Abstract

Although prices are the most discussed topic in consumer conversations, research has mostly neglected the field of price-related word-of-mouth (WOM). The present study picks up this research gap by analyzing the effects of price-WOM valence and price change communicated by WOM on consumer price perception. While a WOM sender’s opinion is a stronger predictor of the recipient’s perceived price fairness, a price change communicated by WOM has a stronger effect on price expensiveness perceptions. Innovators are found to be more positive with their price fairness judgment compared to imitators, and opinion leaders are more prone to price-WOM than non-opinion leaders.

Similar content being viewed by others

Introduction

Word-of-mouth (WOM) is one of the most influential forces in a marketplace and there is no doubt that it will further increase in relevance (Allsopp et al. 2007; Bansal and Voyer 2000; Kozinets et al. 2010; Siems and Gerstandl 2011; Zhu and Zhang 2010). It is characterized as highly persuasive as well as extremely effective (Bristor 1990). In many cases, it has a far greater impact on potential buyers’ behavior compared to traditional marketing communication instruments (Bone 1995; Engel et al. 1969; Goldsmith and Horowitz 2006; Hennig-Thurau and Walsh 2004; Herr, Kardes, and Kim 1991; Katz and Lazarsfeld 1955; Zhang et al. 2018). Recent research has shown that WOM has an elasticity which is 20 times higher compared to marketing events and even 30 times higher than the effect of media appearances (Trusov et al. 2009). In particular, perceived credibility, trustworthiness, and accessibility are higher for WOM than for communication channels such as advertising (Brown and Reingen 1987; Liu 2006; Murray 1991). Companies can utilize consumer WOM to grow their customer base, stimulate purchasing behavior, and gain an advantage over competitors (Chevalier and Mayzlin 2006; Hervas-Drane 2015). In fact, a McKinsey and Company study (Bughin, Doogan, and Vetvik 2010) shows that 20 to 50% of consumers’ purchasing decisions are primarily driven by WOM, which points to the relevance for companies to include WOM as part of their marketing plan (Breazeale 2009; Radighieri and Mulder 2014; Wicken and Asquith 2008).

Price is one of the most dominant parts of communication among consumers (Lexis et al. 2013). When talking to friends or acquaintances about vendors and providers, the price is the number one topic being discussed (Siems and Gerstandl 2011). However, although prices play such a predominant role in consumer-based chats, there are very few studies on price-related WOM. This lack of research makes it difficult for price managers to understand this highly important phenomenon and new insights will have a large impact on everyday management, as the encouragement of chats about prices can be a very strong tool to boost consumer price perceptions (Siems and Gerstandl 2011).

While the widespread use of the internet has magnified WOM communication in general, price is a topic discussed mostly in offline channels (Goles et al. 2009; Packard et al. 2016; Siems and Gerstandl 2011). Baker et al. (2016) demonstrated that offline WOM can lead to stronger consumer reactions compared to WOM that has been transmitted via online channels. Additionally, research has shown that face-to-face WOM is more persuasive than printed forms of WOM and that consumers prefer personal communication compared to online communication (Herr et al. 1991; Lexis et al. 2013). Taking these considerations into account, we focus on price-related WOM in an offline setting in this study.

The literature has emphasized the importance of innovativeness as a concept to explain consumer behavior (Hirschmann 1980, 1984). Traditionally, it has been argued that innovators are less prone to being influenced by discussions with other individuals (Midgley and Dowling 1978). While imitators are strongly influenced by WOM, innovators rather rely on information from mass media, making the distinction between these groups highly relevant for WOM research (Bass 1969; Liu et al. 2011). However, previous discoveries have not been verified for price-related information which could lead to unexpected findings within this study. In addition to innovativeness, there is also opinion leadership as a concept which is not only related to innovativeness but also equally relevant for marketing practitioners to understand WOM behavior (Goodey and East 2008; Yang and Laroche 2011). Innovators are particularly interested in new products, in contrast to opinion leaders who tend to spread great amounts of WOM about a specific category (Feick and Price 1987; Godes and Mayzlin 2009). Therefore, opinion leadership is a highly relevant construct to understand WOM in general and price-related WOM in particular.

Although general consumer innovativeness is a well-known construct, there is a lack of application in the service industry (Quoquab et al. 2016). Van den Bulte and Joshi (2007) identify internet accessibility as a field in which the distinction between innovators and imitators is applicable. Besides being a prominent field for innovativeness, services are also highly relevant for WOM (Christiansen and Tax 2000). Murray (1991) revealed consumer service perceptions to be more prone to WOM than the perception of tangible goods. In particular when considering buying a new service that cannot be tested prior to purchase, WOM plays an important role (Arndt 1967; Brown and Reingen 1987; Herr et al. 1991; Reingen and Kernan 1986). We pick up these findings by using a broadband internet access as our research object in a context in which a purchase is inevitable.

The present study aims to close the previously mentioned research gaps by providing insights into the process of price-related WOM in the sense of consumers talking about their positive or negative opinions concerning a price as well as recent price changes they have noticed. It is the first study to explore the effect of incoming price-WOMFootnote 1 on price perception. Additionally, it takes an unparalleled approach by combining the field of price-WOM with consumer innovativeness and opinion leadership. Consequently, the study contributes insights in two main ways. Initially, (1) the effects of a positive and negative price evaluation of a WOM sender as well as a recent price change being discussed in a face-to-face chat on perceived price fairness and expensiveness are examined. It is highly relevant for both researchers and practitioners to learn whether the opinion of a WOM sender about a price can be a stronger predictor than an actual price change for the perception of prices. Thus, the study answers the following questions: Does WOM information about a price change have an effect comparable to an actual visible price change? Which combination of price-related content of a WOM message leads to the lowest perceived expensiveness? Furthermore, (2), the study takes a first approach to reveal the roles of opinion leadership and consumer innovativeness in the context of price-related WOM and price perception, addressing several research questions: Are opinion leaders more prone to adapting their own opinion because of the notion of a conversation partner about a price, although they are commonly known as a segment influencing others instead of being influenced? Do innovators react differently to price-WOM compared to imitators? Does product purchase innovativenessFootnote 2 play a different role compared to general consumer innovativeness when judging prices?

To test the proposed hypotheses, two studies are conducted. The first study (n = 487), a multivariate analysis of variance (MANOVA), aims to shed light on price-WOM and opinion leadership, whereas the second study (n = 449) derives insights on the role of general consumer innovativeness as well as product-specific innovativeness within the process of price-WOM and price perception based on a MANOVA and a mediation analysis.

Theoretical background, hypotheses, and conceptual framework

The roles of word-of-mouth valence and opinion leadership

Previous research has mainly focused on consumers’ brand-related behavior (e.g., brand outcomes, brand behaviors, purchase intentions) after receiving either positive or negative WOM (Bansal and Voyer 2000; Ryu and Feick 2007). We expect price-related WOM to lead to an expensiveness and fairness perception that aligns with the directional valence of the WOM sender’s information. It should not work inversely, as recent research has found for individuals being closely connected to a brand (Baker et al. 2016; Wilson et al. 2017). While expensiveness only deals with the perceived level of a price, price fairness considerations refer to consumers’ individual judgments as to whether a price is being experienced as just, legitimate, and reasonable (Campbell 2007; Haws and Bearden 2006; Kwak et al. 2015). Since positive/negative WOM about a price is an extreme opinion, it has great diagnosticity and should lead to an acceptance of the sender’s advice (Gershoff et al. 2003).

Opinion leaders are highly important in the process of spreading WOM because they can influence other consumers (Goodey and East 2008; Katz and Lazarsfeld 1955; Rogers and Cartano 1962). Their impact is restricted to a specific product category (Feick and Price 1987; Goodey and East 2008; Midgley 1976). The original definition of opinion leaders as “individuals who were likely to influence other persons in their immediate environment” (Katz and Lazarsfeld 1955) is utilizable for the research string of price-related WOM and emphasizes the importance of opinion leaders as well as their “unequal amount of influence on the decisions of others,” as Rogers and Cartano (1962) add in their conceptualization. In addition to their definition of opinion leaders, Katz and Lazarsfeld formulated the two-step flow model of communication together with their colleagues (Katz and Lazarsfeld 1955; Lazarsfeld et al. 1968). It reveals that opinion leaders operate as intermediaries between mass media and society. Consequently, information from media channels traverses opinion leaders until it reaches their individual followers who act as opinion seekers (Flynn et al. 1996; Katz and Lazarsfeld 1955; Watts and Dodds 2007). Since opinion leaders are usually the first stage of the flow of information, they are expected to take rather extreme stances with regard to highly individually perceived judgments such as price fairness in order to influence their followers in the subsequent process (Campbell 2007; Haws and Bearden 2006; Kwak et al. 2015). Therefore, we predict opinion leadership to strengthen the effect of WOM valence on price fairness. Our assumption is supported by Arndt’s (1967) classical study about the diffusion of a new food product. In his experiment, Arndt was able to demonstrate an effect of opinion leadership on interpersonal communication in a price reduction setting (Rogers 1976). We suspect such an effect to be apparent in a price-related WOM communication, which will lead to the previously mentioned relationship. Leonard-Barton (1985) was able to demonstrate an increased product adoption rate due to opinion leaders’ attitudes, regardless of whether the initial WOM was positive or negative, which underpins our claim that opinion leaders have a vast influence on their followers and must take an appropriate stance to exercise such an influence (Radighieri and Mulder 2014). Additionally, the study of Ruvio and Shoham (2007) has shown that product usage, information seeking, and risk taking are important characteristics of opinion leaders. These attributes could lead to a higher acceptance of the valence of received price-WOM, because opinion leaders might actively seek new information on prices and, in order to try out the product or influence public opinion, take the higher risk of assuming a clear stance on the perceived price fairness (Thakur et al. 2016). Directed by the two-step flow model of communication, and historical as well as recent research studies, we thus propose the following:

H1

Opinion leadership strengthens the positive effect of receiving positive price-related WOM on perceived price fairness.

The content of a price-related WOM message as predictor of price fairness and expensiveness

While numerous studies examine price reductions, price increases have largely been neglected by research (Homburg et al. 2010). We fill this research gap by taking price reductions as well as increases into account for an individual’s adjusted price fairness and price expensiveness perception and advance this string of research on a new level by focusing on price changes that have been transmitted via WOM instead of actual visible price adjustments. To further understand the different impacts of WOM valence and a price change communicated by WOM on price perceptions, we adhere to the accessibility–diagnosticity model (Feldman and Lynch 1988). This theory assesses the likelihood of a cognition to be used as an input for a judgment or specific behavior (Lynch 2006). The likelihood is a function of the accessibility of the input, the accessibility of alternative inputs, and the diagnosticities of the input and a possible alternative. Accessibility means that a piece of information can be recalled easily, whereas diagnosticity stands for the helpfulness of a piece of information to form an evaluation (Feldman and Lynch 1988). If a cognition is accessible and perceived as more diagnostic compared to other accessible cognitions, it will be used to decide. Although they are basically distinct, accessibility and diagnosticity can be related. Consumers evaluate price information as generally diagnostic, which can lead to retrieval cues. In this case, the anticipated diagnosticity leads to a higher accessibility (Lynch et al. 1988). Because of its vividness, face-to-face WOM is highly accessible (Herr et al. 1991). It is also diagnostic, because it is perceived as credible and trustworthy (Bone 1995). The combination of high accessibility and diagnosticity makes WOM a prime candidate for helping individuals form their judgments (Radighieri and Mulder 2014). Due to high diagnosticity, consumers can easily categorize products or services into one group (Bone 1995). In the case of price perceptions, these groups are high versus low price fairness, and high versus low price expensiveness. We assume that WOM valence has a higher diagnosticity when making a fairness judgment, and price change communicated by WOM when deciding about the perceived expensiveness. Past research has shown that valence has a major influence on individual product evaluations and that there is a positivity bias, which leads to the likelihood of positive WOM being used rather than negative WOM (East et al. 2008; Folkes and Patrick 2003). We assume that WOM valence has an equally high diagnosticity on price fairness evaluations, as these are also highly individual and subjective. However, there are cases in which WOM valence does not have the highest diagnosticity. Liu (2006) demonstrates that WOM volume has a higher exploratory power to forecast box office revenue for movies, compared to WOM valence. For perceived price expensiveness, we predict a price change communicated by WOM to have a higher impact than WOM valence, because expensiveness only deals with the perceived level of a price, as opposed to price fairness, which takes personal considerations of the WOM sender for a price being experienced as just, legitimate, and reasonable into account (Campbell 2007; Haws and Bearden 2006; Kwak et al. 2015). Consequently, the following hypotheses apply:

H2

Price-related WOM valence is a stronger predictor of price fairness compared to a price change communicated by WOM.

H3

A price change communicated by WOM is a stronger predictor of price expensiveness compared to price-related WOM valence.

The role of innovativeness in the interaction between WOM valence and price change

Behavioral pricing literature has emphasized the importance of the motive behind a price change for consumer perception (Homburg et al. 2005). Whenever consumers feel that a company’s motive for a price increase is to exploit them or take advantage of them, they evaluate the price even more negatively (Campbell 1999). We suggest that negative price-related WOM works as a cue similar to a firm’s negative assumed motive and leads to an enhanced effect of a price increase. A large body of literature has investigated this issue in the realm of price fairness (Campbell 1999; Homburg et al. 2005; Kwak et al. 2015; Vaidyanathan and Aggarwal 2003). We postulate that such an effect exists for price expensiveness as well. East, Hammond, and Lomax (2008) found that the strength of expression of a WOM message has a strong effect on negative and positive WOM. Transferred to our research topic, a price-related WOM message has a stronger expression when it includes a negative valence and a communicated price increase, instead of opposing contents. This, in turn, should lead to the interaction effect mentioned earlier.

Innovativeness traditionally has a very high immediate relevance to explain consumer behavior and there is still a wide range of research opportunities, which is why we do not want to omit its influence on price-related WOM (Hauser et al. 2006; Hirschman 1980). In addition to opinion leaders, innovators are among the most important group for the diffusion of information by WOM and, although they are two discrete concepts, opinion leadership is high among innovators (Czepiel 1974; Feick and Price 1987). Agarwal and Prasad (1998) state that innovative consumers have a higher risk-taking propensity. These individuals try new things, take chances, and cope with uncertainty (Bruner et al. 2005). The marketing literature uses the construct to segment individuals into either innovators or non-innovators (Thakur et al. 2016). For the present study, the definition of innovativeness as “the degree to which an individual makes innovation decisions independently of the communicated experience of others” (Midgley 1977) is paramount, as it is among the first definitions to express the behavior of innovators in the context of consumer communication. Following the study by Bass (1969), we refer to non-innovators as imitators. We expect general consumer innovativeness to have a moderating effect on the previously mentioned interaction between WOM valence and price change communicated by WOM on price expensiveness, since imitators are easily influenced by WOM, while innovators are rather influenced by mass media (Bass 1969). As both parts of the communication process in our study (valence and price change) are spread by WOM, the effect should apply not only for one, but for the interaction of both. Thus far, we know that imitators learn from consumers that have already bought a product, and adapt their individual buying behavior (Bass 1969). Huettl and Gierl (2012) demonstrate that there is a connection between price expensiveness and purchase intention, which underpins our approach to investigating the effect of innovativeness on price-related WOM in the realm of price expensiveness. Scientific insights let us postulate the following:

H4

General consumer innovativeness moderates the interaction between price-related WOM valence and price change communicated by WOM on price expensiveness.

The impact of different forms of innovativeness on price fairness perception

As previously mentioned, innovators have a higher risk-taking propensity, try new things, take chances, and cope with uncertainty (Agarwal and Prasad 1998; Bruner et al. 2005). In addition to being wealthier, innovators are reluctant to spend time and effort on the adoption of products and have a predisposition to buy new products (Steenkamp et al. 1999; Tellis et al. 2009). We suggest that innovators generally evaluate the price fairness more positively after being subjected to WOM, as price fairness is one of the conditions for a purchase intention (Konuk 2018).

While mass media generate awareness, personal recommendations influence an individual to adopt (Midgley 1977; Rogers and Shoemaker 1971). Innovators usually adopt products very early in their diffusion, proving that they do not need discussions with prior users (Midgley and Dowling 1978). However, for our study, innovators are exposed to WOM information they do not yet possess, which should lead to a strong desire to adopt, and consequently to a higher perceived price fairness as a precursor to a potential buying behavior (Konuk 2018).

Past studies have shown that innovativeness can be described in a three-pronged approach that includes two forms of consumer innovativeness leading to innovative behavior (Bartels and Reinders 2011). We therefore suggest that product purchase innovativeness, as a form of innovativeness focusing on the acquisition of new products, mediates the positive effect of general consumer innovativeness on price fairness (Bruner et al. 2005). The literature has also described general consumer innovativeness to be rather abstract, with general innovators first accumulating product-specific knowledge before considering a purchase (Agarwal and Prasad 1998; Flynn and Goldsmith 1993; Im et al. 2007; Midgley and Dowling 1978). The frequently cited historical study by Ryan and Gross (1943) showed the existence of innovators among American farmers in the context of the launch of hybrid corn, an innovation in agriculture at that time. The adoption of hybrid corn followed an S-shaped normal curve, indicating innovative farmers and imitators. The imitators learned about the product from a salesman, but their adoption did not ignite until interpersonal communication with the innovators occurred. We assume that this process is being mediated by product purchase innovators, who have a stronger influence than general innovators on an individual buying decision. To exhibit buying behavior, innovators must perceive the price fairness to be more positive. We assume that this applies even more to product purchase innovators, who mediate the process between general consumer innovativeness and price fairness:

H5a

Innovators perceive price fairness as higher compared to imitators.

H5b

Product purchase innovativeness mediates the positive effect of general consumer innovativeness on perceived price fairness.

Research design and findings

Study 1: The effects of WOM valence, price change communicated by WOM and opinion leadership on price fairness and price expensiveness

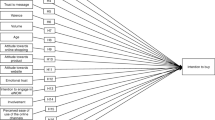

The overarching objective of the first study was to shed light on the under researched topic of price-related WOM by exploring how a person perceives a price after receiving a WOM message from another individual. To evaluate possible strategies for a company’s individual pricing goals, it is fundamental to determine which content of the price-related WOM message is a stronger predictor of each of the consumer price perceptions. As previous research has suggested that opinion leadership is a vital characteristic to explain communication among individuals, we included this construct as a moderating variable and allowed participants to report their level of opinion leadership to divide the sample into opinion leaders and non-opinion leaders (Fig. 1).

Method

We used four different scenarios to manipulate conditions and put participants in a realistic situation in which they had an urgent need for a new broadband internet access and got into a conversation in an offline setting after finding a product that met their expectations. The interlocutor owned the internet access in which the participant was interested. The different scenarios then either stated that the dialogue partner spoke positively or negatively about the price and either reported a recent price increase or a recent price reduction. In accordance with the findings of prior studies, the price change was set at 20% to ensure both a realistic situation and perceptible manipulation (Gupta and Cooper 1992; Homburg et al. 2010; Marshall and Na 2000). A pre-test among doctoral and undergraduate students (n = 190) confirmed that the scenarios differed significantly in WOM valence on a positive WOM scale (α = 0.844, Mpositive = 4.69, Mnegative = 1.57, p < 0.01) and a negative WOM scale (α = 0.885, Mpositive = 1.76, Mnegative = 4.93, p < 0.01) (Alexandrov et al. 2013) and 92.11 percent of respondents were able to recall the price change correctly. Another pre-test among graduate and undergraduate students (n = 275) guided us towards the suitable research subject of a broadband internet access. Compared to the other media product services tested (cell phone contract and streaming media service), the internet access had the highest perceived expensiveness (α = 0.911, Minternet = 4.79, Mcellphone = 4.14, Mstreaming = 4.41, p < 0.05) (Yoo et al. 2000). While the streaming media service had the lowest WOM retransmission intention, the cell phone contract and internet access showed only a slight, insignificant difference (single-item, Minternet = 4.98, Mcellphone = 5.17, Mstreaming = 4.53, p < 0.05) (Baker et al. 2016). By choosing the product with the highest perceived expensiveness and a high WOM retransmission intention, we expect test persons to empathize carefully with the scenarios and perceive the object as relevant to the topic.

All constructs for the pre-tests as well as the main study were represented by reflective Likert-type seven-point multi-item scales, ranging from “fully disagree” to “fully agree.” Price expensiveness was measured using the scale we already applied successfully in one of the pre-tests, originating from Yoo et al. (2000). It measures the subjective sense of a price with special attention to its expensiveness. Price fairness was examined using the scale by Kwak et al. (2015). Opinion leadership was quantified using the scale by Flynn et al. (1996). We used a median split (median = 4.17) to divide test persons into opinion leaders and non-opinion leaders. While the practice of using a median split has some disadvantages compared to continuous measures, it is the only way to guarantee consistency with the factors and past research on opinion leadership that divided individuals into opinion leaders and non-opinion leaders (Feick and Price 1987). In order to overcome the disadvantages, we additionally used continuous data to analyze the effects of opinion leadership. To match the context of the study, all items were modified. The review of reliability measurements showed satisfactory internal consistency: Price expensiveness (α = 0.872, including the items: “I expect the price of the broadband internet access to be high,” “I expect the price of the broadband internet access to be low (reversed),” and “I expect the price of the broadband internet access to be expensive”), price fairness (α = 0.943, including the statements: “I expect the price of the broadband internet access to be fair,” “I expect the price of the broadband internet access to be just,” “I expect the price of the broadband internet access to be reasonable,” and “I expect the price of the broadband internet access to be acceptable”), opinion leadership (OL) (α = 0.870, covering the items: “My opinion on media products seems not to count with other people (reversed),” “When they choose media products, other people do not turn to me for advice (reversed),” “Other people rarely come to me for advice about choosing media products (reversed),” “People that I know pick media products based on what I have told them,” “I often persuade other people to buy the media products that I like,” and “I often influence people’s opinions about media products”). Furthermore, the measurement model fulfilled all remaining premises.

Data

Participants for the main study were recruited by Cint, a reputable external market research company. The cooperation with an external research institute contributes to the independency of results. In addition, the active panel management improves quality of data and prevents issues that frequently occur with platforms such as MTurk, including fake accounts, inattentive answering, and survey professionals. The sample consists of respondents living in the United States and depicts the population concerning age and gender. All participants were assigned randomly to one of the four conditions. After removing participants who reached the median of OL, failed their instructional manipulation check (IMC), or recalled the price change incorrectly, 487 datasets were considered for the analysis. The IMC was designed in accordance with the insights of Oppenheimer et al. (2009) to monitor whether respondents read the instructions on the questionnaire with the necessary diligence and to detect satisfiers.

Results

Analysis of both manipulation checks (positive WOM (α = 0.946, Mpositive = 5.43, SDpositive = 1.41, Mnegative = 2.44, SDnegative = 1.78, p < 0.01) and negative WOM (α = 0.910, Mpositive = 2.79, SDpositive = 1.64, Mnegative = 5.35, SDnegative = 1.87, p < 0.01)) confirmed that WOM valence significantly differed between the positive and negative WOM scenarios (Alexandrov et al. 2013). The effective manipulation of the price change communicated by WOM has been ensured by taking only those respondents who were able to successfully recall the price change into further consideration. Before conducting a MANOVA, we performed a Pearson correlation to test whether the assumptions of parametric requirements of the dependent variables and their moderate correlation are fulfilled (Foster et al. 2005; Meyers et al. 2016). According to Tybout et al. (2001), a correlation can be considered as moderate when it ranges between 0.3 and 0.7. Smaller values contribute unique information and higher values are a sign of statistical redundancy. The dependent variables’ price expensiveness and price fairness showed a correlation of − 0.51, which was significant at the 0.01 level (2-tailed). Additionally, we could observe a Box’s M value of 83.32 (F(21, 701,918) = 3.91) which was significant at the conservative level of p < 0.001. Therefore, we consider Pillai’s trace instead of Wilk’s lambda due to its robustness (Allen et al. 2008). The premise of equal sample sizes was met and hence a MANOVA could be performed.

The 2 (OL: opinion leader vs. non-opinion leader) × 2 (WOM valence: positive vs. negative) × 2 (price change communicated by WOM: price reduction vs. price increase) MANOVA with the dependent variables price expensiveness and price fairness revealed significant multivariate main effects for WOM valence (valence) (Pillai’s Trace = 0.115, F(2, 478) = 31.094, p < 0.001, partial η2 = 0.115, obs. power = 1.0) and price change communicated by WOM (change) (Pillai’s Trace = 0.153, F(2, 478) = 43.221, p < 0.001, partial η2 = 0.153, obs. power = 1.0). Although the interaction of valence*OL was not significant, the outcomes looked encouraging (Pillai’s Trace = 0.009, F(2, 478) = 2.124, p = 0.119, partial η2 = 0.009, obs. power = 0.439). Given the promising effects of the overall test, we examined the univariate main effects to test our postulated research hypotheses. The results indicated a direct effect of valence on price fairness (F(1, 479) = 47.827, p < 0.001, partial η2 = 0.091, obs. power = 1.0). Respondents who were exposed to positive price-related WOM reported a significantly higher perceived price fairness compared to individuals who were confronted by negative price-related WOM (Mnegative = 4.26, SDnegative = 1.79, Mpositive = 5.25, SDpositive = 1.29). Furthermore, valence had a significant impact on price expensiveness (F(1, 479) = 41.679, p < 0.001, partial η2 = 0.080, obs. power = 1.0). When being confronted by positive price-related WOM, consumers perceived the price expensiveness lower compared to individuals being confronted by negative WOM about prices (Mnegative = 4.90, SDnegative = 1.71, Mpositive = 3.94, SDpositive = 1.68). As anticipated, OL moderated the positive effect of positive valence on price fairness (valence*OL) (F(1, 479) = 4.204, p < 0.05, partial η2 = 0.009, obs. power = 0.534). Pairwise comparison indicated that opinion leaders perceived price fairness to be higher when being confronted by positive price-related WOM compared to non-opinion leaders, and lower in the context of negative WOM valence, pointing towards an overall stronger reaction of opinion leaders to price-related WOM concerning perceived price fairness and supporting H1 (OL: Mpositive = 5.46, SDpositive = 1.20, Mnegative = 4.15, SDnegative = 1.79, p < 0.001; Non-OL: Mpositive = 5.03, SDpositive = 1.36, Mnegative = 4.39, SDnegative = 1.78, p = 0.002). To check whether the support for H1 persists when using continuous data for the moderator, we performed a conditional analysis using the PROCESS macro as part of the Statistical Package for the Social Sciences (SPSS). The outcomes confirm a significant influence of opinion leadership strengthening the effect of WOM valence on perceived price fairness (b3 = 0.2663, p = 0.0081, CI [0.0694, 0.4631]).

Data showed that a price change communicated by WOM had a significant effect on price fairness (F(1, 479) = 15.547, p < 0.001, partial η2 = 0.031, obs. power = 0.976). When being confronted by a price reduction within a WOM conversation, participants perceived the price fairness to be higher compared to being exposed to WOM about a price increase (Mreduction = 5.04, SDreduction = 1.41, Mincrease = 4.46, SDincrease = 1.79). Moreover, we found a significant effect of change on price expensiveness (F(1, 479) = 86.599, p < 0.001, partial η2 = 0.153, obs. power = 1.0), indicating that a price reduction communicated by WOM leads to a lower perceived price expensiveness compared to WOM that includes a price increase (Mreduction = 3.77, SDreduction = 1.78, Mincrease = 5.10, SDincrease = 1.45). H2 and H3 were supported, since data showed that valence is a stronger predictor of price fairness (F(1, 479) = 47.827, p < 0.001, partial η2 = 0.091, obs. power = 1.0) compared to change (F(1, 479) = 15.547, p < 0.001, partial η2 = 0.031, obs. power = 0.976) and that change is a stronger predictor of price expensiveness (F(1, 479) = 86.599, p < 0.001, partial η2 = 0.153, obs. power = 1.0) compared to valence (F(1, 479) = 41.679, p < 0.001, partial η2 = 0.080, obs. power = 1.0). All outcomes can be viewed in Table 1.

Discussion

The first study was designed to obtain insights about the effects of different contents of price-related WOM on price perception. Furthermore, we wanted to evaluate the role of opinion leaders within this process. We were able to falsify the widespread accepted view of opinion leaders as individuals with a vast amount of influence on their followers but who do not allow themselves to be influenced by others. In the field of price-related WOM, opinion leaders reacted stronger to WOM valence regarding perceived price fairness compared to non-opinion leaders. Further analyzing the results, we found evidence that price perception evaluations cannot be influenced equally by the valence of a price-WOM message and a price change communicated by WOM. Differentiating between perceived price fairness and price expensiveness, we showed that companies aiming at a positive price fairness perception should induce positive price-related WOM, and firms with a focus on price expensiveness should rather count on price reductions being communicated between potential customers. Thus, we not only underscore the importance of price-related WOM on price perception but also show the complexity of this process for different consumer price perception goals.

Study 2: The role of innovativeness within price-related WOM and the interaction between WOM valence and price change communicated by WOM

As the literature shows that innovativeness is another highly relevant concept for the dissemination of WOM in addition to OL, we replicated study 1 to include the possibility for each participant to report the individual characteristics of general consumer innovativeness and product purchase innovativeness. This gave us the opportunity to distinguish between innovators and imitators at a general and a product purchase level. In the context of this setting and to obtain comprehensive insights, we not only used innovativeness as a factor to explain price perception but also as a moderating variable within the interaction of the WOM message contents. Additionally, study 2 was designed to document whether general consumer innovativeness can be a precursor to product purchase innovativeness in the field of consumer price perception (Fig. 2).

Method

The manipulation of WOM valence and price change communicated by WOM followed the example of study 1. We did not only deploy a median split on general consumer innovativeness (median = 5) to distinguish between innovators and imitators, as proposed by Bass (1969), but additionally used continuous data of general consumer innovativeness, consistent with study 1, for the MANOVA. Within the mediation analysis we only used continuous data of general consumer innovativeness and product purchase innovativeness with the aim to gain a deeper understanding of innovativeness.

To ensure comparability, we used the same scales for price expensiveness and fairness as in study 1. To measure general consumer innovativeness, we used the scale by Donthu and Gilliland (1996). Product purchase innovativeness was quantified using the scale by Ailawadi et al. (2001). The scale measures exploratory consumer behavior with a focus on trying out products (Bruner et al. 2005). To confirm the distinction between these two innovativeness scales, we used data of a pre-test (n = 190) to carry out an exploratory factor analysis. The Kaiser criterion as well as an examination of the scree plot confirmed the scales as they were reported in the literature. For both innovativeness scales, reliability measurements indicated satisfactory outcomes: general consumer innovativeness (α = 0.761 after one reversed item was deleted, ultimately covering the statements: “I like to take chances” and “I like to experiment with new ways of doing things”) and product purchase innovativeness (α = 0.833, including the items: “When I see a product somewhat different from the casual, I check it out,” “I am often among the first people to try a new product,” and “I like to try new and different things”).

Data

Performing the same data collection method as described in study 1, 449 respondents were taken into consideration after removing respondents reaching the median on general consumer innovativeness, failing to pass an IMC or to recall the price change correctly. The sample also depicts the population of the United States concerning age and gender.

Results

To ensure a successful manipulation, we performed the same procedure as in study 1 concerning price change communicated by WOM. Likewise, manipulation checks of WOM valence showed significant differences between groups (positive WOM (α = 0.949, Mpositive = 5.45, SDpositive = 1.39, Mnegative = 2.51, SDnegative = 1.81, p < 0.01) and negative WOM (α = 0.911, Mpositive = 2.87, SDpositive = 1.70, Mnegative = 5.35, SDnegative = 1.85, p < 0.01)). Price expensiveness and price fairness showed a correlation of − 0.48, which was significant at the 0.01 level (2-tailed). Box’s M value was at 64.99 (F(21, 612,228) = 3.05) and significant at the conservative level of p < 0.001. Since the premise of equal sample sizes was met, we could perform a MANOVA and consider Pillai’s trace again (Allen et al. 2008).

To reveal the postulated direct effect of general consumer innovativeness (GI) and the moderating role of GI on the interaction of WOM valence and price change communicated by WOM, we performed a 2 (GI: high vs. low) × 2 (valence: positive vs. negative) × 2 (change: price reduction vs. price increase) MANOVA with the dependent variables price expensiveness and price fairness. Significant multivariate main effects for GI (Pillai’s Trace = 0.031, F(2, 440) = 6.979, p = 0.001, partial η2 = 0.031, obs. power = 0.926) and valence*change (Pillai’s Trace = 0.025, F(2, 440) = 5.700, p < 0.005, partial η2 = 0.025, obs. power = 0.863) were observed. Additionally, the interaction of valence*change*GI showed promising though insignificant results (Pillai’s Trace = 0.008, F(2, 440) = 1.855, p = 0.158, partial η2 = 0.008, obs. power = 0.386). The between-subjects tests showed a significant effect of the interaction effect of valence*change on price expensiveness (F(1, 441) = 8.876, p = 0.003, partial η2 = 0.020, obs. power = 0.844). Under the condition of a price reduction communicated by WOM, participants reported a significantly lower price expensiveness perception compared to a price increase in any WOM valence context. Even though positive price-related WOM generally led to a lower feeling of price expensiveness compared to negative WOM, the effect was significant and stronger in the context of a price reduction. Pairwise comparison showed that positive price-related WOM in combination with a price reduction communicated by WOM led to the lowest perceived price expensiveness (positive valence: Mreduction = 3.18, SDreduction = 1.51, Mincrease = 4.86, SDincrease = 1.39, p < 0.001; negative valence: Mreduction = 4.44, SDreduction = 1.78, Mincrease = 5.30, SDincrease = 1.45, p < 0.001).

We postulated a moderating role of GI on the interaction effect between valence and change on price expensiveness. Although the multivariate tests did not show a significant effect, we decided to analyze the between-subjects effects in order to check for a possible impact on price expensiveness. The test revealed a marginally significant effect, supporting H4 (F(1, 441) = 3.645, p = 0.057, partial η2 = 0.008, obs. power = 0.478). Innovators generally perceived the price expensiveness to be higher in the context of a price increase communicated by WOM compared to a price reduction, and the effect of WOM valence was roughly the same in both price change contexts (positive valence: Mreduction = 3.29, SDreduction = 1.39, Mincrease = 4.76, SDincrease = 1.38, p < 0.001; negative valence: Mreduction = 4.21, SDreduction = 1.90, Mincrease = 5.37, SDincrease = 1.44, p < 0.001). For imitators, a price increase also led to a general feeling of higher price expensiveness compared to a price reduction (positive valence: Mreduction = 3.05, SDreduction = 1.65, Mincrease = 4.98, SDincrease = 1.40, p < 0.001; negative valence: Mreduction = 4.70, SDreduction = 1.62, Mincrease = 5.20, SDincrease = 1.46, p = 0.102). However, for imitators, the effect of valence was far stronger in the context of a price reduction communicated by WOM compared to a price increase. Figure 3 illustrates this relationship. Using the PROCESS macro and continuous data of GI showed that the three-way interaction of valence, change, and GI led to a small increase in R2 in the context of perceived price expensiveness (R2-change: 0.0062, p = 0.0622). Since multivariate tests indicated a significant main effect of GI, we examined the effect of GI on price fairness and found it to be significant (F(1, 441) = 12.723, p < 0.001, partial η2 = 0.028, obs. power = 0.945). Innovators perceived the price fairness to be higher compared to imitators, which supported H5a (Minnovator = 4.98, SDinnovator = 1.65, Mimitator = 4.48, SDimitator = 1.54). All relevant effects of the MANOVA can be tracked in Table 2.

To test the mediation effect postulated in H5b, we deployed nonparametric bootstrapping as the state-of-the-art and most sophisticated concept to analyze the mediating relationships between variables (Preacher and Hayes 2004; Preacher et al. 2007). Our approach was to include product purchase innovativeness (PPI) as a mediator between GI and price fairness. While employing the PROCESS macro in SPSS, we chose model 4 to depict the postulated relationship. A mediation can be rated as significant whenever the 95% bias corrected and confidence intervals do not include 0 at p < 0.05 (two-tailed) (Preacher and Hayes 2004). Using 5000 bootstrapped samples, mediation analysis revealed a significant effect of GI on PPI (CI [0.5970, 0.7163]) and of PPI on price fairness (CI [0.0682, 0.3677]), showing that higher GI led to higher PPI (a = 0.6566, p < 0.001), which in turn led to higher price fairness (b = 0.2179, p < 0.005), supporting H5b. Including PPI as a mediator led to an insignificant direct effect of GI on price fairness (CI [− 0.0887, 0.1864]), indicating the importance of the indirect path with 95% CI not containing 0 (CI [0.0401, 0.2426]). The total effect model supported the outcomes of the MANOVA with a significant effect of GI on price fairness (c = 0.1920, p < 0.001, CI [0.0950, 0.2889]).

Discussion

The results of the second study helped us to obtain a deeper understanding of the role of innovativeness within price-related WOM regarding price perception. We were able to show that price expensiveness was always experienced higher when being confronted by communication about a price increase, no matter how the personal assessment of the WOM sender is. However, WOM valence had an influence and it was stronger in the context of a price reduction. This outcome gives a completely novel insight into an understanding of triggering WOM by stressing the importance of inducing positive WOM while offering a discounted price. We were able to further understand this process by including general consumer innovativeness as a trait. While WOM valence had roughly the same influence for innovators in both price change contexts, imitators change their price expensiveness perception drastically in the context of a price reduction when being confronted by negative or positive WOM about that price. Additionally, we were able to support the characterization of innovators as more daring and interested in new products, as we found them to have a generally higher price fairness perception. Being less critical about prices could be one of the key drivers allowing innovators to try out novel products. A first step to further understanding the process of price perception by innovators has been made by discovering that product purchase innovativeness mediates the effect of general consumer innovativeness on perceived price fairness.

General managerial discussion

It is well known that WOM is one of the most influential and growing drivers in the marketplace, and prices are among the dominant topics in conversations between consumers (Allsopp et al. 2007; Bansal and Voyer 2000; Kozinets et al. 2010; Lexis et al. 2013; Siems and Gerstandl 2011; Zhu and Zhang 2010). Nevertheless, while exploring different fields of WOM, research has been sparse on the topic of price-related WOM (Siems and Gerstandl 2011). This study aimed to shed light onto the field by focusing on the price perception of consumers who engage in communication about prices. It is the first to explore the price fairness and expensiveness perception of a price-WOM recipient. To reach our research goal, two studies, including two MANOVAs and one mediation analysis, were performed.

Concerning the main objectives of this study, we were able to reveal the ambivalent impacts of WOM valence and price change communicated by WOM on price fairness and price expensiveness. Price-WOM seems to be as persuasive and effective as WOM in general with valence as a stronger predictor of price fairness and price change as a stronger predictor of expensiveness (Bristor 1990). The awareness that WOM can influence consumer behavior has been extended by demonstrating the sweeping impact on individual price perceptions (Bone 1995; Engel et al. 1969; Hennig-Thurau and Walsh 2004; Herr et al. 1991; Katz and Lazarsfeld 1955; Zhang et al. 2018).

Several studies have emphasized the relevance of opinion leadership for grasping WOM, as opinion leaders tend to spread WOM about a specific category (Feick and Price 1987; Goodey and East 2008; Yang and Laroche 2011). We found that opinion leaders react more strongly to positive or negative price-WOM when making their price fairness judgment, compared to non-opinion leaders. Although this finding seems to be counterintuitive, because opinion leaders are supposed to be the market actors who influence others rather than the ones being influenced, it can be explained by the two-step flow model of communication (Katz and Lazarsfeld 1955; Lazarsfeld et al. 1968). Since opinion leaders work as intermediaries between mass media and their followers, they used the positive/negative WOM message in our study as their initial cue because they could not obtain the relevant information about the price through mass media and took a rather extreme stance on the price fairness judgment to possibly influence their followers subsequently. Additionally, we find that our assumption that the individual characteristics of opinion leaders allow them to accept the valence of a price-related WOM message is confirmed (Ruvio and Shoham 2007).

To obtain comprehensive insights, we took consumer innovativeness into account, as it traditionally has strong explanatory power relative to consumer behavior and the diffusion of WOM (Feick and Price 1987; Hauser et al. 2006; Hirschman 1980). We were able to reveal a moderating impact of general consumer innovativeness on the interaction between price-WOM valence and price change communicated by WOM on price expensiveness. Supporting traditional research on WOM, we were able to identify imitators as easily influenced by WOM about a price (Bass 1969). Since both parts of the interaction effect are spread by WOM (valence and price change), the moderating effect applies for both, leading to a moderated interaction. Especially in the context of a price reduction, the price expensiveness perception of imitators can be strongly influenced by positive/negative WOM. Innovators as well as imitators perceive the price expensiveness to be higher in the context of a price increase compared to a price reduction. Furthermore, we found a significant direct effect of general consumer innovativeness on perceived price fairness in terms of innovators generally perceiving the price fairness to be higher. This could be an expression of the reluctance of innovators to spend time and effort on adopting new products (Steenkamp et al. 1999; Tellis et al. 2009). Therefore, our insights expand past findings about innovativeness in the direction of behavioral pricing. To obtain an even deeper understanding, we proposed product purchase innovativeness to mediate the effect of general consumer innovativeness on perceived price fairness and found this effect to be significant. This knowledge lets us support the three-pronged approach of innovativeness for the field of pricing, as general consumer innovativeness leads to higher product purchase innovativeness, which in turn leads to a higher price fairness perception representing actualized innovative consumer behavior (Bartels and Reinders 2011). Thus, product purchase innovators are a specific group among innovators which is notably less critical on their price fairness judgment. As recent research has shown that first-time life events can raise the level of consumer innovativeness, some general innovators might develop into product purchase innovators (Koschate-Fischer et al. 2018).

Theoretical and research contributions

As the study at hand is, to the best of our knowledge, the first to analyze the price perception of price-WOM recipients, it contributes to existing studies and theories in many ways. It (1) verifies the transferability of general WOM discoveries to the largely unknown field of price-WOM, (2) advances knowledge about the role of opinion leadership within the process of the diffusion of price-related WOM, and (3) provides insights into different forms of consumer innovativeness within the price perception formation process.

Past research has demonstrated that WOM is generally very persuasive and effective in influencing consumer behavior (Bristor 1990). We were able to reveal direct effects of price-WOM valence and price change communicated WOM, supporting the historical findings on WOM and expanding them to the field of price-related WOM and consumer price perception. Furthermore, this study extends past research in the field of behavioral pricing by pointing out that consumers’ individual price fairness perceptions can work as a buffer to smooth not only directly visible price increases but also price increases communicated by WOM (Bolton and Alba 2006; Campbell 1999; Homburg et al. 2005, 2010). By analyzing the interaction effect, it can be stated that price-related WOM is most effective with many cues in the sense of a WOM message that includes both an opinion of the WOM sender and information about a price change. Therefore, the awareness that the strength of expression of a WOM message is important can be confirmed for price-related WOM (East et al. 2008).

Since opinion leaders are widely known for their ability to influence other individuals in their environment, the findings of this study are counterintuitive, as we found them to be more easily influenced by negative and positive price-WOM concerning their individual price fairness perception compared to imitators (Katz and Lazarsfeld 1955). We expected this relationship, as opinion leaders had no access to mass media in our study, and therefore relied upon WOM, which was presented in a manipulated scenario. Nevertheless, the understanding of opinion leaders within behavioral pricing must be reconsidered due to this finding. We expanded past research on innovators that describes them as individuals trying new things, taking chances, and coping with uncertainty, by revealing that they do not easily buy things but also generally perceive prices to be fairer (Bruner et al. 2005).

We can neither support nor reject the understanding of innovators as being relatively immune to WOM (Midgley and Dowling 1978). While we found innovators to be equally influenced by positive or negative WOM in a price reduction and price increase setting, imitators were heavily influenced by the opinion of the WOM sender in a price reduction setting and less influenced when being confronted by a price increase. The role of product purchase innovativeness as a mediator between general consumer innovativeness and consumers’ price fairness perception lets us resume Arndt’s (1967) classical study on the diffusion of a new food product. We assume that it is the small group of product purchase innovators in particular that drives the diffusion of new products, due to their positive price fairness assessment combined with their influence.

This study showed that the two-step flow model of communication is applicable to the role of opinion leaders in the field of price-WOM (Katz and Lazarsfeld 1955; Lazarsfeld et al. 1968). It revealed that WOM can be an initial cue for opinion leaders’ price fairness perception in the context of an absence of mass media. This leads to a novel understanding of opinion leadership, as they are widely understood as market actors who influence others while not being influenced themselves. The accessibility–diagnosticity model is well known as one of the most important theories for assessing the chance of a cognition to be used as an input for a judgment (Feldman and Lynch 1988; Lynch 2006). The study at hand showed its applicability to behavioral pricing. We found price-WOM valence to be more diagnostic for price fairness judgments and price changes communicated by WOM for price expensiveness perceptions. This finding is not only highly relevant for the valuation of specific price-WOM cues for price perception judgments but also shows that it is not possible to generally determine one specific part of a WOM message to be more diagnostic than another. Consumers’ diagnosticity evaluation is far more complex, as it depends on the pursued area of judgment.

While innovators usually adopt very early, it can be stated that they accept the price-WOM message in this specific context and adjust the individual price fairness perception, possibly as a precursor to potential buying behavior (Midgley and Dowling 1978). We revealed product purchase innovativeness to positively mediate the effect of general consumer innovativeness on price fairness, suggesting that product purchase innovators’ aspiration for newness is even stronger compared to that of general innovators. To diffuse a new product, they are the group of innovators that particularly evaluates price fairness to be higher, supporting our idea that the driving force within the historical study by Ryan and Gross (1943) to initiate buying behavior was product purchase innovator.

Marketing and pricing implications

The findings of this research offer several important implications for marketing practitioners. Especially in the field of pricing, a growing need for practices that consider ethical and psychological circumstances of consumer perceptions can be observed and the study at hand contributes to this topic by exploring consumer price discussions (Rest et al. 2020). Primarily, this research shows the importance of conversations among consumers about prices. As price-related WOM has a strong impact on consumers’ price perceptions, and there has been only very limited research on the topic thus far, our findings shed light on this influential field and offer new insights that should be taken into account by everyday marketing management.

One of the key insights that this study offers to management is the ambiguity between a WOM sender’s opinion and a 20% price change communicated by WOM concerning the WOM recipient’s price perception. While WOM valence is a stronger predictor of price fairness, a price change is a stronger predictor of price expensiveness. Therefore, a corresponding marketing strategy depends on the goal of the firm: Whenever the price of a product is supposed to be perceived as fair, a company should induce positive price-related WOM. If the company, on the other hand, is interested in a consumer judging the price to be inexpensive, pricing can realize better results by reducing the price by 20% and fueling WOM about this price change. However, decision-makers can reach the best outcomes by initiating WOM that includes different cues about a price. A WOM message including a positive opinion of the WOM sender and information about a price reduction will lead to the lowest perceived price expensiveness.

Concerning opinion leadership, this study has shown that an understanding of opinion leaders as individuals who only influence the decisions of others is not applicable for price-related WOM in the context of an absence of mass media (Katz and Lazarsfeld 1955; Rogers and Cartano 1962). In this setting, a WOM sender’s opinion about a price can influence the perceived price fairness of an opinion leader in a stronger way compared to that of a non-opinion leader. This recognition makes opinion leaders a valuable target of firms interested in affecting consumers’ price fairness perception and follows recent findings about the importance of opinion leaders as advocates of a firm’s services (Viswanathan et al. 2018). When influencing opinion leaders’ price fairness perception using rated WOM, they might successively fulfill their role and influence potential customers. Thus, impacting opinion leaders with price-related WOM might lead to a self-reinforcing process which in turn quickly leads to an updated price fairness perception of a large group of demanders. Since online bloggers and influencers act as opinion leaders, it can be worthwhile to target these market actors with offline price-related WOM to pursue subsequent impacts on their followers (Gnambs and Batinic 2012; Uzunoğlu and Kip 2014). This might especially be applicable in a context where no information about the product’s price is being transmitted via mass media.

This study has revealed that in addition to opinion leadership, another useful sector concerning price-WOM pertains to consumer innovativeness. Generally, innovators are less critical when forming their price fairness judgments. Businesses can take advantage of innovators’ high interest in new products by targeting them as a segment not being sensible in terms of their price fairness perception (Feick and Price 1987). In contrast, imitators are more prone to price-WOM when evaluating their feeling of expensiveness towards a product compared to innovators. This applies exceedingly when imitators derive information about a price reduction from a WOM conversation and confirms the understanding of imitators as individuals being easily influenced by WOM in the context of a price reduction communicated by WOM. Therefore, a WOM sender’s opinion is of invaluable importance in influencing imitators when firms launch a price offer that is being spread by WOM.

Limitations and directions for future research

The purpose of this article was to shed light on the field of price-related WOM and price perception. To obtain comprehensive insights, the constructs of opinion leadership and innovativeness were considered to segment consumers. Nevertheless, this work does not claim completeness in this under researched topic. A great deal of previous research into communication between consumers has been able to show an adoption of behavior due to WOM (Bone 1995; Engel et al. 1969; Hennig-Thurau and Walsh 2004; Herr et al. 1991; Katz and Lazarsfeld 1955; Zhang et al. 2018). The present study has revealed an updated price perception due to WOM. At this point, it cannot be convincingly determined whether the changed price perception is a precursor to the behavioral patterns examined in the past. A future study could tackle this issue and clarify the role of the current findings for subsequent observable behavior.

As we have clarified the role of opinion leaders and innovators within the process of price-related WOM and price perception, new questions concerning these segmentation variables arise. We have found opinion leaders to be specifically prone to price-WOM in a context without access to mass media. However, we are not able to clarify whether this is a specific finding for the research string of behavioral pricing, or whether it can be generalized to WOM as a whole. As for innovators, we have found them to have a higher perception of price fairness in general. Given that this result is a completely new addition to our understanding of innovativeness, it can be assumed that it is not the only reason for the specific behavior of innovators. Future research could clarify which other drivers lead innovators to try out new and different products.

Our use of scenarios meant that we deployed specific situations leading to very particular implications, though not general insights. By adapting these manipulations, many of the findings could be generalized. In line with past research, we used a price change of 20% as part of the WOM message (Gupta and Cooper 1992; Homburg et al. 2010; Marshall and Na 2000). By doing so, the study at hand offers very specific implications regarding under which circumstances a price change leads to a more beneficial consumer price perception and under which circumstances the induction of WOM is the better decision. Thus, it lacks insights into other amounts and forms of price discounts or increases. The same applies for WOM valence, as our approach only distinguished between a positive and a negative opinion of the WOM sender. To obtain further insights, it is necessary to conduct research on different gradations of WOM valence as well as on neutral WOM.

References

Agarwal, R., and J. Prasad. 1998. A conceptual and operational definition of personal innovativeness in the domain of information technology. Information Systems Research 9 (2): 204–215.

Ailawadi, K.L., S.A. Neslin, and K. Gedenk. 2001. Pursuing the value-conscious consumer: Store brands versus national brand promotions. Journal of Marketing 65 (1): 71–89.

Alexandrov, A., B. Lilly, and E. Babakus. 2013. The effects of social- and self-motives on the intentions to share positive and negative word of mouth. Journal of the Academy of Marketing Science 41 (5): 531–546.

Allen, M., S. Titsworth, and S.K. Hunt. 2008. Quantitative research in communication. Thousand Oaks, CA: Sage.

Allsopp, D.T., B.R. Bassett, and J.A. Hoskins. 2007. Word-of-mouth research: Principles and applications. Journal of Advertising Research 47 (4): 398–411.

Arndt, J. 1967. Role of product-related conversations in the diffusion of a new product. Journal of Marketing Research 4 (3): 291–295.

Baker, A.M., N. Donthu, and V. Kumar. 2016. Investigating how word-of-mouth conversations about brands influence purchase and retransmission intentions. Journal of Marketing Research 53 (2): 225–239.

Bansal, H.S., and P.A. Voyer. 2000. Word-of-mouth processes within a services purchase decision context. Journal of Service Research 3 (2): 166–177.

Bartels, J., and M.J. Reinders. 2011. Consumer innovativeness and its correlates: A propositional inventory for future research. Journal of Business Research 64 (6): 601–609.

Bass, F.M. 1969. A new product growth model for consumer durables. Management Science 15 (5): 215–227.

Bolton, L.E., and J.W. Alba. 2006. Price fairness: Good and service differences and the role of vendor costs. Journal of Consumer Research 33 (2): 258–265.

Bone, P.F. 1995. Word of mouth effects on short-term and long-term product judgments. Journal of Business Research 32 (3): 213–223.

Breazeale, M. 2009. Word of mouse. International Journal of Market Research 51 (3): 297–318.

Bristor, J.M. 1990. Enhanced explanations of word of mouth communications: The power of relationships. Research in Consumer Behavior 4: 51–83.

Brown, J.J., and P.H. Reingen. 1987. Social ties and word-of-mouth referral behavior. Journal of Consumer Research 14 (3): 350–362.

Bruner, G.C., P.J. Hensel, and K.E. James. 2005. Marketing scales handbook. Pub: Thomson South-Western.

Bughin, J., J. Doogan, and O.J. Vetvik. 2010. A new way to measure word-of-mouth marketing. McKinsey Quarterly 2: 113–116.

Campbell, M.C. 1999. Perceptions of price unfairness: Antecedents and consequences. Journal of Marketing Research 36 (2): 187–199.

Campbell, M.C. 2007. ‘Says Who?!’ How the source of price information and affect influence perceived price (un)fairness. Journal of Marketing Research 44 (2): 261–271.

Chevalier, J.A., and D. Mayzlin. 2006. The effect of word of mouth on sales. Online book reviews. Journal of Marketing Research 43 (3): 345–354.

Christiansen, T., and S.S. Tax. 2000. Measuring word of mouth: The questions of who and when? Journal of Marketing Communications 6 (3): 185–199.

Czepiel, J.A. 1974. Word-of-mouth processes in the diffusion of a major technological innovation. Journal of Marketing Research 11 (2): 172–180.

Donthu, N., and D. Gilliland. 1996. The infomercial shopper. Journal of Advertising Research 36 (2): 69–77.

East, R., K. Hammond, and W. Lomax. 2008. Measuring the impact of positive and negative word of mouth on brand purchase probability. International Journal of Research in Marketing 25 (3): 215–224.

Engel, J.F., R.D. Blackwell, and R.J. Kegerreis. 1969. How information is used to adopt an innovation. Journal of Advertising Research 9 (4): 3–8.

Feick, L.F., and L.L. Price. 1987. The market maven: A diffuser of marketplace information. Journal of Marketing 51 (1): 83–97.

Feldman, J.M., and J.G. Lynch. 1988. Self-generated validity and other effects of measurement on belief, attitude, intention, and behavior. Journal of Applied Psychology 73 (3): 421–435.

Flynn, L.R., and R.E. Goldsmith. 1993. A validation of the Goldsmith and Hofacker innovativeness scale. Educational and Psychological Measurement 53 (4): 1105–1116.

Flynn, L.R., R.E. Goldsmith, and J.K. Eastman. 1996. Opinion leaders and opinion seekers: Two new measurement scales. Journal of the Academy of Marketing Science 24 (2): 137–147.

Folkes, V.S., and V.M. Patrick. 2003. The positivity effect in perceptions of services: Seen one, seen them all? Journal of Consumer Research 30 (1): 125–137.

Foster, J.J., E. Barkus, and C. Yavorsky. 2005. Understanding and using advanced statistics: A practical guide for students. London: Sage.

Gershoff, A.D., A. Mukherjee, and A. Mukhopadhyay. 2003. Consumer acceptance of online agent advice: Extremity and positivity effects. Journal of Consumer Psychology 13 (1 & 2): 161–170.

Gnambs, T., and B. Batinic. 2012. A personality-competence model of opinion leadership. Psychology & Marketing 29 (8): 606–621.

Godes, D., and D. Mayzlin. 2004. Using online conversations to study word-of-mouth communication. Marketing Science 23 (4): 545–560.

Godes, D., and D. Mayzlin. 2009. Firm-created word-of-mouth communication: Evidence from a field test. Marketing Science 28 (4): 721–739.

Goldsmith, R.E., and D. Horowitz. 2006. Measuring motivations for online opinion seeking. Journal of Interactive Advertising 6 (2): 1–16.

Goles, T., V.R. Srinivasan, S. Lee, and J. Warren. 2009. Trust violation in electronic commerce: Customer concerns and reactions. Journal of Computer Information Systems 49 (4): 1–9.

Goodey, C., and R. East. 2008. Testing the market maven concept. Journal of Marketing Management 24 (3–4): 265–282.

Gupta, S., and L.G. Cooper. 1992. The discounting of discounts and promotion thresholds. Journal of Consumer Research 19 (3): 401–411.

Hauser, J., G.J. Tellis, and A. Griffin. 2006. Research on innovation: A review and agenda for marketing science. Marketing Science 25 (6): 687–717.

Haws, K.L., and W.O. Bearden. 2006. Dynamic pricing and consumer fairness perceptions. Journal of Consumer Research 33 (3): 304–311.

Hennig-Thurau, T., and G. Walsh. 2004. Electronic word-of-mouth: Motives for and consequences of reading consumer articulations on the internet. International Journal of Electronic Commerce 8 (2): 51–74.

Herr, P.M., F.R. Kardes, and J. Kim. 1991. Effects of word-of-mouth and product-attribute information on persuasion: An accessibility-diagnosticity perspective. Journal of Consumer Research 17 (4): 454–462.

Hervas-Drane, A. 2015. Recommended for you. The effect of word of mouth on sales concentration. International Journal of Research in Marketing 32 (2): 207–218.

Hirschman, E.C. 1980. Innovativeness, novelty seeking, and consumer creativity. Journal of Consumer Research 7 (3): 283–295.

Hirschman, E.C. 1984. Experience seeking: A subjectivist perspective of consumption. Journal of Business Research 12 (1): 115–136.

Homburg, C., W.D. Hoyer, and N. Koschate. 2005. Customers’ reactions to price increases: Do customer satisfaction and perceived motive fairness matter? Journal of the Academy of Marketing Science 33 (1): 36–49.

Homburg, C., N. Koschate, and D. Totzek. 2010. How price increases affect future purchases: The role of mental budgeting, income, and framing. Psychology & Marketing 27 (1): 36–53.

Huettl, V., and H. Gierl. 2012. Visual art in advertising: The effects of utilitarian vs. hedonic product positioning and price information. Marketing Letters 23 (3): 893–904.

Im, S., C.H. Mason, and M.B. Houston. 2007. Does innate consumer innovativeness relate to new product/service adoption behavior? The intervening role of social learning via vicarious innovativeness. Journal of the Academy of Marketing Science 35 (1): 63–75.

Katz, E., and P.F. Lazarsfeld. 1955. Personal influence. Glencoe, IL: Free Press.

Konuk, F.A. 2018. Price fairness, satisfaction, and trust as antecedents of purchase intentions towards organic food. Journal of Consumer Behaviour 17 (2): 141–148.

Koschate-Fischer, N., W.D. Hoyer, N.E. Stokburger-Sauer, and J. Engling. 2018. Do life events always lead to change in purchase? The mediating role of change in consumer innovativeness, the variety seeking tendency, and price consciousness. Journal of the Academy of Marketing Science 46 (3): 516–536.

Kozinets, R.V., K. de Valck, A.C. Wojnicki, and S.J.S. Wilner. 2010. Networked narratives: Understanding word-of-mouth marketing in online communities. Journal of Marketing 74 (2): 71–89.

Kwak, H., M. Puzakova, and J.F. Rocereto. 2015. Better not smile at the price: The differential role of brand anthropomorphization on perceived price fairness. Journal of Marketing 79 (4): 56–76.

Lazarsfeld, P.F., B. Berelson, and H. Gaudet. 1968. The people‘s choice: How the voter makes up his mind in a presidential campaign. New York: Columbia University.

Leonard-Barton, D. 1985. Experts as negative opinion leaders in the diffusion of a technological innovation. Journal of Consumer Research 11 (4): 914–926.

Lexis, K., A. Huetten, and F. Siems. 2013. Antecedents and target groups of word-of-mouth communication of prices: Theory and new empirical results. Journal of International Business and Economics 13 (3): 77–86.

Liu, Y. 2006. Word of mouth for movies: Its dynamics and impact on box office revenue. Journal of Marketing 70 (3): 74–89.

Liu, Y., H.K. Cheng, Q.C. Tang, and E. Eryarsoy. 2011. Optimal software pricing in the presence of piracy and word-of-mouth effect. Decision Support Systems 51 (1): 99–107.

Lynch, J.G., Jr. 2006. Accessibility-diagnosticity and the multiple pathway anchoring and adjustment model. Journal of Consumer Research 33 (1): 25–27.

Lynch, J.G., Jr., H. Marmorstein, and M.F. Weigold. 1988. Choices from sets including remembered brands: Use of recalled attributes and prior overall evaluations. Journal of Consumer Research 15 (2): 169–184.

Marshall, R., and W. Na. 2000. How much is enough? A preliminary empirical study of the price tolerance zone in Singapore. Advances in Consumer Research 27: 30–33.

Meyers, L.S., G. Gamst, and A.J. Guarino. 2016. Applied multivariate research: Design and interpretation. Thousand Oaks, CA: Sage.

Midgley, D.F. 1976. A simple mathematical theory of innovative behavior. Journal of Consumer Research 3 (1): 31–41.

Midgley, D.F. 1977. Innovation and New Product Marketing. New York: Halsted Press, Wiley.

Midgley, D.F., and G.R. Dowling. 1978. Innovativeness: The concept and its measurement. Journal of Consumer Research 4 (4): 229–242.

Murray, K.B. 1991. A test of services marketing theory: Consumer information acquisition activities. Journal of Marketing 55 (1): 10–25.

Oppenheimer, D.M., T. Meyvis, and N. Davidenko. 2009. Instructional manipulation checks: Detecting satisficing to increase statistical power. Journal of Experimental Social Psychology 45 (4): 867–872.

Packard, G., A.D. Gershoff, and D.B. Wooten. 2016. When boastful word of mouth helps versus hurts social perceptions and persuasion. Journal of Consumer Research 43 (1): 26–43.

Preacher, K.J., and A.F. Hayes. 2004. SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behavior Research Methods, Instruments, & Computers 36 (4): 717–731.

Preacher, K.J., D.D. Rucker, and A.F. Hayes. 2007. Addressing moderated mediation hypotheses: Theory, methods, and prescriptions. Multivariate Behavioral Research 42 (1): 185–227.

Quoquab, F., N.L. Abdullah, and J. Mohammad. 2016. Investigating the effects of consumer innovativeness, service quality and service switching costs on service loyalty in the mobile phone service context. GadjahMada International Journal of Business 18 (1): 21–53.

Radighieri, J.P., and M. Mulder. 2014. The impact of source effects and message valence on word of mouth retransmission. International Journal of Market Research 56 (2): 59–73.

Reingen, P.H., and J.B. Kernan. 1986. Analysis of referral networks in marketing: Methods and illustration. Journal of Marketing Research 23 (4): 370–378.

Rest, J.P.I., A.M. Sears, L. Miao, and L. Wang. 2020. A note on the future of personalized pricing: Cause for concern. Journal of Revenue and Pricing Management 19 (2): 113–118.

Rogers, E.M. 1976. New product adoption and diffusion. Journal of Consumer Research 2 (4): 290–301.

Rogers, E.M., and D.G. Cartano. 1962. Methods of measuring opinion leadership. Public Opinion Quarterly 26 (3): 435–441.

Rogers, E.M., and F.F. Shoemaker. 1971. Communication of Innovations. New York: The Free Press.

Ruvio, A., and A. Shoham. 2007. Innovativeness, exploratory behavior, market mavenship, and opinion leadership: An empirical examination in the Asian context. Psychology & Marketing 24 (8): 703–722.

Ryan, B., and N.C. Gross. 1943. The diffusion of hybrid seed corn in two Iowa communities. Rural Sociology 8 (1): 15–24.

Ryu, G., and L. Feick. 2007. A penny for your thoughts: Referral reward programs and referral likelihood. Journal of Marketing 71 (1): 84–94.

Siems, F., and R. Gerstandl. 2011. Word-of-mouth communication of prices: Theory, implications, and results: An empirical analysis in the airline industry. International Journal of Business Strategy 11: 17–34.

Steenkamp, J.B., F. ter Hofstede, and M. Wedel. 1999. A cross-national investigation into the individual and cultural antecedents of consumer innovativeness. Journal of Marketing 63 (2): 55–69.

Tellis, G.J., E. Yin, and S. Bell. 2009. Global consumer innovativeness: Cross-country differences and demographic commonalities. Journal of International Marketing 17 (2): 1–22.

Thakur, R., A. Angriawan, and J.H. Summey. 2016. Technological opinion leadership: The role of personal innovativeness, gadget love, and technological innovativeness. Journal of Business Research 69 (8): 2764–2773.

Trusov, M., R.E. Bucklin, and K. Pauwels. 2009. Effects of word-of-mouth versus traditional marketing: Findings from an internet social networking site. Journal of Marketing 73 (5): 90–102.

Tybout, A., B. Sternthal, G. Keppel, J. Verducci, J. Meyers-Levy, J. Barnes, S. Maxwell, G. Allenby, S. Gupta, and J.B. Steenkamp. 2001. Analysis of variance. Journal of Consumer Psychology 1 (10): 5–35.

Uzunoğlu, E., and S.M. Kip. 2014. Brand communication through digital influencers: Leveraging blogger engagement. International Journal of Information Management 34 (5): 592–602.

Vaidyanathan, R., and P. Aggarwal. 2003. Who is the fairest of them all? An attributional approach to price fairness perceptions. Journal of Business Research 56 (6): 453–463.

van den Bulte, C., and Y.V. Joshi. 2007. New product diffusion with influentials and imitators. Marketing Science 26 (3): 400–421.

Watts, D.J., and P.S. Dodds. 2007. Influentials, networks, and public opinion formation. Journal of Consumer Research 34 (4): 441–458.

Wicken, G., and R. Asquith. 2008. Turning the amplification up to 11. International Journal of Market Research 50 (6): 777–795.

Wilson, A.E., M.D. Giebelhausen, and M.K. Brady. 2017. Negative word of mouth can be a positive for consumers connected to the brand. Journal of the Academy of Marketing Science 45 (4): 534–547.