Abstract

We develop a two-stage formulation to estimate seaport performance and to understand the drivers of efficiency, which could potentially include specialization, ownership, competition and tariff regulation. The first-stage non-parametric, slacks-based measure estimates the technical efficiency of each port. For the second-stage analysis, we develop a set of contextual variables including an absolute measure of specialization and a berth-level measure of ownership structure. To measure competition, we develop spatial measures that quantify the level of competition as a function of distance. We subsequently apply this formulation to major Indian seaports, covering a period of 21 years, from 1995 to 2015. The first-stage results suggest that average seaport efficiency has increased gradually over time. The second-stage fixed effects regressions show that specialization and external stakeholder participation have significant positive impacts on seaport performance. Perhaps surprisingly, we find that, in a tiered governance framework, competition between major seaports and local seaports has a significant negative impact on performance, potentially due to excessive infrastructure. Finally, changes in the regulatory mechanism over time are shown to be efficiency improving.

Similar content being viewed by others

1 Introduction

A five-fold increase in commodity exports from 1995 to 2011 (UNCTAD 2013) and the emergence of global production processes have led to port reforms over the last two decades. Recurring themes include ownership restructuring, a reduction in the role of the public sector, and improvement in the quality of seaport performance. The devolution of the public sector from port operations has resulted in an increase in private sector participation and in independent regulatory institutions for seaports (Brooks et al. 2017). The most prevalent governance model arising from port reforms has been the landlord port model. According to the World Bank (2001), the landlord seaport model contracts out port operations to the private sector, and the terminal operator thereafter invests in the superstructure, i.e. cargo-handling technology. The terminal operator is in turn eligible to earn returns on the investments made for a predetermined concession period. Under the landlord model, common port infrastructure is either funded by the port authority, by the private sector, or through a public–private partnership agreement. This is in contrast to the public service seaport model which was common before the emergence of port reforms. In a public service seaport, the port authority is responsible for port planning, management and operations. Nautical-technical services (pilotage, towage, mooring and, maybe, dredging) may be provided by a sole private firm (competition for the market), by a number of them competitively (competition in the market), by the port authority, or by a public–private partnership agreement. We attempt to assess whether the port reforms and the landlord model have led to improved efficiency, including a better use of resources, increases in cargo throughput and changes in quality of service. To that effect, we create a performance framework which is then applied to the Indian seaport market and thereafter test the impact that governance-related port reforms have had on the performance of said seaports.

Performance analyses have been proposed as a basis for incentive-oriented regulatory tools (Barros 2003; Estache et al. 2004; Ferrari and Basta 2010). Accordingly, we build measures for reform-related contextual factors such as specialization, ownership structure, competition levels and economic regulation, and test their impact on seaport performance. Mixed results have been obtained with regard to the impact of specialization or diversification strategies on seaports (Martinez-Budria et al. 1999; Inglada and Coto-Millan 2010; Tovar and Wall 2017; Hidalgo-Gallego et al. 2020). Mixed results have also been obtained with regard to the impact of private participation (Cullinane et al. 2005a; Cheon et al. 2010; Wang et al. 2013; Yuen et al. 2013; Wanke and Barros 2015; Zheng and Yin 2015) and seaport competition (Yuen et al. 2013; Oliviera and Cariou 2015; Merkel 2018). As a result, evidence from the existing literature has been inconclusive as to whether specialization, private sector participation and competition lead to an enhancement in seaport performance.

In this research, we apply a two-stage analysis to measure the impact of reform measures on performance, and we collected data on Indian seaports over the last two decades for this purpose. We estimate the relative performance of 11 port authorities in the first stage, which handled 56% of the cargo in 2015.Footnote 1 We collected data from the annual publications of the Indian Ports Association (1996–2016), wherein detailed profiles of all the major ports have been provided. Our unbalanced panel data set spans 21 years from 1995 to 2015. Our first-stage performance estimates present a relative technical efficiency measure, obtained using a slacks-based measure of technical efficiency (Tone 2001). In the second stage, we apply fixed effects regression models to ascertain the impact of reform-related factors, including specialization, external stakeholder participation (Denktas-Sakar and Karatas-Setin 2012), competition from local state-owned seaports, and economic regulation on the relative technical efficiency of the major seaports of India.

This research contributes to the extant literature in two directions. First, we develop a berth-level measure of ownership structure, a spatial measure of competition between ports and an absolute measure of specialization, namely the Keeble and Hauser (1971) Herfindahl–Hirschman Index (HHI) on seaport efficiency, which to the best of our knowledge have not been applied in the transport literature to date. Second, we measure the combined impact of ownership structure, competition and tariff regulation on seaport performance, which has not been studied before either. Moreover, previous research on Indian seaports has analysed the technical efficiency of (i) major Indian seaports (Kamble et al. 2010; Sekar and Deo 2012; Sekar et al. 2014; Dasgupta and Sinha 2016; Monteiro 2018), (ii) minor Indian seaports (Sekar and Deo 2016) and (iii) public and private Indian container terminals (Iyer and Nanyam 2020). This paper adds to the existing literature by estimating the technical efficiency of the major Indian seaports over two decades and by analysing the combined impact of relevant contextual factors on port technical efficiency. Our results may be useful for public policy decision-making with respect to Indian seaports and beyond.

The rest of the paper is organized as follows: a literature survey of the port production process and the impacts of contextual factors on seaport performance is discussed in Sect. 2, seaport governance and the reforms in India are detailed in Sect. 3, the research methodology, variables and data set included in this research are described in Sect. 4, the results are discussed in Sect. 5, and conclusions are drawn and recommendations for further research are provided in Sect. 6.

2 Literature survey

Port performance is often measured by modelling the production process of seaports. Odeck and Bråthen (2012) categorize frontier methodologies, which have been used to measure seaport performance. They note that most studies use either data envelopment analysis (Charnes et al. 1978; Banker et al. 1984) or stochastic frontier analysis (Aigner et al. 1977) to measure technical efficiency of seaports. Data envelopment analysis (DEA), the method applied in this research, is a non-parametric, deterministic approach to measure performance which relies on linear programming to identify the efficiency frontier.

Our objective is to understand the port production process and the input and output factors we have to consider while conducting a seaport performance study. As we are focusing on technical efficiency, we divide the variables according to a broad classification of the production factors. Since we apply DEA in this research, we have reviewed published seaport DEA papers to categorize the most relevant variables. The reader is referred to Panayides et al. (2009) and Gonzales and Trujillo (2009) for literature surveys and to Odeck and Bråthen (2012) for a meta-analysis of DEA and stochastic frontier analysis studies on the technical efficiency of seaports. From the literature survey, we conclude that both inputs and outputs for seaports are broadly classified into three factors. On the input side, these represent capital, labour and short-term variable costs, and on the output side, these are cargo, monetary and service quality measures.

2.1 Inputs

Capital is an important input, but it is often also the most difficult to measure. The book value of assets (Roll and Hayuth 1993; Barros 2003; Barros and Athanassiou 2004) is frequently used, although the perpetual inventory method (Goldsmith 1951; application to transport see for example Waters and Tretheway 1999) would be preferable if required information is available. When this information is not available, the most commonly used monetary proxy for capital is depreciation (Martinez-Budria et al. 1999). Capital has also been proxied by berth and yard side physical assets, including the number of berths (Tongzon 2001; Itoh 2002), total quay length (Estache et al. 2004; Cullinane et al. 2004, 2005a, b, 2006; Turner et al. 2004; Wang and Cullinane 2006), berthing capacity (Park and De 2004), terminal area (Tongzon 2001; Itoh 2002; Cullinane et al. 2004, 2005a, b, 2006; Turner et al. 2004; Wang and Cullinane 2006) and cargo-handling capacity (Park and De 2004). Moreover, cargo-handling equipment, including the number of cranes (Tongzon 2001; Itoh 2002; Cullinane et al. 2004, 2005a, b, 2006; Turner et al. 2004), tug boats (Tongzon 2001) and straddle carriers (Cullinane et al. 2004, 2006, 2005a, b) have also been used as proxies for capital.

Seaports are capital-intensive investments, and there is a trend among seaports to substitute away from labour towards more mechanized or automated technology. Labour is still an important factor that needs to be taken into consideration. This variable is not always easy to measure as port authority labour is often outsourced. When outsourced employee figures are available, care must also be taken to include the nature of employment, e.g. the proportion of full-time and part-time employees or employee-hours. Some proxies for labour include the number of port authority employees (Roll and Hayuth 1993; Tongzon 2001; Itoh 2002; Barros 2003; Estache et al. 2004; Barros and Athanassiou 2004) or expenditure on salaries (Martinez-Budria et al. 1999) when precise information on outsourcing and the nature of employment of cargo-handling workers is not available. The third input includes the variable cost of port authority operations over and above its expenditure on salaries and depreciation (Martinez-Budria et al. 1999).

2.2 Outputs

The most important output measure is the amount of cargo handled at the seaports. While the mass of cargo handled (Roll and Hayuth 1993; Martinez-Budria et al. 1999; Estache et al. 2004; Park and De 2004; Barros and Athanassiou 2004) has most commonly been included, in some cases container counts have also been assessed (Tongzon 2001; Itoh 2002; Barros 2003; Barros and Athanassiou 2004; Cullinane et al. 2004, 2005a, b; 2006; Turner et al. 2004; Wang and Cullinane 2006). Some studies have divided the cargo handled into different categories to account for the multi-output nature of the port production process (Barros 2003). Furthermore, the vessel calls (Roll and Hayuth 1993; Tongzon 2001; Barros 2003; Barros and Athanassiou 2004; Park and De 2004) are included to consider operations at the level of the berth. As a result, cargo handled accounts for the operations in the terminal yard and vessels handled accounts for berth-side operations.

The operating income could be an alternative to cargo measures. Both total revenues and net income have been used as outputs (Martinez-Budria et al. 1999; Park and De 2004). Care should be taken not to include cargo and monetary measures in the output side in order to avoid double counting outputs. The revenue that the port authority earns is a function of cargo and vessel handling, or revenue (fees) from concession contracts.

Quality of service could also be considered as an output in a seaport performance analysis. Subjective measures of the quality of service have been obtained through user satisfaction surveys (Roll and Hayuth 1993; Park and De 2004). Roll and Hayuth (1993) define an objective measure of the level of service, which is the ratio between the handling time and the total time a ship remains in port. Another objective measure is to count the container moves per working hour per ship for a container port or terminal (Tongzon 2001). More recently, negative externalities have been accounted for by including port emissions as an undesirable output within the DEA methodology. For example, Chang (2013) includes CO2 emissions as an undesirable output in the DEA model examining port efficiency.

2.3 Contextual factors

From Kemeny and Storper (2012), a specialized seaport is one that mostly handles one type of cargo and a diversified seaport is one that handles many types of cargo, with no cargo type dominating the composition. Ducruet et al. (2010) argue that seaport diversification strategies are policy matters relevant to both local and national governments. Specialization could have a positive performance impact due to economies of scale in handling a particular type of cargo. Those that diversify could benefit from economies of scope and cost complementarities in cargo handling. Martinez-Budria et al. (1999) argue that Spanish port authorities with higher complexity in operations are more technically efficient than those with medium complexity, and ports with low levels of complexity achieve negative growth in efficiency over time. They also suggest that specialization leads to excess capacity, which could be better utilized in diversified seaports owing to the seasonality of specific cargo types.

The impact of specialization on technical efficiency of Spanish port authorities has been explicitly tested in Inglada and Coto-Millan (2010), Tovar and Wall (2017) and Hidalgo-Gallego et al. (2020). Tovar and Wall (2017) find a positive relationship between cargo concentration and technical efficiency. They also find that specialization of the larger Spanish ports in several outputs and the specialization of the smaller Spanish ports in a single output has a positive impact on technical efficiency. Moreover, they find that the specialization benefits of the larger Spanish ports are higher than those of smaller Spanish ports. In relation to cargo types, Inglada and Coto-Millan (2010) find that specialization in general cargo contributes to technological change improvements, specialization in passenger and liquid bulk cargo enhances scale efficiency, and overall technical efficiency and specialization in containerized cargo has a positive impact on total factor productivity growth. On the other hand, specialization in solid bulk handling has a negative impact on technological change of Spanish port authorities. Hidalgo-Gallego et al. (2020) find that increasing specialization in handling general cargo positively impacts technical efficiency but at a decreasing rate, meaning that the marginal positive impact of specialization in the handling of general cargo on technical efficiency could be low. Moreover, their results show that specialization in the handling of liquid bulk and solid bulk leads to lower technical efficiency. Based on the literature regarding the performance impact of specialization, we formulate the following hypothesis:

Hypothesis 1 (performance impact of specialization)

Specialization has a positive impact on technical efficiency but at a decreasing rate.

Seaport management and operations have seen the emergence of various forms of public–private partnership arrangements ranging from build operate transfer (BOT) concession contracts, dedicated berth and terminal lease contracts, to simpler management contracts. Full privatization has also occurred, as in the case of the UK. To analyse the performance impact of public–private partnerships and privatization, Cullinane et al. (2005a) apply DEA to a data set of 30 container ports worldwide, spanning a time frame of 9 years from 1992 to 1999. They find no significant relationship between cross-sectional and inter-temporal efficiency and private participation, including full privatization. To the contrary, Cheon et al. (2010) conduct a Malmquist DEA for 98 global container ports for the years 1991 and 2004, finding that the total factor productivity of these ports is positively correlated with ownership restructuring, with a higher degree of private sector involvement. They argue that global terminal operators such as Hutchinson Port Holdings (HPH) and Dubai Ports World (DPW) have access to specialized technology, which implies government divestment from container port operations in order to enhance total factor productivity.

Country-specific performance impacts of private participation have been analysed in the case of Brazilian, US and Chinese seaports. Wanke and Barros (2015) show that a higher level of private participation at the major Brazilian seaports leads to significantly higher-scale efficiency due to the operational flexibility of the private terminal operators. Wang et al. (2013) also show that landlord ports in the USA have a higher profit efficiency in comparison with operating ports. In their efficiency analysis of 21 Chinese container terminals, Yuen et al. (2013) find that a majority of foreign investment with a minority of Chinese controlling stake has significant positive impacts on technical efficiency. They argue that this is due to the specialization of the foreign investor complemented with the Chinese stakeholder’s knowledge of the local upstream and downstream markets. Contrary to the results obtained by Yuen et al. (2013), Zheng and Lin (2015) analyse the efficiency of 16 Chinese port corporations and find that ports with a majority state ownership have higher cost efficiencies. They argue that this is because China is transitioning from a planned to a market economy. During this transition period, ports need state support for the provision of transportation infrastructure, and ports with a higher share of state involvement get preferential policies from the Chinese government. Our hypothesis regarding the performance impact of external stakeholder participation in seaport operations is as follows:

Hypothesis 2 (performance impact of external stakeholder participation)

A higher degree of external stakeholder participation in seaport operations leads to higher technical efficiency.

As seaports are parts of complex trade networks, competition occurs at hierarchical levels (Verhoeff 1981). In the extant literature, the impact of competition on performance has been analysed for regional inter-port competition; between container ports globally (Oliviera and Cariou 2015); regional inter-port competition between European container ports (Merkel 2018); and inter- and intra-port competition among Chinese container terminals (Yuen et al. 2013). The Oliviera and Cariou (2015) results show a significant negative impact of inter-container port competition on efficiency between competitors located within a great circle distance of 400–800 km. Merkel’s (2018) analysis of the European container ports shows a significantly higher technical efficiency for container ports locked in regional competition within a Euclidean distance of 300 km, hence proposing the promotion of competition between European container ports.

Yuen et al. (2013) obtain mixed results regarding the performance impacts of competition among container terminals in China. They show that inter- and intra-container port competition has positive impacts on technical efficiency, whereas inter-container terminal competition is shown to have significant negative impacts on efficiency growth. It is argued that the negative impact of inter-container terminal competition on the Malmquist DEA efficiency-growth estimates is due to the free rider problem and the late mover advantage. Trade-oriented regions invest heavily in port infrastructure, and incumbents incur significant costs in shaping the regional port-oriented supply chain, which may lead to over-investment. New entrants then free ride on the incumbents’ investment without the need for additional investments in the region’s port-based knowledge creation and supply chain orientation. As Indian seaports operate in a tiered governance framework which includes federally owned and regulated ports alongside local state-owned seaports, we hypothesize that the impact of competition will be as follows:

Hypothesis 3 (performance impact of competition)

A higher level of competition between federal and state-owned seaports encourages improvements in technical efficiency.

With the advent of the landlord and private service seaport models that opened up the market for private participation, the open question is whether regional market power could impact cargo-handling charges and service quality levels. Estache et al. (2004) address the issue of potential market failure by suggesting that data envelopment analysis (DEA) could be employed in the economic regulation of seaports to ensure that the efficiency gains from port reforms lead to downward revisions in cargo-handling tariffs. Ferrari and Basta (2010) estimate the x-parameter in the price-cap incentive in regulatory mechanisms, as applied to Italian container terminals by employing DEA models. With regard to the regulation of competition for the market, terminal operating and cargo-handling companies might overbid for the rights to operate a terminal and then pass these costs on to the users by charging higher prices (Theys et al. 2010). As a result, regulation of competition for the market may be needed to prevent the bidding companies from overbidding. Our hypothesis with regard to the performance impact of regulation is as follows:

Hypothesis 4 (performance impact of regulation)

(a) Tariff regulation by an independent or partly independent regulator is more efficiency inducing than internally regulated seaports.

(b) Regulation of competition for the market leads to optimal bidding by cargo-handling companies.

3 Seaport reform and governance in India

The Indian seaports were governed by a two-tiered framework wherein the federally owned seaports were under the jurisdiction of the central government in accordance with the Major Ports Trusts Act (1963), while the local state-owned seaports were under the jurisdiction of the respective state governments in accordance with the Indian Ports Act (1908). Currently, the only corporatized port is located in Kamarajar, according to the Companies Act (1956). Within the two-tiered governance framework, the non-economically regulated state seaports have increased their cargo share (Raghuram and Udayakumar 2015), leading to a higher degree of competition between the state and federally owned seaports over time.Footnote 2

The Indian government introduced three seaport reform programmes over the last 15 years. The National Maritime Development Programme (NMDP) was introduced in 2005, with the dual objective of expanding capacity and modernizing the existing federal port infrastructure. The agenda included the deepening of channels, construction of new berths, procurement of modern cargo-handling equipment and improvement of hinterland road and rail connectivity. The investments were funded by the central government, the port’s internal resources and private investors (MoS 2005).

The Indian Maritime Agenda (IMA) 2010:2020 focused on improving port capacity, performance, and coastal and inland waterways shipping. The IMA report (MoS 2011) required governance-related reforms including the corporatization of port trusts, implementation of the landlord port model and promotion of effective competition by revising the existing regulatory mechanism. In addition, establishment of a maritime finance corporation, a public–private partnership forum called the Indian Maritime Council, and state maritime boards were on the agenda. The passing of a new Indian Ports Act was also on the agenda.

Under the Major Port Authorities Act (2015), the government granted greater autonomy to port trusts, with the intention of corporatizing them at a later date. Corporatization, in conjunction with the landlord seaport model, was intended to improve the performance of Indian seaports. The revenue share from concession contracts could be used by port authorities to partly fund seaport and maritime facilities, including the maintenance, innovation and modernization of common port facilities.

The latest program, the Sagarmala project (MoS 2016), was intended to reduce logistics costs and to encourage port regionalization (Notteboom and Rodrigue 2005). The initiative includes the setting up of manufacturing clusters around ports, port-based smart cities and coastal economic zones. Additional objectives included institutional improvements of the public–private partnerships and the development of agglomeration benefits by creating jobs for coastal communities.

For public–private partnerships, build, operate and transfer (BOT) contracts have been readily used to build additional terminals. BOT contracts are awarded to the concessionaire through competitive bidding in India. The bidding criteria include the license fee, revenue share, rent and cargo volume quoted, and the maximum net-present-value bidder wins the contract (Haralambides and Behrens 2000). Upon the expiry of the concession period, the concessionaire shall handover the terminal to the port authority, and new bids will thereafter be invited. According to one of the Sagarmala reports (Vol. 3, MoS 2016), private participation has been lower than anticipated. The report suggests that contracts have been excessively rigid by defining the type of cargo to be handled and by prohibiting bidding for the rights to operate a second terminal at the same seaport, which might, allegedly, inhibit economies of scale.

Encouraging competition has been addressed through economic regulation by a partly independent regulator called the Tariff Authority for Major Ports (TAMP). The regulator publishes guidelines to set tariff ceilings and to regulate the quality of service. The regulation has been cost-based. The first set of guidelines was published in 1998, according to which the operator was allowed a 20% return on equity over and above the project costs. In the same guidelines, the bids were allowed to pass through as operating costs, which could lead to higher cargo-handling charges to the port customer. To effectively regulate the competition for the market, vis à vis competition in the market,Footnote 3 the guidelines published in 2003 created amendments such that only the bid of the second-highest bidder was allowed to pass through as operating costs. This pass-through of bidding costs was not valid after the operator started making profits. The next set of guidelines was published in 2005 (TAMP 2005), according to which terminal operators were allowed a 15% rate of return on the capital rate base.Footnote 4 This change was implemented because a higher equity share in the previous two sets of guidelines would lead to higher cargo-handling rates. The TAMP (2008) guidelines introduced upfront tariff ceilings, aiming to prevent opportunistic behaviour by the regulator and annual tariff escalations. From 2013 (TAMP 2013,2015) onwards, performance incentives were also included in the regulatory guidelines. We evaluate the impact of these governance and reform programmes by modelling the seaport production process.

4 Models and data

This section is organized into three subsections. Section 4.1 explains the DEA model which has been used in this research. Section 4.2 describes the variables and data which have been collected and analysed in the modelling approach. Section 4.3 describes the regression model, along with the variables and the data, which have been applied in a second-stage process to explain the results of the first-stage efficiency estimates.

4.1 Slacks-based measure of efficiency

Tone’s (2001) variable returns-to-scale, slacks-based measure (SBM) was applied to measure relative performance because of many desirable properties, including units invariance.Footnote 5 SBM is non-oriented, allowing the modeller to assess slacks in both input and output variables, similar to that of the additive model (Charnes et al. 1985). Furthermore, the model is non-radial, permitting non-proportionate reduction and expansion rates for respective inputs and outputs. Finally, given the large differences in the sizes of the ports studied, a variable-returns-to-scale model seemed the most appropriate. We construct a static inter-temporal frontier (Tulkens and van den Eeckaut 1995) by including all seaport-year observations, because the unbalanced panel data set prevents us from applying Malmquist DEA. We then test the impact of exogenous factors on seaport performance by applying fixed effects regression models in a second stage.

4.2 Variables for the SBM

The review of the port production process leads us to identify eight variables to be included in the DEA models. Table 1 provides a description of these variables, including their descriptive statistics. The data were collected from the annual publication of the Indian Ports Association (IPA 1996–2016), which provides annual data. After accounting for missing values, we created an unbalanced panel data set of 230 observations.

On the input side, we include measures of capital, variable costs,Footnote 6 full-time equivalent port authority staff and a proxy for cargo-handling labour. With regard to capital, the IPA publications contain information on the depreciation of port authority assets and its annual financial and miscellaneous expenditures. As the depreciation of port authority assets represents an accounting proxy for capital input, we add this measure to the financial and miscellaneous expenditures, which represent a proxy of the annual inflow of investment into a certain port. The capital measure is a proxy because the net book value of assets is not published. We also include the number of berths, which is a physical measure of capital. The variable costs include the operating expenditure of the port authority such as inventory, office and administration, operation and maintenance, security, medical and other expenses. The mean of the capital measure is only slightly higher than the variable costs. This is due to the fact that port asset depreciation is generally spread over a long period. Labour inputs comprise the number of non-cargo-handling, port authority officers and a proxy for the stevedore gangs.Footnote 7 The stevedore gang is a proxy because some port authorities employ the labourers directly whilst others outsource the cargo-handling activity. Stevedore gangs are assumed to be a direct function of the number of mobile, wharf, quay and yard cranes, thus assuming that cranes and cargo-handling employees are used in fixed proportions.

We include three variables on the output side: two cargo-related measures estimating the total number of vessels handledFootnote 8 and the total volume of cargo handled in millions of tonnes annually. Both variables are included because the vessels handled reflect berth side operations and the cargo handled reflects yard side operations. Berth side operations involve a higher share of investment in capital, including the construction of berths, dredging and equipment such as cranes. Yard side operations involve a higher share of variable costs, and cargo handled is a partial indicator of the output generated accordingly. Furthermore, vessel sizes have been increasing, and the inclusion of cargo handled provides a clearer picture of this impact on seaport efficiency over time for this panel data set. The two cargo-related variables contain information on all cargo categories, including dry bulk, liquid bulk, general cargo and containers handled. Finally, as shipping lines have to pay both vessel and cargo-handling fees, including both vessels handled and cargo handled as outputs represents the fee structure charged to the shipping lines (Button and Kramberger 2015). The third output is a measure of the quality of service and is defined as the reciprocal of the average turnaround time of vessels. This variable is used as an output since it is a result of the production process and ensures that we correctly attempt to optimize service quality (Scheel 2001). The wide range of this variable, as shown by the minimum and maximum values in Table 1, denotes the significant difference in the quality of service offered at the ports in our data set.

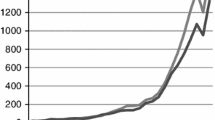

Figure 1 depicts an index constructed over the annual averages of the eight variables and normalized for base year 1995. The trends are indicative of the rate of change per variable over time. All variables, excluding labour inputs, depict a net positive slope in the trend. As the ports appeared to be highly overstaffed in the early years, with as many as 20,019 port authority employees (see Table 1), the reform programmes focused on reducing labour costs. A 65% average reduction in port authority staff was achieved by 2015, suggesting that the reform programs may have achieved some of their goals. Modernization programs focused on equipping ports with better technology, which reduced the number of cranes needed by an average of 25% by 2015. These reductions have occurred despite an increase of 170% in cargo handled and a 65% increase in vessels served. The variable depicting the highest fluctuations is the measure of capital. Whilst depreciation is fairly stable over time, the finance and miscellaneous expenditures vary substantially over time and across seaports, primarily based on port authority forecasts of demand for specific seaport infrastructure. The variable costs show a more stable rate of increase of 100% over the 21-year period. On the output side, cargo handled shows a higher rate of growth compared with vessels served, which confirms that the size of vessels has been increasing over time. The decline after 2010 in the growth rate of cargo and vessels handled is attributed to the global economic recession of 2009. Finally, the quality of service initially improved, followed by a decline after 2002. Quality levels started to improve after the introduction of the Indian Maritime Agenda in 2010 such that the 2002 levels were again achieved in 2015.

We test three DEA models in this research. Model A contains three inputs, namely capital, variable costs and port authority labour levels, and two outputs, the vessels served and cargo handled. Model B includes all model A variables and the service quality indicator. The third model is a principal components analysis and data envelopment analysis (PCA-DEA) model (Adler and Golany 2001). The PCA-DEA model has all outputs included in model B and the variable cost input. The second input is the first principal component of the monetary measure of capital and the number or berths, which explains 85% of the variance in the data. The third input is the first principal component of the port authority labour and the number of cranes, which is a proxy for the cargo-handling labour, and this principal component explains 72% of the variance in the data.

4.3 Second-stage regression

Our aim is to quantify the impact of specialization and governance-related factors on seaport performance. We do this in the second stage of our analysis. Our seaports fixed effects regression modelFootnote 9 is as follows:

where \({Eff}_{it}\) is the efficiency estimate of seaport i in year t; \(\alpha \) is the time-invariant intercept; the \(\beta \)s are the estimated coefficients of the independent governance-related variables; \({\mu }_{i}\) is the time-invariant error component of seaport I; and \({\epsilon }_{it}\) is the independent and identically distributed (IID) error component of seaport i in period t. We test three regression models covering all DEA estimates (models A, B and PCA-DEA).

Specialization and diversification strategies of seaports are a function of the derived demand that seaports face from their respective catchment areas. We derive an absolute measure of specialization using the Keeble and Hauser (1971) HHI, which is an economic measure of the specialization at the seaports. We derive the Keeble and Hauser specialization measures by computing the square root of the sum of squares of the shares per cargo category. This gives us an absolute measure of specialization, with one value for each seaport-year observation. The values range from 0 to 1, with 1 signifying full specialization at the seaport, namely a single cargo type. The reason for applying the HHI is that this is a parsimonious measure satisfying the axioms of anonymity, progressive transfers, bounds, decomposability, splitting and merging of cargo categories handled, and the inclusion of zeroes in the absence of the handling of specific cargo categories (Palan 2010). Specialization, \({Spec}_{i}\), in the models we test, is defined as follows:

where \({s}_{i}^{k}=\frac{{x}_{i}^{k}}{{\sum }_{k=1}^{4}{x}_{i}^{k}}\). \({x}_{i}^{k}\) is the volume of a specific category of cargo handled where \(k=1\) is the volume of dry bulk cargo handled, \(k=2\) liquid bulk handled, \(k=3\) break-bulk cargo handled and \(k=4\) container cargo handled.Footnote 10 We calculate this measure for all seaports over the 21 years of analysis. By squaring the share of a particular type of cargo category, the HHI places a higher emphasis on those cargo types in which a seaport specializes. We run another set of regression models with specialization as a categorical variable by splitting the Keeble and Hauser HHI into five levels, namely below 60%, between 60% and 70%, between 70% and 80%, between 80% and 90% and above 90% specialization. This has been done to test whether increasing specialization impacts performance at a decreasing rate.

With regard to particular cargo categories, in absolute terms, dry bulk and liquid bulk have the highest shares of cargo handled. However, over time, these shares decline from around 45% of dry bulk cargo to around 37%. The share of liquid bulk went up to 41% in 1999, after which it declined to around 37%. Break-bulk cargo handled has the lowest share, which declined to around 4%. Container cargo has the highest rate of increase, and its share in the total volume of cargo handled has grown from 10% to 22% over the timeframe.

We calculate the ownership measure, \({O}_{it}\) by including information on the number of berths that are operating with external stakeholder participation out of the total number of berths of the seaport. This measure thus contains information on dedicated berth, management and concession contracts that the external stakeholders have signed with a port authority. The dedicated berth operators in the country are mostly from the petroleum, chemical, fertilizer and mining sectors. For example, at the Jawaharlal Nehru Port Trust, the loading and unloading of the liquid bulk is handled by the port authority, while the storage operations of the liquid cargo are handled by private operators. For containerized cargo, port authorities sign standard concession contracts with terminal operators, of a typical duration of around 30 years. After creating this measure, we define three levels: (i) between 0% and 33%, (ii) between 33% and 66%, and (iii) above 66% stakeholder participation at the level of the berth. We use a categorical measure to give policy suggestions on the degree of public–private partnership which may be conducive to seaport performance. A level below 33% of stakeholder participation is indicative of a public service seaport. A landlord seaport with BOT contracts would have either between 33% and 66% or above 66% stakeholder involvement, depending on the degree to which seaport services have been contracted out to the private sector. The second and third categories compare the performance impact of varying levels of stakeholder involvement in seaport operations.

Market entry by state seaports governed by state maritime boards has increased competition intensity. The existence of an uneven governance and regulatory framework necessitates the measurement of the impact of competition on efficiency. Since location is one of the most relevant determinants of port choice (see review of Martínez Moya and Feo Valero 2017), we develop a competition measure based on distance to and size of competing ports. Given a seaport i, where n is the number of state seaports operating in the predefined geographical zone, and c is the number of state seaports operating outside the predefined geographical zone, our measure of competition is defined as follows:

where \({CarHan}_{j}\) is the cargo handled by the state seaport j. \(n-i-c\) indicates that the major seaports and state seaports outside the predefined geographical zone have been excluded from the calculation of the respective measure of competition. The above-defined competition measure has been calculated for each seaport and for each year from 1995 to 2015. This is a distance-weighted competition measure that is related to the concept of accessibility. It is the distance-discounted size of neighbouring ports. The larger this measure, the stronger the competition between a port and its neighbours.Footnote 11 The distance between ports, dij, is measured using the great circle distance between major-state seaport pairs. The distance is the weighting factor that takes into account the fact that competition intensity declines with increasing distance between seaports owing to a reduction in the overlap of hinterlands. We have also run a set of regressions where we use the distance along the coast between major state–seaport pairs, but we report only the results which are significant.

The geographical zones we use are the state, the coast and the opposite coast. As a result, we obtain three competition-related variables: \({CompState}_{i}\), \({CompCoa}_{i}\) and \({CompOppCoa}_{i}\). The first variable measures competition within a state. The second variable measures competition along the coast by excluding the ports that operate in the same state and the ports that operate along the opposite coast. The third variable measures the competition with state seaports from the opposite coast by excluding the ports operating within the same state as well as the ports operating along the same coast. The reason for separately measuring competition within the state and along the coast is that ports within the same state operate under a similar governance framework. As a result, the characteristics of the competition that a major seaport faces from a set of state ports from within the state would be similar in nature, due to the existence of common governance and policy framework for local ports within a state. The three competition variables are adjusted with the respective sample standard deviations to account for the wide dispersion in the values of these variables. To estimate the performance impact of regulatory changes over time, we create dummy variables covering the specific timeframes between each of the guidelines, creating seven dummies respectively. Finally, we also include year dummies, \({Time}_{t}\).

Table 2 presents the descriptive statistics for the continuous variables in the regressions. As regards specialization, the mean value of 0.73 indicates that seaports are pursuing a specialization strategy rather than striving to diversify. Concerning competition, some ports in states such as Goa and West Bengal face no competition from state seaports; hence, minimum values are zero.

Since many state seaports along the east coast entered the market after 1999, the minimum value for competition along the coast, and with the opposite coast, is also zero. The mean value for competition within the state is lower than that of competition along the coast, because the number of state ports operating along the coast is higher than those operating within an individual state, with the exception of Gujarat and Maharashtra. The same line of reasoning explains the lower mean value for competition within a state, compared with the competition with the opposite coast. Weighting by distance implies that the mean value of competition along the coast is higher than that of competition with the opposite coast. In Gujarat and Maharashtra, there is a higher degree of competition because there are several state seaports. Therefore, we expect competition to have a positive impact on technical efficiency. In the rest of the states, with a lower number of state seaports, we expect lower competition to have a negative impact on technical efficiency. For example, JNPT, which is in Maharashtra, has 22 cargo-handling state seaports within a distance of 300 km and 22 cargo handling state seaports within a distance of between 300 and 700 km. Meanwhile, Haldia, which is in West Bengal, has only one cargo-handling state seaport within a distance of 300 km and one cargo-handling state seaport within a distance of between 300 and 700 km. Table 4 contains information on the regulation and ownership variables.

5 Results

The results we obtain show that the Indian seaports have significant scope for improvement. Ports which specialize benefit from economies of scale, which leads to better performance. External stakeholder participation improves the performance of the major seaports. Competition between major and state seaports in a tiered governance framework has negative impacts on the performance of the major seaports. Finally, cost-based regulation is preferred over internal regulation by the port authority. These results are further elaborated in the upcoming sub-sections. Section 5.1 discusses the results of the slacks-based measure of efficiency, and Sect. 5.2 discusses the results of the second-stage regression models.

5.1 Slacks-based measure of efficiency

Figure 2 depicts the box plots of the SBM efficiency estimates of the 11 seaports, for the 21-year time duration considered. These measures of relative technical efficiency are based on the assumption that the ports minimize the relative excess in inputs and maximize the relative shortfall in outputs. We observe a high correlation in efficiency scores of the three DEA models. Figure 4 contains the DEA scores for all seaports for the 21 years.

Model A has a higher discriminatory power than model B because quality of service is not included. This is reflected in the lower mean score for technical efficiency. Ports that get a better ranking in model A, in comparison with model B, are those that have a relatively poorer service quality. This may be due to the presence of capacity constraints that can lead to congestion at the seaports, resulting in higher average turnaround times due to decreasing returns to scale on investment. This could also be due to the size and type of vessels handled. If a seaport handles larger vessels on average, this could result in longer turnaround times. Finally, ports which do not invest heavily in providing services of superior quality will get a higher ranking in model A. These could be some of the reasons why ports such as Mumbai, Paradip, Vizag and Kandla are offering relatively poorer service quality in comparison with the other ports.

Moreover, ports that achieve a higher ranking in model B, in comparison with the PCA-DEA model, are those that have a relative excess of cranes, cargo-handling employees or berths. One reason may be that such ports are specializing in handling containers, hence the high amount of crane usage. Secondly, this may also be due to the usage of outdated technology, which leads to a lower performance score in the PCA-DEA model when in comparison with model B. With regard to overall performance, ports such as Tuticorin, Kandla, NMPT and JNPT are the best performers, while ports such as Mumbai, Kolkata Port Trust, Chennai, Mormugao, Paradip, Cochin and Vizag have significant scope for improvement.

Figure 3 shows the trend in the average annual technical efficiency in models A, B and PCA-DEA. The results should be interpreted as the technical efficiency trend with respect to a static efficiency frontier. All three models show that there are two phases of decline and improvement in technical efficiency across all seaports. The first phase of decline occurred till 1999, after which there is an improvement until 2007. The second, shorter phase of decline continued until the end of 2012, after which performance improves. The first phase of decline in performance has been addressed by the Indian Ministry of Shipping by introducing the National Maritime Development Programme in 2005. Thereafter, even though the second reform programme, namely the Indian Maritime Agenda, was introduced in 2010, the second phase of decline can be attributed to macroeconomic shocks such as the economic recession, the illegal mining of iron ore in India, and the contraction of Chinese imports of Indian iron ore. Fitting a trend line for performance across the three models reveals that the average annual performance gradually increased from around 45% average efficiency in 1995 to around 75% in 2015.

5.2 Second stage regression

Table 3 presents the results of the regression models. The coefficient for the absolute measure of specialization has a significant positive impact on performance. Moreover, specialization has the highest positive impact among all variables, which suggests that economies of scale are very important for efficient use of resources. As the coefficient tends to be higher when service quality is not included in the first stage (model A), the rate of improvement in service quality is lower than the rate of increase of cargo-related outputs when seaports pursue specialization strategies. The results obtained here are broadly in line with those obtained by Tovar and Wall (2017). With regard to the categorical specialization variable, model A results show that specialization impacts performance with an increasing rate for specialization levels of up to 90%, after which the magnitude of the impact decreases. Similar results are obtained for the performance impact of specialization in model B. The results for the PCA-DEA model show that the positive performance impact of specialization is sustained with an increasing rate for specialization levels of more than 90% as well. As a result, we only partly accept our first hypothesis, which states that specialization has a positive impact on technical efficiency but at a decreasing rate.

Regarding external stakeholder participation, the higher the participation, the higher the level of relative efficiency estimates. The higher magnitude of the coefficient for external stakeholder participation above the level of 66% suggests that the landlord seaport model with port authorities in an administrative role while contracting out most seaport operations to third parties is conducive to better seaport performance. These results confirm our second hypothesis, that a higher degree of external stakeholder participation in seaport operations leads to higher technical efficiency.

Interestingly, competition appears to harm the performance of the major seaports owing to the significant negative coefficients obtained in model A. The results reveal that competition along the coast has a higher negative impact on the performance of the major seaports than competition within a state. This may be due to the fact that seaports have large catchment areas that present a higher likelihood of overlap. This also indicates that there is potential for substitution between seaports. These results are in line with the results presented by Oliviera and Cariou (2015). They show that competition has a negative impact on technical efficiency of container ports when competition arises from container ports that are at a distance of between 400 and 800 km to each other. But in contrast to their results, our results show that local competition originating from within the state also negatively affects technical efficiency of the seaports. As a result, we observe that reform and modernization programmes have not impacted sufficiently the major seaports in order to be able to effectively compete with the state seaports. Nevertheless, coastal competition does not have a significant negative impact on performance in model B and the PCA-DEA. This would mean that the seaports are offering a better quality of service in anticipation of higher coastal competition from the state seaports. The least important form of competition draws from the opposite coast, which is insignificant. This is likely due to the distances involved and the poor road and rail infrastructure within India. We hence reject our null hypothesis, that a higher level of competition between the state and federal seaports leads to a higher technical efficiency of the federal seaports.

Although the competition-related results show a negative impact on the technical efficiency of federal seaports, the increasing degree of competition might have an overall positive impact on the technical efficiency of the system of seaports in the country, which is inclusive of both the federal and the state seaports. This is what has been shown by Merkel (2018) in the case of European container ports. These findings are also a part of the results obtained by Yuen et al. (2013) in the case of Chinese container ports. Our results show that, within the two-tiered governance framework, the federal seaports are not able to effectively react to competition that they face from the state seaports.

With regard to regulation, the modified TAMP 1998 guidelines are taken as the base case. We observe that internal regulation by the port authority has a negative impact on performance relative to the base case. Next, the TAMP 1998 guidelines did not take competition for the market into account in the design of the bidding process. Our results show that this also has a significant negative performance impact relative to the base case. Subsequent tariff guidelines introduced by TAMP show significant positive performance impacts relative to the base case in all regression models. Shifting regulation from the return-on-equity to the return-on-capital employed has had significant positive performance impacts. This is because a higher equity share in the previous two sets of guidelines would imply higher rates for cargo-handling services. The upfront fixation of tariffs also has a significant positive performance impact as it prevents opportunistic behaviour by the regulator. The inclusion of performance terms in determining the subsequent year’s cargo and vessel handling charges has a positive performance impact as it encourages the terminal operators to offer a high service quality. The indexation of rates to the wholesale price index has also had a positive impact on efficiency relative to the base case as it takes inflation into account in the regulatory mechanism. These results confirm our fourth set of hypotheses, that tariff regulation by an independent or partly independent regulator is more efficiency inducing than when seaports are internally regulated by the port authority and regulation of competition for the market leads to optimal bids being offered by cargo handling companies to the port authority. to separate the regulation-related categorical variables from time-related exogenous factors, we included time dummies. The vast majority of the time dummies are not significant in our second-stage regression models. Therefore, we do not display them in Table 3.

6 Conclusions and future directions

In this paper, we estimate the impact of specialization and governance-related factors on the performance of the ports of India based on a two-stage model. We find that ports such as Tuticorin, Kandla, JNPT and NMPT achieve relatively higher average efficiency scores. Indeed, during the 21-year time period analysed, the average efficiency estimates have increased from around 45% to about 75%, which are all explained by the contextual variables. It becomes clear that further reform programmes should focus on the modernization of major seaports. Specialization has the highest significant positive impact on seaport performance, highlighting the importance of economies of scale. As the Sagarmala projectFootnote 12 aims at port-facilitated industrialization, the Indian Ministry of Shipping could work on regionalization strategies that consider the performance benefits of seaport specialization.

Concerning the ownership structure, our results show that external stakeholder participation improves technical efficiency. The landlord seaport model not only reduces the public sector budget demands, but also improves seaport performance. As a result, the environment ought to be made conducive to public–private partnerships, whereby terminal operators need to be provided with an environment that deems concession contracts viable over the duration of the project.

The competition results of our analysis indicate that competition from state ports has a significantly negative impact on the performance of the federal seaports within a state as well as along the coast. It would be helpful if common governance, institutional and regulatory frameworks were applied to all seaports. This may promote effective competition among all the seaports in the country, thereby further improving performance.

As the landlord seaport model leads to market entry by firms with a profit maximization objective, market power needs to be regulated. Our results show that TAMP oversight has had an overall positive impact on performance. We conclude that cost-based regulation by an independent regulator is more performance inducing than internal regulation. Moreover, to avoid excessive quotes at the bidding stage, the introduction of regulation of competition for the market has had significant positive impacts on performance. The upfront tariff-fixation policy and the inclusion of performance terms in determining the scale of rates for subsequent tariff periods have also had a significant positive impact on performance.

We also suggest that, alongside an independent regulator, it is necessary to collect data for benchmarking. This may help prevent market power abuse, guarantee superior services to the port customer, and promote the long-term viability of seaport stakeholder investment. Benchmarking could contribute to the estimation of rates, performance standards and tariff guidelines. As partial indicators have been used to analyse performance, the forum of regulators should be encouraged to apply methods such as total factor productivity, data envelopment analysis or stochastic frontier analysis to measure the performance at the level of the port, port authority and terminal.

As this research estimates technical efficiency, future research will have to focus on estimating cost efficiency of the Indian seaports. Benchmarking at the level of the terminal, inclusion of state-governed seaports in the data sets, and comparison of the performance of Indian seaports to the performance of international seaports are also venues for further research. This paper uses DEA to estimate efficiency. Future research could use other methods such as stochastic frontier analysis (SFA) and total factor productivity (TFP). It should also consider port-generated externalities. Finally, the impacts of improved port performance on the surrounding regions will also have to be studied.

Notes

The figure represents the cargo handled in financial year 2015–2016, which runs from 1 April 2015 to 31 March 2016. This has been written as 2015 for the sake of convenience. The same format has been used for the rest of the paper.

We note that the state-owned seaports are free to set charges based on market conditions and determine service quality based on agreements with shipping lines.

Competition for the market may be implemented when direct competition is not possible, for example due to the size of required investments (e.g. in the electricity distribution market). Instead, firms bid for the right to serve the market for a specific timeframe. Competition in the market takes place after entry, wherein a firm competes with other firms serving the same or overlapping markets.

The capitalization rate indicates the rate of return permitted as a function of the net income generated, divided by the terminal asset value.

The model was run using the additiveDEA package in R (Soteriades 2017).

Ports provide services such as mooring, pilotage, berthing, cargo handling and storage (Meersman et al. 2014), and they incur both fixed and variable costs in providing these services. According to Bisevac et al. (2019), the variable costs incurred include expenditure on fuel for the operation of cargo-handling equipment, maintenance, rental charges of equipment and wages. At Indian seaports, these variable costs are broadly categorized as stores, office and administrative, operation and maintenance, security, medical and other expenditure. In 2015, stores accounted for 5.56%, office and administrative expenditure accounted for 5.53%, operation and maintenance accounted for 41.97%, security accounted for 10.19%, medical expenditure accounted for 6.23% and other expenditure accounted for 30.52% of the variable costs incurred at all major Indian seaports. Wages are also a part of the variable costs, but as we have two other inputs that account for labour, we do not include wages in computing the variable costs.

The capital and labour measures are positively correlated, with a correlation of 0.51 between capital and non-cargo-handling labour and a correlation of 0.28 between capital and cargo-handling labour. Despite the positive correlation, we include capital and labour measures as inputs in the DEA models because the literature review revealed that both measures are required to get a complete representation of the production process of seaports. Moreover, as capital and labour are substitutes, the decision of the choice of composition of the inputs decides the capital intensity of the seaport.

The berth occupancy rate could be used as a service-quality-related output instead of the total vessels handled. However, due to the practical difficulties of aggregating berth-level occupancy rates for each port, we have instead opted to use the total vessels handled as an output.

We ran the open source plm package in R (Croissant and Millo 2008).

Each cargo category has its own terminal. For example, K = 2 would mean a liquid bulk terminal. This is mostly the case, except for multi-purpose terminals. We have aggregated this information at the level of the port because we do not have sufficient information at the level of each individual terminalto perform a disaggregated analysis.

For instance, Desmet et al. (2020) use it as a measure of competition among cities. In gravity estimates of trade, a term called multilateral resistance measures the size of all alternative destinations that may divert trade to these destinations. It depends on size and distance or trade costs. The concept of multilateral resistance was first suggested by Anderson and van Wincoop (2004).

The Sagarmala project intends to reduce logistics costs and encourage port regionalization. The initiative includes the setting up of manufacturing clusters around ports, port-based smart cities and coastal economic zones. Additional objectives include institutional improvements for public–private partnerships and the development of agglomeration benefits by creating jobs for coastal communities.

References

Adler, N., and B. Golany. 2001. Evaluation of deregulated airline networks using data envelopment analysis combined with principal component analysis with an application to Western Europe. European Journal of Operational Research 132: 18–31.

Aigner, D., C.A.K. Lovell, and P. Schmidt. 1977. Formulation and estimation of stochastic frontier production function models. Journal of Econometrics 6: 21–37.

Anderson, J.E., and E. van Wincoop. 2004. Trade costs. Journal of Economic Literature 42 (3): 691–751.

Banker, R.D., A. Charnes, and W.W. Cooper. 1984. Some models for estimating technical and scale inefficiencies in data envelopment analysis. Management Science 30 (9): 1078–1092.

Barros, C.P. 2003. The measurement of efficiency of Portuguese sea port authorities with DEA. International Journal of Transport Economics 30 (3): 335–354.

Barros, C.P., and M. Athanassiou. 2004. Efficiency in European seaports with DEA: Evidence from Greece and Portugal. Maritime Economics and Logistics 6: 122–140.

Bisevac, I.V., N. Milesic, K. Prskalo, N. Vidic, and K. Vukadinovic. 2019. Application of the methodology for calculating cargo handling tariffs at river ports. In 4th logistics international conference, Belgrade, 23–25 May.

Brooks, M.R., K.P.B. Cullinane, and A.A. Pallis. 2017. Revisiting port governance and port reform: A multi-country examination. Research in Transportation Business and Management 22: 1–10.

Button, K., and T. Kramberger. 2015. European Union expansion and seaport efficiency in the North Adriatic. Applied Economics Letters 22 (9): 700–703.

Chang, Y.-T. 2013. Environmental efficiency of ports: A data envelopment analysis approach. Maritime Policy & Management 40 (5): 467–478.

Charnes, A., W.W. Cooper, B. Golany, L. Seiford, and J. Stutz. 1985. Foundations of data envelopment analysis for Pareto-Koopmans efficient empirical production functions. Journal of Econometrics 30 (1–2): 91–107.

Charnes, A., W.W. Cooper, and E. Rhodes. 1978. Measuring the efficiency of decision making units. European Journal of Operational Research 2 (6): 429–444.

Cheon, S.H., D.E. Dowall, and D.-W. Song. 2010. Evaluating impacts of institutional reforms on port efficiency changes: Ownership, corporate structure, and total factor productivity changes of world container ports. Transportation Research Part E 46: 546–561.

Companies Act. 1956. Government of India.

Croissant, Y., and G. Millo. 2008. Panel data econometrics in R: The plm package. Journal of Statistical Software 27 (2): 1–43.

Cullinane, K., J. Ping, and T. Wang. 2005. The relationship between privatization and DEA estimates of efficiency in the container port industry. Journal of Economics and Business 57: 433–462.

Cullinane, K., J. Ping, and T. Wang. 2005. The application of mathematical programming approaches to estimating container port production efficiency. Journal of Productivity Analysis 24: 73–92.

Cullinane, K., D.-W. Song, P. Ji, and T.-F. Wang. 2004. An application of DEA windows analysis to container port production efficiency. Review of Network Economics 3 (2): 184–206.

Cullinane, K., T.-F. Wang, D.-W. Song, and P. Ji. 2006. The technical efficiency of container ports: Comparing data envelopment analysis and stochastic frontier analysis. Transportation Research Part A 40: 354–374.

Dasgupta, M.K., and D. Sinha. 2016. Impact of privatization of ports on relative efficiency of major ports of India. Foreign Trade Review 51 (3): 225–247.

Denktas-Sakar, G., and C. Karatas-Setin. 2012. Port sustainability and stakeholder management in supply chains: A framework on resource dependence theory. The Asian Journal of Shipping and Logistics 23 (3): 301–320.

Desmet, K., A. Greif, and S.L. Parente. 2020. Spatial competition, innovation and institutions: The industrial revolution and the great divergence. Journal of Economic Growth 25: 1–35.

Ducruet, C., H.R.A. Koster, and D.J. Van der Beek. 2010. Commodity variety and seaport performance. Regional Studies 44 (9): 1221–1240.

Estache, A., B. Tovar de la Fe, and L. Trujillo. 2004. Sources of efficiency gains in port reform: A DEA decomposition of a Malmquist TFP index for Mexico. Utilities Policy 12: 221–230.

Ferrari, C., and M. Basta. 2010. Port concession fees based on the price-cap regulation: A DEA approach. Maritime Economics & Logistics 11: 121–135.

Goldsmith, R.W. 1951. A perpetual inventory of national wealth. NBER Chapters, Studies in income and wealth, vol. 14, 5–73. New York: National Bureau of Economic Research, Inc.

González, M.M., and L. Trujillo. 2009. Efficiency measurement in the port industry: A survey of the empirical evidence. Journal of Transport Economics and Policy 43 (2): 157–192.

Haralambides, H.E., and R. Behrens. 2000. Port restructuring in a global economy: An Indian perspective. International Journal of Transport Economics 27 (1): 19–39.

Hidalgo-Gallego, S., M.D.L. Fuente, I. Mateo-Mantecon, and P. Coto-Millan. 2020. Does cargo specialization improve port technical efficiency? The paradigm of specialized infrastructure. Maritime Policy & Management 47 (2): 258–272.

Indian Ports Association. Major Ports of India. A Profile: 1996–2016. New Delhi.

Inglada, V., and P. Coto-Millan. 2010. Analysis of technical efficiency and rate of return on investment in ports. In Essays on port economics, ed. P. Coto-Millan, M. Pesquera, and J. Castanedo, 287–304. Heidelberg: Physica.

Itoh, H. 2002. Efficiency changes at major container ports in Japan: A window application of data envelopment analysis. Review of Urban and Regional Development Studies 14 (2): 133–152.

Iyer, K.C. and V.P.S.N Nanyam. 2020. Technical efficiency analysis of container terminals in India. The Asian Journal of Shipping and Logistics.

Kamble, S.S., A.D. Raoot, and V.B. Khanapur. 2010. Improving port efficiency: A comparative study of selected ports in India. International Journal of Shipping and Transport Logistics 2 (4): 444–470.

Keeble, D.E., and D.P. Hauser. 1971. Spatial analysis of manufacturing growth in outer South-East England 1960–1967. Regional Studies 5: 229–262.

Kemeny, T. and M. Storper. 2012. Specialization and regional economic development. SERC Discussion Paper 121. London: UK Spatial Economics Research Centre.

Martinez-Budria, E., R. Diaz-Armas, M. Navarro-Ibanez, and T. Ravelo-Mesa. 1999. A study of the efficiency of Spanish port authorities using data envelopment analysis. International Journal of Transport Economics 26 (2): 237–253.

Martínez Moya, J., and M. Feo Valero. 2017. Port choice in container market: A literature review. Transport Reviews 37: 300–321.

Meersman, H., S.P. Strandenes, E. Van de Voorde. 2014. Port pricing: Principles, structure and models. NHH Discussion Paper, ISSN: 0804-6824. Bergen: Norwegian School of Economics.

Merkel, A. 2018. Competitive intensity and inefficiency in European container ports: An empirical investigation using SFA. Maritime Business Review 3 (2): 165–184.

Monteiro, J.G.R. 2018. Measuring productivity and efficiency of seaports in India using DEA technique. The Central European Review of Economics and Management 2 (3): 155–174.

MoS (Ministry of Shipping). 1908. Indian Ports Act. Government of India.

MoS (Ministry of Shipping). 1963. Major Ports Trusts Act. Government of India.

MoS (Ministry of Shipping). 2005. National Maritime Development Programme. Government of India.

MoS (Minsitry of Shipping). 2011. Indian Maritime Agenda: 2010–2020. Government of India.

MoS (Ministry of Shipping). 2015. Major Port Authorities Act. Government of India.

MoS (Ministry of Shipping). 2016. Sagarmala Reports. Government of India.

Notteboom, T.E., and J.-P. Rodrigue. 2005. Port regionalization: Towards a new phase in port development. Maritime Policy and Management 32 (3): 297–313.

Odeck, J., and S. Bråthen. 2012. A meta-analysis of DEA and SFA studies of the technical efficiency of seaports: A comparison of fixed and random-effects regression models. Transportation Research Part A 46: 1574–1585.

Oliviera, G.F.D., and P. Cariou. 2015. The impact of competition on container port (in)efficiency. Transportation Research Part A 78: 124–133.

Palan, N. 2010. Measurement of specialization – The choice of indices. FIW Working Paper, No. 62. Vienna: FIW - Research Centre International Economics.

Panayides, P.M., C.N. Maxoulis, T.F. Wang, and K.Y.A. Ng. 2009. A critical analysis of DEA applications to seaport economic efficiency measurement. Transport Reviews 29 (2): 183–206.

Park, R.-K., and P. De. 2004. An alternative approach to efficiency measurement of seaports. Maritime Economics and Logistic 6: 53–69.

Raghuram, G. and P.D. Udayakumar. 2015. Effect of tariff regulation in major port container terminals: The case of Jawaharlal Nehru Port Trust. IIMA Working Paper, No. 2015-12-04. Ahmedabad: Indian Institute of Management Ahmedabad.

Roll, Y., and Y. Hayuth. 1993. Port performance comparison applying data envelopment analysis (DEA). Maritime Policy & Management: The Flagship Journal of International Shipping and Port Research 20 (2): 153–161.

Scheel, H. 2001. Undesirable outputs in efficiency valuations. European Journal of Operational Research 132 (2): 400–410.

Sekar, R.T., P.S. Ashraf, and P.M. Deo. 2014. Measurement of efficiency of major ports in India – A data envelopment analysis approach. International Journal of Environmental Sciences 4 (5): 926–936.

Sekar, R.T., and M. Deo. 2012. The size effect of Indian major ports on its efficiency using DEA-additive models. International Journal of Advances in Management and Economics 1 (5): 12–18.

Sekar, R.T., and M. Deo. 2016. Do the minor ports of India operate efficiently. Commonwealth Journal of Commerce and Management Research 3 (4): 1–24.

Soteriades, A.D. 2017. additiveDEA: Additive data envelopment analysis models. R package version 1.1. https://CRAN.R-project.org/package=additiveDEA.

TAMP (Tariff Authority for Major Ports). 2005. Guidelines for Regulation of Tariff at Major Ports, 2004. Ministry of Shipping. Government of India.

TAMP (Tariff Authority for Major Ports). 2008. Guidelines for upfront tariff setting for PPP Projects at Major Port Trusts, 2008. Ministry of Shipping. Government of India.

TAMP (Tariff Authority for Major Ports). 2013. Guidelines for Determination of Tariff for Projects at Major Ports, 2013. Ministry of Shipping. Government of India.

TAMP (Tariff Authority for Major Ports). 2015. Policy for Determination of Tariff for Major Port Trusts, 2015. Ministry of Shipping. Government of India.

Theys, C., T.E. Notteboom, A.A. Pallis, and P.W.D. Langen. 2010. The economics behind the awarding of terminals in seaports: Towards a research agenda. Research in Transportation Economics 27: 37–50.

Tone, K. 2001. A slacks-based measure of efficiency in data envelopment analysis. European Journal of Operational Research 130: 498–509.

Tongzon, J. 2001. Efficiency measurement of selected Australian and other international ports using data envelopment analysis. Transportation Research Part A 35: 107–122.

Tovar, B., and A. Wall. 2017. Specialisation, diversification, size and technical efficiency in ports: An empirical analysis using frontier techniques. European Journal of Transport and Infrastructure Research 17 (2): 279–303.

Tulkens, H., and van den Eeckaut. 1995. Non-parametric efficiency, progress and regress measures for panel data: Methodological aspects. European Journal of Operational Research 80: 474–499.

Turner, H., R. Windle, and M. Dresner. 2004. North American containerport productivity: 1984–1997. Transportation Research Part E 40: 339–356.

UNCTAD. 2013. Facts and figures on commodities and commodities trade.

Verhoeff, J.M. 1981. Seaport competition: Some fundamental and political aspects. Maritime Policy and Management 8 (1): 49–60.

Wang, G.W., K.J. Knox, and P.T.-W. Lee. 2013. A study of relative efficiency between privatised and publicly operated US ports. Maritime Policy & Management 40 (4): 351–366.

Wang, T.-F., and K. Cullinane. 2006. The efficiency of European container terminals and implications for supply chain management. Maritime Economics and Logistics 8: 82–99.

Wanke, P.F., and C.P. Barros. 2015. Public-private partnerships and scale efficiency in Brazilian ports: Evidence from two-stage DEA analysis. Socio-Economic Planning Sciences 51: 13–22.

Waters, W.G., II., and M.W. Tretheway. 1999. Comparing total factor productivity and price performance: Concepts and application to Canadian railways. Journal of Transport Economics and Policy 33 (2): 209–220.

World Bank. 2001. World Bank Port Reform Toolkit. www.worldbank.org/transport/ports/toolkit/.

Yuen, A.. C.-l, A. Zhang, and W. Cheung. 2013. Foreign participation and competition: A way to improve the container port efficiency in China? Transportation Research Part A 49: 220–231.

Zheng, S., and C. Yin. 2015. Technical, allocative and cost efficiencies of Chinese ports. Maritime Policy & Management 42 (8): 746–758.

Acknowledgements

The authors would like to thank the referees of Maritime Economics & Logistics for their valuable feedback, which has helped in improving our paper. Shravana Kumar would like to thank the Erasmus Mundus/ IBIES program and the Dynamics, Tension and Xtreme Events research cluster of the Hochschule Bremen City University of Applied Sciences for the PhD scholarships. He would like to thank the BENCHPORTS project of the Hochschule Bremen City University of Applied Sciences for funding the data collection. He would also like to thank the participants of the WCTRS SIGA2 Conference 2018, Antwerp, Verkehrsökonomik und –politik Konferenz 2019, Berlin, WCTRS Conference 2019, Mumbai, ITEA 2019, Paris and the European Transport Conference 2020, Milan, for their helpful comments on earlier versions of this paper.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions