Abstract

Healthcare financing is crucial for sustainable development and has been gaining attention, particularly since the COVID-19 pandemic. Although ample studies have explored the determinants of healthcare spending, the current study examines the determinants of health financing transition in 124 low- and middle-income countries (LMICs) for 19 years, from 2000 to 2018. The study first estimates the elasticity of health expenditure (i.e., government, private, and external) to per capita income, fiscal spending, age dependency, control of corruption, and time; second, it investigates crowding-out/in effects between domestic and external health financing. As the sample countries are heterogeneous in terms of development and universal health coverage (UHC) reform, our study employs a panel regression model with cluster-robust fixed effects and a bootstrapping quantile regression with fixed effects model to capture unobserved heterogeneity and produce robust estimates across quantile distributions. The results show that an increase in per capita government health expenditure (GHE) and per capita external health expenditure from foreign donors can reduce the share of out-of-pocket health expenditure to total health expenditure (OOPHE), thereby improving the health status and well-being of the people. The study also finds crowding-out effects of per capita external health financing on GHE in LIMCs. Interestingly, the results show that the control of corruption increases the per capita GHE in low-income countries. Thus, in low-income countries, improving governance would improve efficiency in fund utilization and strengthen the health system. Further, our study concludes that those countries that have passed UHC legislation are moving faster toward health financing transition by increasing public spending on health care. Healthcare policy in developing countries should prioritize (i) the adoption and implementation of UHC reform, (ii) alternative revenue mobilization strategy for financing public health care.

Resumen

La financiación de la asistencia sanitaria es crucial para el desarrollo sostenible y ha estado ganando atención, particularmente desde la pandemia de COVID-19. Aunque numerosos estudios han explorado los determinantes de los gastos en salud, el presente estudio examina los determinantes de la transición en la financiación de la salud en 124 países de ingresos bajos y medios (PIBM) durante 19 años, entre 2000 y 2018. El estudio, antes de todo, estima la elasticidad de los gastos en salud (es decir, gubernamentales, privados, y externos) al ingreso per cápita, gastos fiscales, dependencia a la edad, control de la corrupción, y tiempo; en segundo lugar, el estudio investiga los efectos de desplazamiento entre la financiación de la salud doméstica y externa. Dado que los países de la muestra son heterogéneos en términos de desarrollo y reforma de la cobertura de salud universal (CSU), nuestro estudio emplea un modelo de regresión de panel con efectos fijos robustos al agrupamiento y una regresión cuantil de bootstrapping con un modelo de efectos fijos para capturar la heterogeneidad no observada y producir estimaciones robustas a través de las distribuciones cuantiles. Los resultados muestran que un aumento en el gasto en salud per cápita del gobierno (GHE) y en el gasto en salud externo per cápita de los donantes extranjeros puede reducir la participación del gasto de salud de bolsillo en el gasto total en salud (OOPHE), mejorando así el estado de salud y el bienestar de las personas. El estudio también encuentra efectos de desplazamiento del financiamiento de salud externo per cápita en el GHE en los PIBM. Curiosamente, los resultados muestran que el control de la corrupción aumenta el GHE per cápita en los países de bajos ingresos. Por lo tanto, en los países de bajos ingresos, mejorar la gobernanza mejoraría la eficiencia en la utilización de fondos y fortalecería el sistema de salud. Además, nuestro estudio concluye que aquellos países que han aprobado legislación de CSU están avanzando más rápido hacia la transición en la financiación de la salud al aumentar el gasto público en atención sanitaria. La política de atención sanitaria en los países en desarrollo debería priorizar (i) la adopción e implementación de la reforma de la CSU, (ii) la estrategia de movilización de ingresos alternativa para financiar la atención sanitaria pública.

Résumé

Le financement de la santé publique est fondamental pour le développement durable et attire l'attention, en particulier depuis la pandémie de COVID-19. Bien que de nombreuses études aient exploré les déterminants des dépenses de santé, cette étude examine les déterminants de la transition du financement de la santé dans 124 pays à revenu faible et intermédiaire (PRFI) pendant 19 ans, de 2000 à 2018. L'étude estime d'abord l'élasticité des dépenses de santé (c'est-à-dire, gouvernementales, privées et externes) par rapport au revenu par habitant, aux dépenses fiscales, à la dépendance de l'âge, au contrôle de la corruption, et au temps; ensuite, l’étude examine les effets d'éviction/entrée entre le financement domestique et externe de la santé. Comme les pays de l'échantillon sont hétérogènes en termes de développement et de réforme de la couverture sanitaire universelle (CSU), notre étude utilise un modèle de régression en panel avec effets fixes robustes aux clusters et une régression quantile bootstrap avec un modèle à effets fixes pour capturer l'hétérogénéité non observée et produire des estimations robustes sur les distributions quantiles. Les résultats montrent qu'une augmentation des dépenses de santé gouvernementales par habitant (DSG), et des dépenses de santé externes par habitant des donateurs étrangers, peut réduire la proportion des dépenses de santé directes parmi les dépenses totales de santé (DSD), améliorant ainsi l'état de santé et le bien-être des personnes. L'étude trouve également des effets d'éviction des dépenses de santé externes par habitant sur les DSG dans les PRFI. De manière intéressante, les résultats montrent que le contrôle de la corruption augmente les DSG par habitant dans les pays à faible revenu. Ainsi, dans les pays à faible revenu, l'amélioration de la gouvernance améliorerait l'efficacité de l'utilisation des fonds et renforcerait le système de santé. De plus, notre étude conclut que les pays qui ont adopté une législation sur la CSU progressent plus rapidement vers la transition du financement de la santé en augmentant les dépenses publiques en soins de santé. La politique de santé dans les pays en développement devrait prioriser (i) l'adoption et la mise en œuvre de la réforme de la CSU, (ii) une stratégie alternative de mobilisation des revenus pour le financement des soins de santé publics.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Health financing transition states the existence of a trade-off between per capita government health expenditure and the share of out-of-pocket to total health spending (Fan and Savedoff 2014). Further, a recent Organization for Economic Co-operation and Development (OECD) report (OECD 2021) revisited the health financing transition in the wake of the COVID-19 crisis, arguing that external finance for health might crowd out as countries move to higher income levels and can raise their health expenditure from domestic financing. With the rise in income, government health spending increases, and out-of-pocket and external health financing should decline, but this is not always the case. For instance, even a country with greater spending on government health may continue to rely on households’ out-of-pocket payments and external financing.

Existing literature has studied health financing transitions to examine the determinants of an increase in per capita government health expenditure and the associated fall in the share of out-of-pocket payments (OOP) to total health expenditure (THE) (Fan and Savedoff 2014; Ke et al. 2011). While some studies have explored the crowding-out concept in the health financing transition, they have not estimated the effects of government health expenditure on out-of-pocket payments and external assistance on health and vice versa (Dieleman and Hanlon 2014; Liang and Mirelman 2014; Fosu 2008). Many studies have found that per capita income, fiscal improvement, and demographic changes are significant drivers of the rise in government health expenditure (Di Matteo 2005; Baltagi and Moscone 2010). The literature has mostly analyzed whether health spending is a necessity good (i.e. elasticity less than one) or luxury good (i.e. elasticity more than one) by estimating the responsiveness of government health expenditure to income (Baltagi and Moscone 2010).

Similarly, some studies have argued that improving macro-fiscal policies leads to higher fiscal capacity and higher government health spending (Fan and Savedoff 2014; Behera and Dash 2020a). Along similar lines, other studies have found that fiscal decentralization tools in the economy improve government health spending (Busemeyer 2008; Arends 2017). Regarding demographic changes, literature has argued that the rising older age population and demand for long-term health care for the elderly lead to a rise in health spending termed Baumol’s disease effect (Dormont et al. 2006; Hartwig 2008; Di Matteo 2005).

Although ample studies have explored the determinants of health spending, the current study has many novelties compared to the existing literature. First, we adopt a good governance indicator, i.e., control of corruption, to determine whether controlling corruption improves financing from domestic sources and reduces the burden of out-of-pocket expenditure. These research questions are derived from the past literature, which argues that corruption leads to poor health outcomes and diverts public resources away from health (Swaleheen et al. 2019; Azfar and Gurgur 2008). Similarly, quality of governance increases the returns on health investment by improving better health care delivery, patient outcomes, and equity in resource distribution (Makuta and O’Hare 2015; Moschovis 2010). Second, we examine whether external assistance for health can be a pertinent factor similar to domestic sources of government health expenditure to reduce the share of out-of-pocket health spending to total health expenditure (OOPHE) in LMICs.

Past literature has used socio-demographic characteristics, disease prevalence, and domestic fiscal policies to determine the level of out-of-pocket payment (OOP) spending in the economy but has not examined the role of external grants, corruption, and technological change on the OOP (You and Kobayashi 2011; Dormont et al. 2006; Hartwig 2008). Third, we investigate whether the rise in the domestic flow of government health spending reduces the health finance from external grants or vice versa. Therefore, our study examines the measurement of crowding-out/in effects of both domestic and external health expenditure by controlling for macro-fiscal policies, good governance, aging, and technological change over time. In a similar vein, literature has linked this with the economic crisis that led to reduced external assistance for health (Cylus et al. 2012), while some have argued the improvement in human development rank reduces foreign assistance for health in the receiving country (Hall and Jones 2007).

Against the above backdrop, this study has three objectives—first, it estimates the elasticity of health expenditure (i.e., government, private, and external) to per capita income, fiscal spending, age dependency, corruption, and time; second, it examines the elasticity of out-of-pocket spending to domestic government health expenditure and foreign assistance for health; third, it investigates the crowding-out/in effects between domestic and external health financing. Based on the available data, this study uses data from 124 countries from low- and middle-income countries from 2000 to 2018. Further, our study sample is categorized into three groups based on the income-based level of development (i.e., low-income, lower-middle, and upper-middle-income) and five groups based on the level of health spending quantiles (i.e., 5th quantile, 25th quantile, 50th quantile, 75th quantile, and 95th quantile). Further, we divided the 124 LMICs based on their health reforms, i.e., countries that have passed legislation on Universal Health Coverage (UHCFootnote 1) and countries that have not passed legislation on UHC. Hence, our sample coverage can provide a better health financing transition analysis compared to past literature that took LMICs samples for their study (Ke et al. 2011; Savedoff et al. 2012; Dieleman et al. 2018).

As our sample countries are very heterogeneous in terms of geographical features and health reform status, we employed a panel regression model with cluster-robust fixed effects (F.E.) and a bootstrapping unconditional quantile regression with fixed effects (FE-UQR) model to capture unobserved heterogeneity and produce a robust estimate across quantile distributions. We also conducted diagnostic tests to examine the suitability of the model, such as multicollinearity, panel unit-root, heteroscedasticity, and cross-sectional dependency tests. The cluster-robust and bootstrapping techniques in both the FE and FE-UQR models control for the issues of endogeneity, unobserved heterogeneity, and cross-sectional dependency in the model. Further, we included lagged values of the dependent variables to control for endogeneity, as suggested by the literature (Behera and Dash 2020a, b; Behera et al. 2020). Earlier studies used macro-panel regression, such as Fully Modified OLS, Dynamic OLS, and Generalized Method of Moments, to examine the income elasticity of health expenditure, but in the current study, we used the micro-panel regression model FE-UQR to calculate the elasticity by controlling for unobserved distributional heterogeneity as well as time-variant factors in the sample.

This study has four sections. “Introduction” section is the introduction, which has already been discussed. “Overview of the Health Financing Transition” section provides an overview of healthcare financing. “Data and Methodology” section contains the methodology; “Result” and “Discussion” sections discuss the empirical results and critical inferences from the existing literature. Finally, “Conclusion and Policy Recommendations” section provides the conclusion and policy suggestions.

Overview of the Health Financing Transition

Figure 1 summarizes the health financing transitions by country group (low, lower-middle, upper-middle, and high-income countries) from 2000 to 2018. In low-income countries, external assistance for health has been increasing since 2008, leading to the crowding-out of government health spending. The share of out-of-pocket health spending to total health expenditure (OOPHE or OOP/THE) declined from 60 in 2000 to 40% in 2019, while the increase in the per capita health spending (i.e., government and external) has been sluggish (See Fig. 1a).

Similarly, Fig. 1b shows a drastic reduction in the share of OOP to total health expenditure (THE). Per capita government health spending increased at an increasing rate in low-middle-income countries, while external health assistance rose at a decreasing rate.

Figure 1c shows a substantial increment in per capita government health spending associated with a considerable reduction in the share of OOP/THE in upper-middle-income countries. On the contrary, there is negligible funding from external sources in upper-income countries. As a country’s income improves and develops, the share of domestic government health spending sources increases, reducing the dependency on external health funding.

Figure 1d shows the movement of health financing transition in high-income countries, with a negative relationship between per capita government health spending and OOP/THE. Meanwhile, around 20% of health care spending is sourced from private sources in developed economies. Some studies also projected the health financing trends in LMICs and suggested that the share of government health spending has steadily increased over time (Jakovljevic et al. 2017; Dieleman et al. 2018).

Additionally, Fig. 2 shows the geographic distributions of the top high-spending countries in per capita domestic general government health expenditure (GGHE) versus the out-of-pocket share in total health expenditure (OOP/THE).Footnote 2 It shows that in the majority of the upper-middle-income countries, the GGHE is high (in the range of US$611–US$2,240), while the OOP/THE share is also high (in the range of 42–84%) (see Fig. 2e and f). Similarly, Fig. 2c and d shows that the GGHE ranges from US$185 to US$523 and the OOP/THE ranges from 52 to 77% in the top-15 high-spending low-middle-income countries. Figure 2a and b shows the top-15 high-spending low-income countries for the GGHE (in the range of US$21–US$67) versus the OOP/THE (in the range of 41–78%). Overall, the results show that higher GGHE does not lead to lower OOP/THE. Instead, it depends on income and whether health care is sought from private sources, even if government facilities are available. Therefore, examining the determinants of health expenditure transition in LMICs across levels of development is important for predicting the elasticity of spending.

Data and Methodology

Data

This study empirically examines the determinants of health financing transition trends in 124 low-to-middle-income countries (LMICs) for 19 years from 2000 to 2018 (N = 2224). The study uses an LMICs sample that includes low-income (N = 28), low-middle (46), and upper-middle-income (50) countries, following the World Bank’s country classifications based on income. Details of the countries selected and excluded in our analysis are reported in Table A1 (Supplementary files). We used unbalanced panel data and included countries with at least three years of data available for all variables adopted in this study. The descriptions of the variables used in the study are summarized in Table 1. In this study, we used three health financing indicators, namely domestic general government health expenditure per capita (GGHEFootnote 3), external health expenditure per capita (EXTFootnote 4), and out-of-pocket health expenditure as a percentage of current health expenditure (OOPHEFootnote 5). Other parameters included in this study are per capita gross domestic product (GDP), the proportion of fiscal spending to GDP (Fiscal), Control of Corruption (COCFootnote 6), and Old-age dependency (Aging). The annual time series data for health financing and GDP were obtained from the global health expenditure database of the World Health Organization (2022). The fiscal spending and aging data were collected from the World Development Indicators (WDI) of the World Bank (2022), and control of corruption from the World Governance Indicators (WGI) of the World Bank (2022).

Figure 3 presents the health financing sources trends for government, private, external, and share of out-of-pocket expenditure to current health expenditure (OOPHE) in low-to-middle-income countries (LMICs) using quantile distribution graphs. It shows a considerable variation in the per capita distribution of health expenditure among quantiles, which suggests estimating the quantile distribution function for health care expenditure to capture the unobserved heterogeneity.

Methods

This study examines two important research questions. First, it investigates whether external health expenditure crowds out domestic government health expenditure or vice versa. Second, it explores whether governments and external health expenditure reduce the out-of-pocket health expenditure share. This estimation is done by controlling other covariates, including per capita income, old-age dependency, control of corruption, and fiscal capacity. To better understand the health financing transition pattern among different components of health expenditure in LMICs, we divided the full sample into a few categories using three criteria. First, the sample was divided based on income as per the World Bank’s income classifications, such as low-income, low-middle, and upper-middle. Second, the sample was divided by health spending quantiles, such as 5th percentile (Q05), 25th percentile (Q25), 50th percentile (Q50), 75th percentile (Q75), and 95th percentile (Q95). Third, the sample was divided based on health reform implementation. In this study, we use universal health coverage (UHC) indicators on whether a country has passed health reforms to provide UHC. We found that out of 124 sample countries, only 28 countries had passed legislation on UHC. Thus, our sample is divided into two categories based on UHC: legislation on UHC passed (N = 28) and UHC legislation not passed (N = 96). The sample and descriptive statistics of the UHC sub-samples are reported in the Table A2 and Table A3 (Supplementary files).

In this study, we used the panel robust fixed effects (FE) regression model to estimate the elasticity of the dependent and independent variables. The unique feature of the robust FE model is that it captures the unobserved country-specific heterogeneity, and robust specifications control all heteroscedasticity and autocorrelation issues in the data (Behera and Dash 2020a; b). Further, to control the endogeneity problem in the FE model, we added the lagged values of the dependent variables. The health economics literature assumes that there is always a gap between the budget estimate and actual spending, leading to less absorption capacity of the health budget. Therefore, it is a general practice to use the lag of the spending variables to control for any budgetary re-allocation over the period. This study follows the seminal paper on health financing transition by Fan and Savedoff (2014) to formulate the concept and methodology. Additionally, our empirical procedure is more robust compared to similar studies on health financing transition. For example, we include two new variables—control of corruption and external health financing. Also, sample classification to examine the heterogeneity based on the level of economic growth, health spending quantiles, and UHC reform is a unique contribution. The study estimates the following regression equations.

From Eqs. 1–3, we calculated the per capita share in GGHE, EXT, and GDP by dividing by the total population (POP) in a particular year denoted by t and in a particular country denoted by i. For other variables, fiscal spending (Fiscal) is calculated as the percentage share of general government expenditure to GDP; Control of Corruption (COC) is an index with values ranging from − 2.5 to + 2.5; and Aging is the old-age dependency.Footnote 7 OOPHE is the share of out-of-pocket health spending to current health expenditure.

Equation 1 estimates the crowding-out effects of external health expenditure (EXT) on domestic government health expenditure (GGHE) by controlling GDP, COC, Fiscal, and aging. Equation 2 estimates the crowding-out effects of GGHE on EXT by controlling GDP, COC, Fiscal, and aging. Equation 3 estimates the effects of both GGHE and EXT on OOPHE by controlling GDP, COC, Fiscal, and aging.\(\alpha\) denotes the intercept; \(\beta\) shows the coefficients of the parameters estimated; \(\delta_{i}\) denotes the individual country-specific unobserved effects; \(\gamma .t\) denotes the year trends for time-specific effects; \(\varepsilon_{it}\) denotes the disturbances error term, and ln denotes the natural logarithmic transformation of our real data. Further, we have included lags of the dependent variables in the above equation to control for endogeneity effects. Previous health financing literature has used lagged dependent variables in their econometric specifications (Behera and Dash 2020b; Behera et al. 2020). This regression specification has also been applied in countries across the levels of development—low-income, low-middle, and upper-middle—and across UHC reforms—UHC legislation passed and UHC legislation not passed.

This study performed preliminary tests before the regression estimation, such as unit-root, and some diagnostic tests, like Hausman FE, cross-sectional dependency, multicollinearity, and heteroscedasticity tests for the adopted variables which are reported in Table A4 and Table A5 (Supplementary files). The application of the FE model is verified through the Hausman test, which rejects the null hypothesis at a 1% level of significance. The unit-root test results show that all our adopted variables are level-stationary and have no unit roots, indicating that there is no need to conduct long-run regression tests such as for cointegration. Therefore, we adopted short-run panel regression estimation techniques, such as the FE model, which are applicable for micro-panel data (i.e., N is larger than T), rather than long-run panel regression estimation techniques, such as Fully Modified OLS and Dynamic OLS, which are applicable for macro-panel data (i.e., T is larger than N).

Further, our study does not use a dynamic panel data model, such as generalized method of moments (GMM) techniques, for two reasons. First, the sample has many outliers (see Fig. 3), and the minimum number of years of data included in this study is 3 years (see supplementary files Table A1). As per the requirement of the GMM model, we need to have sufficient observations in each cross-sectional unit to add instruments to control for endogeneity in the model. Further, adding unnecessary instruments, such as the lag of independent variables, or any exogenous variables in the system GMM dynamic model, will overestimate our model due to weak instrument problems (Bun and Windmeijer 2010). Second, we use the unconditional FE quantile regression model, which is efficient in the context of outliers and small sample sizes (Borgen 2016). The supplementary files (Table A4 and Table A5) report all the unit-root tests and diagnostic test results.

For a robustness check of our FE model, this study examines the distributional effects of healthcare financing transition trends across LMICs using unconditional quantile regression with fixed effects (UQR-FE), as suggested by Borgen (2016). The application of the quantile regression model is gaining more importance than the linear FE regression model due to the conditional mean distribution across the quantile of dependent variables (Koenker and Bassett 1978). In other words, quantile regression provides estimates of the linear relationships between regressors \(X\) and a specified quantile of the dependent variable \(Y\). The study computes the quantile regression equations by following Koenker (2005).

Equation (4) shows the conditional quantile functions of the response of the jth observation on the ith individual, \(y_{ij}\). \(\alpha_{i}\) shows the location shift effect on the conditional quantiles of the response; \(x_{ij}\) denotes the predicted variables, and the effects of \(x_{ij}\) are permitted to depend upon the quantile, \(\tau\), of interest. Further, we added an FE estimator in Eq. (4) because our cross-sectional observations are larger than time, and the shrinking of the number of observations by panelized QR with FE is advantageous to control the variability in estimated \(\alpha_{i}\) parameters (Borgen 2016).

Equation (5) shows the fixed effects QR model, in which \(\lambda\) denotes an FE estimator. Likewise, cluster-robust standard errors have been used in the FE model, and we have used bootstrapped standard errors in the UQR-FE model. The conventional standard error estimation would not measure the asymptotic covariance matrices of the estimates, and it requires the estimation of the sparsity nuisance parameter either at a single point or conditionally for each observation. So, bootstrapping techniques can directly estimate the covariance matrix (Kocherginsky et al. 2005).

Result

Descriptive Statistics

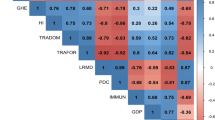

Table 2 shows the descriptive statistics and correlation results of the sample of low-to-medium-income countries (LMICs) and by income categories for the period 2000–2018. The sub-sample of UHC categories is reported in Table A3 (Supplementary files). The average (i.e., mean) government health expenditure (GGHE) per capita is US$181, while the minimum and maximum values vary from US$0.28 to US$2872, which shows a considerable variation in the distribution of health expenditure among countries with a high standard deviation of 243. The average (i.e., mean) OOPHE is 40.39%, while the minimum and maximum values in LMICs vary from 0.08 to 86%. There is a huge variation in the distribution of OOPHE among countries, with a high standard deviation of 20.21. The correlation results show that OOPHE and external health expenditure per capita (EXT) are negatively correlated with government health expenditure per capita (GGHE), whereas GDP, Fiscal, COC, and Aging are positively correlated with government health expenditure per capita (GGHE). On the contrary, external health expenditure per capita (EXT) is positively correlated with GGHE in low-income and low-middle-income countries, whereas it is negatively correlated in upper-middle-income countries. The results show that all variables are negatively correlated with OOPHE.

Empirical Results

Table A4 (Supplementary files) presents the panel unit-root test results of the dependent variables. The unit-root test examines whether the data are stationary in the first difference, and this process is essential before regression estimation. As the panel data structure is unbalanced, the study employed Im–Pesaran–Shin (IPS) and Fisher-type unit-root tests, which were recommended by Im et al. (2003), and Choi (2001), respectively. Our results show that per capita general government health expenditure per capita (GGHE), External health expenditure per capita (EXT), and OOPHE are stationary (i.e., no unit-root) at level. The study finds that health expenditure data will become stationary at the level series in LMICs samples.

Table A5 (Supplementary files) shows the diagnostic tests before using the panel regression model. This study used a fixed effects (FE) model because the Hausman test rejects the null hypothesis that the difference in the coefficient is not systematic and suggests a FE model. This study also used a robust FE model to control for heteroscedasticity and autocorrelation in the error term. Further, no multicollinearity problems exist in the model, as shown by the mean variance inflation factor (VIF). The significance of the country-specific F-test shows that our FE model has controlled for the unobserved individual heterogeneity in disturbance terms across countries. The significance of the time-specific F-test indicates that our model needs to control the time-trend dummy in the model.

Distributions of Government Health Expenditure Elasticity Across Income Levels

Table 3 presents the results of the panel cluster-robust FE regression model, which examines the determinants of general government health expenditure (GGHE) in LMICs. The results show that the effects of per capita GDP on per capita GGHE are positive and statistically significant in LMICs and across income-wise country categories (low-income, lower-middle-income, and upper-middle-income countries groups). It implies that a 1% increase in per capita GDP leads to 0.398% increase in per capita government health expenditure annually in LMICs, which shows that the elasticity is less than one. The elasticity of GGHE in low-income (0.439%), low-middle (0.447%), and upper-middle (0.389%) countries is less than one.

Fiscal capacity shows positive and statistically significant relationships with per capita GGHE in LMICs. It implies that a 1% increase in fiscal capacity leads to a 0.293% increase in GGHE, which shows the elasticity is less than one. Further, the elasticity in low-income, low-middle-income, and upper-middle-income countries is 0.378%, 0.331%, and 0.234%, respectively, which is less than 1.

We found a crowding-out effect of external health financing (EXT) on GGHE in LMICs. It implies that a 1% increase in EXT leads to a marginal reduction (− 0.0174%) in GGHE. The crowding-out effect is also exhibited in low-income and low-middle-income countries; a 1% rise in EXT leads to a 0.0969% and 0.0196% decline in GGHE, respectively. In contrast, the crowding-out effects of EXT on GGHE are not statistically significant in upper-middle-income countries. Control of corruption (COC) shows a positive relationship with GGHE in low-income countries, implying that a unit increase in control of corruption leads to a rise in GGHE at 0.111%. However, COC has shown an insignificant relationship in other sub-samples and full samples (i.e., LMICs). The result shows that with a 1% increase in the aging population, the per capita GGHE reduces by 0.440%, implying a negative relationship between aging and GGHE. In contrast, age dependency is insignificant in the case of other samples. The year dummy is statistically insignificant in all sample specifications.

Distributions of Government Health Expenditure Elasticity Across Quintile

Table 3 examines the elasticity of government health expenditure across distributions using a panel unconditional quantile regression (UQR) model, which controls the country-specific unobserved distribution heterogeneity. The study distributed the countries in five quantiles based on the dependent variable: Q05, Q25, Q50, Q75, and Q95, and estimated the model with the same independent variables. The significance of the quantile-specific F test indicates that our UQR fixed effects model has controlled for the unobserved distribution heterogeneity in error terms across countries.

Our results show that the effects of per capita GDP on GGHE are positive and statistically significant across two quantiles (i.e., Q50 and Q95). The elasticity of GGHE is less than one in the respective quantiles, and the coefficient varies from 0.424 to 0.738%. It implies that the responsiveness of GGHE to GDP is less than the unit in both Q50 and Q95 and insignificant in other quantiles. Similarly, the effects of fiscal capacity on GGHE are positive and statistically significant in the lower quantiles (i.e., 5th, 25th, and 50th quantiles). The elasticity of GGHE to fiscal capacity is close to one (0.949%) in the 5th quantile, while the elasticity is less than one (0.290% and 0.346%) in 25th and 50th quantiles, respectively. On the contrary, the changes in fiscal capacity negatively affect GGHE in higher quantiles (i.e., Q75 and Q95).

We find that external health financing (EXT) reduced the domestic government health expenditure across all quantiles except lower quantiles (5th quantile). It shows that an increase in the external flow of funds from foreign countries has no crowding-out effects on the share of GGHE in the countries with lower quantiles of spending. On the contrary, an increase in EXT crowds out domestic government health expenditure, but the effects are marginal, and the elasticity value is less than one.

Interestingly, the result shows that the control of corruption increases the per capita domestic government health expenditure (GGHE) in lower quantiles (5th, 25th, and 50th). It implies that the government’s domestic health expenditure (GGHE) increases in countries with lower GGHE spending when corruption controls improve. On the contrary, control of corruption reduces the GGHE in the higher quantiles spending countries (75th and 95th quantile). This implies that corruption control policies also help reduce per capita government health spending in upper quantile groups because they improve the efficiency of government spending on healthcare. This result supports the findings of Holmberg and Rothstein (2011); and Sommer (2020) on the role of corruption in rising health spending in rich countries due to overbilling—around 80% of the population experienced corrupt practices in the health sector. This suggests that improvement in the quality of governance is necessary to finance quality healthcare, irrespective of the economic development status.

The results show that old-age dependency reduces the per capita share of GGHE in lower quantiles (5th, 25th, 50th), while it increases the per capita GGHE in higher quantiles (75th and 95th). In countries with lower GGHE, the per capita GGHE declines as old-age dependency increases because the rising healthcare demand from the older population reduces the per capita availability of health resources for others in the family. Therefore, old-age health insurance facilities could be a solution for copping healthcare costs for the older population. Further, per capita GGHE increases as old-age dependency increases in higher quantiles in LMICs. This is because the rising healthcare demand from the older population increases the per capita GGHE in higher quintiles.

Year shows a positive and statistically significant relationship with GGHE in higher quantile (75th) distribution, which implies that technological progress increased the per capita distribution of government health expenditure over the years.

Distributions of External Health Expenditure Elasticity Across Income Levels

Table 4 presents results from the panel cluster-robust fixed effects (FE) regression model to examine the determinants of health expenditure from external sources (EXT) in LMICs. The results show that the effects of per capita GDP on per capita EXT are positive and statistically significant in LMICs and different income groups. A 1% increase in per capita income leads to a 0.339% increase in per capita external health expenditure annually in LMICs, which shows the elasticity is less than one. Similarly, the elasticity of EXT is also less than one in both low (0.658%) and low-middle-income (0.464%) countries. In contrast, we found an insignificant relationship between EXT and GDP in upper-middle-income countries.

Fiscal capacity shows positive and statistically significant relationships with per capita EXT in LMICs. It implies that a 1% increase in fiscal capacity leads to a 0.203% increase in per capita EXT, which shows the elasticity is less than one. The result also shows a positive and statistically significant effect of fiscal capacity on EXT in low (0.335%) and low-middle-income (0.267%) countries and insignificant effects in upper-middle-income countries. So, it can be inferred that both per capita income and fiscal spending have no adverse effects on the flow of external funds for the health sector in low-income and low-middle-income countries. However, the coefficient values are lower when countries move from a low-income to a high-income trajectory.

We find a crowding-out effect of domestic government health expenditure (GGHE) on health expenditure from external sources (EXT) in LMICs. It implies that a 1% increase in GGHE leads to a − 0.147% reduction in EXT. The crowding-out effect is also exhibited in low-income countries, which means that a 1% rise in GGHE leads to a − 0.188% decline in EXT. In contrast, the crowding-out effect of GGHE on EXT is not statistically significant in both low-middle and upper-middle-income countries. Control of corruption (COC) shows a positive relationship with the flow of external health financing, but the effects are statistically insignificant across the sub-samples. Aging population has established a negative association with EXT, and the coefficient is statistically significant across samples. It implies that the rising older population reduces the working-age population in the economy, which might lessen the flow of external healthcare funds from abroad. The year has no impact on external health expenditure, which shows technological progress has no relationship with external sources of fund flow.

Distributions of External Health Elasticity Across Quintiles

Table 4 presents the elasticity of health expenditure from external sources (EXT) across distribution using bootstrapping quantile regression. The results show that per capita GDP has a positive and statistically significant relationship with EXT in three quantiles, i.e., 25th, 50th, and 75th. The elasticity is lower than one in three quantiles, and the coefficient varies from 0.376 to 0.606%. It can be inferred that as a country moves from being lower-income to higher-income, the flow of funds from external sources becomes inelastic. Similarly, fiscal capacity shows a positive and statistically significant relationship with EXT in the 25th and 75th quantiles, and the elasticity is less than one.

The results show that GGHE crowds out EXT across quantiles except for lower quantiles, and the elasticity is less than one. This implies that GGHE reduces EXT financing in higher spending quantile countries, whereas in lower quantiles, EXT financing increases. We found that COC has no relationship with the external flow of funds toward the health sector. Aging shows a negative and statistically significant relationship with EXT in 50th and 75th quantiles. This implies that old-age dependency reduces per capita EXT because aging requires more long-term health care and external assistance usually comes for reducing communicable diseases. The year shows a positive trend in higher quantiles (i.e., Q50 and Q75).

Distributions of Out-of-Pocket Health Expenditure Elasticity Across the Level of Income

Table 5 presents a panel cluster-robust fixed effects (FE) regression model to examine the determinants of out-of-pocket health expenditure as a ratio of current health expenditure (OOPHE) in LMICs. The results show that the effects of per capita GDP on OOPHE are positive and statistically significant in LMICs. A 1% increase in per capita income leads to a 0.0824% increase in OOPHE annually in LMICs, which shows the elasticity is less than one. Similarly, the elasticity of OOPHE is positive and statistically significant in all income sub-samples. It shows that with a 1% increase in per capita income, OOPHE increases by around 0.147% in low-income countries. This implies that OOPHE increases among LMICs due to rising per capita income. Further, the result implies that as the per capita income of a country grows, its demand for private healthcare increases in the case of LMICs.

Fiscal capacity shows a positive and statistically significant relationship with OOPHE in the case of LMICs as well as upper-middle-income countries. It implies that a 1% increase in fiscal capacity leads to a 0.106% increase in OOPHE in upper-middle-income countries. It means that an increase in per capita income will improve the fiscal capacity, increasing the demand for private healthcare resources. On the contrary, fiscal capacity has no impact on OOPHE in the case of low and low-middle-income countries, which is evident because the demand for private healthcare services is less due to less financial resources and a low level of per capita income.

The result shows that an increase in the per capita GGHE reduced the share of OOPHE in LMICs. A 1% increase in government health expenditure from domestic sources leads to a − 0.112% reduction in OOPHE. This is also exhibited in the case of income-wise country classifications sample regression specifications. Additionally, the result shows that a rise in per capita health expenditure from external sources (EXT) also reduced the share of OOPHE in LMICs. A 1% rise in EXT leads to a − 0.0224% fall in OOPHE. The effects of domestic sources of health care financing are more on the reduction of OOPHE in the economy than the external sources of financing. But both sources of healthcare financing can reduce the household’s out-of-pocket health spending and minimize the impoverishment effects of OOPHE.

Control of Corruption (COC) and age dependency show a positive and insignificant relationship with OOPHE in LMICs and income-wise samples. Year has negative and statistically insignificant relationships with OOPHE in LMICs, which implies that the technical progress of a country has no impact on reducing OOPHE. It shows that the share of OOPHE is declining with technological progress but not effectively.

Distributions of Out-of-Pocket Health Expenditure Elasticity Across Quintiles

Table 5 presents the elasticity of out-of-pocket health expenditure (OOPHE) across distributions using bootstrapping quantile regression. Our results show that the effects of per capita GDP on OOPHE are positive and statistically significant across quantiles. The elasticity of OOPHE to GDP is less than one across quantiles, and the coefficient varies from 0.152 to 0.489%. This implies that demand for private health care (i.e., ability and willingness to pay for private health care services) increases with an increase in per capita income.

Improvements in fiscal capacity reduce the share of OOPHE in higher quantiles (i.e., Q95), while fiscal spending has positive effects on OOPHE in lower quantiles (i.e., Q25). The result shows that an increase in the per capita share of GGHE and EXT reduces the share of OOPHE. However, the effects are more in the case of domestic sources of health financing than external health expenditure. Control of corruption shows a negative and statistically significant relationship with OOPHE in the 95th quantile and implies that a 1% improvement in corruption control could reduce the burden of OOPHE by around 0.108%.

The results show that aging increased the share of OOPHE in 50th quantiles. A 1% increase in old-age dependency increases the OOPHE by 0.199% in the 50th quantile. The year trend shows a negative relationship with OOPHE, which implies that technological change each year could reduce the out-of-pocket healthcare burden, but the elasticity is less than one.

Health Financing Transition Based on Universal Health Coverage Reforms

Based on Universal Health Coverage (UHC) reforms, this section identifies the determinants of public and private health financing transitions in LMICs. We divided the sample into two components to examine whether the adoption of universal health coverage legislation increases government expenditure on healthcare and reduces private out-of-pocket spending over the period. Table 6 presents the health financing transition across countries based on the adoption of legislation on UHC.

Table 6 shows that a 1% increase in GGHE reduces OOPHE by 0.221% in countries that have adopted UHC and 0.109% in countries that have not adopted UHC. This implies that the reduction of OOPHE is higher in those countries that have passed UHC. A 1% increase in GGHE reduces EXT by 0.177% in countries without UHC legislation (Column 4, Table 6). Similarly, in countries without UHC, the EXT reduces GGHE by 0.0254% (Column 2, Table 6). This implies that crowding-out effects between GGHE and EXT are present in countries without legislation on UHC. The effect of GDP per capita and fiscal capacity are positive and significant for GGHE, EXT, and OOPHE; however, the elasticity is higher in those countries that have passed UHC legislation compared to those that have not passed UHC. Irrespective of UHC legislation adoption, the COC does not show a significant relationship with the health financing transition movement. Old-age dependency increases GGHE and reduces OOPHE in countries with UHC legislation. Possibly due to old-age health insurance packages provided by the government under the UHC program, the per capita GGHE increases, while out-of-pocket spending is reduced in countries with UHC legislation.

Discussion

Using country-level panel data sets from low- and middle-income countries (LMICs), this study empirically examines the determinants of health financing transition from 2000 to 2018. We estimated the distribution of health expenditure elasticity by income, expenditure quantiles, and UHC legislation adoption using panel cluster-robust fixed effects and panel unconditional quantile regression with a fixed effects model (See Tables 3, 4, 5, 6). Crucial insights into the health financing transition from analyzing a sample of 124 LMICs are summarized below.

First, a rise in per capita government health expenditure sourced from domestic revenue (GGHE) can reduce the share of out-of-pocket health expenditure to total health expenditure (OOPHE). The coefficient value varies between − 0.0921 and − 0.236 and is inelastic (i.e., less than one) across sub-samples. Our result is similar to past studies, including those by Fan and Savedoff (2014), Silverman (2018), and Behera and Dash (2020a), which argue the determinants of government versus out-of-pocket spending using income elasticity. Additionally, we found that a rise in per capita external health expenditure sourced from foreign donors (EXT) reduces households’ OOPHE like GGHE. The impact of EXT on OOPHE is negative and inelastic across sub-samples. However, the influence of EXT on the reduction of OOPHE is more in the sample of lower-income countries. The findings of our study are similar to those of OECD (2021), Behera and Dash (2020b), and Hecht et al. (2018), which show that external health financing improves health outcome and reduces the burden of OOPHE.

Second, we explore the crowding-out effects of GGHE on EXT across the economic development status. Our study shows that a 1% rise in GGHE reduces the scope for EXT financing for health by 0.147% in LMICs. This inverse relationship between GGHE and EXT is also seen across spending quantiles and across levels of development. Further, the result shows a crowding-out effect between GGHE and EXT in countries without legislation on UHC. Even though past literature has not directly measured the crowding-out effects of health expenditure, it has measured the displacement or replacement of GGHE during the external economic crisis (Dieleman and Hanlon 2014; Ke et al. 2011; Fosu 2008; Liang and Mirelman 2014). Liang and Mirelman (2014) argue that development assistance for health (DAH) is interchangeable with domestically funded government health expenditure, and their research shows a negative relationship in the sample of 120 countries. Fosu (2008) found that external debt servicing arrangement for structural adjustment during an economic crisis reduces domestic government health expenditure in Sub-Saharan African countries. Ke et al. (2011) also found crowding-out effects of external aid on government health spending in a sample of 143 countries. On the contrary, few have also cautioned that domestic government health expenditure also crowd out external health spending (Dieleman and Hanlon 2014; OECD 2021).

Third, the effect of corruption control (COC) is positive and statistically significant on GGHE in low-income (i.e., 0.11%) and lower-spending quantiles (i.e., 0.54%). This implies that corruption control in an economy can enhance healthcare financing in resource-poor countries. Further, the study reveals that COC does not affect other health financing components, such as external health spending and out-of-pocket expenditure. Our results align with past studies that discuss corruption in the health system (Holmberg and Rothstein 2011; Swaleheen et al. 2019; Azfar and Gurgur 2008; Delvallade 2006; Lewis 2006; Makuta and O’Hare 2015). Holmberg and Rothstein (2011) argue that over 80% of the population in many poor nations has encountered corruption in the health sector and suggest that quality of governance plays a crucial role in better health outcomes and improves government funding in health care. Swaleheen et al. (2019) argue that corruption diverts public resources away from health in the sample of 16 high-corruption countries. Similarly, Delvallade (2006) found that the prioritization of social expenditure (i.e., health and education) is reduced due to public corruption. Lewis (2006) argues that poor governance forces the general public to spend considerable amounts of disposable income on private care and suggests that the health system requires support from both government sources of funding and good governance to strengthen the health system.

Fourth, we found positive income elasticity of GGHE in LMICs and sub-samples. The elasticity value is less than one and varies from 0.398 to 0.738 across sub-samples. In the case of countries that have passed UHC legislation, the response of per capita income on per capita GGHE is higher. Earlier studies also found a positive and inelastic relationship between government health expenditure and income that treated health as a necessity good (McCullough and Leider 2016; Baltagi and Moscone 2010; Piabuo and Tieguhong 2017). On the contrary, interestingly, the results show that a rise in per capita income increases the share of OOPHE. This implies that demand for private health care increases when the per capita income increases in a country. Similarly, per capita income and EXT show a positive income elasticity in LMICs.

Fifth, the fiscal policy could not reduce OOPHE but improve GGHE in LMICs. Our studies found that a country’s fiscal capacity plays an important role in raising funding from domestic sources and reducing private healthcare dependency in the economy. But, in this study, we found that fiscal capacity directly impacts OOPHE. Along similar lines, past literature also argues that fiscal decentralization and better fiscal performance raise domestic finance for health care and reduce the households’ OOPHE (Busemeyer 2008; Arends 2017). The distribution of fiscal spending between tiers of government would determine a beneficial or adverse impact on government health expenditure (Busemeyer 2008; Lichhetta and Stelmach 2016).

Sixth, our study shows that aging does not affect GGHE and OOPHE in LMICs but increases GGHE and reduces OOPHE in UHC countries. On the contrary, the study finds a mixed response of aging on health care demand across quantiles. Earlier literature also finds aging explains a small portion of health expenditure, and they argue that cost increases in the last few years of life, which would be a great concern for LMICs (Di Matteo 2005). Similarly, Dormont et al. (2006) argue that the effects of demographic change associated with changes in morbidity will threaten health spending in the future.

Finally, the current study used time as a factor to determine the technological progress or innovation that affects healthcare costs, as suggested by previous literature (Dormont et al. 2006; Di Matteo 2005; Smith et al. 2009). Smith et al. (2009) claim that technological changes in the health sector increase government spending and reduce the cost of care for private people. Others argue that controlling the time factor is crucial to get a real effect of aging and income on health expenditure.

Despite the robust analysis of determinants of health expenditure across the level of development, universal healthcare reform, and spending quantiles in LMICs, the study has a few limitations. First, the latest health expenditure data since 2018 are not available, and hence, the elasticity of health expenditure during the COVID-19 period has not been captured. Second, this study could not control for the missing data on a few demand- and supply-side determinants of health, such as public debt, disease-related spending, and institutional factors. Finally, geographic region classification might provide a better insight into the health financing transition path across the globe, which is probably missing in this study. However, this study comprehensively analyzes the distributional effects of elasticity of health expenditure across the level of development and spending quantiles that capture the level of distributional heterogeneity among sample countries.

Conclusion and Policy Recommendations

This study uses a comprehensive dataset from a sample of 124 countries over 19 years to examine the determinants of health financing transition in LMICs. As the aggregate sample analysis might not provide deeper insight into the health financing transition movement and level of elasticity, this study performs analysis at the sub-sample levels by dividing countries based on income level, health spending quantiles, and UHC reform at the country level. Such disaggregated analysis can provide insights into the real effect of income, fiscal policy, corruption, and aging on health.

The study finds that an increase in per capita government health expenditure (GGHE) and per capita external health expenditure sourced from foreign donors (EXT) reduces the share of out-of-pocket health expenditure to current health expenditure (OOPHE), thereby improving the health status and well-being of the people. However, the effect of EXT on OOPHE is more in the case of lower-income countries sample. Increase in GGHE reduces the per capita external financing for health (EXT) in LMICs and sub-samples, including low-income countries and across quantiles except for the lower-spending country samples. The study also finds crowding-out effects of per capita external financing for health (EXT) on GGHE in the case of LIMCs and low-income.

Further, the current study found that control of corruption (COC) positively affects the GGHE in low-income and lower-quintile samples. In low-income countries, improving governance would improve efficiency, strengthen the health system, and reduce OOPHE. On the contrary, a rise in per capita income increases the share of OOPHE. This implies that demand for private health care increases when the per capita income increases. The fiscal policy also reduces OOPHE and improves GGHE in LMICs. Our study shows that aging does not affect GGHE and OOPHE in LMICs and across all income categories. Further, our study concludes that those countries that have passed UHC legislation are moving faster toward health financing transition by increasing public spending on health care.

Based on the analysis and findings, a few policies are recommended for designing healthcare financing strategies in LMICs to achieve the Sustainable Development Goals (SDGs). First, strengthen policies for achieving universal health coverage through political will to prioritise healthcare reforms, funding for UHC implementation, and facilitate health insurance coverage to reduce the burden of out-of-pocket health spending for poor families. Second, tracking external sources of health financing as, during a crisis (economic, pandemic, conflicts), the flow of funds may decline dramatically, affecting the national healthcare system. Third, policies to control corruption in public finance management and improve spending efficiency are required in health systems to raise the absorption capacity of the allocated budget in the health sector. Further, policy to improve healthcare service delivery, reducing overbilling, and need-based health budgeting is crucial for improving health in LMICs. With the advent and development of digital technology, it is possible to track the flow of resources at different levels of health facilities. Fourth, developing countries should generate alternative strategies to raise revenue for financing public health care to move faster toward achieving SDGs because the healthcare needs of people and the cost of medical care are changing so frequently due to the upsurge of many communicable and non-communicable diseases, demographic transition (i.e., rising aging population), and shrinking of donor funding. Therefore, this study will help policymakers by providing evidence about the health financing transition stages in LMICs irrespective of the country’s features in terms of income, fiscal position, and health reforms for achieving healthcare outcomes.

Data Availability

Data are available in the public domain for research purposes and not for commercial use.

Notes

Universal health coverage (UHC) means that all people have access to the full range of quality health services they need, when and where they need them, without financial hardship. It covers the full continuum of essential health services, from health promotion to prevention, treatment, rehabilitation, and palliative care. Doi: https://www.who.int/health-topics/universal-health-coverage#tab=tab_1.

This study has selected the top 15 spending countries based on the availability of the latest years’ datasets from the list of low-income, low-middle, and upper-middle-income countries (Supplementary files Table A1). The top 15 countries were selected based on their pooled financing, i.e., domestic general government health expenditure (GGHE) per capita. Similarly, we also selected the top-15 household out-of-pocket health expenditure (OOP) as ratio of current health expenditure (OOP/THE)for the same sets countries in order to compare trends with the GGHE.

GGHE indicator is the average domestic general government health expenditures per person in US$. It contributes to understanding of the general government health expenditure relative to the population size facilitating international comparison. GGHE is measured as GGHE = (Transfers from government domestic revenue allocated to health purposes + Social insurance contributions)/Population.

EXT indicator calculates the average external sources of current expenditures on health per capita. External sources are composed of direct foreign transfers and foreign transfers distributed by the government encompassing all financial inflows into the national health system from outside the country. This indicator describes the size of the external sector of health expenditures in relation to the population size.

OOPHE indicator estimates how much does households in each country spend on health directly out of their pocket. It estimates the share of out-of-pocket payment of total current health expenditures.

Control of Corruption captures perceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as "capture" of the state by elites and private interests. Estimate gives the country's score on the aggregate indicator, in units of a standard normal distribution, i.e., ranging from approximately − 2.5 to 2.5, where the higher the index the less the corruption indicated.

The old-age dependency ratio is the ratio of older dependents (people older than 64) to the working-age population (those aged 15–64).

References

Arends, H. 2017. More with less? Fiscal decentralisation, public health spending, and health sector performance. Swiss Political Science Review 23 (2): 144–174.

Azfar, O., and T. Gurgur. 2008. Does corruption affect health outcomes in the Philippines? Economics of Governance 9 (3): 197–244.

Baltagi, B.H., and F. Moscone. 2010. Health care expenditure and income in the OECD reconsidered: Evidence from panel data. Economic Modelling 27 (4): 804–811.

Behera, D.K., and U. Dash. 2020a. Healthcare financing in South-East Asia: Does fiscal capacity matter? International Journal of Healthcare Management 13 (sup1): 375–384.

Behera, D.K., and U. Dash. 2020b. Is health expenditure effective for achieving healthcare goals? Empirical evidence from South-East Asia Region. Asia-Pacific Journal of Regional Science 4 (2): 593–618.

Behera, D.K., R.K. Mohanty, and U. Dash. 2020. Cyclicality of public health expenditure in India: Role of fiscal transfer and domestic revenue mobilization. International Review of Economics 67 (1): 87–110.

Borgen, N.T. 2016. Fixed effects in unconditional quantile regression. The Stata Journal 16 (2): 403–415.

Bun, M.J., and F. Windmeijer. 2010. The weak instrument problem of the system GMM estimator in dynamic panel data models. The Econometrics Journal 13 (1): 95–126.

Busemeyer, M.R. 2008. The impact of fiscal decentralisation on education and other types of spending. Swiss Political Science Review 14 (3): 451–481.

Choi, I. 2001. Unit root tests for panel data. Journal of International Money and Finance 20 (2): 249–272.

Cylus, J., P. Mladovsky, and M. McKee. 2012. Is there a statistical relationship between economic crises and changes in government health expenditure growth? An analysis of twenty-four European countries. Health Services Research 47 (6): 2204–2224.

Delavallade, C. 2006. Corruption and distribution of public spending in developing countries. Journal of Economics and Finance 30 (2): 222–239.

Di Matteo, L. 2005. The macro determinants of health expenditure in the United States and Canada: Assessing the impact of income, age distribution and time. Health Policy 71 (1): 23–42.

Dieleman, J.L., and M. Hanlon. 2014. Measuring the displacement and replacement of government health expenditure. Health Economics 23 (2): 129–140.

Dieleman, J.L., N. Sadat, A.Y. Chang, N. Fullman, C. Abbafati, P. Acharya, et al. 2018. Trends in future health financing and coverage: Future health spending and universal health coverage in 188 countries, 2016–40. The Lancet 391 (10132): 1783–1798.

Dormont, B., M. Grignon, and H. Huber. 2006. Health expenditure growth: Reassessing the threat of ageing. Health Economics 15 (9): 947–963.

Fan, V.Y., and W.D. Savedoff. 2014. The health financing transition: A conceptual framework and empirical evidence. Social Science & Medicine 105: 112–121.

Fosu, A.K. 2008. Implications of the external debt-servicing constraint for public health expenditure in sub-Saharan Africa. Oxford Development Studies 36 (4): 363–377.

Hall, R.E., and C.I. Jones. 2007. The value of life and the rise in health spending. The Quarterly Journal of Economics 122 (1): 39–72.

Hartwig, J. 2008. What drives health care expenditure?—Baumol’s model of ‘unbalanced growth’revisited. Journal of Health Economics 27 (3): 603–623.

Hecht, R., K. Flanagan, H. Huffstetler, and G. Yamey. 2018. Donor transitions from HIV programs: What is the impact on vulnerable populations. Bethesda: Health Affairs.

Holmberg, S., and B. Rothstein. 2011. Dying of corruption. Health Economics, Policy and Law 6 (4): 529–547.

Im, K.S., M.H. Pesaran, and Y. Shin. 2003. Testing for unit roots in heterogeneous panels. Journal of Econometrics 115 (1): 53–74.

Jakovljevic, M., E. Potapchik, L. Popovich, D. Barik, and T.E. Getzen. 2017. Evolving health expenditure landscape of the BRICS nations and projections to 2025. Health Economics 26 (7): 844–852.

Ke, X.U., P. Saksena, and A. Holly. 2011. The determinants of health expenditure: A country-level panel data analysis. Geneva: World Health Organization 26: 1–28.

Kocherginsky, M., X. He, and Y. Mu. 2005. Practical confidence intervals for regression quantiles. Journal of Computational and Graphical Statistics 14 (1): 41–55.

Koenker, R. 2005. Quantile regression, vol. 38. Cambridge: Cambridge University Press.

Koenker, R., and G. Bassett Jr. 1978. Regression quantiles. Econometrica: Journal of the Econometric Society 46: 33–50.

Lewis, M. 2006. Governance and corruption in public health care systems. Center for Global Development working paper (78).

Liang, L.L., and A.J. Mirelman. 2014. Why do some countries spend more for health? An assessment of sociopolitical determinants and international aid for government health expenditures. Social Science & Medicine 114: 161–168.

Licchetta, M., and M. Stelmach. 2016. Fiscal sustainability and public spending on health. London: Office for Budget Responsibility.

Makuta, I., and B. O’Hare. 2015. Quality of governance, public spending on health and health status in Sub Saharan Africa: A panel data regression analysis. BMC Public Health 15 (1): 1–11.

McCullough, J.M., and J.P. Leider. 2016. Government spending in health and nonhealth sectors associated with improvement in county health rankings. Health Affairs 35 (11): 2037–2043.

Moschovis, G. 2010. Public spending allocation, fiscal performance and corruption. Economic Papers: A Journal of Applied Economics and Policy 29 (1): 64–79.

OECD. 2021. Financing transition in the health sector: What can Development Assistance Committee members do?. OECD Development Policy Papers, No. 37, Paris: OECD Publishing. https://doi.org/10.1787/0d16fad8-en.

Piabuo, S.M., and J.C. Tieguhong. 2017. Health expenditure and economic growth-a review of the literature and an analysis between the economic community for central African states (CEMAC) and selected African countries. Health Economics Review 7 (1): 1–13.

Savedoff, W.D., D. de Ferranti, A.L. Smith, and V. Fan. 2012. Political and economic aspects of the transition to universal health coverage. The Lancet 380 (9845): 924–932.

Silverman, R. 2018. Projected health financing transitions: timeline and magnitude. Center for Global Development Working Paper (488).

Smith, S., J.P. Newhouse, and M.S. Freeland. 2009. Income, insurance, and technology: Why does health spending outpace economic growth? Health Affairs 28 (5): 1276–1284.

Sommer, J.M. 2020. Corruption and health expenditure: A cross-national analysis on infant and child mortality. The European Journal of Development Research 32 (3): 690–717.

Swaleheen, M., M.S. Ben Ali, and A. Temimi. 2019. Corruption and public spending on education and health. Applied Economics Letters 26 (4): 321–325.

WHO. 2022. National Health Account, Global Health Expenditure Database, World Health Organization. https://apps.who.int/nha/database/Select/Indicators/en. Accessed 11 Mar 2022.

World Bank. 2022. World development indicators. World Bank. https://data.worldbank.org/indicator. Accessed 11 Mar 2022.

You, X., and Y. Kobayashi. 2011. Determinants of out-of-pocket health expenditure in China: Analysis using China Health and Nutrition Survey data. Applied Health Economics and Health Policy 9: 39–49.

Funding

Funding was provided by Asian Development Bank Institute.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing Interests

The authors declare that they have no competing interests.

Ethical Approval

Not applicable.

Statement of Human and Animal Rights

Not applicable.

Consent to Publish

Not applicable.

Consent for Publication

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Behera, D.K., Rahut, D.B., Haridas, H.T. et al. Public Versus Private Health Financing Transition in Low- and Middle-Income Countries: Exploring the Crowding-Out Effects. Eur J Dev Res (2024). https://doi.org/10.1057/s41287-023-00618-5

Accepted:

Published:

DOI: https://doi.org/10.1057/s41287-023-00618-5

Keywords

- Universal health coverage legislation

- Government health expenditure

- Control of corruption

- External health assistance

- Distributional heterogeneity

- Quantile regression