Abstract

With the introduction of IATA’s New Distribution Capability (NDC), airlines will no longer be limited to discrete fare classes for their fare product distribution but could show fare quotes from continuous ranges to booking requests. NDC will also allow airlines to present different fare quotes to passengers from different demand segments as identified by the airline. In theory, airlines can better extract passenger willingness to pay, and thus, see gains in revenue, by offering segmented continuous fare quotes to different passengers requesting to book. This paper describes the revenue management (RM) methods for Segmented Continuous Pricing and examines their potential effects on airlines’ revenue through simulations in the Passenger Origin–Destination Simulator (PODS). We describe a class-based algorithm for continuous pricing, a straightforward extension from the traditional methods used with existing RM systems. Our simulation results show that in a calibrated scenario in which only one airline adopts Segmented Continuous Pricing and has an 80% accuracy in identifying business versus leisure passenger booking requests, the first-mover airline can see as much as a 17% revenue gain, at the expense of competitors. The revenue gains come primarily from the leisure passenger segment by offering lower fares than competitors closer to departure. The first-mover airline loses bookings but does not see losses in revenue from the business passenger segment. We also explore potential response strategies by the competing airlines. We discover that competitors can reverse the first-mover’s revenue gain by removing their fare restrictions while still using traditional RM methods. We conclude that although adopting Segmented Continuous Pricing is promising in theory, its gains in practice will depend heavily on the competitive situation and the responses made by competing airlines.

Similar content being viewed by others

Introduction

Most airline revenue management systems still rely on fare classes associated with fixed price points for flight itineraries. The New Distribution Capability (NDC) will allow airlines to adopt pricing methods that are no longer constrained by fixed price points and to offer fare quotes from a continuous range. With continuous pricing, it will also be possible for airlines to charge different prices to business and leisure passengers if the airline is able to distinguish booking requests from each demand segment. The combination of customer segmentation and continuous pricing is the topic of this paper: Segmented Continuous Pricing.

Previous studies by Papen (2020) and Liotta (2019) focused on testing the effects of continuous pricing mechanisms without customer segmentation. In those studies, all passengers are quoted a single fare from a continuous range. With NDC enabling airlines to generate segmented fare quotes, it is useful to extend the research to examine the combined effect of continuous pricing and customer segmentation and explore the competitive effects in realistic settings.

The main contribution of this paper is to explain the underlying mechanisms and provide an analysis of the potential effects of Segmented Continuous Pricing, in which airlines offer different continuous fare quotes to business and leisure passengers, respectively. First, we present a framework for continuous pricing methods and the mathematics behind the pricing models. The key differences between Segmented and Unsegmented continuous pricing are highlighted. Then, the Segmented Continuous Pricing methods are tested in the Passenger Origin–Destination Simulator (PODS). The effects of Segmented Continuous Pricing are examined under asymmetric competition (where one airline takes the role of a first mover). We also explore some possible counter measures by competitors using traditional revenue management methods, using an asymmetric competitive scenario that is calibrated in Long (2022).

Literature review

The term “dynamic pricing” has recently become popular in the airline industry, but its definition often varies. Wittman and Belobaba (2018) offered a general definition of dynamic pricing: “Firms practice dynamic pricing when they charge different customers different prices for the same product, as a function of an observable state of nature.” Wittman and Belobaba (2019) constructed a definitional framework for dynamic pricing and described three mechanisms for its implementation: assortment optimization, dynamic price adjustment, and continuous pricing.

In assortment optimization, firms decide which subset of a finite set of price points is made available to the customer at different times over the booking process. With dynamic price adjustment, airlines can choose to quote fares that deviate from the fixed price points to certain segments of passengers based on additional transactional information they receive. Wittman (2018) developed the Probabilistic Fare-Based Dynamic Adjustment (PFDynA) method for dynamic price adjustment, and Wittman and Belobaba (2018) demonstrated in simulations that airlines can gain revenues when dynamic price adjustment is deployed. A working group organized by the Airline Tariff Publishing Company (ATPCO) proposed a set of new specifications for “Dynamic Pricing Engines” that allow airlines to mark up or mark down their pre-filed fares for certain booking requests (Dezelak and Ratliff 2018).

The third mechanism in this dynamic pricing framework is continuous pricing, where firms can choose a price from a continuous range without having any pre-filed menu of discrete price points. Continuous pricing requires significant changes to existing revenue management and distribution tools for its implementation (Wittman and Belobaba 2019). Westermann (2006) suggested a continuous pricing mechanism in which revenue-maximizing fares are calculated based on passenger WTP, competitor fares and other contextual information. Westermann (2013) explained how continuous pricing can be realized in an NDC environment.

Details of practical implementations have been presented by Bala (2014), who discussed the potential benefits and risks of implementing continuous pricing and proposed an “automated fare filing” process, in which filed fares are updated continuously to approximate the effect of continuous pricing. More recently, Lufthansa Group (2020) described the implementation of a limited form of continuous pricing applied to existing fare structures and used in direct distribution channels.

There has also been substantial research devoted to the theoretical concepts required for possible future implementations. Liotta (2019) explained several algorithms for generating continuous fare quotes and simulated the revenue benefit from continuous pricing over traditional airline revenue management. Papen (2020) also showed in simulations that airlines can see increases in revenues with Unsegmented continuous pricing, where airlines offer a single fare quote from a continuous range to all passengers. Szymanski et al. (2021) explored different algorithms for determining unsegmented continuous fare quotes, both class-based and classless approaches.

NDC enables the use of contextual information in determining the offered price and allows airlines to use the information to distribute personalized offers (Westermann 2013). Belobaba (2016) suggested that airlines can segment the market demand by trip purpose, price sensitivity, and time sensitivity. Teichert et al. (2008) used behavioral and social-demographic factors to identify passenger segments and argued for segmenting passengers into more than just two categories (i.e., business and leisure travelers), as they do not sufficiently capture the passenger heterogeneity. Bruning et al. (2009) studied segmentation of passengers in NAFTA countries (USA, Canada, and Mexico), and identified five passenger segments through a cluster analysis. Similar studies have also been conducted on passengers in Serbia (Kuljanin and Kalić 2015) and Greater China (Chen and Chao 2015; Pan and Truong 2020), and different discriminant factors were identified.

Although there have been studies done on continuous pricing and passenger segmentation respectively, little research has been done on the combination of both elements in the context of airline revenue management. This paper provides a comprehensive analysis of the combined effect of passenger segmentation and continuous pricing in airline revenue management through simulations in PODS.

Methods and models for continuous pricing

We first introduce a high-level framework for continuous pricing methods to illustrate the distinctions between two types of continuous pricing algorithms: “Class-Based Continuous Pricing” (CBC) and “Classless Continuous Pricing.” In this paper, we focus on the formulation and simulated performance of the CBC algorithm. The segmented fare quotation process for continuous pricing is described, and the implementation of Segmented Continuous Pricing is explained.

Class-based vs. classless continuous pricing

There are two types of continuous pricing algorithms: Class-Based Continuous Pricing (CBC) and Classless Continuous Pricing. Both methods generate continuous fare quotes to passengers, but CBC still requires airlines to keep historical data of bookings and fare values by fare class while Classless Continuous Pricing does not. Figure 1 provides an overview of the main differences between traditional class-based RM, Class-Based Continuous Pricing, and Classless Continuous Pricing.

Differences between Traditional RM, CBC, and Classless Continuous Pricing. (Papen 2020)

The difference between CBC and traditional class-based RM lies in the fare quote generation. As illustrated in Fig. 1, CBC relies on booking and revenue data by fare class just like traditional RM, and thus, it can use the same forecasters and optimizers. In bid price control for traditional RM, the airline determines its fare class availabilities by comparing the adjusted fare values of the requested itinerary with the sum of the bid prices over the flight legs to be traversed. This is equivalent to comparing the unadjusted nominal fare values and the sum of the traversed bid prices plus a marginal revenue fare modifier that reflects the optimizer fare decrement from the fare adjustment process.

Assuming a negative exponential demand model, the fare modifier is calculated by the following equation:

where \(f_{q}\) is the fare value of the lowest fare class, and \(FRAT5_{t}\) is the airline’s estimate of the median conditional willingness to pay (WTP) of total (unsegmented) demand relative to the lowest fare class during timeframe \(t\) in the booking horizon. Specifically, each FRAT5 value is the fare ratio to which 50% of demand is expected to sell up—a FRAT5 equal to 2.5 with lowest fare $100 reflects a median WTP estimate of $250.

In Class-Based Continuous Pricing, the airline offers a continuous fare quote that equals the sum of traversed flight leg bid prices (\(BP_{l}\)) and the fare modifier. Both the bid prices and FRAT5 values are for the current timeframe, as both will change over the remainder of the booking horizon. For simplicity, in the remainder of this paper we omit the subscript t, which is implied. To prevent extreme fares, the generated fare quote can be limited to be between the lowest filed fare \(f_{Q}\). and the highest filed fare \(f_{Y}\). In the PODS simulations below, these constraints on the continuous fare quotes are always applied. The offered fare is, thus, calculated by

Figure 2 provides a detailed illustration comparing the processes of CBC and traditional RM that are used in this paper. In this example, Q-forecasting and discrete fare adjustment is used since there is no differentiation between the fare quotes for different passengers. The adjusted fares and re-partitioned forecasts are then fed into the same traditional class-based ProBP optimizer to calculate the bid prices. The processes only diverge in the last step after the bid price calculation.

Classless Continuous Pricing, on the other hand, does not depend on any information from the pre-determined fare classes. Classless Continuous Pricing optimizes over booking timeframes instead of fare classes. Q-forecasting is used as the forecaster, but the observed bookings are recorded by timeframes only rather than by both fare classes and timeframes. For more details on the Classless Continuous Pricing method and its revenue effects, see Liotta (2019) and Papen (2020).

Unsegmented vs. segmented continuous pricing

With the continuous pricing method described above, a single fare quote is generated at each point in the booking horizon and offered to all passengers shopping for a ticket. Although the fare quote generation process does consider the combined willingness to pay of all passengers arriving at each timeframe through the FRAT5 inputs, it does not consider the differences in willingness to pay between different types of passengers. Furthermore, the continuous fare quotes are not differentiated through restrictions or advance purchase requirements. Passengers cannot self-select into different segments like they do with differentiated fares in traditional class-based revenue management.

With Segmented Continuous Pricing, an airline can generate different continuous fare quotes for distinct passenger groups with various levels of willingness to pay, if the airline can identify passenger requests from each segment with a certain identification accuracy. We assume two segments of passenger demand: business and leisure, with business passengers having higher willingness to pay than leisure passengers.

The difference between Unsegmented Continuous Pricing and Segmented Continuous Pricing lies in the fare quotation step only. Instead of adding a single unsegmented MR modifier to the bid prices, different MR modifiers are used to generate the segmented fare quotes for business and leisure passengers, respectively. The segmented MR modifiers are calculated by:

where \(SegWTP_{B}\) and \(SegWTP_{L}\) are the segmented willingness to pay estimates for business and leisure passengers, respectively, at any given timeframe in the booking horizon. Similar to the FRAT5 values, these segmented WTP values represent the airline’s estimates of the median conditional WTP of the passengers, relative to the lowest fare class, in each demand segment. It is important to note that these segmented willingness to pay estimates are used for calculating the segmented MR modifiers only. The previously described aggregated FRAT5 values are still used for forecasting, fare adjustment, and bid price calculations.

Each passenger shopping for a ticket is identified as a business or leisure passenger at the time of booking request and is shown only one fare quote according to the identification result. The differences between the fare generation processes for Unsegmented and Segmented Continuous Pricing are highlighted in Fig. 3

Passenger segment identification accuracy

In Segmented Continuous Pricing, the airline is assumed to have some ability to correctly identify the passenger segment of an incoming booking request. In practice, characteristics of the booking request can help airlines distinguish between business and leisure travel requests. For example, requests made far in advance of departure (e.g., 30 days), for round-trip travel involving a longer stay at the destination (e.g., 6 days or over a weekend), for multiple passengers on the same itinerary (e.g., 4) are much more likely to be for leisure than business travel.

However, such an identification process can have imperfect accuracy and lead to misidentification of booking requests. In the PODS simulations below, scenarios with both perfect and imperfect identification accuracies are tested. In cases where the identification has imperfect accuracy, misidentification is assumed to be equally likely to happen to both business and leisure passengers. For example, with an assumed 80% identification accuracy, 20% of the business passengers from the total business demand will be identified to be leisure passengers, and vice versa. The misidentified passengers will be quoted the continuous fare generated for the other segment.

Simulation study and results

The potential benefits and competitive effects of implementing Segmented Continuous Pricing were tested with the Passenger Origin–Destination Simulator (PODS). In this section, we first provide a brief overview on the PODS simulation mechanism, followed by descriptions of the experiments where only one airline in a competitive network implements Segmented Class-Based Continuous (CBC) Pricing. We focus on testing the Class-Based method for Segmented Continuous Pricing. We believe the CBC results are more relevant for airlines looking to invest in Continuous Pricing as they are more likely to start with a Class-Based method rather than a Classless method that requires extensive changes to their current RM systems. Lastly, we present the simulation results with detailed analyses and discussion on the competitive effects of Segmented Continuous Pricing. For analysis of effects of Unsegmented Continuous Pricing, see Papen (2020) and Szymański et al. (2021).

Passenger origin–destination simulator

The Passenger Origin–Destination Simulator (PODS) replicates the real-world interactions between passengers and airline RM systems and provides an integrated platform for testing different RM methods. We present here the details of the simulation environment most relevant to the current work. For a more comprehensive overview of PODS, see Fiig et al. (2010) or Wittman (2018).

Fundamentally, the PODS software consists of two main building blocks: passenger choice model and airline RM systems. As illustrated in Fig. 4, the software iteratively simulates the interactions between passengers and airlines and reports detailed performance metrics to provide insights on the effects of the tested RM methods.

Schematic of interactions between passengers and airlines in PODS (Wittman 2018)

The airline RM system in PODS has two major components: a forecaster and an optimizer. The forecaster uses the recorded historic booking data from previous simulated departures to forecast the demand by itinerary (path) and fare class for each future departure date. Given the forecasted demand, the optimizer calculates bid prices and/or fare quotes to maximize the expected revenue for the airline. Like airline RM systems in the real world, the RM systems in PODS do not know the true underlying passenger demand characteristics: the PODS RM systems only use estimates of passenger WTP (i.e., FRAT5 values) as inputs. The underlying WTP of business and leisure passengers generated in the PODS simulation does not change over different timeframes in the booking horizon. However, the mix of business and leisure passengers in the total demand does change from timeframe to timeframe. Thus, the aggregate WTP (as well as FRAT5 values) will increase over the booking horizon.

The simulation tests reported in this paper were performed in Network U10. As illustrated in Fig. 5, Network U10 is an international network with four competing airlines. Airline 3 is intended to represent a low-cost carrier (LCC). It is smaller than the other three competitors as it only serves domestic O-D markets. Each airline operates from a hub city and serves both the local O-D markets as well as the coast-to-coast O-D markets through connections at the hub. There are 572 O-D markets served in Network U10 with a total of 40 spoke cities in addition to the 4 hubs.

In each O-D market, every airline offers the same 10-class fare structure in an all-economy cabin. In Network U10, there are three different fare products (FP) for several types of O-D markets. In domestic O-D markets, the airlines use either FP1 or FP2. In markets where Airline 3 is present, the less differentiated FP2 fare structure is used to simulate the effect of competition from an LCC with a simplified fare structure. In domestic markets without the presence of Airline 3, the more restricted and more differentiated FP1 fare structure is applied. The restricted FP3 fare structure is used in all international O-D markets.

The details on fare structures and restrictions for the three fare products are provided in Table 1. R1, R2, R3, and R4 represent the various restrictions that are associated with each of the fare classes. Among the four restrictions, R1 is the strongest restriction that adds the most disutility to the fare, followed by R3, R4, and R2 in the order of decreasing associated disutilities. The average lowest fares of the three fare products are $166, $157, and $476, while the average fare values of the highest FCL1 are $669, $520, and $1444, respectively, resulting in high-to-low fare ratios of about 3.5:1.

Simulation setup: RM methods

Probabilistic Bid Price (ProBP) is the network RM optimizer used in our simulations, and the class-based continuous pricing optimizers are derived from traditional ProBP. Developed by Bratu (1998), ProBP is an iterative convergence algorithm that determines the bid price of each flight leg in an airline’s network. The bid price control logic is then applied to determine the fare class availabilities for each itinerary request. To update the bid prices in the simulation tests, ProBP is executed daily after decrementing the forecast input by the number of forecasted bookings for that day.

Q-forecasting and fare adjustment are used in conjunction with the continuous pricing optimizers since the continuous fare quotes are not differentiated through restrictions or advance purchase requirements. In Q-forecasting, the observed bookings are converted to an equivalent demand at the lowest filed fare in each timeframe before departure. (Hopperstad and Belobaba 2004). The equivalent Q-demand for the timeframe is re-partitioned back into the higher fare classes to generate forecasts for each of the fare classes, using estimates of sell-up from the lower fare class. The re-partitioned timeframe forecasts from all booking timeframes are then summed to generate a total demand-to-come forecast by path/class for the RM optimizer.

To account for potential buy-down to the lowest available fare class, fare adjustment in the optimizer is needed in addition to Q-forecasting (Fiig et al. 2010). The RM optimizers are fed with decremented fare values for lower fare classes to account for the opportunity costs (i.e., potential lost revenue) associated with passenger buy-down.

FRAT5 estimates of WTP for total demand at each timeframe are used in both Q-forecasting and fare adjustment. It is important to note that the FRAT5 values fed as inputs to the Q-forecasting and fare adjustment algorithms represent the airline’s estimation of passengers’ median conditional WTP but not the actual underlying true WTP of the passengers in the simulation.

We first establish a baseline scenario in which all airlines in PODS Network U10 use traditional RM methods and the standard restricted fare structure shown in Table 1. The RM settings for the baseline experiment are listed in Table 2. The airlines use a set of pre-defined FRAT5 values (FRAT5 C) as their conditional WTP estimates as shown in Fig. 6.

Simulation results

We focus here on the scenario with AL1 implementing Segmented Class-Based Continuous Pricing and compare the results to the baseline scenario where all airlines use traditional class-based RM. We simulated two sets of segmented WTP estimates as inputs—constant and sloped-segmented WTP estimates. Long (2022) found that while the use of constant WTP estimates over the booking horizon can lead to revenue gains, even greater gains were possible by using sloped WTP estimates for both leisure and business demand segments.

The segmented WTP estimate and passenger identification accuracy settings for the first-mover airline (AL1) are summarized in Table 3. The segmented WTP estimate curves used by AL1 for continuous fare quote generation, along with the FRAT5 C curve used for forecasting and fare adjustment, are shown in Fig. 7.

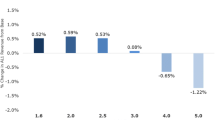

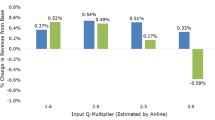

The airlines’ revenues and load factors are presented in Figs. 8 and 9. Compared to the baseline scenario, AL1 sees + 16.8% more revenue from asymmetrically using Segmented Continuous Pricing with sloped business and leisure WTP estimate curves. The competing airlines with traditional RM systems see revenue losses of 1 to 4%. AL1 also sees a substantial increase in its load factor while the international network carrier competitors (AL2 and AL4) see lower load factors than in the baseline.

Table 4 shows AL1’s changes in bookings and revenues in each passenger segment from the baseline. AL1’s + 16.8% revenue gain with sloped WTP estimate curves is much larger than the + 3.4% it saw using constant segmented WTP estimate curves (B = 3.0, L = 1.2). With constant-segmented WTP estimates, AL1 sees its revenue gains mainly from undercutting competitors in the leisure segment with its low-segmented leisure care quotes. However, AL1 loses bookings and revenue in the business segment with its high segmented business fare quotes, especially in the early timeframes. With sloped segmented WTP estimates, AL1’s low business fare quotes remain attractive to the business passengers in early timeframes and AL1 sees large recoveries in bookings and revenue from the business segment. At the same time, AL1 still sees large increases in bookings and revenue from the leisure passengers by offering less expensive, unrestricted fare quotes targeted at leisure passengers.

Table 5 shows the changes in bookings and revenues for each passenger segment of AL2, the largest competing airline with traditional RM. Contrary to AL1’s results, the competitor AL2 sees losses in both bookings and revenues in the leisure segment as it loses leisure passengers to AL1. On the other hand, AL2 sees gains in business revenue and bookings as it accommodates some of the business passengers that are rejected by AL1’s more expensive segmented business fare quotes. Overall, the competitor AL2 sees small losses in total revenue and bookings.

Since AL1 sees higher total revenue without seeing losses in revenue from the business passenger segment in the sloped WTP estimate scenario, we assume that the first-mover airline would be more likely to use sloped WTP estimate curves with its asymmetric adoption of Segmented Continuous Pricing.

Competitors respond by removing restrictions

With asymmetric Segmented Continuous Pricing, AL1 offers continuous fare quotes that are free of fare restrictions. This gives AL1 an advantage over the competitors as these unrestricted fares have no restriction disutilities and, thus, can be very attractive to the passengers. The competitors with traditional RM systems may choose to remove the restrictions associated with their fares as a response, allowing them to also offer fares with no restriction disutilities.

In this test, AL2/3/4 remove all the restrictions in their fares while keeping the advance purchase requirements, as presented in Table 6. All four airlines continue to use the same RM settings as in the above Sloped WTP Estimate Scenario.

The airlines’ revenues are shown in Fig. 10. With the competitors’ removal of fare restrictions, AL1 is not able to maintain its revenue gains from asymmetric adoption of Segmented Continuous Pricing and sees a large − 17.2% total revenue loss as compared to the baseline scenario in which it uses traditional RM. On the other hand, the competitors see full revenue recoveries and see small revenue gains compared to the baseline scenario.

These changes in airlines’ total revenues are directly related to the changes in the airlines’ load factors, as shown in Fig. 11. AL1 sees a large drop in its load factor as it loses passengers to the competitors who now offer fares without restrictions. At the same time, the competitors see much higher load factors that contribute to their revenue recovery.

To further explain the competitive impacts, we focus on analyzing the results of AL2, the largest competing airline using traditional RM. Table 7 summarizes AL2’s revenue and booking changes in each passenger segment as it removes fare restrictions along with the other traditional RM competitors. Since business passengers are more sensitive to fare restrictions, AL2 sees a large increase in business bookings, and consequently a much higher load factor, compared to both the Traditional RM baseline and the Sloped WTP Estimate Scenario. Despite the buy-down in the business segment, the increase in business bookings leads to a further gain in AL2’s business revenue that contributes to its full recovery in total revenue. Although AL2 also sees some small recovery in leisure bookings, it does not see recovery in leisure revenue with the leisure passengers paying less on average due to buy-down.

With the traditional RM airlines regaining their revenues from the business segment, AL1 sees the opposite changes: it sees large losses in both bookings and revenues in the business segment. Since the competitors also offer unrestricted fares, AL1’s expensive segmented business continuous fare quotes become even less attractive to the business passengers.

Table 8 summarizes AL1’s revenue and booking changes in each passenger segment with the traditional RM competitors removing their fare restrictions. AL1 sees enormous losses in business bookings and revenue compared to the traditional RM baseline, as it only retains about half of the bookings and revenue from business passengers. AL1’s asymmetric continuous pricing still offers some advantage in attracting leisure bookings. However, the relatively small gains in the leisure segment cannot offset AL1’s dramatic losses in the business segment. Overall, AL1 still sees a large drop in total revenue and load factor.

These test results show that AL1 cannot maintain its revenue benefit from asymmetric Segmented Continuous Pricing and sees a large revenue loss compared to the baseline when the competitors respond by removing their fare restrictions. (AL1’s relatively expensive but unrestricted business segmented fare quotes become highly undesirable to the business passengers when compared to the lower and now unrestricted fares offered by the competitors.) In Long (2022), tests were also conducted on a scenario where competitors remove their AP requirements but not the non-AP restrictions as the competitive response. The results show that it is an unhelpful strategy, causing the competitors to see further revenue losses with AL1 still maintaining a large revenue advantage over the other airlines.

Summary

In this paper, we simulated and analyzed the potential competitive impacts of Segmented Continuous Pricing in the airline industry through experiments in the Passenger Origin–Destination Simulator (PODS). We examined the effects of asymmetric use of Segmented Continuous Pricing where one airline moves ahead of others in adopting the method. In initial asymmetric tests with constant segmented WTP estimate inputs, the first-mover airline sees revenue gains that came mainly from undercutting the competitors in the leisure segment by offering inexpensive, unrestricted fare quotes to late-arriving leisure demand, which could lead to poor competitive stability. AL1 also saw large booking and revenue losses in the business segment, as it offers much higher segmented fare quotes to the business passengers. Such losses in the business segment would be undesirable for real-world network airlines.

In an attempt to mitigate these problems, we also tested the idea of using sloped segmented WTP estimate curves with asymmetric Segmented Continuous Pricing. The test results show that AL1 can see significant booking and revenue recovery in the business segment using sloped business WTP estimate curves that have lower values in the early timeframes. The extent of undercutting in the leisure segment can also be reduced with AL1 using sloped leisure WTP estimate curves that have higher values in the late timeframes. With sloped WTP estimate curves, AL1 sees a large revenue gain of about 17% from the baseline, while the competitors see revenue losses of about 1% to 4%. It is important to note that the various WTP estimates in our simulations were parametric and not actually estimated from historical booking data. In a simulation world, the tested FRAT5 and SegWTP estimated led to very good revenue gains for Segmented Continuous Pricing but could well over-estimate both the gains achievable in the real world and, in turn, the magnitude of competitive feedback.

We explored a potential response strategy by the competing airlines with traditional RM systems and assessed their effectiveness against the first-mover airline using Segmented Continuous Pricing with sloped WTP estimates. Since the first-mover airline offers continuous fare quotes that are restriction free, it has an advantage over the competitors as the unrestricted fares can be highly attractive to the passengers. To respond, competitors with traditional RM could choose to remove the restrictions associated with their fares, while keeping advance purchase rules. Our test results show that this can be an effective response strategy: the competitors can see full revenue recoveries, while the first-mover airline loses all the revenue benefit from asymmetric Segmented Continuous Pricing and sees a large revenue loss of about 17% compared to the traditional RM baseline. These simulation results suggest that the main advantage of asymmetric adoption of Segmented Continuous Pricing comes from the unrestricted continuous fare quotes rather than from the better pricing granularities, and the first-mover airline may suffer from large revenue losses if the competitors respond by reducing the restrictions in their fare structures.

Although the simulation results suggest that using Segmented Continuous Pricing could lead to revenue benefits in theory, we cannot overlook the potential competitive vulnerabilities of asymmetric Segmented Continuous Pricing to competitor responses. The potential revenue benefits from Segmented Continuous Pricing appear to be highly dependent on competitors’ decisions, raising concerns about competitive stability in the long run. When the competitors try to recover their revenue losses by also offering unrestricted fares, the first mover could lose its revenue leverage from Segmented Continuous Pricing and see revenue loss instead. Consequently, the first-mover airline may need to explore ways to recover its losses, and such consecutive competitive responses could eventually lead to a spiral-down effect and negatively affect the revenues of all airlines competing in the same markets.

Directions for future research

As we found that asymmetric adoption of Segmented Continuous Pricing can be highly vulnerable to competitors’ responses, future work could be done on finding potential ways to incorporate competitive information in the continuous pricing methods. For instance, such competitor-aware methods could use information on competitors’ lowest available fares to model the probability of spilling passenger to competitors, and thus, allows the first-mover airline to adjust its prices accordingly. This could potentially improve the robustness of the Segmented Continuous Pricing methods in competitive situations.

Furthermore, in the Segmented Continuous Pricing algorithms presented in this paper, the segmentation process occurs in the fare quote generation step by using different segmented WTP estimate values for business/leisure passengers. The demand forecaster, however, does not distinguish the bookings from the two segments and uses aggregated WTP estimates (the FRAT5 values) to generate the demand forecasts that are subsequently fed into the optimizer. It could be useful to develop a new forecaster that incorporates the segmented WTP information in the demand forecasting step and generates separate demand forecasts for each passenger segment, as it may lead to more accurate estimates on the overall passenger demand, and potentially greater revenue advantage.

In addition to fare quote segmentation, we could also explore ways to combine product differentiation with the continuous pricing methods. In the tests conducted in this paper, airlines adopting Segmented Continuous Pricing offer one continuous fare quote to each passenger. While business and leisure passengers are offered different prices, the fares are not differentiated from each other by fare restrictions or ancillary services. With product differentiation, each passenger could be offered multiple fare options at booking request. The fare options are differentiated from each other by having different restrictions and/or ancillary services and passengers can choose their most desired fare option. Future research work could also be done on new RM algorithms that integrate the continuous pricing methods with dynamic offer generation (DOG) to generate such fare options.

Data availability

Not applicable.

References

Bala, Praveen Kumar. 2014. Synergizing RM science and airline distribution technologies: A pricing example. Journal of Revenue and Pricing Management 13 (5): 402–410. https://doi.org/10.1057/rpm.2014.21.

Belobaba, Peter P. 2016. Airline pricing theory and practice. In The global airline industry, ed. Peter Belobaba, Amadeo R. Odoni, and Cynthia Barnhart, 76–99. Hoboken: Wiley.

Bratu, Stephane. 1998. Network value concept in airline revenue management. S.M. Thesis, Massachusetts Institute of Technology.

Bruning, Edward R., and Michael YWei. HuHao. 2009. Cross-national segmentation: An application to the NAFTA airline passenger market. European Journal of Marketing 43 (11/12): 1498–1522. https://doi.org/10.1108/03090560910990009.

Chen, Hsi-Tien., and Ching-Cheng. Chao. 2015. Airline choice by passengers from Taiwan and China: A case study of outgoing passengers from Kaohsiung International Airport. Journal of Air Transport Management 49: 53–63. https://doi.org/10.1016/j.jairtraman.2015.08.002.

Dezelak, Melanie, and Richard Ratliff. 2018. Towards new industry-standard specifications for air dynamic pricing engines. Journal of Revenue and Pricing Management 17 (6): 394–402. https://doi.org/10.1057/s41272-018-0148-y.

Fiig, Thomas, Karl Isler, Craig Hopperstad, and Peter Belobaba. 2010. Optimization of Mixed Fare Structures: Theory and Applications. Journal of Revenue and Pricing Management 9 (1–2): 152–170. https://doi.org/10.1057/rpm.2009.18.

Hopperstad, C., and P. Belobaba. 2004. Alternative RM algorithms for unrestricted fare structures. AGIFORS Reservation and Yield Management Meeting, 28–31.

Kuljanin, Jovana, and Milica Kalić. 2015. Exploring characteristics of passengers using traditional and low-cost airlines: A case study of Belgrade Airport. Journal of Air Transport Management 46: 12–18. https://doi.org/10.1016/j.jairtraman.2015.03.009.

Liotta, Nicholas James. 2019. Airline revenue management for continuous pricing : class-based and classless methods. S.M. Thesis, Massachusetts Institute of Technology.

Long, Yanbin. 2022. Airline Revenue Management with Segmented Continuous Pricing: Methods and Competitive Effects. S.M. Thesis, Massachusetts Institute of Technology.

Lufthansa Group. 2020. Continuous Pricing. Conporate report on Continuous Pricing Implementation. https://www.lufthansaexperts.com/shared/files/lufthansa/public/mcms/folder_102/folder_3212/folder_4994/file_148593.pdf.

Pan, Jing Yu, and Dothang Truong. 2020. Low cost carriers in China: Passenger segmentation, controllability, and airline selection. Transportation 48 (4): 1587–1612. https://doi.org/10.1007/s11116-020-10105-z.

Papen, Alexander R. 2020. Competitive impacts of continuous pricing mechanisms in airline revenue management. S.M. Thesis, Massachusetts Institute of Technology.

Szymański, Bazyli, Peter Belobaba, and Alexander Papen. 2021. Continuous Pricing algorithms for airline RM: Revenue gains and competitive impacts. Journal of Revenue and Pricing Management 20 (6): 669–688. https://doi.org/10.1057/s41272-021-00350-x.

Teichert, Thorsten, Edlira Shehu, and Iwan von Wartburg. 2008. Customer segmentation revisited: The case of the airline industry. Transportation Research. Part A, Policy and Practice 42 (1): 227–242. https://doi.org/10.1016/j.tra.2007.08.003.

Westermann, Dieter. 2006. (Realtime) dynamic pricing in an integrated revenue management and pricing environment: An approach to handling undifferentiated fare structures in low-fare markets. Journal of Revenue and Pricing Management 4 (4): 389–405. https://doi.org/10.1057/palgrave.rpm.5170161.

Westermann, Dieter. 2013. The potential impact of IATA’s New Distribution Capability (NDC) on revenue management and pricing. Journal of Revenue and Pricing Management 12 (6): 565–568. https://doi.org/10.1057/rpm.2013.23.

Wittman, Michael D. 2018. Dynamic pricing mechanisms for airline revenue management : theory, heuristics, and implications. Ph. D. Dissertation, Massachusetts Institute of Technology.

Wittman, Michael D., and Peter P. Belobaba. 2018. Customized dynamic pricing of airline fare products. Journal of Revenue and Pricing Management 17 (2): 78–90. https://doi.org/10.1057/s41272-017-0119-8.

Wittman, Michael D., and Peter P. Belobaba. 2019. Dynamic pricing mechanisms for the airline industry: A definitional framework. Journal of Revenue and Pricing Management. https://doi.org/10.1057/s41272-018-00162-6.

Funding

'Open Access funding provided by the MIT Libraries'.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Long, Y., Belobaba, P. Airline revenue management with segmented continuous pricing: methods and competitive effects. J Revenue Pricing Manag 23, 14–27 (2024). https://doi.org/10.1057/s41272-023-00462-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41272-023-00462-6