(\overline{\varphi }\) is the cost of transparency such that, after having chosen \(\theta \) optimally, the bank chooses the same portfolio riskiness when its deposit are fully insured (\(\gamma =1\)) and when they are not (\(\gamma =0\)). Formally, this means \(\widehat{\theta }\left( \overline{\varphi }\right) =\) \(\overline{\theta }.\) Now, note that \(q_{1} ^{*}\) is invariant in \(\theta ,\) but \(\frac{\partial q_{0}^{*}}{\partial \theta }>0.\) Then, since from (24), \(\frac{\partial \widehat{\theta }}{\partial \varphi }>0,\) we have that \(q_{0}^{*}>q_{1}^{*}\Longleftrightarrow \varphi <\overline{\varphi }\). Finally, numerical simulations indicate that \(\max \limits _{\gamma }q^{*}\left( \gamma \right) \) never admits an interior solution, so that \(\arg \max \limits _{\gamma }q^{*}\left( \gamma \right) \in \left\{ 0,1\right\} \). (See Cordella et al. 2017 for numerical examples.) \(\square \)

1.4 Proposition 3

Proof

From 5, it is immediate that \(\frac{\partial q}{\partial k}>0\) (k enters always with a positive sign, actually two negative signs) and \(\frac{\partial ^{2}q}{\partial k\partial \theta }<0.\) It follows that

since \(\frac{{\text {d}}^{2}\Pi }{{\text{d}}k^{2}}<0\) from the second-order conditions. Note that for \(\theta =1,\) we have

and the first-order conditions for k can never be satisfied. Then, the model will only admit a corner solution with \(\widehat{k}=0.\) \(\square \)

1.5 Proposition 4

Proof

From 15, we have that \(\frac{\partial ^{2}\Pi }{\partial k\partial \gamma }<0,\) which, together with the second-order conditions with respect to k, implies that

that is, as government guarantees increase, banks find it optimal to reduce their capitalization (increase their leverage). \(\square \)