The natural rate is an abstraction; like faith, it is seen by its works. Williams (1931)

There is a certain rate of interest on loans which is neutral in respect to commodity prices […] This is necessarily the same as the rate which would be determined by supply and demand if no use were made of money. Wicksell (1898)

Abstract

We use a semi-structural model to estimate neutral rates in the United States. Our Bayesian estimation incorporates prior information on the output gap and potential output (based on a production function approach) and accounts for unconventional monetary policies using estimates of “shadow” policy rates. Results show a significant trend decline in the neutral real rate post-1990s, driven only in part by a decline in trend growth, whereas other factors (including excess global savings and risk premia) matter. Neutral rates likely turned negative during the global financial crisis and are expected to increase only gradually looking forward.

Similar content being viewed by others

Notes

As we will see, by introducing the shadow fed funds rate we try to capture the broader monetary policy stance that includes unconventional monetary policies.

Moreover, neutral rates derived from DSGE models also tend to show more variability than is commonly attributed to neutral rates by policy makers.

Kiley (2015) has recently used a similar approach.

To account for the sensitivity to specific modeling assumptions involved in the construction of shadow policy rates, we take an average of shadow rates from three studies that employ different methods to estimate shadow rates. Lombardi and Zhu (2014) construct a model-free, dynamic factor model-based estimate using several indicators related to monetary policy stance (such as interest rates, monetary aggregates, and components of the Federal Reserves balance sheet). Both Krippner (2013) and Wu and Xia (2014) use a dynamic term structure model that relaxes the ZLB constraint and thus obtains policy rates that account for the compression of term premia in longer term rates attributable to Federal Reserve asset purchases and allow the policy interest rate to be negative. While the results vary across models, all models point to strongly negative shadow policy rates during the GFC, averaging about minus two percent at the end of 2014 (Figure A2).

The real rate and oil and import price inflation are taken as exogenous.

When the real policy rate is equal to the neutral rate at all times, in the absence of transitory disturbances, the output gap is expected to be closed and inflation stable.

Rather than attempting to construct a more complex model, these variables are introduced exogenously within the basic structure of model. While this approach has obvious shortcomings, it retains the simplicity of and minimizes departures from the original Laubach and Williams (2003) model.

The CBO output gap is appealing because it is constructed using the production function approach instead of a filtering exercise that is similar in nature to the one performed here. At the same time, however, the production function approach has various drawbacks (e.g., it relies on assumptions about factor shares and the potential growth rates of TFP, capital, and labor that are subject to large uncertainty) which refrain us from using it as an exact measure of the output gap.

We use a 1-year burn-in period, hence the likelihood is evaluated between 1984:3 and 2015:4, where 1984:3 is usually identified as the start of the great moderation—a period of reduced coefficient instability in the Phillips curve and in the standard deviations of the shocks.

The EMDE group includes major oil exporters.

Since we use a diffuse prior for initializing the Kalman filter, the parameters c and \(z_0\) are weakly identified.

Prior parameters are such that noise (\(\mu +\epsilon ^m\)) has an unconditional standard deviation of about 1.75.

To draw a posterior sample, we have used 2 chains of 250k draws generated using a Random Walk Metropolis–Hastings algorithm. We discard the initial 50,000 and follow Benati’s (2008) approach to obtain a scale for the jumping distribution which yields an acceptance rate of around 0.23. Sample convergence tests and posterior plots are available upon request to the authors. The estimation has been performed using Dynare 4.4.3.

Plots of the likelihood function confirm that the likelihood is quite flat in c.

We select the Jurado, Ludvigson, and Ng (2015) financial uncertainty measure as the measure with the highest Bayes factor (BF) among the three candidates.

We fix the passthrough from oil and import prices in the Phillips curve to core to reasonable values. Their estimates are not precise and it is possible that their coefficients have changed over time, especially for oil.

The instability and weak identification of the estimates of the original Laubach and Williams model have been first documented by Clark and Kozicki (2005).

The output gap sensitivity to the interest rate gap, \(a_r\), is slightly lower when we use the shadow policy rate. This result, though not significant, would be consistent with monetary policy’s effectiveness being constrained, to some extent, by the zero lower bound.

The use of forecasts is also useful to mitigate the end-point problem of two-sided filters as shown in Mise, Kim, and Newbold (2005).

Hamilton, Harris, Hatzius, and West (2015) estimates are based on moving averages that span business cycles and thus refer to a different neutral rate concept.

The difference between in-sample and extended-sample estimates is negligible, suggesting that the end-point problem may not be particularly relevant in the current context.

The “shadow” neutral rate is also estimated to increase in line with the gradual normalization in policy interest rates and the Federal Reserves balance sheet over time. However, the shadow neutral rate remains below the neutral rate based on observed real rates.

A (0, 1) uniform distribution creates a boundary problem. Also, we shut off \(\epsilon _{r,t}\) to improve the precision of the estimation of \(\omega\).

The Laubach and Williams’ methodology is described in their paper (Laubach and Williams 2003); the estimates are available at http://www.frbsf.org/economicresearch/economists/john-williams/Laubach_Williams_updated_estimates.xlsx. The sample period used is 1961Q1-2016Q1, and we restrict the attention to our sample period.

References

An, S. and F. Schorfheide, 2007, “Bayesian Analysis of DSGE Models,” Econometric Reviews, Vol. 26, No. 2–4, pp. 113–72.

Baker, S., N. Bloom, and S. Davis, 2013, “Measuring Economic Policy Uncertainty,” Stanford University Working Paper.

Barsky, R., A. Justiniano, and L. Melosi, 2014, “The Natural Rate and Its Usefulness for Monetary Policy Making,” American Economic Review Papers and Proceedings, Vol. 104, No. 7, pp. 37–43.

Bean, C., C. Broda, T. Ito, and R. Kroszner, 2015, “Low for Long? Causes and Consequences of Persistently Low Interest Rates,” ICMB Geneva Report 17.

Benati, L., 2008, “Investigating Inflation Persistence Across Monetary Regimes.” The Quarterly Journal of Economics, Vol. 123, No. 3, pp. 1005–60.

Blanchard O., D. Furceri, and A. Pescatori, 2014, “A Prolonged Period of Low Real Interest Rates?” in Secular Stagnation: Facts, Causes and Cures, ed. by C. Teulings, and R. Baldwin, VoxEu Aug 2014.

CBO, 2001, “CBO’s Method for Estimating Potential Output: An Update,” Congressional Budget Office, Washington, DC.

CBO, 2014, “The 2014 Long-Term Budget Outlook,” July 2014.

Clark, T. E., and S. Kozicki, 2005, “Estimating Equilibrium Real Interest Rates in Real Time,” North American Journal of Economics and Finance, Vol. 16, No. 3, pp. 395–413.

Curdia, V., A. Ferrero, G. Ng, and A. Tambalotti, 2015, “Has U.S. Monetary Policy Tracked the Efficient Interest Rate?,” Journal of Monetary Economics, Vol. 70, pp. 72–83.

Duarte, F., and C. Rosa, 2015, “The Equity Risk Premium: A Review of Models,” New York Federal Reserve Staff Report.

Eggertson, G., and N. Mehrotra, 2014. “A Model of Secular Stagnation,” NBER working paper 20574.

Engen, E., T. Laubach, and D. Reifschneider, 2015, “The Macroeconomic Effects of the Federal Reserve’s Unconventional Monetary Policies,” Finance and Economic Discussion Series 005.

Fernald, J., 2014, “Productivity and Potential Output Before, During and After the Greater Recession,” Federal Reserve Bank of San Francisco Working Paper 2014–2015.

Giammarioli, N., and N. Valla, 2004, “The Natural Real Interest Rate and Monetary Policy: A Review,” Journal of Policy Modelling, Vol. 26, No. 5, pp. 641–60.

Hamilton, J., E. Harris, J. Hatzius, and K. West, 2015, “The Equilibrium Real Funds Rate: Past, Present and Future.”

Iacoviello, M., and S. Neri, 2010, “Housing Market Spillovers: Evidence from an Estimated DSGE Model,” American Economic Journal: Macroeconomics, Vol. 2, No. 2, pp. 125–64.

International Monetary Fund, 2014, World Economic Outlook, April.

Jurado, K., S. C. Ludvigson, and S. Ng, 2015, “Measuring Uncertainty,” American Economic Review, Vol. 105, No. 3, pp. 1177–216.

Kiley, M., 2015, “What Can the Data Tell Us About the Equilibrium Real Interest Rate?,” 2015–77, Board of Governors of the Federal Reserve System (U.S.).

Krippner, L., 2013, “Measuring the Stance of Monetary Policy in ZLB Environments,” Economics Letters, Vol. 118, No. 1, pp. 135–38.

Laubach, T. and J. Williams, 2003, “Measuring the natural Rate of Interest,” Review of Economics and Statistics, Vol. 85, No. 4, pp. 1063–70.

Laubach, T. and J. Williams, 2016, “Measuring the Natural Rate of Interest Redux,” Federal Reserve Board, Washington, DC.

Lombardi, M. and V. Zhu, 2014, “A Shadow Policy Rate to Calibrate U.S. Monetary Policy at the ZLB,” BIS Working Paper 452.

Mise, E., T.-H. Kim, and P. Newbold, 2005, ”On Suboptimality of the Hodrick–Prescott Filter at Time Series Endpoints,” Journal of Macroeconomics, Vol. 27, No. 1, pp. 53–67.

Orphanides, A., and Williams, J., 2002, “Robust Monetary Policy Rules with Unknown Natural Rates,” Brookings Papers on Economic Activity, Vol. 2, pp. 63–145.

Pescatori, A., and J. Turunen, 2015. “Lower for Longer: Neutral Rates in the U.S.,” IMF Working Paper 15/135.

Rudebusch, G. and L. Svensson, 1999. “Policy Rules for Inflation targeting,” in Monetary Policy Rules, ed. by J. Taylor, Chicago: Chicago University Press.

Stock, J., and M. , 1998, “Median Unbiased Estimation of Coefficient Variance in a Time-Varying Parameter Model,” Journal of the American Statistical Association, Vol. 93, No. 441, pp. 349–58.

Trehan, B., and T. Wu, 2007, “Time-Varying Equilibrium Real Rates and Monetary Policy Analysis,” Journal of Economic Dynamics and Control, Vol. 31, No. 5, pp. 1584–609.

Williams, J. H., 1931, “The Monetary Doctrines of J. M. Keynes,” Quarterly Journal of Economics, Vol. 45, No. 4, pp. 547–87.

Williams, J., 2015, “The Decline in the Natural Rate of Interest.” Manuscript, March.

Wicksell, K., 1898, “The Influence of the Rate of Interest on Commodity Prices,” reprinted in Lindahl, E. ed., 1958, Selected Papers on Economic Theory by Knut Wicksell.

Wu, J., and F. Xia, 2014, “Measuring the Macroeconomic impact of Monetary Policy at the ZLB,” NBER Working Paper 20117.

Author information

Authors and Affiliations

Corresponding author

Additional information

*Andrea Pescatori is a senior economist on the U.S. desk of the IMF’s Western Hemisphere Department. He has published extensively in peer-reviewed journals on a wide range of topics including monetary and fiscal policy. Previously to joining the IMF he was an economist at the Federal Reserve Bank of Cleveland and at the Board of Governors of the Federal Reserve System. Andrea Pescatori received his Ph.D. in economics from Universitat Pompeu Fabra.

Jarkko Turunen is a Senior Economist and Mission Chief in the Western Hemisphere Department of the IMF. He was previously in the IMF’s Strategy, Policy, and Review Department, working on crisis countries and various policy issues, including program conditionality, international trade, and jobs and growth. Before joining the Fund, he was a Principal Economist at the European Central Bank and holds a Ph.D. in Economics from the European University Institute.

Andrea Pescatori: International Monetary Fund, 700 19th St, NW, Washington, DC 20431 (email: apescatori@imf.org). Jarkko Turunen (corresponding author): International Monetary Fund, 700 19th St, NW, Washington, DC 20431 (email: jturunen@imf.org). The views expressed in this paper are solely the responsibility of the authors and should not be interpreted as reflecting the views of the International Monetary Fund, its executive board, or its management. We would like to thank the editor, two referees, our discussant S. Neri, participants at the EUI/CEPR/IMF conference on Secular Stagnation, Growth and Real Interest Rates in Fiesole, as well as seminar participants at the Federal Reserve Board of Governors, the 2015 Canadian Economics Association, S. Gnocchi, and J. Dorich for useful comments.

Appendices

Appendix A

Data Definitions

Two endogenous variables are observable, core PCE inflation and log-GDP, while other observable variables are treated as exogenous processes: real federal funds rate (deflated using one-year-ahead inflation expectations), the oil and import price inflation, the emerging market and developing economies (EMDE) current account balance as a share of U.S. GDP, the equity premium, and a measure of economic uncertainty (Figure A1). Projections are taken from the IMF’s World Economic Outlook (WEO) unless otherwise stated.

-

Real GDP (y): \(100\ln (RGDP)\), where RGDP is real GDP SAAR, Billions of Chained 2009 dollars. WEO projections.

-

Core inflation (\(\pi\)): \(400*\ln (P_t/P_{t-1})\), where P is PCE less Food and Energy Chain Price Index (SA, 2009 = 100). WEO projections.

-

Oil relative price inflation (\(\pi ^o = 400\ln (P_t/P_{t-1})-\pi\)), where P is Petroleum & Products Imports Price Index (SA, 2009 = 100); \(\pi ^o\) is assumed to equal zero for the projection period.

-

Import (ex-oil) relative price inflation (\(\pi ^i = 400\ln (P_t/P_{t-1})-\pi\)), where P is Non-petroleum Goods Imports: Chain Price Index (SA, 2009 = 100); \(\pi ^i\) is assumed to equal zero for the projection period.

-

Federal funds rate (ff): Effective Federal Funds Rate (percentage p.a.). WEO projections.

-

Real federal funds rate (\(r = {\mathrm{ff}}-E[\pi ]\)) ,where \(E[\pi ]\) is the median 1-year-ahead CPI Inflation Expectation (percent) from Survey of Professional Forecasters. It is assumed to equal latest value for the projection period.

-

Shadow federal funds rate: simple average of estimates found in Krippner (2013), Lombardi and Zhu (2014), and Wu and Xia (2014). Shadow rates are projected to normalize (i.e., approach projected policy interest rates) gradually over the projection horizon (Figure A2).

-

Potential output (based on CBO, 2001).

-

EMDE current account balance (USD) as a share of U.S. current-dollar GDP. WEO projections.

-

Uncertainty indices: policy uncertainty index by Baker, Bloom, and Davis (2013) (http://www.policyuncertainty.com/), and macroeconomic and financial uncertainty by Jurado, Ludvigson, and Ng (2015).

-

Equity risk premium. Principal component derived from several models. Source: Duarte and Rosa (2015).

Appendix B

Identification of c

We derive the smoothed estimates of the state vector setting all parameters at their prior mean and then setting the link between the neutral rate and trend growth to a higher value (\(c=2\)). The exercise shows that a higher value of c is substantially offset by a lower \(z_0\) leaving trend growth and output gap unaffected. This result holds qualitatively regardless of using additional information from the CBO output gap (Figure A3).

Weak Identification of c and \(z_0\)

Note: Smoothed estimates of the state vector when all parameters are at their prior mean (dark solid line) and when c = 2 (light dashed line). The parameters governing the signal from the CBO output gap are at their posterior mean. Qualitatively the same result holds when the output gap is not observable. All three z-controls have been set to 0.

Appendix C

Alternative Policy Rate Specification

Here we assume that the (real) policy rate is a convex combination of the (real) fed fund rate and the (real) shadow rate

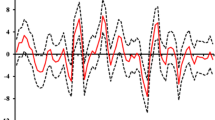

where \(\epsilon _{r,t}\) is an i.i.d. noise with standard deviation \(\sigma _r,\) while \(r_{{\mathrm{ff}},t}\) and \(r_{{\mathrm{sf}},t}\) are treated as exogenous in the model. We set a Beta prior with mean 0.5 and standard deviation 0.25 on \(\omega\).Footnote 25 The posterior estimates of \(\omega\) (mean, mode, median) are between 0.5 and 0.6 but have a large HDP interval (between 0.1 and 0.9). The coefficient \(a_r\) is lower than in the baseline estimates. Qualitatively, the results are not changed; however, it is interesting to note the substantial uncertainty around the estimates of the (real) policy rate itself in the aftermath of the GFC (Figure A4).

Alternative Policy Rate Specification

Note: Smoothed estimates of the state vector based on the alternative specification in Appendix C. The (real) policy rate is a convex combination of the (real) federal funds rate and and (real) shadow rate. Dashed lines represent the 10th and 90th percentile of the posterior’s credible region.

Appendix D

Comparison with Laubach and Williams

Figure A5 compares the estimated smoothed output gap, trend growth g, neutral rate, and z-process under the baseline estimation (using posterior median estimates) with the estimates obtained using the updated version of Laubach and Williams (2003) (LW).Footnote 26 The LW’s approach implies a very smooth estimate of trend growth which, in turn, translates into a very gradual decline in the neutral rate over the last 15 years. The positive output gap is, instead, determined by a series of sizeable negative temporary shocks, \(\epsilon ^n\), to potential output growth. Indeed, LW’s estimates, implicitly, portrait the GFC as a mild fall in excess aggregate demand followed by a quick recovery.

Comparison with Laubach and Williams’ Results

Note: Baseline posterior mediam inference vs. Laubach and Williams (2003)'s estimates“LW” from http://www.frbsf.org/economicresearch/economists/johnwilliams_Laubach_Williams_updated_estimates.xlsx. “CBO” is the CBO output gap.