Abstract

Cannabis, otherwise known as hemp or marijuana, is one of the nation’s fastest growing cash crops. In the late 1990s, proponents of legalization began a successful effort to decriminalize cannabis at the state level. By 2020, over half of the U.S. population will have the ability to purchase legal cannabis in their state of residence. Even in open markets, widely varying state laws and a patchwork of reporting make direct observation of consumer purchases impossible. Governments seeking tax revenue, businesses seeking reliable market indicators, and consumers wanting reliable suppliers all have an interest in filling this knowledge gap. We approach this question from a perspective of fundamental economics and describe a methodology to estimate demand for legal cannabis products across all 50 states. From these estimates, we construct a monthly index of demand for medical and adult-use products and find that the data illustrate (1) continual increases in demand since 2016; (2) significant product substitution, especially for alcoholic beverages; (3) emerging brand differentiation; and (4) the existence of far-reaching regulatory and tax obstacles in many states. We note that these obstacles often cause tax revenue to be substantially smaller (and the black market much larger) than anticipated.

Similar content being viewed by others

Notes

One lyrical passage reads:

And now, with time, space expanded also… The whole atmosphere seemed ductile, and spun endlessly out into great spaces surrounding me on every side.

The film begins with a scrolling narrative: “The film you are about to view may startle you. It would not have been possible, otherwise, to sufficiently emphasize the frightful toll of the new drug menace which is destroying the youth of America in alarmingly increasing numbers. Marihuana is that drug—a violent narcotic—an unspeakable scourge.”.

As noted below, the actual tax imposed was $1 per ounce.

Milton Friedman wrote the foreword to this volume, and the CATO Institute maintains an extensive online library on this topic at cato.org/research/drug-war.

The U.S. Tax Court case (U.S. Tax Court 2007) is an example, if not a precedent. The tax court prevented a legal medical marijuana dispensary from deducting ordinary and normal business expenses of providing marijuana (but not its cost of goods sold). In practice, it appears the tax is often calculated on the gross margin of the business (revenue less Cost of Goods Sold or COGS). A 2015 cannabis industry association guide to Sect. 280E asserts that deducting the cost of goods sold is allowed for state-legal businesses. It helpfully identifies various categories of expenses (such as storage and administrative costs) that may or may not be accepted as part of COGS. The same document declares that it is “not…legal or tax advice.”.

It is difficult to compare income taxes with excise taxes, but nothing in the recent history of corporate income taxes in the United States evidences an “income” tax rate of 25% on gross margin, which would imply a tax on actual income of over 100% for the majority of firms in many industries. The Michigan Single Business Tax was the nation’s only value-added tax until it was repealed by a citizens’ initiative in 2006, and had a rate of 2.35% for most of its existence. It provided for a calculation of value-added that was quite similar to gross margin.

Other history is also instructive. In one of the most famous tax evasion cases, gangster Al Capone was convicted in October 1931 of evading $215,000 in income taxes on millions of dollars in earnings from illegal alcohol trade and other criminal dealings (Federal Bureau of Investigation n.d.). According to historical records kept by the Tax Foundation, the corporate income tax rate during the 1928–1931 period varied between 11 and 12%, after a $3000 exemption. Marginal corporate income tax rates during the rest of the twentieth century ranged as high as 53% in high income brackets (often involving a temporary surtax). Marginal corporate tax rates from 2000 through 2012 were typically 25 to 35%.

The Act was repealed in 1969 when a new federal statute was enacted criminalizing narcotics.

According to the Washington State Liquor Control Board, “recreational marijuana sales to the public began July 8, 2014,” and “I-502 creates three separate tiers: marijuana producer, marijuana processor, and marijuana retailer.”.

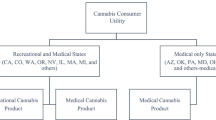

A number of organizations track state laws in this regard. The categorization used here incorporates the classification “medical and decriminalized,” and is associated with the Marijuana Policy Project. Other sources include the National Council of State Legislatures and Governing magazine.

Two implications from these data, one of which we can only now begin to explore, involve the success or failure of the criminalization of the substance during the last few decades, and the degree to which underground market prices reflect a premium for risk and criminal activities.

An additional assumption we intend to revisit involves state-level tax and regulatory burdens borne by cannabis product sellers in newly-legalized states. As discussed below, these vary greatly across states. In some states, they are sufficiently costly to cause reductions in legal sales.

AndCan is a registered trademark of Anderson Economic Group.

One widely-cited estimate stated:

We’re estimating $520 million in taxes from 2020-24,” said Andrew Livingston, a policy analyst with VS Strategies. “By 2023, Michigan will reach maturity with sales of just under $1.5 billion (for both medical and recreational marijuana).

A Senate Fiscal Agency analysis, prepared by government economists, estimated similar figures, concluding that new revenue of over $660 million would be generated from 2019 to 2024.

This story cites both high taxes and the “black market” as reasons for the shortfall.

References

Anderson Economic Group. 2018. Tax note: Revenues from legalizing recreational marijuana under Michigan’s Proposal 18-1. www.andersoneconomicgroup.com. Accessed November 2019.

Anderson, Patrick L. (ed.). 2016. The market for legal cannabis products in the fifty United States. East Lansing, MI: Anderson Economic Group.

Anderson, Patrick L. 2015. Valuation, risk, and damages in an emerging legal marijuana products industry in the U.S. Paper presented at conference. National Association of Forensic Economics International Conference, Amsterdam, Netherlands, May 2015.

Author Unknown. 1854. Our fashionable narcotics. New York Times, 10 January.

Baggio, Michele, Chong, Alberto, and Kwon, Sungoh. 2018. Helping settle the marijuana and alcohol debate: Evidence from scanner data. Working paper found at SSRN, abstract 3063288.

Beverage Information Group. 2012. Beer handbook. Norwalk, CT: Beverage Information Group.

Controlled Substances Act. 1970. U.S. Code. Vol. 21, secs. 812(b)-(c).

Dawsey, Chastity P. 2019. Whitmer to Detroit chamber: ‘There is not enough pot to fill the potholes.’ Bridge Magazine, May 2019.

Federal Bureau of Investigation. n.d. Al Capone. Washington, DC: Federal Bureau of Investigation. https://www.fbi.gov/history/famous-cases/al-capone. Accessed November 2019.

Gray, Kathleen. 2018. Estimated tax haul from marijuana sales would grow to $134 million per year. Detroit Free Press, 1 October.

Livengood, Chad. 2018. Cannabis vs. road costs: Tax money unlikely to be panacea for pavement. Crain’s Detroit Business, 2 November.

Ludlow, Fitz H. 1857. The hashish eater. Upper Saddle River, NJ: Literature House/Gregg Press.

Lynch, Timothy. ed. 2000. After prohibition: An adult approach to drug policies in the 21st century. Washington, DC: CATO books. https://object.cato.org/sites/cato.org/files/articles/the_illegitimate_war_on_drugs.pdf. Accessed November 2019.

Manes, Nick. 2019. Whitmer’s attempt to debunk ‘pot for potholes’ taken as a challenge. Michigan Advance, May 2019. https://michiganadvance.com/2019/05/31/whitmers-attempt-to-debunk-pot-for-potholes-taken-as-a-challenge. Accessed November 2019.

Marihuana Tax Act. 1937. U.S. Code. Stat. 551. http://www.druglibrary.org/schaffer/hemp/taxact/mjtaxact.htm. Accessed November 2019.

Marijuana Policy Project. 2019. Washington, DC. www.mpp.org/states. Accessed November 2019.

Agency, Michigan Senate Fiscal. 2018. November 2018 ballot proposal 18-1: An overview. Lansing, MI: Michigan Senate Fiscal Agency.

O’Shaughnessy, W.B. 1838–1840. On the preparations of the Indian hemp, or gunjah (Cannabis indica): their effets on the animal system in health, and their utility in the treatment of tetanus and other convulsive diseases. Transactions of Medical and Physical Society of Bengal (1838–1840). Calcutta, India.

O’Shaughnessy, William. 1843. New York Journal of Medicine 1 (3): 390–398.

Ozgo, David. 2019. Impact of retail marijuana legalization on alcohol sales in Colorado, Washington State and Oregon. Washington, DC: Distilled Spirits Council.

Pellachia, Thomas. 2018. Alcohol sales dropped 15% in states with medical marijuana laws. Forbes, 22 January. https://forbes.com/sites/thomaspellechia/2018/01/22/alcohol-sales-dropped-15-percent-in-states-with-medical-marijuana-laws. Accessed November 2019.

Nixon, Richard M. 1971. A pragmatic approach to drugs. Press conference. Archived at the Nixon Foundation: nixonfoundation.org/2016/06/26404/, Washington, DC.

Staggs, Brooke. 2018. Marijuana generating more in tax revenue, but still less than expected. Orange County Register, 14 November.

Staggs, Brooke. 2019. California made $345 million, not predicted $1 billion, on legal cannabis in 2018. The Mercury News, 19 February. https://mercurynews.com/2019/02/19/california-made-345-million-not-predicted-1-billion-on-legal-cannabis-in-2018/. Accessed November 2019.

State of California, California Cannabis Advisory Committee. 2018. Annual report: Global issues. Sacramento, CA: State of California, California Cannabis Advisory Committee.

State of Washington. 2012. Initiative 502. Olympia, WA: State of Washington. https://sos.wa.gov/_assets/elections/initiatives/i502.pdf. Accessed November 2019.

The Tax Foundation. 2012. Federal corporate income tax rates, income years 1909-2012. Washington, DC: The Tax Foundation. https://taxfoundation.org/federal-corporate-income-tax-rates-income-years-1909-2012. Accessed November 2019.

U.S. Customs and Border Patrol. 2015. Marijuana. Washington, DC: U.S. Customs and Border Patrol. https://cbp.gov/about/history/did-you-know/marijuana. Accessed November 2019.

U.S. Tax Court. 2007. Californians helping to alleviate medical problems, Inc., v. Commissioner of Internal Revenue. 128 T.C. No. 14, sec. 280E.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Equations

Equation 1: Latent Demand Equation

where Ds,t is the demand for the product among residents of state s, at time increment t; \(\hat{Y}_{s,t}\) the income among residents of state s, at time increment t; pt the relative prices of the product; Ωt the costs, tax burdens, and risks involved in buying and selling the product; λs the consumer tastes for the product, among residents of state s.

Equation 2: estimated demand equation

where \(\hat{D}_{s,t}\) is the estimated demand for the product among residents of state s, at time increment t; \(\overline{Y}_{s,t}\) the trended income among residents of state s, at time increment t; \(\overline{p}\) relative prices of the product, presumed to be constant during a limited time period; \(\overline{\varOmega }\) costs, tax burdens, and risks involved in buying and selling the product, presumed to be constant during a limited time period; \(I( \cdot )\) indicator function for estimation methods; \(\hat{X}_{s,t} = \hat{X}(\lambda_{s,t} )\) the demand estimated from observed sales of substitute product X, (alcoholic beverages) among residents of state s, based on consumer tastes λ, λs consumer tastes for the product, among residents of state s; \(\hat{m}_{s,t} = \hat{m}(\lambda_{s,t} )\) demand estimated from observed sales of substitute product m, (medical marijuana) based on consumer tastes λ; \(\hat{\hat{D}}_{s,t}\) demand estimated from reported sales in state s, at time increment t.

Note: carets indicate observed or calculated variables; bars indicate variables presumed to be constant during a short time period, which may also be unobserved.

Equation 3: index construction

where \(\hat{D}_{s,t}\) estimated demand for residents of state s, at time increment t; AndCanIndexBaseNovember2016 the Level at November 2016.

Appendix 2: Figs. 1, 2, 3, 4

Rights and permissions

About this article

Cite this article

Anderson, P.L. Blue smoke and seers: measuring latent demand for cannabis products in a partially criminalized market. Bus Econ 55, 26–40 (2020). https://doi.org/10.1057/s11369-019-00159-y

Published:

Issue Date:

DOI: https://doi.org/10.1057/s11369-019-00159-y