Abstract

The financialisation of advanced economies has developed in part through the widespread engagement of workers with the financial sector, specifically through the increasing adoption of household debt. Taking on debt establishes “investor identities” for borrowers, which disciplines borrowers to demand employment and marginalises worker bargaining power. Although increased levels of household debt have been linked with a declining wage share of national income, there has been little examination of the effects of the specific channel of mortgage credit, the largest source of household debt, on the wage share. A series of regression models were implemented to test the relationship between the total mortgage stock and the wage share of GDP in four different countries, across three different Varieties of Residential Capitalism. While the panel data results demonstrate a negative relationship between mortgage credit and the wage share across the typologies, the relationship is concentrated in the liberal markets of the UK and the USA, and does not hold independently in Sweden and Denmark. There are four important differences that may explain the divergent results: (1) mortgages in liberal markets are provided at a higher cost than in non-liberal markets; (2) the use of mortgage bonds in non-liberal markets facilitates renegotiations in periods of borrower uncertainty; (3) the level of collective bargaining in Social Democratic states may strengthen worker wage negotiations; and (4) workers in liberal markets are reliant on mortgage finance to access the home as a financial asset in systems of asset-based welfare. The combination of which may explain how the increased disciplinary effects of mortgage finance have resulted in the reproduction of the conditions for capital accumulation in liberal capitalist states.

Similar content being viewed by others

References

Aalbers, M.B. (2008) The financialization of home and the mortgage market crisis. Competition & Change 12: 148–166.

Abiad, A.G., Detragiache, E. and Tressel, T. (2008) A New Database of Financial Reforms. IMF Working Papers. Vol.08/266. Washington, D.C.: International Monetary Fund.

Abildgren, K. (2012) Financial structures and the real effects of credit-supply shocks in Denmark 1922–2011. European Review of Economic History 16: 490–510.

Achen, C. H. (2002) Toward a new political methodology: Microfoundations and ART. Annual Review of Political Science 5: 423–450.

AMECO 2015. Annual macro-economic database. European Commission’s Directorate General for Economic and Financial Affairs.

Ansell, B. (2014) The political economy of ownership: Housing markets and the welfare state. American Political Science Review 108: 383–402.

Aron, J. and Muellbauer, J. (2010) Modelling and forecasting UK mortgage arrears and possessions. Department of Economics Discussion Paper Series (Ref: 499). University of Oxford.

Barba, A. and Pivetti, M. (2009) Rising household debt: Its causes and macroeconomic implications—A long-period analysis. Cambridge Journal of Economics 33: 113–137.

Beck, N. and Katz, J. N. (1995) What to do (and not to do) with time-series cross-section data. American Political Science Review 89: 634–647.

Belsley, D.A., Kuh, E. and Welsch, R.E. (1980) Regression Diagnostics: Identifying Influential Data and Sources of Collinearity, New York; Chichester, Wiley.

Bengtsson, E. and Ryner, M. (2015) The (international) political economy of falling wage shares: Situating working-class agency. New Political Economy 20: 406–430.

Castles, F. G. (1998) The really big trade-off: Home ownership and the welfare state in the new world and the old. Acta Politica 33: 5–19.

Castles, F. G. 2005. The Kemeny thesis revisited. Housing, Theory and Society 22: 84–86.

Chernick, M. R. (2008) Bootstrap Methods : A Guide for Practitioners And Researcers. Hoboken, N.J., Wiley; Chichester: Wiley [distributor].

Clark, K. A. and Hyson, R. (2000) Measuring the demand for labor in the United States: The job openings and labor turnover survey. Bureau of Labor Statistics.

Clarke, S. (1990) The Marxist theory of overaccumulation and crisis. Science & Society 54: 442–467.

Council of Mortgage Lenders. (1997) Compendium of Housing Finance Statistics, Council of Mortgage Lenders.

Council of Mortgage Lenders. 2015. Mortgage arrears and repossessions continue to fall in second quarter [Online]. Council of Mortgage Lenders. Available: https://www.cml.org.uk/news/press-releases/mortgage-arrears-and-repossessions-continue-to-fall-in-second/ [Accessed 18/04 2016].

Dana, J. and Dawes, R. M. (2004) The superiority of simple alternatives to regression for social science predictions. Journal of Educational and Behavioral Statistics 29: 317–331.

Diamond, D. W. & Rajan, R. (2009) The credit crisis: Conjectures about causes and remedies. National Bureau of Economic Research.

Doling, J. and Ford, J. (2007) A union of home owners. International Journal of Housing Policy 7: 113–127.

Dünhaupt, P. (2013) Determinants of functional income distribution: theory and empirical evidence. Working Paper No. 18. Geneva: Global Labour University

Duxbury, C. and Gauthier-Villars, D. (2016) Negative Rates Around the World: How One Danish Couple Gets Paid Interest on Their Mortgage [Online]. Wall Street Journal. Available: http://www.wsj.com/articles/the-upside-down-world-of-negative-interest-rates-1460643111?shareToken=ste5035b6f78914085ac35f70e3f4288cb&mod=e2tw [Accessed 20/04 2016].

Ehrenberg, R.G. & Smith, R.S. (2009) Modern Labor Economics: Theory and Public Policy. Boston, Mass.; London, Pearson/Addison-Wesley.

Esping-Andersen, G. (1990) The three worlds of welfare capitalism, Cambridge, Polity.

Federal Reserve Bank of St. Louis (US). (2015) Mortgage Debt Outstanding [Online]. Available: https://research.stlouisfed.org/fred2/series/MDOAH/, [Accessed August 16 2015].

Ford, J., Bretherton, J., Jones, A. & Rhodes, D. (2010) Giving up home ownership: A qualitative study of voluntary possession and selling because of financial difficulties. Centre for Housing Policy, University of York; Department for Communities and Local Government.

Froud, J., Johal, S. and Williams, K. (2002) Financialisation and the coupon pool. Capital & Class 26: 119–151.

Gelman, A. and Hill, J. (2007) Data Analysis Using Regression and Multilevel/Hierarchical Models. Cambridge, Cambridge University Press.

Gemenis, K. (2013) What to do (and not to do) with the comparative manifestos project data. Political Studies, 61: 3–23.

Gross, D. A. and Sigelman, L. (1984) Comparing party systems: A multidimensional approach. Comparative Politics 16: 463–479.

Hall, P. A. & Soskice, D. W. (2001) Varieties of Capitalism: The Institutional Foundations of Comparative Advantage. Oxford: Oxford University Press.

Harrits, G. S., Prieur, A., Rosenlund, L. and Skjott-Larsen, J. 2010. Class and Politics in Denmark: Are both old and new politics structured by class? Scandinavian Political Studies 33: 1–27.

IMF (2014) Recovery Strengthens, Remains Uneven. In: Furceri, D. and Pescatori, A. (eds.) World Economic Outlook. International Monetary Fund.

IMF (2007) The Globalization of Labor. World Economics Outlook April 2007. Washington, DC: IMF.

Kemeny, J. (1980) Home ownership and privatization. International Journal of Urban and Regional Research 4: 372–388.

Kemeny, J. (2005) “The Really Big Trade-Off” between home ownership and welfare: Castles’ evaluation of the 1980 thesis, and a reformulation 25 years on. Housing, Theory and Society 22: 59–75.

Köhler, K., Guschanski, A. and Stockhammer, E. (2015) How does financialisation affect functional income distribution? A theoretical clarification and empirical assessment. Economics Discussion Paper No. 2015-5. Kingston University. Available: http://eprints.kingston.ac.uk/32032/1/2015_005.pdf.

Korpi, W. (2002) The great trough in unemployment: A long-term view of unemployment, inflation, strikes, and the profit/wage ratio. 30: 365–426.

Krueger, A. B. (1999) Measuring labor’s share. The American Economic Review 89: 45–51.

Lakshminaryanan, V., Keith Chen, M. and Santos, L.R. (2008) Endowment effect in capuchin monkeys. Philosophical Transactions of the Royal Society B: Biological Sciences. 363: 3837–3844.

Lane, P.R. and Milesi-Ferretti, G.M. (2007) The external wealth of nations mark II: Revised and extended estimates of foreign assets and liabilities, 1970–2004. Journal of international Economics 73: 223–250.

Langley, P. (2007) Uncertain subjects of Anglo-American financialization. Cultural Critique 65: 67–91.

Langley, P. (2014) Equipping entrepreneurs: Consuming credit and credit scores. Consumption Markets & Culture 17: 448–467.

Lapavitsas, C. (2009) Financialised capitalism: Crisis and financial expropriation. Historical Materialism 17: 114–148.

Laver, M. (2014) Measuring policy positions in political space. Annual Review of Political Science 17: 207–223.

Lazzarato, M. (2012) The Making of the Indebted Man: An Essay on the Neoliberal Condition. Los Angeles, CA: Semiotext(e).

Mann, M. (1988) States, War and Capitalism: Studies in Political Sociology. Oxford: Basil Blackwell.

Marshall, A. (1920) Principles of Economics: An Introductory Volume. London: Macmillan.

Martin, L.W. and Stevenson, R.T. (2010) The conditional impact of incumbency on government formation. American Political Science Review 104: 503–518.

Mawson, P. (2002) Measuring Economic Growth in New Zealand. Working Paper 02/14. New Zealand Treasury.

Milne, R. (2015) Denmark highlights naked truth about negative lending [Online]. The Financial Times. Available: http://www.ft.com/intl/cms/s/0/7f4e2f4c-dde3-11e4-9d29-00144feab7de.html [Accessed 20/04 2016].

Montgomerie, J. and Büdenbender, M. (2015) Round the houses: Homeownership and failures of asset-based welfare in the United Kingdom. New Political Economy 20: 386–405.

Noel, A. D., & Therien, J. P. (2008). Left and Right in Global Politics. Cambridge: Cambridge University Press.

OECD. (2015a) The Labour Share in G20 Economies [Online]. Organisation for Economic Co-operation and Development. Available: http://www.oecd.org/g20/meetings/antalya/The-Labour-Share-in-G20-Economies.pdf [Accessed December 8th 2015].

OECD. (2015b) Level of GDP per capita and productivity [Online]. OECD. Available: http://stats.oecd.org/Index.aspx?DataSetCode=PDB_LV# [Accessed December 9th 2015].

Plümper, T., Troeger, V. E. and Manow, P. (2005) Panel data analysis in comparative politics: Linking method to theory. European Journal of Political Research 44: 327–354.

Realkreditraadet. (2015) Total Mortgage Outstanding [Online]. Association of Danish Mortgage Banks. Available: http://www.realkreditraadet.dk/Admin/Public/DWSDownload.aspx?File=%2fFiles%2fFiler%2fEngelsk%2fStatistics%2fLending+Activity%2fLending_data_Q4_2014+.xlsx [Accessed 3/24 2015].

Realkreditraadet. (2016) Arrears [Online]. Association of Danish Mortgage Banks. Available: http://www.realkreditraadet.dk/Statistics/Arrears.aspx [Accessed 18/04 2016].

Rex, S. (2013) Yearbook 2013–2014. Building Societies Association.

Ricardo, D. (1821) On the Principles of Political Economy and Taxation. Kitchener: Batoche Books.

Rodrik, D. (1998) Capital Mobility and Labor. Draft Paper Prepared for the NBER Workshop on Trade. Technology, Education, and the U.S. Labor Market: Harvard University.

Rognile, M. (2015) Deciphering the Fall and Rise in the Net Capital Share. BPEA Conference Draft, March 19–20, 2015. Brookings Papers on Economic Activity.

Schwartz, H. (2008) Housing, global finance, and american hegemony: Building Conservative politics one brick at a time. Comparative European Politics 6: 262–284.

Schwartz, H. and Seabrooke, L. (2008) Varieties of residential capitalism in the international political economy: Old welfare states and the new politics of housing. Comparative European Politics 6: 237–261.

Seabrooke, L. (2002) Bringing Legitimacy Back Into Neo-Weberian State Theory and International Relations. Working Paper 2002/6. Canberra: Australian National University.

Sefton, T. (2002) Recent Changes in the Distribution of the Social Wage. LSE STICERD Research Paper No. CASE062. London School of Economics.

Smith, A. (1976) An Inquiry Into the Nature and Causes of the Wealth of Nations. Oxford: Oxford University Press.

Smith, S.J. and Searle, B.A. (2008) Dematerialising money? Observations on the flow of wealth from housing to other things. Housing Studies 23: 21–43.

Solow, R. M. (1958) A skeptical note on the constancy of relative shares. The American Economic Review 48: 618–631.

Statistics Sweden. (2015) Finding Statisitcs [Online]. Available: http://www.scb.se/en_/Finding-statistics/ [Accessed 5/10 2015].

Stockhammer, E. (2010) Neoliberalism, Income Distribution and the Causes of the Crisis. Research on Money and Finance, Discussion Paper No. 19.

Stockhammer, E. (2013) Why Have Wage Shares Fallen? A Panel Analysis of the Determinants of Functional Income Distribution. Conditions of Work and Employment Series; No.35. International Labour Organization.

Stockhammer, E. (2015) Determinants of the wage share: A panel analysis of advanced and developing economies. British Journal of Industrial Relations. doi:10.1111/bjir.12165.

Stockhammer, E. and Ederer, S. (2008) Demand effects of the falling wage share in Austria. Empirica 35: 481–502.

Talani, L.S. (2012) Globalization, Hegemony and the Future of the City of London. Basingstoke: Palgrave Macmillan.

Tronti, M. (1966) Operai e capitale, Torino.

Tversky, A. and Kahneman, D. (1986) Rational choice and the framing of decisions. Journal of Business. S251–S278.

Volkens, A., Lehmann, P., Matthief, T., Merz, N., Regel, S. and Werner, A. (2015) The Manifesto Data Collection. Manifesto Project (MRG/CMP/MARPOR). Version 2015a, Wissenschaftszentrum Berlin f¸r Sozialforschung (WZB).

Wiley, N.F. (1983) The congruence of Weber and Keynes. In: COLLINS, R. (ed.) Sociological Theory.

Winnett, R. and Wallop, H. (2009) Banks triple profit margin on mortgages, despite low interest rates [Online]. The Daily Telegraph. Available: http://www.telegraph.co.uk/finance/personalfinance/borrowing/mortgages/6163205/Banks-triple-profit-margin-on-mortgages-despite-low-interest-rates.html [Accessed 20/04 2016].

World Bank. (2015) World Bank Data [Online]. Available: http://data.worldbank.org [Accessed December 8th 2015].

Wright, E.O. and Perrone, L. (1977) Marxist class categories and income inequality. American Sociological Review 42: 32–55.

Acknowledgements

Earlier versions of this paper were presented at the 2015 International Political Economy workshop at King’s College London, as well as at the 2015 Department of Business and Politics internal seminar at Copenhagen Business School. I would like to thank the participants in both workshops for their insightful comments on this paper. I am also grateful to the anonymous reviewers of this journal for their constructive and challenging feedback that allowed me to adjust the manuscript substantially. Additionally, I am particularly indebted to the assistance of Dr Lee Savage for his repeated comments that have led to the refinement of the econometric models in this paper. However, responsibility for all errors and omissions made in this paper must lie solely with me as the author. I am also grateful to acknowledge receipt of a funding award from the King’s College London Interdisciplinary Social Science Doctoral Training Centre.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Expanded Model Specification

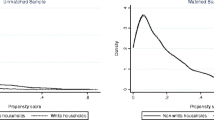

Although the models developed in this paper have sought to adhere to Achen’s (2002) ROT to refine the accuracy of the model specification, the literature has identified key variables that may influence the formation of the wage share that were not included in the regression models. Therefore, a wider specification model has been developed to test the validity of the results of the refined models used in this analysis. Technological change and globalisation have been identified as key determinants of the wage share of national income (IMF, 2007). Technological change has been modelled using the capital-labour ratio, which is measured using the logarithm of net capital stock divided by number of persons employed in domestic industries, and the data were obtained from the AMECO database (Stockhammer, 2013, p. 21). Exports as a share of GDP, and foreign direct investment (FDI) inflows as a share of GDP have been used as proxies for globalisation, and these data were obtained from the World Bank (2015) (Stockhammer, 2013, p. 20). Labour productivity has also been identified as a significant causal factor in the formation of the wage share of national income (e.g., OECD 2015a, p. 7), which can be measured in terms of GDP per hour worked, and the data were obtained from the OECD (2015b). The post-Keynesian analysis of financialisation is measured in terms of financial globalisation, which is the logarithm of external assets plus external liabilities divided by GDP, and as per Stockhammer (2013) the data were obtained from Lane and Milesi-Ferretti (2007). The deregulation of the financial sector is another way to account for the financialisation of the economy, which has been modelled using the summary financial reform index developed by Abiad et al (2008). The financial reform dataset only accounted for years up to 2006, therefore, specification models with and without this variable were included to maximise the number of available observations and degrees of freedom. Table A1 shows the results of the specification models, and in both cases the sign and significance of the OMB variable is consistent with the results from the main models used in this analysis, which is all that is necessary as the variable has been converted to a natural log. Therefore, one may conclude that the efficient model specification in this analysis, according to Achen’s ROT, may be considered valid.

Appendix B: Data Sources

An adequate pre-collated dataset was not readily available to examine the relationship between the wage share of GDP and mortgage credit growth in the USA, the United Kingdom, Sweden, and Denmark between 1979 and 2012; therefore, an original dataset compiling data from each country had to be constructed. Data to construct the wage share variable, employee compensation and nominal GDP at factor cost for each case were obtained from the European Commission’s annual macro-economic database (AMECO, 2015). The data for the OMB variable were obtained from a variety of sources: a complete dataset of British OMB data for the selected time period was not available from a single source, and the data were compiled from two sources; data from 1979 to 1991 were obtained from the Council of Mortgage Lenders’ (CML) compendium of housing finance statistics (CML, 1997, p. 88), and data from 1992 to 2012 were collected from the British Building Societies Association annual yearbook (Rex, 2013, p. 102). All OMB data for the Swedish case were obtained from the Swedish statistics office (Statistics Sweden 2015); while the Danish OMB data from 1979 to 2011 were obtained from the Danish Central Bank (Abildgren, 2012), and the missing 2012 figure was obtained from the Association of Danish Mortgage Banks (Realkreditraadet, 2015). The OMB data for the USA were collected from the Federal Reserve Bank of St Louis (2015) statistical database. The data for the unemployment rate for each country were also collected from the AMECO (2015) database. The RILE data were collected from the Comparative Manifesto Project (CMP) database (version 2015a), which is a subjective qualitative content analysis of party election manifestos from domestic democratic elections, and contains data for each case covered by this analysis (Volkens et al, 2015). The data were transformed to the weighted RILE index using the Stata do-file provided on the CMP website.

Appendix C: Data Validation and Diagnostic Tests

A Levin–Lin–Chu test was run on each variable in the pooled dataset to test for the presence of unit root, and in each case the null hypothesis that all panels contain a unit root could be rejected, which suggests that the panels are stationary for each variable. A cointegration test was also run for the key variables in the pooled data models, the wage share of GDP and OMB, and the tests reject the null hypothesis of no cointegration, which suggests that there is a stable relationship between the key variables in this analysis. Post-regression diagnostic tests were performed on the four OLS models pertaining to the individual VORC (models 3–6), where each model was tested for the normality of the residuals, heteroskedasticity, serial correlation, and multicollinearity. In each case, the residuals were distributed normally, and each variable in each case had a VIF score of less then 5, which demonstrates that there is an absence of multicollinearity in the models (Belsley et al, 1980). A Breusch–Godfrey test was run for each OLS model to test for serial correlation, and the results show that in each case the null of no serial correlation must be rejected, therefore, first-order autocorrelation (AR1) is present in each model. A test for heteroskedasticity was run on the OLS models and in each case, except for the British case (model 5), we fail to reject the null hypothesis of homoscedasticity being true; therefore, it can be stated with at least 95 percent certainty that the errors are homoskedastic in the Swedish, Danish, and US models, and are drawn from a distribution with a constant variance. To account for the serial correlation in each model and heteroskedasticity of the British case, each individual model was re-run to include robust standard errors, which are included in the results table. As stated in the empirical design, the results from the pooled data models (1, 2, 7 and 8) were obtained using the AR1 autocorrelation structure and the assumption of panel-level heteroskedastic errors to address problems of serial correlation and heteroskedasticity respectively. Each of the OLS models was also run using the bootstrap resampling method, which replaces the unknown population distributions with the known empirical distributions originated by the regression to establish precise statistical estimates that allow for robust hypothesis testing using relatively few assumptions (Chernick, 2008). The bootstrap models were re-run with 2,000 repetitions, and each variable retained its statistical significance as reported in the results section (Table 3), with identical parameter estimates to the non-bootstrap models. Diagnostic tests were also run for each bootstrap model with results that were similar to the corresponding non-bootstrap models above. These bootstrap models, and the subsequent diagnostic tests performed on them, suggest that the results from the individual VORC models (models 3–6) may be considered valid and robust.

Rights and permissions

About this article

Cite this article

Wood, J.D.G. The effects of the distribution of mortgage credit on the wage share: Varieties of residential capitalism compared. Comp Eur Polit 15, 819–847 (2017). https://doi.org/10.1057/s41295-016-0006-5

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41295-016-0006-5