Abstract

Drawing on the sociological literature of state bureaucracy, we develop a political incentive perspective on FDI inflows. We argue that political term, as a core feature of career advancement in state bureaucracy, influences the incentives of newly appointed government officials and in turn their efforts toward achieving the state’s goal of attracting FDI. Due to the mandatory retirement age which limits the career advancement, officials in their first terms perceive that they have better chances of promotion and hence have stronger incentives to work toward advancement than those continuing to serve in the current position for the following term. We test this argument by examining Chinese city government leaders and FDI inflows in their cities from 2003 to 2010, using a difference-in-differences design. The results show that first-term leaders, who are newly appointed after political turnover, attract more FDI inflows than continuing leaders. The difference is smaller when the new leaders are close to retirement, but greater if they are appointed to cities with low prior GDP performance. This study offers a new perspective on intra-country FDI variations, and extends the literature on the role of political institutions by investigating the political incentives of government officials.

Résumé

En nous inspirant de la littérature sociologique sur la bureaucratie d’État, nous développons une perspective d’incitation politique concernant les entrées d’IDE. Nous soutenons que le terme politique, en tant que caractéristique essentielle de l’avancement professionnel dans la bureaucratie de l’État, influence les incitations des fonctionnaires nouvellement nommés et, par conséquent, leurs efforts pour atteindre l’objectif de l’État consistant à attirer des IDE. En raison de l’âge de la retraite obligatoire qui limite l’avancement de carrière, les fonctionnaires dans leur premier mandat estiment qu’ils ont de meilleures chances de promotion et sont donc plus incités à travailler en vue de l’avancement que ceux qui continuent à occuper le poste actuel pour le mandat suivant. Nous testons cet argument en examinant les dirigeants du gouvernement de villes chinoises et les entrées d’IDE dans leurs villes de 2003 à 2010, en utilisant un modèle de différence dans les différences. Les résultats montrent que les dirigeants de premier mandat, qui sont nouvellement nommés après un roulement politique, attirent plus d’IDE que les dirigeants permanents. La différence est moindre lorsque les nouveaux dirigeants approchent de la retraite, mais plus importante s’ils sont nommés dans des villes dont la performance en PIB antérieure est faible. Cette étude offre une nouvelle perspective sur les variations des IDE intra-pays et élargit la littérature sur le rôle des institutions politiques en examinant les incitations politiques des fonctionnaires du gouvernement.

Resumen

Basándonos en la literatura sociológica de burocracia estatal, desarrollamos una perspectiva de incentivos políticos para los flujos entrantes de inversión extranjera directa (IED). Sostenemos que el término político, como rasgo central del progreso en la carrera profesional de la burocracia estatal, influencia los incentivos de los funcionarios gubernamentales recientemente designados y a cambio de sus esfuerzos en el logro de la meta de estado de atraer IED. Debido a la edad de jubilación obligatoria que limita el progreso en la carrera profesional, los funcionarios en sus primeros términos perciben que tienen mejores oportunidades de ascenso y, por ende, tienen mayores incentivos para trabajar por el ascenso que los que continúan en el cargo en el siguiente mandato. Probamos estos argumentos al examinar líderes de gobierno de ciudades en China y las entradas de flujos de IED en ciudades desde el 2003 al 2010, usando un diseño de diferencia en las diferencias. Los resultados muestran que los líderes en su primer término, quienes son nombrados recientemente después de un cambio político, atraen más flujos entrantes de IED que los líderes que continúan. La diferencia es menor cuando los nuevos líderes están próximos a la jubilación, pero mayor si son designados a ciudades con un desempeño anterior del PIB bajo. Este estudio ofrece una nueva perspectiva sobre las variaciones de la IED, y amplia la literatura sobre el papel de las instituciones políticas al investigar los incentivos políticos de los funcionarios gubernamentales.

Resumo

Com base na literatura sociológica sobre burocracia estatal, desenvolvemos uma perspectiva de incentivo político a respeito de fluxos de FDI. Argumentamos que o mandato político, como uma característica central de avanço da carreira na burocracia estatal, influencia os incentivos de funcionários do governo recém-nomeados e, por sua vez, seus esforços para alcançar a meta do estado de atrair FDI. Devido à idade de aposentadoria compulsória que limita a progressão na carreira, funcionários em seus primeiros mandatos percebem que têm melhores chances de promoção e, portanto, têm incentivos mais fortes para trabalhar em direção à progressão do que aqueles que continuam servindo no cargo atual durante o mandato seguinte. Testamos esse argumento examinando líderes chineses do governo municipal e fluxos de FDI em suas cidades de 2003 a 2010, usando um modelo de diferenças em diferenças. Os resultados mostram que os líderes no primeiro mandato, que são recém nomeados após uma mudança política, atraem mais fluxos de FDI do que os líderes reconduzidos. A diferença é menor quando os novos líderes estão próximos da aposentadoria, mas maior se forem nomeados para cidades com baixo desempenho anterior do PIB. Este estudo oferece uma nova perspectiva sobre variações de FDI dentro do país e amplia a literatura sobre o papel de instituições políticas ao investigar os incentivos políticos de funcionários do governo.

抽象

借鉴关于国家官僚的社会学文献, 我们对外国直接投资(FDI)流入提出了一种政治激励的观点。我们认为, 任期作为国家官僚职业发展的核心特征, 影响新任命的政府官员的积极性, 进而也影响他们为实现该国吸引FDI的目标所做的努力。由于强制性退休年龄限制了职业发展, 因此官员们在第一任期内就认为, 与下一任期续任现职的官员相比, 他们有更好的晋升机会, 因此有更大的动力争取晋升。我们用双重差分设计法研究了2003–2010年间中国城市政府领导者及其城市的FDI流入以检验这一观点。结果表明, 在政治更替之后新任命的第一届领导人吸引的FDI比续任领导人要多。当新领导人接近退休时, 两者之间的差距就较小, 但如果新任命的领导人被任命到先前国内生产总值(GDP)表现不佳的城市, 则差距更大。这项研究提供了关于国家内FDI变异的新视角, 并通过研究政府官员的政治激励扩展了关于政治制度作用的文献。

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The influence of political institutions on foreign direct investment (FDI) has long been recognized. Political institutions that impose few checks and balances on government officials’ discretion can generate high political risk and deter FDI (Henisz, 2000; Jensen, 2003; Kobrin, 1979), while changes in political leadership at the national and local government levels can lead to policy discontinuity and volatility, which also negatively affect foreign investors (Fails, 2014; Henisz & Delios, 2004; Jamison, Rosenbaum, & Carter, 2017; Vaaler, Schrage, & Block, 2005). While the uncertainties and challenges presented by political institutions have been investigated in the literature, how they may also produce opportunities for foreign investors is relatively under examined (Boddewyn & Brewer, 1994; Rodriguez, Siegel, Hillman, & Eden, 2006). Specifically, the political career-based incentives and the motivations for officials to attract foreign investment require further attention.

We examine how the political career-based incentives of government officials affect the level of FDI flowing into their administrative areas. Given the importance of FDI for substituting imports, facilitating technological transfer, and generating employment, it has been institutionalized in many countries and regarded as a national goal (Bandelj, 2009; Jensen, 2003; Malesky, 2008). We argue that if the government designs a predictable internal career advancement system that aligns the behavior of officials with the goal of attracting FDI, officials will be motivated to work toward this goal (Evans, 1995). Based on the sociological literature that examines state bureaucracy, we identify political term, defined as the tenure of an official at a certain level on the career ladder, as an institutional feature that influences officials’ political incentives. We argue that although serving in one position over more than one term leads to more experience in that particular position, it slows career progress and reduces the likelihood of promotion due to the mandatory retirement age of the state. Officials who remain at the same level for a second term or more thus have fewer opportunities and incentives for promotion, and hence are less inclined to achieve the state’s objectives.

China, as the focus of our study, serves as an ideal research context to examine the impact of political incentives. First, the complex bureaucracy of the Chinese government provides a structure for the career trajectories of its officials and the political turnover process (Huang, 2002; Lin, 2011; Wang & Luo, 2019). Second, China is a major recipient of FDI, but the inflows of investment have significant regional variations, and as local governments are closely involved in the development of the local economy and link it to the careers of their officials, the incentives for the promotion of officials may influence the FDI inflows into regions (Chan, Makino, & Isobe, 2010; Du, Lu, & Tao, 2008; Lu, Song, & Shan, 2018; Meyer & Nguyen, 2005).

In this study, we focus on the bureaucratic level of city government leaders. We consider the political cycle of China’s Communist Party (large-scale leadership turnover coincides with the Party’s National Congress every five years) and identify two groups of city government leaders: first-term leaders, who are newly appointed after the congress, and continuing leaders, who remain in the same position to serve a second term after the congress. As FDI volume is as an evaluation and promotion criterion for government officials, first-term city leaders due to their stronger promotion incentives are more prone to designing and implementing policies to attract FDI. This results in a higher level of FDI flow into their cities than into those governed by continuing leaders. We further argue that structural features related to leaders’ incentives can moderate the impact of political term, such as mandatory retirement age and tournament competition in officials’ promotion. These features can further distinguish first-term leaders from continuing leaders in terms of their incentives for advancement.

This study contributes to the research on the role of political institutions in FDI by revealing a new theoretical mechanism. The uncertainties and risks generated by political institutions, such as those due to the power structure and changes in leadership, have typically been the focus of previous research. We identify potential opportunities brought by political turnover in a state bureaucracy with well-defined political careers and evaluation criteria, as new leaders have stronger incentives to achieve promotion and thus stimulate FDI.

Our focus on officials’ career incentives also provides a new theoretical perspective on FDI inflows. Previous studies have focused on market and institutional explanations, while this new perspective accounts for the heterogeneity of intra-country FDI inflows by highlighting the role of government officials in the host country. We show that although city leaders may manage cities with similar market and institutional environments, the difference in their political terms results in different career incentives and thus different FDI outcomes.

Theory and Hypotheses

Political Institutions and FDI

The influence of political institutions on FDI has been well noted in international business research (Rodriguez et al., 2006). Studies in this area have focused mainly on the structures of political institutions and changes in leadership (Henisz & Delios, 2004). Power structures can affect the decision making of government officials. Fewer formal constraints, such as a lack of institutional vetoes, can enable officials to opportunistically change longstanding policies (Henisz, 2004). However, this can represent political uncertainty to foreign investors, as it exposes them to risk either directly, through expropriation, or indirectly, through policy changes in terms of taxes, regulations, tariffs, etc. (Henisz & Delios, 2004). Forward-looking investors who perceive such political hazards either commit less or avoid investment altogether, particularly if they lack experience of the specific markets (Delios & Henisz, 2003; Henisz, 2000; Pindyck & Solimano, 1993).

Uncertainties and risks also arise when there are changes in political leadership, at either the local or the national level (Zhong, Lin, Gao, & Yang, 2019). As new leaders rise to power after political turnover, they are likely to change the existing conditions, in terms of the policies, regulations, and rules of the business environment. Such changes significantly increase the perceived uncertainty, instability, and political risk for potential investors, and negatively affect the strategy and performance of foreign firms that already invest (Fails, 2014; Zhong et al., 2019).

The potential uncertainties and risks generated by political institutions have been noted in the literature, but foreign investments are becoming increasingly important in the globalized economy. Such investment brings new technology, jobs and skills, and so the pressure on local governments to compete for foreign investments can be as strong as the desire to opportunistically exploit them.1 Political institutions may also create opportunities for foreign investors (Boddewyn & Brewer, 1994), such as through government incentive structures for officials (Wang & Luo, 2019). Linking the political careers of government officials to attracting investment may provide them with incentives to create a better business environment and offer better terms for investors (Jensen, Malesky, & Walsh, 2015). For example, a study of provincial leaders in Vietnam suggested that these leaders have a very strong incentive to attract and maintain foreign investors, as the increased revenues from FDI projects strengthen their autonomy from the central government (Malesky, 2008). Thus, examining the incentives of government officials can help us understand the role of political institutions and assess if they may even have a positive impact on FDI.

We next develop our arguments concerning government officials’ political incentives and their influence on FDI inflows, drawing on the literature on state bureaucracy from sociology.

Political Incentives Based on Political Terms

Effective bureaucracy is the backbone of the state, through which policies are implemented and goals achieved (Evans, 1995). The Weberian view of state bureaucracy is characterized by meritocratic recruitment and a predictable long-term career ladder in the state hierarchy, as is the case in many countries (Kohli, 2004). Such bureaucracy can be effective in formulating and implementing policies (Guillén & Capron, 2016), creating economic growth (Evans & Rauch, 1999), achieving industrial transformation (Evans, 1995; Johnson, 1982; Wade, 1990), and facilitating the institutional transition from socialism to capitalism (Hamm, King, & Stuckler, 2012; King & Sznajder, 2006). Political term, i.e., the institutionalized tenure that an official can serve in a position, such as four or five years, is an important feature of the bureaucratic design. The start of a political term often follows an election in democratic countries or other important political events, such as the convening of party congresses, in non-democratic countries (Besley & Case, 1995; Guo, 2009; Johnson & Crain, 2004). Legally mandated term limits are often imposed to establish how long an official can serve in one position, such as a maximum of one or two terms.

We suggest that when officials are able to serve multiple political terms in the same position, both their careers and their incentives may be jeopardized. Bureaucracy typically has a pyramid-like structure, and those within it must compete at numerous levels before reaching the top, which inevitably takes time. For example, in the Indian Administrative Service the journey from the initial pay scale to the highest scale takes 30 years (Bertrand, Burgess, Chawla, & Xu, 2015). However, a government career is not lifelong, and all officials are subject to retirement age requirements (Wang & Luo, 2019). Under this rigid progression through competition, promotion, and retirement, the optimal strategy for officials is to keep moving before they reach retirement age. Remaining in the same position for multiple terms obviously slows the pace of promotion, and officials lose the momentum to succeed in the next round of competition. These continuing officials are thus demotivated and may lose their incentive to deliver the performance the state expects. Thus, the number of political terms served by officials is an important structural feature of the bureaucracy that shapes their political incentives.

Chinese Government Officials’ Political Incentives and FDI

The Chinese state, also referred to as a “party-state” (due to one-party rule), is regarded as a strong state, with clear development goals and a sophisticated bureaucratic apparatus (Lin, 2011; Nee, Opper, & Wong, 2007). Unlike Western democracies, where politicians are accountable to voters and face periodical elections, Chinese government officials, including leaders at every level of the local bureaucracy, are de facto appointed by their superiors (Huang, 2002). They are evaluated and promoted based on the extent to which they achieve the performance targets set by the state (Zhou, 2010).

Performance indicators that reflect state goals typically include economic indicators (such as local GDP growth rate, fiscal revenue, and FDI inflows), political goals (such as maintaining social stability), and social welfare indicators (such as improving education, providing healthcare, and environmental protection) (Edin, 2003; Wang & Luo, 2019). Economic indicators are the most important determinants of the career advancement of officials. Extensive empirical evidence suggests that officials are more likely to be promoted if they demonstrate outstanding performance in achieving high GDP growth, increasing fiscal revenue, or attracting FDI inflows (Chen, Li, & Zhou, 2005; Lu & Landry, 2014; Tsui & Wang, 2004; Zhang, 2011). Political goals do not directly determine promotion, but they confer veto power, as other achievements will be canceled out by any failure to meet the requirements during evaluations of officials (Edin, 2003). In contrast, social welfare goals such as environmental protection may be overlooked, due to their loose connection with career advancement (Cai, Chen, & Gong, 2016).

The rounds of competition for promotion and the allocation of political terms happen alongside the Communist Party’s National Congress, which is held every five years, when large-scale leadership turnover occurs at all levels from the top down (Lan & Li, 2018). We focus on top government officials at the city level and distinguish between newly appointed leaders in their first terms and those who continue to serve a second term after the National Congress.

The appointment of first-term (new) leaders can result from internal promotion, lateral transfer from other places, or in some very rare cases downward movement (demotion) from provincial or even central government levels (Huang, 2002). Internally promoted leaders have been successful in previous rounds of competition, due to their outstanding performance and achievement of goals such as increasing the GDP growth rate, fiscal revenue, or FDI volume. Rotated leaders make lateral moves from an equally ranked position in a different locality. This rotation mechanism is designed by the central government to limit local ties and curb factionalism (Huang, 2002). Empirical research has suggested that rotated leaders have relatively short horizons and focus on career-related evaluation criteria to boost their record (Persson & Zhuravskaya, 2016; Zhang & Gao, 2008). Downward movement or demotion is very rare in China, although in some cases officials are appointed to lower level positions to gain local experience. Thus, although newly appointed first-term leaders have different circumstances and backgrounds, this term status provides them all with a fresh start.

Unlike first-term leaders, incumbent leaders remain in their current positions, and these two types of leader differ significantly in their subsequent promotion prospects. First-term leaders are much more likely to be promoted because of the structural design of the bureaucracy (Chen & Kung, 2016; Jia, Kudamatsu, & Seim, 2015; Opper, Nee, & Brehm, 2015). Chen and Kung (2016) found that 86% of promotions were given to first-term leaders, while the likelihood of promotion decreased after the first term of office. To achieve promotion, first-term leaders must strategically focus their attention and resource allocation on tasks that are closely associated with their career advancement, while selectively ignoring other goals, given limited attention and resources (Mezias, Chen, & Murphy, 2002). In contrast, those with fewer chances of promotion, such as continuing leaders, are less likely to prioritize promotion-related goals. They, instead, may focus on other state goals, such as maintaining social stability to ensure that they can meet the veto target and well survive their remaining term (Wang & Luo, 2019).

China is now the second largest FDI recipient country worldwide, and had a total FDI stock of US$1.354 billion in 2016.2 Since the beginning of the economic reform, attracting FDI has been an important goal for the Chinese government, as it can facilitate technological development and improve domestic productivity (Liu & Wang, 2003; Madariaga & Poncet, 2007). Thus, the level of FDI attracted has been used by the government as a criterion for the evaluation and promotion of officials (Huang & Khanna, 2003; Kroeber, 2016; Zhang, 2011). The formal documents outlining the evaluation process for government officials typically provide very detailed and specific FDI goals, such as to “attract 2.5 million yuan FDI” (Gao, 2015) or accomplish “10 significant foreign investment projects” (Chen, Ma, & Bao, 2011).

The career incentives thus motivate first-term leaders to attract foreign investment. In the reform era, local governments have been given autonomy and discretion to grant licenses, allocate resources, and formulate local economic and business policies (Oi, 1995). The nature of the party-state also means that leaders’ decisions are not subject to rigorous check and balance, and so city leaders, such as party secretaries, can make influential decisions about FDI (Zang, 2004; Zhang, 2011). To attract foreign investment, city leaders can use their power and discretion to offer lucrative packages to investors, such as tax reductions or exemptions, primary urban land for factory construction, and low interest rates on bank loans (Zhou, Delios, & Yang, 2002). Local governments have even been found to compete by relaxing their environmental standards, so they can attract highly polluting firms (Ljungwall & Linde-Rahr, 2005). Another example is of the city of Zhengzhou, which is located in a relatively underdeveloped inner province. The city’s leader promised no corporate or value-added taxes for the first five years and a 50% reduction for the next five years to encourage Foxconn to invest, and the city was subsequently expanded massively to accommodate Foxconn, including purpose-built hospitals, metros, schools, and residential areas, within half a year.3

As first-term leaders are more likely than continuing leaders to devote effort and resources to attracting FDI, cities under their administration will experience an increase in FDI inflows. In contrast, continuing leaders have limited career advancement opportunities, so their incentives and efforts to attract FDI will be significantly reduced, resulting in a lower level of FDI inflows.

Hypothesis 1:

First-term leaders attract larger volumes of FDI inflows to their cities than continuing leaders.

Next, we consider two important structural features of the career ladder that may lead to further differences between first-term and continuing leaders: mandatory retirement and tournament competition in GDP performance.

The Contingency of Mandatory Retirement

Chinese state bureaucracy imposes a mandatory retirement rule on officials (Li, 1998), and the age of retirement increases with rank. For county leaders it is 55, for city leaders it is 60, and for provincial leaders it is 65. This requirement thus limits future appointment opportunities and changes the career horizons of leaders. Leaders close to retirement age are likely to focus on short-term goals, as they are less likely to benefit from activities that have long-term payoffs (Gibbons & Murphy, 1992). A recent study also confirmed that retiring provincial Chinese leaders were more likely to address imminent social stability issues caused by the lay-off of workers from bankrupt state-owned enterprises (Wang & Luo, 2019). In addition, as promotion opportunities decrease when city leaders approach retirement age (Yu, Zhou, & Zhu, 2016), they are less likely to focus on performance targets that primarily contribute to career advancement. Thus, first-term leaders close to retirement age will have reduced or even no incentives to attract FDI, and therefore the difference between them and continuing leaders may be less prominent.

In contrast, first-term leaders who can serve multiple terms (not necessarily in the same position) before retirement have longer time horizons and thus more incentives to strive for promotion. They take more risks and are more forward-looking than retiring leaders (Vroom & Pahl, 1971), and thus the political incentives are stronger for first-term leaders far from retirement than for continuing leaders of a similar age. Newly appointed leaders may work even harder to attract FDI, in an attempt to boost their future career prospects. Thus, there should be a greater difference between first-term leaders farther away from retirement and continuing leaders with regard to their political incentives, while this difference will decrease as they approach retirement. Hence, when the leaders are close to retirement age, the impact of political term (i.e., first-term vs. continuing leaders) on FDI inflows should be weaker. We therefore propose the following hypothesis:

Hypothesis 2:

The difference in FDI inflows between first-term leaders and continuing leaders is smaller for those approaching retirement.

The Contingency of Tournament Competition in Officials’ Promotion

The political incentives of leaders are also influenced by the structure of the competition for promotion (Lu & Landry, 2014). A tournament competition process characterizes the career reward and promotion system of the Chinese state bureaucracy, in which leaders at the same level compete for limited opportunities for promotion to the next level (Xu, 2011; Zhou, 2010). Units at the same hierarchical level in the Chinese state bureaucracy are comparable, and government leaders evaluate and promote their subordinates in their jurisdiction. For example, they may compare and select city leaders in the same province to promote to the limited higher-level positions. These repeated tournament competitions have important implications for leaders’ incentives and behaviors, as they reinforce social comparison and stimulate efforts. We argue that, due to their higher chances of career advancement, first-term leaders appointed to cities with relatively poor economic performance may perceive more pressure and have greater incentives to improve their performance for the next round.

As described above, officials’ promotion in China is mainly based on economic indicators, such as GDP growth rate and FDI inflows. The tournament competition is thus focused on the economic performance of the official’s local jurisdiction. Poor performance triggers a search for solutions (Cyert & March, 1963). Prior studies suggest, due to the salience of GDP growth for government officials, a shortfall in this target can trigger officials’ efforts to boost local economy in varied ways. For example, Yue, Wang, and Yang (2019) found that a reduction in the GDP growth rate of cities in a specific county led to officials charging admission fees for religious temples in their jurisdictions, in an attempt to develop tourism and catch up with other counties. We further propose that first-term leaders appointed to cities with low levels of GDP growth face more pressure in their evaluations, because continued poor performance can result in a loss of qualification for their promotion (Edin, 2003). Due to the tournament competition for promotion, first-term leaders strive for being favorably compared with peers so as to advance to the next level. Those appointed to cities with poor GDP growth performance in the previous year may have stronger incentives to attract FDI, in order to improve their chances of outcompeting peers. A relatively low GDP growth rate in China may indicate that their infrastructures are not as good as in more developed regions, but they can still provide incentive packages to attract investors, such as lowering environmental standards or offering better tax conditions (Ljungwall & Linde-Rahr, 2005). Meanwhile, confronted with the same low GDP growth performance, continuing leaders may be less concerned about social comparison due to a lack of promotion prospects, and hence have less incentive to improve their economic indicators, including FDI.

In contrast, first-term leaders appointed to cities with high GDP growth performance may be under less pressure to improve local economy as they are already favorably compared with other cities. Hence, the difference between first-term and continuing leaders regarding their incentives and efforts to attract FDI is greater when the cities have poorer prior performance in GDP growth.

Hypothesis 3:

The difference in FDI inflows between first-term leaders and continuing leaders will be greater for those appointed to cities with poorer prior performance of GDP growth.

Method

Sample and Data

Our sample consisted of panel data on the FDI inflows into 224 Chinese cities at the prefecture level from 2003 to 2010. The average city inflows within this period is 2715.707 million yuan. The 17th National Congress occurred during this period, in 2007,4 and we compared the cities’ average FDI inflows before and after the congress. For those that had new leaders after the National Congress, we included the leaders before and after the turnover in the sample and coded the latter as the first-term leader. Leaders who were reappointed after the congress and whose tenures lasted for the entire observation period were included in our sample. Thus, our sample was an unbalanced panel, consisting of 114 cities with first-term leaders and 110 with continuing leaders after the congress.

We collected city level data such as annual FDI inflows and wages from the China City Statistical Yearbooks published by the National Bureau of Statistics of China, and GDP per capita, population, and infrastructure development from China National Knowledge Infrastructure, a national information project supported by the Ministry of Education.

We manually collected the CVs of all city leaders who served during the observation period. The party secretary is at the top of the bureaucracy at each level (including the city) (Yao & Zhang, 2015). Attracting FDI is part of the party-state’s strategy, so we focused on the party secretaries of cities as the leaders responsible for devising FDI policies. After eliminating observations with missing variables, such as city leaders’ backgrounds and FDI inflows at the city level, we obtained 277 city leaders who served between 2003 and 2010 and 1044 observations for the analysis.

Variables

Dependent variable

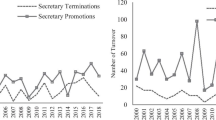

FDI inflows Following previous studies, we measured FDI as annual FDI inflows (logged) to the target city in a given year (Fredriksson, List, & Millimet, 2003; Globerman & Shapiro, 2003). Figure 1 plots the growth trend in annual FDI inflows to the cities in our sample from 2003 to 2010.

Independent variables

Party congress We focused on the 17th National Congress of the Communist Party of China, held in October 2007. Local party congresses typically take place prior to the National Congress, which in this case was in late 2006 and early 2007. For each city we coded the years following and preceding the local party congress as 1 and 0, respectively.

First-term leader When new city party secretaries are appointed, they start a first term of five years, while reappointed incumbent leaders typically serve in the same position for a second term. Each city has only one party secretary position. The variable “first-term leader” was coded as 1 if the party secretary of a city was newly appointed at the time of the local party congress, and coded as 0 if reappointed. The value of this variable remains the same until the next congress, and thus is time invariant.

The main independent variable of interest was the interaction term between the two dummies, first-term leader*party congress, which we discuss in detail in the research design section.

Moderating variables

Retirement Each political term is 5 years, and city leaders are required to retire at the age of 60. The variable “retirement” was thus coded as 1 for city party secretaries whose current term was their last before retirement (Wang & Luo, 2019), and coded as 0 if they had more than five years to serve before reaching the age of 60, i.e., they were appointed at age 55 or younger (they could then serve more than the current term before retirement).

Poor GDP performance We calculated the moving average of the GDP per capita growth rate of the focal city during the entire tenure of each city leader. We then standardized the growth rate by subtracting the mean value of all cities within the same province in the focal year and divided by the standard deviation. We were thus able to compare the GDP performance of all cities in the same province (Yue et al., 2019). We then examined the GDP performance in the year before the leader took office (i.e., the performance achieved by his/her predecessor in the previous year), and created a dummy variable coded as 1 if the focal city’s GDP performance was below the standardized average, and 0 otherwise. This indicates whether the first-term leader was appointed to a city with relatively poorer GDP performance.

Controls

We controlled for personal characteristics that could influence the promotion opportunities of leaders. We controlled for the city party secretary’s tenure in the target position, coded as the number of years passed since they were appointed as the current secretaries (Guo, 2009). We also controlled for education, coded as the number of years of schooling. Their political connections with their superiors can affect their chances of promotion, in addition to their performance (Jia et al., 2015). We considered two types of political connections: whether the city party secretary and the incumbent provincial party secretary shared a birthplace and whether there existed a superior at the higher level of government who promoted the city party secretary to the city party committee (Jiang, 2018; Meyer, Shih, & Lee, 2016). This variable was coded ranging from 0 to 2 (a leader with both types of connections was coded as 2). We also controlled for the party secretary’s gender (female = 1) and ethnicity (minority = 1). We controlled for whether the party secretary was born locally, coded as 1 if yes and 0 otherwise. We also controlled for the number of years it had taken for the party secretary of a target city to reach a position on the party committee since the start of his/her career. This indicated the extent to which this person was on a fast-track political career, as achieving a position on the committee is typically a major career milestone. Fewer years may thus be associated with a greater possibility of achieving further promotion.

We also controlled for other factors found to influence the location of FDI, including population density and GDP per capita for each city, to indicate the market size and economic development level. We measured infrastructure development by the volume of freight per person in the target city. The cost of labor was measured by the wage of the urban population. We further controlled for FDI stock in each city and expenditure by the city government on science and technology. In addition, city fixed effects and year fixed effects were included, with the former controlling city level time-invariant factors and the latter absorbing annual shocks to the cities, such as macroeconomic fluctuations, institutional adjustments, and bureaucratic reform. We also controlled for province-specific trends through the interaction between province dummy variables and years. For example, local governments may become more experienced and better able to attract FDI over time, which may be heterogeneous across provinces.

Research Design and Econometric Estimation

A simple comparison of FDI inflows between cities with first-term leaders and those with continuing leaders after the congress would have been likely to suffer from omitted variable bias, due to observable and unobservable factors that make the two groups of cities inherently different. Thus, we used a difference-in-differences design to consider both the differences before the congress and those of the FDI inflows due to the time trend. This double difference could better capture the variations in FDI inflows due to the different incentives of leaders after the congress. For our other moderating hypotheses, we extended this double difference to a triple difference to examine the heterogeneity across personal and regional characteristics. The validity of the research design relied on a valid common trend assumption. We used two empirical strategies to verify this assumption: (1) a balance check of personal and regional characteristics before the congress; and (2) a common trend check based on a regression analysis.

Our formal model was as follows:

where p refers to the province, i to the city, and t to the year, and \({\text{FDI}}_{pit }\) indicates the volume of FDI inflows (ln) to that city in the given year. The coefficient for the independent variables is \(\beta_{3}\), which is expected to be positive and indicates the differences between the two types of leader before and after the party congress. Standard errors are clustered at the provincial level.5

H1 was tested in the main regression analysis using the interaction between party congress and first-term leader. H2 and H3 were tested through three-way interactions by further interacting retirement and poor GDP performance, respectively, with the main interaction term.

Table 1 presents the mean and standard deviations of the variables and their correlations.6

Results

Balance Check before the Congress

Before conducting the regression analysis, we thoroughly compared the characteristics of the leaders and cities in the two groups, to rule out some alternative explanations. For example, the two types of leaders had inherently different capabilities and characteristics, which affected their appointment to a new city and their subsequent success in attracting FDI. Strong leaders were found to be appointed to economically strong cities that attracted more FDI inflows, and so their capabilities rather than their incentives drove FDI inflows. We used two indicators of capabilities to address this: the level of education and the number of years taken to reach a position in the party committee of the target city since the beginning of the leaders’ careers. The comparisons are presented in Table 2. Neither the level of education nor the years taken to reach a position in the party committee differed between the two groups before the congress, and the leaders in the two groups did not differ in terms of other characteristics. The only exception was age, but we controlled for this using the retirement variable in the regressions. In our robustness checks, we also conducted fixed effect analyses for the leaders to control for any personal invariant characteristics.

In terms of city characteristics, we found no significant differences between the two types of cities. Our balance check before the congress gave us confidence that the two groups of cities did not differ systematically before the congress.

Regression Analyses

As shown in Table 3, Model 1 included only the control variables and moderating variables. Model 2 added our main variables, and Model 3 further included the interaction term, party congress*first-term leader. H1 predicted that the FDI volume would be larger for cities with first-term leaders than for those with continuing leaders after the party congress.7 In Model 3 of Table 3, the interaction coefficient for party congress*first-term leader was positive (p = 0.040), suggesting that first-term leaders were on average associated with a 19.1% increase in FDI inflows to their cities compared with continuing leaders, after controlling for the characteristics of the cities and the general influence of the party congress on FDI. This effect translates into an average of around 518.70 million yuan (19% * 2715.707) more for cities with first-term leaders. Hence, H1 received strong empirical support.

Common trend check

Based on the regression results, we further conducted a common trend check. Figure 2 presents the results. The x-axis represents the years, with 0 referring to the year of the local party congress and −1 and 1 the years before and after the congress, respectively. The y-axis represents the estimated coefficients for the difference in FDI inflows under the two types of leaders. The shaded areas show the confidence intervals for the coefficients, which contained 0 before the congress. This means that the estimated difference was not statistically significant, whereas the difference was significantly greater than 0 after the congress. This result further supported our premise that cities with different types of leaders did not differ before the congress, and the difference in FDI inflows after the congress can be explained by their different political incentives.

Table 4 reports the results of the three-way interactions. Model 1 indicates whether the main estimation was moderated by retirement, and Model 2 shows the moderating effect of poor GDP performance. H2 proposed that the difference between the two types of leaders is smaller for leaders approaching retirement. Based on Model 1 (Table 4), the coefficient for the three-way interaction of party congress, first-term leader, and retirement was negative (p = 0.043). In terms of magnitude, this shows that for the retiring leaders, the difference between first-term and continuing leaders was 31% less than the difference for non-retiring leaders, which is equivalent to 357.90 (518.70 × 69%) million yuan. We also conducted a formal test of whether retiring first-term leaders’ incentives were different from 0, i.e., the sum of the coefficient of the three-way interaction of party congress, first-term leader, and retirement, and the two-way interaction of party congress and first-term leader, as shown in Table 4. The p value was 0.454, suggesting that we could not reject the null hypothesis that retiring first-term leaders’ incentives are equal to 0. This confirms the lack of career advancement incentives for retiring first-term leaders. Thus, H2 received strong empirical support.

To further interpret the results of the three-way interactions, we plotted the results based on a new technique to interpret the non-linear interaction effect (Hainmueller, Mummolo, & Xu, 2019). We first estimated the local effect of the interaction term on FDI at different values of the moderator, and then combined the effects through a kernel reweighting technique. The y-axis in Figure 3 represents the difference in FDI inflows under the two types of leaders and the x-axis displays the age of appointment of the first-term leaders. The difference in FDI inflows was lower after 53 years of age and became 0 at 55, implying that the difference between the two types of leaders became negligible when approaching retirement.

Model 2 in Table 4 presents the three-way interaction between party congress, first-term leader, and poor GDP performance, with all two-way interactions being controlled. The coefficient for the three-way interaction was positive (p = 0.041). In terms of magnitude, this showed that for cities with poor prior GDP performance, the difference between first-term leaders and continuing leaders was 34% greater, which is equivalent to 695.06 (518.70 × 134%) million yuan. Thus, H3 received empirical support. Figure 4 illustrates the effect of GDP performance on the difference in FDI flows, and shows a declining pattern: poorer past GDP performance translates into a higher incentive for FDI inflows.

Robustness Checks

The potential selection bias of first-term leaders is a concern, if the appointment of first-term leaders and the decision to retain incumbents are not random. To address this, we followed Malesky and Samphantharak (2008) and took an instrumental variable (IV) approach by applying a IV two-stage least squares (2SLS) procedure. We estimated the probability of leadership replacement in the first stage, using whether city leaders before the congress had patronage ties in a low-turnover environment as our instrumental variable. Patronage ties are known to be important in Chinese state bureaucracy for enhanced cooperation and governance (Jiang, 2018), and, in our case, the provincial-level party secretary may be prone to keep the city-level party secretary, especially in a stable political environment with generally low turnover of leaders (i.e., a generally low turnover can help the higher-level official to justify decisions of keeping incumbents. We coded the instrumental variable as 1 if before the congress the city party secretary had been promoted to the position by the provincial party secretary at that time and if the turnover in the city was lower than the province’s median (three times in our sample, consistent with other research (Wang & Chong, 2017), and 0 otherwise. We expected a negative relationship between this instrument variable and the appointment of first-term leaders. We tested the validity of the instrument and it passed both the under-identification test (Kleibergen-Paap rk LM statistic: 6.040, p = 0.0140) and the weak identification test (Cragg–Donald F-Statistic: 27.515, above the rule of thumb of 10). The exclusion restriction was also satisfied, as it was not related to any of our control variables, implying that the instrument only influences FDI inflows through the endogenous variable.8 The 2SLS results are presented in Table 5. Our instrument was negatively associated with the appointment of first-term leaders (p = 0.001), and our key results remained in the second stage. This instrumental variable approach confirmed that our hypotheses remained supported after considering the potential endogeneity of the first-term vs. continuing leaders.

We also tested alternative measures and various subsamples to ensure the robustness of the main result (H1). First, Chinese FDI inflows may involve round-tripping investments from the mainland to Hong Kong, Macau, or Taiwan, and then back to the mainland, so the real FDI volume may be overstated. Unfortunately, the city’s statistical yearbooks do not disclose information about each investing country, as FDI data are collected at the aggregated city level instead of the firm level, but they do publish information on the total number of firms with annual sales of over 5 million RMB that have investors from Hong Kong, Macau, or Taiwan and investors from other countries. Based on this information, we first calculated the ratio of firms with investors from other countries for each city, among all firms with foreign investors. We approximated FDI inflows coming from other countries (other than Hong Kong, Macau, or Taiwan) by multiplying the FDI inflows (to the city) with this ratio. We estimated our regression using other foreign countries’ FDI inflows. We present the results in Model 1 of Table 6, which are consistent with those of our main models in Table 3. This analysis gave us more confidence that our results were not driven mainly by round-tripping.

Second, as we explained, some first-term leaders are promoted from below, while others are moved laterally from an equivalent position in a different locality. We grouped these together, with the assumption that they share the common feature of starting again and have stronger incentives for career advancement than continuing leaders. To empirically check this assumption, we conducted subsample analysis of promoted and rotated leaders in Models 2 and 4 in Table 6.9 Results showed that although the promoted leaders had stronger incentives, the coefficients for the two models were not statistically different, confirming our assumption.

Third, if continuing leaders have fewer incentives for career advancement, when we include only retiring continuing leaders the effect should be similar or stronger (Wang & Luo, 2019). We present the results in Model 6 of Table 6, which are consistent.

We also estimated the models by including leaders’ fixed effects to control for all time-invariant individual characteristics, and the results still supported H1 (Models 3, 5, and 7 of Table 6).

Fourth, we conducted a subsample analysis in which first-term leaders’ tenure was more than three years after appointment, to ensure that the FDI inflows into their jurisdiction resulted from their own efforts. Our results were robust (Model 8), and remained so when personal fixed effects were included (Model 9). Another concern was that a surge of FDI inflows one year after the turnover could reflect the efforts of previous leaders. We re-estimated the regression by focusing on the differences of the accumulated FDI inflows two years after and two years before the party congress. H1 was still supported (Model 10). In the last model, we used a random effects model at the city level and the results were robust.

Discussion and Conclusion

We explain FDI inflows by developing a new theoretical perspective based on the political incentives of government officials. Our research setting is Chinese city leaders and FDI inflows into the cities and we use a rigorous difference-in-differences research design. We find that, compared with continuing leaders, first term local leaders are associated with larger volumes of FDI inflows into their cities. The difference between the two types of leaders is smaller if the leaders are approaching retirement, but greater for those appointed to cities with poorer prior GDP performance. These contingencies are consistent with our argument that the incentive structure of the state bureaucracy affects leaders’ efforts at attracting FDI by shaping their incentives for career advancement.

Additional Analyses and Alternative Explanations

As first-term leaders are more motivated to attract investment than continuing leaders, they may exert more efforts to provide preferential treatment to investors (Jensen et al., 2015). Thus, cities with first-term leaders are likely to collect lower taxes, have lower land prices, and produce more environmental pollution,10 at least in the short term. Figure 5 in the Appendix presents three graphs using the same model as Figure 2 but replacing FDI volume with taxes, land price, and chemical oxygen demand (COD) emissions. The patterns confirm our expectations that first-term leaders are associated with lower taxes, lower land prices, and more COD emissions a few years after the congress, as they give foreign investors preferential treatment.

Second, if leaders who have attracted larger volumes of FDI inflows are promoted from their current positions, this will support the argument that first-term leaders are motivated by career incentives to attract FDI inflows. In Table 7 of the Appendix, we present the results with the dependent variable coded as 1 if the leader was promoted to a higher position after the current position. Model 1 shows that the total amount of FDI obtained throughout the leaders’ tenures positively contributed to their likelihood of promotion (p = 0.001). Thus, these additional analyses further support our argument concerning political incentives.

The observed increase in FDI inflows to the city may be subject to alternative explanations.11 Firms may deliberately target locations with newly appointed leaders who lack knowledge about the city, because investors can then rewrite the rules or develop political connections they can benefit from. If this were the case, this would be more likely to happen to first-term leaders from outside the city. Thus, we included a three-way interaction between the DID estimator and a new variable called outsider leaders coded as 1 if the city party secretary previously worked in another city. Model 1 in Appendix Table 2 presents the results, which show that the coefficient of the three-way interaction term is not significant. This alternative explanation is thus not supported.

Foreign investors may also take advantage of new city leaders who lack business experience to obtain better deals. Thus, our findings should be weaker when new leaders had previous management experience. We tested this by examining whether first-term leaders with prior business and investment experience in state-owned companies were associated with less FDI (as they were less likely to be favored by foreign investors). Model 2 of Appendix Table 8 shows that the three-way interaction between party congress, first-term leader, and SOE experiences is not significant. Therefore, this alternative hypothesis is not supported.

Contributions and Implications

Our research makes two main contributions. First, we contribute to studies on the role of political institutions in the international business literature. Most research has focused on how political institutions give rise to risks and uncertainties for foreign investors (Henisz, 2000; Jensen, 2003; Kobrin, 1979). The power structure of political institutions, i.e., a lack of checks and balances (e.g., Henisz & Delios, 2001; Jensen, 2003; Li, 2009), and changes in leadership (e.g., Fails, 2014; Jamison et al., 2017; Vaaler et al., 2005; Zhong et al., 2019) result in instability and policy discontinuity, negatively impacting FDI. However, Boddewyn (1988: 347) pointed out that political opportunities are as important as political risks for multinational enterprises (MNEs). In our research, we demonstrate how political institutions can create opportunities for investors and positively impact FDI, through the state goal of FDI attraction and government officials’ career incentives. Our study complements research on the risks of political institutions, reveals the multifaceted role of such institutions, and offers promising avenues for future research.

Second, our study offers a new theoretical explanation for the heterogeneity in intra-country FDI inflows, which complements economic and institutional perspectives on FDI. The focus of this literature has mainly been on regional characteristics, such as the abundance of resources and the quality of formal and informal institutions (Chan et al., 2010; Du et al., 2008; Lu et al., 2018; Ma, Tong, & Fitza, 2013; Meyer & Nguyen, 2005), as the main drivers for the disparities in regional FDI inflows and the performance of subsidiaries. However, the role of political agents who devise FDI policies has been underexplored (Zhong et al., 2019). We show that variations in intra-country FDI inflows can be due to the political incentives of leaders. Differences in these incentives can lead to different levels of FDI in cities administered by such leaders, despite similarities in their resource endowments and institutional environments.

Our study also has implications for the literature on political turnover (Fails, 2014; Henisz & Delios, 2004; Jamison et al., 2017; Li, 2009; Zhong et al., 2019), in which it has often been proposed that incumbent leaders can maintain policy continuity, which decreases uncertainty for foreign investments (Henisz & Delios, 2004; Vaaler, 2008). We depart from this argument by highlighting the importance of reduced incentives for continuing leaders. Conversely, leaders serving their first term (i.e., new leaders coming to power after political turnover) can have stronger political incentives to climb the career ladder and are thus more motivated to attract FDI, if doing so is linked to their future promotion opportunities.

Our focus on individual leaders’ political incentives and their career concerns also enriches the political exchange perspective. The political exchange perspective suggests that the government is a production factor for MNEs in the political market, in which exchange occurs between government officials and interested firms (Boddewyn & Brewer, 1994). The current IB literature has focused on corruption as an outcome of such exchange, as government officials may seek private gains from their public power (e.g., Cuervo-Cazurra, 2008; Cuervo-Cazurra, 2006; Uhlenbruck, Rodriguez, Doh, & Eden, 2006). We suggest that political career goals constitute another area of interest that officials may pursue when dealing with foreign investors. Our findings thus provide practical implications for MNEs, as they suggest that government officials who are motivated by their political careers can be potential exchanging partners. New leaders can provide investment packages or create better investment environments if the advancement of their careers is closely associated with FDI attraction. Thus, knowledge of the new leaders’ political incentives can facilitate and enhance MNEs’ entry decisions.

This study also has implications for globalization research. FDI is an important indicator of globalization. Research on the dissemination of FDI and the resulting economic integration has considered technological drivers and institutional antecedents, such as the role of information technology and intergovernmental organizations (e.g., Albino-Pimentel, Dussauge, & Shaver, 2018; Alcacer & Ingram, 2013; Rangan & Sengul, 2009a; Rangan & Sengul, 2009b). Unlike this macro focus, we provide a micro perspective centered on individual political leaders’ incentives. Even with similar technological drivers and institutional arrangements, individual leaders who possess power and discretion to approve FDI projects can shape the locations of FDI and influence the extent of economic integration in their locality. Local leaders’ career concerns can significantly affect their efforts at FDI attraction. This micro focus offers further research opportunities in terms of the process of de-globalization.

Generalizability of the Political Incentive Perspective

Our political incentive perspective can also be applied to other outcomes relevant to the evaluation and performance of leaders, such as GDP growth rate, fiscal revenue, and social stability in the Chinese context (Edin, 2003). Outward FDI and cross-border acquisitions have increased rapidly in China (Cui & Jiang, 2012; Li, Xia, & Zajac, 2018), and they are related to the state objectives in certain periods. It is thus worthwhile to examine whether the political incentives of local leaders could account for such an increase. Future research can also explore how political incentives of officials shape important economic, social, and political outcomes.

The context of China provides a unique setting to explore the role of political incentives under a strong party-state and a well-structured bureaucracy (Lin, 2011). However, the theory concerning political incentives can also be applied to other political institutions. For example, government officials in Japan, South Korea, and Taiwan have well-structured career paths with clearly defined evaluation criteria based on state goals. They are often highly motivated and successful in terms of achieving such goals (Evans & Rauch, 1999; Evans, 1995; Johnson, 1982). Research on Eastern European countries also shows that those with a bureaucracy that facilitates and legitimizes FDI attract more FDI (Bandelj, 2009). In contrast, if career paths and state goals are less well defined or subject to change, such as in Brazil or India, government officials are less likely to be motivated to work toward state goals and are more likely to seek personal gain (Evans, 1995). Future studies can apply our framework in different countries to understand the relationship between the strength of the state bureaucracy, political incentives, and economic outcomes related to the state goals.

The mechanism of political incentives can also be found in Western democracies, where politicians are under pressure from voters and election cycles. The incentive of winning elections can motivate politicians to pursue the concerns of voters. For example, Jensen et al. (2015) found that elected mayors of U.S. cities provide larger incentive packages for investors than nonelected city managers. In newly democratic countries, such as those in the former Soviet bloc, politicians are likely to liberalize trade soon after elections, so they can gain the benefits of economic growth before the next round of voting (Frye & Mansfield, 2004).

Our arguments about the effect of political terms may also be generalizable to the election setting. Term limits may reduce the incentives of politicians to consider voters’ issues, which is similar to the behavior of incumbent leaders in our Chinese setting. For example, Besley and Case (1995) found that politicians in the U.S. are less likely to act in the interests of voters by reducing taxes and government spending if they face a binding term limit. A cross-national study of 48 democratic countries also identified an incentive-reducing effect of term limits on politicians’ behavior (Johnson & Crain, 2004). Similarly, the time horizons of young politicians will differ from those of politicians close to retirement, which may shift their career focus. Politicians who will soon retire often focus on preserving their reputations in their last positions, so they can obtain job opportunities in the private sector after retirement (Besley & Case, 1995). Thus, despite the specificities of our research setting, the mechanism of political incentives may be broadly applied to various political institutions, such as developing states with strong bureaucracies or electoral democracies. This new perspective can enhance understanding about the way how political leaders interact with the business sector.

Limitations

Political leaders may obtain other personal benefits when exchanging with the private sector. For example, government officials can serve on boards of firms after retirement (Hillman, 2005; Peng, 2004). The influence of this motivation on investment incentives is a subject for further research. The relationship between political leaders’ personal financial considerations and formal career concerns is another potential area of research in the field of state-firm interactions (Pearce, Dibble, & Klein, 2009).

In our study, we combine different groups of first-term leaders together without theoretically differentiating their motivations, future studies can further explore how the backgrounds and historical career trajectories of leaders may impact their incentives.

Our study focuses only on FDI volume; we did not consider whether the FDI was economically or socially optimal. In our further analyses, we provided preliminary data showing that cities with first-term leaders produced more COD emissions, which might be due to the lower environmental standards used to attract more FDI (Appendix Figure 5). This suggests that the political incentive to pursue FDI may have social and political costs. However, this is beyond the scope of this paper and can be addressed in future studies.

In conclusion, by focusing on how political terms shape the career incentives of government officials, we propose a new theoretical perspective on FDI inflows in this study. We present a novel account of the regional disparity of FDI inflows and extend the focus on uncertainty and risks generated by political institutions, by examining how government officials’ political incentives can provide opportunities for foreign investment.

Notes

-

1

We thank one of the reviewers for this point.

-

2

UNCTAD (2016). United Nations Conference on Trade and Development Statistics Report. http://unctadstat.unctad.org/wds/TableViewer/tableView.aspx.

-

3

Barboza (2016). How China built “iPhone city” with billions in perks for Apple’s partner. The New York Times. https://www.nytimes.com/2016/12/29/technology/apple-iphone-china-foxconn.html.

-

4

We chose the 17th Congress specifically for two reasons. First, there were no major political leadership changes at the central government level (the president and the premier) during the 17th Congress. And we ensured that there was institutional and policy continuity regarding economic development and foreign investments at the macro level. In contrast, political turnover at the central level happened during both the 16th (2002) and 18th (2012) Congress. Second, our difference-in-differences design requires enough data points for both before and after the Congress in 2007. Our observations came from 2003–2010 to suit this purpose. In contrast, if we had chosen the 16th Congress, we would not have had enough observations for the before-Congress period as the data was not readily available before 2000.

-

5

Among the 31 provinces, we excluded Beijing, Shanghai, Tianjin, and Chongqing (four cities with the status of province) from our analysis, as their characteristics differ from those of ordinary cities. Tibet was also excluded because no relevant data were available. We obtained 26 clusters.

-

6

Some economic indicators at the city level were highly correlated, such as wage and GDP per capita. Our results were robust with or without controlling for these indicators.

-

7

In Table 3, \(\beta_{2}\) is not reported because first-term leaderi is a time-invariant variable and is thus absorbed by the city fixed effects. In a subsequent robustness check, we also used a random effects model with the variable and our results were the same.

-

8

Results are available upon request.

-

9

The number of leaders moving downward was very small in our sample.

-

10

We multiplied the city’s fiscal revenues, land price, and COD emissions by the ratio of foreign invested firms among all firms in that city to proxy for these outcomes that result from FDI.

-

11

We thank one of the reviewers for pointing out these alternative explanations.

Change history

18 June 2021

A Correction to this paper has been published: https://doi.org/10.1057/s41267-021-00436-z

References

Albino-Pimentel, J., Dussauge, P., & Shaver, J. M. 2018. Firm non-market capabilities and the effect of supranational institutional safeguards on the location choice of international investments. Strategic Management Journal, 39(10): 2770–2793.

Alcacer, J., & Ingram, P. 2013. Spanning the institutional abyss: The intergovernmental network and the governance of foreign direct investment. American Journal of Sociology, 118(4): 1055–1098.

Bandelj, N. 2009. The global economy as instituted process: The case of Central and Eastern Europe. American Sociological Review, 74(1): 128–149.

Barboza, D. 2016. How China built “iPhone city” with billions in perks for Apple’s partner. The New York Times. https://www.nytimes.com/2016/12/29/technology/apple-iphone-china-foxconn.html.

Bertrand, M., Burgess, R., Chawla, A., & Xu, G. 2015. Determinants and consequences of bureaucrat effectiveness: Evidence from the Indian administrative service. Working paper, University of Chicago, Booth School of Business.

Besley, T., & Case, A. 1995. Does electoral accountability affect economic policy choices? Evidence from gubernatorial term limits. The Quarterly Journal of Economics, 110(3): 769–798.

Boddewyn, J. J. 1988. Political aspects of MNE theory. Journal of International Business Studies, 19(3): 341–363.

Boddewyn, J. J., & Brewer, T. L. 1994. International-business political behavior: New theoretical directions. The Academy of Management Review, 19(1): 119–143.

Cai, H., Chen, Y., & Gong, Q. 2016. Polluting thy neighbor: Unintended consequences of China’s pollution reduction mandates. Journal of Environmental Economics and Management, 76(C): 86–104.

Chan, C. M., Makino, S., & Isobe, T. 2010. Does subnational region matter? Foreign affiliate performance in the United States and China. Strategic Management Journal, 31(11): 1226–1243.

Chen, T., & Kung, J. 2016. Do land revenue windfalls create a political resource curse? Evidence from China. Journal of Development Economics, 123, 86–106.

Chen, Y., Li, H., & Zhou, L.-A. 2005. Relative performance evaluation and the turnover of provincial leaders in China. Economics Letters, 88(3): 421–425.

Chen, H., Ma, J., & Bao, G. 2011. 30 years of performance measurement in Chinese government. Beijing: Central Compilation & Translation Press.

Cuervo-Cazurra, A. 2006. Who cares about corruption? Journal of International Business Studies, 37(6): 807–822.

Cuervo-Cazurra, A. 2008. Better the devil you don’t know: Types of corruption and FDI in transition economies. Journal of International Management, 14(1): 12–27.

Cui, L., & Jiang, F. 2012. State ownership effect on firms’ FDI ownership decisions under institutional pressure: A study of Chinese outward-investing firms. Journal of International Business Studies, 43(3): 264–284.

Cyert, R. M., & March, J. G. 1963. A behavioral theory of the firm. Englewood Cliffs, NJ: Prentice-Hall.

Delios, A., & Henisz, W. J. 2003. Policy uncertainty and the sequence of entry by Japanese firms, 1980–1998. Journal of International Business Studies, 34(3): 227–241.

Du, J., Lu, Y., & Tao, Z. 2008. Economic institutions and FDI location choice: Evidence from US multinationals in China. Journal of Comparative Economics, 36(3): 412–429.

Edin, M. 2003. State capacity and local agent control in China: CCP cadre management from a township perspective. The China Quarterly, 173(173): 35–52.

Evans, P. B. 1995. Embedded autonomy: States and industrial transformation. Princeton, NJ: Princeton University Press.

Evans, P., & Rauch, J. E. 1999. Bureaucracy and growth: A cross-national analysis of the effects of “Weberian” state structures on economic growth. American Sociological Review, 64(5): 748–765.

Fails, M. D. 2014. Leader turnover, volatility, and political risk: Leader turnover and political risk. Politics & Policy, 42(3): 369–399.

Fredriksson, P., List, J., & Millimet, D. 2003. Bureaucratic corruption, environmental policy and inbound US FDI: Theory and evidence. Journal of Public Economics, 87(7–8): 1407–1430.

Frye, T., & Mansfield, E. D. 2004. Timing is everything: Elections and trade liberalization in the postcommunist world. Comparative Political Studies, 37(4): 371–398.

Gao, J. 2015. Pernicious manipulation of performance measures in China’s cadre evaluation system. The China Quarterly, 223, 618–637.

Gibbons, R., & Murphy, K. 1992. Optimal incentive contracts in the presence of career concerns: Theory and evidence. Journal of Political Economy, 100(3): 468–505.

Globerman, S., & Shapiro, D. 2003. Governance infrastructure and US foreign direct investment. Journal of International Business Studies, 34(1): 19–39.

Guillén, M. F., & Capron, L. 2016. State capacity, minority shareholder protections, and stock market development. Administrative Science Quarterly, 61(1): 125–160.

Guo, G. 2009. China’s local political budget cycles. American Journal of Political Science, 53(3): 621–632.

Hainmueller, J., Mummolo, J., & Xu, Y. 2019. How much should we trust estimates from multiplicative interaction models? Simple tools to improve empirical practice. Political Analysis, 27(2): 163–192.

Hamm, P., King, L. P., & Stuckler, D. 2012. Mass privatization, state capacity, and economic growth in post-communist countries. American Sociological Review, 77(2): 295–324.

Henisz, W. 2000. The institutional environment for multinational investment. Journal of Law Economics and Organization, 16(2): 334–364.

Henisz, W. J. 2004. Political institutions and policy volatility. Economics and Politics, 16(1): 1–27.

Henisz, W. J., & Delios, A. 2001. Uncertainty, imitation, and plant location: Japanese multinational corporations, 1990–1996. Administrative Science Quarterly, 46(3): 443–475.

Henisz, W. J., & Delios, A. 2004. Information or influence? The benefits of experience for managing political uncertainty. Strategic Organization, 2(4): 389–421.

Hillman, A. J. 2005. Politicians on the board of directors: Do connections affect the bottom line? Journal of Management, 31(3): 464–481.

Huang, Y. 2002. Managing Chinese bureaucrats: An institutional economics perspective. Political Studies, 50(1): 61–79.

Huang, Y., & Khanna, T. 2003. Can India overtake China? Foreign Policy, 137: 74–81.

Jamison, J. W., Rosenbaum, C. Y., & Carter, J. 2017. Autocratic leadership turnover and foreign direct investment: Empirical analysis. The Journal of Social, Political, and Economic studies, 42(3–4): 307–326.

Jensen, N. M. 2003. Democratic governance and multinational corporations: Political regimes and inflows of foreign direct investment. International Organization, 57(3): 587–616.

Jensen, N., Malesky, E., & Walsh, M. 2015. Competing for global capital or local voters? The politics of business location incentives. Public Choice, 164(3): 331–356.

Jia, R., Kudamatsu, M., & Seim, D. 2015. Political selection in China: The complementary roles of connections and performance. Journal of the European Economic Association, 13(4): 631–668.

Jiang, J. 2018. Making bureaucracy work: Patronage networks, performance incentives, and economic development in China. American Journal of Political Science, 62(4): 982–999.

Johnson, C. 1982. MITI and the Japanese miracle: The growth of industrial policy, 1925–1975. Stanford, CA: Stanford University Press.

Johnson, J. M., & Crain, W. M. 2004. Effects of term limits on fiscal performance: Evidence from democratic nations. Public Choice, 119(1): 73–90.

King, L., & Sznajder, A. 2006. The state-led transition to liberal Capitalism: Neoliberal, organizational, world-systems, and social structural explanations of Poland’s economic success. American Journal of Sociology, 112: 751–801.

Kobrin, S. J. 1979. Political risk: A review and reconsideration. Journal of International Business Studies, 10(1): 67–80.

Kohli, A. 2004. State-directed development: Political power and industrialization in the global periphery. Cambridge: Cambridge University Press.

Kroeber, A. R. 2016. China’s economy: What everyone needs to know. New York, NY: Oxford University Press.

Lan, X., & Li, W. 2018. Swiss watch cycles: Evidence of corruption during leadership transition in China. Journal of Comparative Economics, 46(4): 1234–1252.

Li, D. D. 1998. Changing incentives of the Chinese bureaucracy. American Economic Review, 88(2): 393–397.

Li, Q. 2009. Democracy, autocracy, and expropriation of foreign direct investment. Comparative Political Studies, 42(8): 1098–1127.

Li, J., Xia, J., & Zajac, E. J. 2018. On the duality of political and economic stakeholder influence on firm innovation performance: Theory and evidence from Chinese firms. Strategic Management Journal, 39(1): 193–216.

Lin, N. 2011. Capitalism in China: A centrally managed capitalism (CMC) and its future. Management and Organization Review, 7(1): 63–96.

Liu, X., & Wang, C. 2003. Does foreign direct investment facilitate technological progress?: Evidence from Chinese industries. Research Policy, 32(6): 945–953.

Ljungwall, C., & Linde-Rahr, M. 2005. Environmental policy and the location of foreign direct investment in China. Working paper, Peking University.

Lu, X., & Landry, P. F. 2014. Show me the money: Interjurisdiction political competition and fiscal extraction in China. American Political Science Review, 108(3): 706–722.

Lu, J. W., Song, Y., & Shan, M. 2018. Social trust in subnational regions and foreign subsidiary performance: Evidence from foreign investments in China. Journal of International Business Studies, 49(6): 761–773.

Ma, X., Tong, T. W., & Fitza, M. 2013. How much does subnational region matter to foreign subsidiary performance? Evidence from “Fortune” Global 500 Corporations’ investment in China. Journal of International Business Studies, 44(1): 66–87.

Madariaga, N., & Poncet, S. 2007. FDI in Chinese cities: Spillovers and impact on growth. The World Economy, 30(5): 837–862.

Malesky, E. J. 2008. Straight ahead on red: How foreign direct investment empowers subnational leaders. The Journal of Politics, 70(1): 97–119.

Malesky, E. J., & Samphantharak, K. 2008. Predictable corruption and firm investment: Evidence from a natural experiment and survey of cambodian entrepreneurs. Quarterly Journal of Political Science, 3(3): 227–267.

Meyer, K. E., & Nguyen, H. V. 2005. Foreign investment strategies and sub-national institutions in emerging markets: Evidence from Vietnam. Journal of Management Studies, 42(1): 63–93.

Meyer, D., Shih, V. C., & Lee, J. 2016. Factions of different stripes: Gauging the recruitment logics of factions in the reform period. Journal of East Asian Studies, 16(1): 43–60.

Mezias, S. J., Chen, Y.-R., & Murphy, P. R. 2002. Aspiration-level adaptation in an American financial services organization: A field study. Management Science, 48(10): 1285–1300.

Nee, V., Opper, S., & Wong, S. 2007. Developmental state and corporate governance in China. Management and Organization Review, 3(1): 19–53.

Oi, J. C. 1995. The role of the local state in China’s transitional economy. The China Quarterly, 144, 1132–1149.

Opper, S., Nee, V., & Brehm, S. 2015. Homophily in the career mobility of China’s political elite. Social Science Research, 54, 332–352.